In 2023, several leading players introduced lightweight and recyclable bag-in-box packaging solutions designed to reduce environmental impact while upholding product integrity. This trend can particularly be observed within industries like wine, juices, and concentrates where sustainable packaging solutions are of particular significance. The growth of flexible packaging solutions in Europe is further accelerating adoption across multiple industries.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Bag-in-box packaging continues to increase in sectors like food and beverage, driven by convenience and cost effectiveness. Companies are exploring digital printing technologies as a means of strengthening branding and customer engagement—further expanding the European market growth potential. With the integration of tools such as

Retail Analytics, businesses are gaining deeper insights into consumer buying behavior and improving their supply chain strategies.

Europe's Bag-in-Box packaging market is witnessing significant innovation, as eco-friendly designs become more widely adopted by brands as part of their corporate social responsibility (CSR) strategies to meet rising consumer demand for greener packaging options.

Since consumers are becoming more conscious about sustainability, biodegradable and recyclable bag-in-box options represent tremendous growth potential. Their market is also expanding due to higher wine and liquid food demand, creating opportunities for innovative packaging solutions as well as regional partnerships between packaging manufacturers and suppliers. The adoption of circular economy packaging practices is also expected to play a significant role in shaping the future of this sector.

The demand for Bag-in-Box packaging in Europe grew by 8% annually in the last three years, driven by eco-conscious consumer behavior and increasing demand for convenience. In 2022, more than 700 million liters of beverages were packaged in Bag-in-Box solutions. The packaging's growth is also supported by digital printing technologies, with 20% of products now featuring custom designs. In addition, the integration of

digital logistics and

Digital Retail Logistics solutions has streamlined distribution efficiency and reduced transportation costs, further boosting market scalability.

Bag-in-box is an improved packaging method for semi-liquids and liquids that focuses on extending their shelf life. The bag-in-box packaging system was designed as a restructuring solution to the problems associated with packaging paste-textured &liquid food products like water, wine, sauce, juice, fats, purees, and oils.

Key Takeaways

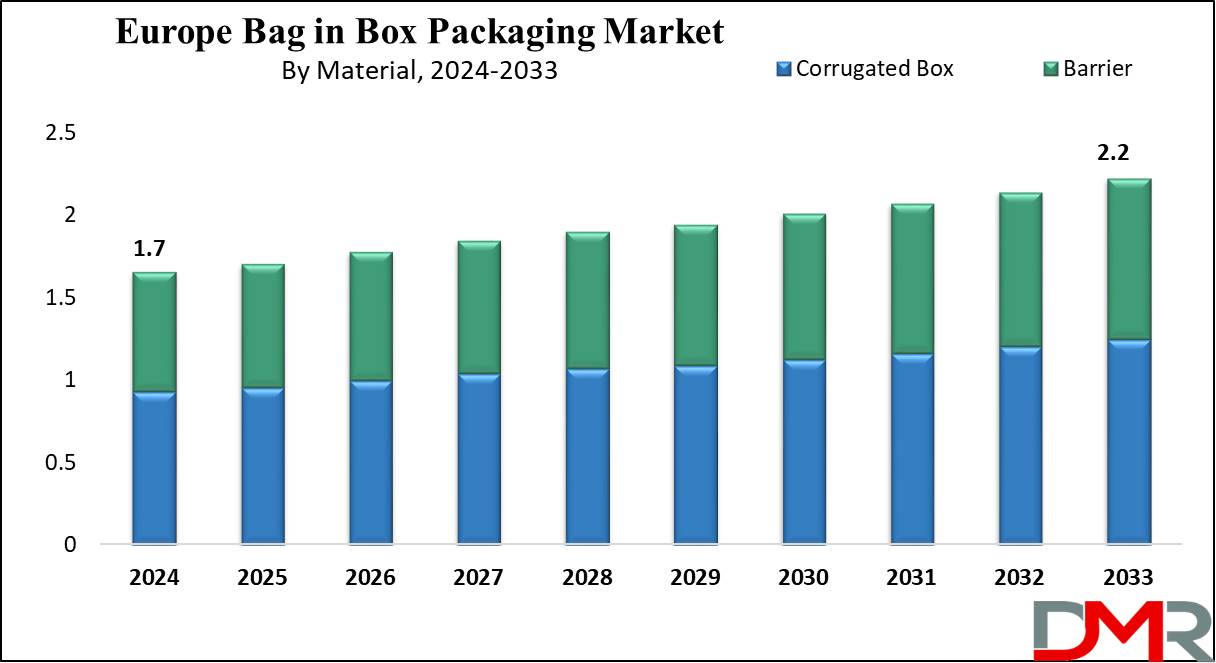

- The Europe Bag in Box Packaging Market is expected to grow by 0.5 billion, at a CAGR of 3.3% during the forecasted period of 2024-2033.

- By Capacity, the 1 to 5-liter segment is expected to lead in 2024 & is anticipated to dominate throughout the forecasted period.

- By Material, Corrugated box is anticipated to drive the growth of the fast fashion market.

- By Barrier, aluminum is predicted to be the dominant segment in the growth of the fast fashion market in Europe in 2024

- By End User, the food & beverage sector is expected to have a lead throughout the forecasted period.

- Some of the use cases of bag in box packaging include wine industry, soft drinks market, and more.

Use Cases

- Wine Industry: Bag-in-box packaging is highly favored by wine producers in Europe due to its ability to maintain product quality, minimize plastic usage, and offer affordable distribution. With the EU being a major wine producer, this packaging solution aligns well with sustainability goals & consumer preferences.

- Soft Drinks Market: Bag-in-box packaging provides a viable alternative for soft drink manufacturers in Europe, mainly in light of the EU's ban on single-use plastics. With its sustainable materials &efficient dispensing, it provides a compelling option for minimizing environmental impact while meeting consumer demand.

- Food Service Sector: Bag-in-box packaging is attaining traction in the food service industry across Europe, giving convenient solutions for storing & dispensing various liquids like sauces, syrups, and oils. Its practicality, along with minimal plastic usage and recyclability, appeals to businesses looking to streamline operations & reduce waste.

- E-commerce and Retail: Bag-in-box packaging is well-suited for e-commerce and retail applications in Europe, providing efficient shipping & storage solutions for a range of beverages and liquid products. Its stackability, lightweight design, & sustainability credentials make it an attractive choice for brands looking to enhance their packaging sustainability while optimizing logistics & shelf space.

Market Dynamic

The Bag-in-box packaging market in Europe is on growth, largely driven by wine packaging manufacturers' growing occurrence for this solution. Its advantages over traditional bottle packaging, like less

plastic usage and smoother dispensing, are allowing a slight shift among wine producers in Europe & North America, which is supported by the European Union's major role in global wine production and consumption. In addition, bag-in-box packaging is supported by its low oxygen transmission rate, allowing better wine quality and making it a leading choice for manufacturers worldwide.

However, despite its benefits, the adoption of bag-in-box packaging creates challenges. The higher initial cost in comparison to traditional alternatives creates a challenge, along with competition from low-cost plastic bottles in the soft drink sector. Moreover, fluctuations in raw material supply for bag-in-box containers are expected to restrain market growth in Europe during the forecast period.

Research Scope and Analysis

By Capacity

The 1 to 5-liter capacity range is expected to play a major role in driving the growth of the European Bag in Box Packaging Market, which meets a diverse array of products, like wines, juices, sauces, and liquid foods, meeting the needs of both consumers & businesses. The compact size makes it ideal for many applications, from retail shelves to e-commerce deliveries, providing convenience & versatility.

In addition, the 1 to 5-liter capacity range follows well with consumer numbers for fewer packaging sizes, promoting portion control and reducing wastage.

Moreover, the bag-in-box packaging is eco-friendly, with less plastic usage & recyclable materials, which resonates with the growth in demand for sustainable packaging solutions in Europe. As a result, this segment is expecting significant growth & driving innovation within the Europe Bag in Box Packaging Market.

By Material

Corrugated box materials are expected to dominate the growth of the European Bag in Box Packaging Market in 2024, as they are essential for bag-in-box packaging, as they provide durability, protection, and ease of handling during storage & transportation. Their strong construction ensures the integrity of the bag-in-box system, securing the contents from damage or leakage.

Moreover, these are lightweight & stackable, improving storage space & logistical efficiency, which is mainly helpful for e-commerce & retail distribution channels. In addition, the recyclable & eco-friendly nature of corrugated materials aligns with the increase in demand for sustainable packaging solutions in Europe, contributing to the market's growth. Also, these material improves the functionality, sustainability, and market appeal of bag-in-box packaging, driving adoption & innovation across the region.

By Barrier

The aluminum barrier is a main growth driver for the Europe Bag in Box Packaging Market throughout the forecasted period, acting as a main part of the bag-in-box packaging system, the aluminum barrier provides a better shield against oxygen & light, preventing the quality & freshness of the packaged contents, like wines, juices, and liquid foods. Its better barrier properties help expand the shelf life of products, creating longer-lasting freshness and reducing the risk of spoilage or degradation.

In addition, the aluminum barrier improves the sustainability profile of bag-in-box packaging by allowing lightweight designs and avoiding the need for additional protective layers, thereby reducing overall material usage & environmental impact, and contributing to overall growth within the European packaging industry.

By End User

The food & beverage sector is expected to lead the Europe Bag in Box Packaging Market throughout the forecasted period. Due to its versatility & practicality bag-in-box packaging meets different packaging requirements of the food & beverage industry. In the food sector, it provides better solutions for packaging liquid products like sauces, cooking oils, and condiments, providing suitable dispensing & portion control. For the beverage industry, mainly wine producers, bag-in-box packaging provides advantages like less plastic usage, more shelf life, and low-cost distribution.

Also, as sustainability becomes highly important to consumers & businesses alike, the eco-friendly features of bag-in-box packaging, like recyclability & lesser carbon footprint, align well with the sustainability goals of the food & beverage sector, further driving its adoption and growth of bag in box packaging market in Europe.

The Europe Bag in Box Packaging Market Report is segmented on the basis of the following

By Capacity

- Less than 1 Liter

- 1 to 5 Liters

- 6 to 10 Liters

- 11 to 15 Liters

- More than 15 Liters

By Material

By Barrier

- Aluminum

- Metalized PET

- Ethylene Vinyl Alcohol

- Polyamide

- Others (PDVC, metalized PP)

By End User

- Food & Beverage

- Industrial

- Household & Personal Care

European Country Analysis

The European Union ban on single-use plastics, like food & beverage packaging, aims to reduce environmental harm and cut down on the consumption of these materials, which is driving the need for bag-in-box beverage packaging, which uses sustainable materials like paperboard & recyclable plastic. Further a main member of the European Union, Germany is expected to lead in bag-in-box sales across the region, as its environmentally concerned consumer base prefers sustainable packaging, providing higher opportunities for manufacturers. Also, it is expected to contribute about one-fifth of bag-in-box sales in Europe over the next decade.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

By European Countries

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Competitive Landscape

The competitive landscape of the European Bag in Box Packaging Market is characterized by a mixture of manufacturers providing innovative solutions customized to the needs of many industries like food, beverage, and household products. Key factors driving competition like product quality, pricing strategies, sustainability initiatives, and distribution networks. In addition, players look to differentiate themselves through technological developments, customer service, and market penetration strategies.

Some of the prominent players in the Europe Bag in Box Packaging Market are

- Aran Packaging

- Peak Liquid Packaging

- DS Smith

- Smurfit Kappa

- Liqui-box

- Goglio SpA

- Optopack Ltd

- Amcor Plc

- Montibox

- Graficas Digraf Sl

- Other Key Players

Recent Developments

- In February 2024, Smurfit Kappa announced a major investment to scale up its Bag-in-Box capacity in Spain, by investing USD 58.8 million which would double the capacity of its Bag-in-Box Ibi plant in Alicante, which aims to enhance the sustainability of both the plant’s operations and its product portfolio.

- In December 2023, Smurfit Kappa developed a recyclable film to substitute nylon which is mainly used in bag-in-box products, as nylon is often used in bag-in-box packaging which needs extra protection, like, motor oil or detergents or large industrial-use food bags. Nylon is also sometimes chosen when there is mainly long or complex supply chain. The Smurfit Kappa Bag-in-Box has developed a polyethylene film that has similar properties to nylon, in terms of strength and resilience but, is different from nylon, due to recyclable.

- In December 2023, LIQUI MOLY introduced Bag-in-Box Packaging LIQUI MOLY with a 20-liter cartridge that provides many advantages. The company looks to live up to its excellent reputation as a high-quality lubricant brand made in Germany.

- In November 2023, Amazon announced that the company has achieved 100% recyclable delivery packaging in Europe, which includes all boxes, bags, and envelopes across all items sold by Amazon, along with the third-party selling partners that use Fulfilment by Amazon. The company outlined some of the sustainable packaging strategies it is piloting across Europe like padded envelopes made only with paper, reusable delivery bags, and incentives for selling partners to reduce their packaging.

- In October 2023, PPG announced that DYRUP Paint PPG introduced new “bag-in-a-box” packaging for its Dyrup Wall Extra Covering paint, made from 75% recyclable & biodegradable materials, as it focuses on sustainability and product development, along with continuously working to enhance its products and processes.

Report Details

| Report Characteristics |

| Market Size (2024) |

USD 1.7 Bn |

| Forecast Value (2033) |

USD 2.2 Bn |

| CAGR (2023-2032) |

3.3% |

| Historical Data |

2018 – 2023 |

| Forecast Data |

2024 – 2033 |

| Base Year |

2023 |

| Estimate Year |

2024 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Capacity (Less than 1 Liter, 1 to 5 Liters, 6 to 10 Liters, 11 to 15 Liters, and More than 15 Liters), By Material (Barrier and Corrugated Box), By Barrier (Aluminum, Metalized PET, Ethylene Vinyl Alcohol, Polyamide, and Others (PDVC, metalized PP)), By End User (Food & Beverage, Industrial, and Household & Personal Care) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA |

| Prominent Players |

Aran Packaging, Peak Liquid Packaging, DS Smith, Smurfit Kappa, Liqui-box, Goglio SpA, Optopack Ltd, Amcor Plc, Montibox, Graficas Digraf Sl, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |