Market Overview

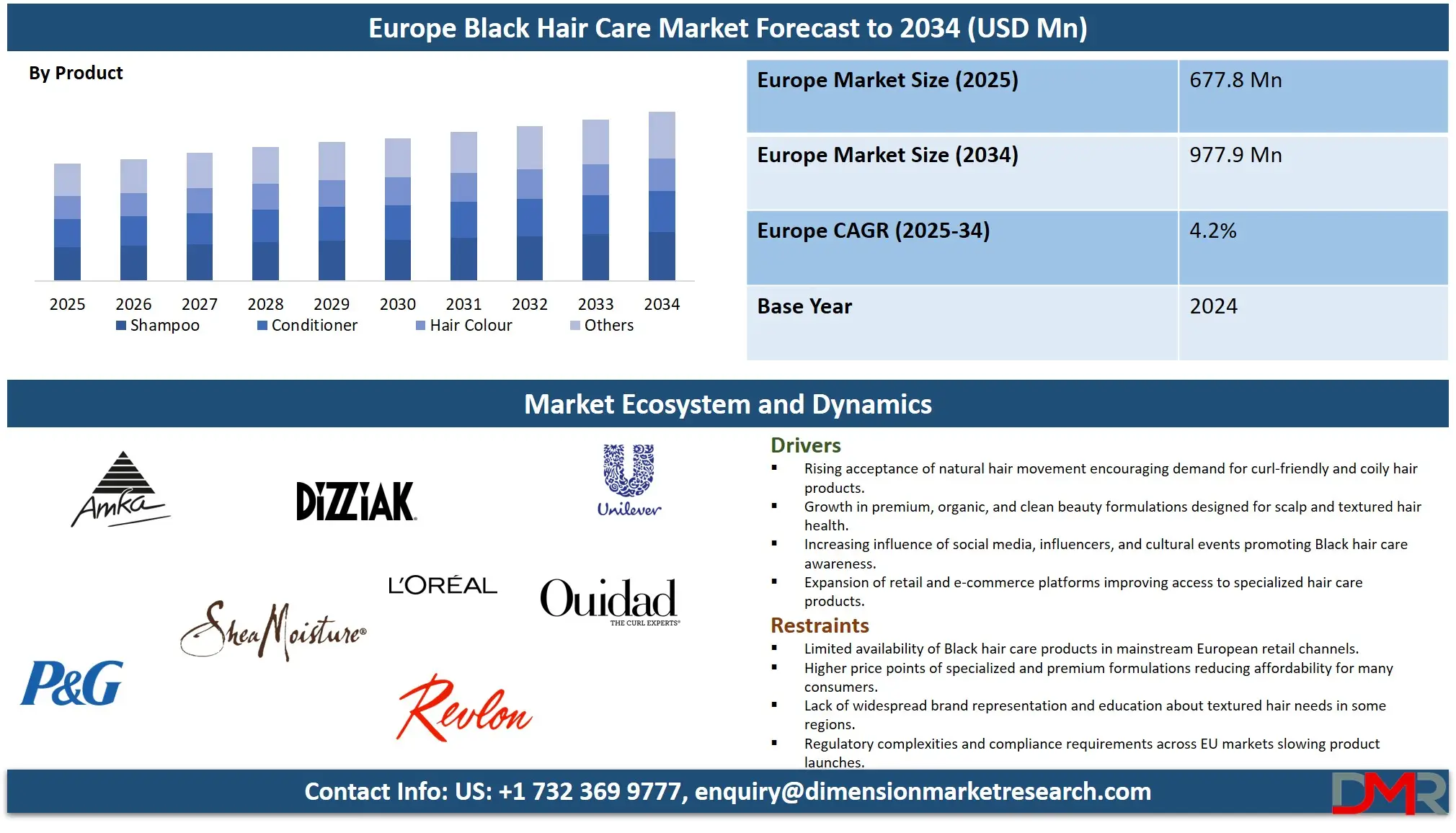

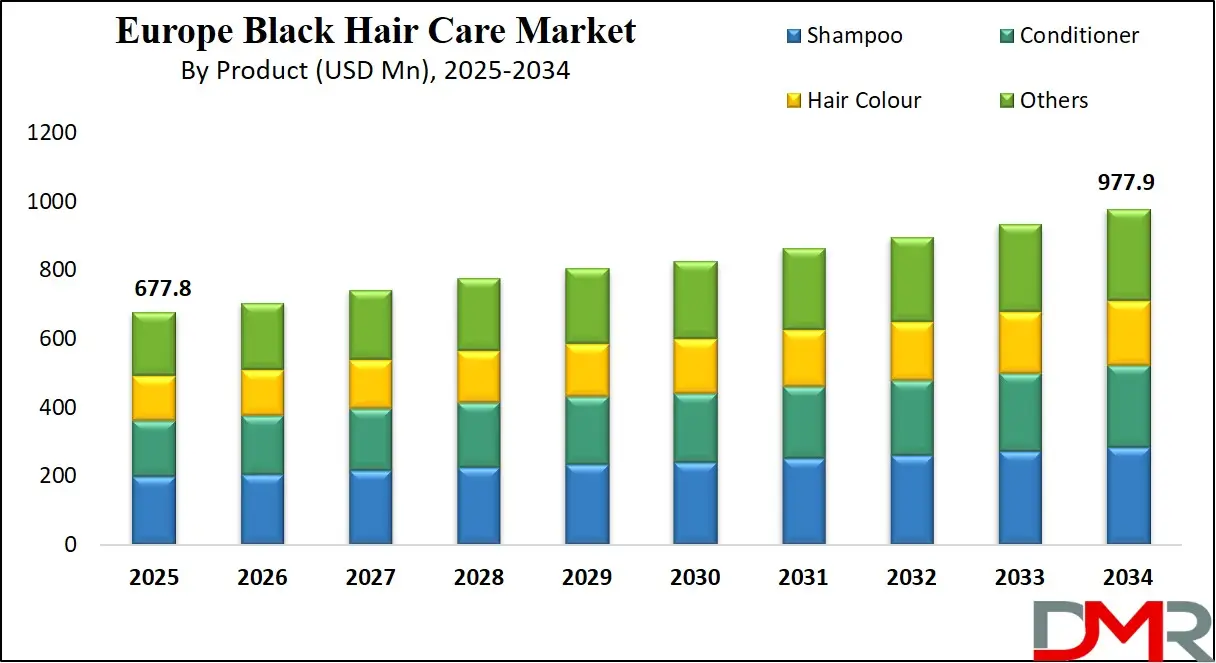

The Europe Black Hair Care Market size is projected to reach USD 677.8 million in 2025 and grow at a compound annual growth rate of 4.2% from there until 2034 to reach a value of USD 977.9 million.

Black Hair Care refers to the focus on the special needs of hair that is naturally curly, coily, or kinky, often found among Black people. This care emphasizes nourishing, styling, and maintaining hair that is sensitive to dryness and breakage. It includes products like deep conditioners, oils, and moisturizers made with natural ingredients such as shea butter or coconut oil, to support hair health beyond just appearance. It values textures and offers respectful care of natural hair traits.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

European brands increasingly use clean, plant-based ingredients and design products that care for both scalp and hair health. There is strong interest in sustainable packaging, natural formulas, and high-performance results. Brands are developing products customized for curl patterns and scalp conditions, even using tech tools to offer personal recommendations.

Recently, festivals and events celebrating natural hair have grown in popularity across Europe— especially in France—like the Natural Hair Academy and similar gatherings that highlight Black hair beauty and culture. Black-owned brands, such as those founded by stylists like Charlotte Mensah, have gained visibility and prestige, offering premium oils and products that nurture textured hair.

This shift reflects increasing recognition of natural textures and the need for inclusive care. As more people seek hair care that respects their identity and improves hair health, markets respond with better products and services. This progress boosts representation, offers more choice, and supports both traditional salons and new consumer-focused brands in Europe.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Europe Black Hair Care Market: Key Takeaways

- Market Growth: The Europe Black Hair Care Market size is expected to grow by USD 274.9 million, at a CAGR of 4.2%, during the forecasted period of 2026 to 2034.

- By Product: The Shampoo segment is anticipated to get the majority share of the Europe Black Hair Care Market in 2025.

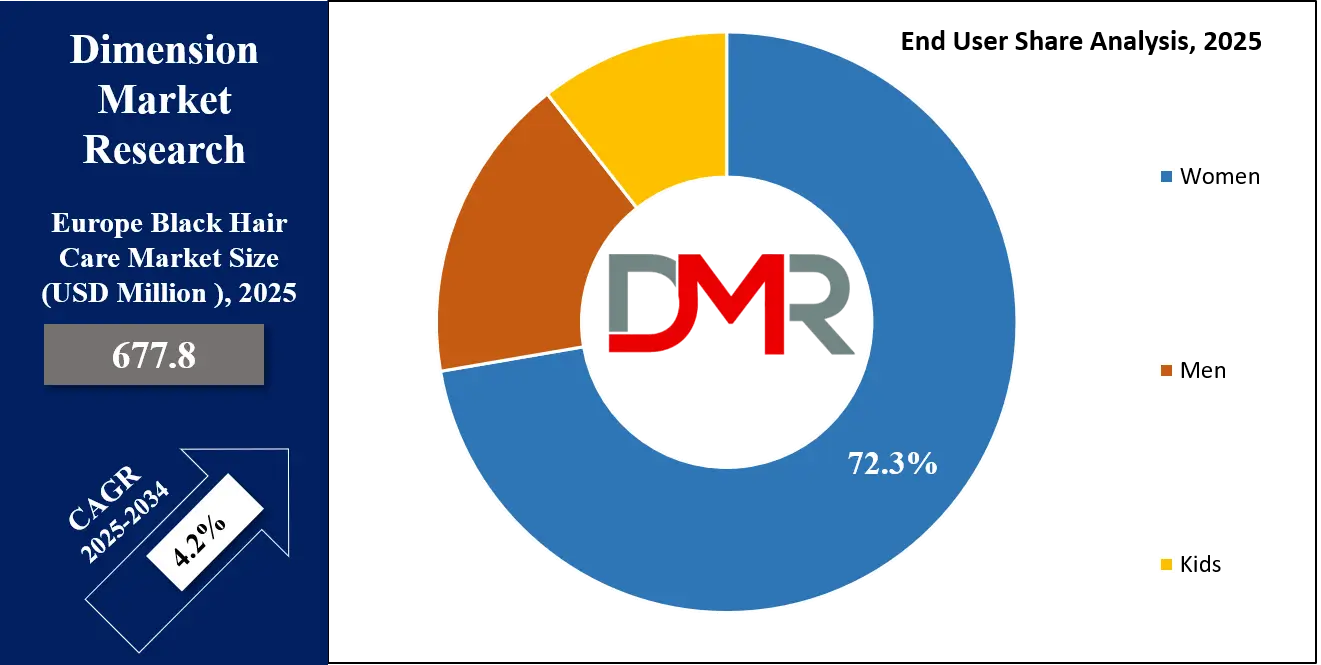

- By End User: The Women segment is expected to get the largest revenue share in 2025 in the Europe Black Hair Care Market.

- Use Cases: Some of the use cases of Black Hair Care include scalp health care, protective styling support, and more.

Europe Black Hair Care Market: Use Cases

- Moisture & Hydration Needs: Products are used to deeply hydrate curly and coily hair, preventing dryness and breakage caused by Europe’s colder climates and hard water conditions.

- Protective Styling Support: Specialized creams, gels, and oils help maintain braids, twists, and other protective hairstyles while reducing scalp stress and promoting hair growth.

- Scalp Health Care: Shampoos and treatments are designed to balance scalp oils, soothe irritation, and address issues like dandruff that are more common with textured hair.

- Natural Hair Movement Influence: Rising embrace of natural textures encourages use of curl-defining creams and leave-in conditioners that highlight natural curls without chemical straightening.

Market Dynamic

Driving Factors in the Europe Black Hair Care Market

Rising Awareness and Acceptance of Natural Hair

of the main growth drivers of the Europe Black Hair Care market is the increasing acceptance of natural textures and hairstyles. More consumers are moving away from chemical relaxers and straightening treatments, choosing instead to embrace curls, coils, and braids. This has created a surge in demand for products that enhance natural styles, such as curl creams, leave-in conditioners, and oils. Social media platforms and community-driven events also promote confidence in natural hair, encouraging people to invest in specialized products. This cultural shift continues to shape the market and drives long-term growth.

Innovation in Product Formulation and Sustainability

Another important driver is the strong innovation trend in product development across Europe. Consumers are looking for clean, safe, and eco-friendly solutions made with plant-based and organic ingredients. This demand has pushed both established and emerging brands to reformulate products, reducing harmful chemicals while improving performance for textured hair.

At the same time, interest in sustainable packaging and ethical sourcing has grown, aligning with wider European consumer values. These advancements not only attract a loyal customer base but also open opportunities for premium-priced products, further boosting the market’s overall expansion.

Restraints in the Europe Black Hair Care Market

Limited Availability and Distribution Challenges

A major restraint in the Europe Black Hair Care market is the limited availability of specialized products across mainstream retail stores. Many consumers still struggle to find the right shampoos, conditioners, and oils for textured hair in local supermarkets or pharmacies. This often forces reliance on niche stores, salons, or online shopping, which can be less convenient. Limited shelf space in larger retail chains reduces visibility and slows down broader adoption. As a result, access barriers prevent the market from reaching its full potential across different European regions.

High Price Sensitivity and Affordability Issues

Another challenge is the higher cost of Black hair care products compared to standard hair care items. Specialized formulations with natural and premium ingredients often come at a higher price point, making them less affordable for a wider group of consumers. Price sensitivity is particularly significant in Eastern and Southern Europe, where income levels may not support frequent purchases of premium products. This restricts market growth and creates a gap between consumer needs and purchasing power. Balancing quality with affordability remains a key hurdle for long-term expansion.

Opportunities in the Europe Black Hair Care Market

Expansion of Online and Direct-to-Consumer Channels

One key opportunity for the Europe Black Hair Care market is the rapid rise of e-commerce and direct-to-consumer platforms. Online shopping gives brands the ability to reach diverse customer bases across different countries without heavy reliance on traditional retail. This channel allows for personalized marketing, subscription services, and access to a wider variety of products. Social media and influencer marketing also make it easier to build trust and community engagement. As digital adoption grows, online sales present strong potential to increase accessibility and market share.

Growing Demand for Inclusive and Customized Solutions

Another opportunity lies in the increasing call for inclusivity and personalized hair care. Consumers want products that match specific curl patterns, scalp conditions, and lifestyle needs, which opens space for targeted product lines. Brands can expand by offering ranges tailored to different textures, from loose curls to tight coils.

Customization through hair quizzes, AI-based recommendations, and salon partnerships can further strengthen consumer loyalty. With inclusivity becoming a core value in Europe, companies that meet these diverse needs can establish long-term growth and brand recognition.

Trends in the Europe Black Hair Care Market

Focus on Scalp Health and Science-Driven Formulas

There’s a rising spotlight on the scalp as a key part of healthy hair routines. Brands are now offering products enriched with targeted ingredients like salicylic acid, probiotics, and antioxidants to address dryness, irritation, and damage from pollution or hard water. This “skinification” of haircare reflects a shift toward personalized and science-backed solutions designed specifically for textured hair types. Consumers are responding positively to this more technical, health-oriented approach.

Inclusive Representation and Natural Texture Embrace

Europe has seen a growing emphasis on inclusive beauty that honors and supports natural hair textures. The natural hair movement continues to extend its reach, encouraging brands to create ranges tailored for waves, curls, coils, and kinks and to celebrate diversity in beauty. This trend is evident in product launches, marketing campaigns, and community events that promote self-expression and pride.

- Personalized Product Recommendations: AI-powered tools analyze hair type, texture, and scalp condition to suggest tailored shampoos, conditioners, and oils, improving consumer satisfaction and brand loyalty.

- Virtual Hair Care Consultations: AI-driven apps and chatbots allow users to get instant advice on routines, styles, and product usage, reducing the gap between salons and at-home care.

- Trend Prediction and Consumer Insights: AI helps brands track online conversations, social media trends, and consumer reviews, enabling them to design products that match changing demands for natural and sustainable solutions.

- Smart E-commerce Experience: AI enhances online shopping with recommendation engines, subscription reminders, and visual try-on tools, making digital platforms more engaging and personalized.

- Research and Product Innovation: By analyzing large data sets on ingredients and performance, AI speeds up the development of clean, effective, and scalp-safe products specifically suited for textured and coily hair.

Research Scope and Analysis

By Product Analysis

Shampoo segment will be leading in 2025 with a share of 28.9% and plays a vital role in shaping the growth of the Europe Black Hair Care Market. For textured, curly, and coily hair, shampoos are not just cleansing products but are formulated to maintain moisture, reduce dryness, and protect natural oils. Growing consumer preference for sulfate-free, hydrating, and scalp-friendly shampoos is driving strong adoption, especially in Western Europe where innovation and premium offerings are expanding quickly.

The segment also benefits from rising demand for natural ingredients like shea butter, aloe vera, and coconut oil that address breakage and scalp sensitivity. With increasing awareness about scalp health, product diversity, and greater accessibility through both retail and online channels, shampoos are expected to remain a key growth driver across the region.

Hair oil segment is having significant growth over the forecast period and is set to be one of the most dynamic product categories within the Europe Black Hair Care Market. Oils are deeply tied to cultural practices and hair maintenance routines, offering nourishment, shine, and protection against dryness common in coily and curly textures.

Consumers increasingly prefer lightweight, non-greasy, and natural blends enriched with argan, jojoba, and castor oils that improve scalp health while reducing breakage. The segment benefits from the popularity of pre-shampoo treatments, hot oil therapies, and styling support, making it versatile for daily care. With the rise of natural hair movement and preference for clean beauty, hair oils are gaining steady traction, strengthening their role in the overall market expansion.

By End User Analysis

Women segment will be leading in 2025 with a share of 72.3% and will continue to drive the expansion of the Europe Black Hair Care Market. Women are the primary consumers of products designed for textured, curly, and coily hair, ranging from shampoos and conditioners to oils, creams, and styling treatments. Increased focus on natural hair care routines and rising participation in the natural hair movement have boosted demand for premium and specialized products.

Women are also more engaged in experimenting with protective styles, color treatments, and scalp-focused solutions, which creates consistent demand across product categories. Social media trends, beauty influencers, and community events further encourage women to adopt new products and practices. With wider retail availability and digital channels making access easier, women remain the most influential group shaping market growth.

Men segment is having significant growth over the forecast period and is set to become an important end-user group within the Europe Black Hair Care Market. Rising awareness among men about scalp health, grooming, and textured hair care routines is expanding product demand. Men increasingly seek specialized shampoos, conditioners, and styling gels that cater to curls, waves, and protective hairstyles, moving beyond traditional grooming habits.

The growing popularity of beard and hair care combinations also supports market growth in this segment. Digital platforms, barbershops, and influencer-led campaigns play a big role in educating men about tailored solutions. With more men embracing natural hair styles and focusing on healthy maintenance, this segment is expected to capture stronger market share in the coming years.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

By Distribution Channel Analysis

Retail stores segment will be leading in 2025 with a share of 37.2% and will play a central role in the growth of the Europe Black Hair Care Market. Physical outlets such as supermarkets, hypermarkets, and specialty beauty stores give customers the chance to explore, test, and compare a wide variety of products designed for curly, coily, and textured hair. Many shoppers prefer in-store purchases for immediate availability and professional advice from sales staff, especially for premium and specialized items.

Retail stores also provide visibility to both global and local brands, helping them build trust among consumers. With frequent product launches, promotional campaigns, and shelf expansions dedicated to textured hair solutions, this channel remains a powerful driver of sales and continues to strengthen consumer confidence across diverse markets in Europe.

Online platform segment is having significant growth over the forecast period and is set to reshape distribution in the Europe Black Hair Care Market. Digital channels make it easier for consumers to access niche and specialized products that are often not widely available in physical stores. E-commerce platforms and brand-owned websites offer a broader range, quick delivery, and personalized shopping experiences supported by reviews and recommendations.

Social media marketing and influencer collaborations further boost awareness, guiding buyers toward tailored solutions for textured hair. Subscription services and discounts also encourage repeat purchases. With growing digital adoption and convenience as a priority, the online platform segment is expected to secure stronger market share and drive wider accessibility in the coming years.

The Europe Black Hair Care Market Report is segmented on the basis of the following:

By Product

- Shampoo

- Conditioner

- Hair Oil

- Others

By End User

By Distribution Channel

- Hypermarket/Supermarket

- Online Platform

- Retail Stores

European Countries Analysis

European countries segment is having significant growth over the forecast period and will play a vital role in driving the overall expansion of the Europe Black Hair Care Market. Nations such as the United Kingdom, France, and Germany are expected to lead demand with strong urban populations and diverse communities seeking textured hair solutions.

Southern and Eastern European countries are also estimated to contribute steadily as awareness and accessibility of specialized shampoos, conditioners, oils, and styling products expand. Growing influence of natural hair movement, rising consumer spending on premium formulations, and the spread of online platforms across these regions are expected to boost adoption and strengthen market growth further.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

By Countries

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Competitive Landscape

In Europe’s market for hair care specially made for textured, curly, or coily hair, competition is mostly dominated by a few large entrants from the broader hair-care industry, while a growing number of smaller, niche brands that focus on natural formulas and sustainability are gaining attention. The big players rely heavily on innovation, marketing, research, and extensive distribution networks to defend their market share.

At the same time, smaller newcomers are carving out space by offering eco-friendly packaging, plant-based ingredients, and products tailored to specific hair textures. This makes the market both consolidated and dynamic, blending the reach of large-scale brands with the fresh appeal of more focused offerings.

Some of the prominent players in the global Europe Black Hair Care are:

- L’Oreal

- Unilever

- Revlon

- Procter & Gamble

- Ouidad

- Shea Moisture

- Afrocenchix

- Uhuru Naturals

- Amka Products

- Alodia Hair Care

- Bouclème

- Flora & Curl

- Charlotte Mensah

- Dizziak

- Equi Botanics

- Trepadora

- Holy Curls

- Nylah's Naturals

- Nala’s Baby

- Other Key Players

Recent Developments

- August 2025, Cliff Vmir announced that his FEMMÈ hair care line, which rose to viral fame on TikTok, will now be distributed nationwide. The brand has built strong momentum through TikTok Shop, where it quickly gained popularity among users. In addition to its digital success, FEMMÈ is also expanding into over 250 beauty supply stores, strengthening its retail presence and making the products more accessible to a wider audience across different regions.

- January 2025, Magic Sleek announced that its hair care products are the first and only ones approved by OSHA, the FDA, and the European Union. As the company stated, its mission is to offer a safer, healthier choice in the hair industry. She emphasized commitment to both exceptional results and strict safety standards, highlighting pride in being the only brand fully compliant while delivering smooth, manageable, and worry-free hair treatments.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 677.8 Mn |

| Forecast Value (2034) |

USD 977.9 Mn |

| CAGR (2025–2034) |

4.2% |

| Historical Data |

2019 – 2024 |

| Forecast Data |

2026 – 2034 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Product (Shampoo, Conditioner, Hair Oil, and Others), By End User (Men, Women, and Kids), By Distribution Channel (Hypermarket/Supermarket, Online Platform, and Retail Stores) |

| Regional Coverage |

North America – US, Canada; Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA |

| Prominent Players |

L’Oreal, Unilever, Revlon, Procter & Gamble, Ouidad, Shea Moisture, Afrocenchix, Uhuru Naturals, Amka Products, Alodia Hair Care, Bouclème, Flora & Curl, Charlotte Mensah, Dizziak, Equi Botanics, Trepadora, Holy Curls, Nylah's Naturals, Nala’s Baby, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |

Frequently Asked Questions

How big is the Europe Black Hair Care Market?

▾ The Europe Black Hair Care Market size is expected to reach a value of USD 677.8 million in 2025 and is expected to reach USD 977.9 million by the end of 2034.

Who are the key players in the Europe Black Hair Care Market?

▾ Some of the major key players in the Europe Black Hair Care Market are L’Oreal, Unilever, Revlon, and others

What is the growth rate in Europe Black Hair Care Market?

▾ The market is growing at a CAGR of 4.2 percent over the forecasted period.