Market Overview

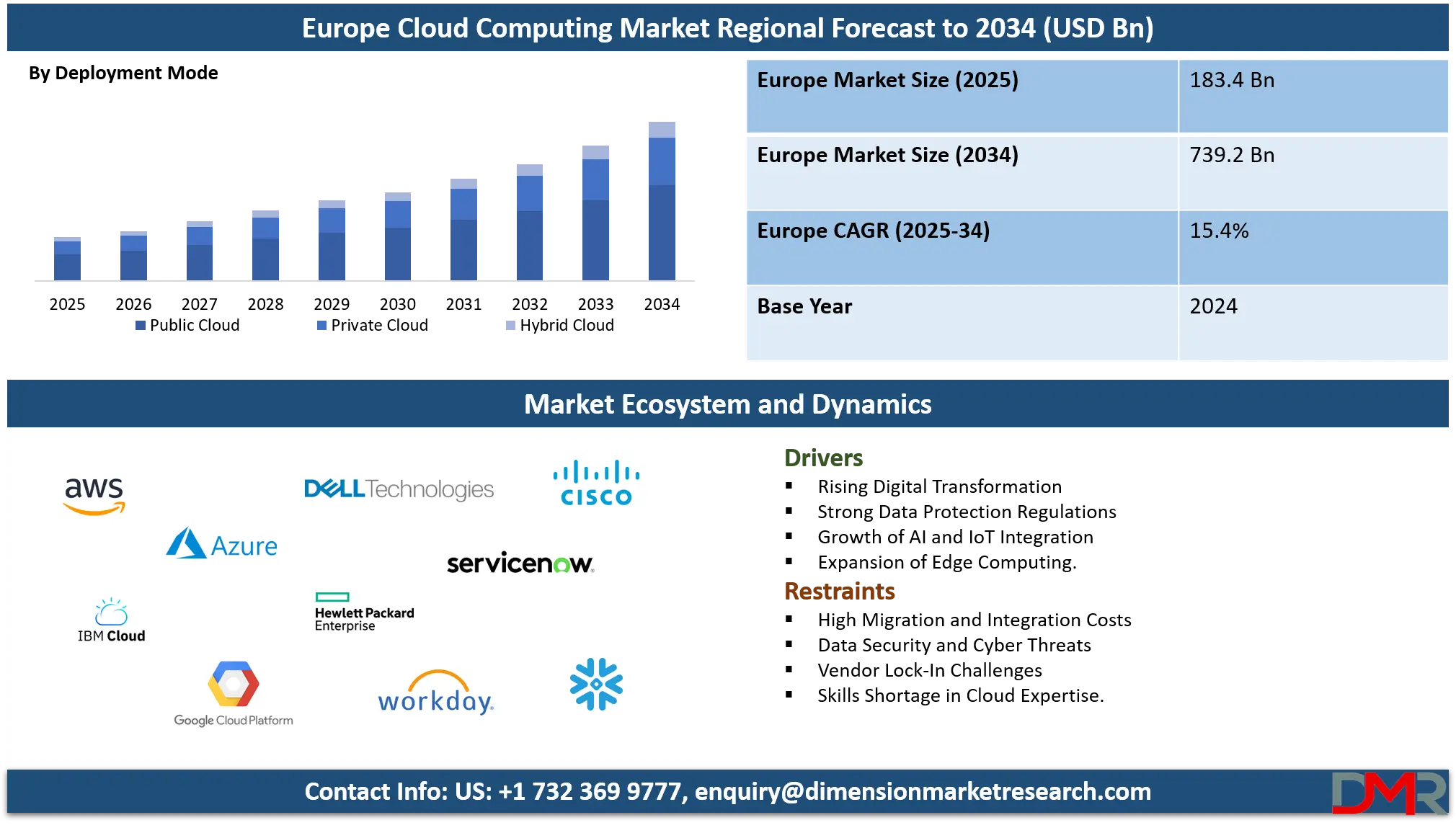

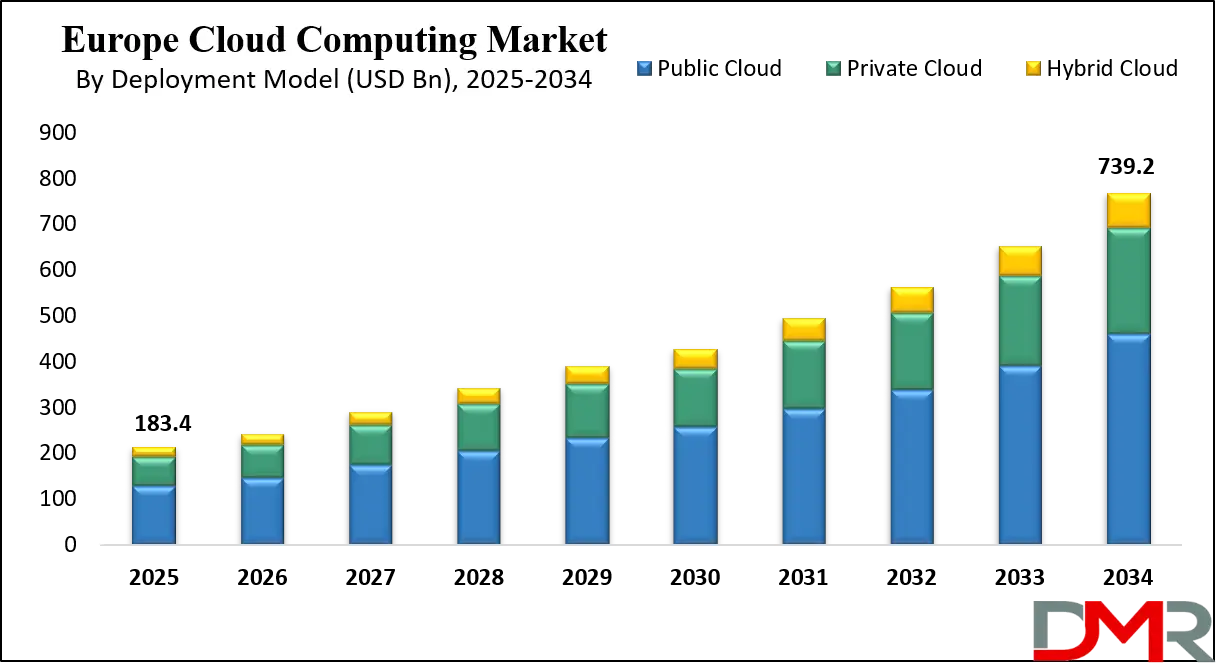

The Europe cloud computing market is projected to reach USD 183.4 billion in 2025 and further expand to USD 739.2 billion by 2034, growing at a CAGR of 15.4%, driven by rising adoption of SaaS, hybrid cloud solutions, AI integration, and increasing demand for scalable digital infrastructure across industries.

Cloud computing refers to the delivery of computing resources such as storage, processing power, networking, software, and analytics over the internet on a pay-as-you-go basis. Instead of maintaining physical servers and infrastructure, businesses and individuals can access scalable and flexible services hosted on remote data centers. This model enhances operational efficiency, reduces costs, and allows organizations to innovate faster by providing seamless access to advanced technologies such as artificial intelligence, big data, and machine learning through cloud platforms.

The Europe cloud computing market is witnessing robust growth driven by the rapid adoption of digital transformation strategies across industries such as banking, retail, healthcare, and manufacturing. Enterprises are increasingly migrating to cloud platforms to achieve agility, strengthen data security, and support hybrid work environments. The region’s emphasis on GDPR compliance, combined with the rising demand for sovereign cloud solutions, is shaping a distinct ecosystem where trust, data protection, and innovation converge to meet business needs.

Furthermore, the European market is expanding due to government initiatives promoting cloud-first strategies, investments in local data centers, and collaborations with hyperscale providers. Small and medium-sized enterprises are embracing cloud services to improve competitiveness, while larger organizations leverage multi-cloud and hybrid deployments for resilience and scalability. With increasing reliance on edge computing, IoT integration, and AI-powered cloud applications, the market is evolving into a critical enabler of Europe’s digital circular economy, digital economy, and long-term technological competitiveness.

Europe Cloud Computing Market: Key Takeaways

- Market Value: The Europe Cloud Computing market size is expected to reach a value of USD 739.2 billion by 2034 from a base value of USD 183.4 billion in 2025 at a CAGR of 15.4%.

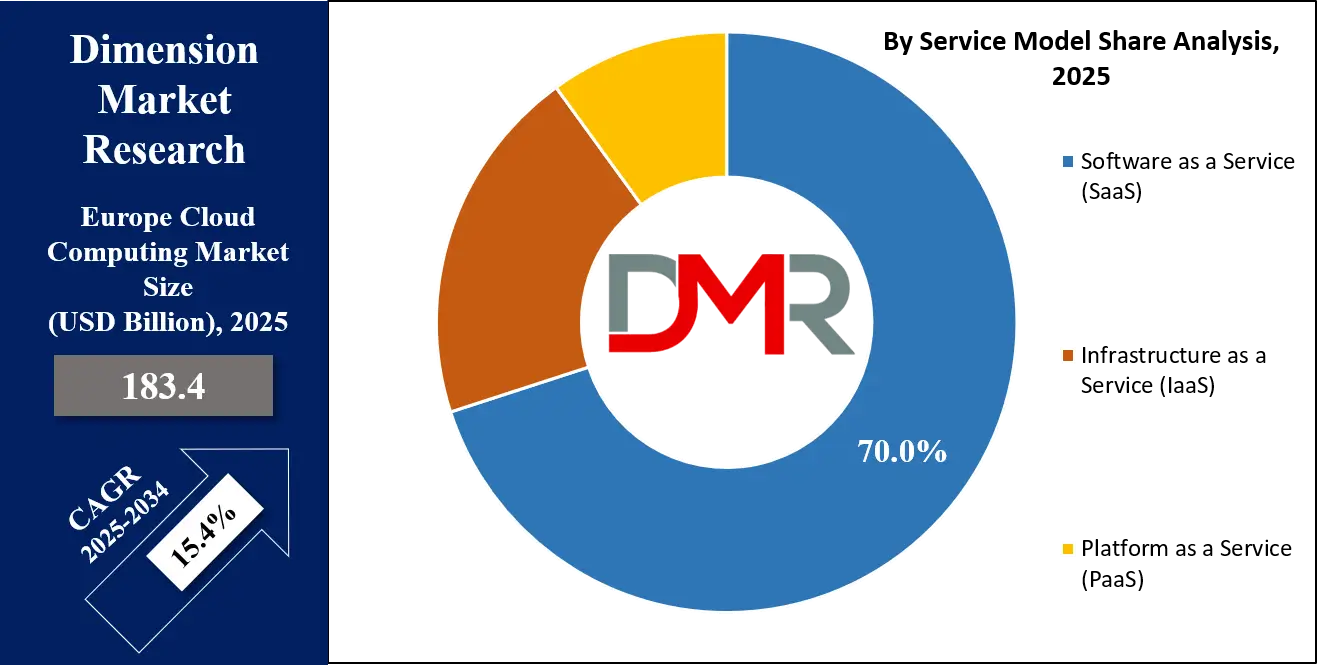

- By Service Model Segment Analysis: Software as a Service (SaaS) is anticipated to dominate the service model segment, capturing 70.0% of the total market share in 2025.

- By Deployment Model Segment Analysis: Public Cloud is expected to maintain its dominance in the deployment model segment, capturing 60.0% of the total market share in 2025.

- By Organization Size Analysis: Large Enterprises will dominate the organization size, capturing 72.0% of the market share in 2025.

- By Industry Vertical Segment Analysis: The BFSI industry will account for the maximum share in the industry vertical segment, capturing 27.0% of the total market value.

- Key Players: Some key players in the Europe Cloud Computing market are Amazon Web Services (AWS), Microsoft Azure, Google Cloud Platform (GCP), IBM Cloud, Oracle Cloud, Alibaba Cloud, Salesforce, SAP, VMware, Dell Technologies, Hewlett Packard Enterprise (HPE), Cisco Systems, Fujitsu, Rackspace Technology, Tencent Cloud, Baidu AI Cloud, Huawei Cloud, DigitalOcean, Snowflake, and Others.

Europe Cloud Computing Market: Use Cases

- Healthcare Data Management and Patient Care: In Europe, cloud computing enables healthcare organizations to securely store, manage, and analyze vast amounts of patient data. Hospitals and clinics use cloud-based electronic health records to improve accessibility and ensure compliance with GDPR. Cloud platforms also facilitate telemedicine and remote patient monitoring, helping doctors provide real-time care across different regions. The scalability of cloud services supports medical research, AI-powered diagnostics, and collaboration among healthcare providers, strengthening the continent’s digital health ecosystem.

- Financial Services and Digital Banking: The European financial sector leverages cloud computing to enhance digital banking, fraud detection, and customer experience. Banks use cloud platforms for real-time transaction monitoring, risk management, and regulatory reporting. The flexibility of hybrid and multi-cloud models ensures security and resilience while handling sensitive data under strict European compliance standards. Cloud adoption also supports the rise of fintech solutions, mobile payments, and AI-driven financial advisory services, fostering innovation in Europe’s financial landscape.

- Manufacturing and Smart Industry: Cloud computing supports Europe’s manufacturing sector by enabling smart factories, predictive maintenance, and supply chain optimization. Manufacturers use cloud-based IoT platforms to collect and analyze real-time data from connected machines, improving efficiency and reducing downtime. Cloud-driven digital twins are increasingly applied for product simulation and lifecycle management. These innovations align with Europe’s Industry 4.0 strategy, helping companies remain globally competitive while integrating automation, robotics, and advanced analytics into production systems.

- Government and Public Sector Services: European governments are adopting cloud computing to enhance public sector efficiency, citizen engagement, and data-driven decision-making. Cloud platforms allow agencies to securely store and process sensitive public records while adhering to sovereignty and compliance requirements. Public administrations are also using cloud services to support smart city initiatives, e-government portals, and digital identity programs. This transformation promotes transparency, reduces operational costs, and accelerates digital transformation across public institutions in Europe.

Impact of Artificial Intelligence on the Europe Cloud Computing Market

Artificial intelligence is reshaping the Europe cloud computing market by enhancing automation, scalability, and intelligent decision-making across industries. Cloud providers in the region are integrating AI capabilities into their platforms to support advanced analytics, natural language processing, and machine learning applications. This integration enables businesses to optimize operations, improve customer experiences, and drive innovation in sectors such as finance, healthcare, retail, and manufacturing. The growing demand for AI-powered cloud services is accelerating multi cloud adoption, boosting data center investments, and strengthening Europe’s digital transformation initiatives.

Europe Cloud Computing Market: Stats & Facts

Eurostat – Cloud Computing Use by Enterprises

- 2023: 45.2 % of EU enterprises purchased cloud computing services.

- 2023: This represented an increase of 4.2 percentage points compared to 2021.

- 2023: 99 % of EU enterprises with 10+ employees had internet access.

Eurostat – Sophisticated / Intermediate Cloud Services

- 2023: 39 % of EU businesses used sophisticated or intermediate cloud computing services such as ERP, CRM, hosted databases, or computing platforms.

Eurostat – Advanced Technology Adoption

- 2023: 55 % of EU enterprises used at least one advanced technology, including AI, cloud computing, or data analytics.

Eurostat – Cloud Use by Enterprise Size

- 2023: 77.6 % of large enterprises used cloud services.

- 2023: 59 % of medium enterprises used cloud services.

- 2023: 41.7 % of small enterprises used cloud services.

Eurostat – Alternate Business Size Measure

- 2023: 78 % of large enterprises purchased cloud services.

- 2023: 44 % of SMEs purchased cloud services.

Eurostat – Common Cloud Service Uses

- 2023: 82.7 % of cloud-using enterprises used cloud for email systems.

- 2023: 68.0 % used cloud for file storage.

- 2023: 66.3 % used cloud for office software.

Eurostat – Other Cloud Service Uses

- 2023: 61.0 % used cloud for security software.

- 2023: 51.6 % used cloud for finance and accounting applications.

- 2023: 43.0 % used cloud for hosting databases.

- 2023: 26.1 % used cloud for development, testing, or deployment platforms.

- 2023: 25.9 % used cloud for ERP software.

- 2023: 25.4 % used cloud for computing power to run own software.

- 2023: 25.0 % used cloud for CRM software.

Europe Cloud Computing Market: Market Dynamics

Europe Cloud Computing Market: Driving Factors

Rising Digital Transformation Initiatives

The Europe cloud computing market is being driven by widespread digital transformation programs across industries such as healthcare, retail, and financial services. Enterprises are adopting cloud platforms to modernize IT infrastructure, improve operational efficiency, and reduce dependency on legacy systems. The increasing need for hybrid work solutions and seamless connectivity further accelerates the adoption of cloud services across the region.

Strong Regulatory Framework and Data Sovereignty

Europe’s focus on GDPR compliance and sovereign cloud solutions is a major growth driver. Organizations are seeking cloud platforms that guarantee data privacy, transparency, and security. This regulatory emphasis has encouraged partnerships between global hyperscalers and European providers, ensuring trust while supporting the region’s innovation-driven digital economy.

Europe Cloud Computing Market: Restraints

Concerns over Data Security and Cyber Threats

Despite advanced frameworks, concerns regarding data breaches, ransomware, and cyberattacks remain a significant barrier. Businesses hesitate to fully transition to the cloud due to fears of losing sensitive data, particularly in sectors like banking and government, where compliance standards are extremely strict.

High Migration and Integration Costs

The cost and complexity of migrating workloads from on-premises infrastructure to cloud platforms act as a restraint. Many enterprises face challenges in integrating multi-cloud or hybrid environments with existing systems, leading to delays and increased expenditure.

Europe Cloud Computing Market: Opportunities

Expansion of Edge Computing and IoT Integration

The rising use of IoT devices across industries provides significant opportunities for the Europe cloud computing market. Edge computing powered by cloud platforms enables real-time processing closer to the source, reducing latency and improving efficiency. This trend is especially relevant for sectors such as smart cities, connected cars, and manufacturing.

Growing Role of AI-Powered Cloud Services

AI-enabled cloud solutions are creating new opportunities by supporting predictive analytics, natural language processing, and automation. Businesses across Europe are leveraging these services to enhance customer engagement, streamline operations, and improve decision-making processes. This integration of AI with cloud services is becoming a catalyst for innovation.

Europe Cloud Computing Market: Trends

Adoption of Multi Cloud and Hybrid Strategies

European enterprises are increasingly shifting toward multi cloud and hybrid models to avoid vendor lock-in, ensure compliance, and achieve greater flexibility. This trend supports resilience and scalability, particularly for organizations operating across multiple countries with varying regulations.

Focus on Green Cloud and Sustainability

Sustainability is emerging as a key trend in Europe’s cloud computing market. Cloud providers are investing in renewable energy-powered data centers and energy-efficient solutions to meet the region’s climate goals. This green cloud movement aligns with the European Union’s sustainability agenda and is becoming a differentiating factor for providers.

Europe Cloud Computing Market: Research Scope and Analysis

By Service Model Analysis

Platform as a Service is expected to dominate the service model segment in the Europe cloud computing market, accounting for nearly 70.0 percent of the total share in 2025. This growth is supported by the increasing demand for rapid application development, cost efficiency, and flexibility offered by PaaS solutions. Enterprises across industries are relying on PaaS platforms to build, test, and deploy applications without the burden of managing underlying infrastructure.

The scalability of PaaS allows organizations to adapt quickly to market changes, while integrated tools for analytics, database management, and AI services enable faster innovation. In addition, startups and SMEs in Europe are increasingly adopting PaaS due to its pay-as-you-go model, which minimizes upfront investments and accelerates digital transformation.

Metal multilayer actuators in this segment are leveraged as advanced technologies integrated within cloud infrastructure and data center environments. These actuators are vital for enhancing performance, precision, and reliability in hardware systems that support cloud services. Their role becomes increasingly important as PaaS platforms demand high efficiency in storage, cooling, and energy utilization. By contributing to optimized hardware functioning, metal multilayer actuators indirectly improve the overall performance and sustainability of cloud operations in Europe.

By Deployment Model Analysis

Public cloud is projected to maintain its dominance in the deployment model segment, securing nearly 60.0% of the total market share in Europe by 2025. The growth of public cloud services is driven by their scalability, cost-effectiveness, and accessibility, which appeal to businesses of all sizes. Enterprises benefit from reduced infrastructure expenses, faster deployment of applications, and flexible pay-per-use models that support diverse workloads.The rise of SaaS platforms, collaboration tools, and digital-first strategies across industries such as retail, healthcare, and financial services further strengthen the position of the public cloud.

Additionally, European governments and SMEs are embracing public cloud to achieve operational agility and digital innovation while leveraging compliance-focused solutions offered by global hyperscalers and regional providers. Private cloud in this segment serves organizations with strict data security, regulatory, and customization requirements. Large enterprises, banks, and public institutions in Europe often choose private cloud deployments to maintain greater control over sensitive information and ensure compliance with GDPR and data sovereignty laws.

Private cloud environments provide higher levels of customization, performance optimization, and integration with existing systems, making them suitable for critical operations. Although adoption levels are lower compared to public cloud, private cloud remains an essential model for industries that prioritize governance, privacy, and seamless hybrid cloud integration.

By Organization Size Analysis

Large enterprises are expected to dominate the organization size segment of the Europe cloud computing market, accounting for nearly 72.0% of the total share in 2025. Their leadership stems from strong financial capabilities, advanced IT infrastructures, and the ability to invest in large-scale cloud deployments. These organizations often adopt hybrid and multi cloud strategies to ensure resilience, scalability, and compliance across multiple regions.

Industries such as banking, healthcare, and manufacturing are leading adopters, using cloud platforms to enhance efficiency, drive digital transformation, and support global operations. The focus on AI integration, data analytics, and cybersecurity within large enterprises further reinforces their dominance in this segment.

Small and medium enterprises in this market are increasingly embracing cloud computing to reduce upfront infrastructure costs and access enterprise-grade technologies. Cloud adoption allows SMEs to scale operations, deploy digital solutions, and enhance customer experiences without heavy capital expenditure. Many European SMEs prefer SaaS and PaaS models due to their affordability and ease of integration with existing processes.

The availability of localized cloud services and pay-as-you-go pricing models is helping SMEs overcome budget constraints while driving innovation and competitiveness. Although their market share is smaller compared to large enterprises, SMEs represent a fast-growing customer base with significant potential in shaping the future of the European cloud landscape.

By Industry Vertical Analysis

The BFSI industry is set to capture the maximum share in the industry vertical segment of the Europe cloud computing market, accounting for 27.0 % of the total market value in 2025. The sector is rapidly adopting cloud platforms to modernize legacy systems, enhance digital banking, and support real-time financial transactions. Cloud solutions help banks and insurers improve fraud detection, regulatory compliance, and customer engagement through AI-driven insights and automation. With increasing demand for mobile banking, fintech innovation, and secure payment gateways, BFSI institutions are leveraging multi cloud strategies to balance efficiency, resilience, and stringent European data protection regulations. This digital shift is transforming the financial services landscape, enabling faster innovation and stronger trust among customers.

Energy and utilities in this segment are turning to cloud computing to optimize grid management, enhance energy distribution, and enable smarter consumption models. Cloud platforms allow companies to integrate renewable energy sources, manage IoT-enabled smart meters, and analyze vast data sets for predictive maintenance.

Utilities benefit from scalable cloud systems that improve operational efficiency, support sustainability goals, and enhance customer services through digital platforms. The adoption of cloud in this industry is also linked to Europe’s clean energy transition, as providers increasingly rely on advanced analytics and real-time monitoring to ensure energy reliability and meet climate commitments.

Europe Cloud Computing Market Report is segmented on the basis of the following:

By Service Model

- Infrastructure as a Service (IaaS)

- Platform as a Service (Paas)

- Software as a Service (SaaS)

By Deployment Model

- Public Cloud

- Private Cloud

- Hybrid Cloud

By Organization Size

- Large Enterprises

- Small & Medium Enterprises

By Industry Vertical

- BFSI

- Energy & Utilities

- Government & Public Sector

- Telecommunications

- Retail & Consumer Goods

- Media & Entertainment

- IT & ITeS

- Healthcare & Life Science

- Others

Europe Cloud Computing Market: Competitive Landscape

The competitive landscape of the Europe cloud computing market is defined by the strong presence of global hyperscalers such as Amazon Web Services, Microsoft Azure, and Google Cloud, alongside regional leaders including OVHcloud, Atos, Deutsche Telekom, and Orange Business Services. The market is highly dynamic, with providers competing on innovation, compliance with GDPR, sustainability initiatives, and localized data center expansion. Strategic partnerships, mergers, and collaborations between global and European players are shaping the ecosystem, while growing demand for sovereign cloud solutions and hybrid models further intensifies competition.

Some of the prominent players in the Europe Cloud Computing market are:

- Amazon Web Services (AWS)

- Microsoft Azure

- Google Cloud

- IBM Cloud

- Oracle Cloud

- SAP SE

- Salesforce

- VMware

- Hewlett Packard Enterprise (HPE)

- OVHcloud

- Atos

- Capgemini

- Deutsche Telekom (T-Systems)

- Orange Business Services

- Fujitsu

- Accenture

- Rackspace Technology

- Dimension Data (NTT Ltd.)

- Alibaba Cloud

- Siemens AG

- Other Key Players

Europe Cloud Computing Market: Recent Developments

- September 2025: SAP introduced a new "On-Site" model as part of its sovereign cloud offerings. This model enables customers to deploy SAP-managed cloud infrastructure within their own premises, providing enhanced data residency and operational control while meeting compliance demands in environments like government and regulated industries.

- June 2025: PoliCloud, a French startup focused on sovereign, eco-responsible high-performance cloud infrastructure, raised €7.5 million in seed funding. This capital will enable global expansion and enhanced HPC capabilities, targeting public institutions and local cloud sovereignty.

- April 2025: NexGen Cloud secured €41 million in its Series A round to expand sovereign AI infrastructure across Europe. The company supports AI workloads with hyperscale-like capabilities, including private clouds and GPU-on-demand services for enterprise and developer needs.

- March 2025: Alphabet agreed to acquire Wiz—a leading cybersecurity startup—for USD 32 billion in cash. This acquisition is aimed at boosting Google Cloud’s security capabilities and reinforcing its competitive position against AWS, Azure, and Oracle in the European market.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 183.4 Bn |

| Forecast Value (2034) |

USD 739.2 Bn |

| CAGR (2025–2034) |

15.4% |

| Historical Data |

2019 – 2024 |

| Forecast Data |

2026 – 2034 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Service Model (Infrastructure as a Service, Platform as a Service, and Software as a Service), By Deployment Model (Public Cloud, Private Cloud, and Hybrid Cloud), By Organization Size (Large Enterprises and Small & Medium Enterprises), and By Industry Vertical (BFSI, Energy & Utilities, Government & Public Sector, Telecommunications, Retail & Consumer Goods, Media & Entertainment, IT & ITeS, Healthcare & Life Science, and Others). |

| Regional Coverage |

The Europe |

| Prominent Players |

Amazon Web Services (AWS), Microsoft Azure, Google Cloud Platform (GCP), IBM Cloud, Oracle Cloud, Alibaba Cloud, Salesforce, SAP, VMware, Dell Technologies, Hewlett Packard Enterprise (HPE), Cisco Systems, Fujitsu, Rackspace Technology, Tencent Cloud, Baidu AI Cloud, Huawei Cloud, DigitalOcean, Snowflake, and Others. |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |

Frequently Asked Questions

The Europe Cloud Computing market is projected to be valued at USD 183.4 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 739.2 billion in 2034 at a CAGR of 15.4%.

Some of the major key players in the Europe Cloud Computing market are Amazon Web Services (AWS), Microsoft Azure, Google Cloud Platform (GCP), IBM Cloud, Oracle Cloud, Alibaba Cloud, Salesforce, SAP, VMware, Dell Technologies, Hewlett Packard Enterprise (HPE), Cisco Systems, Fujitsu, Rackspace Technology, Tencent Cloud, Baidu AI Cloud, Huawei Cloud, DigitalOcean, Snowflake, and Others