Market Overview

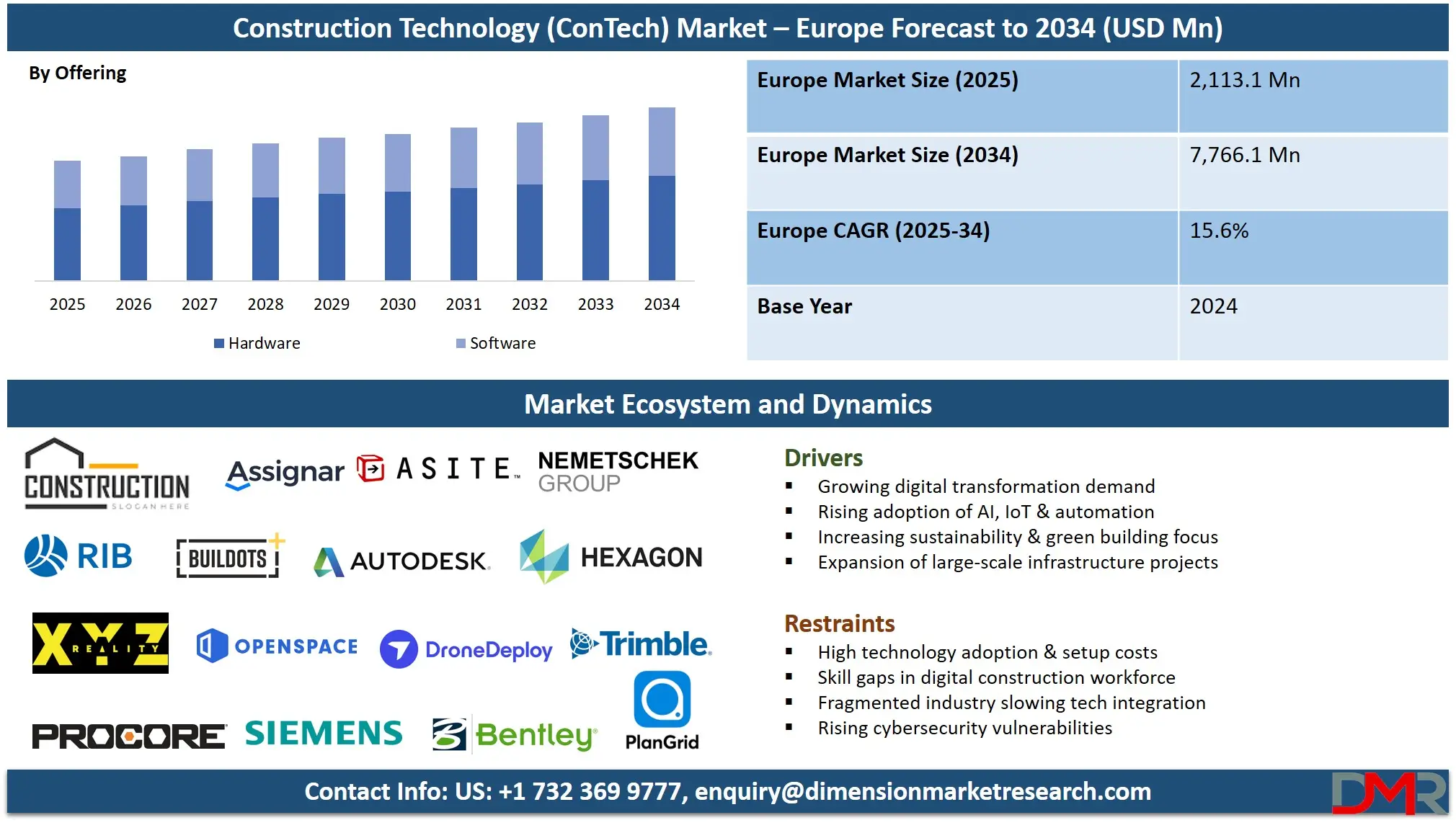

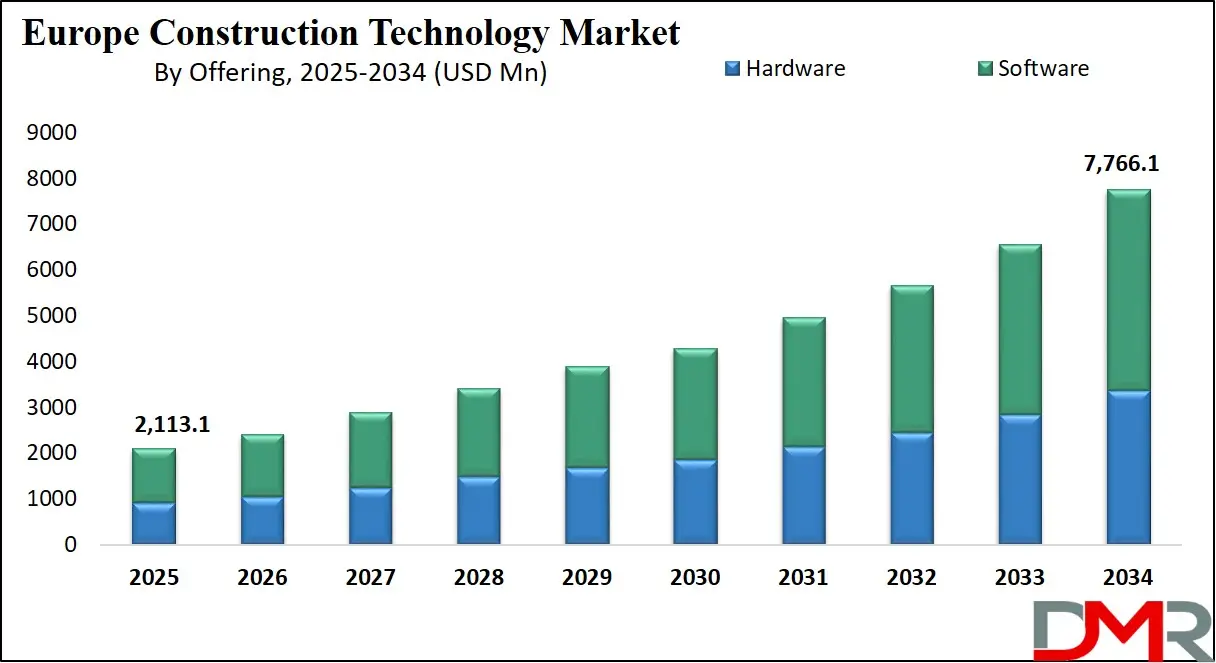

The Europe Construction Technology (ConTech) Market is anticipated to reach USD 2,113.1 million in 2025, driven by the urgent need for digital transformation, sustainability mandates, and labor productivity challenges across the construction sector. The market is expected to expand at a robust compound annual growth rate (CAGR) of 15.6% from 2025 to 2034, reaching a projected value of USD 7,766.1 million by 2034.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Growth is fueled by the rapid adoption of Building Information Modelling (BIM), AI-driven project management, and IoT-enabled smart sites, alongside stringent EU regulations on carbon emissions and building performance. Additionally, the rising prevalence of modular construction, digital twins, and robotic automation, coupled with increasing investment in green and resilient infrastructure, is expected to further accelerate market expansion.

The European construction landscape is undergoing a profound digital shift, moving from traditional manual processes to integrated, data-driven project ecosystems. A significant trend is the convergence of AI, IoT, and cloud platforms to enable real-time collaboration, predictive analytics, and automated workflow management. This digital transformation minimizes delays, reduces cost overruns, enhances safety, and ensures compliance with evolving environmental standards.

Concurrently, ConTech providers are advancing into holistic SaaS solutions, offering end-to-end visibility from design to operation, making efficiency and transparency core components of the modern construction value proposition. The integration of AI with generative design and blockchain for contract management is also emerging, enabling optimized building performance and secure, automated transactions.

The market's expansion is fueled by substantial opportunities in infrastructure modernization, sustainable building retrofits, and smart city developments across the EU and UK. The industrial and mega-project segments have become major adopters, leveraging ConTech for precise scheduling, resource allocation, and compliance in complex environments.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Furthermore, the ongoing development of closed-loop digital twins and autonomous construction equipment opens new avenues for creating lean, waste-free, and carbon-neutral construction processes. These innovations are poised to address chronic industry challenges such as skilled labor shortages, safety incidents, and budget volatility, providing project certainty and sustainability outcomes previously unattainable.

Europe Construction Technology Market: Key Takeaways

- Europe Market Size Insights: The Europe Construction Technology (ConTech) Market is projected to be valued at USD 2,113.1 million in 2025. It is expected to witness subsequent growth in the upcoming period, reaching a projected value of USD 7,766.1 million in 2034.

- The Europe Market Growth Rate: The market is growing at a CAGR of 15.6 percent over the forecasted period from 2025 to 2034.

- Key Drivers: Growth is primarily fueled by strict EU sustainability directives, widespread BIM mandate adoption, rising integration of AI and IoT on construction sites, and significant investment in modular and industrialized construction.

- Competitive Landscape: The market is competitive and features a mix of specialized software vendors (Autodesk, Nemetschek), hardware and robotics providers (Hexagon, Dusty Robotics), technology giants (Siemens, IBM), and established construction firms digitizing their operations.

- Dominant Segment: Building Information Modelling (BIM) remains the largest software segment, driven by regulatory compliance and collaborative design benefits, while AI & Machine Learning is the fastest-growing technology category, revolutionizing project forecasting and risk management.

Europe Construction Technology Market: Use Cases

- Digital Twin for Mega Projects: A major infrastructure consortium in Germany uses a live digital twin integrated with IoT sensors to monitor construction progress, structural health, and energy performance of a new high-speed rail hub, enabling real-time adjustments and lifecycle management.

- Robotic Prefabrication in Residential Construction: A Swedish developer employs automated robotic lines for off-site volumetric modular construction, reducing on-site labor by 60% and project timelines by 30% while achieving near-zero waste.

- AI-Powered Safety Monitoring: A UK contractor implements AI-driven video analytics and wearable sensors across sites to proactively identify unsafe behaviors, PPE compliance, and hazard zones, reducing incident rates by over 40%.

- Blockchain for Supply Chain Transparency: A pan-European sustainable building project utilizes blockchain smart contracts to track ethically sourced materials from supplier to site, ensuring carbon credit validation and reducing administrative fraud.

- AR for On-Site Assembly & Maintenance: A French MEP contractor uses augmented reality glasses to overlay BIM models onto physical installations, guiding technicians in complex assemblies and reducing rework by 25%.

Europe Construction Technology Market: Stats & Facts

European Construction Industry Federation (FIEC) Data

- The EU construction sector employed over 18 million people in 2023.

- Total construction output in Europe exceeded USD 1.6 trillion in 2023.

- Germany, France, and the UK accounted for nearly 50% of European construction activity.

- Skills shortages were reported by over 80% of construction firms across key EU markets.

EU BIM Task Group – Adoption Statistics

- Over 20 European countries have published or are implementing national BIM mandates for public projects.

- Scandinavian nations lead in BIM maturity, with near-100% adoption on major public infrastructure.

- Use of BIM is associated with an average 5–7% reduction in project cost and up to 20% time savings.

Eurostat – Construction & Environment

- The building and construction sector is responsible for ~40% of EU energy consumption and ~36% of greenhouse gas emissions.

- Renovation rates across Europe remain below 1% annually, against a target of 3% for EU climate goals.

- Investments in green construction technologies are projected to grow by a 12% CAGR through 2030.

EU Agency for Safety and Health at Work (EU-OSHA)

- Construction accounts for ~18% of all fatal accidents at work in the EU.

- Adoption of wearable tech and IoT safety solutions is correlated with a 30% reduction in reportable incidents in early-adopter firms.

Europe Construction Technology Market: Market Dynamics

Driving Factors in the Europe Construction Technology Market

Stringent Regulatory Push for Sustainability and Digitalization

Europe’s construction ecosystem is experiencing strong momentum due to regulatory forces that make technology adoption unavoidable. The EU Green Deal, Climate Law, and EPBD collectively impose strict decarbonization, energy efficiency, and lifecycle reporting requirements across new builds and renovations. These directives compel firms to invest in digital design tools, energy modeling platforms, and smart materials that enable compliance with tightening sustainability norms. Simultaneously, national-level BIM mandates, digital twin obligations for government projects, and procurement frameworks that prioritize transparent data exchange are accelerating digital workflows. As regulatory enforcement intensifies, technology becomes not just an operational upgrade but a legal necessity, transforming construction processes and driving sustained ConTech investment across Europe.

Chronic Productivity Gaps and Skilled Labor Shortages

Europe’s construction industry faces longstanding productivity stagnation worsened by severe labor shortages, fueling urgent adoption of ConTech solutions. With an aging workforce, fewer young entrants, and increasing project complexity, traditional labor-intensive methods can no longer meet demand. Companies are turning to robotics, automation, and AI-driven project management tools to fill workforce gaps and maintain project schedules. Off-site and modular construction processes supported by advanced manufacturing technologies are also gaining traction as they deliver faster, safer, and more predictable outcomes. These tools enhance equipment utilization, reduce errors, and improve coordination. The combined pressure of low productivity and worker scarcity positions technology as the only viable pathway to sustaining project capacity and competitiveness across Europe.

Restraints in the Europe Construction Technology Market

High Fragmentation and Resistance to Cultural Change

Europe’s construction landscape is dominated by small and medium-sized enterprises with limited capital, conservative operational cultures, and uneven digital maturity. This structural fragmentation leads to inconsistent technology adoption and a reluctance to abandon well-established manual processes. Many companies remain skeptical about the ROI of ConTech solutions due to high upfront costs, long payback periods, and uncertainty about performance benefits. Traditional procurement models, where risk is distributed among multiple subcontractors, also discourage collaborative digital investment. Additionally, the lack of standardized digital workflows and varying national-level regulations further slows adoption. Collectively, these cultural and structural barriers create a sluggish environment where innovation struggles to scale across the broader European construction ecosystem.

Integration Complexity and Data Security Concerns

Introducing new digital tools into construction environments is challenging due to the multitude of legacy systems, disparate software platforms, and project stakeholders involved. Ensuring seamless interoperability between BIM tools, ERP systems, IoT platforms, and contractor databases demands significant technical integration, often increasing project costs and timelines. Such complexity leads many companies to delay or avoid digital transformation. Meanwhile, concerns over data privacy, cybersecurity vulnerabilities, and unclear data ownership regulations contribute to hesitancy. As construction sites become increasingly connected, firms worry about cyberattacks that could disrupt operations, compromise designs, or expose sensitive information. These challenges collectively hinder the smooth and rapid adoption of construction technologies across Europe.

Opportunities in the Europe Construction Technology Market

Growth in Retrofit and Renovation Tech

Europe’s ambitious climate commitments, especially the 2050 carbon neutrality target, require upgrading millions of existing buildings, creating a massive opportunity for retrofit-focused ConTech. Aging residential blocks, commercial facilities, and public infrastructure demand advanced tools such as digital laser scanning, thermal imaging drones, energy modeling software, and AI-based retrofit design systems. Modular envelope upgrades, prefabricated insulation systems, and smart energy management platforms are becoming essential for accelerating renovation cycles. Governments are allocating substantial funds toward energy-efficient building upgrades, further widening the market. This surge in retrofit activity opens new revenue streams for technology vendors and engineering platforms tailored to building modernization, energy optimization, and large-scale refurbishment programs across Europe.

Expansion of Industrialized Construction Ecosystems

Industrialized construction, such as modular buildings, DfMA, and off-site fabrication, is evolving into a major growth engine for ConTech in Europe. As developers seek faster delivery, higher quality, and lower environmental impact, factory-based construction models supported by robotics, automation, digital twins, and supply chain orchestration platforms are gaining traction. Residential, healthcare, and public-sector projects increasingly prefer modular systems that reduce on-site labor, enhance safety, and deliver predictable results. This shift is encouraging new partnerships between technology providers, manufacturers, and contractors. The rise of construction micro-factories, robotic assembly lines, and integrated digital production planning tools further strengthens Europe’s industrialized construction ecosystems and opens long-term growth pathways for advanced ConTech suppliers.

Trends in the Europe Construction Technology Market

Convergence of Digital Twins and Live IoT Data

One of the most transformative trends reshaping Europe’s construction sector is the integration of digital twins with real-time IoT sensor data, enabling continuous monitoring, simulation, and lifecycle management. On construction sites, IoT sensors embedded in machinery, materials, and wearable devices feed live data into cloud-based models, improving decision-making and operational accuracy. These twins replicate physical assets in virtual environments, allowing predictive maintenance, clash detection, energy analysis, and planning optimization. During operations, facility managers use digital twins to monitor performance, reduce downtime, and enhance sustainability outcomes. As governments mandate greater transparency and lifecycle documentation, this digital twin–IoT convergence is becoming central to modern construction practices across Europe.

AI-First and Autonomous Construction Sites

Europe is rapidly advancing toward AI-driven construction environments where intelligent platforms automate scheduling, logistics, safety monitoring, and quality control. AI-powered analytics predict delays, optimize resource allocation, and enhance compliance with sustainability standards. On-site, autonomous and semi-autonomous machinery such as self-driving excavators, robotic bricklayers, drone-based site inspectors, and tele-operated equipment reduces reliance on scarce labor and minimizes human safety risks. Machine vision systems ensure real-time quality checks, while AI-enhanced robotics enable precision in repetitive or hazardous tasks. This shift toward automation supports the long-term vision of “lights-out” or minimally staffed construction sites for certain controlled processes, accelerating efficiency and transforming traditional job roles across the European construction industry.

Europe Construction Technology Market: Research Scope and Analysis

By Offering Analysis

Software is projected to dominate the Europe Construction Technology (ConTech) Market’s offering segment, with Building Information Modelling (BIM) platforms serving as the central driver of adoption. BIM has evolved into the backbone of digital project delivery, mandated for public-sector construction across the U.K., Nordics, Germany, France, and several EU-funded infrastructure initiatives. Its capacity to enable multi-stakeholder collaboration, detect design clashes early, streamline documentation, and support lifecycle asset management makes it indispensable in an industry under intense productivity and sustainability pressure.

Cloud-based BIM further accelerates software dominance by enabling remote coordination, cross-border project collaboration, and integration with ERP, project management tools, IoT sensors, and digital twin platforms. As Europe moves toward circular construction and carbon-neutral infrastructure, BIM becomes critical for environmental compliance, embodied carbon calculations, and materials traceability.

The European Commission’s digital transformation funding, along with national-level incentives for adopting digital construction tools, is pushing contractors, especially SMEs, to modernize their technology stacks. Software-driven solutions such as Common Data Environments (CDEs), energy modeling platforms, reality capture processing tools, and modular design systems complement BIM and expand the ecosystem.

As contractors face shrinking margins, skilled labor shortages, and rising regulatory scrutiny, the value proposition of software becomes even stronger. BIM-centric SaaS platforms reduce rework, optimize workflows, improve design quality, and enable transparent governance across the project lifecycle. This combination of regulatory pressure, operational benefits, and ecosystem maturity ensures software anchored by BIM remains the dominant offering category in Europe’s construction technology landscape.

By Technology Analysis

Artificial Intelligence (AI) and Machine Learning (ML) are poised to lead the technology landscape of the Europe Construction Technology (ConTech) Market , driven by their ability to directly address long-standing industry challenges. AI-powered tools now support predictive scheduling, design optimization, automated documentation, cost forecasting, and real-time safety analysis functions that significantly reduce risk, rework, and delays across construction projects.

Europe’s strong innovation ecosystem, bolstered by leading universities, engineering firms, and deep-tech startups, accelerates AI readiness. Regulatory frameworks such as the EU AI Act also push the industry toward transparent, data-driven operations. This reinforces trust in AI-powered decision systems, especially for public infrastructure projects where compliance and auditability are essential.

AI generates substantial economic value by improving resource allocation, automating repetitive tasks, and identifying errors before they escalate into costly problems. Machine learning models integrated with BIM tools enable generative design, structural optimization, and carbon-impact simulations that are impossible through manual processes. Meanwhile, AI’s fusion with IoT networks allows predictive maintenance of machinery, energy-efficient building operations, and dynamic site monitoring.

AI adoption is further reinforced by Europe’s early success in pilot deployments, particularly in countries like Germany, the Netherlands, Switzerland, and the U.K., where AI-driven planning and robotics-assisted construction have demonstrated measurable productivity gains. Cloud-native AI platforms allow scalable deployment even for smaller contractors.

This combination of strong regulatory alignment, robust R&D infrastructure, proven ROI, and deep integration with parallel technologies cements AI and ML as the most influential technology segment shaping the future of European construction.

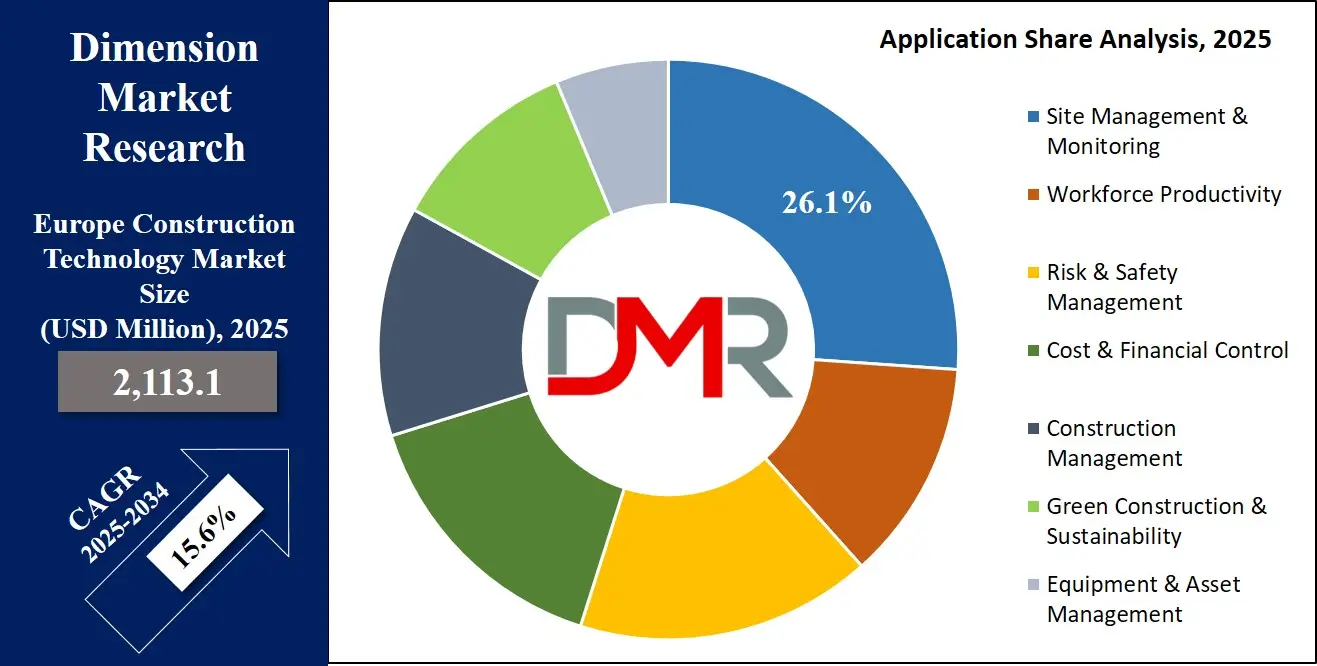

By Application Analysis

Site Management & Monitoring is projected to dominate the application segment within the Europe Construction Technology (ConTech) Market due to the industry’s urgent need for real-time operational visibility, streamlined coordination, and enhanced accountability. European construction sites are typically complex, multi-stakeholder environments involving contractors, subcontractors, regulators, inspectors, and material suppliers located across geographically dispersed regions. Digital site management platforms centralize communication, minimize misalignment, and create a verifiable record of daily progress, an essential requirement as compliance demands rise.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The rapid integration of drones, IoT sensors, AI analytics, and mobile workforce applications has transformed site monitoring into a proactive, data-driven discipline. Drone-generated photogrammetry improves progress verification, IoT-based weather and equipment sensors enhance safety, and AI models help detect deviations before they escalate. These capabilities reduce delays, prevent disputes, and ensure better adherence to safety and regulatory standards key challenges across Europe’s construction sector.

Lean construction, just-in-time logistics, and carbon reporting requirements also make site management technologies indispensable. Platforms that track material delivery, labor productivity, on-site emissions, waste generation, and equipment utilization offer immediate performance improvements that directly impact costs and timelines.

By End User Analysis

The Europe Construction Technology (ConTech) Market is shaped by diverse end users, each adopting digital solutions to address specific operational needs, regulatory pressures, and productivity challenges. Contractors, who account for the largest share, are the primary drivers of ConTech adoption, leveraging BIM, AI-driven planning, drones, and IoT platforms to manage schedules, reduce rework, and optimize labor and machinery utilization. Their need to meet tight project deadlines and comply with stringent safety and documentation requirements makes technology essential.

Builders and Owners increasingly invest in digital tools to improve cost predictability, manage asset lifecycles, and ensure transparency with stakeholders. Smart procurement systems, digital twins, and sustainability tracking platforms enable them to meet ESG targets and future-proof assets.

Architects and Designers rely heavily on BIM, generative design, and visualization tools to streamline collaboration, reduce design conflicts, and support low-carbon building strategies. Their role in early-stage decision-making amplifies technology’s impact across the project lifecycle.

Government and Public Sector entities accelerate ConTech adoption through mandates, digital submission requirements, and funding for innovation. Many public infrastructure programs now require BIM, digital twins, and real-time reporting tools, pushing the entire market forward.

By Project Type Analysis

Commercial projects are projected to dominate the Europe Construction Technology market’s project type segment. Europe’s commercial construction including offices, retail complexes, logistics hubs, hospitals, data centers, educational institutions, and mixed-use developments has been the fastest adopter of advanced digital solutions such as BIM, digital twins, AI-based scheduling, IoT-enabled smart building systems, and modular construction technologies.

Commercial builders face strict ESG mandates, energy-efficiency regulations, decarbonization requirements, and rising operational cost pressures, making digital tools essential for compliance and lifecycle optimization. The growth of e-commerce, data center expansion, healthcare modernization, and large-scale urban redevelopment projects further accelerates ConTech adoption in this segment. Commercial developments typically involve high complexity, multi-stakeholder coordination, and tight timeframes, strengthening their reliance on digital collaboration platforms and automation tools.

The Europe Construction Technology Market Report is segmented on the basis of the following:

By Offering

- Hardware

- Drones

- 3D Printing

- Autonomous Equipment

- Robotic Bricklaying

- Others

- Software

- Building Information Modelling (BIM)

- Construction Automation

- Wearable Technologies

- Visual Technologies

By Technology

- Artificial Intelligence (AI) & Machine Learning

- Robotics & Automation

- Internet of Things (IoT) & Smart Sensors

- Augmented Reality (AR) & Virtual Reality (VR)

- Prefabrication & Modular Construction

- Digital Twin Technology

- Blockchain & Smart Contracts

By Application

- Site Management & Monitoring

- Workforce Productivity

- Risk & Safety Management

- Cost & Financial Control

- Construction Management

- Green Construction & Sustainability

- Equipment & Asset Management

By End User

- Contractors

- Builders & Owners

- Architects & Designers

- Government & Public Sector

- Material Suppliers & OEMs

- Facilities Managers

By Project Type

- Residential

- Commercial

- Industrial

- Mega Projects

Impact of Artificial Intelligence on the Europe Construction Technology Market

- Predictive Project Analytics: AI algorithms analyze historical and real-time project data to forecast delays, cost overruns, and resource bottlenecks, enabling proactive mitigation.

- Automated Design Optimization: Generative AI produces multiple design alternatives optimized for cost, energy use, and structural efficiency, accelerating early-stage planning.

- Intelligent Risk & Safety Management: ML models process site imagery and sensor data to predict potential safety incidents and prioritize high-risk activities for intervention.

- Smart Resource & Logistics Coordination: AI schedules deliveries, equipment usage, and workforce allocation dynamically based on weather, site progress, and supply chain status.

- Quality Control Automation: Computer vision systems automatically inspect workmanship, material defects, and compliance with design specifications from images and 3D scans.

By Region

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Europe Construction Technology Market : Competitive Landscape

The competitive landscape of the Europe Construction Technology market is fragmented and rapidly evolving, characterized by a mix of pure-play SaaS startups, hardware automation specialists, and incumbent engineering software giants. Dominant players like Autodesk, Nemetschek Group, and Hexagon leverage their deep industry integration, extensive product suites, and compliance with European standards to secure enterprise and governmental contracts.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

These companies compete on interoperability, data depth, and scalability. A significant trend is the entry of industrial automation and telecom firms, such as Siemens, Bosch, and Ericsson, which are providing integrated IoT, digital twin, and connectivity solutions to the ecosystem. Simultaneously, the market sees fierce competition from agile regional startups focusing on niche applications like robotic finishing or carbon tracking, ensuring continuous innovation and price pressure across all segments.

Some of the prominent players in the Europe Construction Technology Market are

- Autodesk Inc.

- Nemetschek SE

- Hexagon AB

- Bentley Systems, Inc.

- Siemens AG

- Procore Technologies, Inc.

- PlanGrid (Autodesk)

- Asite

- RIB Software SE

- Trimble Inc.

- Buildots

- Assignar

- OpenSpace

- DroneDeploy

- Dusty Robotics

- Scaled Robotics

- XYZ Reality

- Constru

- Sablono

- LetsBuild

- Other Key Players

Recent Developments in the Europe Construction Technology Market

May 2024

- Investment: Berlin-based construction robotics startup KEWAZO raises USD 27.1 million in Series B funding to scale its autonomous scaffolding robotics across European industrial sites.

- Collaboration: Autodesk and Skanska announce a pan-European partnership to integrate AI-driven schedule and risk analytics into Skanska’s BIM workflows across 12 countries.

- Expo: BAUMA 2024 (Munich, Germany) concludes with over 3,200 exhibitors, highlighting autonomous construction machinery and digital twin platforms.

April 2024

- Merger: Swedish SaaS provider Assemble Systems merges with the UK’s GenieBelt to create a unified cloud platform for site management and real-time project controls.

- Collaboration: Siemens and Vinci Construction launch a joint pilot in France using digital twins and IoT for carbon tracking on a major highway renovation project.

- Conference: Digital Construction Week (DCW) in London features key announcements on the UK’s national digital twin strategy and interoperability standards.

March 2024

- Investment: EU’s Innovation Fund awards USD 162.3 million to a consortium led by Saint-Gobain and RIB Software for developing a circular construction digital platform.

- Collaboration: Hexagon partners with Bouygues Construction to deploy AI-powered reality capture and progress tracking on hospital projects across Europe.

- Product Launch: Trimble launches Trimble Connect for Europe, enhanced with EU-specific regulatory and sustainability data modules.

February 2024

- Merger: Nemetschek Group acquires Finnish AI startup Visualynk, specializing in automated construction quality control via computer vision.

- Investment: French proptech fund Breega leads a USD 19.5 million round in Cemex Ventures-backed construction IoT startup WakeCap for safety and productivity tracking.

- Expo: BATIBOUW (Brussels) showcases smart building technologies, with a dedicated ConTech pavilion featuring over 100 startups.

January 2024

- Collaboration: Bosch Building Technologies and Microsoft announce a strategic alliance to integrate Bosch’s IoT suite with Azure Digital Twins for smart construction sites.

- Conference: FutureBuild 2024 in London focuses on sustainable construction tech, with keynotes from the UK Green Building Council and BRE.

- Investment: Spanish modular construction tech firm BeMore secures USD 13.0 million to expand its AI-driven design-to-fabrication platform across Southern Europe.

November 2023

- Policy/Investment: The European Investment Bank (EIB) launches a USD 1.08 billion “ConTech Digitalization Fund” targeting SMEs in the EU construction sector.

- Collaboration: ABB and Peab (Sweden) collaborate to pilot fully electrified, autonomous construction sites using robotic process automation.

- Conference: Digital Construction Summit in Helsinki highlights Nordic BIM 2025 roadmap and cross-border data exchange initiatives.

October 2023

- Merger: UK’s Asite merges with Dutch cloud platform Aproplan to strengthen its footprint in Benelux and Northern Europe.

- Investment: German autonomous equipment maker IONATE raises USD 32.5 million to scale its hydrogen-powered robotic excavators and site logistics vehicles.

- Expo: Smart City Expo World Congress (Barcelona) features a dedicated track on ConTech for urban infrastructure, with participation from Siemens, Acciona, and Cityzenith.

Frequently Asked Questions

How big is the Europe Construction Technology (ConTech) Market ?

▾ The Europe Construction Technology (ConTech) Market size is estimated to have a value of USD 2,113.1 million in 2025 and is expected to reach USD 7,766.1 million by the end of 2034.

What is the growth rate in the Europe Construction Technology (ConTech) Market?

▾ The market is growing at a CAGR of 15.6 percent over the forecasted period from 2025 to 2034.

Which are the key players in the Europe Construction Technology (ConTech) Market?

▾ Some of the major key players are Autodesk Inc., Nemetschek SE, Siemens AG, Hexagon AB, and Procore Technologies, Inc.