Market Overview

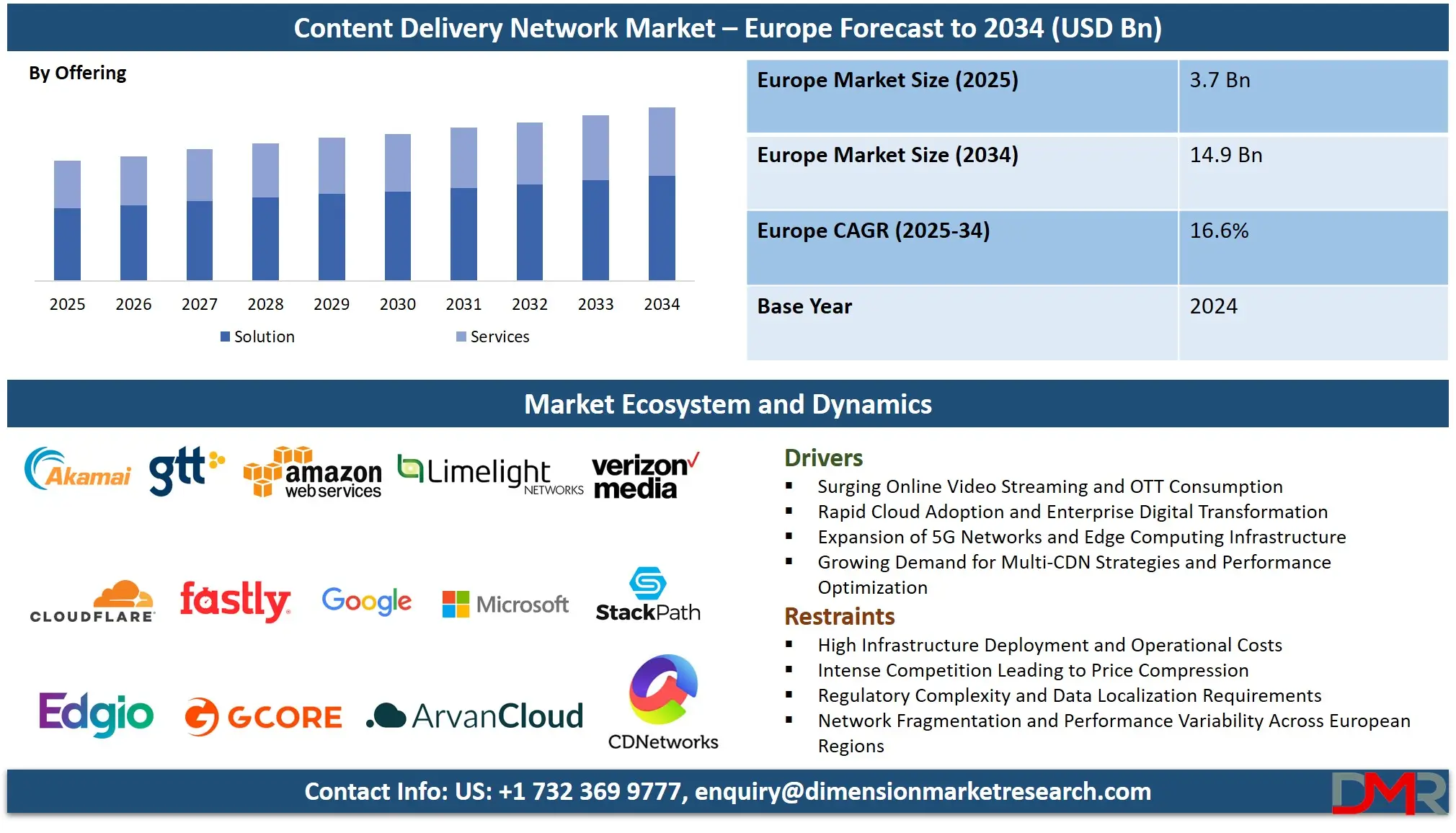

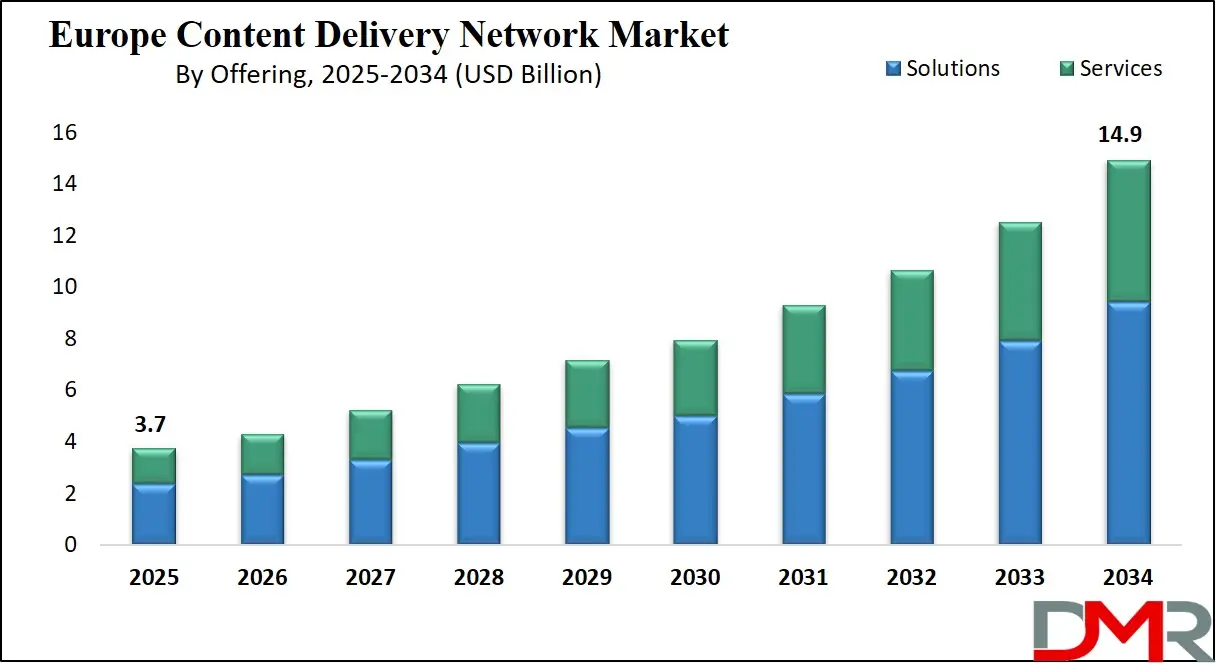

The Europe Content Delivery Network Market is anticipated to reach USD 3.7 billion in 2025, driven by the exponential growth in video streaming, e-commerce, and digital transformation initiatives across the region. The market is expected to expand at a robust compound annual growth rate (CAGR) of 16.6% from 2025 to 2034, reaching a projected value of USD 14.9 billion by 2034.

Growth is fueled by the increasing adoption of edge computing, the rollout of 5G networks, stringent data sovereignty regulations like GDPR, and rising demand for low-latency content delivery. Additionally, expanding applications in media & entertainment, BFSI, and public sector sectors, coupled with the growing need for advanced security and analytics features, are expected to further accelerate market expansion.

The European landscape for Content Delivery Networks is evolving rapidly, moving beyond basic content acceleration to become a critical component of digital infrastructure. A significant trend is the strategic shift towards edge computing, where CDNs are transforming into distributed computing platforms that process data closer to the end-user, crucial for meeting GDPR compliance by keeping data within regional borders.

This decentralization accelerates application performance and enables real-time interactivity for services like industrial IoT and smart city applications. Concurrently, CDN providers are embedding advanced security, offering integrated Web Application Firewalls (WAF) and DDoS mitigation as standard features, making security a foundational element of the content delivery value proposition. The integration of artificial intelligence with CDN orchestration is also emerging, optimizing traffic routing in real-time and automating the detection of performance anomalies or security threats across diverse European networks.

The market's expansion is fueled by substantial opportunities in personalized content delivery, particularly in streaming media and dynamic e-commerce sites that require unparalleled speed and reliability. The media and entertainment industry has become a major adopter, leveraging CDN technology for the seamless and scalable delivery of live sports, Video-on-Demand (VoD), and Over-the-Top (OTT) services, which are experiencing rapid subscriber growth.

Furthermore, the ongoing development of novel, integrated services, including real-time analytics and serverless computing at the edge, opens new avenues for creating dynamic digital experiences that are highly responsive and engaging. These innovations are poised to address complex challenges in latency-sensitive applications like fintech platforms and telemedicine, providing performance guarantees that are essential for cross-border services within the EU.

Europe Content Delivery Network Market: Key Takeaways

- Europe Market Size Insights: The Europe Content Delivery Network Market is projected to be valued at USD 3.7 billion in 2025. It is expected to witness subsequent growth in the upcoming period, reaching a projected value of USD 14.9 billion in 2034.

- The Europe Market Growth Rate: The market is growing at a CAGR of 16.6 percent over the forecasted period from 2025 to 2034.

- Key Drivers: Growth is primarily fueled by the surge in OTT video consumption, the integration of edge computing and security services, the rollout of 5G, and strict data compliance requirements.

- Competitive Landscape: The market is highly competitive and features a mix of global CDN giants (Akamai, Cloudflare), hyperscale cloud providers (AWS, Google, Microsoft), and strong regional telecom providers (Deutsche Telekom, Orange).

- Dominant Segment: The Media & Entertainment sector is the largest application segment, driven by OTT and live streaming, while integrated security features have become a standard expectation.

Europe Content Delivery Network Market: Use Cases

- Pan-European Live Sports Streaming: A premier sports league uses a CDN with extensive Points of Presence (PoPs) across Europe to deliver a major tournament to millions of concurrent viewers, leveraging dynamic routing and compliance with local data laws to ensure zero buffering and high-quality video.

- Cross-Border E-commerce Acceleration: A leading European online retailer uses a CDN with edge computing to dynamically assemble personalized product pages and promotional content in real-time based on a user’s location, language, and local currency, significantly increasing conversion rates across different EU markets.

- DDoS Mitigation for Financial Services: A major pan-European banking institution leverages a CDN's integrated Web Application Firewall (WAF) and DDoS protection to absorb and mitigate a massive multi-vector attack, ensuring its online banking and trading platforms remain available and secure for customers.

- Global Software Distribution with EU Data Residency: A technology company uses a CDN with guaranteed EU-based data centers to distribute large software updates and patches to its European user base, ensuring compliance with GDPR while providing fast, reliable downloads.

- Secure Remote Access for Distributed Workforces: A multinational enterprise implements a CDN provider's Zero-Trust network access solution to provide secure, remote access to internal business applications for its employees across Europe without the need for a traditional VPN, improving both security and performance.

Europe Content Delivery Network Market: Impact of Artificial Intelligence

- Intelligent Traffic Routing: AI algorithms analyze real-time network conditions across Europe's diverse internet exchanges, predicting congestion and dynamically routing user requests to the optimal edge server, minimizing latency and packet loss.

- Predictive Caching: ML models forecast content popularity and pre-position assets at edge locations within specific countries or regions before demand spikes, ensuring instant availability for end-users and reducing origin offload.

- Proactive Security: AI-powered systems detect and mitigate DDoS attacks and malicious bot traffic in real-time by identifying anomalous patterns that traditional rule-based systems miss, crucial for protecting against increasingly sophisticated threats.

- Automated Performance Optimization: AI continuously monitors performance metrics, automatically tuning cache policies and network configurations to maintain Service Level Agreements (SLAs) across different European regions without manual intervention.

- Enhanced Analytics and Insights: AI analyzes vast delivery data sets to provide actionable insights into regional user behavior, content performance, and security threats, enabling data-driven business decisions while maintaining data privacy standards.

Europe Content Delivery Network Market: Stats & Facts

Akamai Technologies

- Akamai's European network is one of the most extensive, with hundreds of PoPs and reportedly handles a significant portion of Europe's peak internet traffic during major events.

Cloudflare, Inc.

- Cloudflare's European edge network spans over 200 cities across more than 40 European countries, providing dense coverage across the region.

Amazon Web Services (AWS)

- AWS has multiple cloud regions in Europe (e.g., Frankfurt, Ireland, London) and its Shield service mitigates tens of thousands of application-layer DDoS events monthly across its European infrastructure.

Google Cloud

- A 2023 case study with a European streaming service reported that Google’s Media CDN reduced video startup time by 40% and rebuffering by 30% compared to their previous provider.

European Union Agency for Cybersecurity (ENISA)

- ENISA's 2024 threat landscape report highlights that DDoS attacks are a top operational threat for European critical infrastructure and digital services, with attacks growing in scale.

Body of European Regulators for Electronic Communications (BEREC)

- BEREC's reports emphasize the role of content delivery infrastructure in improving average download speeds across the EU, which have been steadily increasing, aided by local CDN caching.

International Organization for Standardization (ISO)

- The ISO/IEC 27017 standard for cloud security controls is increasingly referenced in CDN service level agreements (SLAs) for European enterprises, especially in regulated industries like BFSI.

Market Dynamic

Driving Factors in the Europe Content Delivery Network Market

Rising Shift Toward Edge Computing–Integrated CDN Architectures

A major trend shaping the Europe CDN Market is the rapid integration of edge computing capabilities into traditional CDN architectures, driven by the need to deliver ultra-low latency content to end users across densely connected metropolitan hubs. European enterprises across media, e-commerce, gaming, and industrial IoT are adopting edge-enabled CDNs to reduce round-trip delays, bring compute closer to consumers, and support real-time workloads such as cloud gaming, autonomous systems, and augmented/virtual reality.

Regulatory pushes for data localization under GDPR further accelerate investment in distributed edge nodes across EU member states, ensuring compliance while maintaining performance. Telecom operators expanding 5G standalone (SA) networks are also partnering with CDN vendors to embed edge caches directly within mobile networks, supporting high-bandwidth streaming and mission-critical applications. This synergy between CDNs and edge computing is creating a next-generation, distributed delivery fabric across Europe.

Growing Adoption of Multi-CDN Strategies Across Enterprises

Another strong market trend is the increasing adoption of multi-CDN orchestration strategies by European enterprises to combat traffic surges, improve global reliability, and manage growing content volumes from OTT platforms, cloud services, and live streaming events. Broadcasters, online retailers, and gaming companies now rely on multiple CDN providers to reduce single-vendor dependency, optimize routing through real-time performance analytics, and ensure uninterrupted delivery during peak-demand events such as UEFA championships, seasonal sales, and software release cycles.

Multi-CDN setups also help organizations achieve granular regional performance optimization, a critical requirement in Europe where network conditions vary significantly across countries. The availability of AI-based CDN load-balancing platforms and real-time QoE monitoring tools further enhances the feasibility and flexibility of multi-CDN deployments. This trend is reshaping operational strategies and enabling enterprises to consistently deliver superior user experiences across devices and regions.

Restraints in the Europe Content Delivery Network Market

Explosive Surge in Online Video Streaming and OTT Consumption

One of the most powerful growth drivers for the Europe CDN Market is the exponential rise of online video streaming, OTT platforms, live sports broadcasting, and high-definition on-demand content. European households increasingly consume UHD and 4K/8K content across smart TVs, mobile devices, and connected home platforms, driving unprecedented bandwidth demand.

Streaming giants and regional digital broadcasters depend heavily on high-capacity CDNs to support rapid traffic growth, reduce buffering, ensure secure content distribution, and deliver consistent QoE across fragmented European networks. The increasing shift toward subscription-based and ad-supported streaming models further accelerates dependency on CDNs for content personalization and latency-sensitive ad delivery. The rise of remote work and online education post-pandemic has also contributed significantly to higher video usage. Collectively, these dynamics are pushing CDN providers to scale infrastructure and expand PoPs across Europe.

Rise of Cloud Adoption and Digital Transformation Initiatives

The accelerating adoption of cloud platforms and enterprise digital transformation initiatives is another major growth driver fueling CDN expansion across Europe. Enterprises moving workloads to AWS, Azure, and Google Cloud increasingly rely on CDN services to optimize application performance, accelerate website loading, secure APIs, and reduce latency for globally distributed customers. Digital transformation across BFSI, retail, automotive, healthcare, and manufacturing sectors also fuels demand for CDNs to support high-traffic web applications, real-time collaboration platforms, e-commerce portals, telemedicine services, and data-heavy SaaS tools.

Meanwhile, EU-wide initiatives promoting industrial digitalization and cross-border data infrastructure, such as GAIA-X, encourage the deployment of sovereign and high-security CDN solutions. As organizations modernize customer-facing digital channels and operational systems, CDN usage becomes indispensable for handling traffic spikes, securing data flows, and ensuring availability across hybrid cloud environments.

Opportunities in the Europe Content Delivery Network Market

AI-Driven CDN Optimization and Real-Time Traffic Intelligence

AI-driven optimization represents a significant growth opportunity for CDN providers in Europe, enabling real-time traffic prediction, intelligent routing, automated congestion control, and performance enhancement across multi-cloud and multi-network environments. European enterprises increasingly demand advanced analytics to deliver personalized content, reduce load times, and improve customer engagement across high-traffic digital platforms.

CDNs equipped with AI-based load balancing, predictive caching, and anomaly detection can deliver superior performance while minimizing operational costs. Additionally, AI-enabled threat detection enhances CDN security by identifying DDoS attacks, bot traffic, and API abuse in real time, aligning with Europe’s stringent cybersecurity regulations. As cloud-native architectures proliferate, the demand for intelligent CDN solutions capable of automatically adapting to dynamic traffic patterns continues to rise. Vendors investing in AI-driven delivery ecosystems will capture major opportunities in enterprise-grade CDN deployments across Europe.

Expansion of 5G, IoT, and Next-Gen Connected Applications

The rollout of 5G networks, expansion of IoT ecosystems, and increasing adoption of connected applications create substantial growth opportunities for CDN providers across Europe. 5G’s ultra-low latency requirements demand distributed CDN edge nodes for real-time content delivery, especially for immersive AR/VR, cloud gaming, autonomous vehicles, and smart manufacturing systems.

European industries implementing Industry 4.0 technologies require local edge caching and secure content pipelines to ensure operational continuity and high-speed data exchange between machines and cloud systems. The proliferation of smart home devices, connected healthcare platforms, and urban IoT infrastructure further increases the requirement for scalable, geographically distributed CDNs.

Additionally, 5G-enabled live event streaming, such as concerts and sports stadiums, boosts the need for next-generation CDNs capable of managing high bandwidth and concurrency. This ecosystem offers vast opportunities for CDN vendors to integrate localized edge compute capabilities

Trends in the Europe Content Delivery Network Market

High Infrastructure Costs and Complex Deployment Requirements

A major restraint for the Europe CDN Market is the high cost associated with building, maintaining, and scaling CDN infrastructure, especially in regions requiring dense POP networks and localized edge nodes to meet performance expectations. Deploying servers, optical fibers, and data center facilities across multiple European countries involves substantial capital investment and ongoing operational costs such as energy consumption, compliance audits, and security upgrades.

These challenges are amplified by Europe’s strict data protection and storage regulations, which require region-specific infrastructure rather than centralized global deployments. Smaller CDN providers often struggle to compete with hyperscalers due to limited financial capacity, slow market entry, and innovation. Additionally, the diverse telecommunications landscape across Europe, with varying levels of network maturity, makes it difficult to ensure consistent performance across borders, further complicating large-scale deployment strategies for providers.

Intensifying Competition and Price Compression Among CDN Vendors

Price compression driven by fierce competition is another significant restraint impacting profitability in the Europe CDN Market. With hyperscale cloud providers like AWS, Google, and Microsoft offering integrated CDN services at competitive rates, traditional CDN vendors face substantial pressure to lower prices while maintaining high performance.

Multi-CDN adoption among enterprises intensifies this issue, as vendors must compete for traffic distribution rather than full-volume commitments. Commodity-like perception of basic CDN services further reduces margins, pushing companies to differentiate through advanced security, edge computing, and AI-driven optimization, each requiring additional investment.

Moreover, free or low-cost CDN solutions offered by smaller providers disrupt pricing models and influence purchasing decisions among cost-sensitive customers. This high-competition environment makes sustained revenue growth challenging, particularly for mid-sized vendors and regional players, limiting their ability to invest in innovation and infrastructure expansion.

Research Scope and Analysis

By Component Analysis

Solutions are projected to remain the dominant component category in the European CDN market. This segment encompasses the core technology platforms responsible for content acceleration, including media delivery engines, web performance optimization systems, and integrated cloud security suites like DDoS protection and Web Application Firewalls (WAF). The criticality of these solutions stems from the escalating demand for high-definition video streaming, real-time web applications, and secure digital transactions across the region.

As European consumers and businesses alike demand instantaneous and resilient online experiences, enterprises rely on CDN solutions as strategic enablers of uptime, performance, and security. The need to deliver rich media and dynamic content in compliance with GDPR further solidifies the reliance on sophisticated CDN solutions that can process and cache data within geographical boundaries, ensuring both speed and regulatory adherence.

The Services segment is the fastest-growing component, fueled by the increasing complexity of CDN architectures and the stringent regulatory environment in Europe. Enterprises are moving beyond simple CDN implementation to sophisticated multi-CDN strategies, deep edge computing integrations, and hybrid cloud deployments. This complexity necessitates expert Design & Consulting Services for initial setup, Migration Support to ensure seamless transitions, and ongoing Analytics & Performance Monitoring to maintain optimal delivery across diverse European networks.

Furthermore, the imperative for GDPR compliance requires specialized Website & API Management and Security Configuration services to ensure data routing and caching adhere to regional laws. Managed services are becoming indispensable for proactive threat mitigation and continuous tuning of delivery paths, creating a strong, recurring revenue stream for providers who can offer long-term, advisory-based partnerships.

By Content Type Analysis

Static Content forms the foundational layer of the European CDN market, supporting the high-volume, efficient delivery of non-changing assets like images, JavaScript, CSS files, and downloadable documents. The delivery of this content is a mature and standardized capability, crucial for ensuring fast website load times, core web vitals, and overall user experience.

While it contributes steady-state revenue, its growth is not explosive, as most enterprises consider static content acceleration a baseline, commoditized requirement. However, its importance remains undiminished; efficient static content delivery reduces origin server load and bandwidth costs, forming the performance bedrock upon which more complex, dynamic experiences are built. In Europe, the caching of static assets is also leveraged to ensure that common website elements are served from local edge nodes, aligning with principles of data efficiency.

Dynamic/Streaming Content is the largest and most commercially critical segment, driven by the dominance of OTT platforms, live sports broadcasting, personalized e-commerce, and real-time applications. Unlike static assets, this content is unique to each user or session, such as personalized dashboards, live video streams, and API-driven data, and cannot be cached in a simple manner.

This demands sophisticated CDN architectures with advanced routing, edge logic processing, and adaptive acceleration mechanisms. The boom in high-fidelity (4K/8K) Video-on-Demand (VoD) and live events creates enormous bandwidth and scalability demands, making features like multi-bitrate streaming and instant cache purging indispensable. Furthermore, the proliferation of AI-driven real-time personalization across European digital services pushes dynamic CDN capabilities to the forefront of innovation and value creation.

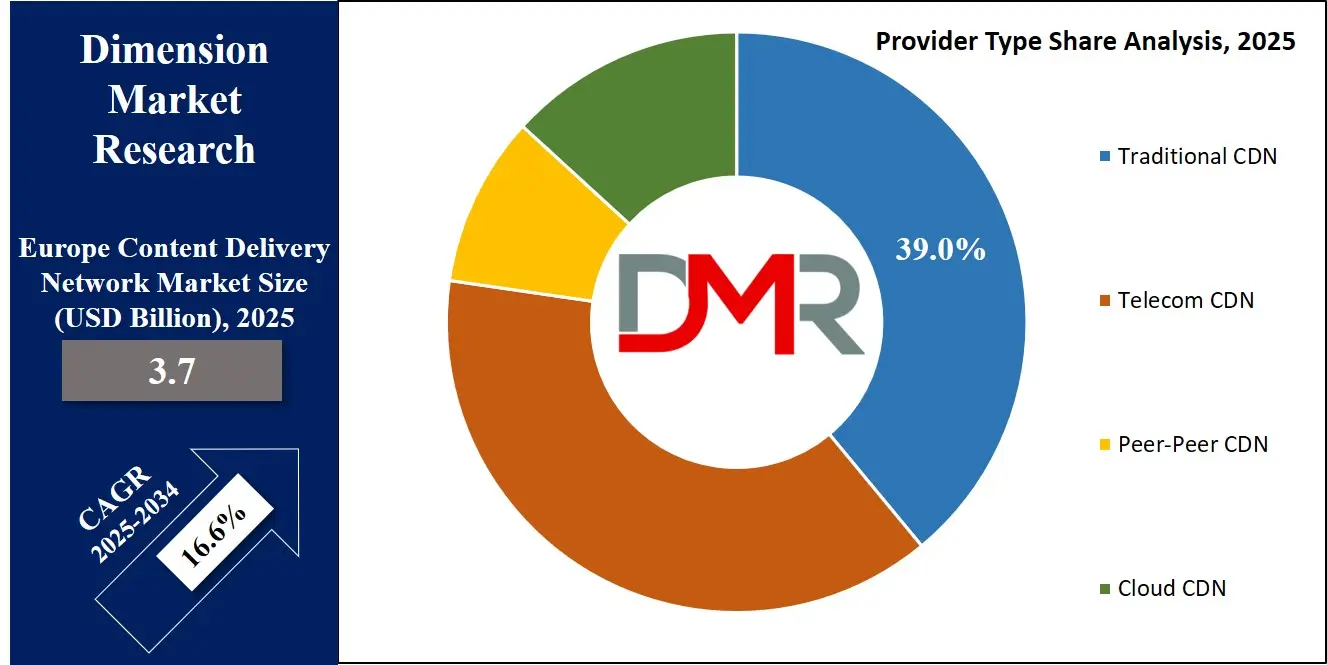

By Provider Type Analysis

Traditional CDN Providers like Akamai, Cloudflare, and Fastly continue to hold a dominant position in the European market. Their strength lies in decades of investment in purpose-built, globally distributed networks with extensive Points of Presence (PoPs) across Europe. These networks are specifically engineered for high availability, redundancy, and superior traffic management, making them ideal for high-volume enterprise workloads in media, gaming, and finance.

They differentiate themselves through deeply integrated security stacks, proprietary performance enhancement technologies, and advanced edge compute environments, offering a one-stop shop for delivery and security that resonates with large multinational corporations operating within the region.

Cloud CDN Providers, such as AWS CloudFront, Google Cloud CDN, and Azure CDN, represent the fastest-growing provider type. Their compelling value proposition is deep integration within their broader hyperscale cloud ecosystems. For businesses already invested in a specific cloud platform, these CDNs offer seamless, simplified access to complementary services like object storage, serverless computing, AI/ML engines, and security suites from European data centers.

This native integration, coupled with a pay-as-you-go pricing model, is highly attractive for digital-native businesses and enterprises undergoing cloud transformation. Their massive, automated global infrastructure ensures scalable and cost-effective content delivery, accelerating their adoption across the continent.

Telecom/CDN Hybrids, including Deutsche Telekom, Orange, and BT, leverage a unique advantage: their ownership of the underlying broadband, fiber, and backbone infrastructure. This convergence allows them to deliver content closer to the end-user than arguably any other provider, reducing network hops and minimizing latency for the "last mile." This is a critical advantage for latency-sensitive applications like video conferencing, cloud gaming, and IoT analytics. By bundling CDN services with their existing connectivity and enterprise contracts, these telecom giants can offer integrated solutions that are highly competitive for real-time delivery needs within their operational regions.

By Application Analysis

Media & Entertainment Delivery is the largest application segment, accounting for the highest commercial adoption of CDNs in Europe. The region's booming OTT ecosystem, including services like Netflix, Amazon Prime Video, and local broadcasters' streaming platforms, is entirely dependent on ultra-reliable, low-latency CDNs. These platforms require robust infrastructure for delivering HD and 4K content with adaptive bitrate streaming to accommodate varying network conditions.

Furthermore, the delivery of live events such as soccer matches, concerts, and news demands massive, instantaneous scalability to handle unpredictable traffic surges without buffering. CDNs are the backbone that enables broadcasters to provide seamless, broadcast-quality viewing experiences to millions of concurrent viewers across diverse European markets.

Web & E-commerce Acceleration is an equally crucial and high-growth application. In the highly competitive online retail space, website speed is directly correlated with conversion rates, customer satisfaction, and revenue. European e-commerce platforms, especially those operating cross-border, rely on CDNs to ensure that dynamic product pages, search results, image-heavy catalogs, and checkout processes load in milliseconds, regardless of the user's location. CDNs support critical functions like dynamic content assembly at the edge, image optimization, and API acceleration. The integration of AI-driven personalization and headless commerce architectures is further elevating the CDN from a performance tool to a critical engine for revenue growth and customer retention.

By End-User Analysis

Media & Entertainment Companies are the most dominant end-users within the European CDN market. Streaming giants, broadcast networks, and gaming platforms have an existential reliance on CDN performance to deliver uninterrupted, high-quality content. Their business models directly depend on quality-of-experience metrics such as buffering ratios, video start-up time, and playback smoothness. The massive, sudden demand spikes during live event releases necessitate a CDN infrastructure capable of real-time load balancing and multi-region delivery, making this segment the top contributor to CDN revenue and a key driver of innovation in low-latency streaming technologies.

Retail & E-commerce Businesses represent another dominant user base. For these companies, the CDN is a direct contributor to the bottom line. Even minor delays in page load times can significantly impact cart abandonment rates and overall sales. CDNs help accelerate the entire online shopping experience, from dynamic product pages to secure payment gateways. As e-commerce in Europe increasingly integrates with live shopping, AI-driven recommendations, and omnichannel strategies, the role of the CDN becomes even more essential, transforming it from a technical utility into a strategic asset for competitive differentiation and sales growth.

BFSI and Healthcare are among the fastest-growing end-user segments. In BFSI, the shift to digital banking, real-time trading platforms, and financial dashboards requires ultra-secure and ultra-fast content and API delivery. CDNs provide the necessary encrypted data transfer, DDoS mitigation, and low-latency performance. In Healthcare, CDNs enable the secure delivery of telehealth sessions, patient portals, and large diagnostic imaging files, all while ensuring compliance with regulations like GDPR. The escalating digital transformation, cybersecurity threats, and remote service models in these highly regulated sectors ensure long-term, robust growth in CDN adoption.

The Content Delivery Network Market Report is segmented on the basis of the following:

By Offering

- Solutions

- Media Delivery

- Web Performance Optimization

- Cloud Security

- Services

- Design & Consulting Services

- Storage Services

- Analytics & Performance Monitoring

- Website & API Management

- Network Optimization Services

- Digital Rights Management

- Others

By Content Type

- Static Content

- Dynamic Content

By Provider Type

- Traditional CDN Provider

- Cloud CDN Provider

- Telecom/CDN Hybrid

- Peer-to-Peer (P2P) CDN

By Application

- Media & Entertainment Delivery

- Web & E-commerce Acceleration

- Website & API Security

- Cloud Security & DDoS Mitigation

- Online Gaming & Software Distribution

- Other Application

By End User

- Media & Entertainment

- E-commerce

- Advertising

- Healthcare

- Financial Services

- Research & Education

- Others

By Region

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Competitive Landscape

The competitive landscape of the Europe Content Delivery Network market is fragmented and dynamic, characterized by a mix of global CDN giants, major cloud providers, and strong regional telecom players. Dominant players like Akamai Technologies, Cloudflare, and Fastly leverage their extensive European networks and integrated security suites to maintain a stronghold, particularly in media delivery and large enterprise accounts.

A significant trend is the aggressive expansion of hyperscale cloud providers, such as Amazon Web Services (AWS CloudFront), Google Cloud (Cloud CDN), and Microsoft Azure (Azure CDN), which bundle CDN services with their broader cloud ecosystems from European data centers. Simultaneously, regional Telecom/CDN Hybrids like Deutsche Telekom and Orange compete effectively by leveraging their network infrastructure for low-latency last-mile delivery, ensuring continuous innovation and intensifying competition across all segments.

Some of the prominent players in the Europe Content Delivery Network are

- Cloudflare

- Akamai Technologies

- Fastly

- Amazon CloudFront

- Google Cloud CDN

- Microsoft Azure CDN

- Limelight Networks

- StackPath

- Edgio

- CDN77

- Bunny.net (BunnyCDN)

- KeyCDN

- G-Core Labs

- CacheFly

- ChinaCache

- OVHcloud CDN

- Leaseweb CDN

- CDNetworks

- ArvanCloud

- QUIC.cloud.

- Other Key Players

Recent Developments

- November 2025: The European Broadcasting Union signed a long-term agreement with LiveU to modernize the Eurovision News Exchange using IP-based delivery. This five-year transition strengthens next-generation contribution workflows and increases reliance on CDN-supported real-time content distribution across Europe.

- October 2025: Capacity Europe 2025 in London brought together carriers, cloud companies, CDN providers, and digital infrastructure leaders. Major CDN-related announcements focused on network expansion, multi-CDN integration, and edge infrastructure upgrades intended to enhance performance, security, and resilience across European digital ecosystems.

- September 2025: IBC2025 in Amsterdam featured extensive demonstrations from CDN, streaming, and cloud providers. Exhibitors presented innovations in edge caching, low-latency video delivery, AI-driven routing, and multi-CDN orchestration, highlighting Europe’s accelerating shift toward high-performance content distribution and real-time streaming optimization.

- September 2025: Orange and Synamedia announced a strategic collaboration to present a fully integrated multi-CDN solution at IBC2025. The partnership aims to improve streaming reliability, dynamically balance traffic, and enhance user experience for large-scale European broadcasters, OTT platforms, and digital media companies.

- August 2025: Zixi partnered with French media platform OKAST to support scalable global FAST and live channel distribution. The collaboration enhances streaming reliability, expands European delivery routes, and strengthens CDN-dependent workflows for content owners targeting broader audiences across connected television and digital platforms.

- December 2024: Akamai acquired selected assets from Edgio, including customer contracts and IP rights, following Edgio’s restructuring. This move expanded Akamai’s reach, strengthened European delivery capabilities, and reinforced its competitive positioning in the region’s evolving CDN and edge services market landscape.

- May 2024: Akamai acquired Noname Security to advance its API security and edge protection capabilities. The integration supports Europe’s rising need for secure CDN operations, enabling improved threat detection, traffic inspection, and enterprise-grade protection for content delivery and cloud-native workloads.

- May 2024: Cloudflare completed multiple technology acquisitions to enhance its security, edge compute, and observability offerings. These investments extended the company’s European CDN capabilities, enabling faster content delivery, advanced threat mitigation, and more reliable performance across multi-cloud, multi-region, and latency-sensitive digital environments.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 3.7 Bn |

| Forecast Value (2034) |

USD 14.9 Bn |

| CAGR (2025–2034) |

16.6% |

| Historical Data |

2019 – 2024 |

| Forecast Data |

2026 – 2034 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Offering (Solutions and Services), By Content Type (Static Content and Dynamic Content), By Provider Type (Traditional CDN, Telecom CDN, Peer-to-Peer CDN, and Cloud CDN), By Application (Media & Entertainment Delivery, Web & E-commerce Acceleration, Website & API Security, Cloud Security & DDoS Mitigation, Online Gaming & Software Distribution, Other Applications), By End User (Media & Entertainment, E-commerce, Advertising, Healthcare, Financial Services, Research & Education, Others) |

| Country Coverage |

Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe |

| Prominent Players |

Cloudflare, Akamai Technologies, Fastly, Amazon CloudFront, Google Cloud CDN, Microsoft Azure CDN, Limelight Networks, StackPath, Edgio, CDN77, Bunny.net, KeyCDN, G-Core Labs, CacheFly, ChinaCache, OVHcloud CDN, Leaseweb CDN, CDNetworks, ArvanCloud, QUIC.cloud, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |

Frequently Asked Questions

The Europe Content Delivery Network Market size is estimated to have a value of USD 3.7 billion in 2025 and is expected to reach USD 14.9 billion by the end of 2034.

The market is growing at a CAGR of 16.6 percent over the forecasted period from 2025 to 2034.

Some of the major key players are Akamai Technologies, Cloudflare, Inc., Amazon Web Services, Inc., Google LLC, Microsoft Corporation, and Deutsche Telekom.