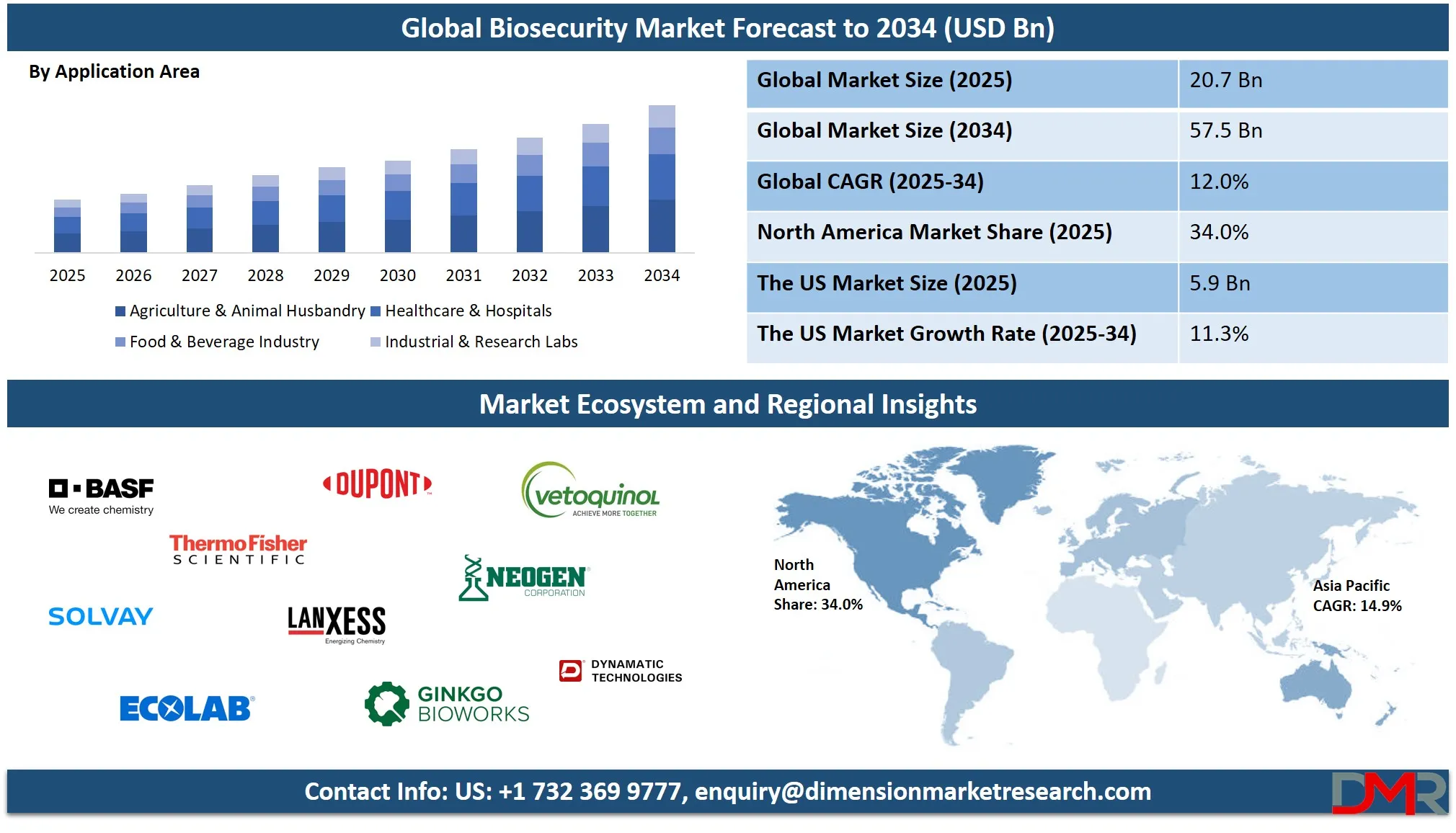

Market Overview

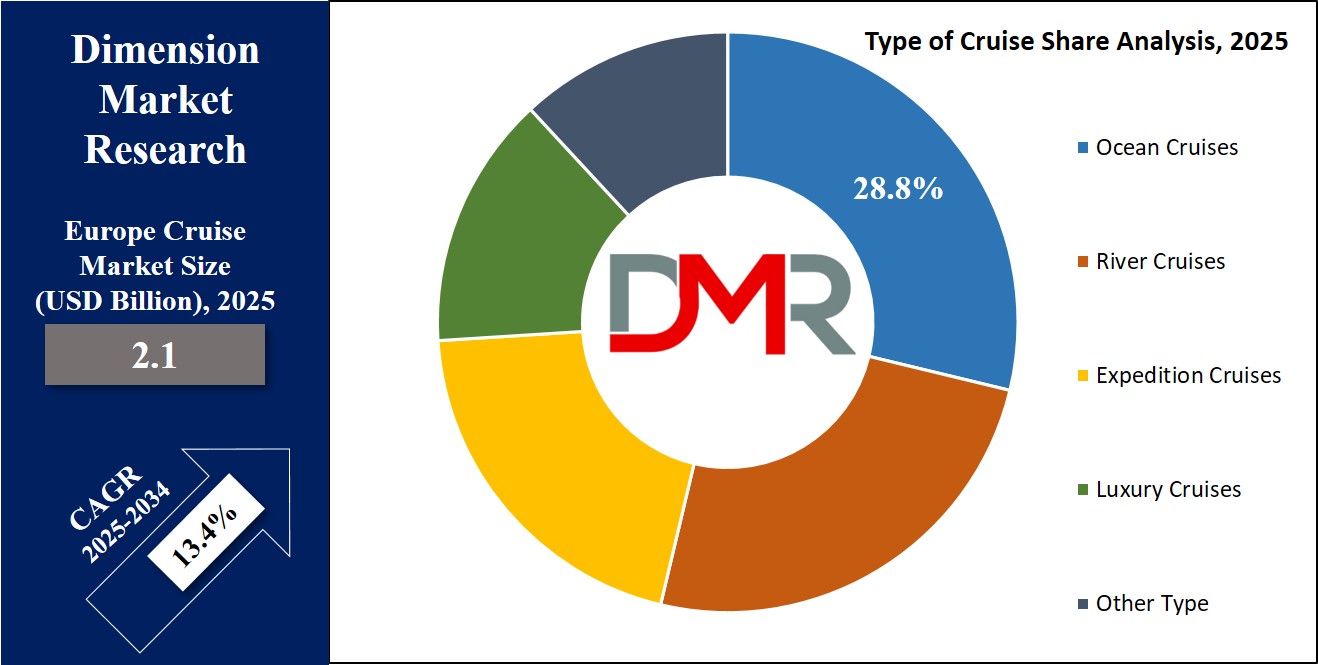

The European Cruise Market is projected to be valued at USD 2.1 billion in 2025. It is further expected to witness subsequent growth in the upcoming period, holding USD 6.5 billion in 2034 at a CAGR of 13.4%.

The European cruise market is witnessing a robust resurgence, driven by evolving traveler preferences, infrastructural advancements, and growing demand for multi-destination leisure travel. The Europe cruise market is growing exponentially, reflecting steady recovery post-pandemic and expanding capacity across key ports. Countries like Italy, Spain, France, and Greece continue to dominate embarkation points, while destinations such as the Mediterranean, Baltic, and Norwegian fjords attract millions annually. A rising trend is the increasing popularity of themed cruises, including wellness, culinary, and cultural expeditions tailored for niche segments, further diversifying the market’s offerings.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

An important growth opportunity lies in river cruising, which is gaining favor among older demographics seeking relaxed, immersive experiences along waterways such as the Danube, Rhine, and Seine. Operators are investing in smaller, eco-efficient ships to access inland cities and towns that traditional ocean liners cannot reach. Moreover, the rise in luxury and expedition cruising reflects a shift toward experiential travel, where passengers prioritize personalized services, exclusive excursions, and sustainable travel practices. This is also boosting demand for high-end cruise packages and increasing average revenue per user (ARPU).

Despite these prospects, the market faces notable restraints. Environmental regulations are tightening, particularly in emission control areas (ECAs), pushing cruise operators to adopt cleaner fuels and greener technologies. Rising operational costs, including port fees and crew expenses, also exert financial pressure. Furthermore, geopolitical instability in parts of Eastern Europe occasionally disrupts cruise itineraries, impacting traveler confidence and booking patterns.

Nevertheless, growth prospects remain strong. Europe's extensive coastline, interconnected waterways, and cultural heritage position it as a premier cruise destination. Cruise lines are increasingly integrating digital tools, AI-powered itinerary planners, and contactless services to enhance guest experience. Younger travelers are showing interest in short-haul cruises with flexible durations, creating new demand segments. With favorable economic indicators and increasing consumer willingness to spend on travel experiences.

Europe Cruise Market: Key Takeaways

- Market Size Insights: The Europe Cruise Market size is estimated to have a value of USD 2.1 billion in 2025 and is expected to reach USD 6.5 billion by the end of 2034.

- By Type of Cruise Segment Insights: Ocean cruises is expected tocommand the Europe cruise market in this segment with the majority market share in 2025.

- By Traveler Age Segment Insights: Travelers aged 31–50 years are projected to lead the age group segment in the European cruise market as it command the highest market share in 2025.

- By Booking Channel Insights: Online Travel Agencies (OTAs) are expected to dominate the booking channel segment of the Europe cruise market with highest market share in 2025.

- Key Players Insights: Some of the major key players in the European cruise Market are MSC Cruises, Costa Cruises, AIDA Cruises, Royal Caribbean International, Norwegian Cruise Line, Carnival Cruise Line, Celebrity Cruises, Princess Cruises, Holland America Line, P&O Cruises, and many others.

- Market Growth Rate Insights: The market is growing at a CAGR of 13.4 percent over the forecasted period of 2025.

Europe Cruise Market: Use Cases

- Cultural Discovery Cruises: Travelers explore historical cities like Rome, Athens, and Dubrovnik while enjoying onboard lectures and guided shore excursions. These cruises appeal to history buffs and cultural enthusiasts who prefer structured, enriching itineraries. Operators partner with local historians to create immersive experiences that extend beyond traditional sightseeing, driving demand for educational and experience-based travel across Europe.

- River Cruises for Seniors: Elderly travelers opt for calm, scenic journeys along rivers like the Danube and Rhine. These cruises offer easy accessibility, smaller ships, and medical assistance, making them ideal for seniors. Operators include gentle-paced excursions, wellness facilities, and all-inclusive pricing to attract this demographic, which accounts for a significant portion of Europe’s cruise revenue.

- Luxury Honeymoon Cruises: Newlyweds seek exclusive, romantic cruises across the Mediterranean or the Greek Isles. Featuring private balconies, gourmet dining, and curated couple experiences, these cruises cater to high-end customers. Premium cruise lines offer honeymoon packages with spa treatments, private shore tours, and intimate on-deck dinners, enhancing the appeal of Europe as a luxury honeymoon destination.

- Family Adventure Cruises: Families book cruises with kid-friendly amenities, interactive entertainment, and flexible dining options. Routes through Spain, Italy, and France offer educational excursions and beach stops. Onboard facilities like water parks, themed cabins, and supervised kids’ clubs help operators cater to multigenerational families seeking value-packed vacations that blend fun and cultural exposure.

- Corporate Incentive Cruises: Companies organize incentive-based cruises for top performers or team-building retreats. Itineraries include conference rooms, networking lounges, and scheduled team activities. Sailing through destinations like the Baltic or Western Mediterranean, these cruises offer a blend of business and leisure, making them an attractive alternative to land-based corporate events.

Europe Cruise Market: Stats & Facts

EU Eurostat – Maritime Passenger & Vessel Statistics

- In 2023, approximately 16.4 million cruise passengers passed through ports in the European Union, exceeding the 14.6 million recorded in 2019, showing full recovery and renewed interest in cruise tourism.

- Italy was the leading embarkation country, with 5.3 million cruise passengers, representing 32.5% of the EU total.

- Spain followed with 3.6 million passengers (22.1%), while Germany recorded 2.8 million (17.3%) of the total EU cruise passengers.

- While cruise passengers account for a relatively small portion of overall maritime passengers, they significantly impact concentrated cruise-focused ports, such as Civitavecchia, Barcelona, and Piraeus.

- In 2023, 2.2 million vessels called at major European Union ports, which marked a 1.5% increase from the previous year.

- Greece recorded the highest number of vessel port calls, particularly attributed to its fragmented geography and strong ferry and cruise networks.

- The average vessel size visiting EU ports was around 8,058 gross tonnage, indicating the growing scale of ships.

- Italy led in gross tonnage throughput, with 3.7 billion GT handled in its major ports in 2023.

- Passenger vessels made up 14.2% of all vessels arriving at the EU's principal ports, underscoring the growing focus on tourism-driven maritime operations.

European Commission – Cruise Tourism and Blue Economy

- The European Commission has positioned cruise tourism as a strategic pillar under its sustainable blue economy goals, linking it directly to green energy transition, digitalization, and coastal community development.

- Between 2010 and 2019, cruise tourism in Europe saw a significant upward trend, growing from 12 million to 17 million cruise passengers annually before the pandemic.

- In 2022, Spain contributed 28% of the Gross Value Added (GVA) from coastal tourism across the EU, followed by France (15%) and Italy (12%), with cruise tourism contributing substantially to these figures.

- The accommodation segment of coastal tourism, which includes cruise ship stays, generated a remarkable EUR 42.4 billion in GVA, representing over half (52%) of the entire sector’s economic output.

EU Blue Economy Observatory – Maritime Transport

- In 2023, 386 million maritime passengers (non-cruise and cruise) embarked or disembarked at EU ports, reflecting a 6.8% increase compared to 2022, as maritime travel continued to recover. Of this, 16 million were cruise passengers, a significant 34% increase from the previous year, demonstrating a strong rebound and surpassing pre-COVID-19 levels.

- Italy topped the list in total maritime passenger traffic, including cruise travelers, with 92 million passengers handled in 2023, a 17% rise year-on-year.

- The maritime transport sector in the EU generated EUR 61.8 billion in Gross Value Added (GVA) in 2022, a 39% increase over 2021, indicating a robust financial recovery.

- The same sector reported a turnover of EUR 228 billion in 2022, growing 29% from the previous year, driven largely by cargo and passenger vessel operations.

- In terms of employment, the maritime transport sector supported approximately 392,800 jobs in 2022, a 4% increase compared to 2021.

- The average remuneration per person employed in this sector reached EUR 44,800 annually in 2023, reflecting relatively high wage levels compared to other blue economy segments.

- EU Blue Economy Observatory – Shipbuilding and Repair

- As of 2023, the European Union hosted approximately 150 major shipyards, several of which specialize in luxury and mid-sized cruise vessel construction.

- Roughly 1 out of every 11 vessels constructed worldwide in 2023 was built in a European shipyard, underlining Europe’s global relevance in shipbuilding.

- Among ship types, European shipyards delivered 38 tugs/dredgers, 29 fishing vessels, 29 general cargo ships, and 26 passenger ships, many of which were river or coastal cruise vessels.

- There was a 9% increase in new ship orders received by EU shipyards in 2023, reflecting improving investor confidence in the maritime sector.

- Cruise ships alone accounted for 11 new orders, marking a substantial portion of high-value builds placed within European yards, primarily in countries like Germany, Italy, and Finland.

Europe Cruise Market: Market Dynamics

Driving Factors in the European Cruise Market

Increasing Disposable Income and Post-Pandemic Travel Resurgence

Europe’s cruise market is benefiting significantly from the resurgence in international travel post-COVID-19, supported by growing disposable incomes and pent-up demand. With the lifting of restrictions and a broad return to normalcy in global mobility, European consumers, especially from Germany, the UK, France, and Italy, are prioritizing leisure spending. Cruise holidays, which offer all-inclusive, multi-country travel experiences, are emerging as attractive options for both families and retirees.

Moreover, the strong recovery of the European aviation sector has reinstated cruise-air packages, facilitating easier access to embarkation points. The market is also being driven by “revenge travel,” a behavioral shift where consumers are eager to make up for lost travel experiences during lockdowns. Cruise companies are reporting record bookings, often surpassing pre-pandemic levels. The affordability of short European itineraries, flexible booking policies, and the availability of varied cruise lengths from weekend escapes to 15-day explorations make cruising increasingly accessible across income groups.

Expansion of Cruise Infrastructure and Smart Port Integration

European countries are aggressively investing in cruise port infrastructure modernization, which is directly accelerating market growth. Major ports such as Barcelona, Civitavecchia (Rome), Piraeus, and Marseille have expanded docking facilities, added terminals, and implemented advanced embarkation technologies to accommodate mega-ships and ensure faster passenger throughput. The integration of smart port systems such as automated check-ins, digital luggage tracking, biometric screening, and AI-powered crowd management enhances passenger convenience and improves operational efficiency.

Furthermore, governments are funding shore power installations and green refueling hubs to support low-emission cruise vessels. Northern European countries are also developing secondary cruise ports in cities like Bergen, Turku, and Kiel to disperse tourist flow and promote regional tourism. This expansion reduces congestion at traditional hubs and attracts new cruise operators seeking diversified itineraries. As European ports become more efficient, environmentally compliant, and passenger-friendly, they strengthen Europe’s appeal as a premier global cruise destination.

Restraints in the European Cruise Market

Environmental Regulations and Emission Compliance Costs

The European cruise industry faces stringent environmental regulations imposed by the EU and national maritime authorities, posing a significant restraint on operational flexibility and cost-efficiency. These include mandates to reduce sulfur content in marine fuels, adoption of low-emission propulsion systems, and the installation of exhaust gas cleaning systems (scrubbers). Moreover, ports in Norway, Denmark, and Germany are implementing "zero-emission zones" where only ships with shore power or electric propulsion are permitted. Compliance requires massive capital investment in fleet modernization or retrofitting, raising costs for operators and potentially reducing profit margins.

Smaller cruise companies may struggle to keep pace with such environmental expectations, limiting fleet deployment in high-demand regions. In addition, navigating different regulatory frameworks across EU member states creates complexity. As sustainability becomes a core expectation among travelers and governments alike, the industry's inability to swiftly meet environmental standards could lead to route restrictions, fines, or negative public perception.

Overtourism and Local Resistance in Key Port Cities

Overtourism has emerged as a critical issue in popular European cruise destinations such as Venice, Dubrovnik, Barcelona, and Santorini. Local governments and resident communities are increasingly voicing concerns about overcrowding, environmental degradation, and strain on local infrastructure caused by mass cruise tourism. In response, authorities are imposing restrictive measures, including daily cruise ship quotas, congestion taxes, and even outright cruise bans in historic city centers, as seen in Venice’s ban on large ships in the lagoon. Such regulatory constraints reduce itinerary options and limit passenger volumes for cruise operators.

Furthermore, negative media coverage and anti-cruise protests can damage the sector’s reputation and deter high-value travelers. Cruise lines are forced to modify routes, dock at alternative ports, or invest in mitigation measures each carrying logistical and financial challenges. If not addressed through sustainable tourism frameworks and community engagement, this resistance may significantly limit growth potential in Europe’s most iconic destinations.

Opportunities in the European Cruise Market

Penetration into Untapped Eastern and Northern Europe Markets

The European cruise market holds untapped potential in regions like the Baltic, Balkans, and Eastern Europe. Destinations such as Romania, Bulgaria, Albania, and Lithuania are emerging as alternative cruise stops, offering cultural richness, affordability, and less saturation than traditional Western European ports. Cruise operators have begun launching itineraries to Constanta (Black Sea), Riga (Latvia), and Durres (Albania) to tap into this demand. These markets provide opportunities for customized routes that combine historical exploration with natural scenery, especially on river and expedition cruises.

Similarly, Arctic and Nordic expeditions to Iceland, Greenland, and Svalbard are growing due to climate awareness and adventure tourism trends. These new cruise circuits enable operators to extend the sailing season and avoid over-touristed ports. Additionally, governments in these regions are offering incentives and investing in port development to attract cruise business. Targeting these underserved areas can significantly boost passenger volumes and diversify Europe’s cruise portfolio.

Digitization and Personalized Cruise Experiences

Technological innovations are enabling cruise operators in Europe to offer highly personalized, data-driven travel experiences that enhance customer satisfaction and encourage repeat business. Cruise lines are deploying AI-powered recommendation engines, mobile apps, and wearable tech to customize itineraries, dining preferences, onboard activities, and shore excursions in real time. Facial recognition technology expedites boarding, while digital concierge services elevate passenger service quality. Virtual reality previews of shore destinations and augmented reality-enhanced onboard entertainment are reshaping passenger engagement.

Furthermore, integrated booking ecosystems allow travelers to customize pre- and post-cruise stays, transfers, and excursions from a single platform. The ability to hyper-personalize every aspect of the cruise, especially for luxury, wellness, and family segments, creates significant value and brand loyalty. Digitization also reduces operational inefficiencies, increases upselling opportunities, and provides cruise lines with deep behavioral data that can be monetized. Embracing digital transformation opens vast growth opportunities in an increasingly experience-driven market.

Trends in the European Cruise Market

Rise of Sustainable and Green Cruising Practices

The European cruise market is undergoing a pivotal transformation led by the increasing emphasis on environmental sustainability. Cruise operators are adopting low-emission propulsion technologies such as LNG (liquefied natural gas), shore power connectivity, and hybrid-electric engines to comply with European Union environmental directives and port-specific regulations. Countries like Norway and Germany are imposing strict emission limits in fjords and coastal zones, prompting cruise lines to modernize fleets or retrofit older ships.

The integration of waste management systems, advanced water treatment facilities, and zero-discharge policies is also becoming standard. Additionally, “slow cruising,” which includes longer stays and reduced fuel use, is gaining popularity. This shift aligns with Europe’s Green Deal and the IMO’s carbon reduction targets, signaling a trend that is both regulatory and consumer-driven. Travelers are increasingly favoring lines that demonstrate transparent environmental responsibility, making eco-tourism a competitive advantage in the cruise industry.

Growing Demand for River and Cultural Cruises

There is a notable uptick in the popularity of river cruises across European destinations such as the Danube, Rhine, Seine, and Douro. These cruises offer an intimate, immersive travel experience focused on cultural exploration, culinary tourism, and historical education appealing particularly to mature travelers aged 50+. Unlike ocean cruises, river cruises dock directly in city centers, enabling greater access to cultural landmarks and reducing transit fatigue.

The demand is fueled by increased marketing of off-season and themed cruises, including wine tours, music festivals, and Christmas market itineraries. Additionally, river cruise operators are diversifying offerings to attract younger demographics through wellness, biking, and gastronomy-focused trips. The trend reflects a shift in consumer preference towards more localized, personalized, and culturally enriching experiences. Moreover, the lower environmental impact of river cruising compared to ocean liners positions it as a more sustainable option, contributing to its growing appeal among European and North American travelers.

Europe Cruise Market: Research Scope and Analysis

By Type of Cruise Analysis

Ocean cruises are projected to dominate the European cruise market due to their expansive itineraries, large ship capacities, and access to iconic destinations across the Mediterranean, Baltic, and Northern European seas. These cruises offer multi-country journeys that connect major cities like Barcelona, Rome, Athens, Copenhagen, and Dubrovnik, making them attractive to international travelers looking to maximize cultural exposure within a single trip. Ocean liners are equipped with extensive onboard amenities, including fine dining, entertainment, spas, and family-friendly facilities, making them ideal for a broad demographic from families to retirees.

Another driver of dominance is the presence of established ports and well-developed maritime infrastructure throughout coastal Europe. Cruise hubs such as Barcelona, Venice, and Southampton are highly accessible via international airports and railways, allowing seamless integration of air-sea travel. Additionally, ocean cruises appeal to both first-time and repeat travelers due to their affordability, flexible duration (ranging from 3-day mini-cruises to 14-day voyages), and competitive packages offered by major cruise lines like MSC Cruises, Costa Cruises, and Royal Caribbean.

Moreover, ocean cruises have scaled sustainability efforts, with many ships adopting LNG propulsion, shore power connectivity, and waste reduction practices to meet EU emission standards. The large-scale nature of ocean cruises also allows for better pricing flexibility and operational efficiency. Their appeal is further supported by aggressive marketing campaigns, loyalty programs, and themed voyages such as music, wellness, and gourmet cruises that attract niche customer segments. The diversity in offerings, robust logistics, and strong port ecosystems collectively cement ocean cruises as the dominant force in the European cruise market.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

By Traveler Age Analysis

Travelers aged 31–50 years are expected to form the dominant age group in the European cruise market due to their financial stability, travel ambition, and lifestyle preferences. This demographic typically includes working professionals, dual-income families, and millennials who are entering peak earning years and seeking immersive, value-driven travel experiences. Cruises provide a seamless combination of luxury, cultural enrichment, and convenience, making them particularly attractive to this age group, who prioritize efficient vacation planning amid busy careers.

Many cruise itineraries, especially in Europe, are designed to appeal to this segment by offering a mix of historical exploration, culinary experiences, nightlife, wellness amenities, and adventure excursions. The availability of short-duration cruises (3–7 days) and flexible booking policies allows younger professionals to plan around work schedules or holidays without long downtimes. Moreover, cruise packages cater to tech-savvy travelers in this age group by incorporating digital services such as mobile check-ins, Wi-Fi connectivity, app-based itineraries, and social media-friendly onboard experiences.

Another factor contributing to dominance is the rising trend of multigenerational travel, with 31–50-year-olds often serving as travel planners for both children and older relatives. Cruise ships, with their inclusive facilities, kids’ clubs, teen lounges, fitness centers, and elder care services, make ideal vacation choices. Furthermore, many in this age group seek eco-conscious travel and are more inclined to choose cruise lines that align with sustainability values. Coupled with strong promotional campaigns and early-booking discounts, the 31–50 age group continues to drive volume and revenue in Europe’s cruise market with high engagement and repeat travel intent.

By Booking Channel Analysis

Online Travel Agencies (OTAs) are expected to dominate the booking channel segment of the European cruise market due to their broad accessibility, dynamic pricing models, and customer-friendly interfaces that simplify complex cruise selections. Platforms like Expedia, Cruise Critic, Booking.com, and regional agencies such as eDreams and TUI provide users with real-time availability, multi-operator comparisons, verified reviews, and customizable filters that make cruise planning easier for digitally fluent consumers. OTAs cater especially well to younger and mid-aged travelers who prefer self-service, mobile-first booking methods over traditional agents.

Additionally, OTAs enable cross-selling opportunities such as flight and hotel bundles, car rentals, and shore excursions all within a single platform delivering convenience and cost efficiency. Their integration with loyalty programs and the ability to offer flash sales, last-minute deals, and dynamic discounts make them highly attractive to price-sensitive as well as experience-seeking customers. OTAs also drive cruise bookings by leveraging data analytics and AI-based recommendation engines to personalize offerings, send timely alerts, and enhance engagement.

The European market, with its high internet penetration and growing online shopping behavior, naturally supports this channel’s growth. OTAs provide 24/7 access, multilingual support, and instant confirmations, which are particularly beneficial for international travelers navigating different time zones. During the post-pandemic period, OTAs rapidly adapted with flexible cancellation policies, insurance add-ons, and health and safety updates, restoring traveler confidence. Furthermore, cruise lines themselves often partner with OTAs for wider distribution and to fill remaining cabins quickly. The convenience, transparency, and adaptability of OTAs position them as the leading channel for cruise bookings in Europe.

By Customer Type Analysis

International tourists are expected to dominate the European cruise market customer type segment due to the continent’s global appeal, rich cultural diversity, and compact geography that allows multiple country visits within a short timeframe. Travelers from North America, Asia-Pacific, Latin America, and the Middle East view Europe as a once-in-a-lifetime or aspirational destination. Cruises offer an efficient and comfortable way for these travelers to explore iconic cities like Rome, Paris, Barcelona, Venice, and Amsterdam without the hassle of intercity transportation or hotel changes.

International travelers prefer cruises for their all-inclusive structure, which simplifies logistics and reduces language barriers, making them ideal for navigating unfamiliar regions. Cruise lines also curate shore excursions with multilingual guides and culturally immersive activities, enhancing appeal for overseas customers. Packages often include flight-cruise bundles and visa assistance, making it easier for international tourists to plan comprehensive European experiences.

Another factor driving this dominance is the strong air connectivity into major European port cities such as Barcelona, Athens, Copenhagen, and Southampton. Cruise lines target international travelers through global campaigns, travel fairs, and partnerships with OTAs and travel agencies across key outbound markets. Moreover, international tourists often travel during shoulder seasons to avoid peak crowds, helping cruise companies maintain year-round occupancy.

High-spending international travelers are also more likely to book premium cabins, specialty dining, and luxury services, increasing average revenue per passenger. Their demand for long-duration cruises (10–14+ days) aligns well with Europe’s vast cultural offerings. With strong brand loyalty and repeat travel intent, international tourists continue to be the cornerstone of growth and profitability for the European cruise industry.

The Europe Cruise Market Report is segmented on the basis of the following:

By Type of Cruise

- Ocean Cruises

- River Cruises

- Expedition Cruises

- Luxury Cruises

- Other

By Age Group of Travelers

- 18–30 Years

- 31–50 Years

- 51–70 Years

- 71+ Years

By Booking Channel

- Online Travel Agencies (OTAs)

- Cruise Line Direct Booking

- Travel Agents

- Corporate/Group Bookings

By Customer Type

- Domestic Tourist

- International Tourist

By Region

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Europe Cruise Market: Competitive Landscape

The European cruise market is characterized by the presence of well-established international players and region-specific operators competing across various cruise segments. Key global brands like MSC Cruises, Costa Cruises, Royal Caribbean International, Norwegian Cruise Line, and Carnival Corporation dominate the market with large fleets, expansive itineraries, and diversified onboard offerings. These players leverage brand loyalty, robust marketing strategies, and long-standing partnerships with European port authorities to maintain a competitive advantage.

Meanwhile, regional operators such as Viking Cruises, AIDA Cruises, TUI Cruises, and Ponant cater to niche segments like river cruises, luxury expeditions, and eco-conscious voyages. These companies focus on immersive local experiences, sustainability, and premium services to differentiate themselves.

Competition is further intensified by charter operators, boutique lines, and all-inclusive luxury brands like Regent Seven Seas Cruises and Seabourn, which attract affluent travelers seeking exclusivity. Companies are investing in fleet modernization, shore power integration, LNG-fueled ships, and digital experiences to stay competitive amid tightening environmental regulations.

Post-COVID, competitive dynamics have shifted towards enhanced health safety protocols, flexible booking, and hybrid marketing approaches. Strategic alliances with OTAs, loyalty programs, and expansion into emerging Eastern European ports are also reshaping competition. Innovation, sustainability, and customer-centricity remain central to market leadership.

Some of the prominent players in the European Cruise Market are:

- MSC Cruises

- Costa Cruises

- AIDA Cruises

- Royal Caribbean International

- Norwegian Cruise Line

- Carnival Cruise Line

- Celebrity Cruises

- Princess Cruises

- Holland America Line

- P&O Cruises

- Cunard Line

- TUI Cruises

- Viking Cruises

- Silversea Cruises

- Seabourn Cruise Line

- Azamara

- Fred. Olsen Cruise Lines

- Marella Cruises

- Hapag-Lloyd Cruises

- Crystal Cruises

- Other Key Players

Recent Developments in the European Cruise Market

- December 2024 : Carnival Cruise Line announced the addition of four ships to its Australian fleet beginning in March 2025. These include rebranded P&O Cruises Australia vessels Pacific Adventure and Pacific Encounter, renamed as Carnival Adventure and Carnival Encounter.

- FITUR Cruises 2025, scheduled for January 2025 in Madrid, previewed its agenda, focusing on cruise sector growth, sustainability, and expanding cruise tourism, with an expected 35.7 million global passengers and a 10% rise in capacity from 2024–2028.

- November 2024 , The Cruise Forward Summit in Miami, hosted by CLIA, emphasized sustainable maritime practices, health security, guest innovations, and decarbonization strategies. Over 100 industry stakeholders participated in panels and networking sessions.

- Seatrade Cruise Asia was held in Manila, focusing on the resurgence of Asia’s cruise industry, regional tourism development, crewing challenges, and infrastructure investment.

- October 2024, OSM Thome and Ship Management Group announced a major collaboration to offer integrated ship management solutions. The alliance aims to combine global reach with agile, boutique services.

- The first Expedition Cruise Conference was launched in London, serving as a dedicated B2B platform for expedition and adventure cruise operators, suppliers, and port representatives.

- The Adriatic Sea Forum in Ravenna spotlighted port sustainability, new ship fuels, and investment in green cruise infrastructure. Ravenna reported over €100 million invested in port upgrades to support eco-friendly operations.

- September 2024, Seatrade Cruise Med in Malaga focused on managing mass tourism, sustainable cruise development, and decarbonization. It brought together regional ports, cruise lines, and environmental groups to shape cruise policies for the Mediterranean.

- SMM Hamburg, the leading international maritime fair, centered on digital transformation, energy transition, and sustainable propulsion systems for cruise vessels, featuring 2,000+ exhibitors from over 100 countries.

- August 2024, Seatrade Cruise Asia revealed its full conference program for the November event in Manila. Themes included the future growth of Asia’s cruise market, improved port facilities, and supply chain solutions for regional cruising

- June 2024, Carnival Cruise Line announced a fleet expansion plan that would increase its ship capacity by 50% compared to 2019 levels. The Carnival brand is projected to account for 37% of Carnival Corporation’s fleet mix by 2028.

- April 2024, Cruise Saudi presented its cruise ecosystem plans at Seatrade Cruise Global in Miami, showcasing progress in transforming the Red Sea and Arabian Gulf into global cruise destinations with dedicated terminals and sustainable tourism goals.

- Norwegian Cruise Line placed its largest ship order to date eight new vessels to be delivered from 2026 to 2036 reflecting strong long-term demand and a shift toward next-generation, energy-efficient ships.

- January 2024, Viking made its public trading debut in early January and registered the second-highest IPO capital raise in the cruise sector’s history. Its strong post-listing performance reflected high investor confidence in the premium river and ocean cruise segments.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 2.1 Bn |

| Forecast Value (2034) |

USD 6.5 Bn |

| CAGR (2025–2034) |

13.4% |

| Historical Data |

2019 – 2024 |

| Forecast Data |

2025 – 2033 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Type of Cruise (Ocean Cruises, River Cruises, Expedition Cruises, Luxury Cruises, Other), By Age Group of Travelers (18–30 Years, 31–50 Years, 51–70 Years, 71+ Years), By Booking Channel (Online Travel Agencies (OTAs), Cruise Line Direct Booking, Travel Agents, Corporate/Group Bookings), By Customer Type (Domestic Tourist, International Tourist). |

| Regional Coverage |

North America – US, Canada; Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA |

| Prominent Players |

MSC Cruises, Costa Cruises, AIDA Cruises, Royal Caribbean International, Norwegian Cruise Line, Carnival Cruise Line, Celebrity Cruises, Princess Cruises, Holland America Line, P&O Cruises, Cunard Line, TUI Cruises, Viking Cruises, Silversea Cruises, Seabourn Cruise Line, Azamara, Fred. Olsen Cruise Lines, Marella Cruises, Hapag-Lloyd Cruises, Crystal Cruises., and Other Key PlayersGroup Ltd, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |