Market Overview

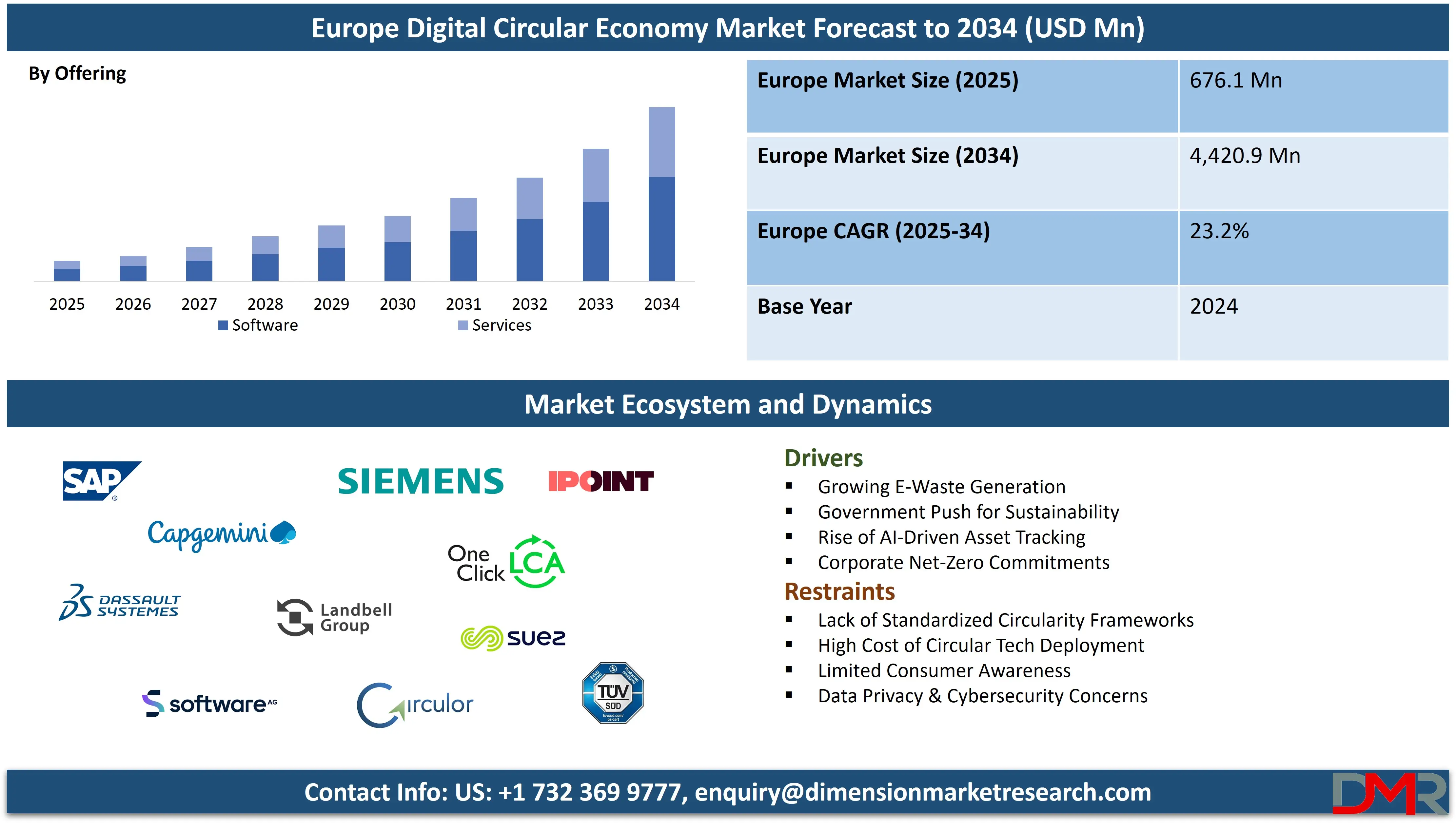

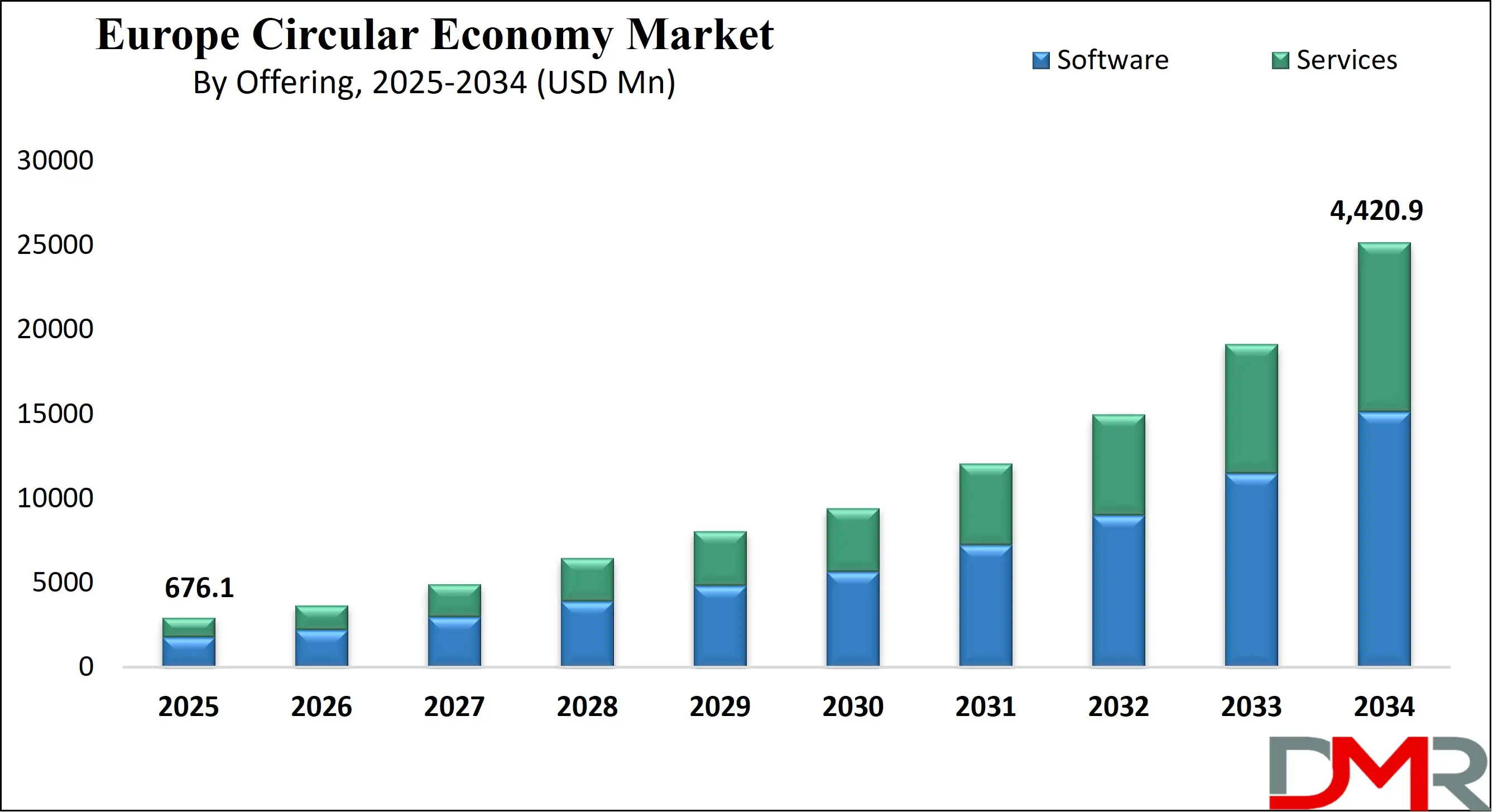

The Europe Digital Circular Economy Market is projected to rise from USD 676.1 million in 2025 to USD 4,420.9 million by 2034, reflecting a strong CAGR of 23.2%.

This growth is driven by the rapid adoption of circular platforms, digital product passports, material traceability tools, smart waste management solutions, and lifecycle assessment technologies. Increasing regulatory pressure, sustainability initiatives, and the shift toward data driven resource efficiency are accelerating market expansion across manufacturing, electronics, retail, construction, and industrial supply chains.

Digital circular economy refers to an economic framework where digital technologies enable products materials and resources to be used for longer continuously recovered and reintroduced into the value chain. It combines principles of circularity such as reuse repair remanufacturing recycling and resource optimization with tools like IoT blockchain AI cloud platforms and lifecycle assessment software.

These technologies make it possible to track materials in real time enhance product transparency enable digital product passports optimize waste streams and support data driven decisions that minimize environmental impact. As a result companies can shift from linear take make dispose models to closed loop intelligent systems that conserve resources reduce emissions and promote long term sustainability.

The Europe digital circular economy market is expanding rapidly as governments industries and consumers push for smarter resource efficiency and data driven sustainability. Growing implementation of digital product passports material traceability tools smart waste management platforms and advanced sustainability analytics is enabling manufacturers and service providers to redesign value chains around reuse and regenerative systems.

Europe’s strong policy environment including circular transition strategies eco design regulations and extended producer responsibility requirements is accelerating technology adoption across sectors. Enterprises are increasingly deploying circular software platforms to meet compliance expectations while improving operational transparency and lowering waste generation.

The market is also benefiting from rapid growth in digital infrastructure cloud computing artificial intelligence and IoT enabled asset monitoring which support real time lifecycle assessment and predictive resource planning. Rising investments in refurbished electronics sharing economy platforms industrial recycling automation and digital material marketplaces are further strengthening Europe’s shift toward circular value creation. With increased collaboration across stakeholders and the rise of circular by design manufacturing approaches Europe is becoming a global leader in merging sustainability innovation and digital transformation.

Europe Digital Circular Economy Market: Key Takeaways

- Market Value: The Europe Digital Circular Economy market size is expected to reach a value of USD 4,420.9 million by 2034 from a base value of USD 676.1 million in 2025 at a CAGR of 23.2%.

- By Offering Segment Analysis: Services are anticipated to dominate the offering segment, capturing 60.0% of the total market share in 2025.

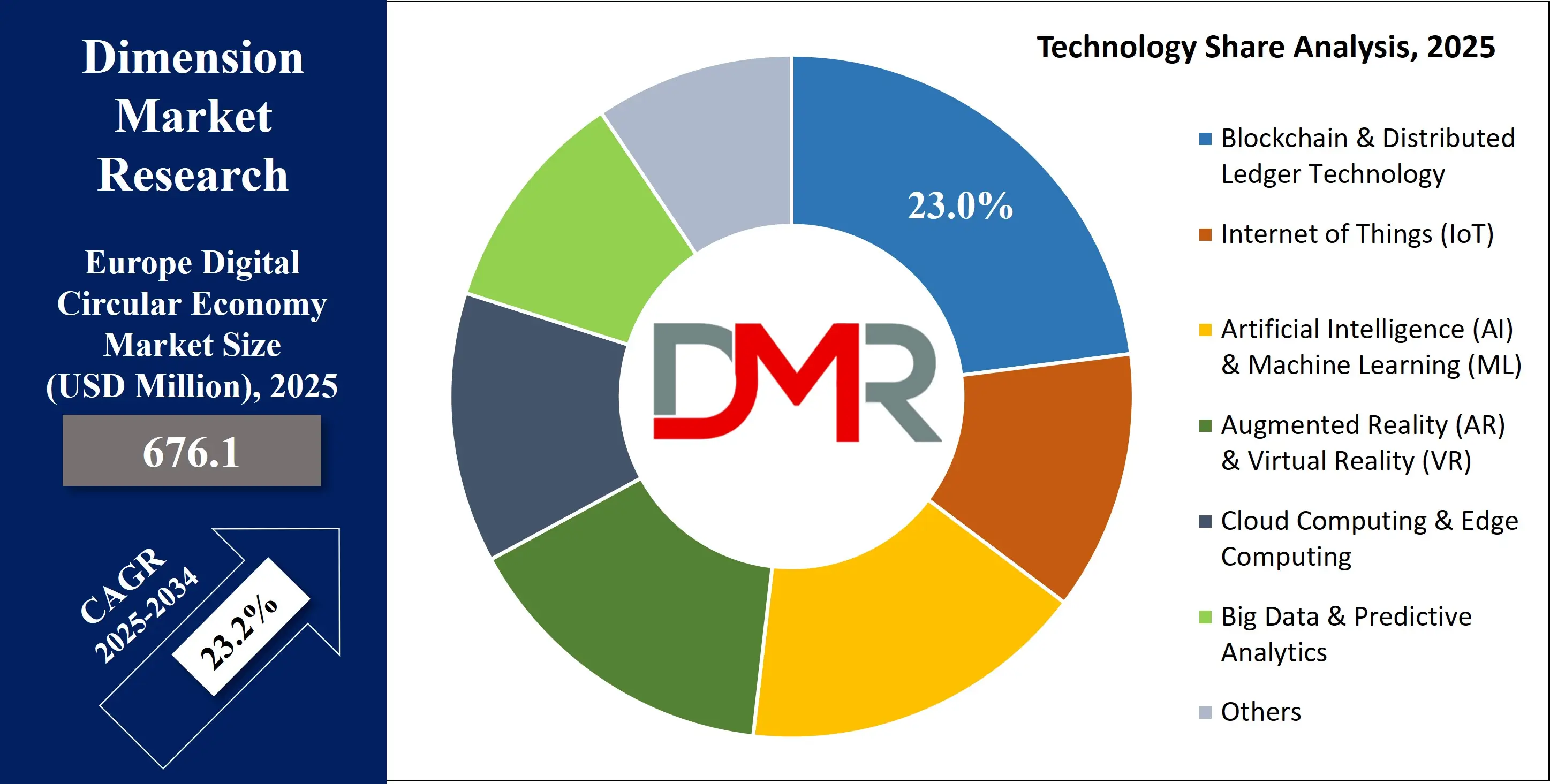

- By Technology Segment Analysis: Blockchain & Distributed Ledger Technology is expected to maintain its dominance in the technology segment, capturing 23.0% of the total market share in 2025.

- By Application Segment Analysis: Supply Chain & Material Tracking applications will dominate the application segment, capturing 21.0% of the market share in 2025.

- By End User Segment Analysis: Consumer Electronics are anticipated to maintain their dominance in the end user segment, capturing 27.0% of the market share in 2025.

- Key Players: Some key players in the Europe Digital Circular Economy market are SAP, Capgemini, Dassault Systèmes, Software AG, Siemens (Siemens-Advanta), Landbell Group, iPoint Systems, One Click LCA, TÜV SÜD, SUEZ, Circulor, Anthesis Group, GeoFluxus, Grover, and Others.

Europe Digital Circular Economy Market: Use Cases

- Smart Waste Management and Resource Optimization: European cities are deploying IoT sensors AI enabled analytics and cloud based platforms to monitor waste streams optimize collection routes and classify recyclables with higher precision. These digital tools increase recycling rates reduce landfill dependence and support circular resource recovery. Municipalities and waste management providers use real time data to improve sorting quality maximize material reuse and create more efficient circular value loops across urban regions.

- Digital Product Passports for Supply Chain Transparency: Manufacturers across Europe are adopting digital product passports to track materials components and environmental footprints throughout a product’s lifecycle. These passports enable better repairability recyclability and compliance with evolving EU circular economy regulations. By integrating blockchain traceability and lifecycle assessment tools companies gain deeper visibility into supply chains reduce resource loss and support circular by design product development.

- Refurbishment and Recommerce of Electronics: The region is witnessing rapid growth in digital platforms that enable refurbishment resale and subscription based use of electronic devices. AI driven diagnostics and automated quality assessment tools accelerate refurbishment cycles while improving product longevity. These recommerce models reduce e waste support responsible consumption and promote reuse within Europe’s expanding digital circular ecosystem.

- Industrial Circularity Through Smart Manufacturing: Factories are integrating IoT enabled asset monitoring predictive maintenance and digital twins to extend equipment life and reduce material waste. Real time analytics help optimize production flows while enabling the reuse and remanufacturing of industrial components. This digital integration strengthens circular manufacturing practices enhances resource efficiency and allows companies to reduce operational costs while aligning with Europe’s sustainability and net zero goals.

Impact of Artificial Intelligence on the Europe Digital Circular Economy market

Artificial intelligence is becoming a central catalyst in accelerating the Europe Digital Circular Economy market by enabling smarter resource management, deeper lifecycle visibility, and data driven circularity across industries. Artificial Intelligence enhances material traceability by analyzing large datasets from sensors, supply chain platforms, and digital product passports to identify resource flows, predict waste generation, and optimize recovery processes.

This boosts recycling accuracy, reduces contamination in waste streams, and improves material quality for reuse. In manufacturing, AI powered predictive maintenance and digital twins extend equipment life, lower resource consumption, and support circular production models.

AI also plays a key role in automating refurbishment and recommerce operations through intelligent diagnostics, quality grading, and component matching, enabling faster turnaround of electronic devices and industrial assets. Retailers and logistics providers use AI algorithms to manage reverse logistics, forecast product returns, and maximize reuse potential.

Additionally, AI driven sustainability analytics help enterprises measure carbon footprints, optimize circular supply chains, and ensure compliance with evolving EU circular economy regulations. As Europe pushes for digital product passports and circular by design policies, AI is becoming essential for scaling circular business models and driving long term environmental and economic value.

Europe Digital Circular Economy Market: Stats & Facts

- Eurostat – Circular Economy & Waste (2023–2025)

- EU circular material use rate was 11.8% in 2023.

- It increased to 12.2% in 2024.

- In 2022, the circularity rate was 11.5%.

- Municipal waste generated in the EU in 2023 was 511 kg per person.

- This was 4 kg lower than 2022 and 23 kg lower than 2021.

- In 2023, 48.0% of municipal waste was recycled.

- In 2023, 246 kg per person of municipal waste was recycled.

- In 2023, 129 kg per person was incinerated (25.2%).

- In 2023, 115 kg per person went to landfill (22.5%).

- Compared with 2013, municipal waste per person in 2023 was 32 kg higher.

- Total packaging waste in the EU in 2023 was 79.7 million tonnes.

- Packaging waste per person in 2023 was 177.8 kg.

- From 2022 to 2023, packaging waste per person fell by 8.7 kg.

- In 2023, 40.4% of packaging waste was paper & cardboard.

- In 2023, packaging breakdown: 19.8% plastic, 18.8% glass, 15.8% wood, 4.9% metal.

- EU plastic packaging waste generated per person in 2023: 35.3 kg.

- Plastic packaging recycled per person in 2023: 14.8 kg.

- Recycling rate for plastic packaging in 2023: 42.1%.

- Highest plastic packaging recycling (2023): Belgium 59.5%, Latvia 59.2%, Slovakia 54.1%.

- Lowest plastic packaging recycling (2023): Hungary 23.0%, France 25.7%, Austria 26.9%.

- Lightweight plastic carrier bag consumption in 2023: 65 bags per person.

- Reduction (2018–2023) in carrier bags: Sweden −131 bags, Lithuania −125, Latvia −118.

Europe Digital Circular Economy Market: Market Dynamics

Europe Digital Circular Economy Market: Driving Factors

Strong EU Regulatory Push for Circular Compliance

Europe’s digital circular economy is strongly driven by regulatory frameworks such as the Circular Economy Action Plan, Ecodesign requirements, Extended Producer Responsibility rules, and mandatory Digital Product Passports. These policies push manufacturers and service providers to adopt lifecycle assessment tools, material traceability systems, and digital sustainability platforms.

The regulatory pressure accelerates the transition from linear to circular models, stimulating investment in digital product tracking, resource optimization and smart recycling innovations across industries.

Rapid Adoption of Smart Technologies for Resource Efficiency

The market is gaining momentum due to increasing deployment of AI powered waste sorting, IoT based monitoring, cloud enabled circular platforms, and blockchain supply chain tools. These technologies enhance asset visibility, improve recycling accuracy, and support circular by design processes. Rising enterprise demand for predictive analytics, digital twins and circular resource mapping solutions further accelerates digital transformation in Europe’s sustainability ecosystem.

Europe Digital Circular Economy Market: Restraints

High Integration Costs and Technology Complexity

Small and mid sized enterprises face challenges adopting digital circular solutions due to high deployment costs, long integration cycles, and limited technical expertise. Incorporating blockchain traceability, AI based sorting, digital product passports and advanced lifecycle analytics requires substantial investment and workforce upskilling. These barriers slow market penetration and limit scalability across less digitized sectors.

Data Privacy and Interoperability Limitations

Circular models rely heavily on data sharing across supply chains, yet many industries struggle with fragmented data architectures, privacy concerns and inconsistent standards. The lack of interoperable systems makes it difficult to unify material data, lifecycle footprints and product identifiers. This creates obstacles for cross border circular operations and restricts the effectiveness of digital product passport ecosystems.

Europe Digital Circular Economy Market: Opportunities

Expansion of Recommerce and Refurbishment Ecosystems

Europe’s surge in refurbished electronics, reusable packaging, and industrial asset recovery platforms creates significant growth potential. Digital diagnostics, automated quality assessment and cloud based recommerce management systems support scalable reuse ecosystems. As consumer preference shifts toward sustainable and cost efficient alternatives, digital recommerce platforms gain a strong market expansion channel.

Growth of Circular Manufacturing and Smart Industrial Solutions

Industries are increasingly embracing AI enabled predictive maintenance, material flow optimization, and IoT based energy efficiency tools to advance circular manufacturing. Companies can reduce waste, extend equipment lifespan and integrate secondary materials through digital twins and real time analytics. This opens large opportunities for technology providers offering circular production software and sustainable industrial automation solutions.

Europe Digital Circular Economy Market: Trends

Rise of Digital Product Passports for Full Lifecycle Transparency

Digital product passports are emerging as a dominant trend across electronics, textiles, batteries and construction materials. These systems integrate data on repairability, recyclability, material composition and carbon footprint, enabling companies to improve circular value retention. As the EU mandates broader adoption, DPP platforms and traceability software are becoming essential components of Europe’s digital circular ecosystem.

Growing Shift Toward Circular Data Platforms and Material Marketplaces

Europe is seeing rapid growth in cloud based circular data hubs, digital material exchanges and resource sharing platforms that connect manufacturers, recyclers and logistics providers. These platforms use AI and IoT to match secondary materials, optimize waste recovery and support circular supply chain collaboration. The trend enhances material circulation, reduces resource extraction and accelerates Europe’s shift toward a regenerative digital economy.

Europe Digital Circular Economy Market: Research Scope and Analysis

By Offering Analysis

Services are anticipated to dominate the offering segment with a 60.0% share in 2025 as organizations across Europe increasingly rely on consulting, integration, lifecycle assessment, and digital transformation services to enable circular operations. Many enterprises require expert support for implementing digital product passports, conducting material flow analysis, deploying traceability systems, and redesigning supply chains for circularity.

Service providers also help companies navigate complex EU regulations, integrate AI and IoT tools, and develop circular by design strategies that align with sustainability goals. The demand for continuous monitoring, platform maintenance, compliance reporting, and circular performance optimization further strengthens the role of servicebased models in this market.

Software in this market segment is gaining strong traction as companies adopt digital platforms that support circular data management, resource optimization, and lifecycle visibility. Circular economy software solutions enable real time tracking of materials, carbon footprint monitoring, asset management, predictive maintenance, and waste analytics.

These platforms integrate AI, blockchain, and IoT to streamline product traceability and compliance with European sustainability regulations. Software tools also enhance transparency across supply chains by providing digital product passport management, recyclability assessments, inventory of materials, and endoflife decision models. As European industries shift to data driven sustainability, the demand for advanced circular software solutions continues to expand.

By Technology Analysis

Blockchain and distributed ledger technology is expected to maintain its dominance with a 23.0% share in 2025 because it provides a secure and transparent foundation for circular operations across Europe. Industries are increasingly adopting blockchain to create immutable records of material flows, verify product origins, authenticate recycled content, and manage digital product passports with higher accuracy.

Its decentralized structure eliminates data tampering risks and strengthens trust between manufacturers, recyclers, suppliers, and regulators. Blockchain also enables smart contracts that automate compliance, resource tracking, and circular transactions, reducing manual intervention and improving operational efficiency. As Europe pushes for stricter sustainability reporting and lifecycle transparency, blockchain becomes a crucial technology for enabling trusted data exchange and supporting largescale circular collaboration ecosystems.

Internet of Things (IoT) is equally essential in the digital circular economy market as it provides the real time data needed to optimize resource usage and extend product lifecycles. IoT sensors embedded in equipment, waste bins, manufacturing lines, and logistics networks help monitor material consumption, detect faults early, and improve asset performance through predictive maintenance.

These connected devices support circular manufacturing by tracking component conditions, enabling component reuse, and reducing waste during production. In waste management, IoT improves sorting efficiency, route planning, and recycling outcomes. The technology also enhances transparency in reverse logistics by monitoring product returns and endoflife pathways. As Europe accelerates data driven sustainability initiatives, IoT becomes a backbone for intelligent resource optimisation and circular operations.

By Application Analysis

Supply chain and material tracking applications will dominate with a 21.0% share in 2025 because European industries increasingly require end-to-end visibility of materials, components, and product lifecycles. These applications allow companies to monitor material origin, movement, composition, and environmental impact through digital product passports, blockchain traceability, and real time analytics.

With growing EU regulations targeting product transparency, recyclability, and responsible sourcing, manufacturers and recyclers rely on these tools to authenticate recycled content, prevent resource leakage, and ensure accurate compliance reporting. The ability to map materials across complex cross-border supply chains supports circular by design strategies and helps enterprises achieve higher levels of reuse, repair, and regeneration.

This makes supply chain and material tracking a foundational pillar of the European digital circular ecosystem.

Resource optimization and efficiency applications are also becoming essential as companies focus on reducing waste, lowering energy use, and improving asset performance through digital intelligence. These tools use AI, IoT data, and lifecycle analytics to identify inefficiencies, predict maintenance needs, and optimize resource flow across production lines and distribution networks.

Businesses can reduce operational costs, extend product lifespans, and minimize raw material dependency by leveraging real time monitoring and predictive insights. In industrial settings, resource optimization platforms help align operations with circular economy goals by improving material yield, enabling component reuse, and reducing carbon intensity. As sustainability becomes a strategic priority, such applications play a pivotal role in enabling data driven and regenerative resource management across Europe.

By End User Analysis

Consumer electronics are anticipated to maintain their dominance with a 27.0% share in 2025 because this sector generates high volumes of devices that require robust circular solutions for repair, refurbishment, recycling, and responsible material recovery. The rapid turnover of smartphones, laptops, tablets, and household electronics drives demand for digital product passports, lifecycle tracking, and AI-driven diagnostics that support reuse and recommerce models.

Manufacturers and retailers in Europe are increasingly adopting traceability platforms, blockchain-enabled material authentication, and IoT-based asset monitoring to manage electronic components across their lifecycle. With EU regulations tightening around e-waste reduction, right-to-repair requirements, and sustainable product design, the consumer electronics sector relies heavily on digital circular tools to ensure product longevity, material recovery, and transparent supply chain reporting.

Information technology and telecom also represent a major contributor to the digital circular economy market as enterprises work to optimize hardware usage, extend equipment lifecycles, and manage large-scale infrastructure through data-driven sustainability tools. IT and telecom companies utilize IoT monitoring, predictive maintenance, and digital asset management systems to track server equipment, network devices, and data center components.

These technologies support refurbishment, component harvesting, and recycling programs that reduce electronic waste and operational costs. Telecom operators increasingly adopt circular software platforms to manage device returns, enable secondary markets, and ensure compliance with environmental standards. As demand for cloud services, connectivity, and digital infrastructure grows across Europe, the IT and telecom sector strengthens its reliance on circular resource strategies powered by intelligent data ecosystems.

The Europe Digital Circular Economy Market Report is segmented on the basis of the following:

By Offering

- Circularity Analytics Platforms

- Digital Twin Platforms

- Lifecycle Assessment Software

- Circular Supply Chain Management Software

- Consulting & Implementation

- Integration & Deployment

- Support & Maintenance

- Training & Education

By Technology

- Blockchain & Distributed Ledger Technology

- Internet of Things (IoT)

- Artificial Intelligence (AI) & Machine Learning (ML)

- Augmented Reality (AR) & Virtual Reality (VR)

- Cloud Computing & Edge Computing

- Big Data & Predictive Analytics

- Others

By Application

- Supply Chain & Material Tracking

- Resource Optimization & Efficiency

- Digital Resale & Reuse

- Reverse Logistics & Remanufacturing

- Circular Economy Reporting & Compliance

- Circular Waste Management & Recycling

- Smart Material Selection & Testing

- Others

By End User

- Consumer Electronics

- Information Technology & Telecom

- Automotive & Transportation

- Industrial Manufacturing

- Construction & Building Materials

- Retail & E-Commerce

- Others

Europe Digital Circular Economy Market: Regional Analysis

The Europe Digital Circular Economy Market shows strong regional momentum as EU member states accelerate digital transformation and circular resource strategies backed by strict sustainability regulations. Northern and Western Europe lead adoption due to advanced digital infrastructure, mature recycling ecosystems, and strong policy enforcement supporting digital product passports, smart waste management, and traceability platforms.

Countries such as Germany, France, the Netherlands, and the Nordics are early adopters of AI driven material tracking, circular manufacturing, and recommerce solutions. Southern and Eastern Europe are rapidly expanding their circular capabilities as governments invest in smart waste systems, digital supply chain tools, and industrial refurbishment programs. Regionwide initiatives including the Circular Economy Action Plan, Green Deal, and Ecodesign requirements are creating a unified digital ecosystem that promotes cross border transparency, resource optimization, and circular collaboration across industries.

By Region

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Europe Digital Circular Economy Market: Competitive Landscape

The competitive landscape of the Europe Digital Circular Economy Market is characterized by a mix of established technology providers, sustainability-focused consultancies, and emerging circular startups driving innovation across the region. Major players are expanding their capabilities in digital product passports, blockchain traceability, lifecycle assessment software, and IoT-enabled waste management solutions to meet growing regulatory and industry demand.

Large European firms are strengthening partnerships with recyclers, manufacturers, and logistics providers to build integrated circular platforms, while startups are focusing on niche areas such as recommerce, material marketplaces, and AI-powered resource analytics. Competition is intensifying as companies differentiate through advanced data ecosystems, real-time material tracking, and cloud-based circular platforms, enabling users to achieve compliance, improve resource efficiency, and transition toward circular by design business models.

Some of the prominent players in the Europe Digital Circular Economy market are

- SAP

- Capgemini

- Dassault Systèmes

- Software AG

- Siemens / Siemens-Advanta

- Landbell Group

- iPoint Systems

- One Click LCA

- TÜV SÜD

- SUEZ

- Circulor

- Anthesis Group

- GeoFluxus

- Grover

- TooGoodToGo

- Refurbed

- PreZero

- Interzero Holding

- Lindström

- Verkor

- Other Key Players

Europe Digital Circular Economy Market: Recent Developments

- October 2025: Germany’s Aevoloop raised €8 million in seed funding to accelerate commercialization of its circular-plastics technology aimed at reducing waste and microplastics.

- July 2024: TotalEnergies acquired Tecoil, a used-oil regeneration specialist, to expand its circular lubricants and sustainable oil-recovery operations in Europe.

- June 2025: Nordic Salt Cycle secured €3.5 million to scale its molten-salt mineral recovery process for extracting critical metals from end-of-life EV batteries and electronic waste.

- June 2025: Captoplastic, a Spanish microplastics-removal startup, raised €2 million led by BeAble Capital to scale its detection and filtration technology.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 676.1 Mn |

| Forecast Value (2034) |

USD 4,420.9 Mn |

| CAGR (2025–2034) |

23.2% |

| Historical Data |

2019 – 2024 |

| Forecast Data |

2026 – 2034 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Offering (Software, Services), By Technology (Blockchain & Distributed Ledger Technology, Internet of Things (IoT), Artificial Intelligence (AI) & Machine Learning (ML), Augmented Reality (AR) & Virtual Reality (VR), Cloud Computing & Edge Computing, Big Data & Predictive Analytics, Others), By Application (Supply Chain & Material Tracking, Resource Optimization & Efficiency, Digital Resale & Reuse, Reverse Logistics & Remanufacturing, Circular Economy Reporting & Compliance, Circular Waste Management & Recycling, Smart Material Selection & Testing, Others), By End User (Consumer Electronics, Information Technology & Telecom, Automotive & Transportation, Industrial Manufacturing, Construction & Building Materials, Retail & E-Commerce, Others) |

| Regional Coverage |

Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe |

| Prominent Players |

SAP, Capgemini, Dassault Systèmes, Software AG, Siemens (Siemens-Advanta), Landbell Group, iPoint Systems, One Click LCA, TÜV SÜD, SUEZ, Circulor, Anthesis Group, GeoFluxus, Grover, and Others |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users) and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |

Frequently Asked Questions

The Europe Digital Circular Economy market is projected to be valued at USD 676.1 million in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 4,420.9 million in 2034 at a CAGR of 23.2%.

Some of the major key players in the Europe Digital Circular Economy market are SAP, Capgemini, Dassault Systèmes, Software AG, Siemens (Siemens-Advanta), Landbell Group, iPoint Systems, One Click LCA, TÜV SÜD, SUEZ, Circulor, Anthesis Group, GeoFluxus, Grover, and Others.