Market Overview

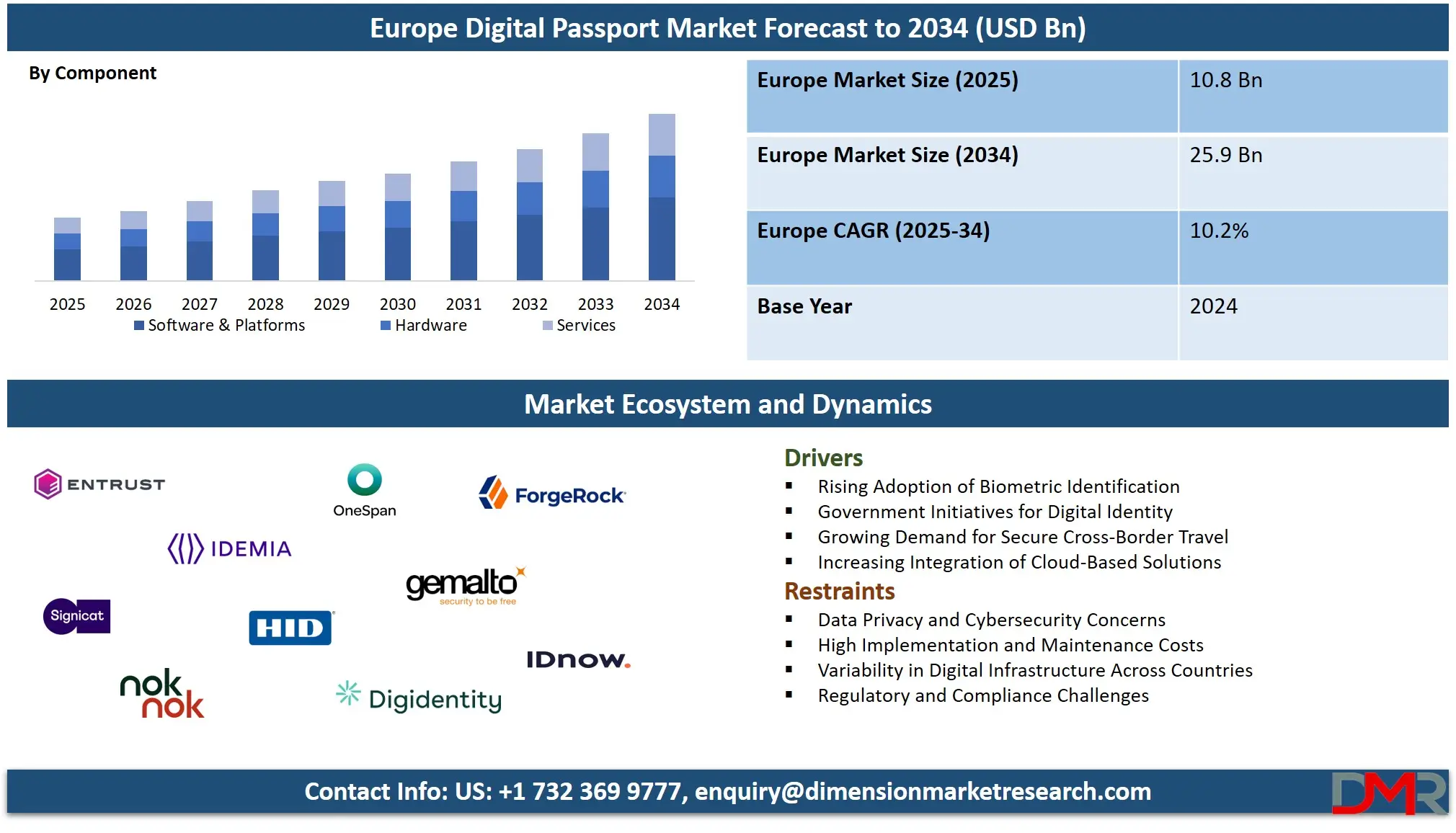

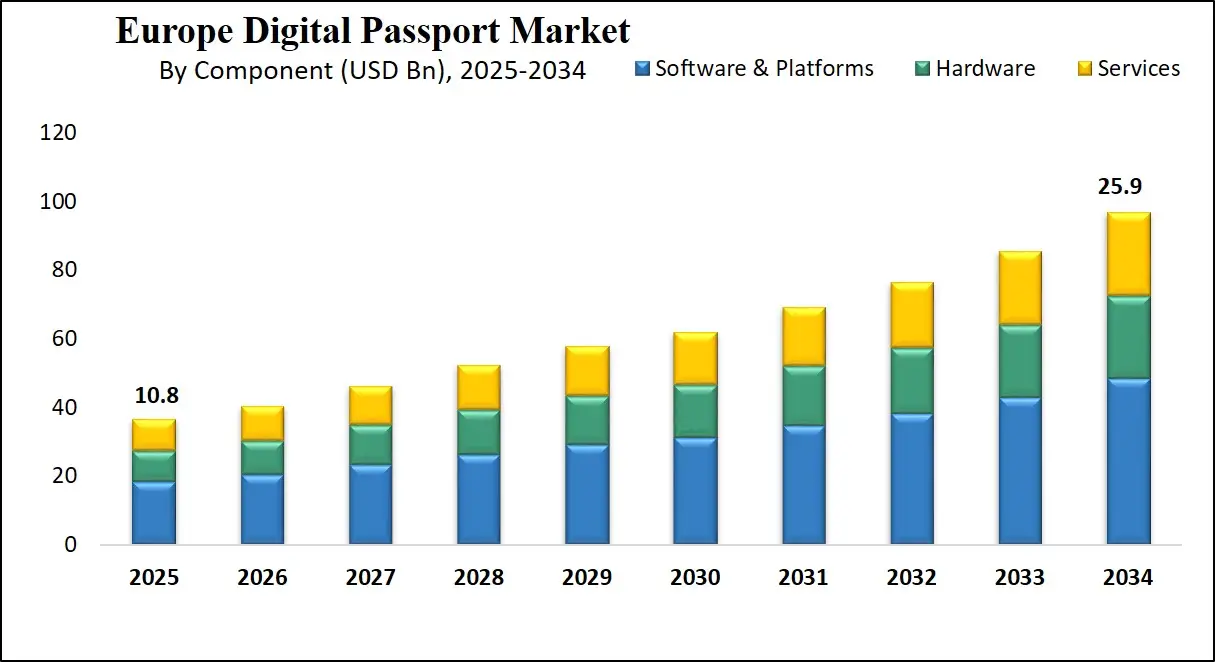

The European Digital Passport Market is anticipated to grow from USD 10.8 billion in 2025 to USD 25.9 billion by 2034, registering a strong CAGR of 10.2%. Rising adoption of biometric identification, e-passports, and secure digital travel credentials is driving market expansion, supported by government initiatives and advancements in border security and identity management solutions.

A digital passport is an advanced form of travel document that leverages electronic technology to securely store and transmit an individual’s identity information. Unlike traditional paper passports, digital passports integrate biometric data such as facial recognition, fingerprints, and iris scans to ensure a higher level of authentication. These documents are often linked to secure government databases, enabling faster verification processes at border checkpoints, reducing fraud, and enhancing overall travel efficiency.

They also facilitate interoperability with international travel systems, supporting seamless movement across countries while maintaining privacy and data protection standards. As global travel and digital governance evolve, digital passports represent a critical step toward modernizing border control and identity verification processes.

The European digital passport market is experiencing significant growth due to increasing demand for secure and efficient travel solutions across member states. The market encompasses electronic travel documents, national digital IDs, and digital travel credentials that integrate with border management systems.

Governments and private technology providers are investing in biometric systems, secure software platforms, and cloud-based identity management solutions to streamline immigration and border control procedures. Advancements in encryption, blockchain, and RFID technologies are further driving adoption by ensuring data integrity and real-time verification.

In parallel, digital health solutions are increasingly becoming an integral component of digital identity and travel ecosystems, with health credentials such as electronic vaccination records, interoperable health certificates, and secure digital health IDs being incorporated into broader digital passport frameworks.

These technologies support cross-border healthcare access, enhance public-health monitoring, and enable seamless verification of health data during travel. The convergence of digital passports and digital health tools is accelerating innovation, strengthening trust in digital identity systems, and shaping a more resilient, secure, and interconnected European digital infrastructure.

Market growth in Europe is supported by regulatory initiatives and cross-border digital identity frameworks that encourage standardization and interoperability of electronic identification systems. The expansion is also fueled by increasing traveler awareness of digital identity benefits and the need to mitigate identity theft and document fraud. With collaboration between governments, technology vendors, and cybersecurity firms, the European digital passport ecosystem continues to evolve, integrating innovative solutions that enhance security, efficiency, and user experience across both travel and public service applications.

Europe Digital Passport Market: Key Takeaways

- Market Value: The Europe Digital Passport market size is expected to reach a value of USD 25.9 billion by 2034 from a base value of USD 10.8 billion in 2025 at a CAGR of 10.2%.

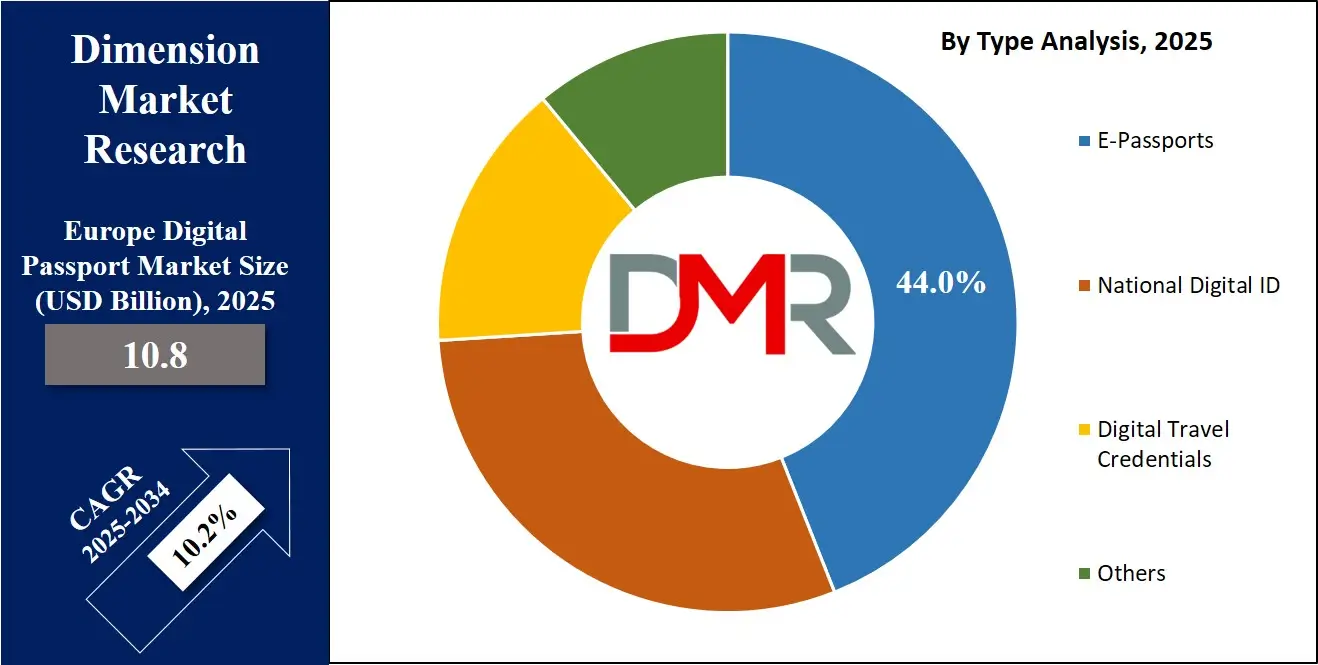

- By Type Segment Analysis: E-Passports are expected to maintain their dominance in the type segment, capturing 44.0% of the total market share in 2025.

- By Component Segment Analysis: Software & Platforms are anticipated to dominate the component segment, capturing 50.0% of the total market share in 2025.

- By Technology Segment Analysis: Biometrics will dominate the technology segment, capturing 39.0% of the market share in 2025.

- By Deployment Model Segment Analysis: Cloud-based deployment will account for the maximum share in the deployment model segment, capturing 66.0% of the total market value.

- By Application Segment Analysis: Border Control & Immigration will dominate the application segment, capturing 47.0% of the market share in 2025.

- By End User Segment Analysis: Government Agencies will capture the maximum share in the end user segment, capturing 63.0% of the market share in 2025.

- Key Players: Some key players in the Europe Digital Passport market are Entrust, IDEMIA, Daon, Mitek Systems, OneSpan, ImageWare Systems, Jumio, ID R&D, IBM, Okta, Ping Identity, ForgeRock, NEC Corporation, HID Global, 1Kosmos, and others.

Europe Digital Passport Market: Use Cases

- Border Control and Immigration Management: Digital passports streamline border processing by enabling automated verification of travelers’ identities through biometric authentication and secure e-passport validation. This reduces waiting times at airports and land crossings while preventing identity fraud. Integration with national and European immigration databases ensures real-time updates, enhancing security and compliance with international travel regulations.

- E-Government Services and National ID Integration: European governments are linking digital passports with national digital ID systems, allowing citizens to access public services such as healthcare, social security, and taxation securely online. The interoperability of these digital credentials improves service efficiency and reduces administrative costs while maintaining strong data protection and encryption standards.

- Travel and Airline Operations: Airlines and travel agencies leverage digital passport technology for automated check-in, boarding, and identity verification. By using biometric-enabled e-passports and mobile digital travel credentials, carriers enhance passenger experience, minimize human errors, and strengthen compliance with aviation security protocols, enabling smoother cross-border travel.

- Fraud Prevention and Identity Verification: Digital passports provide a secure platform to prevent document forgery and identity theft. By combining PKI encryption, blockchain-based verification, and biometric authentication, European authorities and private organizations can validate identities reliably for visa issuance, customs clearance, and financial transactions, reducing fraud-related risks in travel and digital identity ecosystems.

Impact of Artificial Intelligence on the Europe Digital Passport market

Artificial Intelligence is transforming the European digital passport market by enhancing identity verification, security, and operational efficiency. AI-powered facial recognition and biometric matching allow authorities to authenticate travelers in real time, significantly reducing manual checks and human error. Machine learning algorithms help detect fraudulent documents and unusual travel patterns, strengthening border security and minimizing identity-related risks.

AI also supports predictive analytics for immigration and border management, enabling governments to optimize staffing, streamline passenger flows, and forecast high-traffic periods. In addition, integration of AI with digital identity platforms improves user experience by enabling seamless, automated e-passport issuance and verification processes. As European countries increasingly adopt AI-driven solutions, the market benefits from faster processing times, heightened security, and scalable digital identity infrastructure that aligns with smart border and e-governance initiatives.

Europe Digital Passport Market: Stats & Facts

- Eurostat / European Commission

- In 2023, 41% of EU individuals aged 16–74 reported having used their eID in the previous 12 months to access online services for private purposes.

- In 2023, use of eID by age group: 50% of 25–34 year olds, 49% of 35–44, 44% of 45–54, 40% of 16–24, 36% of 55–64, and 25% of 65–74.

- In 2023, 36% of people aged 16–74 used their eID to access public authority services in their own country.

- In 2023, 6% of people in the EU used an eID to access public services of another EU country.

- In 2023, 16% of people used their eID to access services from the private/business sector.

- In 2024, 70.0% of people aged 16–74 in the EU used a website or app of a public authority in the previous 12 months.

- Between 2023 and 2024, this share rose by 0.7 pp (from ~69.3% to 70.0%).

- In 2024, of the e‑government activities: 44.0% used online public services to obtain information (services, benefits, laws, etc.).

- In 2024, 40.0% accessed their personal information via public authority apps/websites.

- In 2024, 38.1% of EU people downloaded or printed official forms from public authority websites.

- In 2023, 69% of EU citizens (16–74) had used a public authority website or app in the prior 12 months.

- In 2023, among e‑government use: 42% used public services to obtain information; 40% downloaded/printed forms; 39% accessed personal information; 37% made requests or got official communications; 29% submitted tax declarations; 19% accessed public registers; 18% requested certificates; 17% requested benefits or entitlements.

- European Commission / EU Digital Identity Framework

- At the start of 2025, 24 EU Member States have notified at least one national eID scheme to the European Commission under the eIDAS regulation.

- In 2024, notified eID schemes covered 93.16% of the EU population.

- The European Digital Identity Framework entered into force on 20 May 2024.

- By the end of 2026, all EU Member States must make at least one EU‑certified Digital Identity Wallet available to their citizens, residents, and businesses.

- Over 350 public authorities and private organisations across 26 Member States (and Norway, Iceland, Ukraine) participate in large‑scale pilot projects for the EU Digital Identity Wallet.

- On 21 May 2025, the European Commission adopted implementing regulations for wallet registration, certification, security breaches, and cross‑border identity matching under the European Digital Identity Framework.

- On 28 November 2024, the Commission adopted technical standards to ensure cross‑border interoperability and security for EU digital identity wallets.

- According to the 2024 State of the Digital Decade report, ~93% of the EU population has access to a notified eID scheme.

Europe Digital Passport Market: Market Dynamics

Europe Digital Passport Market: Driving Factors

Rising Adoption of Biometric Identification

The increasing use of biometric technologies such as facial recognition, fingerprint scanning, and iris authentication is a key driver of the European digital passport market. Governments are implementing these technologies to enhance border security, reduce identity fraud, and streamline immigration processes. Integration with national and cross-border databases ensures accurate verification and improves overall travel efficiency.

Government Initiatives for Digital Identity

Regulatory frameworks and policies promoting digital identity adoption are driving market growth. Initiatives such as eIDAS compliance and national digital ID programs encourage secure electronic travel credentials, enabling interoperability across European countries. Investments in secure software platforms and cloud-based identity management solutions further accelerate the deployment of digital passports.

Europe Digital Passport Market: Restraints

Data Privacy and Cybersecurity Concerns

Concerns over data breaches, unauthorized access, and misuse of sensitive biometric and personal information pose a challenge to market growth. Stringent GDPR regulations require secure storage, encryption, and handling of citizen data, which increases the complexity and cost of implementing digital passport systems.

High Implementation and Maintenance Costs

Deploying digital passport infrastructure, including biometric scanners, software platforms, and secure databases, requires significant investment. Small and medium-sized countries may face budgetary constraints, which can slow adoption rates and limit the scalability of digital identity solutions across Europe.

Europe Digital Passport Market: Opportunities

Integration with Mobile Digital Travel Credentials

The rising use of mobile-based digital passports presents opportunities for growth. By integrating biometric e-passports with mobile applications, travelers can enjoy contactless verification, faster boarding, and seamless cross-border travel, creating a more convenient and secure travel ecosystem.

Expansion of Cross-Border Identity Frameworks

European initiatives to standardize digital identity verification across member states open opportunities for interoperable digital passport solutions. Collaborative frameworks enable secure sharing of identity data, enhance border efficiency, and support government and private sector services, creating new avenues for technology providers and solution vendors.

Europe Digital Passport Market: Trends

Adoption of AI and Machine Learning for Identity Verification

Artificial intelligence and machine learning are increasingly used to improve accuracy in biometric authentication, detect fraudulent documents, and optimize border operations. These technologies enhance security, reduce manual intervention, and support predictive analytics for traveler flow management.

Blockchain-Based Digital Passport Solutions

Blockchain is emerging as a trend for ensuring tamper-proof and decentralized identity verification. By leveraging distributed ledger technology, digital passports can provide secure, immutable records of identity and travel history, strengthening data integrity while enhancing trust in electronic identity systems.

Europe Digital Passport Market: Research Scope and Analysis

By Type Analysis

In the type segment of the European digital passport market, e-passports are poised to maintain their leading position, capturing around 44.0% of the total market share in 2025. These electronic passports incorporate embedded chips that securely store biometric data such as fingerprints, facial recognition templates, and personal identification details.

The integration of such technology allows automated identity verification at airports, seaports, and land borders, significantly reducing processing times and human intervention. E-passports also enhance security by preventing counterfeiting, forgery, and unauthorized alterations, which are common challenges with traditional paper passports. European governments are increasingly investing in e-passport infrastructure to comply with international travel regulations, improve border efficiency, and provide a safer, more seamless travel experience for citizens and international travelers alike. The adoption of advanced encryption and tamper-proof technologies further strengthens their role in modernizing border management and digital identity verification systems.

National digital IDs constitute another critical component of this market segment, serving as government-issued digital credentials that authenticate an individual’s identity across multiple domains. Unlike e-passports, which are primarily used for international travel, national digital IDs provide citizens with secure access to a broad spectrum of services, including healthcare, taxation, banking, and social security programs.

They often work in conjunction with digital passports to enable cross-border recognition and compliance with European Union digital identity regulations, such as eIDAS. The adoption of national digital IDs is driven by the growing need for secure online verification, reduction of identity fraud, and the demand for convenient, unified access to both public and private services.

By integrating with cloud-based platforms, mobile applications, and biometric systems, national digital IDs offer a flexible, scalable solution that enhances digital governance while fostering trust between citizens and authorities. This convergence of travel and domestic identity management is shaping the European digital passport market, supporting the development of an interoperable and highly secure digital identity ecosystem.

By Component Analysis

In the component segment of the European digital passport market, software and platforms are expected to dominate, capturing approximately 50.0% of the total market share in 2025. These software solutions provide the backbone for managing digital identities, enabling secure storage, authentication, and verification of personal and biometric data. Platforms include identity management systems, encryption tools, biometric verification software, and cloud-based frameworks that facilitate real-time processing at border checkpoints and government service portals.

The widespread adoption of these platforms is driven by the need for robust security measures, interoperability between national and cross-border systems, and efficient handling of large volumes of traveler and citizen data. Software and platform providers are continuously innovating to integrate artificial intelligence, machine learning, and advanced analytics, improving the accuracy of identity verification, detecting fraudulent activities, and optimizing operational efficiency for immigration authorities and government agencies.

Hardware also plays a vital role in this market segment by providing the physical infrastructure required to support digital passport systems. This includes biometric scanners, secure card readers, fingerprint sensors, facial recognition cameras, and embedded chip readers that interact with e-passports and national digital IDs. Hardware ensures that data stored in digital credentials can be accurately captured, verified, and transmitted to backend software systems in real time.

High-quality hardware is essential for minimizing errors, preventing tampering, and maintaining the integrity of digital identity verification processes. Combined with software and platform solutions, hardware enables governments and border authorities to deliver faster, more secure, and reliable identity verification, thereby enhancing traveler experience and strengthening overall security across European digital passport ecosystems.

By Technology Analysis

In the technology segment of the European digital passport market, biometrics is expected to dominate, accounting for approximately 39.0% of the market share in 2025. Biometric technologies, including facial recognition, fingerprint scanning, and iris detection, are critical for verifying the identity of travelers and citizens with high accuracy. These technologies enable automated and secure authentication at airports, border checkpoints, and government service centers, reducing manual processing times and minimizing the risk of identity fraud.

The growing emphasis on secure and reliable digital identity systems, coupled with advancements in artificial intelligence and machine learning, has further accelerated the adoption of biometric solutions. Governments across Europe are increasingly integrating biometrics with national digital ID programs and e-passports to create a seamless and interoperable identity verification ecosystem that enhances security while improving operational efficiency.

RFID and NFC technologies also play an important role in this technology segment by enabling contactless and quick data exchange between digital passports or identity cards and verification systems. These technologies allow embedded chips in e-passports or ID cards to be read without physical contact, facilitating faster processing at airports, border crossings, and access points for public services.

RFID and NFC help reduce manual errors, prevent tampering, and improve the overall reliability of identity verification processes. When combined with biometric authentication and secure software platforms, these contactless technologies ensure efficient, secure, and user-friendly digital passport solutions, supporting seamless travel and trusted identity management across Europe.

By Deployment Model Analysis

In the deployment model segment of the European digital passport market, cloud-based solutions are expected to account for the largest share, capturing approximately 66.0% of the total market value. Cloud-based deployment allows governments and agencies to manage digital identity systems and e-passport databases with greater scalability, flexibility, and cost efficiency. By leveraging secure cloud infrastructure, authorities can enable real-time access to biometric data, traveler records, and authentication services across multiple locations and border points.

This model supports rapid updates, seamless integration with national and cross-border systems, and advanced analytics for fraud detection and operational optimization. Cloud-based solutions also reduce the need for heavy upfront investments in physical infrastructure and facilitate maintenance, making them a preferred choice for modernizing digital identity and border control processes in Europe.

On-premises deployment, on the other hand, involves hosting digital passport and identity management systems locally within government data centers. This model offers direct control over hardware, software, and sensitive citizen data, which can be important for countries with stringent data privacy regulations or security concerns. While on-premises solutions require higher upfront capital expenditure and ongoing maintenance, they provide enhanced control, reliability, and compliance with national data protection policies.

Governments opting for this model can customize systems to meet specific operational needs and maintain full oversight of authentication processes. Both deployment approaches coexist in the market, with cloud-based solutions driving widespread adoption while on-premises systems cater to security-sensitive or resource-specific applications.

By Application Analysis

In the application segment of the European digital passport market, border control and immigration are expected to dominate, accounting for approximately 47.0% of the market share in 2025. Digital passports and e-passport systems are extensively used at airports, seaports, and land borders to authenticate travelers quickly and securely.

The integration of biometric verification, RFID/NFC technology, and cloud-based platforms enables automated identity checks, reduces processing time, and minimizes human errors. Governments are increasingly adopting these solutions to strengthen border security, prevent identity fraud, and comply with international travel regulations. Advanced analytics and AI-driven monitoring further enhance operational efficiency, allowing authorities to detect suspicious travel patterns and respond proactively, thereby improving both security and traveler experience.

Citizen services also represent a significant application area within the European digital passport market. Digital passports and national digital IDs allow citizens to access a wide range of public services securely and efficiently, including healthcare, banking, taxation, and social welfare programs. By linking digital identity credentials with government portals and online platforms, authorities can provide seamless authentication, reduce paperwork, and ensure data privacy through encrypted transactions.

The integration of digital passports into citizen services also enables cross-border recognition for travel, facilitating interoperability between countries. This dual functionality not only enhances convenience for individuals but also supports governments in building robust, secure, and user-friendly digital identity ecosystems.

By End User Analysis

In the end user segment of the European digital passport market, government agencies are expected to capture the largest share, accounting for approximately 63.0% of the market in 2025. These agencies are primarily responsible for issuing e-passports, national digital IDs, and managing secure identity verification systems.

Their adoption of digital passport technologies enables more efficient border control, immigration management, and law enforcement operations. By leveraging biometric authentication, cloud-based platforms, and advanced encryption, government authorities can ensure secure storage and real-time verification of traveler and citizen data. Investments in these solutions also help governments comply with international travel standards, reduce identity fraud, and streamline administrative processes, reinforcing their central role in driving the growth of the European digital passport market.

Airports and airlines also represent a key end user segment in this market. These entities utilize digital passport systems to facilitate faster check-ins, automated boarding, and seamless identity verification for travelers. Integration of biometric e-passports, RFID/NFC technology, and cloud-based verification platforms allows airlines to enhance operational efficiency, reduce delays, and improve passenger experience.

Additionally, these systems help aviation authorities maintain compliance with international security protocols while minimizing manual interventions and errors. As air travel volumes increase and the need for secure, contactless solutions grows, airports and airlines are increasingly adopting digital identity technologies to support smooth and secure cross-border travel.

The Europe Digital Passport Market Report is segmented on the basis of the following:

By Type

- E-Passports

- National Digital ID

- Digital Travel Credentials

- Others

By Component

- Software & Platforms

- Hardware

- Chips

- Readers

- Biometric Devices

- Integration

- Managed Services

By Technology

- Biometrics

- RFID/NFC

- PKI & Encryption

- Blockchain/DLT

- Others

By Deployment Model

By Application

- Border Control & Immigration

- Citizen Services

- Travel & Tourism

- Law Enforcement & Security

- Others

By End User

- Government Agencies

- Airports & Airlines

- Enterprises

- Others

Europe Digital Passport Market: Regional Analysis

The European digital passport market is witnessing varied adoption across the region, with Western European countries leading due to advanced digital infrastructure, strong government initiatives, and higher traveler volumes. Countries such as Germany, France, and the United Kingdom are investing heavily in e-passports, national digital IDs, and cloud-based identity management systems to enhance border security and streamline immigration processes.

Northern European nations are also rapidly integrating biometric verification and mobile digital credentials, while Eastern and Southern Europe are gradually expanding digital passport deployment through regulatory frameworks and cross-border interoperability initiatives. Overall, the market is characterized by a mix of mature and emerging implementations, driven by technological advancements, government policies, and increasing demand for secure, efficient, and interoperable digital identity solutions across the continent.

By Region

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Europe Digital Passport Market: Competitive Landscape

The competitive landscape of the European digital passport market is characterized by intense innovation and strategic collaborations between technology providers, government agencies, and cybersecurity firms. Key players are focusing on developing advanced biometric solutions, secure software platforms, and cloud-based identity management systems to enhance border security and streamline citizen services.

There is a strong emphasis on integrating AI, machine learning, and blockchain technologies to improve authentication accuracy, prevent identity fraud, and ensure data integrity. Companies are also investing in partnerships and cross-border projects to support interoperability, comply with regulatory standards, and expand their presence across multiple European countries. The market is highly dynamic, with continuous technological advancements and a focus on scalable, secure, and user-friendly digital identity solutions driving competitive differentiation.

Some of the prominent players in the Europe Digital Passport market are

- Thales Group

- IDEMIA

- Entrust

- OneSpan

- Signicat

- Nok Nok Labs

- ForgeRock

- HID Global

- Gemalto (Thales)

- Digidentity

- IDnow

- Nets Group

- Veridos

- SICPA

- iProov

- Authenteq

- Samsung SDS

- Infineon Technologies

- Microsoft

- Atos

- Other Key Players

Europe Digital Passport Market: Recent Developments

- September 2025: Signicat launches ReuseID, a reusable digital identity solution that enables organisations to create, manage, and reuse verified identities across platforms and countries.

- July 2025: A pan‑European identity provider releases a new NFC‑based digital verification product by integrating ReadID technology into its identity wallet ecosystem.

- July 2025: A European digital identity firm acquires a Dutch NFC identity verification company to strengthen its capabilities in smartphone‑based secure document authentication.

- February 2025: Two digital trust and identity‑services companies announce plans to merge, forming a larger group with enhanced eIDAS‑compliant wallet and signature capabilities.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 10.8 Bn |

| Forecast Value (2034) |

USD 25.9 Bn |

| CAGR (2025–2034) |

10.2% |

| Historical Data |

2019 – 2024 |

| Forecast Data |

2026 – 2034 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Type (E-Passports, National Digital ID, Digital Travel Credentials, Others); By Component (Software & Platforms, Hardware, Services); By Technology (Biometrics, RFID/NFC, PKI & Encryption, Blockchain/DLT, Others); By Deployment Model (Cloud-based, On-Premises); By Application (Border Control & Immigration, Citizen Services, Travel & Tourism, Law Enforcement & Security, Others); By End User (Government Agencies, Airports & Airlines, Enterprises, Others). |

| Regional Coverage |

Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe |

| Prominent Players |

Entrust, IDEMIA, Daon, Mitek Systems, OneSpan, ImageWare Systems, Jumio, ID R&D, IBM, Okta, Ping Identity, ForgeRock, NEC Corporation, HID Global, 1Kosmos, and others |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users) and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |

Frequently Asked Questions

The Europe Digital Passport market size is estimated to have a value of USD 10.8 billion in 2025 and is expected to reach USD 25.9 billion by the end of 2034, with a CAGR of 10.2%.

Some of the major key players in the Europe Digital Passport market are Entrust, IDEMIA, Daon, Mitek Systems, OneSpan, ImageWare Systems, Jumio, ID R&D, IBM, Okta, Ping Identity, ForgeRock, NEC Corporation, HID Global, 1Kosmos, and others.