Market Overview

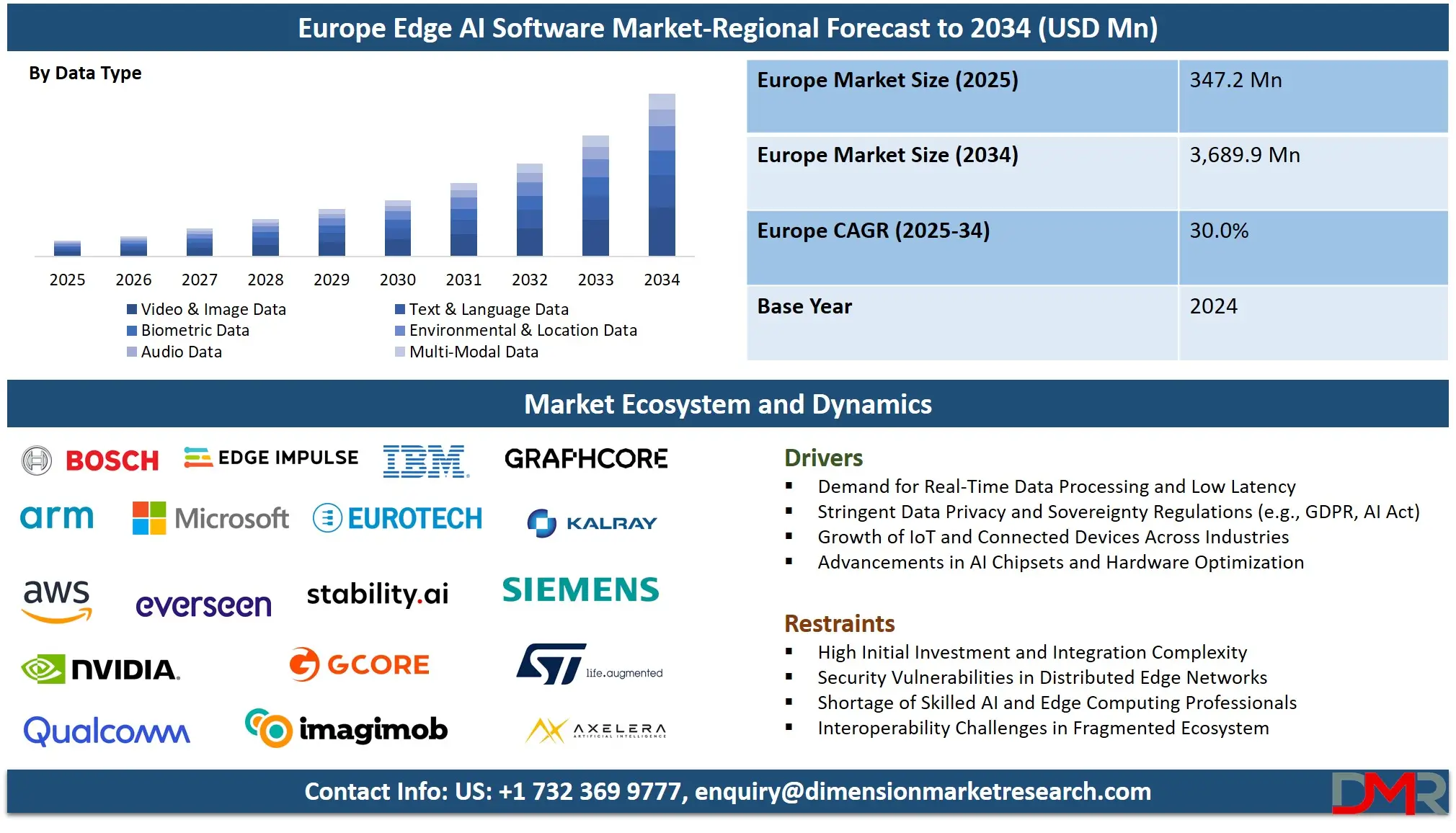

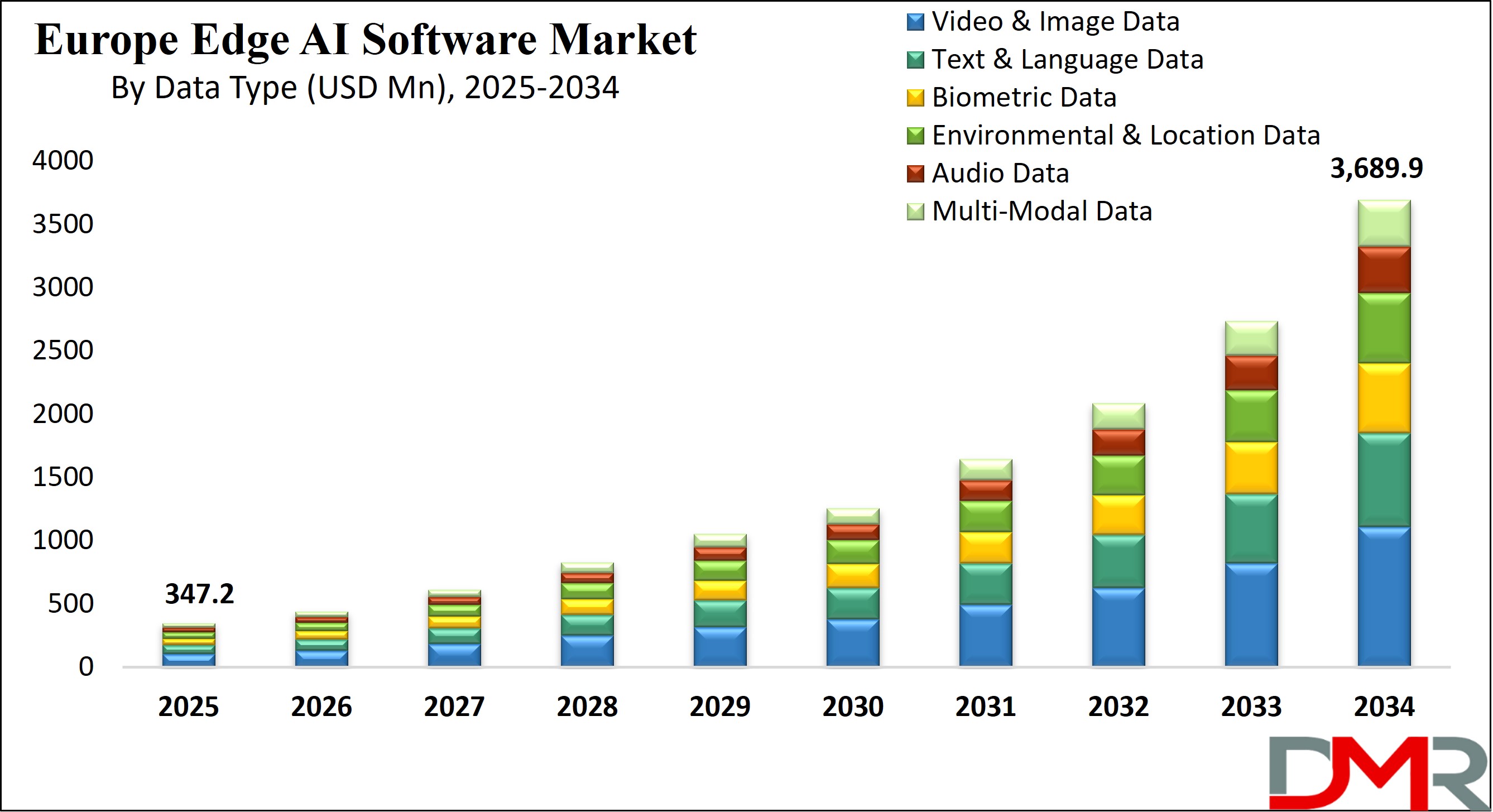

Europe’s edge AI software market is projected to reach USD 347.2 million in 2025 and is expected to expand significantly, hitting USD 3,689.9 million by 2034, registering a strong CAGR of 30.0%. The surge in growth is being propelled by the widespread adoption of real-time data processing, industrial automation, connected mobility, IoT ecosystems, and AI-driven operational intelligence. These factors are cementing Europe’s position as a major center for intelligent edge computing, highlighting its growing influence and competitiveness in the global digital economy.

The European Edge AI Software Market is gaining strong momentum, driven by a unique combination of regulatory clarity, public investment, industrial demand, and demographic advantage. Europe has consistently prioritized digital sovereignty, ensuring that technological advancements are anchored in ethical, secure, and inclusive frameworks. Large-scale initiatives such as the European High-Performance Computing Joint Undertaking (EuroHPC JU) are providing billions of euros to strengthen computing capacity across the continent, enabling the deployment of real-time edge AI solutions in multiple industries. At the same time, the enforcement of the Artificial Intelligence Act in 2024 has created the world’s first comprehensive AI law, setting global benchmarks for responsible development and ensuring that data sovereignty, safety, and accountability remain at the forefront of AI adoption. This combination of funding and regulation provides a stable foundation for enterprises to scale edge AI deployments with confidence.

Demographically, Europe presents significant opportunities for the expansion of edge AI software. Its dense urban population drives demand for intelligent traffic management, smart energy grids, and real-time environmental monitoring within smart city ecosystems. The region’s advanced industrial base, especially in Germany, France, and Italy, is embracing Industry 4.0 practices that rely on edge AI for predictive maintenance, robotics, and factory automation. Europe’s aging population also contributes to growing adoption in healthcare, with edge AI enabling secure and low-latency applications such as remote monitoring, assisted living, and personalized treatment. The emphasis on GDPR compliance further encourages adoption by enterprises and governments seeking to balance innovation with stringent privacy safeguards.

Ultimately, Europe’s edge AI software market is defined by the synergy between policy, infrastructure, and societal needs. Its ability to combine advanced research ecosystems with practical, large-scale applications is positioning the region as a global leader in the responsible development and deployment of edge AI technologies..

Europe Edge AI Software Market: Key Takeaways

- Market Value: The Europe Edge AI Software market size is expected to reach a value of USD 3,689.9 million by 2034 from a base value of USD 347.2 million in 2025 at a CAGR of 30.0%.

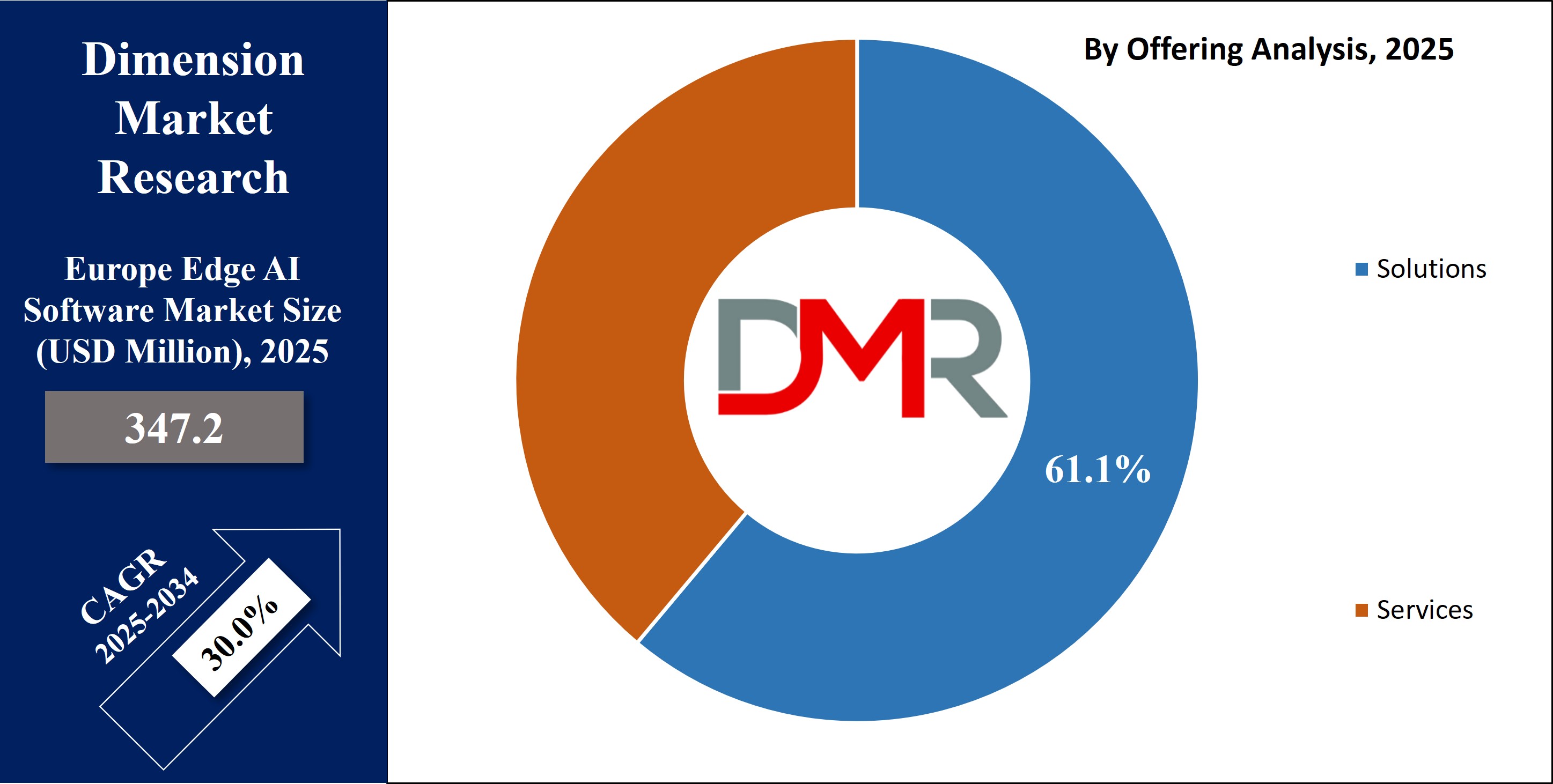

- By Offering Segment Analysis: Solutions are anticipated to dominate the offering segment, capturing 61.1% of the total market share in 2025.

- By Data Type Segment Analysis: Video & Image Data is expected to maintain its dominance in the data type segment, holding the highest market share in 2025.

- By End-User Segment Analysis: Manufacturing users are expected to consolidate their dominance in the end-user segment, with the largest portion of the market share in 2025.

- Key Players: Some key players in the Europe edge AI Software market are Graphcore Limited, Kalray S.A., Axelera AI B.V., Imagimob AB, Gcore S.A., Eurotech S.p.A., STMicroelectronics N.V., International Business Machines Corporation (IBM), and Others.

Europe Edge AI Software Market: Use Cases

- Smart Manufacturing: Edge AI software enables predictive maintenance, robotics coordination, and quality inspection directly on the factory floor. By processing data locally, manufacturers reduce downtime, improve efficiency, and enhance safety without depending on constant cloud connectivity. European industries, especially in Germany and Italy, are integrating Edge AI into Industry 4.0 strategies to achieve sustainable, high-performance production environments.

- Connected Vehicles: In Europe’s automotive sector, edge AI software supports real-time decision-making in autonomous and connected vehicles. It processes sensor and camera data locally for functions like lane detection, collision avoidance, and traffic monitoring. By reducing latency and ensuring compliance with safety standards, edge AI enhances driver assistance systems, paving the way for intelligent mobility solutions across European road networks.

- Smart Cities: European smart city initiatives leverage edge AI software for real-time analytics in traffic control, energy management, and surveillance. By processing data at the edge, municipalities improve efficiency, reduce congestion, and enhance citizen safety while respecting GDPR guidelines. This decentralized intelligence empowers cities to optimize resource usage and respond dynamically to environmental and infrastructural challenges.

- Healthcare Monitoring; Edge AI software powers medical devices and wearables that deliver real-time diagnostics, remote patient monitoring, and personalized treatments. In Europe, where demand is rising due to an aging population, edge-enabled healthcare reduces strain on hospitals while ensuring compliance with strict data privacy rules. It enhances patient care by providing low-latency, secure, and reliable health insights.

- Industrial IoT (IIoT): Factories and logistics networks in Europe adopt edge AI software for real-time tracking, equipment optimization, and supply chain efficiency. Processing IoT data locally improves decision-making speed, prevents bottlenecks, and strengthens cybersecurity. By reducing reliance on cloud connectivity, industrial enterprises achieve higher productivity and resilience while aligning with Europe’s push toward sustainable and intelligent manufacturing ecosystems.

Europe Edge AI Software Market: Stats & Facts

European Commission Digital Strategy / EuroHPC / AI policy

- EuroHPC Joint Undertaking budget for 2021–2027: ≈ USD 7.0 billion to strengthen supercomputing and AI infrastructure.

- The EU’s Artificial Intelligence Act was published in the Official Journal and entered into force on 1 August 2024.

- The Commission’s Broadband Coverage monitoring (Digital Decade) shows Europe progressing on gigabit and 5G targets used to support edge deployments.

Eurostat (EU statistics)

- 9.8 million people in the EU worked as ICT specialists in 2023.

- ICT specialists represented 4.8% of total employment in the EU (2023).

- From 2014 to 2024, the number of ICT specialists in the EU rose by 62.2%.

- In 2024, 80.5% of ICT specialists were men (vs 19.5% women).

- In 2024, about 67.4% of ICT specialists held a tertiary education.

- In 2024, 13.48% of EU enterprises (≥10 employees) used AI technologies.

- In 2024, 41.17% of large EU enterprises used AI technologies.

- In 2024, 20.05% of EU enterprises employed ICT specialists.

- In 2021, 29% of EU enterprises with 10+ employees used IoT devices or systems.

- In 2023, 45.2% of EU enterprises bought cloud computing services (noting growth vs 2021).

- Of enterprises buying cloud services, 75.3% purchased sophisticated cloud services (databases, platforms, security).

ENISA (EU Agency for Cybersecurity)

- ENISA’s Threat Landscape (2023): ransomware remained the most prevalent threat, accounting for ~34% of reported threats.

- ENISA’s Trust Services security reporting: 63 incidents were reported in 2023 (an ~80% increase vs 2022).

- ENISA (Threat Landscape 2024) identified ~19,754 vulnerabilities, with 9.3% critical and 21.8% high-severity.

- ENISA’s 2024/2025 reporting highlights a sharp increase in disruptive cyber incidents across the EU, stressing resilience needs for edge deployments.

Joint Research Centre (European Commission) Data centres & sustainability

- EU data centres report an average Power Usage Effectiveness (PUE) ≈ of 1.6, used to benchmark the efficiency of infrastructure that supports edge/cloud stacks.

Digital Economy and Society Index (DESI) / Digital Decade

- DESI/Broadband monitoring: fixed broadband infrastructure availability is near-universal (coverage metrics used in Digital Decade reporting e.g., very high-capacity networks expanding across member states).

- DESI indicators show that a large share of European households can access high-speed broadband (benchmark country-level figures often exceed 70% for high-speed access in leading states).

OECD

- OECD broadband update: nine OECD countries (several European) have >70% fibre connections of total broadband indicating fast-growing fibre penetration in Europe.

European Investment Bank (EIB)

- EIB Investment Survey: the net share of firms expecting to increase investment fell to 7% in 2024 (from 14% in 2023), indicating investment caution even as digital funding pools grow.

OECD / WIPO / Global R&D context (supporting R&D environment)

- Global R&D spending has risen substantially; Euro area and EU R&D intensity (GERD/GDP) is a key enabler for AI and edge software R&D (Eurostat GERD and WIPO context underscore a strong R&D base across Europe).

Europe Edge AI Software Market: Market Dynamics

Europe Edge AI Software Market: Driving Factors

Regulatory Clarity with the AI Act and GDPR Compliance

One of the strongest growth drivers of the Europe Edge AI Software Market is the continent’s unique regulatory clarity, especially with the Artificial Intelligence Act, which took effect in 2024. This legislation provides the world’s first comprehensive legal framework for AI, ensuring ethical standards, transparency, and risk management. When combined with the General Data Protection Regulation (GDPR), it gives organizations the confidence to adopt edge AI software for sensitive, real-time applications while minimizing compliance risks. Unlike other regions where AI adoption is slowed by uncertain legal boundaries, Europe offers businesses a clear framework that balances innovation with accountability. This regulatory certainty fosters stronger investments in edge deployments across healthcare, manufacturing, automotive, and smart cities. For example, healthcare providers can confidently deploy AI-powered edge devices for patient monitoring, knowing that they comply with privacy laws while enhancing operational efficiency. Thus, Europe’s legal ecosystem acts as a growth driver, encouraging widespread adoption of edge AI software by businesses, governments, and industries alike.

Public Investment and Infrastructure Development

Large-scale public investment in AI, digital transformation, and supercomputing capacity is another major driver of the European edge AI software market. The European High-Performance Computing Joint Undertaking (EuroHPC JU) alone has allocated approximately USD 7 billion for 2021–2027 to strengthen Europe’s computing infrastructure. This funding not only enhances central and supercomputing capacity but also supports distributed edge deployments that rely on localized intelligence. Additionally, the European Investment Bank (EIB) has announced plans to invest into technology firms from 2025 to 2027, directly boosting innovation and scaling capabilities for edge software applications. Such initiatives ensure that enterprises, startups, and public institutions have the resources to integrate edge AI at scale, from industrial IoT networks to mobility and healthcare. The synergy between funding programs, innovation accelerators, and regulatory clarity accelerates adoption across member states. These investments ensure Europe remains competitive in the global AI race, while empowering industries to transition toward real-time, decentralized AI software solutions at the edge.

Europe Edge AI Software Market: Restraints

High Implementation and Maintenance Costs

Fragmented Infrastructure and Uneven Adoption Across Member States

Despite strong growth potential, the Europe Edge AI Software Market faces the restraint of fragmented infrastructure and uneven adoption across its member states. While countries like Germany, France, and the Netherlands lead in Industry 4.0 and smart city deployments, others lag behind in broadband penetration, 5G rollout, and digital infrastructure. This uneven progress creates disparities in market opportunities and slows overall adoption of edge AI software. Additionally, varying levels of digital skills across the workforce further compound the challenge, as some regions lack the necessary expertise to implement and maintain advanced edge AI systems. Smaller enterprises, which form a significant portion of Europe’s economy, often struggle with financial and technical barriers to adoption. This digital divide undermines the EU’s goal of a harmonized digital market and restricts the scalability of edge AI innovations. Unless infrastructural and workforce disparities are addressed, Europe risks a two-speed market where only advanced economies benefit fully from edge AI software.

High Implementation Costs and Cybersecurity Concerns

Another key restraint is the high cost of deploying and maintaining edge AI software, especially for small and medium enterprises (SMEs). Implementation requires investment in edge hardware, integration with existing IT systems, and ongoing software updates, all of which create financial barriers. In addition, while Europe has strong regulatory frameworks, cybersecurity remains a growing concern. Edge devices, by nature, are decentralized and thus increase the attack surface for cybercriminals. Recent reports by the European Union Agency for Cybersecurity (ENISA) highlight rising threats, including ransomware and vulnerabilities in IoT networks, which directly affect edge AI deployments. Enterprises adopting these systems must implement robust cybersecurity measures, often adding to the overall cost burden. These dual challenges of financial strain and security risks discourage widespread adoption among smaller firms and public institutions. Unless addressed through cost-effective solutions and strengthened cybersecurity frameworks, these restraints could hinder the pace of Europe’s edge AI software market growth.

Europe Edge AI Software Market: Opportunities

Rising Demand for AI in Healthcare and Personalized Medicine

Healthcare is becoming one of the most promising growth opportunities for Europe’s edge AI software market. With an aging population and increasing pressure on healthcare systems, edge AI software can deliver secure, real-time insights at the point of care. Applications include remote patient monitoring, AI-assisted diagnostics, and personalized treatment recommendations. Edge deployment ensures that sensitive medical data is processed locally, maintaining compliance with GDPR and the AI Act, while also reducing latency in life-critical applications. Hospitals and clinics can leverage AI software embedded in wearable devices and diagnostic tools to provide faster, more accurate care while reducing the load on centralized servers. Moreover, national healthcare digitalization initiatives, such as those supported by EU funding, create fertile ground for adoption. The rise of AI-enabled telehealth platforms also underscores how edge solutions can make healthcare more accessible, especially in rural or underserved regions. As Europe emphasizes sustainable healthcare models, edge AI software represents a transformative opportunity to balance patient privacy, efficiency, and innovation.

Expansion of Connected Mobility and Autonomous Vehicles

Another significant growth opportunity lies in Europe’s expanding connected mobility and autonomous vehicle sector. Automotive leaders in Germany, Sweden, and France are deploying edge AI software to support next-generation driver assistance and autonomous driving capabilities. Edge AI processes data from vehicle sensors and cameras locally, enabling real-time decision-making that is essential for safety-critical applications such as collision avoidance, adaptive navigation, and smart traffic interactions. As Europe accelerates investments in connected infrastructure and 5G rollouts, the ecosystem for intelligent mobility becomes stronger. Moreover, EU-funded projects and strict safety regulations are encouraging the integration of AI-driven edge systems into public transportation and logistics networks. This creates an opportunity not only for automakers but also for software providers, telecommunications companies, and municipalities. With Europe positioning itself as a global hub for sustainable mobility, the convergence of AI, IoT, and edge computing in the automotive space opens long-term opportunities to redefine transportation, logistics, and mobility services across the continent.

Europe Edge AI Software Market: Trends

Integration of Edge AI in Smart Cities and Public Services

Europe is witnessing a steady integration of edge AI software into smart city initiatives, reflecting the continent’s broader goals of sustainability, digital sovereignty, and efficient governance. From traffic monitoring to real-time environmental control, edge AI enables immediate data analysis at the source, reducing latency and dependence on centralized cloud infrastructure. This trend is particularly notable across densely populated urban areas such as Paris, Berlin, and Amsterdam, where governments are deploying edge-driven solutions to optimize energy use, enhance public safety, and improve transportation efficiency. The growing enforcement of Europe’s Artificial Intelligence Act, coupled with existing GDPR principles, creates a regulatory environment that emphasizes privacy and accountability while still fostering innovation. Municipalities benefit from AI-powered decision-making that improves citizen experiences and streamlines urban planning. By embedding intelligence directly into street cameras, sensors, and energy grids, Europe is creating an ecosystem where edge AI software is not just a technological upgrade but a foundational enabler of sustainable and resilient cities.

Convergence of Industrial IoT and Edge AI for Industry 4.0

A defining trend in the Europe edge AI Software Market is the convergence of industrial IoT (IIoT) systems with edge AI to create highly automated, self-optimizing factories. Europe’s manufacturing powerhouses, particularly Germany, Italy, and France, are implementing smart automation strategies where edge AI software processes machine data locally to predict failures, optimize workflows, and reduce operational downtime. Unlike cloud-based AI, edge deployment offers low latency and greater compliance with Europe’s strict data protection frameworks, ensuring that sensitive industrial data remains within local infrastructure. This is particularly critical for advanced robotics and collaborative systems in industries such as automotive and aerospace, where milliseconds of delay can disrupt entire production lines. The trend is reinforced by strong policy support from European industrial modernization initiatives and EU-level funding programs, including Horizon Europe and EuroHPC projects, that encourage AI adoption. The result is a dynamic ecosystem where edge AI and IIoT integration becomes the backbone of Europe’s Industry 4.0 vision, driving competitiveness and innovation globally.

Europe Edge AI Software Market: Research Scope and Analysis

By Offering Analysis

In the Europe Edge AI Software Market, the solutions segment is projected to lead the offering category, capturing close to 61.1% of the total share in 2025. This segment consists of diverse software platforms, AI models, and frameworks designed to run directly on edge devices such as smart cameras, industrial robots, connected sensors, and autonomous machinery. These solutions empower industries to process data locally in real time, eliminating reliance on distant cloud infrastructure. By enabling faster decision-making, predictive maintenance, robotics coordination, and automated quality control, solutions deliver significant improvements in efficiency and resilience. Key European industries including manufacturing, automotive, healthcare, telecommunications, and energy are increasingly adopting these AI-driven edge solutions to meet rising demands for low-latency operations and mission-critical analytics.

The services segment, though comparatively smaller, plays an essential role in ensuring successful deployment. This category includes consulting, system integration, application customization, and ongoing maintenance support. Services extend to model training, performance updates, and compliance assurance, making them indispensable for enterprises lacking deep in-house AI expertise. As more European companies aim to integrate AI-driven edge systems while aligning with GDPR and the AI Act, they seek external service providers to streamline implementation. With Europe emphasizing digital transformation through initiatives like Horizon Europe, the demand for professional services will grow steadily. Thus, while solutions dominate the revenue share, services represent the backbone of long-term adoption, ensuring that enterprises maximize the performance and scalability of their edge AI investments. Together, both offerings form the foundation of Europe’s edge AI software ecosystem, supporting its evolution into a global leader in real-time intelligent computing.

By Data Type Analysis

The video and image data segment is expected to set to dominate the Europe Edge AI Software Market, accounting for the highest market share in 2025. This category revolves around real-time visual analytics, leveraging data captured by cameras, drones, surveillance systems, and industrial imaging devices. By analyzing video and image data locally at the edge, organizations reduce latency, minimize bandwidth usage, and enhance responsiveness. Industries such as manufacturing, retail, automotive, security, and public safety are driving adoption by deploying edge-based image recognition, object detection, defect analysis, and surveillance solutions. For instance, factories use AI-powered vision systems for quality inspection, while transportation networks rely on visual analytics to manage traffic and improve safety. The capacity to generate insights directly at the edge transforms operational agility, making video and image analysis indispensable in Europe’s digitized economy.

Meanwhile, text and language data emerge as another critical growth segment. This includes natural language processing (NLP), speech recognition, and automated document handling applications that are increasingly integrated into enterprise operations. European organizations deploy AI-enabled chatbots, real-time translation tools, and voice assistants to improve customer engagement and workplace efficiency. Processing text and voice data at the edge allows businesses to maintain compliance with Europe’s strict data privacy rules, while delivering seamless, real-time interactions without relying heavily on the cloud. The adoption of localized text analytics is further encouraged by Europe’s multilingual business environment, where demand for translation and multilingual automation is high. Combined, these segments highlight Europe’s focus on enabling both machine vision and conversational AI at the edge, positioning data processing as a cornerstone of future intelligent applications.

By End-User Analysis

In the Europe Edge AI Software Market, the manufacturing sector is poised to remain the leading end-user, securing the highest share of the total in 2025. European manufacturers are rapidly embedding edge AI into smart factory ecosystems to enhance efficiency, reliability, and adaptability. Applications include predictive maintenance, robotics automation, sensor-driven quality control, and real-time process optimization. For industries such as automotive components, electronics, and heavy machinery, where precision and uptime are critical, edge AI solutions enable operational excellence while reducing costs associated with downtime. This transformation aligns closely with Europe’s Industry 4.0 vision, which emphasizes intelligent automation, and Society 5.0 initiatives, which focus on human-centered digital innovation. By processing machine and production data directly at the edge, manufacturers reduce reliance on cloud systems, improve data security, and achieve faster response cycles. These benefits make manufacturing the most prominent growth driver for edge AI adoption in the region.

The automotive, transportation, and logistics segment also represents a major opportunity. With Europe being home to global automotive leaders, the deployment of edge AI in connected mobility solutions is expanding rapidly. Real-time analysis of sensor and video data enables advanced driver assistance, autonomous navigation, fleet optimization, and predictive vehicle maintenance. Logistics providers utilize AI software at the edge to optimize routes, track assets, and minimize fuel consumption, contributing to efficiency and sustainability. As investments in connected cars, 5G networks, and smart logistics infrastructure accelerate, edge AI becomes a crucial enabler of safe, efficient, and adaptive transportation systems. This integration not only enhances road safety but also supports Europe’s ambition to achieve greener, smarter, and digitally connected mobility ecosystems.

The Europe Edge AI Software Market Report is segmented on the basis of the following

By Offering

- Solutions

- Services

- Professional Services

- Consulting Services

- Deployment & Integration

- Support & Maintenance

- Managed Services

By Data Type

- Audio Data

- Video & Image Data

- Text & Language Data

- Environmental & Location Data

- Biometric Data

- Multi-Modal Data

By End User

- Predictive Maintenance

- Quality Inspection (Vision AI)

- Supply Chain Optimization

- Robotics Automation

- Worker Safety Monitoring

- Autonomous Driving

- In-Vehicle Assistants

- Predictive Maintenance

- Smart Manufacturing

- Fleet Management

- Transportation & Logistics

- Route Optimization

- Cargo Tracking

- Demand Forecasting

- Automated Warehouses

- Drone Deliveries

- Smart Grid Management

- Predictive Maintenance

- Renewable Energy Forecasting

- Infrastructure Monitoring

- Energy Analytics

- Fraud Detection

- AI Chatbots

- Credit Scoring

- Financial Advisory

- Claims Automation

- Drug Discovery

- Medical Imaging

- Telemedicine

- Patient Monitoring

- Disease Prediction

- Network Optimization

- Predictive Maintenance

- AI Chatbots

- Fraud Detection

- 5G Integration

- Government & Public Sector

- Smart Cities

- Public Surveillance

- Digital Governance

- Disaster Response

- Crime Analytics

- Content Recommendations

- Video Editing AI

- Sports Analytics

- Automated Dubbing

- Sentiment Analysis

Impact of Artificial Intelligence on Europe's Edge AI Software Market

Artificial Intelligence is profoundly shaping Europe’s Edge AI Software Market by enabling real-time, localized decision-making and driving efficiency across industries. AI-powered edge solutions reduce latency, enhance data privacy, and optimize resource use key priorities under Europe’s stringent GDPR and the AI Act. In manufacturing, AI supports predictive maintenance and robotics, while in healthcare, it enables secure patient monitoring and personalized care. Smart city projects utilize AI at the edge for traffic optimization, energy management, and surveillance, improving urban resilience. The automotive sector benefits through AI-enhanced driver assistance and connected mobility. Furthermore, AI integration empowers industrial IoT by streamlining logistics and strengthening cybersecurity. Combined with Europe’s regulatory clarity and public investment in computing infrastructure, AI is accelerating widespread adoption, positioning the region as a leader in intelligent edge technologies.

By Region

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Europe Edge AI Software Market: Competitive Landscape

The Europe Edge AI Software Market is characterized by a highly competitive and rapidly evolving landscape, shaped by both global technology giants and specialized European innovators. Large multinational corporations such as Microsoft, IBM, AWS, NVIDIA, and Qualcomm play a dominant role by offering scalable AI frameworks, cloud-to-edge integration, and advanced developer ecosystems. Their investments in edge-native tools, AI accelerators, and hardware-software integration strengthen their market presence across diverse industries, including healthcare, automotive, and manufacturing.

Alongside these global leaders, Europe is witnessing the rise of homegrown pioneers like Graphcore, Kalray, Axelera AI, Eurotech, and Edge Impulse. These companies are leveraging Europe’s strong R&D ecosystem, academic partnerships, and access to EU-funded AI initiatives to deliver domain-specific edge AI solutions. Their focus lies in energy efficiency, ultra-low latency processing, and compliance with strict regional regulations like the EU AI Act, giving them a competitive edge in regulated industries such as healthcare, defense, and industrial automation.

Moreover, strategic collaborations, joint ventures, and public-private partnerships are becoming increasingly common. Initiatives like GAIA-X and European AI research programs encourage data sovereignty and technological independence, further shaping competitive strategies. Startups and scale-ups are also gaining traction by offering niche solutions in areas like computer vision, autonomous mobility, and cybersecurity. With continuous funding support, favorable policies, and a growing ecosystem of innovators, the competitive environment is expected to intensify. This blend of global tech giants and European specialists positions the market for robust growth while driving technological leadership in edge AI across the region.

Some of the prominent players in the Europe Edge AI Software market are

- Graphcore Limited

- Kalray S.A.

- Axelera AI B.V.

- Imagimob AB (an Infineon Technologies company)

- Gcore S.A.

- Eurotech S.p.A.

- STMicroelectronics N.V.

- International Business Machines Corporation (IBM)

- Qualcomm Incorporated

- NVIDIA Corporation

- Siemens Aktiengesellschaft (Siemens AG)

- Microsoft Corporation

- Amazon Web Services, Inc. (AWS)

- Arm Holdings plc

- Xilinx, Inc. (now part of Advanced Micro Devices, Inc. – AMD)

- Edge Impulse, Inc.

- Robert Bosch GmbH

- PolyPerception BV

- Everseen Limited

- Stability AI Ltd.

- Other Key Players

Europe Edge AI Software Market: Recent Developments

- June 2024: NXP Semiconductors acquired Silexica to enhance AI tooling for software-defined vehicles, strengthening its automotive tech portfolio. This move accelerates the integration of advanced AI capabilities into next-generation vehicle platforms. The deal terms were not publicly disclosed.

- May 2024: Sensable secured USD 6 million in seed funding for its industrial AI vision platform. Led by VSquared Ventures and Onsight Ventures, the investment will accelerate development of its edge AI solutions for manufacturing quality control and automation.

- April 2024: Siemens and AWS expanded their collaboration to integrate generative AI into industrial automation. This partnership aims to simplify the deployment of AI solutions in factory settings, enhancing productivity and enabling new data-driven optimization possibilities for manufacturers.

- April 2024: Hannover Messe 2024 featured major Edge AI showcases from Siemens, Bosch, and Schneider Electric. The expo highlighted AI-driven industrial automation, robotics, and predictive maintenance solutions, demonstrating the rapid adoption of intelligent edge technologies in manufacturing.

- April 2024: Embedded World 2024 saw new Edge AI kits unveiled by STMicroelectronics and NXP. The conference highlighted advancements in hardware-optimized development tools, enabling more efficient and powerful AI applications at the deepest layers of the IoT edge.

- March 2024: Axelera AI raised a USD 68 million Series B round for its AI inference hardware and software. This significant investment will accelerate the production and deployment of their advanced, European-designed AI solutions for edge computing applications across various industries.

- February 2024: Google Cloud launched a new sovereign cloud region in Berlin for secure AI workloads. This infrastructure is designed to meet strict EU data governance requirements, supporting secure and compliant edge AI and data processing for enterprises.

- February 2024: MWC Barcelona 2024 featured Deutsche Telekom and Vodafone demonstrating Edge AI for 5G networks. The focus was on using AI to optimize network slicing, reduce latency, and enable new, intelligent enterprise services at the mobile edge.

- January 2024: Qualcomm and BMW Group partnered to integrate AI-powered Snapdragon platforms into future vehicles. This collaboration aims to enhance in-cabin experiences, driver assistance, and automated driving features through advanced AI capabilities running directly on next-generation BMW automotive platforms.

- December 2023: Deep Render closed a USD 9.2 million Series A round for its AI video compression technology. This funding will advance development of its codecs, which are critical for efficient video transmission in bandwidth-constrained edge computing and streaming applications.

- November 2023: Graphcore and Dell Technologies deepened their partnership to offer integrated on-premise AI systems. This collaboration combines Graphcore's AI processors with Dell's server infrastructure, targeting enterprises that require powerful, localized AI training and inference capabilities

- October 2023: The AI Hardware & Edge AI Summit in Germany featured leaders from ARM and Infineon. The event focused on the co-design of advanced AI chips, systems, and software stacks specifically optimized for deployment at the network edge.

- September 2023: STMicroelectronics and Google Cloud partnered to simplify AI development on STM32 microcontrollers. This collaboration integrates TensorFlow Lite Micro, making it easier for developers to deploy machine learning models on low-power, resource-constrained edge devices across various applications.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 347.2 Mn |

| Forecast Value (2034) |

USD 3,689.9 Mn |

| CAGR (2025–2034) |

30.0% |

| Historical Data |

2019 – 2024 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Offering (Solutions and Services), By Data Type (Audio Data, Video & Image Data, Text & Language Data, Environmental & Location Data, and Multi-Modal Data), and By End User (BFSI, Government & Public Sector, Telecommunication, Healthcare & Life Science, Media & Entertainment, Energy & Utilities, Automotive, Transportations & Logistics, Manufacturing, and Others) |

| Regional Coverage |

Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe |

| Prominent Players |

Graphcore Limited, Kalray S.A., Axelera AI B.V., Imagimob AB, Gcore S.A., Eurotech S.p.A., STMicroelectronics N.V., International Business Machines Corporation (IBM), Qualcomm Incorporated, NVIDIA Corporation, Siemens AG, Microsoft Corporation, Amazon Web Services Inc. (AWS), Arm Holdings plc, Xilinx Inc. (AMD), Edge Impulse Inc., Robert Bosch GmbH, PolyPerception BV, Everseen Limited, Stability AI Ltd., and Others. |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |

Frequently Asked Questions

The Europe Edge AI Software market size is estimated to have a value of USD 347.2 million in 2025 and is expected to reach USD 3,689.9 million by the end of 2034.

Some of the major key players in the Europe Edge AI Software market are Graphcore Limited, Kalray S.A., Axelera AI B.V., Imagimob AB, Gcore S.A., Eurotech S.p.A., and Others.

The market is growing at a CAGR of 30.0 percent over the forecasted period.