Market Overview

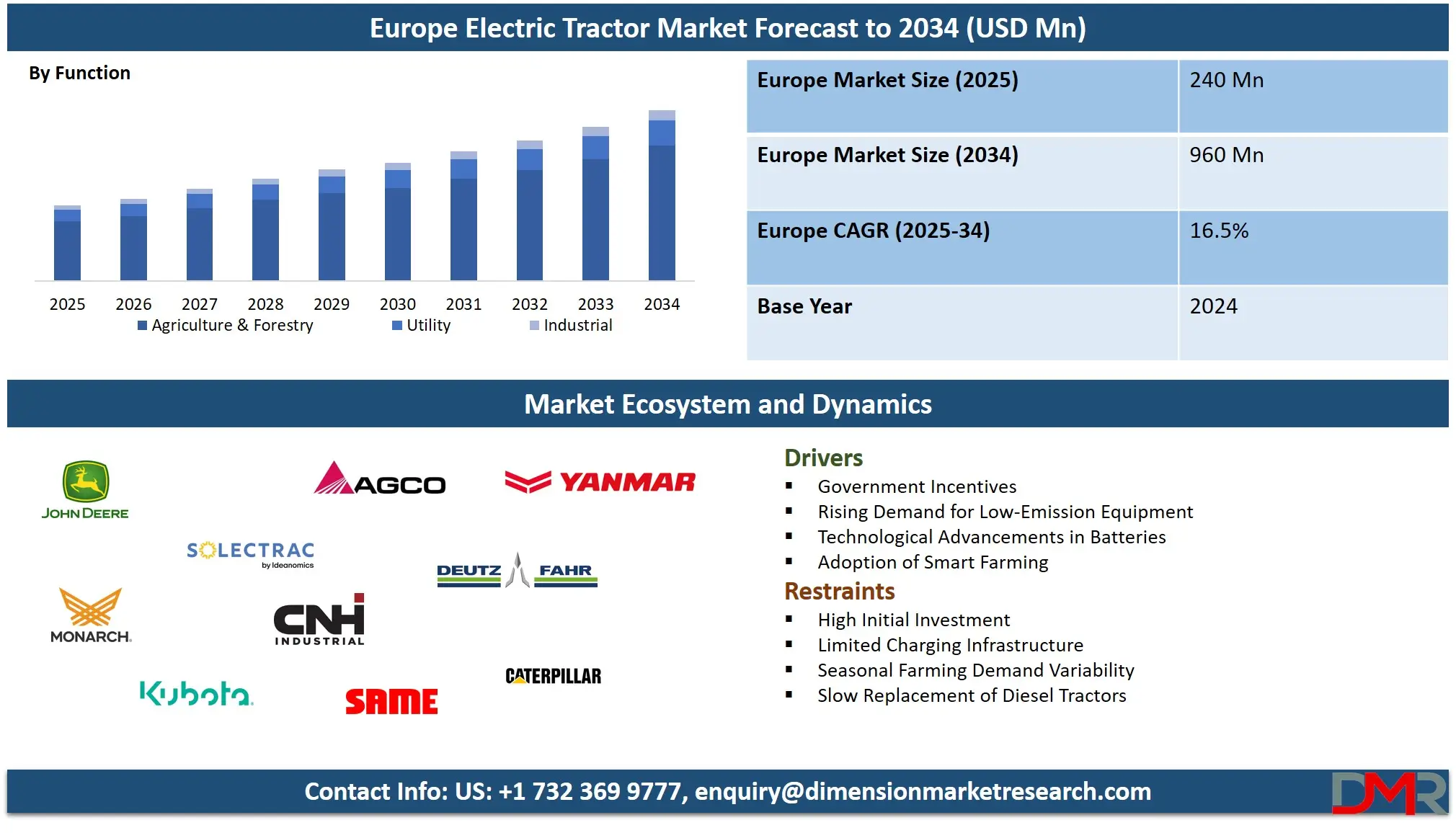

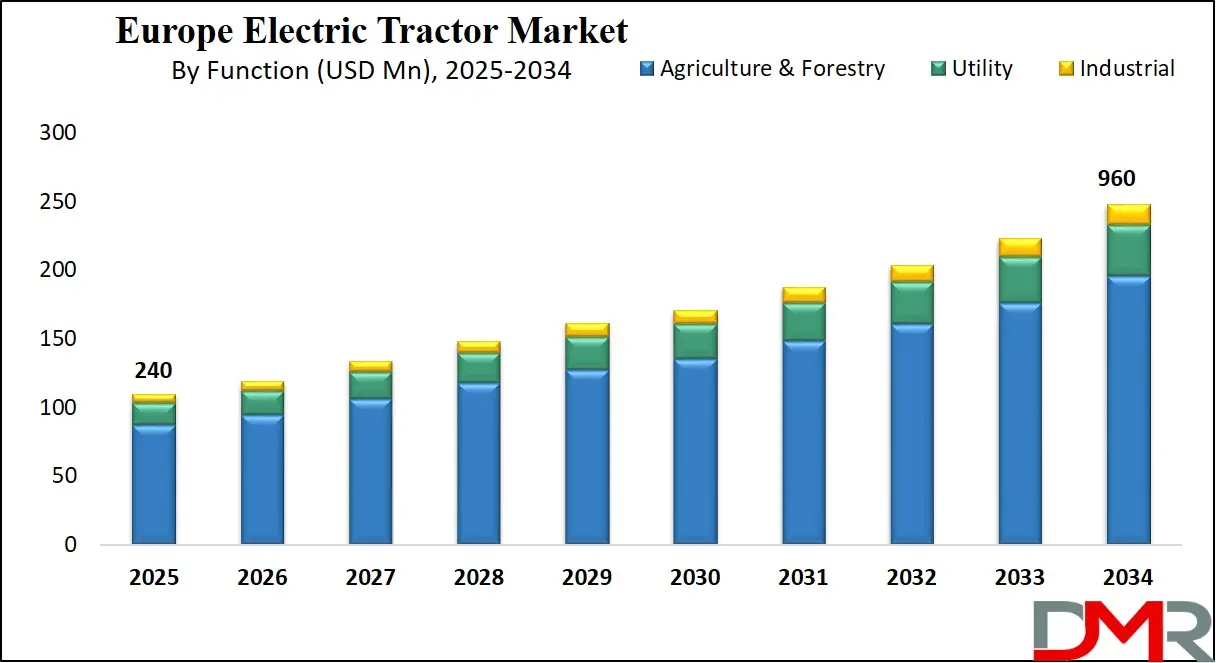

The Europe electric tractor market is projected to grow from USD 240 million in 2025 to USD 960 million by 2034, registering a CAGR of 16.5%. Rising adoption of battery-powered tractors, increasing demand for sustainable farming equipment, and supportive government policies are driving market expansion across key regions including Germany, France, Italy, and the Netherlands. The shift toward zero-emission agriculture and integration of smart farming technologies are further fueling market growth.

An electric tractor is an advanced agricultural vehicle powered entirely or partially by electric energy instead of conventional fossil fuels. It utilizes high-capacity batteries or hybrid systems to drive electric motors that operate the tractor’s wheels and implements. These tractors are designed to perform essential farming tasks such as plowing, seeding, and harvesting while producing zero emissions, reducing noise pollution, and lowering operational costs.

With intelligent energy management systems and regenerative braking, electric tractors offer enhanced efficiency and sustainability. They also support precision farming technologies by integrating sensors and IoT devices, enabling farmers to optimize field operations and improve productivity while contributing to environmental conservation and compliance with stricter agricultural emission standards.

The Europe electric tractor market has witnessed substantial growth as agricultural stakeholders increasingly adopt sustainable and energy-efficient machinery. Driven by government incentives for low-emission farming equipment, rising environmental awareness, and the need to reduce dependency on fossil fuels, the market is evolving rapidly. European farmers are integrating electric tractors into their operations to enhance soil health, reduce fuel expenditures, and meet stringent carbon reduction targets. Leading countries such as Germany, France, Italy, and the Netherlands are spearheading adoption due to supportive policies, advanced infrastructure, and strong research and development initiatives by manufacturers.

The market landscape is characterized by increasing investments from established agricultural equipment companies and innovative startups focusing on battery technology, charging infrastructure, and automation solutions. Collaboration between technology providers and farmers has led to customized electric tractors suitable for diverse European terrains and crop types. Furthermore, the integration of smart farming technologies, including GPS navigation and automated implement controls, is enhancing operational efficiency and promoting sustainable agriculture practices. With continuous technological advancements and growing government support, the Europe electric tractor market is poised for robust expansion in the coming years.

Europe Electric Tractor Market: Key Takeaways

- Market Value: The Europe electric tractor market size is expected to reach a value of USD 960 million by 2034 from a base value of USD 240 million in 2025 at a CAGR of 16.5%.

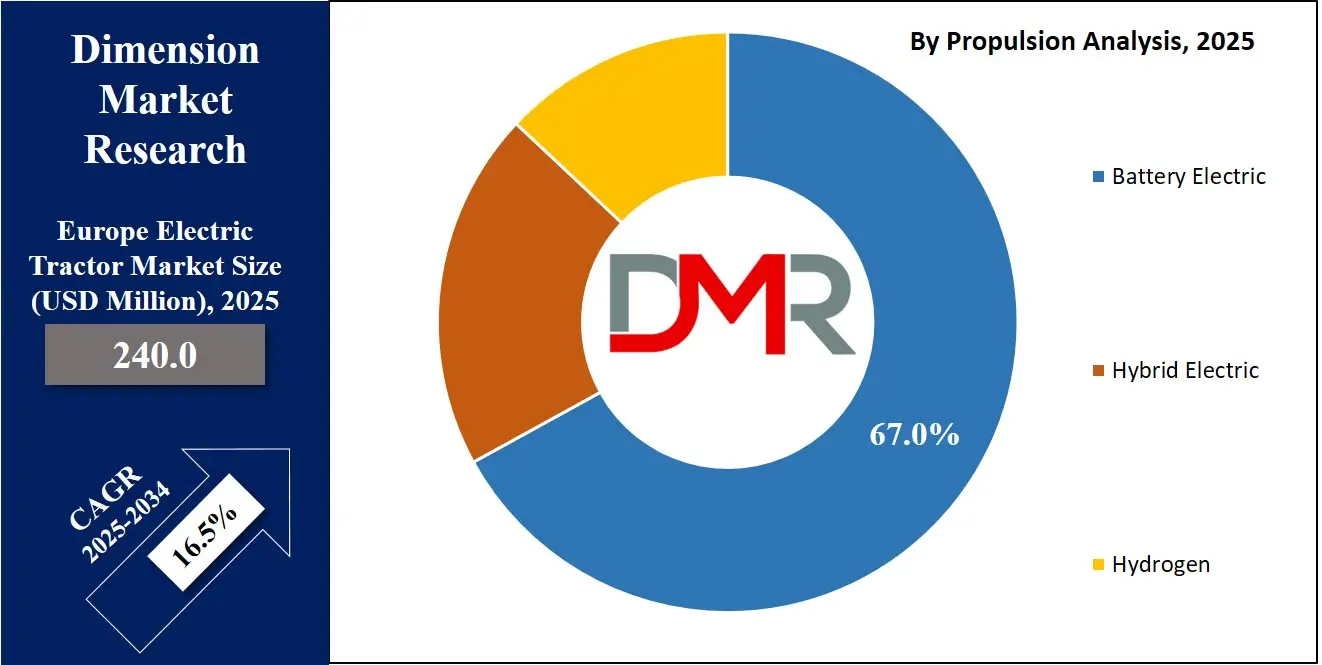

- By Propulsion Segment Analysis: Battery electric is anticipated to dominate the propulsion segment, capturing 67.0% of the total market share in 2025.

- By Battery Chemistry Segment Analysis: Lithium Iron Phosphate (LFP) is expected to maintain its dominance in the battery chemistry segment, capturing 60.0% of the total market share in 2025.

- By Battery Capacity Segment Analysis: Less than 50 kWh will account for the maximum share in the battery capacity segment, capturing 50.0% of the total market value.

- By Power Output Segment Analysis: Less than 50 HP will dominate the power output segment, capturing 56.0% of the market share in 2025.

- By Function Segment Analysis: Agriculture & Forestry functions will dominate the function segment, capturing 79.0% of the market share in 2025.

- By Equipment Type Segment Analysis: Electric Sprayers will capture the maximum share in the equipment type segment, capturing 54.0% of the market share in 2025.

- Key Players: Some key players in the Europe electric tractor market are AGCO Corporation, CNH Industrial, Deere & Company (John Deere), Kubota Corporation, Monarch Tractor, Yanmar, Deutz‑Fahr, Solectrac, Alamo Group, SAME, Caterpillar, International Tractor Limited, and Others.

Europe Electric Tractor Market: Use Cases

- Precision Farming Operations: Electric tractors are increasingly used in precision farming to optimize crop management and field efficiency. Equipped with GPS guidance, IoT sensors, and automated implement controls, these tractors allow farmers to precisely manage planting, fertilization, and irrigation. This reduces fuel consumption, minimizes soil compaction, and enhances yield per hectare. The quiet operation of electric tractors also supports greenhouse farming and sensitive crop environments.

- Sustainable Vineyard and Orchard Management: In vineyards and orchards across Europe, electric tractors are ideal for narrow-row operations and low-emission zones. Their compact size and zero-emission performance enable safe maneuvering between delicate crops while reducing environmental impact. Battery-powered tractors facilitate pruning, spraying, and harvesting tasks while supporting sustainable agriculture goals and compliance with EU carbon reduction regulations.

- Smallholder and Urban Farming Applications: Electric tractors are gaining traction among small-scale farmers and urban agriculture setups. Their low noise levels and reduced maintenance requirements make them suitable for peri-urban farms, community gardens, and rooftop farming projects. These tractors help improve operational efficiency while promoting green farming practices in densely populated areas.

- Automated and Smart Farm Integration: The Europe electric tractor market benefits from growing automation and smart farming adoption. Electric tractors can be integrated with farm management software, autonomous navigation systems, and data analytics platforms to enable remote monitoring and predictive maintenance. This use case enhances productivity, lowers operational costs, and supports precision agriculture initiatives across large-scale European farms.

Impact of Artificial Intelligence on the Europe Electric Tractor market

- Artificial intelligence is significantly transforming the Europe electric tractor market by enabling smarter, more efficient farming operations. AI-powered tractors utilize machine learning algorithms and real-time data analytics to optimize routes, predict maintenance needs, and manage energy consumption effectively. This enhances operational efficiency, reduces downtime, and extends battery life, making electric tractors more reliable for European farms.

- AI integration also supports precision agriculture by analyzing soil conditions, crop health, and weather patterns to make informed decisions about planting, irrigation, and fertilization. This allows farmers to achieve higher yields while minimizing environmental impact and operational costs. Moreover, AI-driven autonomous tractors are facilitating labor reduction and improving safety on farms, particularly in large-scale operations where continuous monitoring and repetitive tasks are required.

- The adoption of AI in electric tractors further encourages the development of connected farm ecosystems. These systems integrate sensors, drones, and farm management platforms to provide comprehensive insights for strategic planning. As European agriculture moves toward sustainability and smart farming, AI-enhanced electric tractors are becoming a critical tool for achieving carbon reduction targets and improving overall farm productivity.

Europe Electric Tractor Market: Stats & Facts

- Eurostat / EU Agricultural Census & Energy Use Data

- In 2020 the EU had 9.1 million agricultural holdings (farms).

- Of those, about 93% were family-run farms.

- In 2023, the agriculture & forestry sector in the EU consumed 26.4 million tonnes of oil equivalent (toe) of direct energy, down 1.1% compared with 2022.

- In that 2023 consumption breakdown: oil/petroleum products made up 58.3%, electricity 15.1%, natural gas 12.1%, and renewables/biofuels 11.7%.

- The agriculture and forestry sector’s share of total EU energy consumption remained at 3.0% in 2023.

- According to the 2024 data set, agricultural labour productivity in the EU rose by 1.6% year-on-year, supported by a 0.6% rise in real factor income and a 0.9% reduction in labour volume.

- In 2024, the gross value added (GVA) of EU agriculture increased by 4.4% compared with 2023.

- European Environment Agency (EEA) / EU Emissions Data

- Non‑CO₂ greenhouse gas emissions from agriculture decreased 7% between 2005 and 2023.

- A further 1% reduction is estimated between 2023 and 2024 under current policies.

- Methane (enteric fermentation) and nitrous oxide (soil emissions) remain dominant, accounting for roughly 49% and 30% respectively of total agricultural GHG emissions.

Europe Electric Tractor Market: Market Dynamics

Europe Electric Tractor Market: Driving Factors

Government Incentives for Sustainable Agriculture

Supportive policies and subsidies from European governments are accelerating the adoption of electric tractors. Incentives such as tax credits, grants, and low-interest loans for zero-emission farming equipment encourage farmers to transition from diesel-powered machinery. These initiatives not only reduce the initial investment burden but also align with the EU’s carbon reduction targets, making battery-powered tractors a more viable and attractive option for precision and sustainable farming.

Rising Demand for Low-Emission Farming Equipment

The growing awareness of environmental impact and the need to reduce greenhouse gas emissions are driving demand for electric tractors across Europe. Farmers are increasingly prioritizing energy-efficient machinery to meet sustainability goals, minimize fuel costs, and improve soil health. The integration of electric tractors into precision agriculture and smart farm operations further enhances productivity while maintaining eco-friendly practices.

Europe Electric Tractor Market: Restraints

High Initial Investment Costs

Despite long-term savings, the high upfront cost of electric tractors remains a significant barrier for many European farmers. Advanced battery systems, electric motors, and smart farming integration increase capital expenditure compared to conventional diesel tractors, limiting adoption among small and medium-scale farms. This cost factor can slow market penetration, particularly in regions with limited financial support.

Limited Charging Infrastructure in Rural Areas

The availability of charging stations and reliable electrical infrastructure in remote farming regions is still limited. Farmers often face challenges in recharging high-capacity batteries for large-scale operations, which can hinder the efficient use of electric tractors. Insufficient infrastructure delays adoption despite growing interest in sustainable farming solutions.

Europe Electric Tractor Market: Opportunities

Expansion of Smart Farming Integration

There is a growing opportunity to integrate electric tractors with AI, IoT devices, and farm management platforms. This enables precision agriculture, real-time monitoring, predictive maintenance, and optimized energy usage. As more European farms adopt connected farm ecosystems, electric tractors equipped with smart technologies can enhance operational efficiency and promote sustainable farming practices.

Development of Advanced Battery Technologies

Advancements in battery performance, energy density, and faster charging capabilities present significant growth opportunities. Enhanced batteries can extend operational hours, reduce downtime, and make electric tractors more competitive with diesel alternatives. Investment in battery innovation also opens potential for collaboration between agricultural equipment manufacturers and technology providers across Europe.

Europe Electric Tractor Market: Trends

Rise of Autonomous Electric Tractors

Automation is a prominent trend, with self-driving electric tractors gaining attention in European farms. These autonomous vehicles perform repetitive tasks such as plowing, seeding, and spraying with minimal human intervention. The trend aligns with labor shortage solutions, precision farming, and increased productivity while maintaining eco-friendly farming practices.

Focus on Regional Sustainable Farming Initiatives

European countries are increasingly implementing region-specific programs to promote green agriculture. Electric tractors are central to initiatives targeting emission reduction, soil conservation, and efficient energy use. These programs encourage localized adoption, collaboration with technology providers, and tailored solutions for vineyards, orchards, and smallholder farms, reinforcing market growth.

Europe Electric Tractor Market: Research Scope and Analysis

By Propulsion Analysis

In the Europe electric tractor market, the battery electric segment is expected to lead the propulsion category, accounting for approximately 67.0% of the total market share in 2025. Battery electric tractors are fully powered by high-capacity lithium-ion or advanced battery systems, providing a sustainable alternative to traditional diesel-powered machinery. These tractors offer advantages such as zero emissions, low operational noise, and reduced maintenance costs due to fewer moving parts. They are particularly suitable for precision farming and environmentally sensitive agricultural zones, where sustainability and efficiency are critical. The growing availability of charging infrastructure and advancements in battery technology are further supporting the adoption of fully electric tractors across European farms, enabling longer operational hours and enhanced productivity.

Hybrid electric tractors, on the other hand, combine an internal combustion engine with an electric motor to optimize energy efficiency and extend operational range. These tractors are particularly useful in large-scale farming operations where continuous work is required, and charging facilities may be limited. The hybrid configuration allows farmers to switch between electric power for low-speed operations and diesel power for high-demand tasks, offering flexibility and reduced fuel consumption. By integrating regenerative braking and intelligent energy management systems, hybrid electric tractors contribute to lower greenhouse gas emissions while maintaining performance comparable to conventional tractors, making them an attractive option for European farms transitioning toward sustainable agriculture.

By Battery Chemistry Analysis

In the Europe electric tractor market, Lithium Iron Phosphate (LFP) batteries are projected to dominate the battery chemistry segment, accounting for around 60.0% of the total market share in 2025. LFP batteries are favored for their long cycle life, thermal stability, and safety, making them well-suited for heavy-duty agricultural operations. They provide consistent power output for extended periods, support fast charging, and reduce the risk of overheating or fire compared to other battery types. Farmers benefit from lower maintenance requirements and reliable performance across varying European climates, which enhances the adoption of fully electric tractors for precision farming, orchard management, and other agricultural applications. The cost-effectiveness and sustainability of LFP batteries further strengthen their position as the preferred choice in the market.

Lithium Nickel Manganese Cobalt Oxide (Li-NMC) batteries, in contrast, offer higher energy density and longer driving ranges, making them suitable for tractors requiring extended operational hours or heavier workloads. While Li-NMC batteries are relatively more expensive and require careful thermal management, they provide superior performance in terms of power-to-weight ratio and efficiency. This makes them an attractive option for large-scale European farms where high productivity and longer uninterrupted field operations are essential. With ongoing research and improvements in battery technology, Li-NMC-equipped electric tractors are increasingly being considered for applications demanding both energy efficiency and high performance.

By Battery Capacity Analysis

In the Europe electric tractor market, tractors with battery capacities of less than 50 kWh are expected to capture the largest share in the battery capacity segment, accounting for approximately 50.0% of the total market value. These smaller-capacity batteries are ideal for compact tractors and light-duty agricultural operations, such as vineyard management, orchard maintenance, and urban or smallholder farming. They offer advantages including lower upfront costs, reduced weight, and faster charging times, making them suitable for farms that require shorter operational hours or operate in areas with easy access to charging infrastructure. The ease of integration with precision farming tools and minimal maintenance requirements further enhance the adoption of less than 50 kWh battery electric tractors across European farms.

Tractors with battery capacities ranging from 51 to 100 kWh are designed to meet the demands of medium to large-scale farming operations. These batteries provide extended operational hours and higher power output, enabling continuous fieldwork such as plowing, seeding, and harvesting without frequent recharging. While the initial investment and weight of the battery system are higher, the enhanced range and efficiency make these tractors suitable for farms with larger land areas or more energy-intensive tasks. The combination of moderate battery capacity and electric propulsion supports sustainable farming practices while balancing productivity and operational flexibility in European agricultural applications.

By Power Output Analysis

In the Europe electric tractor market, tractors with a power output of less than 50 HP are expected to dominate the segment, capturing approximately 56.0% of the market share in 2025. These low-power tractors are particularly suitable for small farms, vineyards, orchards, and urban agriculture where maneuverability, precision, and reduced soil compaction are critical. They offer efficient energy usage, lower maintenance costs, and ease of operation, making them ideal for farms focusing on sustainable and environmentally friendly practices. The compact design and quiet operation also allow their use in noise-sensitive areas and in close proximity to residential zones, further driving their adoption across Europe.

Tractors with a power output of 51 to 100 HP cater to medium-scale farming operations that require higher productivity and greater versatility. These tractors are capable of handling more demanding agricultural tasks such as tilling, planting, and harvesting larger plots while still benefiting from electric propulsion. The balance between power and efficiency enables farmers to achieve longer operational hours without compromising performance, making them suitable for farms that need both sustainability and enhanced productivity. With growing adoption of precision agriculture and energy-efficient machinery, this segment is increasingly gaining traction in the European electric tractor market.

By Function Analysis

In the Europe electric tractor market, tractors designed for agriculture and forestry functions are expected to dominate the segment, capturing around 79.0% of the market share in 2025. These tractors are primarily used for tasks such as plowing, planting, harvesting, and transporting crops, as well as managing forests and woodlands. Their electric propulsion allows for quiet operation, reduced emissions, and lower fuel costs, making them suitable for environmentally sensitive areas and compliance with European sustainability regulations. The integration of precision farming technologies and smart farming tools enhances productivity, soil management, and operational efficiency, further supporting the widespread adoption of electric tractors in traditional agricultural and forestry applications.

Utility electric tractors, on the other hand, are designed for versatile farm operations beyond core agriculture and forestry activities. They are used for tasks such as landscaping, transportation of materials, irrigation, and maintenance of farm infrastructure. These tractors benefit from moderate power output, flexible battery capacities, and easy maneuverability, making them suitable for small and medium-scale farms, municipal projects, and urban farming setups. Their multi-functional design allows farmers to maximize operational efficiency while maintaining eco-friendly practices, creating opportunities for broader adoption across different European farming environments.

By Equipment Type Analysis

In the Europe electric tractor market, electric sprayers are expected to capture the largest share in the equipment type segment, accounting for approximately 54.0% of the market in 2025. These sprayers are widely used for precise application of fertilizers, pesticides, and herbicides in crops, vineyards, and orchards, ensuring uniform coverage and minimizing chemical wastage. Their electric propulsion allows for quiet, emission-free operation, which is particularly beneficial in environmentally sensitive areas and regions with strict agricultural regulations. Integration with GPS and smart farming technologies enhances precision, reduces operational costs, and supports sustainable farming practices, making electric sprayers a preferred choice for European farmers.

Electric weeders, in contrast, are specialized equipment designed to remove weeds efficiently while minimizing soil disruption. These tools are particularly useful in vineyards, orchards, and organic farms where mechanical or chemical weed control is limited. Battery-powered operation ensures low noise and zero emissions, enabling frequent use without affecting crop health or the surrounding environment. By automating repetitive weeding tasks, electric weeders improve labor efficiency and support sustainable farm management, creating opportunities for broader adoption across various European agricultural operations.

The Europe Electric Tractor Market Report is segmented on the basis of the following:

By Propulsion

- Battery Electric

- Hybrid Electric

- Hydrogen

By Battery Chemistry

- Lithium Iron Phosphate (LFP)

- Lithium Nickel Manganese Cobalt Oxide (LI-NMC)

- Others

By Battery Capacity

- Less than 50 KWH

- 51 to 100 KWH

- More than 100 KWH

By Power Output

- Less than 50 HP

- 51 to 100 HP

- More than 100 HP

By Function

- Agriculture & Forestry

- Utility

- Industrial

By Equipment Type

- Electric Sprayers

- Electric Weeders

Europe Electric Tractor Market: Regional Analysis

The Europe electric tractor market is primarily concentrated in Western European countries such as Germany, France, Italy, and the Netherlands, driven by supportive government policies, advanced agricultural infrastructure, and increasing adoption of sustainable farming practices. Northern and Southern European regions are also witnessing steady growth due to rising awareness of low-emission agriculture and the integration of smart farming technologies.

The market is characterized by a mix of established global tractor manufacturers and innovative local startups focusing on electric propulsion, battery optimization, and precision farming solutions. Regional initiatives promoting carbon reduction, energy-efficient machinery, and automated farm operations are further accelerating the adoption of electric tractors across diverse European agricultural landscapes.

By Region

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Europe Electric Tractor Market: Competitive Landscape

The Europe electric tractor market is highly competitive, characterized by continuous technological innovation, strategic collaborations, and product differentiation. Key players are focusing on enhancing battery efficiency, expanding charging infrastructure, and integrating smart farming technologies to gain a competitive edge. Companies are investing in research and development to offer tractors with improved operational range, reduced maintenance, and optimized performance for diverse agricultural applications. Market competition also emphasizes sustainability, with manufacturers prioritizing zero-emission solutions, energy-efficient designs, and autonomous functionalities to meet the growing demand for eco-friendly and high-productivity farming equipment across Europe.

Some of the prominent players in the Europe Electric Tractor market are:

- AGCO Corporation

- CNH Industrial

- Deere & Company (John Deere)

- Kubota Corporation

- Monarch Tractor

- Yanmar

- Deutz‑Fahr

- Solectrac

- Alamo Group

- SAME

- Caterpillar

- International Tractor Limited

- VST Tractors

- TAFE

- Rigitrac Traktorenbau AG

- EoX Tractors

- EVE SRL

- SABI AGRI

- Ideanomics

- Ztractor

- Other Key Players

Europe Electric Tractor Market: Recent Developments

- Nov 2025: At a major agricultural machinery event in Germany, a leading tractor manufacturer unveiled a new electric-hybrid tractor combining electric battery power with a diesel engine, offering both zero-emission mode for light tasks and hybrid mode for heavy field work.

- Nov 2025: A European deep-tech startup raised €7 million in a funding round to scale production of its autonomous tractors, targeting output of roughly 100 units per year by 2026, aiming to broaden market reach across European farms and logistics operations.

- Jun 2025: A European deep-tech startup launched an autonomous electric tractor platform aimed at agriculture and frontline logistics, positioning it as a modular, software-defined alternative to legacy tractors, and simultaneously secured €2 million in pre-seed funding to support initial development and early field deployment.

- Mar 2025: A Netherlands-based agricultural equipment manufacturer acquired a majority stake in an Italian agricultural machinery dealer arm, expanding its footprint in key European markets and strengthening distribution, after-sales support, and smart farming solution delivery.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 240 Mn |

| Forecast Value (2034) |

USD 960 Mn |

| CAGR (2025–2034) |

16.5% |

| Historical Data |

2019 – 2024 |

| Forecast Data |

2026 – 2034 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Propulsion (Battery Electric, Hybrid Electric, and Hydrogen), By Battery Chemistry (Lithium Iron Phosphate (LFP), Lithium Nickel Manganese Cobalt Oxide (LI-NMC), and Others), By Battery Capacity (Less than 50 KWH, 51 to 100 KWH, and More than 100 KWH), By Power Output (Less than 50 HP, 51 to 100 HP, and More than 100 HP), By Function (Agriculture & Forestry, Utility, and Industrial), and By Equipment Type (Electric Sprayers and Electric Weeders) |

| Regional Coverage |

Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe |

| Prominent Players |

AGCO Corporation, CNH Industrial, Deere & Company (John Deere), Kubota Corporation, Monarch Tractor, Yanmar, Deutz Fahr, Solectrac, Alamo Group, SAME, Caterpillar, International Tractor Limited, and Others. |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users) and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |

Frequently Asked Questions

The Europe electric tractor market size is estimated to have a value of USD 240 million in 2025 and is expected to reach USD 960 million by the end of 2034, with a CAGR of 16.5%.

Some of the major key players in the Europe electric tractor market are AGCO Corporation, CNH Industrial, Deere & Company (John Deere), Kubota Corporation, Monarch Tractor, Yanmar, Deutz Fahr, Solectrac, Alamo Group, SAME, Caterpillar, International Tractor Limited, and Others.