Market Overview

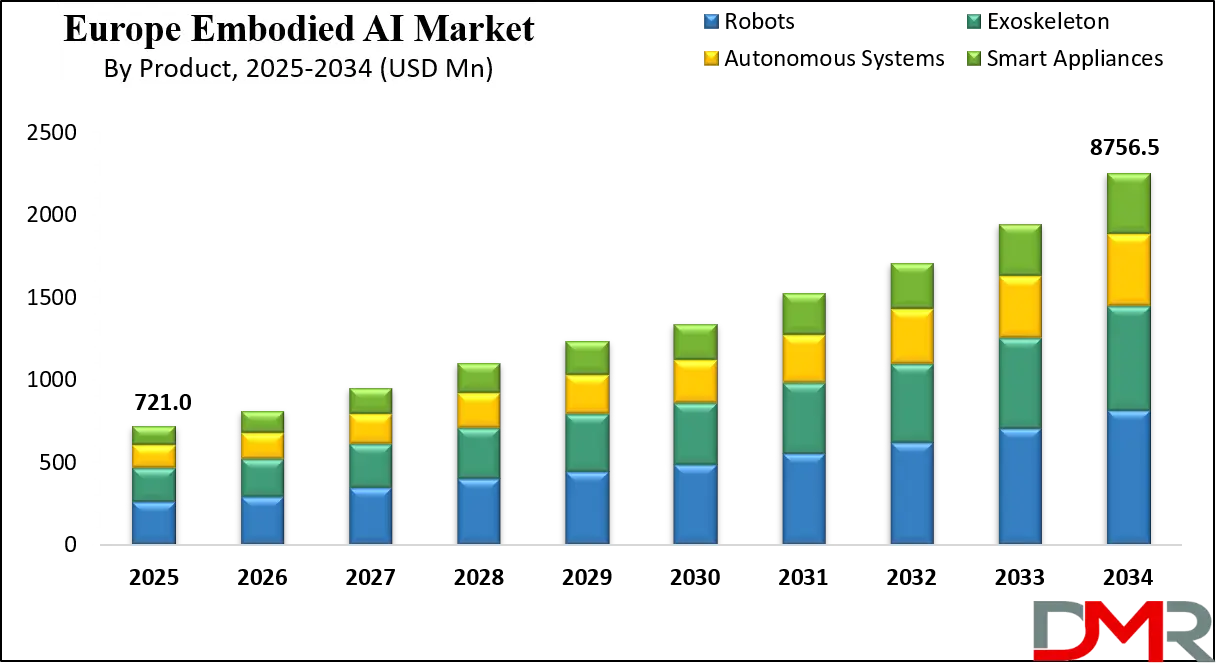

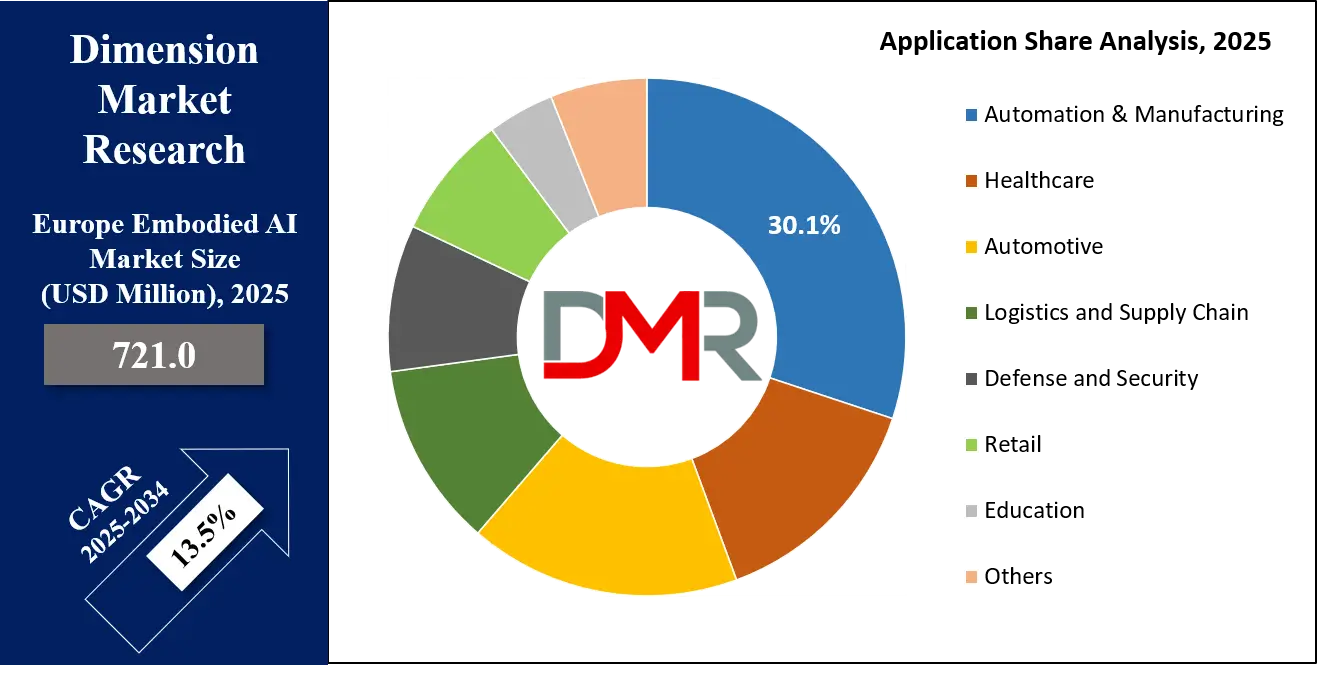

The Europe Embodied AI Market is projected to attain a valuation of USD 721.0 million in 2025 and is expected to expand significantly, reaching USD 8,756.5 million by 2034, advancing at a robust compound annual growth rate (CAGR) of 13.5%.

This strong growth trajectory reflects increasing adoption of intelligent robotics, autonomous systems, natural language processing, and computer vision across diverse industries such as manufacturing, healthcare, retail, logistics, and automotive. The demand for human-like interaction, enhanced automation, real-time decision-making, and advanced machine learning integration is driving the market forward, establishing Europe as a key hub for AI-driven robotics, cognitive computing, and embodied intelligence solutions.

The European Embodied AI Market is evolving into a transformative force as robotics, machine learning, and advanced automation converge with the region’s demographic realities, industrial heritage, and policy-driven innovation ecosystem.

According to Eurostat, more than one in five Europeans is over the age of 65, a trend that is accelerating. This demographic shift creates urgent demand for assistive robotics, healthcare exoskeletons, and AI-driven companion systems designed to support aging societies. Unlike other regions, Europe is tackling this challenge head-on with policy frameworks such as the European Commission’s Horizon Europe program and the Artificial Intelligence Act, which encourage innovation while embedding ethical safeguards into AI deployment.

Industrial leadership is another factor fueling adoption. Countries such as Germany, France, and the Nordic nations are integrating embodied AI into their advanced manufacturing and logistics operations. Germany’s strength in industrial robotics, coupled with Denmark’s expertise in collaborative robots, positions Europe as a global hub for embodied AI. The Digital Europe Programme further strengthens this ecosystem by funding digital infrastructure, AI skills development, and cross-border collaboration. Institutions like the European Robotics Association ensure that knowledge sharing and innovation flow freely between academia, industry, and governments.

Application areas are rapidly diversifying. In logistics and supply chains, autonomous mobile robots are revolutionizing warehouses and last-mile delivery, directly supporting Europe’s expanding e-commerce economy, which Eurostat highlights as steadily rising across EU member states. In the automotive sector, embodied AI is embedded in both autonomous vehicle systems and smart factories, reinforcing Europe’s leadership through hubs in Germany, Italy, and Spain. In healthcare, robotic assistants and rehabilitation exoskeletons are mitigating workforce shortages identified by the European Centre for Disease Prevention and Control (ECDC), particularly in long-term care and rehabilitation services.

Moreover, defense, education, and public services are increasingly incorporating embodied AI. Defense agencies deploy autonomous drones and surveillance robots to enhance border security and disaster response. Universities and training institutions are using embodied AI to accelerate STEM education and foster digital literacy, complementing the EU’s Digital Education Action Plan (2021–2027).

Europe’s unique combination of demographic necessity, policy support, industrial expertise, and research leadership creates an environment where embodied AI can thrive. Unlike other global regions, Europe is not only investing in technological capacity but also embedding ethical frameworks and human-centric design principles. This ensures that embodied AI solutions balance innovation with responsibility, making the continent a frontrunner in shaping the global embodied AI landscape.

Europe Embodied AI Market: Key Takeaways

- The Market Size Insights: The Europe Embodied AI Market size is estimated to have a value of USD 721.0 million in 2025 and is expected to reach USD 8,756.5 million by the end of 2034.

- The Market Growth Rate Insights: The market is growing at a CAGR of 13.5 percent over the forecasted period of 2025.

- Key Players Insights: Some of the major key players in the Europe Embodied AI Market are ABB Robotics, KUKA AG, Bosch Robotics, PAL Robotics, SoftBank Robotics Europe, Festo AG, Universal Robots, Robotnik Automation, Comau Robotics, Aldebaran Robotics, and many others.

- Robots as the Core Growth Driver: Robots are poised to dominate the European embodied AI market due to strong industrial roots, high robot density in countries like Germany, and rising demand in healthcare, logistics, and public services.

- Factory Automation as the Leading End User: Europe’s highly industrialized economies (Germany, Italy, France) rely heavily on embodied AI for smart manufacturing, addressing labor shortages, boosting productivity, and aligning with the EU’s Industry 5.0 vision of human-centric and sustainable production.

- Policy and Sustainability as Catalysts: EU programs such as Horizon Europe, the Digital Europe Programme, and the Green Deal accelerate adoption, while the AI Act ensures ethical deployment, making Europe a global leader in responsible and sustainable embodied AI innovation.

Europe Embodied AI Market: Use Cases

- Healthcare Robotics for Elderly Care: With Europe’s aging population, embodied AI enables humanoid robots and exoskeletons that support mobility, elderly monitoring, and patient rehabilitation. These solutions reduce healthcare staff shortages while ensuring personalized care delivery.

- Logistics & Warehousing Automation: European e-commerce expansion demands faster, more reliable logistics. Embodied AI robots optimize warehouse operations through autonomous navigation, object recognition, and adaptive load handling. Companies integrate embodied AI to manage inventory, reduce human error, and accelerate last-mile delivery.

- Manufacturing & Smart Factories: Embodied AI powers collaborative robots (cobots) in European factories, enabling adaptive assembly, quality checks, and predictive maintenance. By combining AI, sensor fusion, and real-time analytics, embodied AI enhances operational resilience and productivity within the EU’s Industry 5.0 transformation roadmap.

- Defense & Security Applications: Embodied AI supports surveillance, disaster response, and defense robotics in Europe, helping NATO-aligned nations enhance security. Autonomous drones, AI-driven ground robots, and reconnaissance systems provide real-time situational awareness.

- Educational & Service Robotics: Universities, research institutions, and training centers across Europe adopt embodied AI robots to support STEM education, language learning, and skill development. In public spaces, AI-enabled service robots provide customer assistance, navigation, and information.

Europe Embodied AI Market: Stats & Facts

Eurostat

- Over 20% of Europe’s population is above the age of 65 (2023).

- Europe’s R&D expenditure reached USD 386.5 million in 2022, with over 2.3% of GDP invested in research.

- Around 72% of EU enterprises had access to high-speed internet in 2022.

- Over USD 544 million worth of ICT goods were imported into the EU in 2022, reflecting tech adoption.

- Manufacturing accounts for 14.6% of EU GDP and employs over 29 million people in 2023.

- Over USD 1.57 trillion in e-commerce sales were recorded in Europe in 2022.

OECD (Organisation for Economic Co-operation and Development)

- Automation and robotics could affect 14% of jobs in Europe directly, with another 32% facing significant transformation.

- Average robot density in Europe is 118 robots per 10,000 employees, higher than the global average of 92.

European Commission

- The Digital Europe Programme (2021–2027) allocated over USD 8.7 million to accelerate digital and AI adoption.

- Horizon Europe, the EU’s research program, has a budget of USD 109.1 million from 2021–2027, supporting AI and robotics.

- The EU’s Artificial Intelligence Act (2021 draft) makes Europe the first region to introduce comprehensive AI regulation.

- The EU’s Robotics Strategic Research Agenda emphasizes embodied AI in healthcare, logistics, and mobility as priority areas.

European Centre for Disease Prevention and Control (ECDC)

- Europe faces a projected shortage of 4.1 million healthcare workers by 2030, driving demand for assistive robotics and AI-powered care systems.

World Bank

- Europe has an urban population of 75%, driving automation needs in mobility and logistics.

- Labor productivity in the EU grew at 1.2% annually between 2015–2022, partly due to automation and AI integration.

International Federation of Robotics (IFR)

- In 2022, Europe installed 84,302 industrial robots, representing 24% of global installations.

- Germany alone deployed 26,000 robots in 2022, making it the largest robotics market in Europe.

- Robot density in Germany reached 397 robots per 10,000 employees, ranking among the top five globally.

- Italy installed 12,000 new robots in 2022, while France recorded 7,400 installations.

European Investment Bank (EIB)

- In 2022, the EIB invested USD 16.3 million in innovation, digital transformation, and AI-driven projects.

- Over USD 5.4 million was directed toward digital infrastructure and AI research.

UNESCO (United Nations Educational, Scientific, and Cultural Organization)

- Europe contributes nearly 34% of the world’s AI-related scientific publications, showing strong research intensity.

- Women represent 32% of AI researchers in Europe, higher than the global average of 26%.

European Robotics Association (euRobotics)

- There are over 250 robotics research centers in Europe collaborating under EU-funded networks.

- Europe accounts for nearly 30% of global robotics patents, driven by Germany, France, and the Nordics.

World Health Organization (WHO, Europe Office)

- By 2050, nearly 30% of Europe’s population will be over 65, boosting the need for embodied AI in healthcare and elder care.

Europe Embodied AI Market: Market Dynamics

Driving Factors in the Europe Embodied AI Market

Public Funding, Procurement Signals, And Clustered R&D Ecosystems

Large, sustained public funding and procurement commitments are a major growth driver specific to Europe. Multi-million euro programs for research, digitalization, and skills spur the upstream innovation required for embodied AI funding that underwrites sensor development, simulation-to-real pipelines, and safety-critical control stacks. At the same time, public procurement rules and regional digitalization projects create early adopter anchors: hospitals, ports, logistics hubs, and municipalities deploying pilot fleets or large-scale assistive systems.

Because much of this investment flows through collaborative grants and cross-border consortia, it reinforces regional clusters (robotics hubs in Germany, the Nordics, and France) and encourages university-industry partnerships to commercialize hard-to-replicate IP in perception, tactile sensing, and secure on-device inference. The combined effect reduces technology risk for private buyers, accelerates standards formation, and increases available capital for scale-up, making Europe an attractive market for start-ups that can co-design with public sector partners and then scale into private sector procurement.

Industrial Modernization And Labour Substitution In Strategic Sectors

Europe’s advanced manufacturing base and logistics network are actively modernizing to remain competitive, and embodied AI plays a central role in that renewal. In manufacturing, cobots and adaptive robotic cells enable flexible production lines that reduce changeover time, increase product customization, and support circular-economy processes that many EU policies now incentivize.

In logistics, autonomous mobile robots, intelligent sorting, and vision-guided goods handling address persistent labour shortages and peak-demand variability driven by e-commerce growth. The drivers here are practical: embodied AI systems directly cut unit labour costs, reduce workplace injuries through collaborative safety systems, and permit cost-effective round-the-clock operations.

Importantly, these gains are often measured at the facility level (throughput, quality yield, downtime reduction), which helps procurement teams build ROI cases that justify capital investment even when compliance and integration effort is substantial. As a result, sectoral modernization programs and labour-market pressures create steady, measurable tailwinds for embodied AI adoption across European industry. (See Eurostat and sector modernization policy signals.)

Restraints in the Europe Embodied AI Market

Compliance Costs, Fragmented National Implementations, and Scale Friction

While Europe’s regulatory rigor builds trust, it also raises the cost of entry. Compliance overhead conformity assessments, documentation, model cards, data-provenance controls, and potential clinical validation drives up upfront engineering and legal expenses, disproportionately impacting SMEs and nascent start-ups.

Moreover, although EU regulation provides a common framework, national interpretation and enforcement capacity can vary; member states are rolling out national AI authorities and implementation pathways at different paces, which creates fragmentation in interpretation and procurement practices. This combination of high compliance cost and uneven national rollouts introduces scale friction for vendors: they must manage multiple certification timelines, local procurement rules, and language/localization requirements while financing long development cycles. The net effect is slower commercial scaling for pure software-first entrants and a structural advantage for established industrial incumbents with deeper compliance budgets and existing public procurement relationships.

Data-Governance Constraints and Human-Factors Integration Challenges

Embodied AI systems rely heavily on high-quality sensor data, continuous model updates, and cross-domain datasets (health records, operational telemetry, video feeds). Europe’s robust data-protection framework (GDPR) and the EDPB’s evolving guidance on AI place strict requirements on consent, data minimization, and purpose limitation that complicate data collection strategies, especially for long-tail, in-facility learning.

Additionally, human factors worker acceptance, ergonomic integration, and organizational change management are non-trivial barriers: deploying an embodied system requires workflow redesign, staff retraining, and safety culture shifts. Where cultural resistance is high or data access is constrained, learning cycles extend and model performance degrades relative to unconstrained environments. These limitations slow adaptive, on-device learning approaches and create a preference for offline, rigorously audited updates, reducing agility. Vendors must therefore invest in privacy-preserving learning techniques, federated approaches, and deep stakeholder engagement to overcome both legal and human-operational restraints that could otherwise limit scale.

Opportunities in the Europe Embodied AI Market

Healthcare & Aged-Care Deployments Driven By Demographic Shifts And Reimbursement Models

Europe’s aging demographics create a clear blue-ocean opportunity for embodied AI in healthcare and social care. There are multiple monetizable vectors: mobility-assistance exoskeletons for rehabilitation clinics, telepresence and companion robots for long-term care facilities, and robotic lifting and transfer systems that lower occupational injury risk for nursing staff. Crucially, European health systems often operate under centralized or regional reimbursement frameworks; once clinical efficacy and safety are demonstrated in pilot programs, regional procurement and reimbursement pathways can scale adoption rapidly.

Tying clinical evidence generation to public research grants and regulatory approvals can shorten the commercialization timeline; suppliers that partner with academic hospitals and integrate with electronic health records will unlock recurring revenue through device leasing, outcome-based contracts, and long-term service agreements. For startups and incumbents alike, converging clinical validation, regulatory compliance, and public procurement alignment is the strategic path to mass adoption in Europe’s sizable healthcare market.

Edge Compute, Sim-To-Real Transfer, And Standards-Led Component Markets

As embodied systems migrate from cloud-centric prototypes to distributed, safety-critical deployments, there’s an expanding opportunity in edge computing, simulation platforms, and modular sensor suites standardized for interoperability. European policy emphasis on secure, sovereign infrastructure (edge nodes, trusted clouds) alongside industry demand for low-latency perception creates a market for silicon, embedded AI accelerators, and validated middleware that can run certified models on-device.

Additionally, high-fidelity simulation and sim-to-real toolchains reduce field-testing costs and accelerate model generalization across European environments (multi-lingual voice control, diverse urban layouts, climate variability). Vendors offering certified stacks sensor fusion, deterministic control, and explainable decision modules can capture high-margin licensing and support revenue as enterprises demand predictable, auditable performance. Standards bodies and cross-industry consortia that define APIs and safety profiles will further open markets for third-party components and verification services, creating a vibrant supplier ecosystem around core embodied-AI platforms.

Trends in the Europe Embodied AI Market

Regulatory-led industrialization and responsible-AI integration

Europe’s embodied-AI adoption is unfolding within one of the world’s most structured regulatory landscapes. The AI Act and complementary Guidance (including EDPB positions on data protection for AI models) are actively shaping product design, testing, and deployment requirements for embodied systems, especially where health, safety, biometric processing, or decision-making are involved.

That means vendors and system integrators targeting European markets must bake compliance and explainability into models and control systems from the earliest R&D stages. The effect is twofold: product lifecycles lengthen as ethical-by-design processes, conformity assessments, and documentation become standard; and a higher bar for validation fosters customer trust among EU purchasers (health authorities, public bodies, regulated industries) that view compliance as an operational requirement rather than optional. Over time, this regulation-driven framework will create a resilient European ecosystem where certified, auditable embodied AI systems are the norm, favoring suppliers who invest in transparent data pipelines, robust safety envelopes, and human-in-the-loop controls.

Convergence of demographic demand and digital infrastructure

Europe’s ageing population and rising digital adoption are converging to create sustained, sector-specific demand for embodied AI. The high share of older adults increases the need for assistive robotics, rehabilitation exoskeletons, and ambient-assistance systems in healthcare and long-term care, while expanding e-commerce and logistics activity drives warehouse automation and last-mile robotics.

Simultaneously, EU investment in digital infrastructure and skills (via programs like Horizon Europe and the Digital Europe Programme) is raising the baseline technical capacity edge compute, secure cloud, and interoperable data flows required for real-time embodied systems. This twin dynamic means demand is not just transient procurement but tied into public policy pipelines (health funding, regional digitalization grants) and long-term capital expenditure cycles in manufacturing and logistics. As infrastructure and human capital scale, embedded intelligence moves from pilot proofs to fleet-level rollouts, increasing market predictability and the total addressable market for system integrators, component suppliers, and service partners.

Europe Embodied AI Market: Research Scope and Analysis

By Product Analysis

Robots are projected to dominate the European Embodied AI market due to their pivotal role in bridging advanced artificial intelligence with real-world industrial, healthcare, and service applications. Europe has a long-standing leadership in robotics innovation, particularly in countries like Germany, Denmark, and France, which serve as hubs for industrial robotics, humanoid systems, and collaborative robots (cobots). According to the International Federation of Robotics (IFR), Europe is home to some of the largest robot density rates in the world, with Germany alone operating nearly 397 industrial robots per 10,000 employees.

The demand for robots is fueled by Europe’s demographic shift, with over 20% of the population above 65 years, as per Eurostat, increasing the reliance on healthcare and service robots for elderly care, rehabilitation, and assisted living. Moreover, robots integrated with embodied AI enhance adaptability, perception, and interaction in dynamic environments, enabling use across diverse domains such as logistics, agriculture, and public services.

Policy support also strengthens this segment. The European Commission’s Horizon Europe and Digital Europe Programmes encourage funding for robotics R&D, while the EU’s AI Act creates an ethical and regulated framework for deployment. The manufacturing and automotive sectors' major European strengths are heavily dependent on robotic integration for efficiency, precision, and competitiveness.

The combination of Europe’s robotics heritage, policy-driven ecosystem, and rising demand across industries ensures that robots remain the most dominant product category in the embodied AI landscape, positioning the continent as a global leader in both innovation and deployment.

By End User Analysis

Factory automation is anticipated to stand as the leading end-user segment for embodied AI in Europe, driven by the continent’s highly industrialized economy and strong emphasis on smart manufacturing. Germany, Italy, and France serve as Europe’s manufacturing powerhouses, with advanced automotive, aerospace, and electronics sectors relying heavily on automation to remain globally competitive. According to Eurostat, manufacturing contributes nearly 20% of Europe’s GDP, underlining the sector’s strategic importance.

Embodied AI integrates into factory automation through intelligent robots, machine vision systems, and adaptive assembly lines, enabling greater flexibility, precision, and productivity. Unlike traditional automation, embodied AI allows machines to learn from their environment, collaborate with human workers, and adapt to complex production processes. This aligns with the EU’s Industry 5.0 framework, which emphasizes human-centric, resilient, and sustainable manufacturing.

Labor shortages in technical roles also accelerate adoption. As reported by the European Centre for the Development of Vocational Training (Cedefop), Europe faces skills gaps in engineering and manufacturing, making embodied AI systems essential to fill workforce gaps. Autonomous mobile robots, robotic arms, and exoskeletons are increasingly used to enhance efficiency, reduce downtime, and improve workplace safety.

Sustainability targets are another driver. The EU’s Green Deal and digitalization goals push industries to adopt energy-efficient, AI-driven automation systems, lowering emissions while optimizing resource use. The integration of embodied AI into factory automation ensures that Europe maintains its global industrial competitiveness while addressing workforce and environmental challenges, solidifying this segment’s dominance in the market.

The Europe Embodied AI Market Report is segmented on the basis of the following:

By Product

- Robots

- Humanoid Robots

- Mobile Robots

- Industrial Robots

- Service Robots

- Cobots (Collaborative Robots)

- Exoskeleton

- Autonomous Systems

- Smart Appliances

By End User

- Automation & Manufacturing

- Factory Automation

- Quality Control and Inspection

- Healthcare

- Robotic Surgery and Assistance

- Patient Care and Rehabilitation

- Medical Imaging and Diagnostics

- Automotive

- Autonomous Vehicles

- Driver Assistance Systems (ADAS)

- Logistics and Supply Chain

- Autonomous Delivery Systems

- Warehouse Automation

- Defense and Security

- Autonomous surveillance drones

- Search and Rescue Operations

- Autonomous Combat Systems

- Retail

- Customer Service Robots

- In-Store Robotics for Inventory Management

- Personalized Shopping Assistants

- Education

- Teaching Robots

- Interactive Learning Systems

- AI Tutors

- Others

By Region

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Europe Embodied AI Market: Competitive Landscape

The competitive landscape of the European Embodied AI Market is defined by the presence of robotics manufacturers, AI software innovators, and cross-sector collaborations that integrate machine learning with industrial and healthcare applications. Germany, France, and the Nordic countries host some of the strongest robotics clusters in Europe, anchored by companies such as ABB Robotics, KUKA, and Bosch, which lead in industrial automation, factory robotics, and service-oriented robots. These firms benefit from Europe’s advanced manufacturing ecosystem and are strategically aligning their product lines with embodied AI capabilities.

Startups across France, the Netherlands, and the UK contribute significantly to service robotics, exoskeletons, and human–robot interaction technologies. Organizations like PAL Robotics (Spain) and SoftBank Robotics Europe specialize in humanoid robots and healthcare-support systems, further diversifying the market. Collaboration is a hallmark of Europe’s strategy, with research hubs, universities, and EU-funded initiatives under Horizon Europe accelerating the commercialization of embodied AI solutions.

The competitive environment is further strengthened by the EU’s regulatory framework, including the AI Act, which emphasizes ethical, safe, and transparent deployment. This fosters trust, giving European firms a strong edge in markets where responsible AI is paramount.

Overall, the landscape is characterized by established robotics leaders, innovative startups, and policy-driven collaboration, positioning Europe as a balanced ecosystem that combines industrial strength, research excellence, and ethical oversight to dominate embodied AI innovation.

Some of the prominent players in the Europe Embodied AI Market are:

- ABB Robotics

- KUKA AG

- Bosch Robotics

- PAL Robotics

- SoftBank Robotics Europe

- Festo AG

- Universal Robots

- Robotnik Automation

- Comau Robotics

- Aldebaran Robotics

- Shadow Robot Company

- ANYbotics

- Neura Robotics

- Rethink Robotics GmbH

- Cyberdyne Europe

- Hocoma AG

- Blue Ocean Robotics

- Engineered Arts

- Exotec

- Robocertics

- Other Key Players

Recent Developments in the Europe Embodied AI Market

- July 2024: SoftBank Robotics partnered with European healthcare providers to expand humanoid robots for elderly care facilities across Germany and France.

- June 2024: PAL Robotics launched a new humanoid service robot in Barcelona aimed at healthcare and hospitality applications.

- May 2024: ABB Robotics opened its European AI-powered robotics hub in Västerås, Sweden, to accelerate embodied AI integration in manufacturing.

- April 2024: The European Robotics Forum 2024 was held in Rimini, Italy, showcasing embodied AI innovations in logistics and healthcare.

- March 2024: Siemens and Universal Robots collaborated on AI-enhanced cobots for smart factories across Europe.

- February 2024: Horizon Europe funded new research projects on embodied AI in rehabilitation robotics and assistive healthcare devices.

- January 2024: The European Parliament advanced deliberations on the AI Act, shaping regulatory frameworks for embodied AI adoption.

- December 2023: Fraunhofer IPA unveiled its latest autonomous mobile robot prototypes for logistics operations in Stuttgart.

- November 2023: KUKA Robotics introduced AI-driven robotic arms designed for precision tasks in automotive assembly plants across Germany.

- October 2023: The UK Robotics and Autonomous Systems Network (UK-RAS) hosted the Robotics and AI Conference, focusing on embodied AI for healthcare and automation.

- September 2023: PAL Robotics signed an MoU with French universities to advance humanoid AI research and development.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 13.0 Bn |

| Forecast Value (2034) |

USD 25.7 Bn |

| CAGR (2025–2034) |

8.3% |

| The US Market Size (2025) |

USD 4.2 Bn |

| Historical Data |

2019 – 2024 |

| Forecast Data |

2026 – 2034 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Component (Hardware, Software, Services), By ACaaS Deployment (Hosted, Managed, Hybrid), By Authentication Method (Single-Factor, Multi-Factor, Mobile Credential/Bluetooth LE), By Connectivity Technology (RFID/NFC, Smart Cards, Bluetooth Low Energy, Ultra-Wideband), By Technology (Authentication Systems, Detection Systems, Alarm Panels, Communication Devices, Perimeter Security Systems), By End-Use Vertical (Commercial Buildings, Industrial & Manufacturing, Government & Public Sector, Military & Defense, Transport & Logistics, Healthcare, Residential & Smart Homes, Education & Research, Energy & Utilities, Hospitality & Entertainment, Retail & Customer-Facing, Financial Institutions, Others) |

| Regional Coverage |

Europe |

| Prominent Players |

ASSA ABLOY, dormakaba Group, Johnson Controls, Allegion plc, Honeywell International, Identiv Inc., Nedap N.V., Suprema Inc., Bosch Security Systems, Thales Group, AMAG Technology, Axis Communications, NEC Corporation, Gallagher Group, Brivo Systems, SALTO Systems, Genetec Inc., HID Global, Siemens, Cansec Systems., and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |

Frequently Asked Questions

The Europe Embodied AI Market size is estimated to have a value of USD 721.0 million in 2025 and is expected to reach USD 8,756.5 million by the end of 2034.

The market is growing at a CAGR of 13.5 percent over the forecasted period of 2025.

Some of the major key players in the Europe Embodied AI Market are ABB Robotics, KUKA AG, Bosch Robotics, PAL Robotics, SoftBank Robotics Europe, Festo AG, Universal Robots, Robotnik Automation, Comau Robotics, Aldebaran Robotics, and many others.