Europe Energy Storage Market

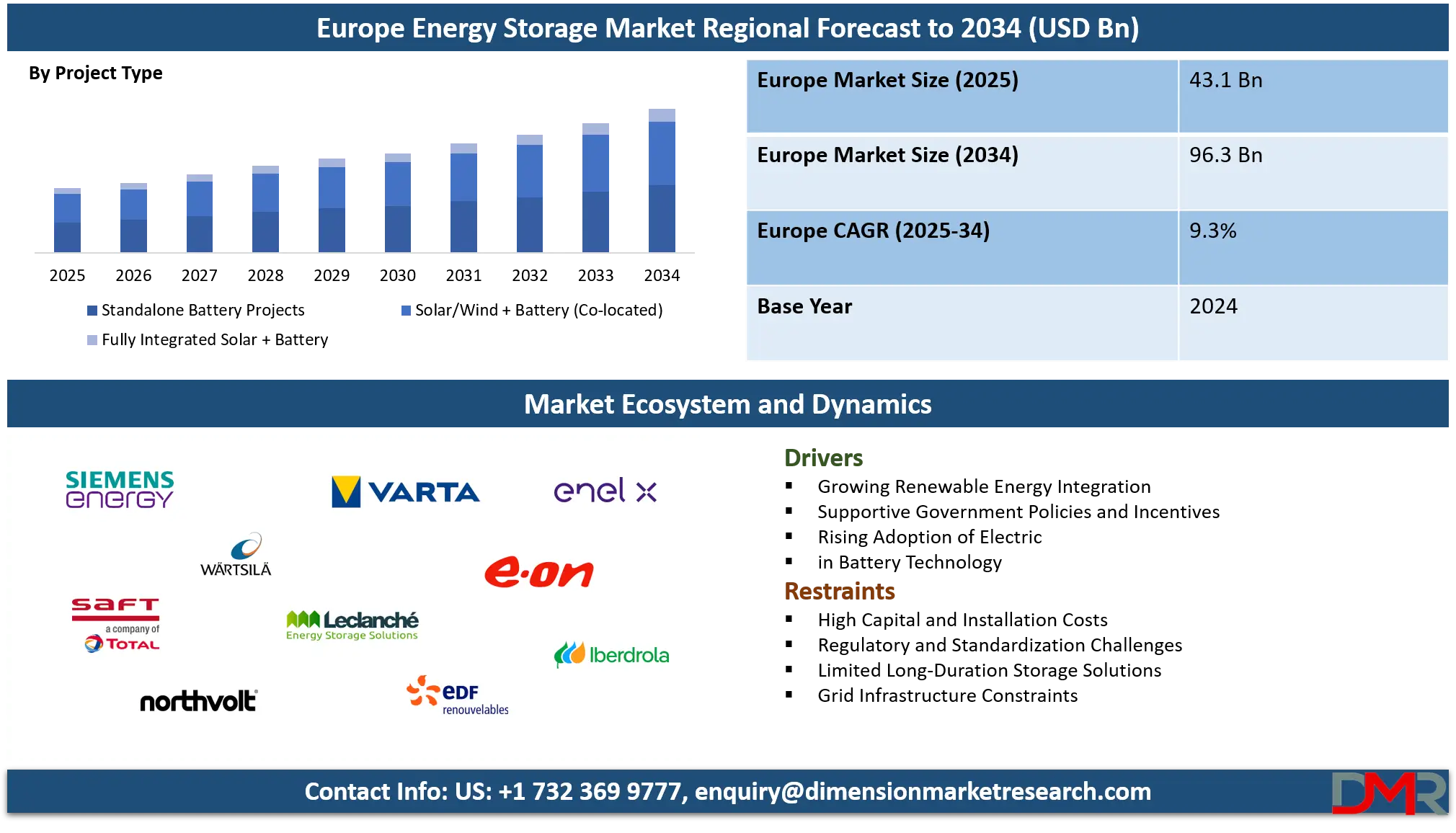

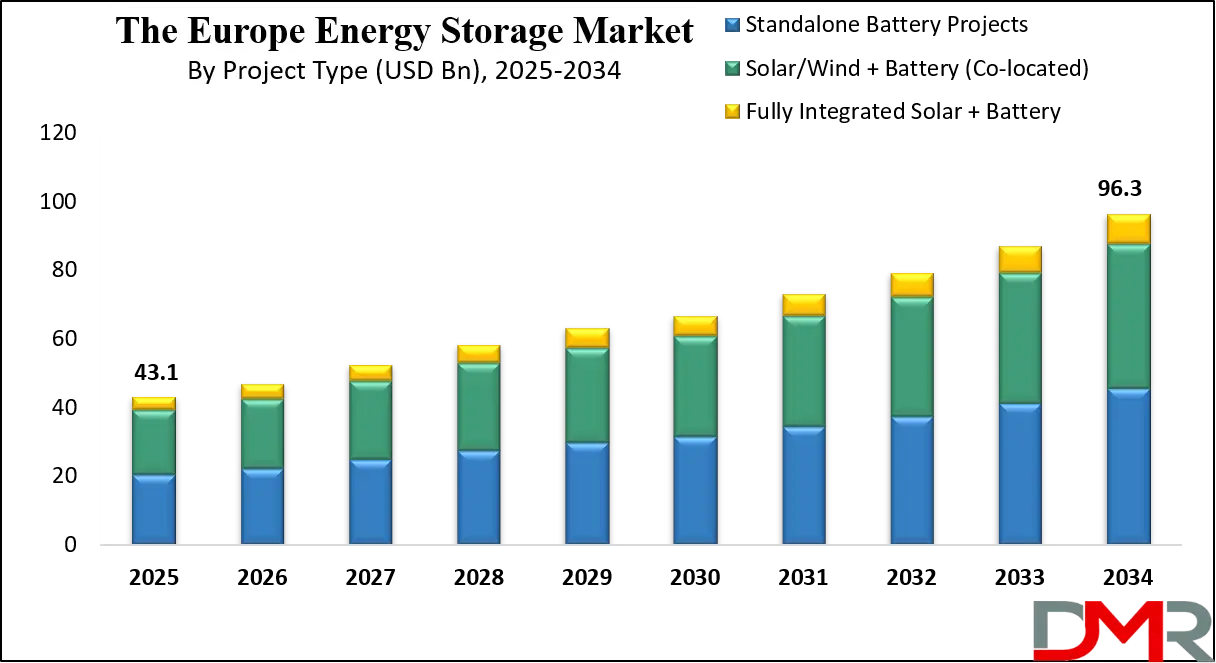

The Europe energy storage market is projected to reach USD 43.1 billion in 2025 and is expected to grow steadily to USD 96.3 billion by 2034, registering a CAGR of 9.3%. This growth reflects rising renewable energy integration, grid modernization, and increasing adoption of advanced storage technologies across residential, commercial, and utility-scale applications.

Europe energy storage refers to the systems, technologies, and infrastructure that enable the capture, storage, and delivery of energy for future use across the continent. It plays a crucial role in balancing supply and demand, stabilizing the electricity grid, and supporting the integration of renewable energy sources such as wind, solar, and hydropower. By storing energy during periods of low demand and releasing it during peak consumption, energy storage enhances grid reliability, improves efficiency, and reduces dependence on conventional fossil fuel-based generation. This transition is vital for Europe’s ambitions toward carbon neutrality, energy security, and sustainable economic growth.

The Europe energy storage market is experiencing rapid development, driven by increasing renewable energy penetration, rising electricity demand, and supportive policy frameworks such as the European Green Deal. Governments and utilities are investing in advanced technologies like lithium-ion batteries, flow batteries, and thermal storage to enable flexible power generation and grid stability. Additionally, the expansion of electric vehicles, smart grids, and distributed energy systems is contributing to the growing demand for storage solutions across residential, commercial, and industrial sectors.

Furthermore, the market is characterized by growing investments from both public and private stakeholders to accelerate clean energy transitions. Strategic initiatives in cross-border interconnections, energy communities, and hydrogen-based storage are shaping the future landscape of Europe’s energy ecosystem. Innovations in digital platforms, energy management systems, and real-time monitoring are enhancing the performance of storage projects, making them more scalable and cost-effective. This dynamic environment positions Europe as a global leader in energy storage deployment, offering long-term opportunities for technology providers, investors, and policymakers.

Europe Energy Storage Market: Key Takeaways

- Market Value: The Europe energy storage market size is expected to reach a value of USD 96.3 billion by 2034 from a base value of USD 43.1 billion in 2025 at a CAGR of 9.3%.

- By Technology Segment Analysis: Lithium-ion Batteries are anticipated to dominate the technology segment, capturing 95.0% of the total market share in 2025.

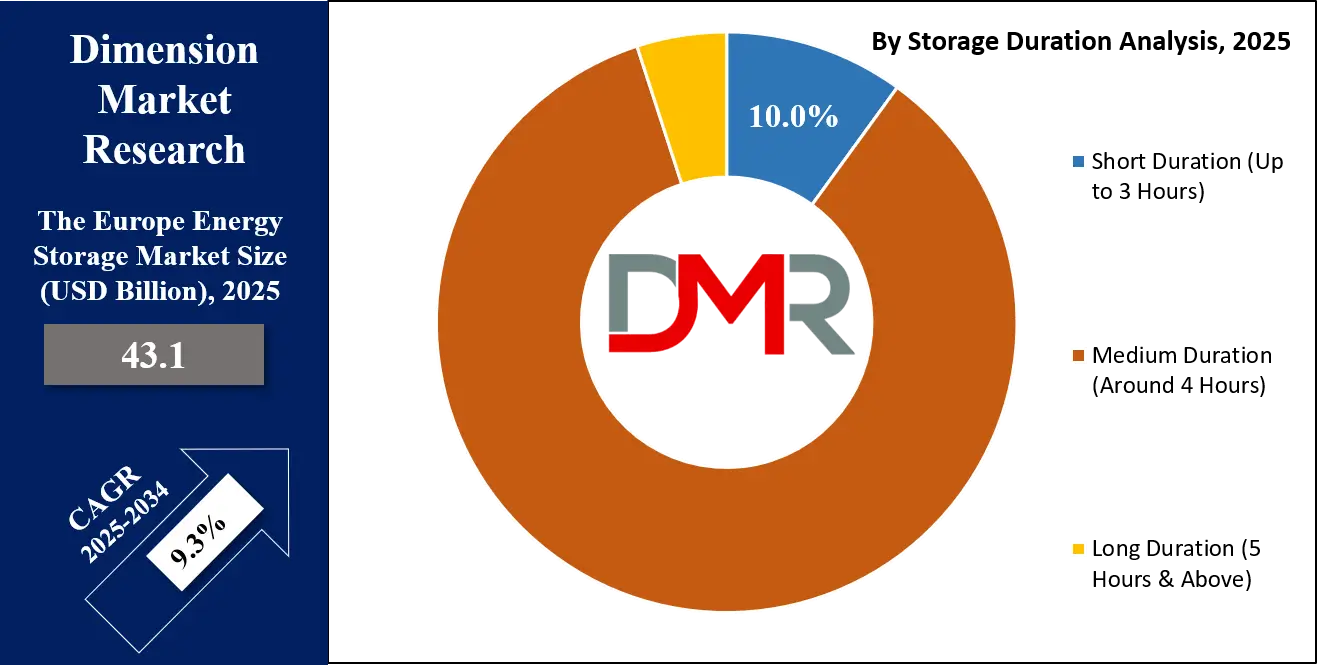

- By Storage Duration Segment Analysis: Medium Duration (Around 4 Hours) is expected to maintain its dominance in the storage duration segment, capturing 85.0% of the total market share in 2025.

- By Overall Storage Type Segment Analysis: Battery Storage is poised to consolidate its dominance in the overall storage type segment, capturing 59.0% of the market share in 2025.

- By Project Type Segment Analysis: Standalone Battery Projects will hold the maximum market share in the project type segment, capturing 47.0% of the market share in 2025.

- By Application Segment Analysis: Energy Shifting & Peak Demand Management applications are expected to dominate the application segment, capturing 54.0% of the market share in 2025.

- By End User Segment Analysis: Utility-scale / Grid Projects will dominate the end user segment, capturing 94.0% of the market share in 2025.

- Key Players: Some key players in the Europe energy storage market are Siemens Energy, Wärtsilä, Saft (TotalEnergies), Northvolt, Varta AG, Leclanché, Enel X, E.ON, EDF Renewables, Iberdrola, Engie, ABB, BASF Battery Materials, Ingeteam, SMA Solar Technology, Fluence Energy, Powin Energy, Skeleton Technologies, EnerSys, Zenobe Energy, and Others.

Europe Energy Storage Market: Use Cases

- Grid Balancing and Renewable Integration: Energy storage in Europe is widely used to balance the grid and ensure stability as renewable energy generation continues to expand. Wind and solar power are intermittent by nature, and storage systems allow excess electricity to be captured during peak production and supplied back during high demand. This use case reduces curtailment, enhances grid flexibility, and supports Europe’s transition toward a low-carbon energy mix.

- Electric Vehicle Charging Infrastructure: With the rapid adoption of electric vehicles across Europe, energy storage systems are increasingly deployed to support charging networks. Storage technologies help reduce stress on the grid during peak charging hours, enable fast-charging stations, and lower energy costs through load shifting. This application strengthens Europe’s sustainable mobility goals and promotes a cleaner transportation ecosystem.

- Industrial and Commercial Energy Management: Large industrial facilities and commercial buildings in Europe are turning to energy storage to optimize energy consumption, reduce operational costs, and improve reliability. By leveraging storage, businesses can manage peak demand charges, ensure uninterrupted operations during outages, and participate in demand response programs. This use case enhances competitiveness and aligns with corporate sustainability commitments.

- Cross-Border Energy Trade and Interconnections: Europe’s interconnected energy networks benefit significantly from large-scale energy storage projects that facilitate cross-border electricity trade. Storage enables efficient energy transfer between countries, stabilizes fluctuations across regions, and strengthens energy security. This approach supports the European Union’s integrated energy market strategy and promotes resilience in the face of increasing energy demand.

Impact of Artificial Intelligence on the Europe Energy Storage Market

Artificial intelligence is playing a transformative role in shaping the Europe energy storage market by enabling smarter, more efficient, and predictive energy management. AI-driven analytics are enhancing forecasting accuracy for renewable energy generation, allowing storage systems to better align with supply-demand fluctuations. This predictive capability minimizes grid instability, reduces reliance on fossil fuel backup, and ensures efficient integration of solar and wind energy across Europe’s power networks.

In addition, AI algorithms are optimizing the performance and lifespan of battery systems through real-time monitoring, predictive maintenance, and intelligent charging and discharging cycles. By automating these processes, utilities and energy providers can reduce operational costs and maximize return on investment in storage assets. AI also supports demand response programs by analyzing consumption patterns and enabling dynamic energy pricing, which improves grid flexibility and customer participation.

Furthermore, AI-powered digital twins and advanced control systems are accelerating the deployment of smart grids and distributed energy resources across Europe. These technologies allow energy storage to work seamlessly with electric vehicles, microgrids, and decentralized renewable projects, strengthening Europe’s clean energy transition. Overall, AI is not only increasing efficiency and cost-effectiveness but also positioning Europe as a global leader in next-generation energy storage innovation.

Europe Energy Storage Market: Stats & Facts

European Commission

- EU electricity in 2024: renewables reached 47.3% of generation, up from 44.7% in 2023, while fossil fuels fell to 29.2%; renewables output totalled about 1.31 million GWh in 2024.

- EU gas storage target of 90% fullness was achieved months ahead of the legal deadline in both 2023 and 2024; in 2024 the 90% level was reached on 19 August. Storages stood at 34% on 1 April 2025 at the end of the gas winter.

Eurostat

- EU electricity from renewables increased by 12.4% year-over-year in 2024 to 1.31 million GWh; coal generation fell by 26.9% from 2023 to 2024.

ACER – EU Agency for the Cooperation of Energy Regulators

- In 2023 eight EU Member States operated capacity mechanisms that can remunerate flexible resources including storage: Belgium, Ireland, France, Italy, Poland, Germany, Finland and Sweden; Spain had begun the process to establish one.

- ACER approved ENTSO-E’s 2023 pan-EU adequacy assessment methodology, underpinning security-of-supply decisions relevant to storage procurement in 2024.

United Kingdom Government (Department for Energy Security and Net Zero – Clean Power 2030 Action Plan)

- Battery storage operating capacity was reported at around 4.5 GW in Great Britain as of December 2024.

- UK targets by 2030 include 23–27 GW of battery storage and 4–6 GW of long-duration energy storage to support a decarbonised power system.

UK Parliament (Research Briefing)

- As of April 2025, the UK had about 2.63 GW of battery storage physically operating, with a much larger pipeline under development and construction.

Ofgem – Great Britain Regulator

- Proposed cap-and-floor regime for long-duration energy storage introduced in December 2024, with design parameters tailored to assets that can deliver multi-hour system services; consultation timelines set out to enable projects to commission before 2030.

Bundesnetzagentur (Germany)

- Germany’s residual peak load currently around 70 GW and falling compared with historic peaks, with analysis highlighting a growing role for storage and demand-side flexibility to ensure security of supply as dispatchable capacity declines below 90 GW in 2024.

- In 2023 Germany maintained over 14 GW of out-of-market reserve capacity to safeguard security of supply, underscoring the value of flexible resources such as storage.

Government of Baden-Württemberg (Germany)

- By mid-2024 the state recorded more than 400,000 residential battery storage systems connected alongside PV; the cumulative storage capacity of these home batteries reached multiple GWh, illustrating rapid behind-the-meter growth since 2023.

RTE – Bilan Électrique de la France 2024

- France’s pumped-hydro storage fleet totals 5.0 GW turbining capacity and 4.3 GW pumping capacity; 2024 saw 4.2% lower turbined energy due to high nuclear, while average daily pumping rose 9.7% as operators shifted arbitrage and balancing, signalling active storage utilisation.

Spain – Red Eléctrica (REE) Informe del Sistema Eléctrico 2024

- Spain’s installed storage capacity in 2024 totalled 3,356 MW, of which 3,331 MW were pumped-hydro and 25 MW were grid-connected batteries, up 1.0% versus 2023; renewable installed generation capacity rose by 7.3 GW in 2024 to 64.3% of total capacity.

Spain – CNMC (Regulator)

- Distribution operators reported about 7.5 GW of storage connection requests on distribution networks during 2023, reflecting accelerating project interest ahead of Spain’s emerging capacity mechanism consultations in 2024–2025.

Portugal – DGEG and Environmental Fund

- Portugal’s 2024 “Energia em Números” and subsequent funding notice set a minimum of 500 MW of grid storage supported for installation by end-2025 under the national flexibility and storage investment window, with up to 20% cost coverage.

- New licensing rules adopted in December 2024 formalised permits for storage assets above 1 MW and simplified procedures up to 1 MW, streamlining deployment from 2025 onward.

Ireland – EirGrid/ENTSO-E

- Ireland’s system adequacy planning includes storage as an eligible capacity resource; connection offers and auctions since 2023 increasingly admit battery projects to deliver fast frequency response and DS3 services, with several hundred MW of batteries operational or in advanced connection stages by 2024.

Italy – ARERA (Regulator)

- By 31 December 2024, Italy recorded 733,766 storage systems connected, totalling 5.56 GW of power and 12.94 GWh of capacity, with about 70% coupled to PV; stand-alone storage accounted for roughly 29.6% of installed energy capacity.

- ARERA’s 2024 acts and monitoring note over 298,000 new grid connections completed in 2023 across generation and storage users, indicating significant grid-edge activity relevant to storage integration.

Italy – Terna Adequacy Report 2024

- Ten-year adequacy analysis underscores the need for additional flexible capacity including storage to meet evening ramps with higher solar penetration; Italy’s planning scenarios incorporate multi-GW battery additions through 2030 to maintain LOLE within standards.

European Commission – Energy Efficiency Directive

- Binding 2030 energy-efficiency target set at 763 Mtoe final energy and 992.5 Mtoe primary energy, requiring greater system flexibility and demand-shifting supported by storage to meet peak-load reductions.

United Kingdom – Ofgem/Policy design for LDES

- The LDES cap-and-floor consultation in 2024 defined eligibility for long-duration assets capable of multi-hour to multi-day storage, laying out an investment framework intended to unlock several GW before 2030.

Europe Energy Storage Market: Market Dynamics

Europe Energy Storage Market: Driving Factors

Rising Renewable Energy Penetration

The rapid growth of renewable energy projects across Europe is a key driver for the energy storage market. With countries investing heavily in wind and solar power, storage systems are essential to manage intermittency and maintain grid reliability. Energy storage ensures surplus renewable electricity is stored and released when demand peaks, accelerating Europe’s shift toward decarbonization.

Supportive Policy Frameworks and Investments

Strong government initiatives such as the European Green Deal and EU-funded clean energy programs are propelling large-scale adoption of storage technologies. Subsidies, incentives, and regulatory reforms are attracting private investments, fostering innovation, and strengthening Europe’s leadership in sustainable energy infrastructure.

Europe Energy Storage Market: Restraints

High Capital and Installation Costs

Despite falling battery prices, the upfront cost of large-scale storage projects remains a significant barrier. Expenses related to infrastructure, integration, and maintenance create challenges for smaller utilities and businesses, slowing down widespread deployment.

Complex Regulatory and Standardization Issues

Different regulatory frameworks across European nations pose challenges in harmonizing energy storage adoption. Lack of uniform standards for grid integration and storage operations creates uncertainty for investors and slows cross-border project development.

Europe Energy Storage Market: Opportunities

Expansion of Electric Vehicle Ecosystem

The growing adoption of electric vehicle presents major opportunities for the Europe energy storage market. Vehicle-to-grid (V2G) technologies and charging infrastructure powered by storage systems can support grid stability, reduce energy costs, and open new revenue streams for utilities and mobility providers.

Advancements in Hydrogen and Hybrid Storage Solutions

Innovations in hydrogen-based storage and hybrid systems combining batteries with thermal or mechanical technologies are creating new market opportunities. These solutions can deliver long-duration storage, making them suitable for industrial applications and supporting Europe’s long-term energy security goals.

Europe Energy Storage Market: Trends

Integration of Artificial Intelligence and Digital Platforms

AI-driven analytics, predictive maintenance, and digital twin technologies are transforming energy storage operations in Europe. These innovations improve system efficiency, extend battery life, and enable smarter grid management, making storage projects more scalable and cost-effective.

Decentralized Energy Systems and Microgrids

The rise of distributed energy resources, community-based storage, and microgrids is a growing trend across Europe. These systems empower consumers to generate, store, and share energy locally, reducing transmission losses and fostering energy independence in both urban and rural regions.

Europe Energy Storage Market: Research Scope and Analysis

By Technology Analysis

Lithium-ion batteries are set to dominate the European energy storage market in 2025, accounting for nearly 95.0% of the total technology share. Their dominance is largely attributed to their high energy density, long cycle life, faster charging capabilities, and falling costs, which make them the most preferred option for grid-scale storage, renewable energy integration, and electric vehicle charging infrastructure.

The technology’s versatility across residential, commercial, and utility-scale applications positions it as the backbone of Europe’s clean energy transition. Growing investments in manufacturing facilities, research advancements, and recycling initiatives are further strengthening the role of lithium-ion batteries in achieving the region’s sustainability and decarbonization targets.

In addition to lithium-ion, other battery technologies such as flow batteries, sodium-sulfur, lead-acid, and emerging solid-state solutions also contribute to the market, albeit on a smaller scale. These technologies are often adopted in niche applications where long-duration storage, lower cost per cycle, or higher safety standards are prioritized.

For instance, flow batteries are particularly useful for large-scale renewable projects requiring long discharge durations, while sodium-sulfur batteries are deployed for grid stabilization and industrial use. Although their market share remains limited compared to lithium-ion, these alternatives are gaining attention due to their potential in addressing specific storage needs, offering Europe diversified pathways to strengthen energy security and system resilience.

By Storage Distribution Analysis

Medium-duration storage, typically around 4 hours, is expected to dominate the storage duration segment in the European energy storage market, holding nearly 85.0% of the total share in 2025. This segment has emerged as the most practical solution for balancing renewable energy generation with consumption patterns, as it aligns well with the daily variability of solar and wind output. Its ability to effectively shift energy from periods of excess generation to times of peak demand makes it a preferred choice for utilities and grid operators across Europe. The balance between cost efficiency, scalability, and reliability has positioned medium duration storage as the backbone of grid modernization and renewable integration strategies.

Medium duration systems are particularly well-suited for addressing challenges such as evening demand peaks when solar generation declines and consumption rises sharply. These storage solutions also play a vital role in improving grid stability, supporting demand response programs, and reducing reliance on fossil-fuel-based peaker plants.

Their adoption is expanding in residential and commercial applications as well, where users seek to optimize energy consumption and lower electricity bills. As Europe accelerates its clean energy transition, medium duration storage continues to prove its effectiveness in enhancing grid flexibility, promoting sustainability, and ensuring a more resilient energy ecosystem.

By Overall Storage Type Analysis

Battery storage is projected to consolidate its dominance in the European energy storage market by capturing 59.0% of the overall storage type share in 2025. The rapid expansion of battery technologies, particularly lithium-ion, has positioned them as the most flexible and scalable solution for diverse applications ranging from residential backup systems to large-scale grid stabilization projects.

Batteries offer advantages such as fast response times, modular deployment, and integration with renewable energy projects, making them highly attractive for utilities, businesses, and households. Their ability to provide both short and medium duration storage, coupled with ongoing cost reductions and advancements in recycling, is further accelerating their widespread adoption across Europe.

Alongside batteries, pumped hydro storage continues to play an important role in Europe’s energy ecosystem, although its market share is smaller compared to modern battery solutions. Pumped hydro remains the most established and reliable long-duration storage technology, capable of delivering large-scale energy capacity over extended periods.

It is particularly valuable for stabilizing national grids, supporting cross-border energy exchanges, and maintaining energy security during periods of high demand. While the construction of new pumped hydro facilities faces geographical and environmental constraints, upgrades to existing plants and hybrid integration with renewable projects are sustaining its relevance. This makes pumped hydro a strategic complement to battery storage in Europe’s pursuit of a balanced and resilient energy mix.

By Project Type Analysis

Standalone battery projects are expected to dominate the project type segment in the European energy storage market, accounting for 47.0% of the total share in 2025. These projects are gaining traction due to their ability to provide flexible, modular, and scalable storage solutions that can be deployed independently of renewable energy plants.

Standalone batteries are increasingly used for grid balancing, peak shaving, and frequency regulation, offering utilities and operators greater control over energy flows. Their versatility allows deployment across residential, commercial, and utility-scale applications, making them a critical component in enhancing energy reliability, reducing operational costs, and supporting Europe’s growing clean energy infrastructure.

In addition to standalone projects, solar or wind combined with battery storage, often referred to as co-located projects, is emerging as a significant segment in Europe’s energy storage landscape. These projects directly integrate renewable generation with storage systems, enabling on-site energy capture and dispatch during periods of higher demand. This model reduces curtailment of renewable output, increases project profitability, and enhances grid efficiency by supplying clean electricity more predictably and reliably.

Co-located projects are particularly valuable in regions with high renewable penetration, as they strengthen local grid stability and maximize the utilization of renewable resources. As Europe advances toward its decarbonization targets, co-located solar and wind with battery storage are expected to see accelerated growth, complementing standalone projects in building a resilient energy ecosystem.

By Application Analysis

Energy shifting and peak demand management are projected to dominate the application segment in the European energy storage market, capturing 54.0% of the total share in 2025. These applications are central to addressing Europe’s growing renewable energy integration and fluctuating electricity demand. Energy storage systems enable the transfer of surplus electricity generated during off-peak hours, particularly from wind and solar, to periods of high demand, reducing reliance on fossil-fuel-based peaker plants.

This not only lowers energy costs for consumers but also enhances the efficiency of grid operations. As countries across Europe move toward carbon neutrality, the ability of storage to smoothen supply-demand mismatches positions energy shifting and demand management as the cornerstone of the region’s energy transition strategy.

Alongside this, grid stability and frequency regulation represent another crucial application for energy storage in Europe. Modern grids require constant balancing to maintain frequency within a narrow range, and renewable intermittency makes this task even more challenging. Storage systems provide rapid-response capabilities, injecting or absorbing power in real time to stabilize grid frequency and prevent blackouts.

This application is especially valuable for transmission system operators and utilities that must manage increasing renewable inputs while ensuring an uninterrupted energy supply. With the expansion of smart grids and decentralized energy resources, the role of storage in maintaining grid reliability is becoming indispensable across Europe.

By End User Analysis

Utility-scale or grid projects are anticipated to dominate the end user segment in the European energy storage market, capturing nearly 94.0% of the share in 2025. These large-scale deployments are essential for integrating renewable energy into national grids, supporting long-duration storage needs, and ensuring a reliable supply during peak demand. Utility-scale storage offers significant advantages such as stabilizing voltage and frequency, reducing transmission losses, and minimizing dependence on fossil fuel-based backup systems.

Governments and grid operators across Europe are investing heavily in these projects to enhance energy security, meet climate targets, and manage the rapid growth of renewable generation. With expanding interconnections between European countries, utility-scale storage also facilitates cross-border electricity trade, further strengthening the region’s integrated energy framework.

In addition to grid-scale adoption, solar or wind paired with battery storage, often deployed as co-located projects, is also gaining traction within the end user landscape. By directly linking renewable energy generation with storage systems, these projects allow operators to maximize the value of intermittent resources, reduce curtailment, and deliver clean electricity in a more consistent manner.

Co-located solar and wind with storage are particularly effective in rural and semi-urban areas where renewable projects are concentrated, enabling more efficient use of infrastructure and reducing grid congestion. While their share remains smaller compared to utility-scale projects, the increasing focus on decentralized clean energy solutions ensures steady growth for co-located systems across Europe.

Europe Energy Storage Market Report is segmented on the basis of the following:

By Technology

- Lithium-ion Batteries

- Other Batteries

By Storage Duration

- Short Duration (Up to 3 Hours)

- Medium Duration (Around 4 Hours)

- Long Duration (5 Hours & Above)

By Overall Storage Type

- Battery Storage

- Pumped Hydro Storage

By Project Type

- Standalone Battery Projects

- Solar/Wind + Battery (Co-located)

- Fully Integrated Solar + Battery

By Application

- Energy Shifting & Peak Demand Management

- Grid Stability & Frequency Regulation

- Other Grid Services

By End User

- Utility-scale/ Grid Projects

- Residential & Commercial

By Region

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Europe Energy Storage Market: Competitive Landscape

The competitive landscape of the Europe energy storage market is highly dynamic, driven by a mix of established energy companies, innovative battery manufacturers, and emerging technology providers. Leading players are focusing on expanding their presence through large-scale utility projects, strategic partnerships, and advanced product offerings tailored to renewable integration and grid modernization. European firms are leveraging strong policy support and funding initiatives, while global battery leaders are setting up regional manufacturing hubs to meet rising demand.

Competition is also intensifying with the entry of startups specializing in flow batteries, hydrogen storage, and digital energy management platforms, adding diversity to the market. As consolidation, innovation, and cross-border collaborations accelerate, the market is evolving toward a more integrated and technology-driven ecosystem.

Some of the prominent players in the Europe energy storage market are:

- Siemens Energy

- Wärtsilä

- Saft (TotalEnergies)

- Northvolt

- Varta AG

- Leclanché

- Enel X

- E.ON

- EDF Renewables

- Iberdrola

- Engie

- ABB

- BASF Battery Materials

- Ingeteam

- SMA Solar Technology

- Fluence Energy

- Powin Energy

- Skeleton Technologies

- EnerSys

- Zenobe Energy

- Other Key Players

Europe Energy Storage Market: Recent Developments

- August 2025: US battery startup Lyten acquired significant assets from bankrupt Swedish firm Northvolt, including its Skellefteå gigafactory, the Västerås R&D facility, and a planned German factory in Heide. This strategic purchase accelerates Lyten’s expansion into European energy storage.

- July 2025: Lyten also took over Northvolt’s enormous Dwa ESS manufacturing facility in Gdansk, Poland—Europe’s largest BESS plant—marking a major footprint expansion in the continental storage sector.

- June 2025: ENPH introduced its most powerful IQ Battery 5P with FlexPhase series targeting key solar markets in Europe, aiming to bolster regional growth through advanced energy storage integration.

- May 2025: CATL unveiled its groundbreaking TENER Stack, a world-first 9 MWh ultra-large capacity energy storage system primed for mass production. This innovation, introduced at ees Europe 2025, boasts enhanced deployment flexibility and transportability.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 43.1 Bn |

| Forecast Value (2034) |

USD 96.3 Bn |

| CAGR (2025–2034) |

9.3% |

| Historical Data |

2019 – 2024 |

| Forecast Data |

2026 – 2034 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Technology (Lithium-ion Batteries and Other Batteries), By Storage Duration (Short Duration up to 3 Hours, Medium Duration around 4 Hours, and Long Duration 5 Hours & Above), By Overall Storage Type (Battery Storage and Pumped Hydro Storage), By Project Type (Standalone Battery Projects, Solar/Wind + Battery Co-located, and Fully Integrated Solar + Battery), By Application (Energy Shifting & Peak Demand Management, Grid Stability & Frequency Regulation, and Other Grid Services), and By End User (Utility-scale/Grid Projects and Residential & Commercial). |

| Regional Coverage |

Europe |

| Prominent Players |

Siemens Energy, Wärtsilä, Saft (TotalEnergies), Northvolt, Varta AG, Leclanché, Enel X, E.ON, EDF Renewables, Iberdrola, Engie, ABB, BASF Battery Materials, Ingeteam, SMA Solar Technology, Fluence Energy, Powin Energy, Skeleton Technologies, EnerSys, Zenobe Energy, and Others. |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |

Frequently Asked Questions

The Europe energy storage market is projected to be valued at USD 43.1 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 96.3 billion in 2034 at a CAGR of 9.3%.

Some of the major key players in the Europe energy storage market are Tesla, Fluence, NextEra Energy, LS Energy Solutions, Wärtsilä, Siemens Energy, General Electric, LG Energy Solution, Panasonic, Samsung SDI, CATL, BYD, Eos Energy Enterprises, Form Energy, and Others.