Market Overview

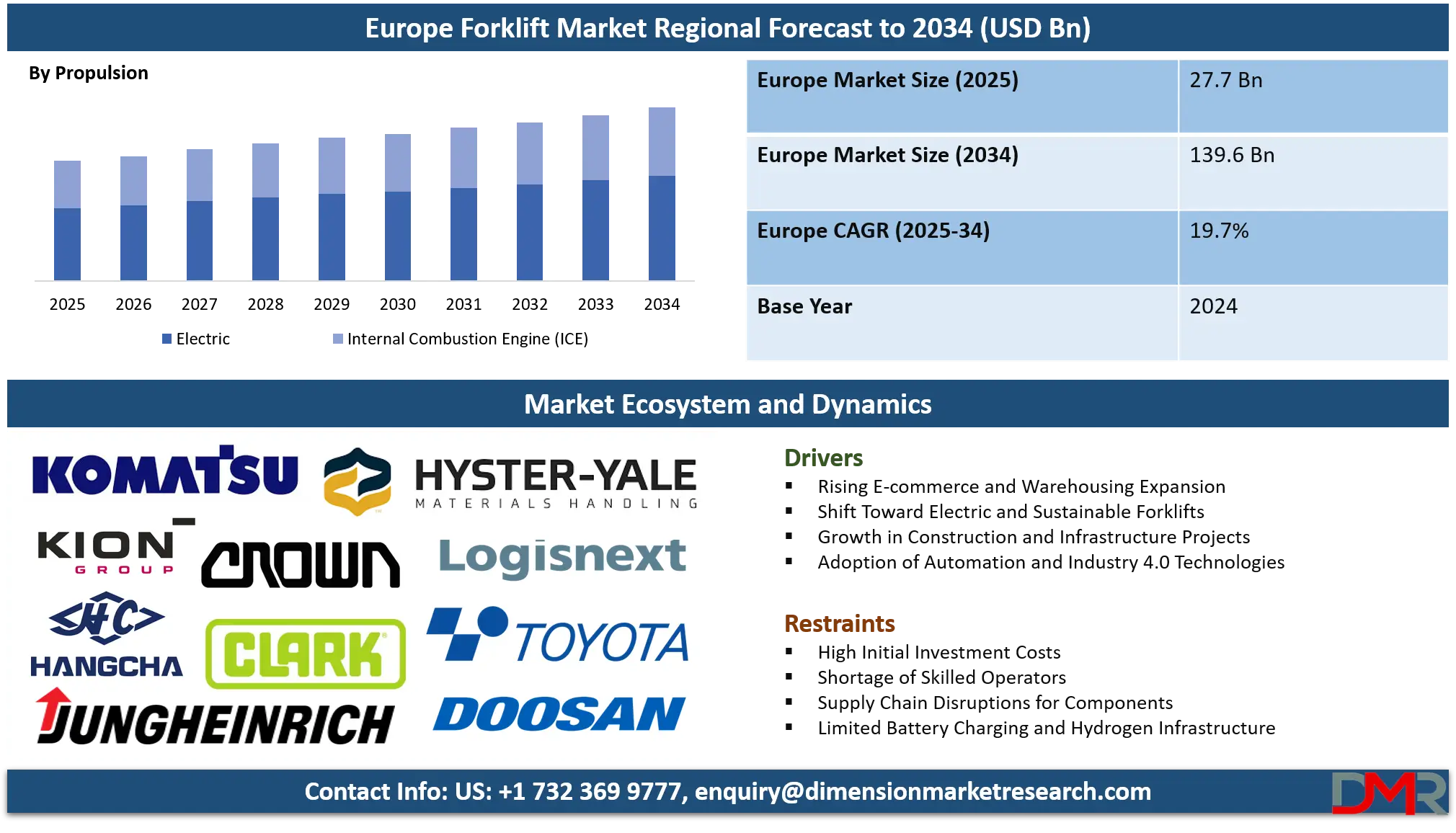

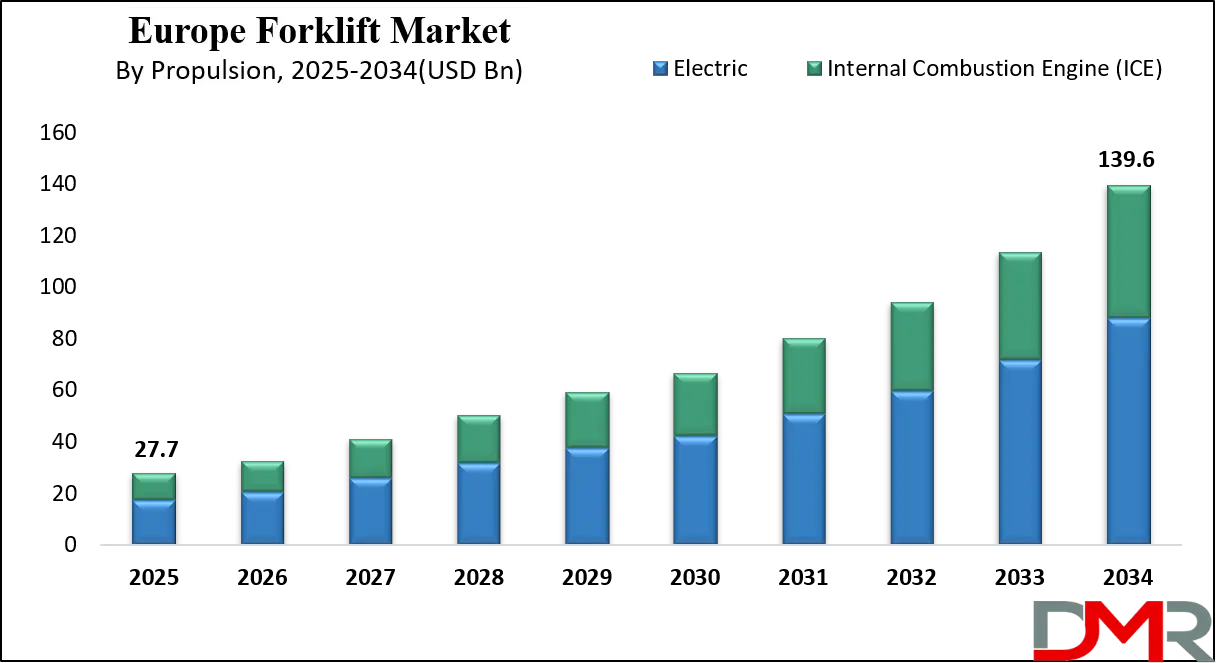

The Europe Forklift Market is anticipated to reach USD 27.7 billion by 2025 and is forecasted to expand at a CAGR of 19.7% from 2025 to 2034, ultimately attaining a market valuation of USD 139.6 billion. The strong growth trajectory is driven by increasing warehouse automation, e-commerce expansion, industrial modernization, and the adoption of electric and autonomous forklifts across logistics, retail, construction, and manufacturing industries.

Furthermore, the region’s emphasis on sustainability, energy efficiency, and smart material handling solutions is accelerating investments in lithium-ion-powered forklifts, AI-driven fleet management systems, and IoT-enabled equipment monitoring. Government regulations promoting low-emission vehicles and safety compliance further support market adoption, positioning Europe as a global leader in the forklift industry.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Europe’s forklift market sits at the intersection of rapid electrification, intralogistics modernization, and circular-economy practices; manufacturers and fleet operators are accelerating adoption of

lithium-ion batteries, hydrogen fuel cells, and telematics to reduce total cost of ownership (TCO) while meeting stricter emissions rules. Warehouse automation, plug-and-play AGVs, and integration with warehouse management systems (WMS/OMS) are reshaping fleet composition and service models.

Significant commercial opportunities are emerging in electrification retrofits, fleet-as-a-service (rental/subscription), used-truck refurbishment, and software-driven fleet optimization. E-commerce growth and omni-channel distribution create demand for dense, high-throughput lift trucks and narrow-aisle solutions, while ports and heavy industry push for high-capacity, zero-emission yard trucks opening after-sales, battery-swapping, and hydrogen-ecosystem revenue streams for OEMs and service partners.

Key restraints include supply-chain volatility for semiconductors and specialty components, elevated raw-material and battery costs, and uneven infrastructure for fast charging or hydrogen refuelling across EU member states. Fragmented regulation and varying national incentives raise deployment risk for zero-emission fleets, while skilled technician shortages limit rapid rollouts of advanced telematics and autonomous forklifts.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Growth prospects are favourable through 2030, driven by decarbonisation targets, industrial automation, and retrofit demand. Analysts forecast mid-single to high-double-digit regional CAGRs depending on the segment (electric, autonomous, rental). Success will favour OEMs and service providers who combine modular energy solutions, software platforms for predictive maintenance, and flexible financing to lower adoption friction for logistics operators.

Europe Forklift Market: Key Takeaways

- Market Size Insights: The Europe forklift market is projected to grow from USD 27.7 billion in 2025 to USD 139.6 billion by 2034, registering a remarkable CAGR of 19.7%, driven by electrification, automation, and e-commerce expansion.

- Electrification Leads Propulsion: Electric forklifts is projected to dominate the propulsion segment, propelled by EU Green Deal targets, rising fossil fuel costs, and advancements in lithium-ion and hydrogen fuel cell technologies, while ICE forklifts continue to decline.

- Below 5 Ton Forklifts Dominate Capacity: The below 5-ton segment is poised to remains the market leader, particularly suited for e-commerce warehouses, retail distribution, and SMEs, where compact, agile, and cost-effective forklifts are essential for high-throughput operations.

- Lithium-Ion Batteries Outperform Lead-Acid: The market is shifting rapidly toward lithium-ion batteries, offering faster charging, longer life cycles, lower maintenance, and alignment with EU sustainability goals, making them the preferred choice for modern fleets.

- Class 3 Forklifts in High Demand: Electric Motor Hand Trucks & Pallet Jacks (Class 3) is anticipated to dominate due to their suitability for indoor operations, narrow aisles, and high-density warehouses, particularly in e-commerce and food & beverage distribution.

- Retail & E-commerce Drive End-User Demand: The retail and e-commerce sector is poised to leads forklift adoption in Europe, fueled by the rise of online shopping, omni-channel logistics, and warehouse automation that require high-speed, high-precision forklift operations.

Europe Forklift Market: Use Cases

- Warehouse e-commerce fulfilment: High-turnover warehouses deploy narrow-aisle electric forklifts, pallet stackers, and telematics to squeeze storage density and speed order picking. Integrated WMS and fleet-management software prioritize energy-efficient routing, predictive charging, and shift scheduling to maximize throughput while reducing downtime and operating costs.

- Cold-chain distribution: Refrigerated food warehouses use electric forklifts with battery thermal management and insulated cabins to operate reliably at sub-zero temperatures. Lithium-ion systems reduce charging time and avoid lead-acid maintenance, improving uptime for time-sensitive inventory like fresh produce and pharmaceuticals.

- Port and terminal handling: Heavy-duty yard trucks and reach stackers perform container handling, increasingly with electrified or hybrid powertrains. Automation, geofencing, and tele-operation improve safety and cycle times, while shore-side charging infrastructure supports continuous operations.

- Manufacturing just-in-time logistics: Automotive and heavy manufacturing integrate autonomous forklifts and AGVs into production lines for JIT delivery of components. Fleet orchestration platforms schedule lifts to match line takt, reduce buffer inventories, and enable predictable material flow for lean manufacturing.

- Rental, refurbishment, and secondary markets: Rental fleets supply flexible capacity to seasonal or project-based users; refurbished used forklifts meet budget-constrained buyers and emerging markets. Service models bundling maintenance, battery leases, and uptime SLAs extend asset life and create recurring revenue streams for providers.

Europe Forklift Market: Stats & Facts

Eurostat / European Commission statistical services

- Transport & storage enterprises in the EU employed ~10.4 million persons in 2022.

- There were ~1.4 million enterprises in the EU’s transport & storage sector in 2022.

- Around 27% of people working in transport & storage were in warehousing and supporting activities in 2022.

- In 2022 the EU business economy counted ~32 million active enterprises employing ~160 million persons.

European Commission (policy targets / Green Deal context)

- The EU’s “Fit for 55” target aims to reduce net greenhouse gas emissions by at least 55% by 2030 (relative to 1990).

- The EU’s long-term objective remains climate neutrality by 2050, shaping the decarbonisation of transport and logistics equipment.

International Energy Agency (IEA)

- Global demand for EV batteries reached more than 750 GWh in 2023.

- Battery demand increased by ~40% in 2023 relative to 2022.

- Automotive lithium-ion battery demand rose to ~550 GWh in 2022 (a ~65% rise from 2021).

- Global battery storage capacity additions included ~42 GW of new capacity (bringing total to ~85 GW) in the period reported.

International Labour Organization (ILO / ILOSTAT)

- The ILO estimates nearly 3 million workers die each year from work-related accidents and occupational diseases (global estimate).

- ILO/ILOSTAT maintains occupational safety statistics (fatal and non-fatal injuries) used to benchmark vehicle-at-work risks across countries.

U.S. Bureau of Labor Statistics (BLS)

- From 2011–2017, 614 workers lost their lives in forklift-related incidents (BLS compilation).

- In 2017, forklifts were involved in 9,050 nonfatal workplace injuries or illnesses with days away from work.

- For forklift cases in 2017, the median days away from work was 13 days (higher than the all-case median).

U.S. Bureau of Labor Statistics Census of Fatal Occupational Injuries (CFOI)

- The U.S. recorded 5,283 fatal work injuries in 2023 (CFOI national total for all industries; used to contextualize workplace risk).

U.S. Occupational Safety & Health Administration (OSHA)

- OSHA enforces the Powered Industrial Trucks standard (29 CFR 1910.178), the primary U.S. regulatory requirement governing forklift operation, training, and maintenance.

UK Health & Safety Executive (HSE)

- HSE estimates over 5,000 incidents involving vehicles at work occur in Great Britain each year.

- Of those vehicle-at-work incidents, about 50 result in people being killed annually.

- HSE estimates that up to one-third of all road traffic accidents involve someone who is at work at the time.

National Safety Council (NSC) Injury Facts (U.S. data compilation)

- NSC reports 67 worker deaths in 2023 involving forklifts, order pickers, or platform trucks.

- NSC reports 24,960 DART (days away, restricted or transferred) cases related to forklifts in 2021–2022, including ~15,480 DAFW (days away from work) cases.

Material Handling Equipment Distributors Association / National Forklift Safety Day (industry organization statistics used by safety authorities)

- MHEDA / National Forklift Safety Day materials report ~40,513 forklift-related incidents resulting in days away from work, job restriction, or transfer in 2021–2022.

- UK RIDDOR-based compilations used by National Forklift Safety Day show ~43% of forklift incidents involve impact with a third person.

- Of those impact incidents, roughly 65% involved pedestrians who were not engaged in the immediate truck operation.

European transport/mobility context (EU Commission transport briefings)

- In 2022, the transport & storage sector represented ~6.5% of employment in the EU business economy.

Eurostat structural business statistics (SME composition)

- ~99% of EU enterprises were small and medium-sized enterprises (SMEs) in 2022 (context for fleet ownership structures and service markets).

IEA / battery economics (policy reporting quoting IEA findings)

- IEA reporting noted battery costs have fallen by roughly 90% over the past ~15 years, a key driver for electrification of industrial vehicles and forklifts.

Europe Forklift Market: Market Dynamics

Driving Factors in the Europe Forklift Market

Expansion of E-commerce and High-Velocity Warehousing

The explosive rise of e-commerce is a primary growth driver for the forklift market, as logistics providers and retailers demand high-throughput handling solutions capable of keeping pace with consumer expectations for rapid delivery. Warehouses are increasingly designed with narrow aisles, high racks, and dense storage systems, requiring advanced forklifts such as reach trucks, order pickers, and turret trucks for optimal efficiency.

Seasonal spikes in demand, such as holiday shopping periods, further accelerate the need for scalable forklift fleets. Forklifts equipped with telematics and semi-autonomous functions reduce order fulfillment times while increasing safety in environments where humans and machines coexist.

In Europe, urban logistics hubs are expanding rapidly, intensifying demand for electric forklifts that comply with stringent emissions standards in low-emission zones. Moreover, e-grocery and last-mile delivery models are reshaping warehouse footprints, requiring multi-shift forklifts capable of continuous operation with minimal downtime. This e-commerce surge is not only expanding the total addressable forklift market but also catalyzing innovation in rental and leasing models that provide flexible access to material handling equipment without long-term capital commitments.

Regulatory Push for Safety and Sustainability

Government regulations and corporate ESG initiatives are acting as powerful growth drivers by reshaping purchasing decisions in the forklift market. Safety compliance standards such as OSHA in the U.S. and EU directives on machinery safety are prompting companies to adopt forklifts with enhanced operator-assist technologies, automated braking systems, and collision avoidance sensors. Meanwhile, environmental regulations are accelerating the phase-out of diesel-powered forklifts in favor of electric and hydrogen alternatives. The European Union’s Fit-for-55 package and carbon neutrality targets are directly stimulating forklift fleet electrification by 2030 and beyond.

Incentives for green equipment, such as subsidies for battery-electric trucks and tax credits for hydrogen adoption, are lowering the barriers to entry for sustainable forklifts. These regulations also indirectly boost after-sales markets, as compliance-driven retrofits and upgrades to older fleets become necessary. The combination of mandated safety protocols and decarbonization goals is creating a dual driver effect, where companies simultaneously modernize fleets for safety performance and environmental impact reduction, thereby expanding overall forklift demand across industries from warehousing to construction and manufacturing.

Restraints in the Europe Forklift Market

High Upfront Costs and Infrastructure Gaps

One of the major restraints facing the forklift market is the high upfront cost associated with modern electric and autonomous forklifts, particularly when compared to conventional internal combustion (IC) models. Lithium-ion battery forklifts, while offering long-term cost savings, demand significant initial investment, which can deter smaller enterprises with tight capital budgets. The situation is further complicated by the lack of standardized charging infrastructure across regions, creating operational inefficiencies for fleets that operate in multiple locations. In developing economies, the limited availability of advanced charging networks and hydrogen refueling stations significantly slows adoption.

Even in advanced markets like Europe, fragmented infrastructure policies across member states make it difficult for companies to achieve seamless electrification. Without reliable and scalable energy support systems, fleet managers hesitate to transition fully from IC to electric or hydrogen-powered forklifts. This infrastructure gap, combined with high acquisition costs, continues to constrain widespread adoption, delaying the forklift market’s full transition to sustainability and automation despite clear long-term operational and environmental benefits.

Labor Shortages and Skilled Workforce Constraints

The forklift industry also faces growing challenges from labor shortages and the lack of adequately trained operators and technicians. As warehouses and factories expand capacity to meet e-commerce and industrial demand, the pool of qualified forklift drivers has not kept pace. This shortage has been exacerbated by demographic shifts, with an aging workforce and fewer young workers entering industrial trades. Furthermore, the rise of technologically advanced forklifts equipped with autonomous navigation, IoT sensors, and telematics requires operators and technicians with digital literacy, expanding the skill gap.

Training programs and certifications mandated by safety regulators such as OSHA or EU directives demand time and resources, creating additional barriers for companies already grappling with workforce constraints. Shortages of maintenance specialists for electric and hydrogen-powered forklifts also increase downtime risks and raise operational costs. Unless comprehensive workforce development initiatives are implemented, the forklift market will face slower adoption of advanced technologies, undermining its ability to fully capitalize on electrification, automation, and digital integration.

Opportunities in the Europe Forklift Market

Rise of Fleet-as-a-Service and Rental Models

A major growth opportunity in the forklift market lies in the increasing adoption of fleet-as-a-service and rental business models. Companies are moving away from outright ownership of forklifts to subscription-based arrangements that provide flexibility, predictable costs, and access to the latest technology without significant capital expenditure.

This shift is especially attractive for small and medium-sized enterprises (SMEs) in logistics and manufacturing, which often face budgetary constraints. Rental models enable them to scale operations rapidly during seasonal peaks or large projects. Fleet-as-a-service packages typically bundle equipment rental with maintenance, telematics monitoring, training, and even energy solutions such as battery leasing.

OEMs and third-party providers benefit by establishing recurring revenue streams and closer customer relationships. With increasing forklift electrification, these service models also address concerns around the high upfront costs of batteries and charging infrastructure. The opportunity is particularly strong in Europe, where SMEs dominate the industrial landscape and sustainability goals require constant technology refreshes. Rental and subscription models are positioning forklifts as service-driven assets rather than depreciating capital goods, fundamentally reshaping the economics of material handling.

Integration with Industry 4.0 and Smart Supply Chains

Another promising growth opportunity is the integration of forklifts into Industry 4.0 ecosystems and smart supply chain platforms. As factories and warehouses adopt advanced digital infrastructure, forklifts are evolving into connected, intelligent assets capable of generating actionable data.

Integration with warehouse management systems (WMS), manufacturing execution systems (MES), and IoT platforms allows forklifts to function as nodes in a broader cyber-physical system. This connectivity enables predictive analytics, automated inventory tracking, and seamless coordination with robotics and conveyor systems. Forklifts embedded with AI can dynamically adjust to changes in workload, energy demand, and real-time order priorities.

In ports and heavy industry, the convergence of 5G networks and edge computing further enhances forklift autonomy and safety by reducing latency in navigation and remote operation. For OEMs and technology providers, the integration opportunity lies in offering holistic solutions combining hardware, software, and analytics. Companies that position forklifts as data-rich platforms supporting end-to-end visibility and control of supply chains will unlock significant value and secure competitive differentiation in an increasingly digital economy.

Trends in the Europe Forklift Market

Electrification and Sustainable Powertrains

A dominant trend in the forklift market is the rapid transition from internal combustion engines (ICE) to electric-powered forklifts, reflecting global decarbonization mandates and corporate sustainability commitments. Lithium-ion batteries have displaced traditional lead-acid batteries in premium segments due to faster charging, extended lifecycle, and reduced maintenance. European and North American markets are witnessing the accelerating deployment of fuel cell forklifts, particularly in high-utilization logistics hubs, where hydrogen infrastructure is gradually being integrated with fleet operations. Simultaneously, OEMs are focusing on hybridized powertrains and modular energy solutions to meet diverse industrial applications ranging from warehouses to ports.

As governments enforce stricter emissions regulations and provide incentives for low-carbon technologies, enterprises are redesigning intralogistics fleets around battery-electric forklifts. The trend is amplified by total cost of ownership advantages, as electrification reduces fuel expenditure, increases uptime through opportunity charging, and aligns with ESG reporting obligations. Beyond equipment, electrification is driving ecosystem transformation, encouraging investment in charging infrastructure, smart grid integration, and energy optimization software that monitors forklift fleets in real time for efficiency and environmental compliance.

Digitalization and Autonomous Forklift Deployment

The forklift industry is undergoing a digital revolution, marked by the integration of IoT, telematics, and autonomous navigation technologies. Fleets are increasingly equipped with telematics systems to monitor utilization rates, energy consumption, operator behavior, and predictive maintenance requirements.

Autonomous forklifts, often referred to as Automated Guided Vehicles (AGVs) or Autonomous Mobile Robots (AMRs), are becoming mainstream in highly automated warehouses, e-commerce distribution centers, and advanced manufacturing facilities. These systems reduce human error, enhance workplace safety, and support 24/7 operations with minimal downtime. Forklift manufacturers are embedding AI-driven navigation systems with LiDAR, cameras, and advanced sensor fusion to enable safe maneuvering in dynamic environments populated by humans and other machinery.

Digitalization is also extending to cloud-based fleet management platforms, which integrate seamlessly with warehouse management systems (WMS) and enterprise resource planning (ERP) solutions. This convergence provides managers with actionable insights on operational bottlenecks, enhances route planning, and supports compliance with safety standards. The broader trend reflects a shift toward forklift fleets functioning not just as material movers but as data-rich assets contributing to efficiency, sustainability, and strategic decision-making in global supply chains.

Europe Forklift Market: Research Scope and Analysis

By Propulsion Analysis

Electric forklifts are poised to dominate the European market, primarily driven by the European Union’s stringent emission norms and regional sustainability mandates. The EU’s ambitious Green Deal targets and carbon neutrality goals have placed immense pressure on industries to cut carbon footprints, leading companies to transition away from diesel-powered forklifts toward electric alternatives.

In addition, the rising cost of fossil fuels across Europe has further accelerated this adoption trend, as electric models offer lower operating expenses and predictable long-term savings. Electric forklifts are particularly popular in retail warehouses, automotive production facilities, and food & beverage sectors, where zero-emission and low-noise operations are critical for compliance and worker comfort.

Moreover, advancements in lithium-ion battery technology delivering faster charging times, longer cycles, and reduced maintenance requirements have positioned electric forklifts as the future of intralogistics across the continent. Governments and corporate sustainability agendas further incentivize this transition, with subsidies for electrification and energy efficiency.

Unlike ICE forklifts, electric models provide flexibility for both indoor and outdoor operations, meeting safety standards and operational efficiency needs simultaneously. As European businesses increasingly prioritize eco-friendly supply chain solutions, electric forklifts are expected to remain the most preferred propulsion segment, far outpacing the adoption of internal combustion engine counterparts.

By Tonnage Capacity Analysis

Below 5 Ton forklifts are expected to dominate the European forklift market, reflecting the operational needs of the region’s logistics, retail, and warehousing industries. Most e-commerce hubs and retail distribution centers in Germany, France, and the United Kingdom handle high volumes of palletized goods rather than extremely heavy cargo, making lighter tonnage forklifts the most efficient and economical solution.

These forklifts are compact, maneuverable, and designed for narrow aisles and high-density storage systems, aligning perfectly with Europe’s warehouse layouts, where maximizing cubic storage space is essential. The surge in e-commerce activity, accelerated by online retail giants like Amazon and Zalando, has created an immense demand for smaller forklifts to handle rapid order fulfillment, picking, and inventory management. Additionally, food & beverage facilities, chemical warehouses, and SMEs prefer below 5 Ton models due to their cost-effectiveness, low maintenance, and operational agility.

Europe’s intralogistics sector also emphasizes efficiency and safety, both of which are strengthened by smaller, lighter forklifts optimized for high-throughput indoor operations. While heavier forklifts above 15 Tons find utility in ports and steel industries, their application remains limited compared to the widespread reliance on compact forklifts. With urban distribution centers expanding across Europe’s cities and supply chain digitization reshaping warehouse operations, forklifts below 5 Tons are set to maintain dominance, supported by their unmatched flexibility and adaptability.

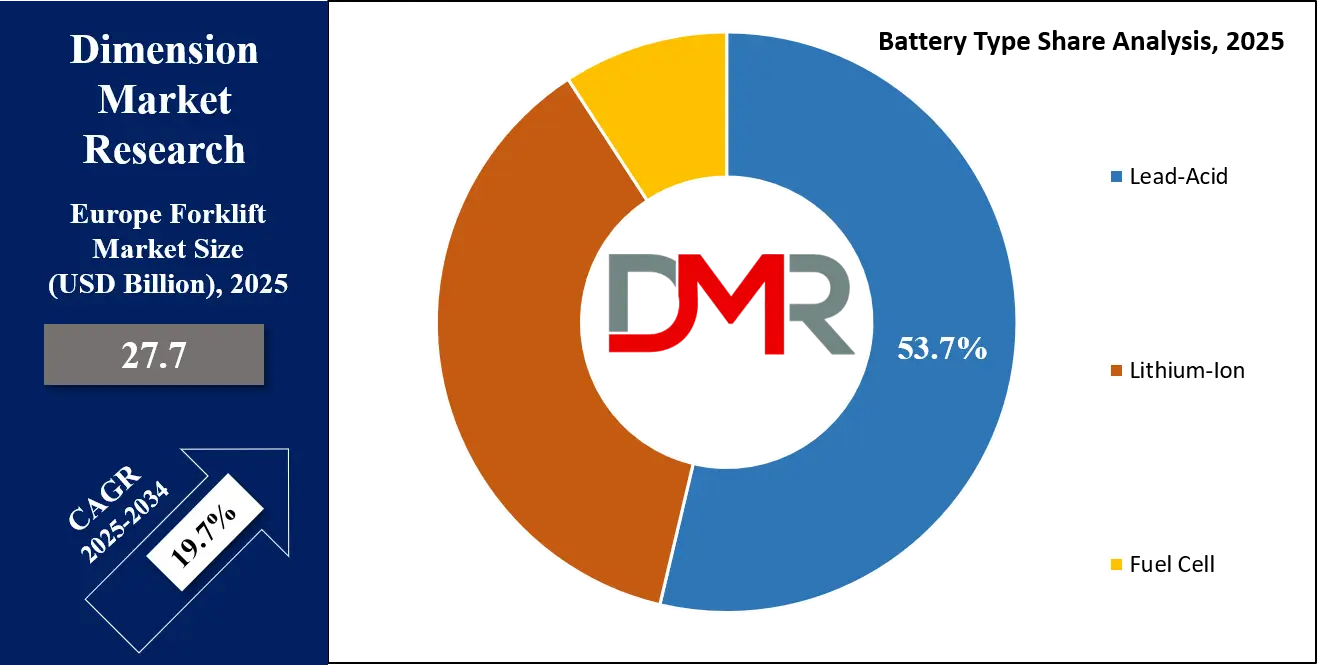

By Battery Type Analysis

Lithium-ion batteries are poised to dominate the European forklift battery market due to their superior performance, efficiency, and long-term cost benefits compared to traditional lead-acid batteries. One of the key factors driving their dominance is the push for sustainable and energy-efficient warehouse operations across the EU. Lithium-ion batteries offer faster charging times, longer lifespan, and higher energy density, making them particularly valuable in high-volume logistics operations where downtime needs to be minimized.

European industries, especially in e-commerce, automotive manufacturing, and food logistics, increasingly demand equipment that aligns with energy conservation goals, and lithium-ion perfectly matches these requirements. Unlike lead-acid, which requires frequent maintenance and longer charging periods, lithium-ion batteries deliver consistent performance with minimal upkeep, reducing operational disruptions and labor costs. Furthermore, with Europe’s strong focus on carbon reduction and circular economy practices, lithium-ion batteries contribute by reducing waste and supporting recyclability initiatives.

The total cost of ownership (TCO) advantage also plays a major role: although the initial investment in lithium-ion is higher, long-term savings in operational efficiency and energy costs outweigh the upfront expenses. The rise of automation and autonomous forklifts further boosts demand for lithium-ion, as these technologies require dependable, high-capacity, and maintenance-free energy solutions. With government and corporate agendas aligning toward cleaner energy adoption, lithium-ion batteries have cemented themselves as the standard choice for modern European forklift fleets.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

By Class Analysis

Class 3 forklifts (Electric Motor Hand Trucks & Pallet Jacks) are anticipated to dominate the European forklift market, driven by the explosive growth of e-commerce and retail distribution hubs. These forklifts are designed for indoor material handling applications, such as order picking, pallet transportation, and short-distance load shifting, making them ideal for Europe’s dense warehouse and intralogistics ecosystem.

Their compact size, cost-effectiveness, and ease of use make them the most practical choice for small and large-scale retailers, where high efficiency and low operational costs are critical. The ongoing digitalization of supply chains and the need for faster inventory turnover have further increased reliance on Class 3 forklifts in automated storage and retrieval systems.

Additionally, as Europe experiences rapid warehouse expansion, especially in Germany, France, and the UK, the need for lightweight, maneuverable equipment to handle growing order volumes has surged. Class 3 forklifts are also widely used in food & beverage distribution centers due to their clean, emission-free operations and compatibility with health and safety standards.

Their ability to operate efficiently in narrow aisles and cold storage facilities enhances their utility. Unlike heavy-duty forklifts, which are limited to specialized operations, Class 3 forklifts have mass appeal due to their versatility and affordability. As businesses continue to optimize last-mile delivery and high-frequency inventory handling, Class 3 forklifts remain the backbone of Europe’s logistics operations.

By Operation Analysis

Manual forklifts are expected to dominate the European forklift market, mainly because of their affordability, accessibility, and established reliability across diverse industries. While autonomous forklifts are emerging in technologically advanced warehouses, their adoption is still limited due to high upfront costs, integration challenges with legacy warehouse systems, and the need for advanced infrastructure such as IoT-enabled networks.

Manual forklifts, on the other hand, are extensively deployed by small and medium-sized enterprises (SMEs), which form a significant portion of Europe’s industrial and retail ecosystem. These forklifts are versatile, easy to operate, and require less capital investment, making them suitable for businesses with moderate throughput requirements. Furthermore, manual forklifts offer operational flexibility in warehouses where human judgment and adaptability are still valued over full automation.

Many industries, such as chemicals, retail, and food processing, prefer manual forklifts because they provide immediate deployment without requiring advanced robotics integration. Even in large enterprises, manual forklifts remain in use for tasks requiring quick adaptability and lower cost-per-operation. While autonomous forklifts are gaining traction in Germany, the Netherlands, and Scandinavia due to advancements in smart warehousing, their scalability is still limited. Manual forklifts will continue to dominate in the medium term due to Europe’s fragmented logistics market, cost-sensitive SMEs, and the balance between automation and workforce-driven operations.

By Tire Type Analysis

Pneumatic tires are projected to dominate the European forklift tire market because of their superior performance in outdoor and mixed-use operations. Europe’s industries, including automotive, construction, logistics yards, and ports, require forklifts capable of navigating rough, uneven, and outdoor terrains, making pneumatic tires the preferred option.

Unlike cushion tires, which are confined to smooth indoor surfaces, pneumatic tires offer versatility, durability, and shock absorption, improving operator safety and load stability. With a growing share of Europe’s forklift activity taking place in hybrid indoor-outdoor facilities, pneumatic tires provide the flexibility needed to handle both environments efficiently. Their resilience in demanding conditions also reduces downtime and maintenance costs, making them more cost-effective in the long run. Logistics hubs in Germany, France, and Poland, which serve as gateways for pan-European supply chains, rely heavily on pneumatic tire forklifts to ensure smooth cargo handling in outdoor yards.

Similarly, Europe’s food & beverage and chemical industries benefit from pneumatic tires in distribution facilities that require forklifts capable of operating on varying surfaces. Cushion tires, though valuable indoors, are restricted in scope, keeping pneumatic tires in the lead. As Europe’s logistics and industrial infrastructure evolves to handle higher throughput and outdoor logistics expansion, pneumatic tires will continue to dominate this market segment.

By Application Analysis

Indoor applications are anticipated to dominate the European forklift market, propelled by the expansion of e-commerce, warehousing, and retail distribution centers across the continent. The surge in online shopping has created a massive demand for efficient material handling solutions within controlled environments such as high-density warehouses, cold storage facilities, and fulfillment centers. Indoor forklifts, particularly electric and Class 3 models, are preferred in these environments due to their compact design, emission-free operations, and efficiency in handling palletized goods.

Major retail and logistics players in Germany, the UK, and France are heavily investing in automated indoor storage systems, further boosting forklift demand in this application segment. Additionally, indoor forklifts contribute to safety and precision in sensitive industries like food & beverage and chemicals, where environmental control is mandatory. With rising labor costs and growing throughput requirements, companies increasingly rely on forklifts optimized for narrow aisles, shelving systems, and high-speed operations. Indoor forklift demand is also strengthened by the EU’s push for smart warehousing and green logistics initiatives.

Although outdoor applications remain important in ports, yards, and construction, the sheer scale of Europe’s e-commerce warehousing footprint ensures that indoor use cases dominate. Indoor forklifts’ adaptability, efficiency, and sustainability make them the backbone of Europe’s forklift ecosystem.

By End-User Industry Analysis

Retail & E-commerce is expected to dominate the European forklift market, fueled by the region’s booming online shopping culture and the rapid digitalization of retail supply chains. The rise of e-commerce giants and expanding online marketplaces in Germany, the UK, and France has reshaped intralogistics requirements, creating unprecedented demand for forklifts in warehouses, fulfillment centers, and last-mile distribution hubs.

Forklifts are indispensable for fast-moving goods, pallet handling, and efficient inventory turnover in e-commerce logistics, where high throughput and timely delivery are critical. Retail chains also depend on forklifts to streamline store replenishment, back-end inventory, and omnichannel order fulfillment.

Moreover, the COVID-19 pandemic accelerated Europe’s online retail penetration, solidifying long-term shifts toward digital commerce and warehouse automation. With consumers demanding shorter delivery windows, forklifts play a vital role in ensuring accuracy and speed. Retail & e-commerce companies also prioritize electric forklifts, aligning with sustainability and zero-emission goals. While industries like automotive, food & beverage, and chemicals contribute significantly, the scale and pace of retail and e-commerce growth set them apart as dominant end users. As Europe’s consumers increasingly embrace digital shopping and cross-border trade expands, forklifts in this segment will remain central to enabling smooth, efficient, and sustainable supply chains.

The Europe Forklift Market Report is segmented on the basis of the following:

By Propulsion

- Electric

- Internal Combustion Engine (ICE)

By Tonnage Capacity

- Below 5 Ton

- 5-15 Ton

- 11–36 Tons

- Above 36 Tons

By Battery Type

- Lead-Acid

- Lithium-Ion

- Fuel Cell

By Class

- Class 1

- Class 2

- Class 3

- Class 4/5

By Operation

By Tire Type

By Application

- Indoor

- Outdoor

- Indoor And Outdoor

By End-User Industry

- Retail & E-Commerce

- Industrial

- Logistics

- Chemical

- Food & Beverage

- Others

Impact of Artificial Intelligence on the Europe Forklift Market

- Enabling Autonomous Forklifts: AI powers autonomous forklifts with machine vision, LiDAR, and predictive navigation, allowing them to operate safely without human intervention. In Europe, where labor shortages and rising wages challenge logistics, AI-driven forklifts optimize operations in warehouses, ports, and manufacturing plants, improving efficiency and reducing dependency on manual operators.

- Enhanced Safety and Collision Avoidance: AI-enabled forklifts use sensors and real-time data analytics to detect obstacles, pedestrians, and other vehicles in dynamic environments. This significantly reduces workplace accidents and aligns with Europe’s stringent worker safety standards, particularly in industries such as logistics, food & beverage, and chemicals.

- Predictive Maintenance and Downtime Reduction: Through AI-powered predictive analytics, forklift fleets can monitor battery health, engine performance, and component wear. This minimizes unexpected breakdowns, lowers maintenance costs, and increases uptime critical in Europe’s high-volume e-commerce and retail warehousing sector.

- Smart Fleet Management and Energy Efficiency: AI integrates forklifts into connected fleet management systems, optimizing route planning, load balancing, and energy usage. For electric forklifts, AI maximizes battery life and charging cycles, aligning with Europe’s push for carbon-neutral operations and reduced operational costs.

- Data-Driven Decision Making for Warehousing Automation: AI transforms forklifts from material movers into intelligent data-collecting assets. They provide insights into warehouse workflows, inventory placement, and space utilization, helping European enterprises enhance throughput and streamline supply chains in industries like automotive, retail, and logistics.

By Region

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Europe Forklift Market: Competitive Landscape

The Europe forklift market is characterized by strong competition among global leaders, regional manufacturers, and technology-driven innovators, each striving to expand their presence across diverse industry verticals. Key players such as KION Group, Jungheinrich AG, Toyota Material Handling Europe, and Hyster-Yale Materials Handling dominate the market with extensive product portfolios, including electric, internal combustion engine (ICE), and automated forklifts. Their strong manufacturing bases in Germany, Italy, and France give them an advantage in addressing the region’s growing demand for sustainable and intelligent material handling equipment.

In recent years, competition has increasingly centered around electrification and automation. Companies are investing heavily in lithium-ion battery technology, hydrogen fuel cells, and AI-powered autonomous forklifts to meet Europe’s stringent emission reduction policies and labor efficiency requirements. Strategic partnerships with technology firms and software providers have become a defining trend, enabling integration of fleet management systems, telematics, and predictive analytics.

Meanwhile, smaller regional manufacturers and niche players are carving a space by offering cost-effective forklifts tailored to local industries such as food & beverage, chemicals, and logistics. The aftermarket service network, rental offerings, and customization capabilities also act as competitive differentiators. With the rising adoption of AI and Industry 4.0 in Europe, the competitive landscape is expected to intensify, pushing companies toward mergers, acquisitions, and R&D investments to sustain long-term growth.

Some of the prominent players in the Europe Forklift Market are:

- Toyota Material Handling Europe

- KION Group AG

- Jungheinrich AG

- Crown Equipment Corporation

- Hyster-Yale Materials Handling, Inc.

- Mitsubishi Logisnext Co., Ltd.

- UniCarriers Europe AB

- Clark Europe GmbH

- Doosan Industrial Vehicle Europe

- Hangcha Group

- Anhui Heli (Anhui Forklift Group)

- Kalmar (Cargotec Corporation)

- Cargotec Corporation

- Linde Material Handling

- STILL GmbH

- Combilift

- EP Equipment Co., Ltd.

- Godrej Material Handling

- Hubtex Maschinenbau

- Komatsu Ltd.

- Other Key Players

Recent Developments in the Europe Forklift Market

- July 2024: Toyota Material Handling Europe launched lithium-ion powered counterbalance forklifts at LogiMAT Stuttgart, focusing on sustainability, efficiency, and supporting Europe’s transition toward greener intralogistics solutions within modernized warehouses and industrial facilities.

- May 2024: Jungheinrich announced a €50 million investment in Germany to expand lithium-ion battery production, addressing growing demand for electric forklifts across Europe and strengthening its competitive position in the green propulsion segment.

- March 2024: KION Group entered collaboration with Bosch Rexroth to co-develop AI-powered driver assistance systems for forklifts, aimed at enhancing safety, operational efficiency, and automation capabilities in European warehouses and logistics environments.

- January 2024: Crown Equipment introduced advanced connected fleet management solutions across Europe, enabling predictive maintenance, optimized operations, real-time analytics, and improved productivity for forklift fleets in manufacturing, logistics, and e-commerce distribution networks.

- November 2023: Hyster-Yale showcased hydrogen fuel cell forklift prototypes during the HyVolution Conference in Paris, highlighting Europe’s shift toward sustainable propulsion technologies and reinforcing hydrogen’s role in next-generation forklift fleet transformation strategies.

- September 2023: STILL GmbH unveiled fully automated reach trucks at IMHX Birmingham, targeting Europe’s fast-growing e-commerce sector by combining robotics, efficiency, and warehouse automation to address labor shortages and rising logistics demand.

- June 2023: Jungheinrich acquired a Swedish automation startup, strengthening its autonomous forklift capabilities and expanding solutions for advanced distribution centers across Europe, addressing increased automation demand in logistics, retail, and industrial applications.

- April 2023: Toyota Material Handling UK collaborated with logistics associations to launch safety training initiatives, focusing on reducing warehouse forklift accidents, improving operator efficiency, and raising industry safety standards across European facilities.

- February 2023: Linde Material Handling expanded hydrogen fueling pilot projects in France, supporting wider adoption of fuel cell forklifts, reducing operational emissions, and advancing hydrogen-powered logistics infrastructure across Europe’s industrial and warehousing operations.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 27.7 Bn |

| Forecast Value (2034) |

USD 139.6 Bn |

| CAGR (2025–2034) |

19.7% |

| Historical Data |

2019 – 2024 |

| Forecast Data |

2026 – 2034 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Propulsion (Electric, Internal Combustion Engine), By Tonnage Capacity (Below 5 Ton, 5-15 Ton, 11-36 Tons, Above 36 Tons), By Battery Type (Lead-Acid, Lithium-Ion, Fuel Cell), By Class (Class 1, Class 2, Class 3, Class 4/5), By Operation (Manual, Autonomous), By Tire Type (Cushion, Pneumatic), By Application (Indoor, Outdoor, Indoor And Outdoor), By End-User (Industry Retail & E-Commerce, Industrial, Logistics, Chemical, Food & Beverage, Others) |

| Regional Coverage |

North America – US, Canada; Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA |

| Prominent Players |

Toyota Material Handling Europe, KION Group AG, Jungheinrich AG, Crown Equipment Corporation, Hyster-Yale Materials Handling Inc., Mitsubishi Logisnext Co. Ltd., UniCarriers Europe AB, Clark Europe GmbH, Doosan Industrial Vehicle Europe, Hangcha Group, Anhui Heli, Kalmar (Cargotec Corporation), Cargotec Corporation, Linde Material Handling, STILL GmbH, Combilift, EP Equipment Co. Ltd., Godrej Material Handling, Hubtex Maschinenbau, Komatsu Ltd, and Other Key Players

|

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |

Frequently Asked Questions

How big is the Europe Forklift Market?

▾ The Europe forklift Market size is estimated to have a value of USD 27.7 billion in 2025 and is expected to reach USD 139.6 billion by the end of 2034.

What is the growth rate in the Europe Forklift Market in 2025?

▾ The market is growing at a CAGR of 19.7 percent over the forecasted period of 2025.

Who are the key players in the Europe Forklift Market?

▾ Some of the major key players in the Europe forklift Market are Toyota Material Handling Europe, KION Group AG, Jungheinrich AG, Crown Equipment Corporation, Hyster-Yale Materials Handling Inc., Mitsubishi Logisnext Co. Ltd., UniCarriers Europe AB, Clark Europe GmbH, and many others.