Market Overview

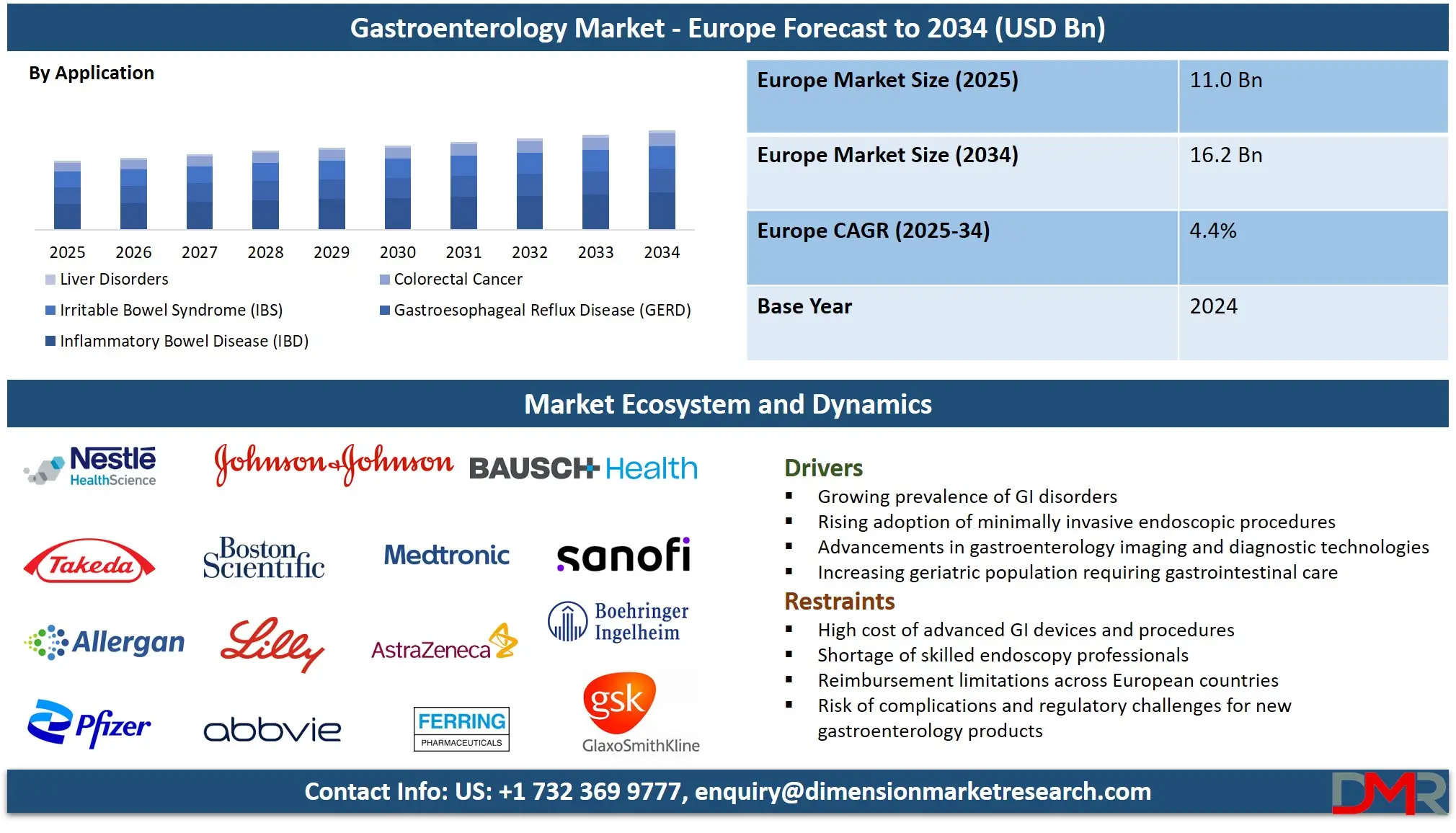

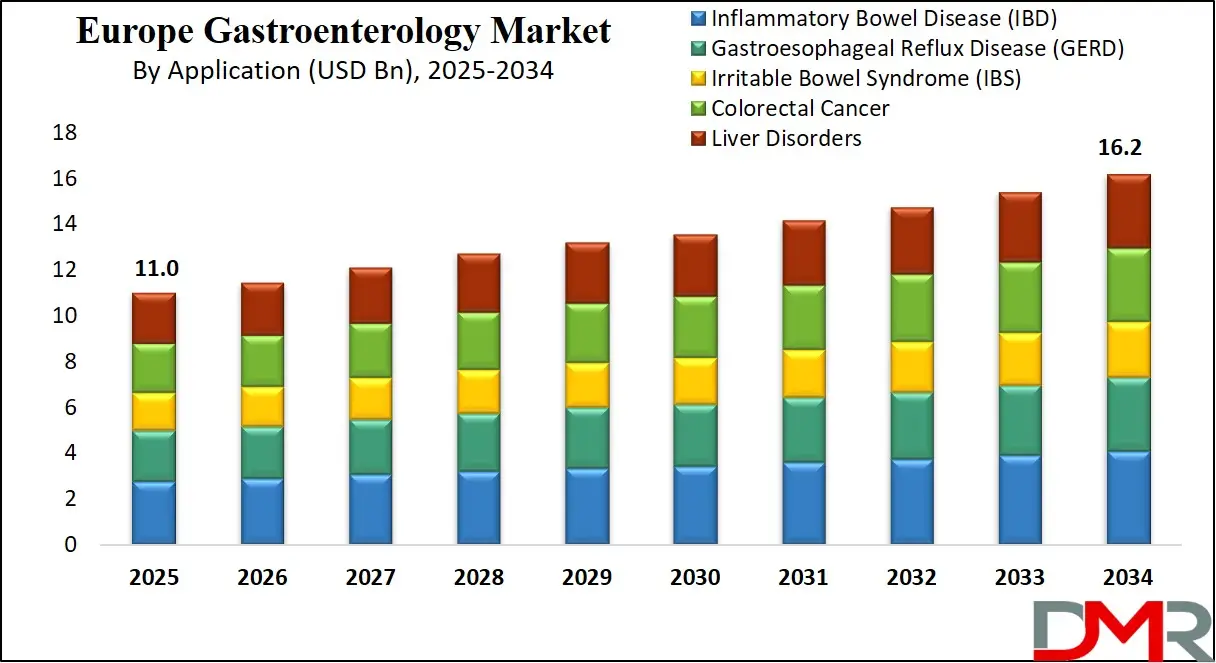

The Europe Gastroenterology Market is projected to grow from USD 11.0 billion in 2025 to USD 16.2 billion by 2034, registering a CAGR of 4.4%, reflecting steady growth driven by the rising prevalence of gastrointestinal disorders and strong healthcare infrastructure across the region.

Countries such as Germany, France, the United Kingdom, and Italy are key contributors due to well-established hospitals, advanced diagnostic facilities, and high patient awareness of digestive health conditions. The growing incidence of inflammatory bowel disease, gastroesophageal reflux disease, colorectal cancer, and liver disorders is driving demand for advanced therapeutics, endoscopic devices, and minimally invasive procedures.

This growth is supported by technological advancements such as high-definition endoscopy systems, AI-assisted diagnostic tools, and precision medicine tailored to patient-specific conditions. Rising healthcare expenditure, favorable reimbursement policies, and ongoing research and development by leading pharmaceutical and medical device companies are further propelling market expansion. The growing adoption of outpatient care centers and specialized gastroenterology clinics is also enhancing access to innovative diagnostics and therapies, strengthening Europe’s position as a key segment in the Europe gastroenterology market.

Gastroenterology is a critical medical specialty in Europe, focused on disorders of the digestive system. The regional market is a mature and technologically advanced sector, characterized by high standards of care, significant R&D investment, and a strong focus on early diagnosis and chronic disease management. It encompasses a comprehensive range of products and services, from diagnostic endoscopy and imaging to pharmaceutical therapeutics and surgical devices.

The market dynamics are influenced by an aging population, high prevalence of chronic digestive diseases, and a robust regulatory framework. Emerging trends, including the integration of artificial intelligence in diagnostics, the growth of telemedicine, and the shift towards personalized biologic therapies, are actively shaping the future of gastroenterology care across European healthcare systems.

Europe Gastroenterology Market: Key Takeaways

- Market Value: The Europe gastroenterology market is projected to be valued at USD 11.0 billion in 2025, growing at a CAGR of 4.4% over the forecast period.

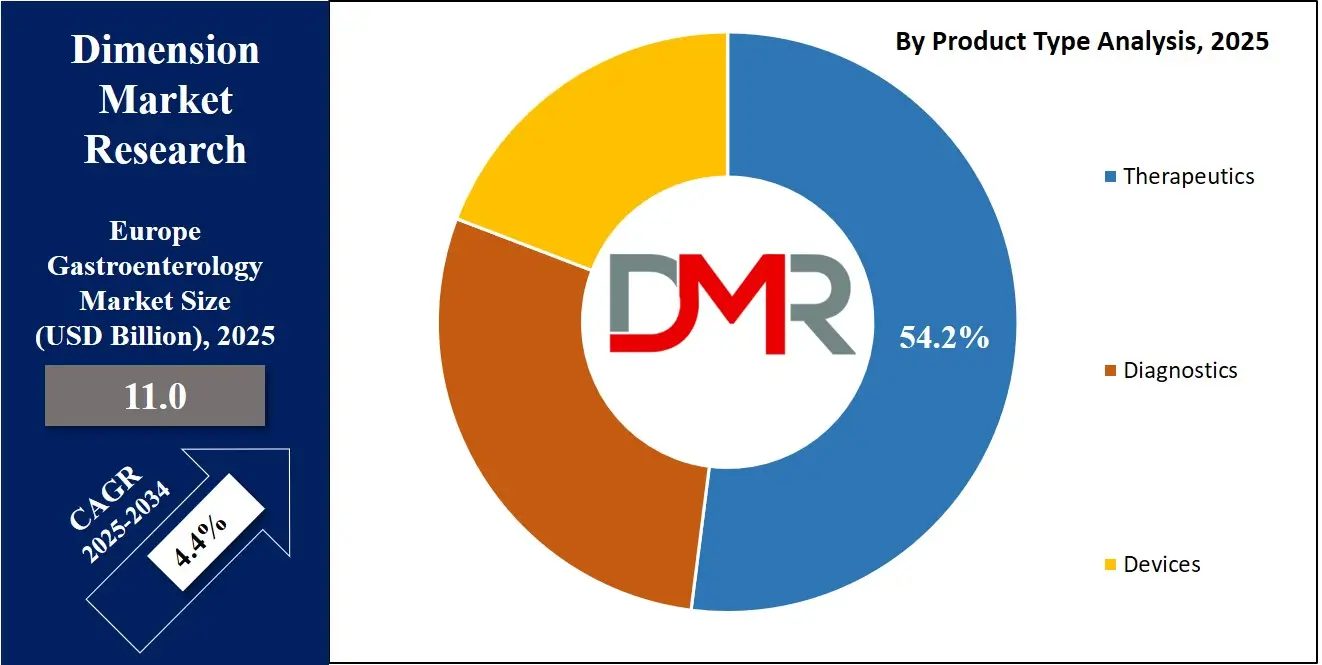

- By Product Type Segment Analysis: Therapeutics are anticipated to dominate the product type segment, capturing a leading share of the total European market in 2025.

- By Route of Administration Segment Analysis: Injectables are expected to maintain their dominance, driven by the use of biologics for complex conditions like inflammatory bowel disease.

- By Drug Type Segment Analysis: Branded Drugs will dominate the drug type segment, supported by strong clinical validation and physician trust.

- By Application Segment Analysis: Inflammatory Bowel Disease (IBD) will dominate the application segment, representing a major clinical and economic focus.

- By End-User Segment Analysis: Hospitals will account for the maximum share in the end-user segment, serving as the primary hub for complex procedures and integrated care.

- Regional Position: Europe represents a major, advanced regional market with a significant share of the Europe gastroenterology landscape.

- Key Players: Leading players in the European market include AbbVie Inc., AstraZeneca plc, Bayer AG, Boehringer Ingelheim GmbH, Ferring Pharmaceuticals, GlaxoSmithKline plc, Novartis AG, Sanofi S.A., and Takeda Pharmaceutical Company, among others.

Europe Gastroenterology Market: Use Cases

- Management of Chronic Digestive Conditions: The European market is fundamentally geared toward the sustained care of lifelong disorders like inflammatory bowel disease (IBD), irritable bowel syndrome (IBS), and gastroesophageal reflux disease (GERD). The use of advanced biologics, next-generation small molecules, and sustained-release drug formulations is central to controlling symptoms and maintaining remission.

- Preventive Screening and Early Detection Programs: A major pillar of the European healthcare approach is preventive medicine, which drives significant market activity in early diagnosis. National and regional screening programs for colorectal cancer, alongside advanced diagnostic protocols for liver diseases like NAFLD/NASH, utilize high-definition endoscopy, non-invasive imaging (e.g., FibroScan), and biomarker panels.

- Advanced Therapeutic Endoscopy and Minimally Invasive Surgery: There is a pronounced shift from traditional open surgery to minimally invasive interventions, a trend strongly supported by the market's medical device segment. Advanced therapeutic endoscopy allows for the resection of early-stage cancers, management of complex polyps, and treatment of obstructions without external incisions.

- Precision Medicine and Tailored Biologic Therapies: Europe is at the forefront of adopting precision medicine in gastroenterology. The management of complex conditions, particularly IBD and certain gastrointestinal cancers, increasingly relies on biomarker testing (e.g., pharmacogenomics, therapeutic drug monitoring) to guide therapy selection.

Impact of Artificial Intelligence on the Europe Gastroenterology market

- Enhanced Diagnostic Accuracy and Early Detection: AI algorithms, particularly in computer-aided detection (CADe) and diagnosis (CADx), are revolutionizing endoscopy. They provide real-time assistance to clinicians by automatically identifying and highlighting suspicious lesions, polyps, and early-stage cancers during colonoscopies and other procedures.

- Streamlined Workflow and Operational Efficiency: AI is optimizing clinical workflows by automating time-consuming tasks. This includes the triage and prioritization of capsule endoscopy videos, where AI can flag abnormal segments for specialist review, reducing reading times by up to 90%. AI

- Predictive Analytics for Personalized Treatment: Beyond diagnostics, AI leverages vast datasets from electronic health records, genomic profiles, and imaging to predict disease progression and treatment response. Machine learning models can forecast which patients with inflammatory bowel disease (IBD) are likely to flare or which are most likely to respond to a specific biologic therapy.

- Expansion of Access via Telemedicine and Remote Care: AI-powered tools are a cornerstone of scalable tele-gastroenterology. They support remote symptom assessment, risk stratification, and monitoring of chronic conditions. Automated analysis of patient-reported data and connected device inputs allows for proactive management outside clinical settings.

- Accelerated Drug Discovery and Clinical Research: In the pharmaceutical segment of the market, AI is accelerating R&D for new gastroenterology therapeutics. It analyzes complex biological data to identify novel drug targets, predict drug efficacy, and optimize clinical trial design by identifying ideal patient cohorts.

Europe Gastroenterology Market: Stats & Facts

United European Gastroenterology (UEG)

- GI and liver disorders are responsible for around 1 million deaths each year across Europe.

- The incidence and prevalence of many GI disorders are highest among the very young and the elderly, and the ageing European population is projected to increase this disease burden.

IARC / GLOBOCAN (WHO Cancer Observatory)

- Population (Europe) used in GLOBOCAN: ~747,543,827 (population base used in the factsheet).

- New cancer cases in Europe (2022): 4,471,422 (all cancers combined).

- Cancer deaths in Europe (2022): 1,986,093 (all cancers combined).

- 5-year prevalent cancer cases (Europe): 13,646,087 (5-year prevalence, all cancers).

European Centre for Disease Prevention and Control (ECDC)

- The EU/EEA population-weighted mean total consumption of antibacterials for systemic use decreased by 2.5% since 2019 (progress toward the EU 2030 target).

- ECDC maintains a Surveillance Atlas and datasets used for tracking infectious and antimicrobial resistance trends across Europe (used in GI infection surveillance and stewardship programmes).

European Medicines Agency (EMA

- In 2023 EMA’s CHMP recommended 77 medicines for marketing authorisation (39 of which were new active substances that had not previously been authorised in the EU).

- EMA publishes rolling annual summaries of human-medicine approvals and conditional authorisations relevant to GI therapeutics.

Eurostat / Regional hospital statistics

- Eurostat provides standardized hospital discharges by diagnosis (ICD-10 K00–K93 diseases of the digestive system) expressed per 100,000 population (country-level time series available across EU member states).

- Eurostat’s hospital discharge datasets are the official source for cross-country comparisons of in-patient GI disease burden and length-of-stay statistics in the EU.

- Country example from official regional statistics: Germany’s reported hospital discharges for digestive system diseases were ~2,230 per 100,000 inhabitants in the most recent comparable year shown in the dataset (country/region time series available up to 2023/2024 in national statistical offices).

NHS England / UK official health statistics

- In 2023–24 NHS figures showed 191,927 hospitalisations due to iron deficiency (reported rise in admissions for iron deficiency in England).

- NHS hospital episode statistics are the authoritative UK source for admissions and procedure volumes (including GI procedures and endoscopy activity).

- Analysis using OECD data reported country examples of IBD hospitalisation rates; for example Austria had an IBD hospitalisation rate around 72.9 per 100,000 in the period assessed (used to illustrate inter-country variation in Europe).

WHO / European mortality databases (digestive disease mortality indicators)

- WHO European databases provide age-standardized death rates and counts for “diseases of the digestive system”, and track number of deaths from intestinal infectious diseases and other specific digestive-system causes across member countries.

- These WHO indicators are used for trend analysis of digestive-disease mortality by age groups (e.g., 65+ age-standardized death rates are available per 100,000).

Europe Gastroenterology Market: Market Dynamics

Europe Gastroenterology Market: Driving Factors

High and Rising Disease Prevalence

The increasing burden of chronic digestive disorders, such as inflammatory bowel disease, gastroesophageal reflux, and colorectal cancer, is a primary market driver. This rise is fueled by an aging European population more susceptible to gastrointestinal conditions and widespread lifestyle factors, including poor dietary habits, obesity, and stress. The growing patient pool creates sustained demand for diagnostic procedures, long-term treatments, and disease management solutions. This epidemiological trend ensures a continuous need for gastroenterology services and products, from endoscopy equipment to pharmaceutical therapies. It compels healthcare systems to allocate resources and fosters ongoing investment in the field, establishing a stable foundation for market growth and innovation.

Technological Advancement and Adoption

Europe's position as a rapid adopter of cutting-edge medical technology significantly propels the gastroenterology market. Innovations like high-definition and AI-enhanced endoscopes improve diagnostic accuracy, while capsule endoscopy enables non-invasive visualization. Advancements in minimally invasive surgical devices and biologic therapeutics for conditions like Crohn's disease enhance treatment efficacy and patient outcomes. This environment of technological embrace drives market renewal by creating demand for next-generation equipment and drugs. It encourages manufacturers to innovate and healthcare providers to upgrade their capabilities, fostering a competitive landscape focused on superior clinical performance and procedural efficiency.

Europe Gastroenterology Market: Restraints

Regulatory and Reimbursement Complexity

The European market is characterized by a fragmented landscape of national regulations and reimbursement policies, posing a significant commercial challenge. While the EU provides a regulatory framework via CE marking, individual member states retain autonomy over pricing, reimbursement, and market access criteria. This diversity requires tailored market entry strategies for each country, increasing time, cost, and administrative burden for companies. Navigating varied health technology assessment bodies and proving value to different payers complicates commercialization. This complexity can lead to staggered product launches and unequal patient access across the region, acting as a barrier to achieving uniform and timely market penetration.

Cost Containment and Budgetary Pressure

A primary market restraint is the intense pressure on European healthcare budgets, leading to stringent cost-containment policies. Payers increasingly demand demonstrable value, slowing the adoption of high-price innovative drugs, devices, and diagnostic tools. New entrants face rigorous Health Technology Assessment (HTA) processes that evaluate clinical benefit against cost. This environment can delay market access, limit premium pricing, and force manufacturers into competitive pricing and reimbursement negotiations. It prioritizes cost-effectiveness over technological novelty alone, potentially stifling the uptake of cutting-edge solutions unless they clearly prove superior outcomes or long-term savings for the healthcare system.

Europe Gastroenterology Market: Opportunities

Strong Healthcare Infrastructure and Investment

Europe's robust and well-funded healthcare ecosystem provides a critical foundation for the gastroenterology market. Extensive networks of specialized hospitals and clinics, coupled with high per-capita healthcare expenditure, facilitate the adoption of advanced, often costly, medical technologies. This infrastructure supports specialized training for gastroenterologists and dedicated procedural units. Significant public and private investment in healthcare ensures that sophisticated diagnostic tools and innovative treatments can be integrated into clinical practice. This established framework reduces market entry barriers for new products and services, enabling widespread patient access to high-quality, specialized digestive care across the region.

Expansion of Digital Health and Telemedicine

Significant opportunity exists in digital health solutions, including AI-powered diagnostic platforms for endoscopy or histopathology, and remote patient monitoring for chronic conditions like IBD. Tele-gastroenterology facilitates specialist consultations and follow-ups, improving access in rural or underserved areas and streamlining care pathways. These technologies support proactive disease management, potentially reducing hospitalizations. The growing acceptance of telemedicine post-pandemic, coupled with initiatives to modernize healthcare, creates a favorable environment for investment and adoption. This digital shift opens new revenue streams for tech companies and service providers, enhancing care efficiency and patient engagement in gastroenterology.

Europe Gastroenterology Market: Trends

Accelerated Integration of AI and Machine Learning

AI and ML are transitioning from pilot projects to clinical integration, becoming a defining market trend. Applications include real-time polyp detection during colonoscopy, automated disease severity scoring, and predictive analytics for patient risk stratification. These tools enhance diagnostic accuracy, standardize assessments, and improve procedural efficiency. The trend is supported by growing digital data volumes and advanced computing power. It drives demand for compatible endoscopic hardware and software solutions, creating partnerships between device manufacturers and AI firms. This integration represents a paradigm shift towards data-driven, assisted decision-making, aiming to improve early detection rates and overall quality of care in gastroenterology.

Shift Towards Value-Based and Ambulatory Care

The overarching trend is a systemic shift from volume-based to value-based care, prioritizing patient outcomes and cost-effectiveness. This favors minimally invasive techniques that reduce complications and enable faster recovery, often performed in outpatient settings. The trend drives demand for devices and therapies that demonstrate superior long-term value through improved quality of life and reduced total care costs. It encourages bundled payment models and emphasizes holistic disease management. Consequently, market success increasingly depends on proving economic and clinical value to payers, aligning product development and service offerings with efficient, patient-centered care pathways in both hospital and ambulatory environments.

Europe Gastroenterology Market: Research Scope and Analysis

By Product Type Analysis

In the Europe Gastroenterology Market, the therapeutics segment is expected to hold a leading share in 2025, accounting for approximately 54.2% of total market value. This dominance is driven by the high prevalence of chronic gastrointestinal conditions across Europe, particularly inflammatory bowel disease (IBD), gastroesophageal reflux disease (GERD), irritable bowel syndrome (IBS), colorectal cancer, and chronic liver diseases, which collectively place a sustained demand on long-term pharmacological management.

Europe has one of the highest IBD prevalence rates globally, especially in countries such as the U.K., Sweden, Germany, and Denmark, which significantly increases the usage of biologics, immunomodulators, and targeted small-molecule therapies. The region also benefits from strong public healthcare funding, enabling broader access to novel and advanced GI medications.

The diagnostics segment also forms a critical pillar of Europe’s gastroenterology landscape. High colon cancer screening participation rates made mandatory or nationally recommended in many EU states drive continuous demand for endoscopy, imaging, and biomarker testing. European hospitals and diagnostic centres are rapidly deploying high-definition endoscopy systems, capsule endoscopy, and AI-assisted imaging, supported by EU-level innovation programs aimed at improving early cancer detection. As digestive cancers remain among Europe’s top causes of mortality, investment in screening and early detection continues to expand.

By Route of Administration Analysis

In Europe, the route of administration landscape for gastroenterology treatments is shaped by clinical practice patterns, reimbursement models, and patient preference. The injectables segment, is poised to dominated by biologics and targeted immunotherapies, represents approximately 40.1% of the total market value in 2025. Europe’s high adoption of biologics for inflammatory bowel disease management particularly in Western and Northern Europe drives substantial spending on injectable therapies. Countries such as Germany, France, the Netherlands, and the U.K. exhibit strong hospital-based biologic utilisation, supported by structured reimbursement systems that encourage the use of advanced therapies for moderate-to-severe cases of Crohn’s disease and ulcerative colitis. Injectables continue to be preferred in complex disease management due to their higher bioavailability, rapid therapeutic onset, and robust clinical outcomes compared with many oral agents.

However, oral medications account for the majority of prescription volumes, representing 31.1% of all gastrointestinal drug use. These include proton pump inhibitors (PPIs), H2 blockers, antispasmodics, anti-diarrheal agents, and oral anti-inflammatory medications. Europe has a high reliance on oral therapies in primary care settings, particularly for GERD, IBS, peptic ulcer disease, and functional gastrointestinal disorders. The availability of low-cost generics, strong pharmacy penetration, and physician preference for non-invasive, self-administered therapies support the continuing dominance of oral formulations in terms of volume.

By Drug Type Analysis

The Europe Gastroenterology Market demonstrates a unique dynamic in the drug type segment, shaped by strong generic adoption and accelerated biosimilar penetration. In 2025, generic and biosimilar drugs are expected to command 60.5% of prescription volume, driven by the region’s cost-containment policies and highly regulated drug pricing frameworks. European countries maintain strict health technology assessment (HTA) processes, mandatory substitution policies in pharmacies, and nationwide cost-efficiency strategies that collectively promote generics as the first-line choice in many gastrointestinal treatment pathways. This is especially evident in widely used therapies such as PPIs, aminosalicylates, antacids, and various supportive care medications used for chronic digestive disorders.

This value dominance is attributed to the use of specialty biologics and advanced targeted therapies primarily in IBD, liver disorders, colorectal cancer, and severe gastroesophageal conditions. European hospitals, especially in Western Europe, maintain strong adoption rates of branded biologics due to their superior efficacy, safety, and role in reducing disease flares and hospitalisations.

Additionally, pharmaceutical companies operating in Europe invest heavily in R&D for next-generation GI treatments, including oral biologics, microbiome-modulating agents, and precision-based therapeutic platforms. These innovations help branded drugs maintain a competitive edge.

Overall, Europe’s drug type distribution reflects a dual-market structure: generics and biosimilars ensure accessibility and affordability, while branded therapies drive innovation and high-value care for complex gastrointestinal diseases.

By Application Analysis

IBD including Crohn’s disease and ulcerative colitis is projected to dominates the European gastroenterology application segment in terms of revenue, biologic usage, and specialty-care demand. Europe has one of the highest IBD prevalence rates globally, particularly in Northern and Western Europe. Countries such as the U.K., Sweden, Denmark, Germany, the Netherlands, and Norway report rapid year-on-year growth in IBD diagnoses, especially among younger populations. This high prevalence creates a sustained need for advanced therapies, including biologics (anti-TNF, anti-integrin, anti-IL agents), immunomodulators, and targeted small-molecule drugs such as JAK inhibitors.

IBD cases often require long-term management, continuous monitoring, and repeated treatment adjustments, which increases healthcare expenditure significantly. Hospitals and specialized IBD centers dominate care delivery, further increasing the revenue share of this segment. The integration of precision-medicine approaches such as therapeutic drug monitoring, biomarker-based decision-making, and individualized biologic regimens adds to the segment’s market leadership.

GERD dominates the European gastroenterology landscape in terms of patient volume, prescription frequency, and primary care interactions. It is one of the most commonly diagnosed digestive disorders in Europe, affecting a large share of the adult population due to dietary habits, obesity, sedentary lifestyles, smoking prevalence, and aging demographics. GERD drives massive demand for daily-use medications such as PPIs, H2 blockers, antacids, and prokinetics many of which fall under the generic category, ensuring high prescription rates.

By End User Analysis

Hospitals dominate the Europe gastroenterology end-user segment, capturing highehst of total market value due to their essential role in delivering advanced GI care. Hospitals serve as the central hubs for diagnostic endoscopy, interventional gastroenterology, emergency GI procedures, colorectal cancer surgeries, liver disease management, and infusion-based biologic therapy for IBD. Their technological capability, multidisciplinary infrastructure, and access to skilled gastroenterologists make them the preferred setting for complex gastrointestinal care.

European hospitals are equipped with advanced tools such as high-definition endoscopy systems, endoscopic ultrasound, AI-assisted polyp detection, ERCP/ESD devices, robotic surgery platforms, and comprehensive imaging units. These devices require specialized environments and trained personnel, reinforcing hospital dominance. Hospitals also manage inpatient care for acute GI bleeding, pancreatitis, liver failure, and cancer complications conditions that cannot be treated in outpatient settings.

National screening programs for colorectal cancer across Europe (especially in France, Germany, the U.K., Italy, and the Nordic countries) drive large procedure volumes in hospital-based endoscopy units. Additionally, biologic infusions for IBD and liver disease monitoring typically occur in hospital infusion centers, strengthening this segment’s revenue lead.

Reimbursement structures in Europe often favor hospital settings for high-value procedures, making hospitals the financial backbone of the gastroenterology market. Their clinical capacity, infrastructure investment, and ability to manage complex GI conditions ensure that hospitals remain the dominant end-user segment in Europe’s gastroenterology ecosystem.

The Europe Gastroenterology Market Report is segmented on the basis of the following:

By Product Type

- Biologics

- Biosimilars

- Small Molecules

- Endoscopic Procedures

- Imaging

- Lab Tests

- Biopsy Tools

- Surgical Instruments

By Route of Administration

- Injectables

- Oral Medications

- Others

By Drug Type

- Branded Drugs

- Generic Drugs

By Application

- Inflammatory Bowel Disease (IBD)

- Gastroesophageal Reflux Disease (GERD)

- Irritable Bowel Syndrome (IBS)

- Colorectal Cancer

- Liver Disorders

By End-User

- Hospitals

- Diagnostic Centers

- Retail Pharmacies

- Online Pharmacies

By Region

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Europe Gastroenterology Market: Competitive Landscape

The Europe gastroenterology competitive landscape is defined by the interplay between high-value therapeutics including biologics and targeted small-molecule drugs and advanced medical devices and diagnostics, such as endoscopy platforms, imaging systems, and single-use scopes. Leading medtech companies, including Medtronic, Boston Scientific, Olympus, Fujifilm, and Ambu, dominate the device and endoscopy segment through extensive product portfolios, strong hospital relationships, and continuous innovation in high-definition imaging, minimally invasive procedures, and single-use endoscopes. Their focus on technological upgrades, integrated services, and training programs strengthens adoption across European hospitals.

In pharmaceuticals, major multinational drugmakers such as AbbVie, Takeda, Pfizer, Johnson & Johnson, alongside emerging players like Eli Lilly, compete intensively in indications including inflammatory bowel disease (IBD), liver disorders, and colorectal cancer. Biologics, oral therapies, and next-generation precision medicines are central areas of competition. Companies are leveraging strategic partnerships, acquisitions, and pipeline expansions to enhance market access, broaden treatment options, and improve scale.

Some of the prominent players in the Europe Gastroenterology market are

- Johnson & Johnson

- AbbVie

- Takeda Pharmaceutical Company

- Pfizer

- Sanofi

- AstraZeneca

- Bausch Health (Salix)

- Eli Lilly & Company

- Ferring Pharmaceuticals

- Nestlé Health Science

- GlaxoSmithKline (GSK)

- Boehringer Ingelheim

- Allergan (part of AbbVie)

- Valeant Pharmaceuticals

- Medtronic

- Boston Scientific Corporation

- Olympus Corporation

- Stryker Corporation

- Fujifilm Holdings Corporation

- Ambu A/S

- Other Key Players

Europe Gastroenterology Market: Recent Developments

- October 2025: Tremfya (guselkumab) received European Commission approval for subcutaneous induction and maintenance in adult Ulcerative Colitis (UC), providing a new treatment option for chronic IBD in Europe.

- May 2025: Tremfya (guselkumab) received European Commission approval for moderately to severely active Crohn’s Disease in adults, offering both intravenous induction and subcutaneous maintenance therapy.

- April 2025: ESGE Days 2025 conference was held in Barcelona, Spain, organized by the European Society of Gastrointestinal Endoscopy (ESGE); total registrations increased by 21% to approximately 5,300 delegates, reflecting growing engagement in GI endoscopy across Europe.

- February 2025: Biomerica, Inc. achieved IVDR (In Vitro Diagnostic Regulation) certification in the EU for its food-intolerance tests targeting patients with Crohn’s Disease and Ulcerative Colitis, enabling expansion of non-invasive diagnostics in Europe.

- July 2024: Skyrizi (risankizumab) received European Commission approval for treating moderately to severely active Ulcerative Colitis in adults who had inadequate response or intolerance to conventional or biologic therapy, broadening therapeutic options for IBD.

- November 2024: REFLECT Symposium “The Future of Minimally Invasive GI and Capsule Diagnostics” was held in Nyborg, Denmark, emphasizing innovation in capsule endoscopy and non-invasive diagnostics in Europe.

- September 2024: ESGE launched the ESGE Academy e-learning platform, the Next Generation Award for young GI researchers, and the first ESGE Endoscopy Camp in Zagreb, Croatia, to train early-career endoscopists.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 11.0 Bn |

| Forecast Value (2034) |

USD 16.2 Bn |

| CAGR (2025–2034) |

4.4% |

| Historical Data |

2019 – 2024 |

| Forecast Data |

2026 – 2034 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Product Type (Therapeutics, Diagnostics, Devices), By Route of Administration (Injectables, Oral Medications, Others), By Drug Type (Branded Drugs, Generic Drugs), By Application (Inflammatory Bowel Disease, Gastroesophageal Reflux Disease, Irritable Bowel Syndrome, Colorectal Cancer, Liver Disorders), By End-User (Hospitals, Diagnostic Centers, Retail Pharmacies, Online Pharmacies) |

| Regional Coverage |

Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe |

| Prominent Players |

Johnson & Johnson, AbbVie, Takeda Pharmaceutical Company, Pfizer, Sanofi, AstraZeneca, Bausch Health (Salix), Eli Lilly & Company, Ferring Pharmaceuticals, Nestlé Health Science, GlaxoSmithKline (GSK), Boehringer Ingelheim, Allergan, Valeant Pharmaceuticals, Medtronic, Boston Scientific, Olympus Corporation, Stryker Corporation, Fujifilm Holdings Corporation, Ambu A/S., and Others. |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |

Frequently Asked Questions

The Europe Gastroenterology market size is estimated to have a value of USD 11.0 billion in 2025 and is expected to reach USD 16.2 billion by the end of 2034.

Some of the major key players in the Europe Gastroenterology market are AbbVie Inc., Abbott Laboratories, AstraZeneca plc, Bayer AG, Bausch Health Companies Inc., Boehringer Ingelheim GmbH, Boston Scientific Corporation, Cipla Ltd., Ferring Pharmaceuticals, GI Alliance, GlaxoSmithKline plc, Johnson & Johnson, Medtronic plc, Novartis AG, and Others.

The market is growing at a CAGR of 4.4 percent over the forecasted period.