Market Overview

The Europe Heparin Market is expected to reach a value of USD 4.0 billion by the end of 2024, and it is further anticipated to reach a market value of USD 7.1 billion by 2033 at a CAGR of 6.6%. This growth is supported by increasing adoption of anticoagulant therapies and expanding applications in blood clot prevention across critical care and surgical procedures in Europe.

Heparin is an anticoagulant drug that is important for preventing & treating blood clotting disorders like separated intravascular coagulation, deep vein thrombosis, & pulmonary embolism. It hinders clot growth post-surgery, during transfusions, dialysis, and blood sampling by creating anti-clotting proteins, making easy blood flow.

Derived from the mucosal tissues of slaughtered livestock animals, heparin does not reduce clots but restricts their enlargement, preventing severe complications. The integration of

Medical Devices and

Telemedicine in patient care enhances the monitoring and administration of heparin in European healthcare facilities

Key Takeaways

- The Europe Heparin Market is expected to grow by 3.1 billion, at a CAGR of 6.6% during the forecasted period.

- By Product, the low molecular weight heparin segment is expected to lead in 2024 & is anticipated to dominate throughout the forecasted period.

- By End User, hospitals are expected to have a lead throughout the forecasted period.

- Some of the use cases of heparin include anticoagulation in critical care, prophylaxis in major surgeries, and more.

Use Cases:

- Anticoagulation in Critical Care: Heparin is vital in European critical care settings for preventing clot formation in intravascular devices & preventing circuit patency during procedures like ECMO & hemodialysis. Hospitals increasingly leverage Healthcare Analytics to optimize heparin dosing and patient safety.

- Management of Acute Ischemic Stroke: Heparin plays an important role in Europe for the management of acute ischemic stroke, helping in preventing blood clot extension and promoting reperfusion in eligible patients experiencing thrombolysis or endovascular thrombectomy.

- Prevention of Thromboembolism in Atrial Fibrillation: Broadly prescribed in Europe, Heparin assists prevent thromboembolic events in patients with atrial fibrillation by inhibiting clot formation in the atria, minimizing the risk of stroke & systemic embolism.

- Prophylaxis in Major Surgeries: Heparin is usually administered in European hospitals as prophylaxis against venous thromboembolism in patients facing major surgeries like orthopedic procedures or abdominal surgeries, reducing the risk of postoperative clot formation.

Market Dynamic

The rising number of cardiovascular ailments drives the need for heparin, a primary blood thinner used in conditions like DVT & pulmonary embolism. Surgeries like open-heart procedures and & transplants need to prevent clotting, further driving its usage. The advent of low molecular weight heparin (LMWH) improves safety and efficacy, expanding its application across many medical scenarios.

However, strict regulations on heparin production create challenges for manufacturers, demanding costly observation. Novel oral anticoagulants (NOACs) like dabigatran provide convenient alternatives with lower risks, challenging traditional heparin markets. Yet the competition, heparin's longstanding efficacy, and broad usage continue to drive its demand in clinical settings.

Research Scope and Analysis

By Product

The European heparin market, based on products includes low molecular weight heparin, unfractionated heparin, and ultra-low molecular weight heparin, of which low molecular weight heparin is expected to show dominance throughout the forecast period, which is due to its broad availability & increasing adoption of new pharmaceuticals. The market's preference for low molecular weight heparin is driven by its proven usage and safety profile, along with its easier administration in comparison to other variants.

In addition, regulatory approvals for new drugs within this category further contribute to its growth expansion. As healthcare trends prioritize patient convenience & therapeutic effectiveness, low molecular weight heparin becomes the lead in meeting to these evolving demands, positioning itself as an important component within the European heparin market landscape.

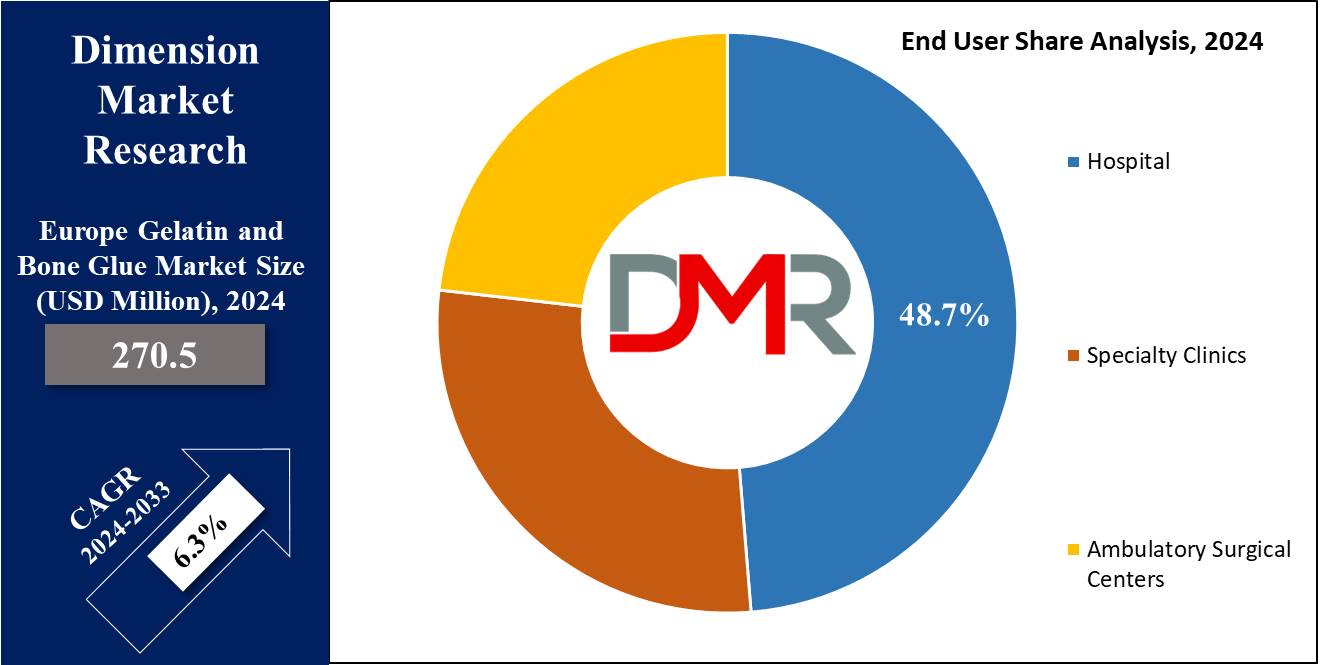

By End User

The market includes hospitals, blood and stem cell banks, and other establishments like laboratories and acute care centers. Among these hospital sector will emerge as the leading segment throughout the forecast period, which is mainly driven by a notable increase in hospitalizations across the region. With an increase in the number of patients looking for medical care for many conditions, hospitals remain the main hub for handling heparin-based therapies.

The need for heparin within hospital settings is driven by its critical role in preventing & managing thrombotic disorders, making it a major medication in acute care protocols. As healthcare facilities give importance to patient safety and effective treatment outcomes, the dependency on heparin within hospital environments is expected to sustain, holding its position as the leading segment within the Europe Heparin Market, supported by advanced Medical Devices and Healthcare Analytics systems.

The Europe Heparin Market Report is segmented based on the following:

By Product

- Low Molecular Weight Heparin

- Unfractionated Heparin

- Ultra-Low Molecular Weight Heparin

By End User

- Hospitals

- Blood & Stem Cell Bank

- Others (Laboratories, Acute Care Centers)

European Country Analysis

The U.K. is expected to emerge as the fastest-growing segment in the European heparin market as per projections. EuroPCR and the European Association of Percutaneous Coronary Interventions, recently discussed how pretreatment with unfractionated heparin led to a decline in coronary artery occlusion among patients with segment elevation myocardial infarction.

Further, the study revealed a major outcome, with an NNT (number needed to treat) of 12, without increasing the risk of major in-hospital bleeding. Further, fewer deaths were observed with unfractionated heparin pretreatment, although its strength across all sensitivity analyses remains uncertain, mainly due to residual confounding factors that couldn't be entirely ruled out.

By European Countries

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Competitive Landscape

The European heparin market experiences a strong competitive characterized by many key players competing for market share. These companies compete through product development, pricing strategies, & distribution networks. In addition, partnerships & collaborations with healthcare providers & regulatory bodies play an important role in shaping competitive dynamics. As the need for heparin continues to grow, companies aim for differentiation & market expansion strategies to maintain their competitive edge.

Some of the prominent players in the European heparin Market are

- Leo Pharma

- Pfizer Inc

- Sanofi SA

- Dr Reddy’s Laboratories

- Abbott Laboratories

- Bayer AG

- Sagent Pharmaceuticals

- Aspen Holdings

- Mylan N.V.

- OPOCRIN SPA

- Other Key Players

Recent Developments

- In February 2024, B. Braun Medical Inc. launched its new Heparin Sodium 2,000 units in 0.9% Sodium Chloride Injection, 1,000 mL or 2 units/mL, the fifth product in its portfolio of Heparin premixed bags, which enhances its ability to serve various needs of healthcare facilities & their patients for this high-alert medication.

- In February 2024, Roche introduced three new coagulation tests for the oral Factor Xa inhibitors edoxaban, apixaban, and rivaroxaban in countries adopting the CE mark1. These anticoagulants were listed on the WHO's Model List of Essential Medicines in 2019 due to the impact they can have on patients as they support clinical decision-making in patients treated with direct oral anticoagulants for prevention of stroke and systemic embolism in patients with peripheral arterial disease (PAD), non-valvular-atrial-fibrillation, coronary artery disease (CAD), and for the prevention and treatment of venous thromboembolism (VTE).

- In December 2023, The European Medicines Agency (EMA) published its first version of the Union list of critical medicines, which has over 200 medicines examined as critical for healthcare systems across the EU, and was introduced along with the Heads of Medicines Agencies (HMA), and the European Commission as it was created as part of the EU’s effort to look into shortages of important medicines.

- In May 2023, Vall Companys along with Bioiberica created Biovall Heparin Science, a joint business project that allows the production of crude heparin extracted from porcine intestinal mucosa, which focuses on supporting a sustainable circular economy based on the reuse & reprocessing of a co-product of porcine origin by providing it a second useful life.

- In January 2022, Optimvia and Ginkgo Bioworks introduced a partnership to enhance the manufacturing efficiency of biosynthetic heparin, an important medicine currently produced from industrial animal agriculture, where Optimvia looks to use Ginkgo's cell and enzyme engineering platform, along with its fermentation process development expertise, to quickly improve the performance of its biosynthetic heparin manufacturing technology.

Report Details

| Report Characteristics |

| Market Size (2024) |

USD 4.0 Bn |

| Forecast Value (2033) |

USD 7.1 Bn |

| CAGR (2023-2032) |

6.6% |

| Historical Data |

2018 – 2023 |

| Forecast Data |

2024 – 2033 |

| Base Year |

2023 |

| Estimate Year |

2024 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Product (Low Molecular Weight Heparin, Unfractionated Heparin, and Ultra-Low Molecular Weight Heparin), By End User (Hospitals, Blood & Stem Cell Bank, and Others) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA |

| Prominent Players |

Leo Pharma. Pfizer Inc, Sanofi SA, Dr Reddy’s Laboratories, Abbott Laboratories, Bayer AG, Sagent Pharmaceuticals, Aspen Holdings, Mylan N.V., OPOCRIN SPA, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |

Frequently Asked Questions

The Europe Heparin Market size is estimated to have a value of USD 4.0 billion in 2024 and is expected

to reach USD 7.1 billion by the end of 2033.

Some of the major key players in the Europe Heparin Market are Leo Pharma, Pfizer Inc, Sanofi SA, and

many others.

The market is growing at a CAGR of 6.6 percent over the forecasted period.

Contents

1.1.Objectives of the Study

1.3.Market Definition and Scope

2.Europe Heparin Market Overview

2.1.Global Europe Heparin Market Overview by Type

2.2.Global Europe Heparin Market Overview by Application

3.Europe Heparin Market Dynamics, Opportunity, Regulations, and Trends Analysis

3.1.1.Europe Heparin Market Drivers

3.1.2.Europe Heparin Market Opportunities

3.1.3.Europe Heparin Market Restraints

3.1.4.Europe Heparin Market Challenges

3.2.Emerging Trend/Technology

3.4.PORTER'S Five Forces Analysis

3.6.Opportunity Map Analysis

3.11.Supply/Value Chain Analysis

3.12.Covid-19 & Recession Impact Analysis

3.13.Product/Brand Comparison

4.Global Europe Heparin Market Value ((US$ Mn)), Share (%), and Growth Rate (%) Comparison by Product, 2017-2032

4.1.Global Europe Heparin Market Analysis by Product: Introduction

4.2.Market Size and Forecast by Region

4.3.Low Molecular Weight Heparin

4.4.Unfractionated Heparin

4.5.Ultra-Low Molecular Weight Heparin

5.Global Europe Heparin Market Value ((US$ Mn)), Share (%), and Growth Rate (%) Comparison by End User, 2017-2032

5.1.Global Europe Heparin Market Analysis by End User: Introduction

5.2.Market Size and Forecast by Region

5.4.Blood & Stem Cell Bank

5.5.Others (Laboratories, Acute Care Centers)

10.Global Europe Heparin Market Value ((US$ Mn)), Share (%), and Growth Rate (%) Comparison by Region, 2017-2032

10.1.1.North America Europe Heparin Market: Regional Analysis, 2017-2032

10.2.1.Europe Europe Heparin Market: Regional Trend Analysis

10.3.1.Asia-Pacific Europe Heparin Market: Regional Analysis, 2017-2032

10.3.1.7.Rest of Asia-Pacifc

10.4.1.Latin America Europe Heparin Market: Regional Analysis, 2017-2032

10.4.1.5.Rest of Latin America

10.5.Middle East and Africa

10.5.1.Middle East and Africa Europe Heparin Market: Regional Analysis, 2017-2032

11.Global Europe Heparin Market Company Evaluation Matrix, Competitive Landscape, Market Share Analysis, and Company Profiles

11.1.Market Share Analysis

11.3.2.Financial Highlights

11.3.5.Key Strategies and Developments

11.4.2.Financial Highlights

11.4.5.Key Strategies and Developments

11.5.2.Financial Highlights

11.5.5.Key Strategies and Developments

11.6.2.Financial Highlights

11.6.5.Key Strategies and Developments

11.7.Dr Reddy’s Laboratories

11.7.2.Financial Highlights

11.7.5.Key Strategies and Developments

11.8.2.Financial Highlights

11.8.5.Key Strategies and Developments

11.9.2.Financial Highlights

11.9.5.Key Strategies and Developments

11.10.Sagent Pharmaceuticals

11.10.2.Financial Highlights

11.10.3.Product Portfolio

11.10.5.Key Strategies and Developments

11.11.2.Financial Highlights

11.11.3.Product Portfolio

11.11.5.Key Strategies and Developments

11.12.2.Financial Highlights

11.12.3.Product Portfolio

11.12.5.Key Strategies and Developments

11.13.2.Financial Highlights

11.13.3.Product Portfolio

11.13.5.Key Strategies and Developments

11.14.2.Financial Highlights

11.14.3.Product Portfolio

11.14.5.Key Strategies and Developments

12.Assumptions and Acronyms