Market Overview

The Europe Insurtech Market is projected to reach USD 7.9 billion by 2025 and is expected to witness robust expansion, growing at a compound annual growth rate (CAGR) of 21.0% through 2034 to attain a market value of approximately USD 44.1 billion.

This growth trajectory highlights the accelerating adoption of digital insurance solutions, AI-driven platforms, big data analytics, blockchain integration, robo-advisory services, and cloud-based underwriting models across the European insurance sector. Increasing consumer demand for personalized policies, seamless claims processing, and mobile-first insurance platforms, combined with strong regulatory support for open insurance ecosystems and the rising influence of insurtech startups, will be key drivers fueling the market’s expansion.

The European Insurtech Market is undergoing rapid transformation, fueled by technological innovation, consumer demand, and a supportive regulatory framework. The European Insurance and Occupational Pensions Authority (EIOPA) emphasizes that digitalisation is now a central driver of insurance operations across the continent, with insurers adopting artificial intelligence, blockchain, cloud computing, telematics, and robo-advisory tools to strengthen underwriting, enhance fraud detection, and streamline claims management. These innovations are enabling insurers to move away from traditional, paper-based processes and toward automated, customer-centric platforms that deliver speed, transparency, and personalization.

Demographics and digital readiness provide Europe with a strong foundation. EUROSTAT reports that internet penetration exceeds 90% among people aged 16–44 in the EU, highlighting a tech-savvy generation that demands mobile-first services. Younger demographics, along with freelancers, gig economy workers, and SMEs, are particularly inclined toward flexible, usage-based, and on-demand insurance solutions. This consumer shift is creating opportunities for insurtech startups to deliver embedded insurance and micro-coverage products that can be purchased instantly and tailored in real time.

Such a scale underscores the importance of digital transformation to maintain resilience and competitiveness. Meanwhile, regulations such as GDPR and Solvency II are shaping the balance between innovation, consumer protection, and data security, while regulatory sandboxes in countries like the UK, France, and the Netherlands allow insurtech firms to test new business models safely.

Overall, the European Insurtech Market is positioned as a global leader in insurance innovation. Its blend of advanced digital infrastructure, regulatory alignment, and an increasingly digital-native population creates fertile ground for rapid insurtech adoption, driving a new era of embedded insurance, personalized products, and data-driven ecosystems.

Europe Insurtech Market: Key Takeaways

- Strong Market Growth: The Europe Insurtech Market is valued at USD 7.9 billion in 2025 and is projected to reach USD 44.1 billion by 2034, expanding at a CAGR of 21.0%.

- AI and Automation: Artificial intelligence, machine learning, and predictive analytics are at the core of European insurtech, driving efficiency in claims automation, fraud detection, underwriting, and customer personalization.

- Embedded Insurance Momentum: Partnerships between insurtech firms and industries such as e-commerce, mobility, and fintech are fueling embedded insurance, allowing policies to be purchased seamlessly at the point of sale.

- High Venture Capital Interest: European insurtech startups, including Wefox, Alan, Zego, and Hedvig, are attracting significant investment to scale operations and expand product offerings across the continent.

- IoT and Telematics Integration: The adoption of telematics in auto insurance and IoT devices in property insurance is enabling risk-based pricing, safer driving incentives, and improved loss prevention strategies.

- Regulatory Alignment: Frameworks like GDPR and Solvency II, along with regulatory sandboxes in the UK, France, Germany, and the Netherlands, are enabling safe innovation and enhancing consumer trust.

- Shift Toward Niche Markets: Insurtech firms are increasingly targeting underserved sectors, such as SMEs, freelancers, and gig economy workers, with modular, flexible, and on-demand coverage options.

Europe Insurtech Market: Use Cases

- AI-Powered Claims Automation: European insurers are increasingly deploying artificial intelligence and machine learning to streamline claims processes. Automation reduces manual intervention, accelerates settlement times, and enhances fraud detection. For example, AI-driven damage assessment in auto and property insurance lowers costs and improves customer satisfaction.

- Usage-Based Auto Insurance with Telematics: Insurtechs such as Zego and Flock leverage telematics to monitor driving behavior, mileage, and usage patterns in real time. This enables pay-as-you-drive and pay-how-you-drive policies, rewarding safer drivers with lower premiums and reducing accident-related losses for insurers.

- Embedded Insurance in Digital Ecosystems: Partnerships with e-commerce, mobility platforms, and fintech applications allow insurance to be purchased seamlessly at the point of sale. Consumers can add coverage for travel, electronics, or financial products instantly, improving accessibility and boosting insurer cross-selling opportunities.

- Health and Wellness Integration with Wearables: European insurtechs such as Alan combine wearable technology and telemedicine with health insurance offerings. Data from fitness trackers and medical devices enable personalized premiums, wellness incentives, and preventive care models, strengthening consumer engagement in health policies.

- Cybersecurity Insurance for SMEs: With cyberattacks rising across Europe, insurtech firms are creating dynamic, real-time cyber insurance solutions tailored to small and medium-sized enterprises. These policies use advanced analytics to assess threats and adjust coverage, helping businesses mitigate risks in the digital economy.

Europe Insurtech Market: Stats & Facts

European Insurance and Occupational Pensions Authority (EIOPA)

- 50% of non-life insurers already use AI; 24% of life insurers already use AI.

- A further 30% of non-life and 39% of life insurers expect to start using AI within three years.

- Around 80% of surveyed insurers outsource cloud data storage to BigTech cloud providers.

- Digital channels account for 19% of non-life gross written premiums and 9% of life gross written premiums.

- Customer service (such as chatbots) is the most common AI use area, followed by fraud detection and claims management.

- AI is also used for pricing, sales and distribution, and underwriting, though fewer insurers apply it across the full value chain.

- 66% of AI use cases are developed in-house.

- Only 16% of insurers have a dedicated AI strategy today; another 56% plan to develop one within three years.

- IoT, blockchain, and parametric products are currently used by a minority of insurers.

- Most undertakings report cyber-insurance market growth in the past two years, with products mainly targeted at corporates and SMEs.

Insurance Europe

- European insurers pay out over USD 1.1 trillion in claims annually (about USD 2.8 billion per day).

- They manage USD 11.6 trillion in assets invested in the economy.

- The sector writes roughly USD 735 billion in life premiums, USD 461 billion in property and casualty, and USD 190 billion in health annually.

- The industry employs about 920,000 people across Europe.

- Around 70% of insurer investments are within the EU.

European Central Bank (ECB)

- In the second half of 2024, euro-area non-cash payments totaled 77.6 billion transactions, up 8.6% year-on-year.

- Their total value reached USD 128.6 trillion, an increase of 3.8% year-on-year.

- In 2024, card payments made up 57% of all transactions; credit transfers 21%; direct debits 15%.

- In 2023, instant credit transfers accounted for 14% of credit transfer volumes and 4% of their value.

European Payments Council (EPC)

- In the second half of 2022, card payments represented 54% of all non-cash transactions; credit transfers 20%; direct debits 16%; e-money 7%.

- SEPA Instant Credit Transfer allows transfers up to USD 16,500 in under 10 seconds.

Eurostat

- In 2024, 93% of EU residents aged 16–74 used the internet in the previous three months.

- In 2024, 77% of internet users purchased goods or services online.

- In 2023, 63.9% of EU residents aged 16–74 used internet banking.

- In Denmark, nearly 97% of people used internet banking in 2023.

ENISA – EU Agency for Cybersecurity

- In 2024, 9% of observed cyber incidents targeted finance organisations, including banks and insurers.

- Between 2023 and mid-2024, there was a notable escalation in both the number and variety of cyberattacks across the EU finance ecosystem.

UK Financial Conduct Authority (FCA)

- The UK has over 11.7 million active open-banking users.

- More than 22.1 million open-banking payments are processed monthly (as of early 2025).

- One FCA sandbox cohort accepted 29 firms for live testing.

- Across the first five FCA sandbox cohorts, 118 firms were supported.

Open Banking Limited (UK implementation body)

- In June 2025, failed open-banking API calls totaled about 10.7 million, equal to 0.54% of all calls that month.

- Rejected API calls were about 2.7 million, or 0.13% of total calls.

Bank of England / Prudential Regulation Authority

- 33% of firms cite data protection and privacy as a key regulatory burden for AI use.

- 23% cite the FCA’s Consumer Duty as a regulatory constraint on AI.

- 20% cite other FCA rules as obstacles; 18% cite intellectual property clarity; 13% cite Consumer Duty clarity; 11% cite operational resilience and cyber rules.

Europe Insurtech Market: Market Dynamics

Driving Factors in the Europe Insurtech Market

Rising Demand for Flexible, Affordable, and On-Demand Insurance

One of the strongest growth drivers for the European insurtech market is the rising demand for transparent, flexible, and on-demand insurance solutions. Younger generations, particularly millennials and Gen Z, along with freelancers, gig economy workers, and SMEs, are reshaping demand by rejecting rigid, long-term policies that lack adaptability. These groups favor microinsurance, pay-per-use coverage, and subscription-based models that can be activated instantly and tailored to individual needs. For example, mobility insurance can now cover rides or car-sharing services per trip, while travel insurance can be embedded directly at the time of ticket purchase.

The adoption of mobile-first platforms, digital wallets, and embedded ecosystems accelerates the ability of insurtechs to deliver these solutions seamlessly. Furthermore, affordability remains critical, especially as households across Europe face inflationary pressures. By automating underwriting, using telematics, and eliminating intermediaries, insurtechs can reduce premiums and deliver fairer, risk-adjusted pricing. In rural areas or underserved communities, digital-first insurance expands access where traditional channels are limited. This strong consumer-driven demand for flexibility, transparency, and affordability directly aligns with the strengths of insurtech innovation, creating sustained market momentum across Europe.

Supportive Regulatory Environment Promoting Innovation

Europe’s regulatory landscape plays a central role in accelerating insurtech adoption. Frameworks such as GDPR ensure stringent data protection, giving consumers confidence in digital-first services, while Solvency II strengthens transparency and capital adequacy in the insurance sector.

Beyond compliance, regulators actively encourage innovation through initiatives such as regulatory sandboxes in the UK, France, Germany, and the Netherlands, which allow startups to test novel insurance models under controlled environments. These sandboxes provide clarity, reduce compliance burdens for early-stage firms, and accelerate time-to-market for digital products.

Open banking and open finance directives further support insurtechs by facilitating secure data-sharing between financial institutions and insurers, enabling personalized and cross-sector products. European regulators are also focusing on AI governance, ensuring that algorithm-driven underwriting remains fair, explainable, and non-discriminatory. By providing structured oversight while enabling innovation, European authorities create an environment where insurtech firms can thrive. This proactive regulatory stance differentiates Europe from other regions, as consumer protection and innovation are balanced, fostering trust and encouraging adoption of digital-first insurance solutions across the continent.

Restraints in the Europe Insurtech Market

Data Privacy Concerns and Cybersecurity Risks

One of the most pressing restraints in the European insurtech market is the heightened concern around data privacy and cybersecurity. With GDPR as the strictest data protection law globally, insurers must navigate complex compliance requirements when processing sensitive personal and behavioral data. Insurtech firms rely heavily on data from telematics, wearables, financial transactions, and IoT devices, all of which expose them to risks of cyberattacks, data breaches, and unauthorized exploitation. Consumer trust is fragile; a single data breach can result in reputational damage, regulatory penalties, and customer attrition.

European regulators have also intensified scrutiny on algorithmic decision-making, requiring explainability and fairness in AI-driven underwriting and claims processes. For startups with limited resources, the cost of implementing advanced cybersecurity infrastructure and compliance systems can be prohibitive, slowing innovation. The rising frequency of ransomware and phishing attacks in Europe’s financial sector adds further risk. Unless insurtech companies can ensure robust privacy safeguards and resilient cybersecurity frameworks, these challenges may act as significant barriers to adoption, particularly in consumer-facing insurance segments.

Legacy Infrastructure and Resistance from Traditional Insurers

Another critical restraint in Europe’s insurtech market is the challenge of integrating digital solutions with the legacy infrastructure of traditional insurers. Many incumbent companies continue to rely on decades-old IT systems, which are costly and complex to modernize. Integrating cloud-native applications, AI-driven underwriting, or blockchain-based claims systems into such environments often requires significant financial and operational investment. Furthermore, cultural resistance within established insurers slows collaboration with insurtech firms, as hierarchical structures and risk-averse attitudes dominate decision-making.

While partnerships between startups and incumbents are increasing, many legacy insurers still view insurtechs as disruptors rather than allies, limiting the pace of collaboration. For smaller insurers with limited resources, the challenges are even greater, as they lack the budgets to upgrade IT systems or adopt digital-first approaches. This technological inertia delays the scaling of innovative models such as embedded insurance and usage-based policies. Unless traditional insurers embrace modernization and adopt open collaboration with insurtech firms, the full potential of digital transformation in the European insurance industry will remain constrained.

Opportunities in the Europe Insurtech Market

Untapped Potential in Health, Life, and Cyber Insurance

Significant growth opportunities exist in health, life, and cyber insurance, where insurtech innovation is only beginning to gain momentum in Europe. Health insurance remains fragmented across EU states, with rising costs and aging populations driving demand for cost-efficient and personalized solutions. Insurtechs are leveraging telemedicine integration, wearable technology, and AI-driven health risk assessments to offer preventive care and wellness-linked policies.

Similarly, life insurance adoption among younger demographics remains low due to perceptions of complexity and cost. Digital-first insurtech firms are addressing this gap with simplified, gamified, and instant underwriting platforms that appeal to digitally native customers.

Cyber insurance represents another high-growth frontier, particularly as SMEs and corporates across Europe face escalating risks from ransomware, phishing, and data breaches. Insurtechs can deliver dynamic cyber policies using real-time analytics to assess vulnerabilities and adjust coverage accordingly. As Europe strengthens its digital economy through initiatives like the Digital Services Act, demand for cyber protection will expand. By addressing these underpenetrated segments with innovative models, insurtech firms can capture new revenue streams and reinforce Europe’s leadership in insurance innovation.

Ecosystem Integration and Cross-Sector Partnerships

Insurtech growth in Europe is further enabled by expanding partnerships across ecosystems that integrate insurance into broader consumer and business services. Collaborations between insurers, fintechs, e-commerce platforms, mobility providers, and health-tech companies are unlocking opportunities to embed insurance into everyday digital transactions. For example, automakers are partnering with insurers to embed usage-based auto coverage at the point of vehicle sale, while smart home providers integrate property insurance directly with connected devices. In healthcare, partnerships with telemedicine and wellness platforms enable bundled products that combine health services with insurance protection.

These collaborations create frictionless insurance access, enhance customer trust, and improve adoption rates. Insurtechs benefit from access to established customer bases and real-time behavioral data, while incumbents leverage digital innovation and agility from startups. The integration of insurance into non-traditional channels aligns with Europe’s broader digital ecosystem goals, supporting financial inclusion and customer empowerment. As partnerships proliferate, ecosystem-driven delivery models are set to dominate, creating diverse opportunities for product innovation and scaling across multiple industries.

Trends in the Europe Insurtech Market

Acceleration of Digitalisation and Embedded Insurance Models

The European insurance sector is experiencing a profound digital transformation, with insurtech companies pioneering embedded insurance models that integrate coverage seamlessly into consumer journeys. Instead of purchasing policies separately, European consumers can now access insurance at the point of sale for retail products, travel bookings, automotive purchases, and fintech transactions. This trend is reinforced by rising digital adoption across Europe, with EUROSTAT reporting over 93% internet usage among citizens aged 16–44. Regulatory frameworks, particularly the Single Digital Market and open finance initiatives, encourage cross-border digital integration, making it easier for insurers to offer embedded products at scale.

E-commerce platforms, mobility services, and fintech applications are embedding insurance options that can be activated in real time, reducing friction and enhancing accessibility. This shift is reshaping customer expectations, where insurance becomes invisible yet ever-present, aligned with the consumer’s lifestyle. For insurers, embedded distribution reduces acquisition costs, expands reach, and generates valuable behavioral data that strengthens predictive analytics. In Europe, where financial inclusion and digital readiness are high, embedded insurance is evolving into a dominant distribution channel.

Expansion of Artificial Intelligence, IoT, and Predictive Analytics

Artificial intelligence, IoT-enabled devices, and predictive analytics are driving hyper-personalization in European insurtech solutions. AI-powered chatbots, automated underwriting algorithms, and advanced fraud detection systems are transforming how insurers assess risk, set premiums, and handle claims. European regulators, through EIOPA and national bodies, actively monitor AI usage to ensure compliance with GDPR and ethical standards, creating a unique environment where technological adoption balances innovation with consumer protection. IoT devices, including telematics in vehicles and connected home sensors, are increasingly integrated into policies, enabling usage-based insurance models that reward safe driving and proactive risk management.

Wearables in health insurance support wellness-linked premiums, strengthening preventive care initiatives. Predictive analytics, meanwhile, allows insurers to detect fraud, anticipate climate-related risks, and forecast claim frequency, reducing operational losses. In Europe, where digital infrastructure and data literacy are advanced, insurers are leveraging AI and IoT not just for efficiency but also for customer engagement. The ability to provide individualized coverage in real time resonates strongly with Europe’s digitally native generations, positioning insurtech as a driver of competitive differentiation in the region’s evolving insurance landscape.

The Europe Insurtech Market: Research Scope and Analysis

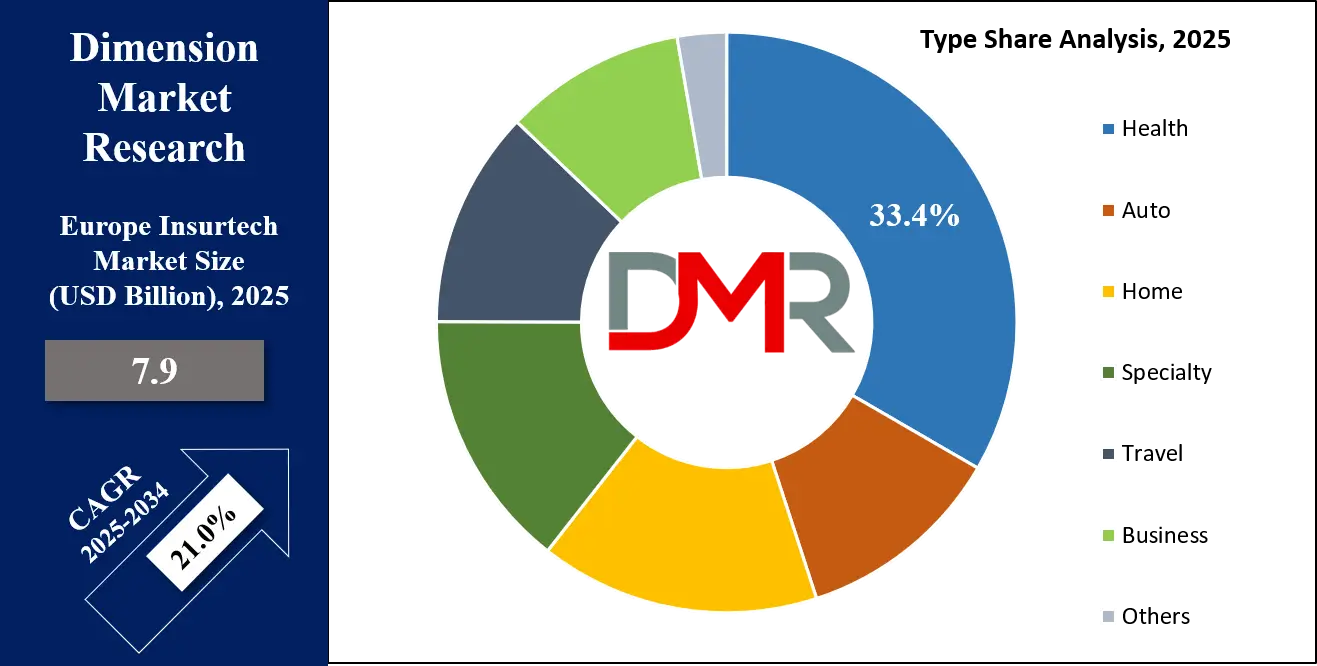

By Type Analysis

In the European insurtech market, the health insurance segment is projected to dominate in 2025, securing the largest revenue share. Europe’s demographic realities, aging populations, rising healthcare costs, and increased demand for preventive care make digital health solutions highly relevant. Insurtech platforms are bridging gaps by connecting insurers, healthcare providers, brokers, and consumers into integrated ecosystems.

AI and machine learning are streamlining claims processing, fraud detection, and risk assessment, while wearables and telemedicine enable personalized coverage. In countries like France, insurtech firms such as Alan SA are pioneering digital-first health insurance with mobile-first portals, instant approvals, and wellness-linked incentives. These platforms not only lower administrative costs but also increase transparency and accessibility, which are priorities under EU consumer protection regulations.

At the same time, the home insurance segment is expected to record the fastest growth. Europe faces escalating climate risks, with floods, wildfires, and storms becoming more frequent. This trend is driving demand for innovative, customizable property coverage. Insurtech firms such as Luko Insurance (France) and Getsafe Digital (Germany) are leveraging IoT devices and connected home sensors to offer proactive risk management solutions.

Policies can now adapt dynamically to a property’s risk profile, reducing reliance on brokers and expediting claims through automation. Furthermore, insurance is increasingly embedded into real estate and rental workflows, with coverage activated instantly when tenants sign digital contracts. These developments show how health and home insurance are being reshaped by digitalization, positioning insurtech as a driver of accessibility, personalization, and resilience in Europe.

By Technology Analysis

Cloud computing is expected to hold the largest share of Europe’s insurtech revenues in 2025, as insurers continue to migrate from legacy IT systems to agile, secure, and scalable cloud environments. Cloud platforms enable real-time claims processing, seamless integration with third-party apps, and rapid deployment of AI-powered services such as chatbots, fraud detection, and digital underwriting. With GDPR in place, cloud adoption also requires high standards of data protection, sovereignty, and compliance, making partnerships with providers such as AWS, Microsoft Azure, and European cloud alliances critical. Many insurtech startups rely on cloud-native infrastructure to scale operations quickly across multiple EU countries. The technology also supports API-driven ecosystems, enabling open finance collaboration between banks, fintechs, and insurers.

Meanwhile, blockchain technology is forecasted to achieve the fastest growth. Blockchain’s transparency and immutability are being used to create smart contracts that automate policy issuance and claims settlements, reducing disputes and operational inefficiencies. European insurers are exploring blockchain for parametric insurance models, particularly in agriculture and climate risk coverage, where payouts are triggered automatically by predefined events such as rainfall or temperature changes.

Companies like Etherisc (Germany) and B3i (Switzerland) are driving adoption, developing decentralized platforms that enhance trust, cut costs, and ensure compliance with Solvency II reporting requirements. Blockchain also plays a role in cybersecurity, an increasing concern for Europe’s financial ecosystem, by creating tamper-proof data exchanges between insurers, reinsurers, and intermediaries. Together, cloud and blockchain are revolutionizing the European insurance landscape, making it more customer-centric, efficient, and resilient against emerging risks.

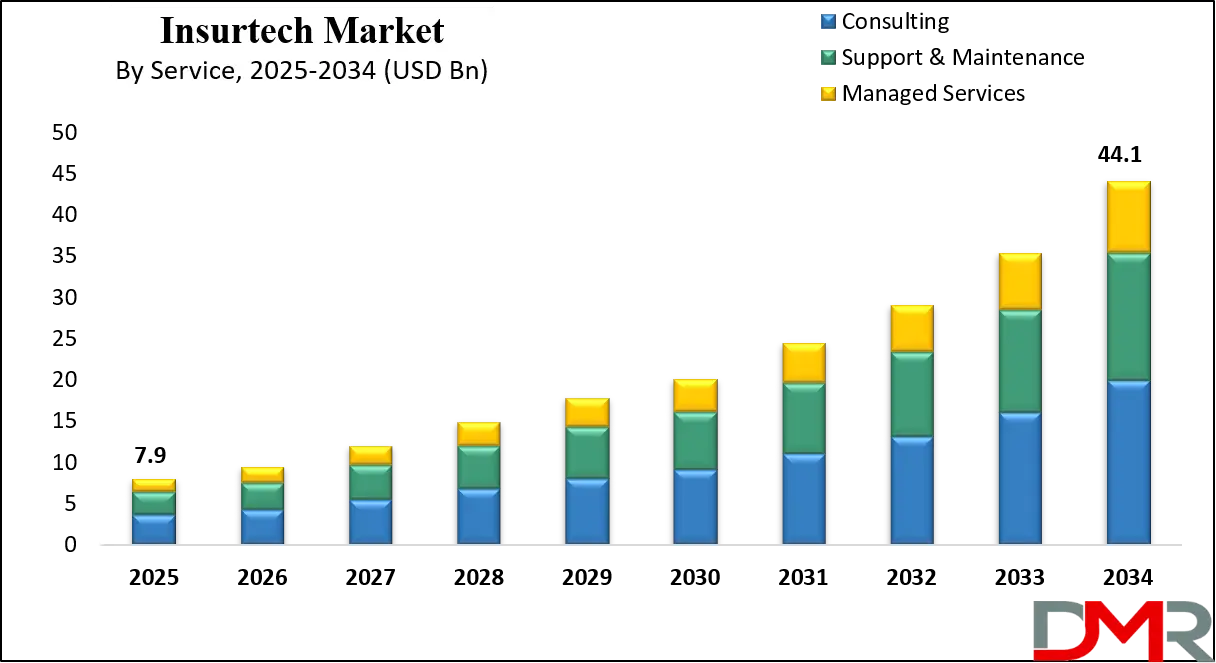

By Service Analysis

In the European insurtech market, managed services are expected to dominate by 2025, as insurers increasingly outsource digital transformation to specialized providers. Managed service providers help insurers modernize legacy systems, integrate AI, blockchain, and IoT, and maintain compliance with complex EU regulations. This is particularly relevant given Solvency II requirements, which place significant reporting and governance obligations on insurers.

Managed services deliver operational efficiency, cybersecurity protection aligned with GDPR, and optimized IT infrastructure that allows insurers to focus on innovation and customer engagement. Partnerships between insurtech firms and traditional insurers illustrate this trend, as incumbents seek to remain competitive in an increasingly digital market.

The support and maintenance segment is projected to be the fastest-growing during the forecast period. As insurers across Europe adopt advanced digital platforms, the demand for continuous technical support, system upgrades, and cybersecurity monitoring is rising. Cloud-native applications, AI-driven underwriting models, and blockchain-based claims systems require ongoing optimization to remain efficient and compliant.

Insurers in countries such as Germany, the UK, and France are heavily investing in IT support frameworks to ensure seamless digital distribution and 24/7 operations. Many mid-sized insurers that cannot afford in-house IT modernization are relying on insurtech vendors for end-to-end support, ensuring system reliability and customer satisfaction. Ultimately, managed services and technical support form the backbone of Europe’s insurtech transformation, helping insurers maintain agility while delivering secure, customer-centric insurance experiences.

By End User Analysis

The BFSI sector is projected to lead the European insurtech market in 2025, capturing the largest share of revenues. Banks and financial institutions are embedding insurance directly into digital ecosystems, leveraging widespread mobile banking adoption across Europe. Nearly two-thirds of EU citizens now use internet banking, creating opportunities for insurers to cross-sell products through integrated platforms.

Partnerships between banks, insurers, and startups are enabling predictive risk models, automated onboarding, and personalized policy offers. Insurtech firms like Wefox (Germany) and Qover (Belgium) are driving embedded insurance solutions in financial services, creating seamless experiences for customers while reducing distribution costs for insurers. BFSI’s embrace of insurtech reflects the sector’s pursuit of efficiency, data-driven decision-making, and enhanced customer loyalty in a competitive financial environment.

Meanwhile, the healthcare sector is expected to record the fastest growth. Europe’s healthcare systems are facing pressures from aging populations, rising costs, and the demand for digitization. Insurtech platforms are stepping in with blockchain-enabled patient data exchange, AI-powered risk profiling, and wearables that enable personalized health and wellness coverage. Firms like Alan SA (France) are pioneering mobile-first healthcare insurance platforms that integrate telemedicine and preventive care into insurance offerings.

Governments across Europe are also promoting interoperability and eHealth standards, which support the adoption of digital insurance. Insurtech firms are aligning with these initiatives by providing transparent, accessible, and wellness-oriented policies. This dual momentum in BFSI and healthcare underscores the diversity of insurtech’s impact in Europe, reshaping both financial services and healthcare delivery through innovation and digital-first strategies.

Europe Insurtech Market Report is segmented on the basis of the following:

By Type

- Health

- Auto

- Home

- Specialty

- Travel

- Business

- Others

By Technology

- Blockchain

- Cloud Computing

- IoT

- Machine Learning

- Robo Advisory

- Others

By Service

- Consulting

- Support & Maintenance

- Managed Services

By End User

- BFSI

- Automotive

- Manufacturing

- Transportation

- Government

- Health

- Retail

- Others

Impact of Artificial Intelligence on the Europe Insurtech Market

- Advanced Risk Assessment and Underwriting: AI enables European insurers to analyze diverse datasets, including financial behavior, telematics, and social indicators, delivering accurate risk profiles compliant with GDPR and Solvency II requirements. This allows for personalized premium pricing, reduces underwriting errors, and expands coverage to underserved demographics such as gig workers and SMEs.

- Enhanced Fraud Detection and Compliance: Fraudulent claims remain a growing challenge in Europe, especially with the rise of digital transactions. AI-driven anomaly detection identifies irregular claim behavior in real time, reducing financial losses. AI also strengthens regulatory compliance, helping insurers meet transparency and accountability expectations set by EIOPA and national regulators.

- Personalized Customer Engagement Across Multilingual Markets: AI-driven chatbots, voice assistants, and recommendation engines are enabling insurers to deliver hyper-personalized services in multiple European languages. By tailoring policy offerings to lifestyle, geography, and cultural preferences, insurers improve engagement, retention, and brand loyalty across fragmented European markets.

- Claims Management and Automation: European insurers increasingly adopt AI-driven automation to streamline claims. Computer vision tools assess auto or property damage, reducing reliance on manual inspections. This accelerates settlement times, lowers costs, and improves customer satisfaction, particularly in climate-risk-prone regions like Germany, France, and Italy.

- Predictive Analytics for Emerging European Risks: AI provides predictive insights into climate risks, demographic shifts, and cyber threats across Europe. For example, predictive models anticipate flooding or wildfire patterns to price home insurance dynamically. In health, AI helps track chronic disease trends in aging populations, supporting preventive care models.

- Cross-Border Policy Standardization: AI is assisting insurers in navigating Europe’s fragmented regulatory environment. By automating compliance checks and aligning with EU-wide standards, AI helps insurers design products that can be scaled across multiple countries while respecting local legal frameworks.

By Region

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

The Europe Insurtech Market: Competitive Landscape

The Europe insurtech market is highly competitive, shaped by a mix of fast-scaling startups, established insurers, and cross-sector collaborations with fintech and mobility platforms. Leading players such as Wefox (Germany), Alan (France), Zego (UK), Luko (France), Getsafe (Germany), and Qover (Belgium) have redefined insurance distribution and customer engagement by focusing on digital-first, customer-centric platforms. These firms leverage artificial intelligence, cloud-native infrastructure, IoT, and blockchain to deliver personalized, transparent, and embedded insurance solutions.

Incumbent insurers such as Allianz, AXA, and Generali are not passive competitors; they are actively investing in or partnering with insurtechs to accelerate digital transformation. Regulatory initiatives, including GDPR, Solvency II, and national regulatory sandboxes in the UK, France, and Germany, have fostered a supportive environment for both startups and established players, encouraging safe experimentation while maintaining consumer protection.

Venture capital activity remains strong, with Europe witnessing several multi-million-dollar funding rounds for insurtech firms focused on health, auto, cyber, and embedded insurance. Strategic acquisitions are also reshaping the market as larger insurers acquire niche insurtechs to expand digital capabilities. At the same time, competition is not confined within the sector; fintechs, e-commerce platforms, and digital banks are embedding insurance into their ecosystems, broadening the scope of competition.

Overall, the landscape reflects a hybrid model where nimble startups innovate at speed, traditional insurers modernize through collaboration, and ecosystem partners drive embedded distribution, positioning Europe as a global hub for insurtech innovation.

Some of the prominent players in the Europe Insurtech Market are:

- Wefox Insurance AG

- Clark Germany GmbH

- Coya AG

- Luko Insurance S.A.

- FRISS Fraud Detection Software B.V.

- Getsafe Digital GmbH

- Simplesurance GmbH

- INZMO Europe GmbH

- Alan SA

- Zego Insurance Limited

- Shift Technology SAS

- Hedvig AB

- Flock Ltd.

- Descartes Underwriting SAS

- Qover SA/NV

- Amodo Ltd.

- Bsurance GmbH

- CelsiusPro AG

- Leocare Technologies SAS

- Element Insurance AG

- Other Key Players

Recent Developments in the Europe Insurtech Market

- August 2025: European deal trackers highlighted strong capital activity in fintech and insurtech. Investor interest centered on companies like Wefox, Zego, and Alan, reflecting confidence in embedded insurance, AI adoption, and cross-border expansion strategies despite macroeconomic headwinds.

- July 2025: Wefox raised hundreds of millions to expand operations. Laka closed an USD 8.8 million Series B, while Wrisk secured USD 14 million funding, making July a record month for European insurtech investments across health, auto, and embedded insurance.

- June 2025: Zego advanced toward profitability and explored IPO options, preferring New York over London. The company expanded across European mobility markets, applying AI and data analytics to diversify offerings beyond traditional fleet and commercial vehicle insurance coverage.

- May 2025: Alan announced AI as its strategic growth driver, positioning itself as a digital health companion. Reporting strong ARR growth, Alan expanded services across France, Spain, and Belgium, underscoring Europe’s accelerating health-focused insurtech transformation momentum.

- April 2025: Wefox executed divestments under a restructuring plan, reflecting ongoing European insurtech consolidation. Incumbents and private equity firms engaged in acquisitions to strengthen portfolios, shifting capital toward digital-first platforms and embedded insurance distribution for competitive advantage.

- March 2025: Insurtech Insights Europe 2025, hosted in London, gathered firms like Wefox, Alan, Zego, and Getsafe alongside global insurers and investors. Discussions emphasized embedded insurance, AI-driven claims, climate-risk products, and collaborative pilots enhancing cross-border scalability.

- January 2025: Wefox secured significant funding to reinforce European expansion and enhance digital-first product offerings. The investment supported restructuring and innovation programs, establishing Wefox as one of Europe’s most prominent and competitive insurtech scaleups.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 7.9 Bn |

| Forecast Value (2034) |

USD 44.1 Bn |

| CAGR (2025–2034) |

21.0% |

| Historical Data |

2019 – 2024 |

| Forecast Data |

2026 – 2034 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Type (Health, Auto, Home, Specialty, Travel, Business, and Others), By Technology (Blockchain, Cloud Computing, IoT, Machine Learning, Robo Advisory, and Others), By Service (Consulting, Support & Maintenance, and Managed Services), By End User (BFSI, Automotive, Manufacturing, Transportation, Government, Health, Retail, and Others) |

| Regional Coverage |

Europe |

| Prominent Players |

Wefox Insurance AG, Clark Germany GmbH, Coya AG, Luko Insurance S.A., FRISS Fraud Detection Software B.V., Getsafe Digital GmbH, Simplesurance GmbH, INZMO Europe GmbH, Alan SA, Zego Insurance Limited, Shift Technology SAS, Hedvig AB, Flock Ltd., Descartes Underwriting SAS, Qover SA/NV, Amodo Ltd., Bsurance GmbH, CelsiusPro AG, Leocare Technologies SAS, Element Insurance AG, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |

Frequently Asked Questions

The Europe Insurtech Market size is estimated to have a value of USD 7.9 billion in 2025 and is expected to reach USD 44.1 billion by the end of 2034.

The market is growing at a CAGR of 21.0 percent over the forecasted period of 2025.

Some of the major key players in the Europe Insurtech Market are Wefox Insurance AG, Clark Germany GmbH, Coya AG, Luko Insurance S.A., FRISS Fraud Detection Software B.V., Getsafe Digital GmbH, Simplesurance GmbH, INZMO Europe GmbH, and many others.