Market Overview

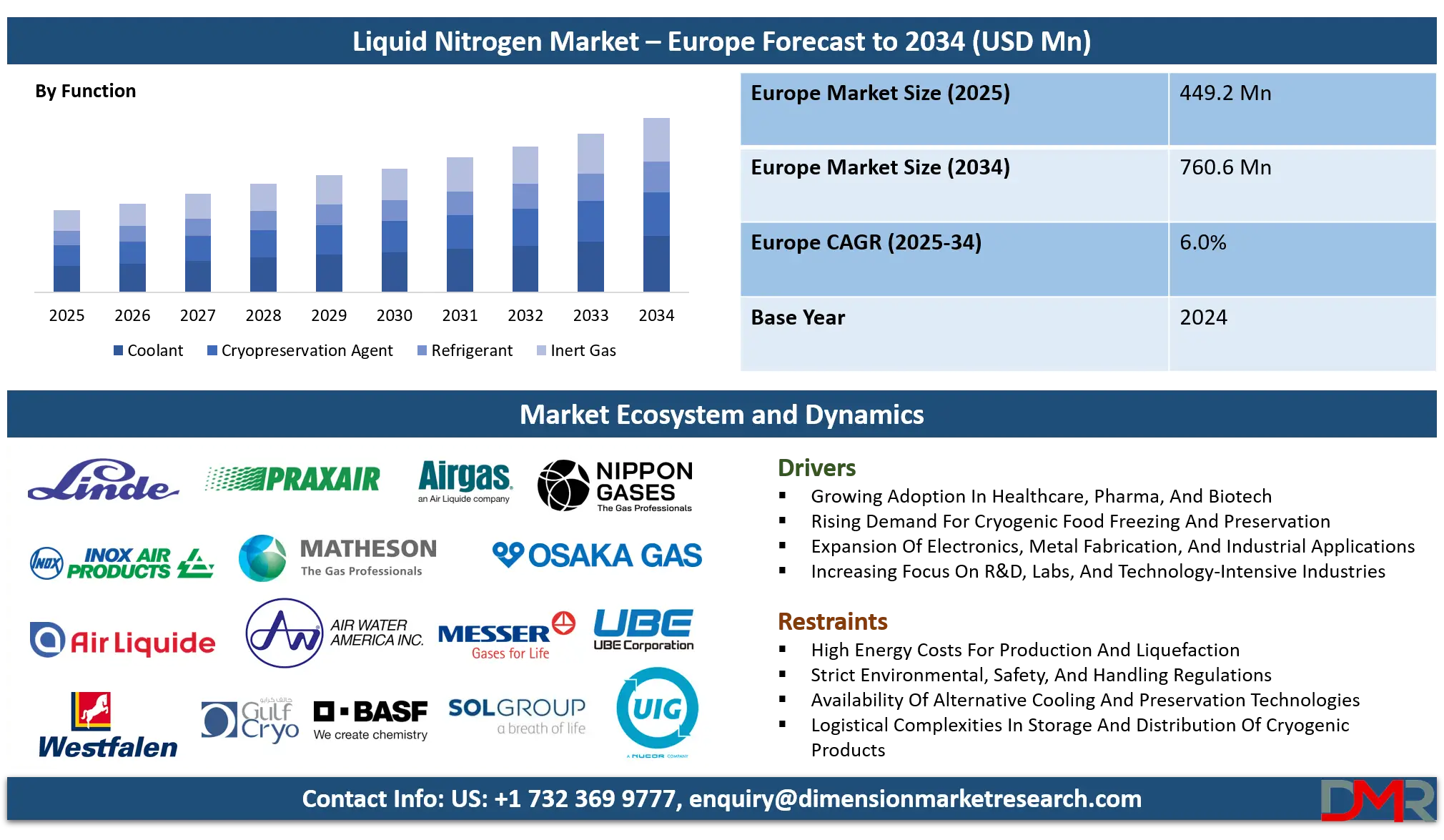

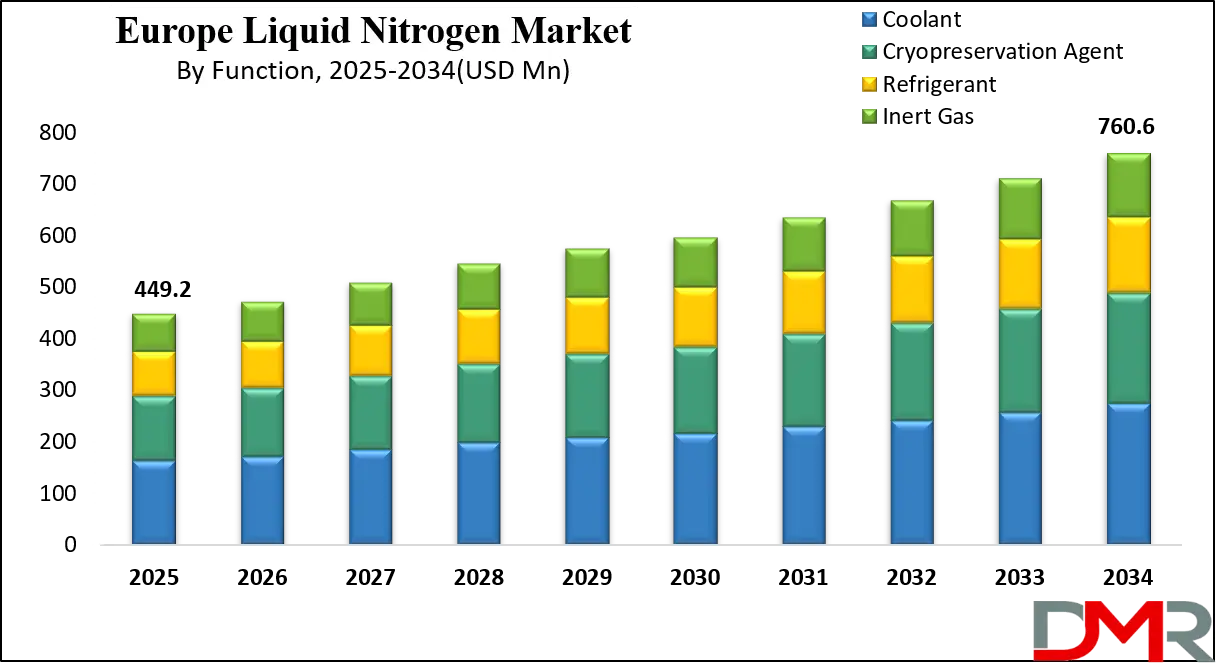

The Europe Liquid Nitrogen Market is projected to be valued at USD 449.2 million in 2025 and is expected to reach USD 760.6 million by 2034, expanding at a CAGR of 6.0% over the forecast period.

This steady growth is propelled by Europe's advanced manufacturing base, strong pharmaceutical and biotechnology sectors, and stringent food safety standards, all of which rely heavily on cryogenic technologies. The region's leadership in industrial innovation, coupled with ambitious climate policies and sustainability goals under the European Green Deal, is shaping demand patterns and driving technological evolution in liquid nitrogen production and application. Key growth drivers include expansion in healthcare cryopreservation, food processing modernization, semiconductor manufacturing investments, and the transition toward clean energy and circular economy solutions, where liquid nitrogen plays an enabling role.

Europe maintains a sophisticated industrial gas ecosystem characterized by high regulatory standards, mature infrastructure, and strong emphasis on sustainability and energy efficiency. The region's well-established healthcare sector, particularly in biobanking, reproductive medicine, and cell therapies, represents a high-value, stable demand segment with stringent quality requirements.

Furthermore, Europe's globally competitive food and beverage industry, renowned for quality and innovation, continues to adopt advanced cryogenic freezing and packaging technologies to maintain product excellence and extend shelf life. The European semiconductor industry, while smaller than Asia's, is strategically important and growing through initiatives like the European Chips Act, driving demand for ultra-high-purity gases. Additionally, Europe's chemical and pharmaceutical sectors, concentrated in manufacturing hubs like Germany's Rhine Valley and Belgium's Antwerp, provide substantial, consistent demand for inert gas applications.

Significant opportunities are emerging from Europe's dual focus on technological sovereignty and environmental sustainability. The European Green Deal's emphasis on decarbonization is accelerating the adoption of energy-efficient production technologies and circular economy applications for liquid nitrogen, including cryogenic recycling of plastics and advanced carbon capture solutions. The region's strength in healthcare innovation is fostering growth in cryopreservation for advanced therapies and biobanking.

Digital transformation across the industrial gas value chain through IoT-enabled smart tanks, AI-driven demand forecasting, and automated delivery systems is enhancing supply chain efficiency and customer service. Additionally, Europe's regulatory framework, which favors energy-efficient technologies, is driving the adoption of on-site nitrogen generation systems among medium and large industrial users seeking to reduce their carbon footprint and enhance supply security.

However, the market faces challenges from high energy costs, complex regulatory compliance, and competitive pressures. Europe's industrial energy prices, particularly for electricity and natural gas, are among the highest globally, directly impacting the cost structure of energy-intensive cryogenic air separation. Compliance with extensive EU regulations, including REACH, industrial emissions directives, transportation safety rules (ADR), and medical device regulations, adds operational complexity and cost. Furthermore, while the market is dominated by major multinational players, competition remains intense, particularly in standard applications, with price sensitivity in certain segments and increasing customer expectations for value-added services and sustainability credentials.

Despite these challenges, Europe's liquid nitrogen market is positioned for steady, innovation-driven growth. The region's strong industrial base, commitment to high-value manufacturing, and leadership in sustainability initiatives create a favorable environment for advanced applications. Success will depend on providers' ability to deliver reliable, efficient, and sustainable solutions while adapting to evolving regulatory requirements and customer expectations for digital integration and circular economy alignment.

Europe Liquid Nitrogen Market: Key Takeaways

- Sustainable Market Expansion: The European market is projected to grow from USD 449.2 million in 2025 to USD 760.6 million by 2034, achieving a CAGR of 6.0%. Growth is driven by healthcare innovation, food processing standards, and strategic industrial investments, tempered by high energy costs and regulatory complexity.

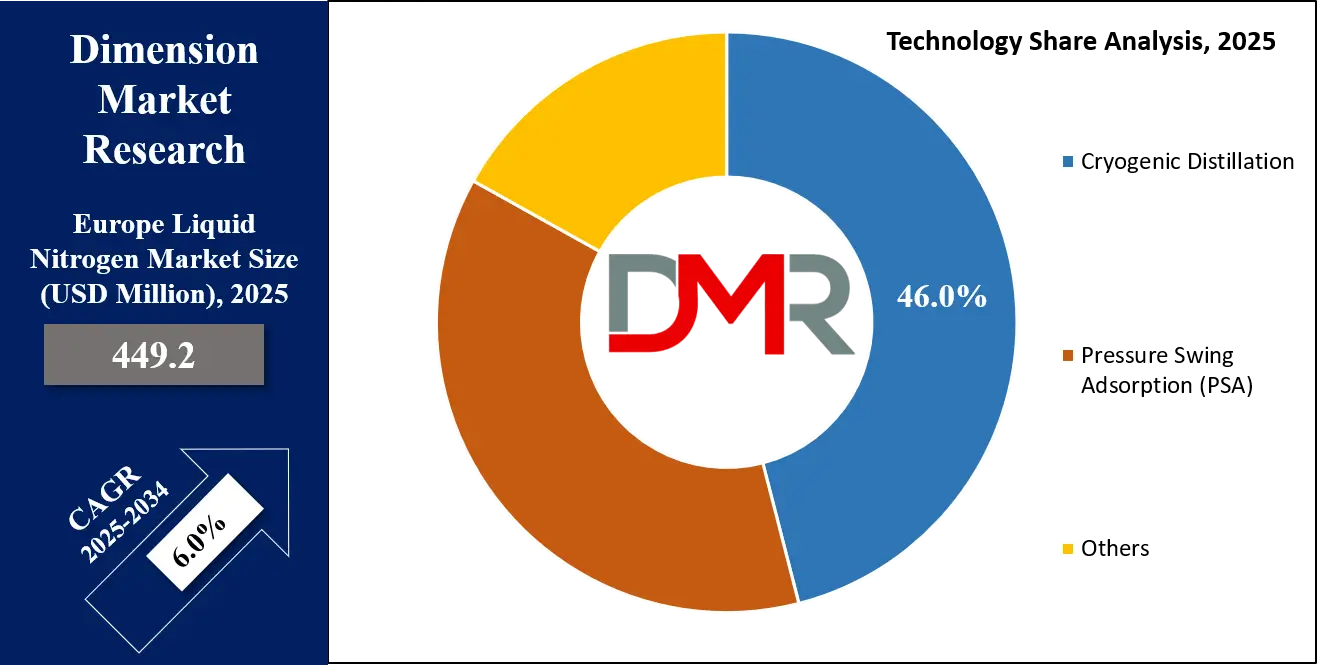

- Technology Mix Evolution: Cryogenic Distillation dominates large-scale production (~70% share), but Pressure Swing Adsorption (PSA) and on-site generation are growing at >6% CAGR, driven by energy efficiency goals and supply security concerns among industrial users.

- Healthcare as Premium Growth Segment: The Healthcare sector represents the highest-value growth segment, with demand for cryopreservation in biobanking, cell therapies, and reproductive medicine expanding at approximately 7.5% CAGR, supported by Europe's advanced medical infrastructure and regulatory frameworks.

- Food & Beverage: Volume Leader with Quality Focus: The Food & Beverage sector is the largest end-user by volume, consuming over 35% of Europe's liquid nitrogen, driven by stringent EU food safety standards, demand for premium frozen products, and advanced modified atmosphere packaging applications.

- Sustainability Driving Distribution Innovation: Bulk tank delivery serves core industrial demand, but microbulk systems and on-site generation are gaining significant traction (growing at 8% CAGR), supported by EU energy efficiency directives and corporate sustainability commitments.

Europe Liquid Nitrogen Market: Use Cases

- Pharmaceutical & Biotech Cryopreservation: European pharmaceutical companies and biobanks utilize liquid nitrogen for long-term preservation of cell lines, stem cells, vaccines, and biological samples at -196°C. Compliance with EU Good Manufacturing Practice (GMP) and Good Distribution Practice (GDP) guidelines requires validated storage systems, documented temperature monitoring, and guaranteed supply continuity for critical biological materials in facilities across Germany, Switzerland, the UK, and Scandinavia.

- Premium Food Processing & Cryogenic Freezing: European food processors employ liquid nitrogen for Individual Quick Freezing (IQF) of premium seafood, berries, gourmet vegetables, and prepared meals. The rapid freezing preserves texture, flavor, and nutritional value superior to mechanical methods. Additionally, liquid nitrogen enables crust freezing of bakery products and creates inert atmospheres in Modified Atmosphere Packaging (MAP) to extend shelf life while maintaining product quality, meeting stringent EU food safety regulations (EC No 178/2002).

- Semiconductor Manufacturing & Electronics Testing: European semiconductor fabs and electronics manufacturers in Germany, France, and Ireland use ultra-high-purity liquid nitrogen for wafer testing, chamber purging, and equipment cooling. Applications include thermal testing of microprocessors, creating inert environments during deposition processes, and cooling superconducting magnets in advanced manufacturing equipment, with purity requirements often exceeding 99.999% to prevent contamination.

- Chemical Process Safety & Inerting: Europe's chemical industry, concentrated in the Rhine Valley and Benelux regions, utilizes liquid nitrogen for reactor blanketing, pipeline purging, and storage tank inerting to prevent oxidation and explosive atmospheres during the production of specialty chemicals and pharmaceuticals. This is particularly critical for processes involving pyrophoric materials or oxygen-sensitive compounds under ATEX directives.

- Metal Treatment & Advanced Manufacturing: European automotive and aerospace manufacturers apply liquid nitrogen for cryogenic treatment of high-performance components (engine parts, landing gear, tooling) to enhance wear resistance and dimensional stability. Additional applications include shrink-fitting for precision assemblies, cryogenic cooling during machining of heat-sensitive alloys, and inerting during laser cutting and welding processes in Germany, Italy, and France.

Europe Liquid Nitrogen Market: Stats & Facts

European Union & Industry Data Sources

- Eurostat: Tracks industrial gas production under NACE code 20.11 ("Manufacture of industrial gases"). Latest data indicates the broader EU industrial gas market exceeded USD 8 billion in annual production value.

- European Industrial Gases Association (EIGA): Provides industry statistics, safety standards, and sustainability reports for the European industrial gases sector, representing over 90% of production capacity across Europe.

- European Chemicals Agency (ECHA): Administers REACH regulations affecting chemical substances, including classification and labeling requirements for nitrogen under specific conditions.

- European Food Safety Authority (EFSA): Regulates liquid nitrogen as a food additive (E941) for freezing and packaging applications, establishing purity and safety standards for food contact.

- European Medicines Agency (EMA): Sets guidelines for cryopreservation of biological medicines and advanced therapy medicinal products (ATMPs), influencing healthcare sector requirements.

- ADR (European Agreement concerning the International Carriage of Dangerous Goods by Road): Governs transportation of cryogenic liquids across European road networks, requiring specialized equipment and trained personnel.

Production & Infrastructure Distribution

- Major production clusters are located near key industrial regions: Germany's Ruhr Valley (chemicals, manufacturing), Benelux (chemicals, petrochemicals), France's Lyon-Grenoble corridor (pharmaceuticals, electronics), and Northern Italy (manufacturing, food processing).

- Europe has approximately 180 large-scale air separation units (ASUs), with Germany, France, and the UK hosting the highest concentration.

Regulatory & Policy Impact

- The European Green Deal and Fit for 55 package are driving investments in energy-efficient production technologies and circular economy applications for industrial gases.

- The European Chips Act (USD 43 billion investment) is stimulating semiconductor manufacturing capacity, with corresponding demand for supporting industrial gas infrastructure.

- EU Emission Trading System (ETS) costs directly affect energy-intensive air separation operations, incentivizing efficiency improvements and renewable energy adoption.

Energy Cost Context

- European industrial electricity prices are approximately 40-60% higher than in the US and 2-3 times higher than in China, making energy efficiency a critical competitive factor for cryogenic production.

- Natural gas price volatility, particularly following geopolitical developments, significantly impacts production economics for gas-based ASUs.

Methodology/Data Availability

- Comprehensive market data is available through EIGA publications, company annual reports of major producers (Linde, Air Liquide, Air Products), and Eurostat PRODCOM data for industrial gases (code 20.11.13).

- Country-specific data is accessible through national statistical offices and industry associations in key markets like Germany (BDBe), France (SNIF), and the UK (BOC, part of Linde).

Europe Liquid Nitrogen Market: Market Dynamics

Driving Factors in the Europe Liquid Nitrogen Market

Advanced Healthcare Innovation and Regulatory Frameworks

Europe's globally leading position in pharmaceutical innovation, biotechnology, and medical research creates robust, high-value demand for liquid nitrogen. The region is at the forefront of advanced therapy medicinal products (ATMPs), including cell and gene therapies, which depend absolutely on cryogenic preservation at -196°C. Additionally, Europe's extensive network of biobanks for medical research, growing IVF sector, and blood banking infrastructure all rely on a reliable liquid nitrogen supply. Strict EU regulatory frameworks (GDP, GMP) for biological materials mandate validated cold chains and documented storage conditions, creating premium service requirements and driving adoption of advanced monitoring and supply assurance solutions from gas providers.

Food Quality Standards and Processing Innovation

Europe's food and beverage industry is characterized by exceptionally high quality standards, consumer demand for premium products, and stringent food safety regulations. Liquid nitrogen enables processors to meet these demands through superior freezing technologies that preserve texture, flavor, and nutritional content better than mechanical methods. The growth of convenience foods, premium frozen categories (berries, seafood, gourmet meals), and advanced packaging solutions (MAP) all drive consumption. Furthermore, EU initiatives to reduce food waste (Farm to Fork Strategy) are encouraging technologies that extend shelf life, where nitrogen-based MAP plays a significant role.

Restraints in the Europe Liquid Nitrogen Market

High and Volatile Energy Costs

Europe's industrial energy prices represent the most significant constraint on market competitiveness. Cryogenic air separation is extremely energy-intensive, with electricity costs constituting 50-70% of production costs. European industrial electricity prices are substantially higher than in other major economies due to carbon costs, taxes, and renewable energy levies. The 2022-2023 energy crisis dramatically highlighted this vulnerability, with spot prices increasing 5-10 times in some markets, forcing temporary plant shutdowns and contract renegotiations. While prices have moderated, they remain structurally high, squeezing margins and making European production less competitive against imports in border regions.

Regulatory Complexity and Compliance Costs

Operating in the EU requires navigating one of the world's most comprehensive regulatory environments. For liquid nitrogen producers and distributors, this includes compliance with REACH for chemical substances, Seveso III Directive for major accident hazards, ATEX for explosive atmospheres, ADR/RID for transportation, and various national implementations of EU directives. For healthcare applications, additional layers of GDP, GMP, and medical device regulations apply. This regulatory density increases administrative burdens, requires specialized staff, and adds significant compliance costs, particularly challenging for smaller players and creating barriers to market entry and expansion.

Opportunities in the Europe Liquid Nitrogen Market

Energy Transition and Circular Economy Applications

The European Green Deal and circular economy action plan are creating new application frontiers for liquid nitrogen. In carbon capture, cryogenic technologies using liquid nitrogen are being developed for direct air capture and point-source emissions. In recycling, cryogenic grinding with liquid nitrogen enables efficient separation and recovery of materials from complex waste streams like electronics, composites, and tires. In energy storage, liquid air energy storage (LAES) systems use liquefied air (78% nitrogen) as a medium for storing renewable electricity. Companies that can develop and commercialize these sustainable applications can access new funding streams (EU innovation funds) and align with corporate sustainability goals.

Digitalization and Service Model Innovation

Europe's advanced digital infrastructure and IoT adoption enable next-generation service models. Smart tank telemetry with real-time monitoring and predictive refill algorithms can optimize delivery routes, reduce truck kilometers (and associated emissions), and prevent stockouts. Digital platforms can provide customers with detailed consumption analytics, sustainability reporting (carbon footprint of their gas supply), and automated ordering. For healthcare customers, validated digital monitoring solutions that integrate with quality management systems address regulatory requirements for temperature-controlled storage. These digital services create differentiation beyond product supply and improve customer stickiness.

Trends in the Europe Liquid Nitrogen Market

Decentralization and On-site Generation Growth

Driven by energy security concerns, sustainability goals, and supply chain resilience considerations, European industrial customers are increasingly evaluating on-site nitrogen generation. Pressure Swing Adsorption (PSA) and membrane systems, sometimes coupled with small liquefiers, allow medium-to-large users to produce their own nitrogen, avoiding transportation costs and supply risks. This trend is accelerated by EU policies promoting energy efficiency and renewable energy integration, and on-site generation can be optimized to run on a facility's own renewable power. Gas companies are adapting by offering "gas-as-a-service" models where they own and operate the on-site equipment.

Sustainability Integration Across the Value Chain

Sustainability is becoming a core competitive dimension. Producers are investing in: Energy-efficient ASUs with heat integration and advanced compressors; Renewable power sourcing through PPAs for their plants; Carbon footprint tracking and reduction programs for their products; and Circular solutions like recovering waste cold for other processes. Customers, particularly multinational corporations with science-based targets, are increasingly requesting Environmental Product Declarations (EPDs) and low-carbon supply options. This is transforming the value proposition from commodity supply to sustainable partnership.

Europe Liquid Nitrogen Market: Research Scope and Analysis

By Technology Analysis

Cryogenic Distillation is projected to remain the technological backbone for large-scale production across Europe, favored for its ability to produce high-purity liquid nitrogen, oxygen, and argon simultaneously. European ASUs are among the world's most energy-efficient, incorporating advanced heat integration, turbo-expanders, and process optimization systems to minimize specific energy consumption, a critical factor given high European electricity prices. The technology is evolving with hybrid systems that integrate with renewable power sources and carbon capture readiness features. However, the high capital intensity and energy requirements make new greenfield ASU investments challenging, leading to more brownfield expansions and efficiency upgrades.

Pressure Swing Adsorption (PSA) technology is experiencing accelerated adoption in Europe, particularly for on-site generation of gaseous nitrogen, with growing integration of liquefaction modules for liquid production. European manufacturers lead in developing energy-optimized PSA systems with advanced valve technologies, smart cycling algorithms, and heat recovery. Growth is driven by mid-sized industrial users in food processing, metal treatment, and chemicals seeking to reduce supply chain carbon footprint (eliminating truck deliveries) and secure supply. The technology benefits from EU funding for industrial energy efficiency and circular economy projects.

Other Technologies include Membrane Separation for lower-purity applications (typically 95-99.5% nitrogen), valued for simplicity and low maintenance in applications like tire inflation and food packaging. Cryogenic Liquid Vaporizers are seeing innovation with ambient air vaporizers that eliminate steam or electrical heating requirements, improving overall energy efficiency of the supply chain. Liquid Air Energy Storage (LAES) represents an emerging application technology rather than a production method, using liquefied air (predominantly nitrogen) as an energy storage medium for grid balancing.

By Function Analysis

As a Refrigerant/Cryogen, liquid nitrogen's extreme cold (-196°C) is exploited across multiple sectors. In food processing, it enables rapid freezing that preserves cellular structure. In electronics, it provides precise low-temperature environments for testing. In healthcare, it facilitates cryosurgery and sample preservation. The European market for this function is characterized by high-quality requirements, particularly in food and healthcare, where process validation and documentation are paramount.

As an Inert Gas, nitrogen's chemical inertness is critical for safety and quality. Applications include blanketing of chemical reactors to prevent fires/explosions (under ATEX directive), inerting of food packaging (MAP under EU food contact regulations), and purging of pipelines and storage tanks. Europe's stringent safety regulations for chemical and pharmaceutical manufacturing make this a stable, high-compliance demand segment.

As a Cryopreservation Agent, this represents the most specialized, high-value function. Liquid nitrogen enables long-term storage of biological materials at temperatures where all biological activity ceases. This is essential for biobanks (research and therapeutic), cell and gene therapy products, reproductive cells (IVF), and vaccine storage. The European market for this function requires guaranteed supply reliability, validated storage equipment, and comprehensive documentation for regulatory compliance (GDP, GMP).

By Storage and Distribution Method Analysis

Bulk Tanks & Microbulk Systems are projected to dominate supply to industrial and large commercial customers. Europe has a mature infrastructure of customer-site storage tanks supplied by cryogenic tankers. Microbulk (typically 500-5,000 liters) is growing rapidly, particularly for medium-sized food processors and manufacturers, offering a balance between the economics of bulk supply and the flexibility of cylinders. European microbulk systems often incorporate advanced telemetry for remote monitoring and predictive delivery.

Cylinders & Dewars serve fragmented, lower-volume markets including small laboratories, hospitals, workshops, and retail food outlets. The European cylinder market is highly standardized with common valve connections (particularly for medical applications), but faces pressure from sustainability initiatives to reduce transportation frequency and improve cylinder tracking/management.

On-site Generation is gaining significant traction, aligned with EU energy efficiency and industrial decarbonization goals. Systems range from small PSA units for gaseous nitrogen to larger installations with liquefaction capabilities. The business model is shifting from product sale to service provision, where gas companies may own and operate the on-site equipment, charging for output or through full-service contracts.

Pipeline Supply exists in major industrial clusters like the Rhine Valley and Antwerp port, where large chemical complexes are directly connected to ASUs via pipeline networks, representing the most efficient delivery method for very large consumers.

By End-user Analysis

Food & Beverage is poised to be the largest volume segment, driven by Europe's high-quality food standards and advanced processing sector. Applications include IQF freezing of premium products, crust freezing of bakery items, cryogenic grinding of spices, and MAP packaging. The sector is characterized by stringent hygiene and food safety requirements (HACCP, ISO 22000) and growing demand for sustainable processing technologies.

Healthcare & Life Sciences is the highest-value growth segment. Europe is a global leader in pharmaceutical innovation, biotechnology, and medical research. Demand comes from biobanks, pharmaceutical companies (particularly for ATMPs), IVF clinics, hospitals (for cryosurgery and sample storage), and research institutions. This segment demands ultra-reliable supply, validated equipment, and comprehensive quality documentation.

Chemicals & Pharmaceuticals represents steady, high-volume demand primarily for inerting applications. Europe's chemical industry, particularly in Germany, Belgium, and the Netherlands, uses nitrogen for reactor blanketing, purging, and safety systems. The pharmaceutical subset has additional purity and validation requirements for GMP manufacturing.

Electronics & Semiconductors, while smaller than in Asia or the US, are strategically important and growing through the European Chips Act. Demand is for ultra-high-purity nitrogen for wafer fabrication and testing, concentrated in clusters in Germany, France, Ireland, and Eastern Europe.

Automotive & Aerospace utilizes nitrogen for cryogenic treatment of high-performance components, shrink-fitting, and inerting applications. Europe's strong automotive manufacturing base (particularly in Germany and Central Europe) and aerospace sector (Airbus) provide stable demand.

Metallurgy & Manufacturing includes applications in metal heat treatment, laser cutting assist gas, and general manufacturing inerting, with demand correlating with overall industrial production levels across Europe.

Europe Liquid Nitrogen Market Report is segmented on the basis of the following:

By Technology

- Cryogenic Distillation

- Pressure Swing Adsorption (PSA)

- Others

By Function

- Coolant

- Cryopreservation Agent

- Refrigerant

- Inert Gas

By Storage and Distribution Method

- Cylinders & Dewars

- Bulk Tanks

- On-site Generation

By End-user

- Food & Beverage

- Healthcare

- Electronics & Semiconductors

- Chemicals & Pharmaceuticals

- Automotive & Aerospace

- Metallurgy

By Region

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Impact of Artificial Intelligence on the Europe Liquid Nitrogen Market

- Energy-Optimized Production Scheduling: AI algorithms analyze electricity price forecasts (day-ahead markets, intraday trading), renewable energy availability, and demand patterns to optimize ASU operation. Systems can recommend running at full capacity during low-price/high-renewable periods and reducing during peak times, significantly reducing energy costs while maintaining supply critical in Europe's volatile energy markets.

- Intelligent Logistics & Route Optimization: AI-powered route planning systems incorporate real-time traffic data, weather conditions, customer inventory levels (from IoT sensors), delivery time windows, and vehicle constraints to optimize cryogenic tanker routes across complex European road networks. This minimizes fuel consumption, reduces emissions, improves delivery reliability, and helps comply with EU mobility and emissions regulations.

- Predictive Maintenance for Critical Infrastructure: Machine learning models analyze sensor data from ASU compressors, distillation columns, vaporizers, and storage tanks to predict equipment failures before they occur. This enables condition-based maintenance, reduces unplanned downtime (critical for healthcare and semiconductor customers), and extends asset life, particularly valuable for capital-intensive equipment in the high-cost European operating environment.

- Demand Forecasting with Macro-Economic Integration: Advanced AI models incorporate not just historical consumption but also macroeconomic indicators (industrial production indices, PMI data), weather patterns affecting food freezing demand, and even pharmaceutical product launch timelines to create highly accurate demand forecasts. This improves inventory management across Europe's distributed production and storage network.

- Regulatory Compliance & Documentation Automation: AI-powered systems can automatically generate and manage the extensive documentation required for EU regulatory compliance, including batch records, transportation documents (ADR), quality certificates, and environmental reporting. Natural language processing can monitor regulatory updates and alert to necessary changes in procedures or documentation.

Europe Liquid Nitrogen Market: Competitive Landscape

The European liquid nitrogen market is characterized by a consolidated structure with strong multinational players, regional specialists, and a focus on sustainability and service differentiation. The market is dominated by three global giants, Linde plc, Air Liquide, and Air Products, who together control the majority of large-scale production capacity and own extensive distribution networks across the continent. These companies compete on scale, technological capability, and ability to serve multinational customers with consistent standards across borders.

Linde plc (with BOC in the UK) maintains a leading position with a dense network of ASUs and a strong presence in key industrial regions. Air Liquide has particularly strong positions in France, Benelux, and Germany, with significant healthcare and electronics segments. Air Products has major facilities in the Netherlands and the UK, with strengths in chemicals and energy applications. Beyond the global players, Messer Group (now owned by a consortium) has strong positions in Germany and Central Europe, while Nippon Sanso Holdings (through its European subsidiaries) competes in selected markets and segments.

Competition operates on multiple levels: for large industrial contracts (chemical complexes, semiconductor fabs), competition is based on reliability, technical capability, and increasingly on carbon footprint of supply; in the healthcare and food segments, quality systems, regulatory compliance, and service levels are key differentiators; for smaller commercial customers, distribution network density, responsiveness, and digital service offerings matter most. A significant trend is competition from alternative supply models, particularly on-site generation equipment providers (not always traditional gas companies), which is transforming some customer relationships from product supply to service provision.

Some of the prominent players in Europe Liquid Nitrogen Market are:

- Linde

- Air Liquide

- Air Products

- SOL Group

- Praxair (Linde)

- Nippon Sanso Holdings

- Ube Corporation

- Air Water

- Osaka Gas

- Messer Group

- Matheson Tri-Gas

- Taiyo Nippon Sanso

- Gulf Cryo

- Iwatani Corporation

- Westfalen AG

- BASF SE

- Cryotec Anlagenbau

- Universal Industrial Gases

- Southern Industrial Gas

- Yingde Gases Group

- Other Key Players

Recent Developments in Europe Liquid Nitrogen Market

- March 2025: Air Liquide inaugurated Europe's first "green" air separation unit in Antwerp, Belgium, powered entirely by renewable energy through a long-term PPA and equipped with carbon capture technology, reducing the carbon footprint of its nitrogen production by over 90%.

- January 2025: The European Medicines Agency (EMA) published new guidelines requiring continuous digital monitoring and blockchain-based chain-of-custody documentation for cryopreserved advanced therapy medicinal products (ATMPs), driving immediate demand from pharmaceutical companies for upgraded liquid nitrogen storage and monitoring solutions.

- November 2024: Linde announced a USD 300 million investment to expand liquid nitrogen capacity in Germany's Saxony region, specifically to support new semiconductor fabrication plants being built under the European Chips Act, including a dedicated pipeline network to the fab cluster.

- September 2024: A consortium of European food processors, including Nestlé and Danone, launched a joint initiative to standardize liquid nitrogen-based freezing protocols across their supply chains, aiming to reduce energy consumption by 20% while maintaining product quality, working closely with gas suppliers on optimization.

- July 2024: Messer Group deployed a fleet of LNG-powered cryogenic tankers in Germany, reducing CO2 emissions from transportation by approximately 25% compared to diesel, responding to both customer sustainability requirements and German transport emission regulations.

- May 2024: The European Commission approved funding for five pilot projects using liquid nitrogen-based cryogenic recycling technologies for complex plastic and composite waste streams, under the Circular Economy Innovation Fund, potentially creating new demand centers.

- March 2024: Air Products completed the acquisition of a specialist Scandinavian medical gas company, strengthening its position in the Nordic healthcare market, particularly in cryopreservation services for biobanks and cell therapy companies.

- January 2024: Following the energy crisis, several major chemical companies in the Rhine Valley signed 10-year "energy-linked" liquid nitrogen supply contracts with price mechanisms tied to renewable energy PPA rates rather than grid electricity prices, sharing energy cost risks with suppliers.

- November 2023: Linde launched its "Blue Nitrogen" certified low-carbon product line across Europe, with carbon footprint verified by third parties and up to 50% lower lifecycle emissions than standard product, targeting multinational customers with science-based emission targets.

- September 2023: A major European automotive manufacturer standardized liquid nitrogen cryogenic treatment for all its high-performance electric vehicle motor components, signing a pan-European supply agreement with Air Liquide covering 12 manufacturing plants.

- June 2023: The UK's National Health Service (NHS) initiated a centralized procurement framework for liquid nitrogen and cryogenic storage services for its network of biobanks and cell therapy centers, emphasizing sustainability criteria and digital monitoring capabilities.

- April 2023: A Dutch agricultural cooperative invested in Europe's largest liquid nitrogen-based cryogenic freezing facility for fruits and vegetables, utilizing excess renewable energy from nearby wind farms to power the ASU during off-peak hours.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 742.3 Mn |

| Forecast Value (2034) |

USD 1,279.0 Mn |

| CAGR (2025–2034) |

6.2% |

| Historical Data |

2019 – 2024 |

| Forecast Data |

2026 – 2034 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Technology (Cryogenic Distillation, Pressure Swing Adsorption (PSA), Others), By Function (Coolant, Cryopreservation Agent, Refrigerant, Inert Gas), By Storage and Distribution Method (Cylinders & Dewars, Bulk Tanks, On-site Generation), By End-user (Healthcare, Food & Beverage, Electronics & Semiconductors, Chemicals & Pharmaceuticals, Automotive & Aerospace, Metallurgy) |

| Regional Coverage |

Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe

|

| Prominent Players |

Linde plc, Air Liquide S.A., Air Products and Chemicals, Inc., SOL Group (SOL SpA), Praxair Technology, Inc., Nippon Sanso Holdings Corp, Ube Corporation, Air Water Inc., Osaka Gas Co Ltd, Messer SE & Co. KGaA, Matheson Tri-Gas, Inc., Taiyo Nippon Sanso Corporation, Gulf Cryo, Iwatani Corporation, Westfalen AG, BASF SE, Cryotec Anlagenbau GmbH, Universal Industrial Gases, Southern Industrial Gas (Sdn Bhd), Yingde Gases Group Company Ltd, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |

Frequently Asked Questions

The Europe Liquid Nitrogen Market size is estimated to have a value of USD 449.2 million in 2025 and is expected to reach USD 760.6 million by the end of 2034.

The market is growing at a Compound Annual Growth Rate (CAGR) of 6.0 percent over the forecast period from 2025 to 2034.

Key drivers of this market include advanced healthcare and biotech applications; high-quality food processing standards; semiconductor manufacturing investments under the European Chips Act; and sustainability initiatives driving energy-efficient technologies and circular economy applications.