Market Overview

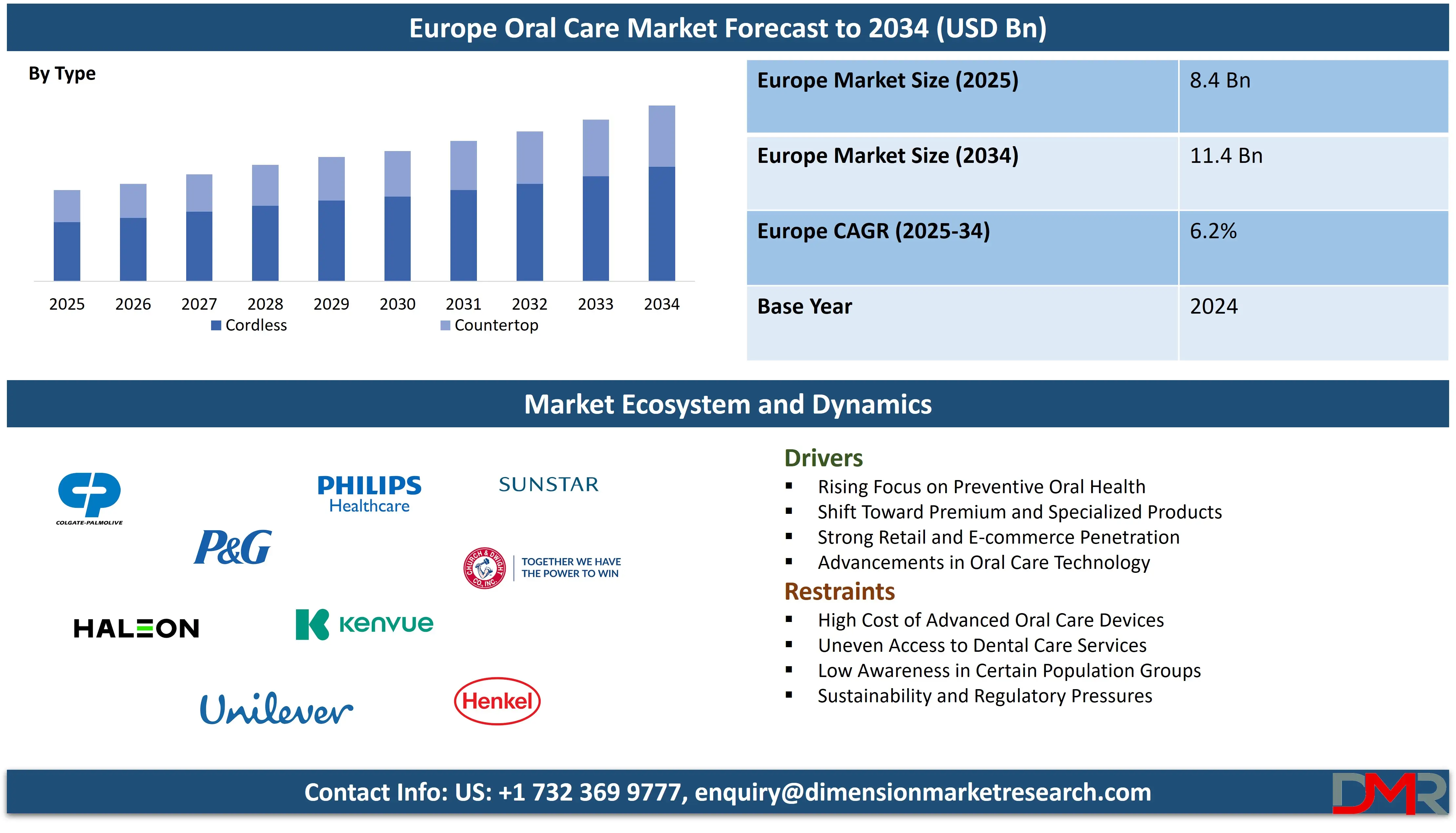

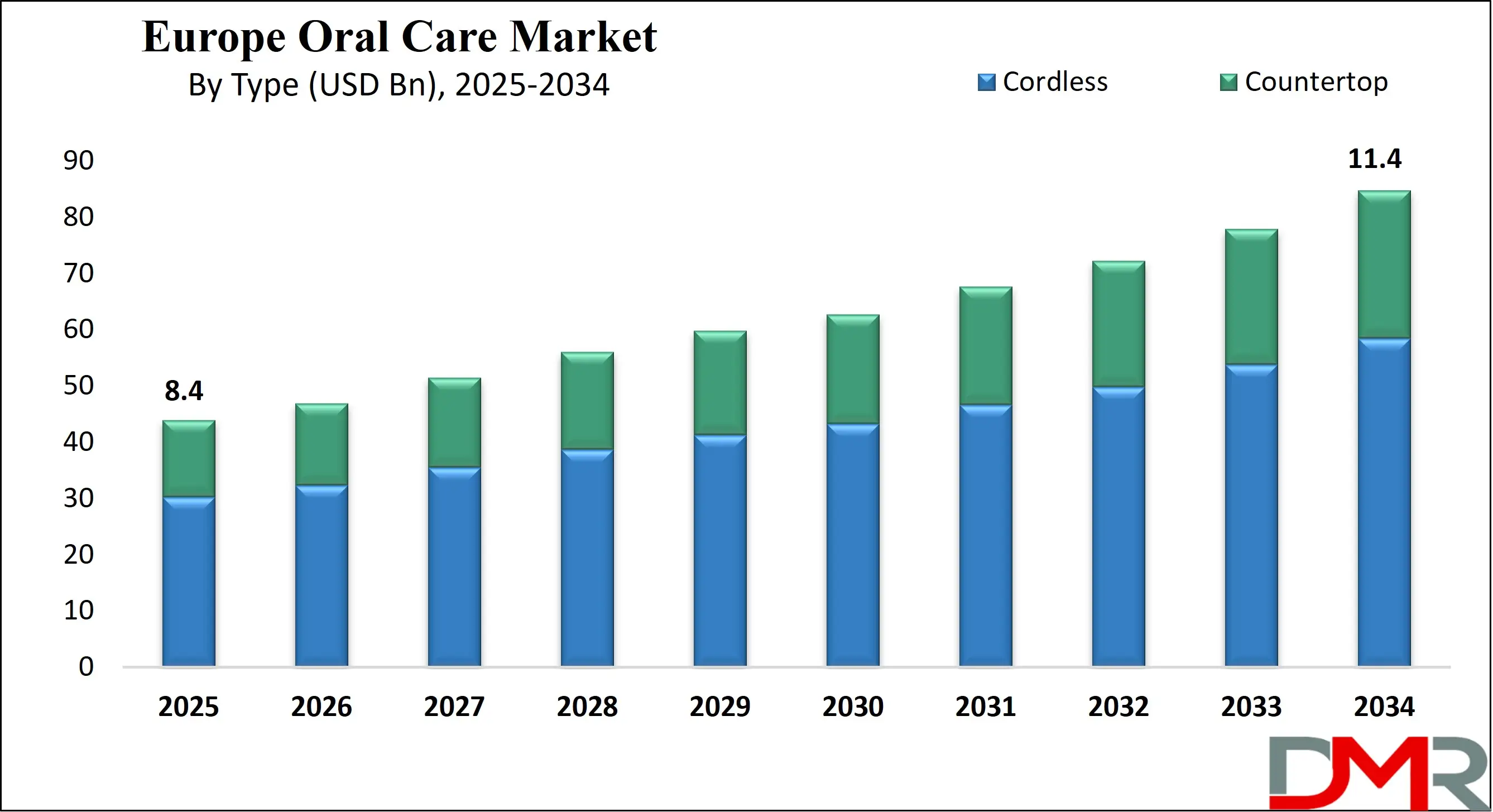

The Europe oral care market is valued at USD 8.4 billion in 2025 and is projected to reach USD 11.4 billion by 2034, registering a CAGR of 6.2%. This growth reflects rising demand for advanced oral hygiene products, preventive dental care solutions, and premium oral health formulations across the region.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Oral care refers to the comprehensive practice of maintaining the health and hygiene of the teeth, gums, tongue, and overall mouth environment. It includes daily habits such as brushing, flossing, and using mouth rinses along with preventive dental visits. Oral care focuses on plaque control, cavity prevention, gum disease management, and maintaining fresh breath. It also supports long term oral hygiene by promoting healthy dietary practices, fluoride usage, and awareness of early signs of dental issues. Together these actions help reduce oral infections, tooth decay, sensitivity problems, and periodontal disorders.

The Europe oral care market represents a structured ecosystem of products and solutions that support oral hygiene routines across households and professional dental settings. This market includes toothpaste, toothbrushes, mouthwashes, dental floss, whitening products, dentures, and electric oral devices. It is shaped by rising consumer awareness about preventive dental care, a growing elderly population with specific oral health needs, and technological upgrades in oral appliances such as electric toothbrushes and smart brushing systems.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

In Europe the oral care market is also influenced by lifestyle changes, premiumization trends, and the increasing demand for natural, vegan, and sustainable oral hygiene products. Regulatory support for dental wellness programs, strong distribution networks, and the presence of global brands further contribute to market expansion. The region experiences steady growth driven by higher disposable incomes, interest in cosmetic dentistry, and a rising focus on long term oral health management.

Europe Oral Care Market: Key Takeaways

- Market Value: The Europe Oral Care market size is expected to reach a value of USD 11.4 billion by 2034 from a base value of USD 8.4 billion in 2025 at a CAGR of 6.2%.

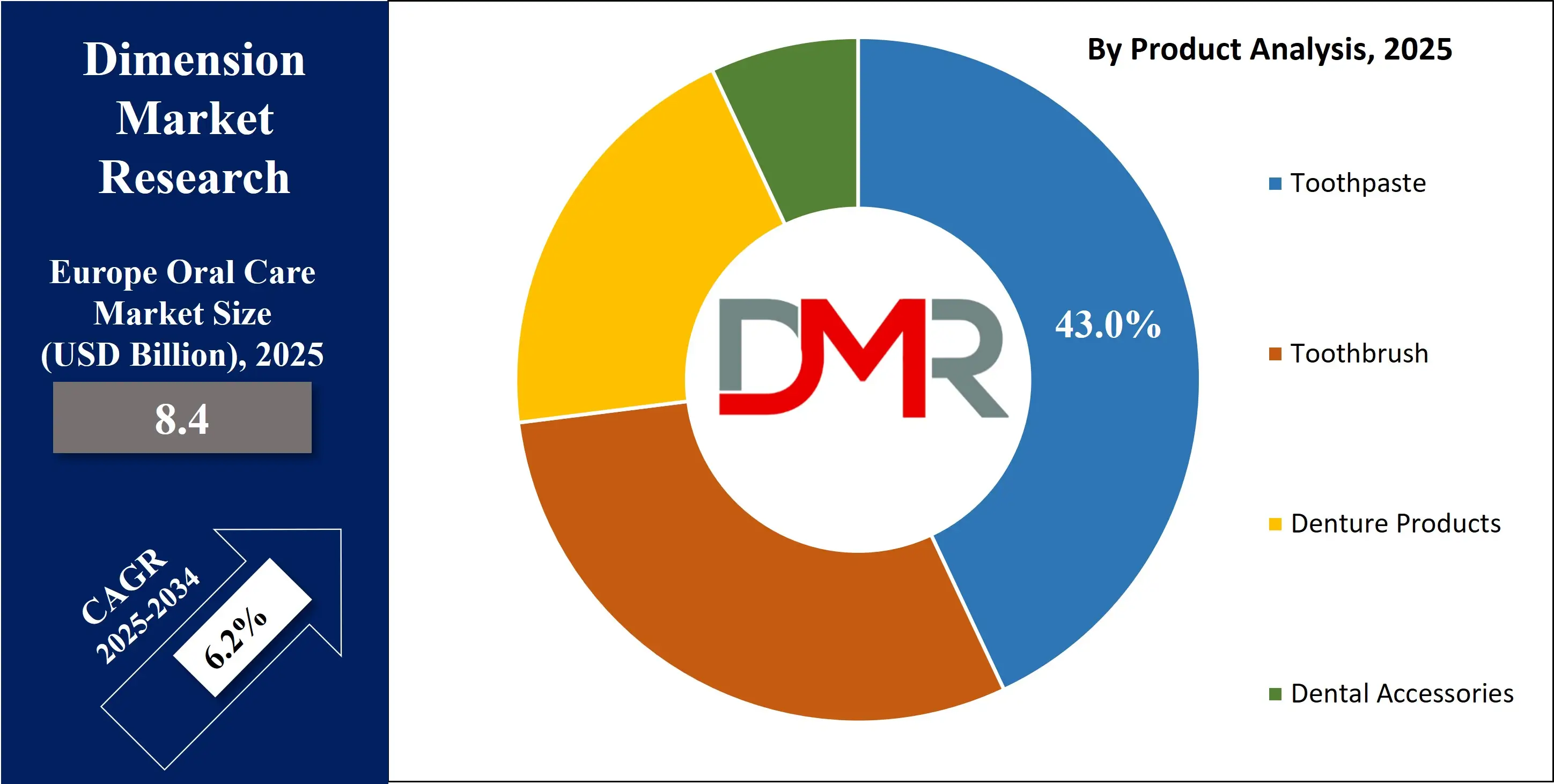

- By Product Segment Analysis: Toothpastes are anticipated to dominate the product segment, capturing 43.0% of the total market share in 2025.

- By Type Segment Analysis: Cordless is expected to maintain its dominance in the type segment, capturing 69.0% of the total market share in 2025.

- By Application Segment Analysis: Homecare applications will dominate the application segment, capturing 74.0% of the market share in 2025.

- By Distribution Channel Segment Analysis: Specialty Stores will dominate the distribution channel segment, capturing 38.0% of the market share in 2025.

- Key Players: Some key players in the Europe Oral Care market are Colgate‑Palmolive Company, Procter & Gamble Company, Unilever PLC, Haleon PLC, Kenvue, Inc., Koninklijke Philips N.V., Sunstar Suisse S.A., Church & Dwight Co., Inc., Henkel AG & Co. KGaA, Pierre Fabre S.A., Hawley & Hazel (BVI) Co., Ltd., Denttabs GmbH, and others.

Europe Oral Care Market: Use Cases

- Adoption of Smart Oral Hygiene Devices: Consumers across Europe are increasingly integrating electric toothbrushes, sonic cleaning tools, and app enabled oral health trackers into their routines. These devices support personalized brushing guidance, real time performance monitoring, and better plaque removal which boosts demand for premium oral hygiene solutions. The shift toward connected care is strengthening the region’s digital oral care ecosystem.

- Rising Preference for Natural and Sustainable Oral Care Products: European buyers are showing strong interest in eco friendly toothpaste, biodegradable toothbrushes, herbal mouth rinses, and fluoride free formulations. This trend is driven by clean label awareness, reduced chemical usage, and sustainability focused purchasing behaviour. Brands offering plant based and recyclable oral hygiene products are gaining significant traction in retail and online channels.

- Growth of Preventive Dental Care and At-Home Oral Treatments: The market is witnessing higher consumption of cavity protection pastes, gum care gels, sensitivity solutions, and therapeutic mouthwashes. With increasing focus on early oral disease prevention European consumers prefer at home dental care kits that reduce clinical visits. This shift supports wider adoption of daily oral hygiene regimens and professional grade products.

- Expansion of Cosmetic and Whitening Oral Care Solutions: Demand for whitening strips, enamel safe brightening pastes, polishing powders, and enamel repair formulations is rising across the region. European consumers are prioritizing aesthetic oral health which fuels growth of cosmetic dentistry inspired products. This segment benefits from lifestyle changes, social media influence, and interest in long lasting oral beauty outcomes.

Impact of Artificial Intelligence on the Europe Oral Care market

Artificial intelligence is reshaping the Europe oral care industry by enabling smart diagnostics, personalized hygiene recommendations, and advanced product innovation. AI powered electric toothbrushes and oral health apps help users monitor brushing patterns, detect plaque zones, and receive real time coaching for better oral hygiene practices. This enhances consumer engagement and drives adoption of connected oral care devices across the region.

AI is also transforming dental clinics by supporting early detection of cavities, gum disease, enamel erosion, and orthodontic issues through image analysis and predictive algorithms. These tools enable faster and more accurate clinical decisions which improve preventive dental care outcomes. Manufacturers in Europe are leveraging AI to develop customized toothpaste formulations, optimize supply chains, and enhance consumer product experiences. Overall AI integration strengthens digital oral health ecosystems, boosts device demand, and accelerates innovation across the Europe oral care market.

Europe Oral Care Market: Stats & Facts

-

Eurostat — Unmet dental care needs (EU)

- 2024: 6.0% of the EU population reported unmet dental care needs.

- 2024: People at risk of poverty reporting unmet dental care needs: 13.7%; people not at risk: 5.1%.

- 2024: Highest national shares were Greece 27.1%, Latvia 16.5% and Romania 16.2%.

- 2024: Lowest national shares were Malta 0.4%, Germany 0.9% and Croatia 1.1%.

- WHO Regional Office for Europe — Regional prevalence and burden

- The European Region recorded the highest global prevalence of major oral diseases, affecting 50.1% of the adult population.

- Prevalence of caries of permanent teeth in the Region was 33.6%, representing around 335 million cases.

- WHO — Global Oral Health Data Portal

- WHO data identifies untreated dental caries, severe periodontal disease and complete tooth loss as high-burden indicators monitored across European member states.

- European countries use WHO oral health indicators for national surveillance and reporting.

Europe Oral Care Market: Market Dynamics

Europe Oral Care Market: Driving Factors

Growing Focus on Preventive Oral Hygiene

Europe is experiencing a strong shift toward preventive dental care as consumers increasingly prioritize early detection of cavities, gum problems, and enamel sensitivity. Rising awareness campaigns, routine dental checkups, and demand for plaque control solutions are supporting consistent growth in oral hygiene products. This fuels higher adoption of premium toothpaste, therapeutic mouth rinses, and advanced oral care kits across the region.

Expansion of Smart and Connected Oral Care Devices

The proliferation of AI enabled toothbrushes, real time oral health trackers, and app integrated hygiene tools is accelerating market development. Consumers prefer personalized brushing guidance and digital monitoring of oral wellness which boosts sales of advanced oral care appliances. This trend strengthens the region’s smart oral health ecosystem and enhances long term product engagement.

Europe Oral Care Market: Restraints

High Cost of Premium and Tech Enabled Oral Care Solutions

Smart toothbrushes, whitening devices, and specialized dental care kits often come with higher price tags which restrict adoption in price sensitive consumer groups. Limited affordability reduces penetration rates for technologically advanced oral care solutions and slows adoption of connected oral hygiene routines in emerging European markets.

Variability in Dental Reimbursement and Access to Oral Health Services

Differences in healthcare coverage across European countries affect access to regular dental checkups and preventive oral treatments. Inconsistent reimbursement for dental care creates disparities in adoption of therapeutic oral hygiene products and slows consumer spending on specialized dental health solutions.

Europe Oral Care Market: Opportunities

Rising Demand for Natural and Eco Friendly Oral Care Products

Growing preference for herbal toothpaste, biodegradable toothbrushes, and fluoride free formulations opens new avenues for green oral hygiene brands. Consumers are actively seeking clean label oral care options aligned with sustainability goals and reduced chemical exposure which presents strong expansion opportunities for manufacturers.

Growth of At Home Cosmetic and Whitening Oral Care Solutions

Europe is seeing increasing interest in teeth whitening strips, enamel brightening pastes, and cosmetic oral care kits as consumers pursue aesthetic enhancements. The shift toward home based cosmetic oral care presents a lucrative opportunity for brands offering safe and fast acting whitening products.

Europe Oral Care Market: Trends

Personalization of Oral Care through Digital Tools

AI powered oral health apps and smart brushing systems are enabling customized oral hygiene routines. Personalized recommendations and real time coaching tools are becoming mainstream driving demand for connected devices and tailored oral care experiences.

Integration of Sustainability across Oral Care Portfolios

Brands are increasingly adopting recyclable packaging, biodegradable materials, and plant based formulations across their product lines. Sustainability focused innovations are reshaping consumer purchasing behaviors and influencing product development strategies throughout the European oral care market.

Europe Oral Care Market: Research Scope and Analysis

By Product Analysis

Toothpastes are set to remain the leading product category in the Europe oral care market, accounting for an estimated 43.0% share in 2025. This strong position is supported by the essential role of toothpaste in daily oral hygiene and the rising demand for specialized formulations focused on sensitivity relief, gum protection, enamel strengthening, whitening, and natural ingredients. Continuous product development, expanding premium ranges, and greater consumer emphasis on preventive oral health further reinforce its dominance. The availability of fluoride based, herbal, and charcoal infused variants also drives broad adoption across diverse age groups in Europe.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Toothbrushes also hold a substantial portion of the market with growing adoption of both manual and electric models. European consumers are increasingly choosing advanced toothbrushes equipped with sonic cleaning, pressure control features, and AI enabled brushing insights that improve plaque removal and support better oral hygiene habits. The rise of eco friendly toothbrushes made from bamboo and biodegradable materials is influencing buying choices as sustainability becomes a key factor. These trends collectively support steady growth in the toothbrush segment as users seek enhanced cleaning efficiency and more environmentally conscious oral care solutions.

By Type Analysis

Cordless oral care devices are projected to lead the type segment with a substantial 69.0% market share in 2025, reflecting the strong consumer shift toward portable, convenient, and travel friendly oral hygiene solutions. These devices offer greater flexibility, ease of handling, and enhanced user comfort compared to wired alternatives. Rising adoption of cordless water flossers and rechargeable electric toothbrushes is fueled by longer battery life, compact designs, and advanced features such as pressure control, customizable cleaning modes, and smart connectivity. The preference for clutter free bathroom setups and increasing consumer mobility across Europe further support the dominance of cordless oral care solutions.

Countertop devices continue to hold a steady position in the market as they cater to users seeking powerful performance, larger water reservoirs, and more consistent pressure control. These systems are commonly preferred by households focused on comprehensive oral hygiene routines and by individuals with orthodontic appliances or gum care needs. Their durability and higher cleaning efficiency make them suitable for regular, intensive use. Although less portable than cordless options, countertop oral care devices remain an important part of the segment due to their strong cleaning capability and suitability for multi user households.

By Application Analysis

Homecare applications are expected to lead the Europe oral care market with a significant 74.0% share in 2025, driven by the rising adoption of at home oral hygiene devices and daily care products. Consumers increasingly prefer convenient solutions such as electric toothbrushes, water flossers, whitening kits, therapeutic mouthwashes, and specialized toothpaste formulations that support preventive oral health. The shift toward home based oral wellness routines is supported by higher awareness of plaque control, gum care, enamel protection, and overall dental hygiene. Growing interest in personalized oral care and digital monitoring tools further strengthens the dominance of homecare applications across the region.

Dentistry applications also play an important role in this market as dental clinics continue to integrate advanced diagnostic tools, professional cleaning systems, dental equipment, and AI-supported imaging technologies. These applications support early detection of cavities, gum disease, and orthodontic issues while enabling more precise treatments and enhanced patient outcomes. Professional dentistry relies on high performance oral care devices, scaling equipment, polishers, and therapeutic formulations that are not typically available for home use. Although smaller in share compared to homecare, dentistry applications remain essential for specialized procedures, restorative treatments, and long term oral health management across Europe.

By Distribution Channel Analysis

Specialty stores are expected to lead the Europe oral care market distribution landscape with a 38.0% share in 2025, driven by their strong focus on curated oral hygiene products, professional grade solutions, and premium device assortments. These stores offer expert guidance, product demonstrations, and access to advanced oral care technologies such as electric toothbrushes, water flossers, whitening systems, and therapeutic dental formulations.

Their ability to provide personalized recommendations and stock niche, high performance oral care brands makes them a preferred choice for consumers seeking targeted oral health solutions. The growing demand for premiumization and specialized oral wellness products further enhances the dominance of specialty stores across Europe. Hypermarkets and supermarkets also hold a significant role in this market as they cater to mass consumers with a wide range of affordable oral care essentials including toothpaste, toothbrushes, mouthwashes, and floss.

Their strong shelf presence, promotional pricing, and high footfall support steady sales volumes across diverse customer groups. These retail formats benefit from convenience driven purchasing, allowing shoppers to easily compare brands and access bundled offers. Although they cater more to everyday oral hygiene needs rather than premium devices, hypermarkets and supermarkets remain crucial distribution channels due to their broad reach, competitive pricing, and consistent availability of oral care products.

The Europe Oral Care Market Report is segmented on the basis of the following

By Product

- Manual

- Electric (Rechargeable)

- Battery-Powered (Non-rechargeable)

- Others

- Cleaners

- Fixatives

- Floss

- Others

- Cosmetic Whitening Products

- Fresh Breath Dental Chewing Gum

- Tongue Scrapers

- Fresh Breath Strips

- Others

By Type

By Application

By Distribution Channel

- Specialty Stores

- Hypermarket & Supermarkets

- Drug Stores & Pharmacies

- Convenience Store

- Online Retailers

- Others

Europe Oral Care Market: Regional Analysis

The Europe oral care market shows strong regional variation driven by differences in consumer behavior, healthcare access, and product penetration across key countries. Western Europe, led by Germany, the United Kingdom, France, and Italy, accounts for the largest share due to higher adoption of premium oral hygiene products, strong retail networks, and widespread awareness of preventive dental care. Northern European nations demonstrate strong interest in sustainable oral care solutions and advanced electric toothbrush technologies.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Southern and Eastern Europe are witnessing rising demand for affordable oral care essentials and growing penetration of whitening products and therapeutic formulations as urbanization and disposable incomes increase. Overall, regional growth is supported by a mix of digital oral health adoption, premiumization trends, and expanding distribution channels across Europe.

By Region

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Europe Oral Care Market: Competitive Landscape

The competitive landscape of the Europe oral care market is characterized by strong participation from global oral hygiene manufacturers, specialized dental care brands, and emerging natural product companies. The market is shaped by continuous innovation in toothpaste formulations, smart electric toothbrushes, whitening solutions, and sustainable oral care products. Companies compete through product diversification, premium positioning, eco friendly packaging, and advanced technologies such as AI enabled brushing systems. Intense marketing activities, strategic retail partnerships, and expansion into digital and e commerce channels further influence competitive dynamics. Rising consumer demand for personalized oral wellness solutions and clinically backed products continues to drive competition across the region.

Some of the prominent players in the Europe Oral Care market are:

- Colgate‑Palmolive Company

- Procter & Gamble Company

- Unilever PLC

- Haleon PLC

- Kenvue, Inc.

- Koninklijke Philips N.V. (Philips Oral Healthcare)

- Sunstar Suisse S.A.

- Church & Dwight Co., Inc.

- Henkel AG & Co. KGaA

- Pierre Fabre S.A.

- Hawley & Hazel (BVI) Co., Ltd.

- Denttabs GmbH

- The Humble Co.

- Curaden AG

- TePe Munhygienprodukter AB

- Jordan AS (Orkla)

- GC Corporation (Europe)

- Venture Life Group

- Polished London

- Ludovico Martelli SpA

- Other Key Players

Europe Oral Care Market: Recent Developments

- July 2024: A leading oral care manufacturer introduced a new AI enabled electric toothbrush tailored for European consumers, featuring real time brushing guidance, plaque detection technology, and app based oral health insights designed to enhance at home preventive dental care routines.

- March 2024: A major oral hygiene brand launched a plant based toothpaste line in Europe formulated with herbal ingredients, recyclable tubes, and sensitivity friendly compositions aimed at addressing rising demand for natural and sustainable oral care products.

- December 2023: A prominent oral care company acquired a European dental device startup to strengthen its position in smart oral hygiene solutions and expand its portfolio of connected brushing technologies across key regional markets.

- September 2023: A global oral health group completed the acquisition of a specialty oral care firm to enhance its presence in whitening solutions, therapeutic formulations, and premium oral wellness categories within Europe.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 8.4 Bn |

| Forecast Value (2034) |

USD 14.4 Bn |

| CAGR (2025–2034) |

6.2% |

| Historical Data |

2019 – 2024 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Product (Toothpaste, Toothbrush, Denture Products and Dental Accessories), By Type (Cordless and Countertop), By Application (Home and Dentistry), By Distribution Channel (Specialty Stores, Hypermarket & Supermarkets, Drug Stores & Pharmacies, Convenience Stores, Online Retailers and Others) |

| Regional Coverage |

Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe |

| Prominent Players |

Colgate Palmolive Company, Procter & Gamble Company, Unilever PLC, Haleon PLC, Kenvue, Inc., Koninklijke Philips N.V., Sunstar Suisse S.A., Church & Dwight Co., Inc., Henkel AG & Co. KGaA, Pierre Fabre S.A., Hawley & Hazel (BVI) Co., Ltd., Denttabs GmbH, and others. |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |

Frequently Asked Questions

How big is the Europe Oral Care market?

▾ The Europe Oral Care market size is estimated to have a value of USD 8.4 billion in 2025 and is expected to reach USD 14.4 billion by the end of 2034, with a CAGR of 6.2%.

Who are the key players in the Europe Oral Care market?

▾ Some of the major key players in the Europe Oral Care market are Colgate Palmolive Company, Procter & Gamble Company, Unilever PLC, Haleon PLC, Kenvue, Inc., Koninklijke Philips N.V., Sunstar Suisse S.A., Church & Dwight Co., Inc., Henkel AG & Co. KGaA, Pierre Fabre S.A., Hawley & Hazel (BVI) Co., Ltd., Denttabs GmbH, and others.