Europe Power Purchase Agreement Market Overview

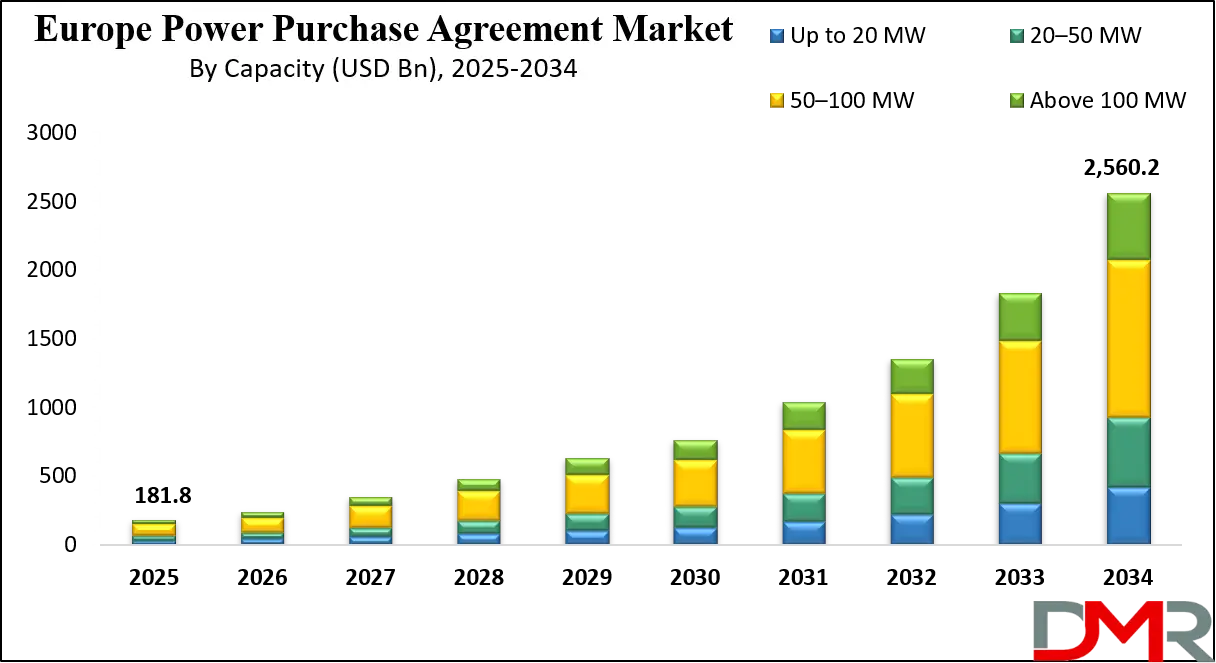

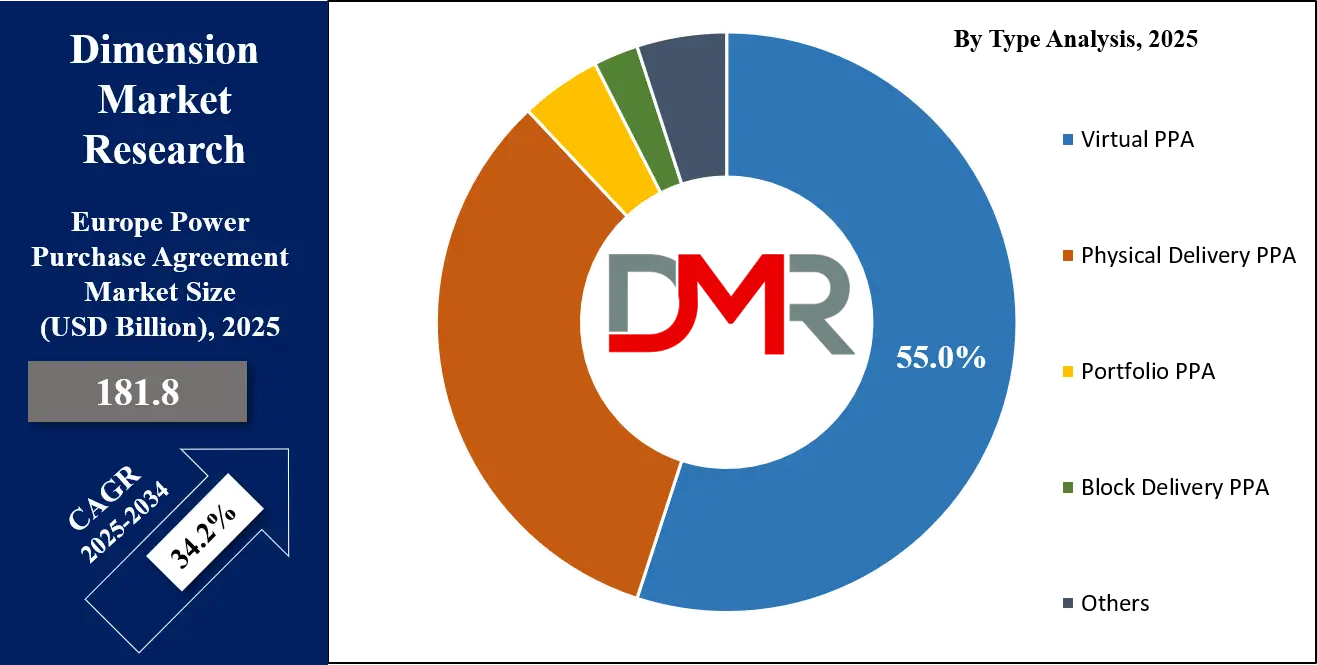

The Europe power purchase agreement market is projected to reach USD 181.8 billion in 2025 and is expected to expand to USD 2,560.2 billion by 2034, registering a strong CAGR of 34.2% driven by rising renewable energy adoption, corporate sustainability commitments, and favorable regulatory frameworks across the region.

A power purchase agreement is a long term contract between an electricity generator and a buyer where the buyer agrees to purchase electricity at predetermined terms and prices over a fixed period. These agreements are often signed for renewable energy projects such as solar and wind farms because they provide revenue certainty for developers and cost predictability for buyers. A power purchase agreement also supports energy transition goals by ensuring stable financing for clean energy projects and by allowing corporations and governments to secure renewable energy without owning or operating generation assets directly.

The Europe power purchase agreement market refers to the structured ecosystem of corporate and utility energy buyers, renewable project developers, and intermediaries who engage in long term contracts across the region. In recent years, Europe has witnessed a surge in corporate renewable energy procurement driven by ambitious decarbonization targets, high electricity demand, and supportive regulatory policies from the European Union. Large corporations from industries such as technology, manufacturing, and retail are increasingly signing physical and virtual PPAs to meet sustainability commitments, while utilities and energy suppliers use these agreements to hedge price volatility and diversify their supply portfolios.

The market is characterized by growing adoption of innovative deal structures, cross border power transactions, and portfolio PPAs that cater to diverse energy needs. Countries such as Spain, Germany, the United Kingdom, and the Nordic region have emerged as hotspots for PPA activity due to favorable renewable resources and market liberalization. The Europe power purchase agreement market is evolving as a key enabler of renewable integration, energy security, and long term price stability, attracting both international investors and local developers to participate in expanding green infrastructure.

Europe Power Purchase Agreement Market: Key Takeaways

- Europe Market Value: Europe Power Purchase Agreement Market is projected to be valued at USD 2,560.2 billion in 2034 from a base value of USD 181.8 billion, with a CAGR of 34.2%.

- By Type Segment Analysis: Virtual PPAs are anticipated to dominate the type segment, accounting for 55.0% of the total market share in 2025.

- By Location Segment Analysis: Off-site PPAs are expected to lead the location segment, capturing 79.0% of the market share in 2025.

- By Category Segment Analysis: Corporate PPAs are projected to dominate the category segment, representing 83.0% of the overall market share in 2025.

- By Deal Type Segment Analysis: Wholesale PPAs are anticipated to dominate the deal type segment, securing 60.0% of the total market share in 2025.

- By Capacity Segment Analysis: PPAs with a capacity range of 50–100 MW are forecasted to dominate the capacity segment, accounting for 45.0% of the market share in 2025.

- By Application Segment Analysis: Solar PPAs are expected to dominate the application segment, capturing 54.0% of the total market share in 2025.

- By End-User Segment Analysis: Commercial users are anticipated to dominate the end-user segment, holding 45.0% of the market share in 2025.

- Key Players: Some of the major key players in the Europe Power Purchase Agreement Market are Iberdrola, RWE, Ørsted, Statkraft, Vattenfall, Engie, Enel Green Power / Enel Global Trading, EDF Renewables, TotalEnergies, Shell Energy Europe, BayWa r.e., Axpo Holding, Pexapark, DLA Piper, Encavis, MET Group, and many others.

Europe Power Purchase Agreement Market: Use Cases

- Corporate Renewable Energy Procurement: In the US power purchase agreement market, one of the most significant use cases is corporate renewable energy procurement. Large enterprises such as technology firms, retailers, and manufacturers are entering long term PPAs to directly source solar and wind power. This approach allows companies to lower carbon emissions, stabilize electricity costs, and demonstrate environmental leadership to stakeholders while reducing exposure to wholesale market volatility.

- Utility-Scale Renewable Project Financing: PPAs play a critical role in financing large renewable energy projects across the United States. Developers of utility-scale wind farms and solar parks rely on long term contracts with utilities or corporates to secure predictable cash flows. These agreements provide the financial certainty required to obtain investment, de-risk projects, and accelerate the growth of clean energy infrastructure nationwide.

- Virtual Power Purchase Agreements (VPPAs): Virtual PPAs have become a popular use case in the US, especially for companies with geographically dispersed operations. Through a VPPA, organizations can purchase renewable energy credits and hedge against electricity price fluctuations without taking physical delivery of power. This model enables corporations to meet sustainability goals while maintaining operational flexibility in deregulated energy markets.

- Government and Public Sector Adoption: Federal agencies, state governments, and public institutions are increasingly leveraging PPAs to meet renewable portfolio standards and climate targets. By signing long term agreements with solar and wind developers, public sector entities can ensure reliable clean energy supply, reduce long term energy costs, and contribute to national decarbonization goals, setting an example for private sector adoption.

Impact of Artificial Intelligence on the Europe Power Purchase Agreement Market

Artificial intelligence is beginning to play a transformative role in the Europe power purchase agreement market by enabling smarter forecasting, risk assessment, and contract optimization. AI-powered predictive analytics help both buyers and sellers of renewable energy anticipate fluctuations in electricity generation from wind and solar farms with higher accuracy. This allows corporate and utility offtakers to better align energy procurement with actual consumption, minimizing imbalance costs and enhancing grid stability. By improving generation and demand forecasting, artificial intelligence is reducing uncertainty, which directly strengthens the bankability of long term PPAs in the region.

Another important impact of AI is in PPA pricing and risk management. Advanced algorithms can simulate multiple market scenarios, assess price volatility, and identify the most cost-efficient structures for both physical and virtual PPAs. This empowers companies to negotiate contracts that balance sustainability goals with financial performance. AI-driven platforms are also streamlining the contract lifecycle by automating compliance checks, managing renewable energy certificates, and optimizing portfolio PPAs that span multiple countries across Europe.

In addition, artificial intelligence is fostering innovation in cross-border energy trading within Europe’s liberalized power markets. By analyzing real time grid data, AI helps stakeholders unlock opportunities for flexible PPAs that integrate energy storage, demand response, and distributed renewable generation. As European corporations and governments push toward aggressive decarbonization targets, the integration of AI into PPA processes is expected to enhance efficiency, reduce transaction complexity, and accelerate the scale-up of renewable power adoption across the continent.

Europe Power Purchase Agreement Market: Stats & Facts

Eurostat

- Renewables supplied 44.1% of EU net electricity in 2023, rising to 46.9% in 2024 (+2.8 pp).

- Total renewable generation in 2024 reached 1.31 million GWh, a 7.7% increase from 2023, while fossil-fuel generation declined to 0.81 million GWh, down 7.2% year-on-year.

- In 2023, renewables accounted for 24.5% of the EU’s gross final energy consumption. By 2024, this share rose further, supported by continued solar and wind growth.

- The EU’s 2030 renewable energy target was raised in 2023 to 42.5% of final consumption, with a voluntary aim of 45%.

European Environment Agency (EEA)

- The EU’s renewable share in final energy consumption reached 24.5% in 2023, increasing steadily into 2024 and 2025 as renewable electricity adoption accelerated.

- The EEA confirmed that 2023 saw a reduction in fossil fuel intensity alongside record renewable penetration, laying the foundation for stronger uptake in 2024–2025.

ACER / CEER (EU Energy Regulators)

- In 2023, the frequency of low or negative wholesale power prices was around 12 times higher than in 2022, highlighting the impact of variable renewable generation.

- Flexibility requirements in the EU power system are expected to more than double by 2030, driving greater interest in PPAs tied to storage and demand-response solutions.

- About 73% of EU households were covered by regulated or fixed-price electricity contracts in 2023, reflecting policy protection for consumers.

- EU congestion-management costs reached about €4 billion in 2023, prompting regulators in 2024 to recommend stronger cross-border grid integration.

European Commission (DG Energy)

- The EU added about 13 GW of new wind power capacity in 2024, raising cumulative installed wind capacity across the Union to roughly 231 GW, up from 188 GW in 2021.

- The Commission noted that combined with record solar additions, renewable PPAs are increasingly being used to secure financing for this rapid capacity buildout.

ENTSO-E (European Network of Transmission System Operators for Electricity)

- In March 2025, ENTSO-E published provisional statistical data for 2023–2024 showing rising renewable generation, steady electricity demand, and stronger cross-border flows.

- The data confirms increasing reliance on long-term contracts and PPAs as grid operators integrate fluctuating renewable output into the European system.

Europe Power Purchase Agreement Market: Market Dynamics

Europe Power Purchase Agreement Market: Driving Factors

Corporate Sustainability Commitments

One of the strongest drivers in the Europe power purchase agreement market is the rising wave of corporate sustainability commitments. Global enterprises with significant European operations are pledging to achieve net zero targets and reduce their carbon footprint, pushing demand for long term renewable energy contracts. Power purchase agreements enable corporations to secure clean energy supply at stable prices while meeting environmental, social, and governance benchmarks.

Supportive Regulatory Policies

The European Union’s renewable energy directives and national decarbonization frameworks are also accelerating market growth. Policies promoting renewable integration, competitive electricity markets, and cross border energy trading encourage utilities and corporates to adopt PPAs. These frameworks provide the legal certainty and market stability required to stimulate investment in large scale solar and wind projects.

Europe Power Purchase Agreement Market: Restraints

Complexity of Contract Structures

Despite rapid growth, the complexity of structuring power purchase agreements often acts as a restraint. Negotiations involve multiple stakeholders, financial risks, and long term forecasting, which can be challenging for companies without in house expertise. This slows down adoption among small and mid-sized enterprises seeking renewable energy procurement.

Market Price Volatility

Fluctuating wholesale electricity prices can limit the attractiveness of PPAs. When market prices drop below contracted rates, offtakers may face financial disadvantages. Such risks make some corporates hesitant to enter into long term commitments, especially in regions with uncertain policy frameworks or high exposure to fossil fuel price fluctuations.

Europe Power Purchase Agreement Market: Opportunities

Growth of Virtual PPAs

Virtual power purchase agreements present significant opportunities across Europe, particularly for multinational corporations with distributed operations. By purchasing renewable energy credits and financial hedges rather than physical electricity, companies gain flexibility and access to clean energy regardless of geographic constraints. This model expands the addressable market for renewable developers.

Integration with Energy Storage

The increasing deployment of battery storage alongside renewable energy plants creates opportunities for more innovative PPAs. Contracts that incorporate storage provide stable power supply, reduce intermittency risks, and open the door for new deal structures. This is particularly valuable in markets with high penetration of solar and wind resources.

Europe Power Purchase Agreement Market: Trends

Cross Border Renewable Energy Contracts

A key trend shaping the Europe PPA market is the rise of cross border agreements that leverage interconnected power markets. Corporations and utilities are increasingly sourcing renewable power from countries with abundant wind and solar resources, such as Spain and the Nordics, and consuming it in markets with high demand.

Digitalization and AI Adoption

Digital platforms and artificial intelligence are becoming central to PPA management. From automated risk assessment to advanced generation forecasting, technology is improving contract efficiency and transparency. This trend is expected to reduce transaction costs, accelerate deal closures, and attract more participants to the PPA ecosystem.

Europe Power Purchase Agreement Market: Research Scope and Analysis

By Type Analysis

By type, virtual power purchase agreements are anticipated to dominate the Europe market, accounting for 59.2% of the total share in 2025. The rising preference for this model comes from its ability to provide flexibility and financial hedging benefits for corporate buyers and utilities. Virtual PPAs enable organizations to access renewable energy projects regardless of their physical location, making them especially valuable for multinational companies operating in deregulated energy markets. They also offer a way to secure renewable energy certificates, reduce exposure to price volatility, and demonstrate commitment to decarbonization targets without requiring complex infrastructure connections.

In contrast, physical delivery PPAs continue to play a crucial role in the segment, particularly for buyers seeking direct and tangible access to renewable electricity. Under this model, the generated power is physically delivered to the buyer through the grid, ensuring a stable and predictable supply of clean energy. Physical PPAs are often favored by utilities, industrial facilities, and large-scale operations where proximity to renewable energy plants supports seamless integration into daily consumption. These agreements also provide long term cost stability, helping buyers shield themselves from market fluctuations while contributing to the broader renewable energy transition.

By Location Analysis

By location, off-site power purchase agreements are expected to lead the market, capturing 79.0% of the share in 2025. The dominance of this segment is driven by the scalability and flexibility off-site PPAs provide to both corporates and utilities. With this model, renewable energy is generated at large solar or wind farms and delivered through the grid, enabling buyers to source clean energy even if they are located far from the generation site.

Off-site PPAs are particularly attractive for multinational corporations, technology firms, and manufacturing companies that have widespread operations and require large volumes of renewable electricity. They also allow companies to benefit from economies of scale, access favorable pricing, and meet sustainability commitments without having to manage on-site installations.

On-site PPAs, while smaller in market share, remain an important option for organizations looking to directly integrate renewable generation into their facilities. In this arrangement, solar panels or other renewable systems are installed on rooftops, industrial campuses, or nearby land to directly supply energy to the buyer. On-site PPAs are popular among commercial buildings, warehouses, and institutions seeking to reduce grid dependency, lower operational costs, and enhance energy security. Although they lack the scale of off-site projects, on-site PPAs provide direct visibility of clean energy use and strengthen a company’s green credentials while supporting local sustainability efforts.

By Category Analysis

By category, corporate power purchase agreements are projected to dominate the market, representing 83.0% of the overall share in 2025. This dominance is driven by the growing number of multinational companies and large enterprises that are committing to ambitious decarbonization targets and net zero strategies. Corporate PPAs allow businesses to lock in renewable energy prices for the long term, hedge against electricity market volatility, and secure renewable energy certificates to meet sustainability reporting standards.

Sectors such as technology, retail, automotive, and heavy manufacturing are among the largest adopters, as they seek cost savings and reputational benefits from aligning with renewable energy. The surge in demand for corporate PPAs also reflects the broader trend of businesses taking proactive roles in energy transition and supporting the financing of large-scale renewable energy projects across Europe.

Government PPAs, while representing a smaller share, remain an important part of the segment by providing stability and credibility to the renewable energy ecosystem. National and local governments across Europe use PPAs to meet renewable energy mandates, achieve climate targets, and ensure reliable supply for public infrastructure such as schools, hospitals, and transport networks.

These agreements not only help public institutions reduce long-term energy costs but also encourage private developers by creating secure demand for clean electricity. Government participation in PPAs plays a critical role in building confidence in the market and in supporting policy-driven renewable integration, especially in countries with strong decarbonization frameworks and ambitious green energy goals.

By Deal Type Analysis

By deal type, wholesale power purchase agreements are anticipated to dominate the market, securing 60.0% of the total share in 2025. Wholesale PPAs are generally signed between large-scale renewable energy developers and utilities or energy suppliers that purchase electricity in bulk and distribute it to end users. This model offers economies of scale, price stability, and reliable long-term revenue streams for developers, while allowing utilities to diversify their energy portfolios with significant volumes of renewable power. The wholesale approach is particularly favored in Europe’s liberalized energy markets where grid access and large consumption needs make bulk transactions more efficient and financially attractive.

Retail PPAs, while smaller in market size, serve an important role in enabling smaller corporations, institutions, and commercial consumers to directly access renewable energy. In this arrangement, retailers or energy service providers act as intermediaries, offering tailored contracts to organizations that may not have the capacity to negotiate large wholesale deals.

Retail PPAs provide flexibility in contract size, shorter terms, and localized solutions, making them suitable for small and medium enterprises seeking to improve sustainability credentials. Although retail deals lack the scale of wholesale contracts, they are instrumental in expanding the reach of renewable energy procurement across a wider customer base.

By Capacity Analysis

By capacity, power purchase agreements in the range of 50–100 MW are forecasted to dominate the segment, accounting for 45.0% of the total share in 2025. This range is particularly attractive to large corporates and utilities as it provides sufficient scale to support industrial operations and data centers while still maintaining manageable project risks compared to mega-scale renewable installations.

Developers also prefer this capacity band since it strikes a balance between investment requirements and predictable offtake demand, ensuring financial viability. The dominance of 50–100 MW PPAs reflects the rising trend of corporates seeking mid to large-scale projects that can deliver significant carbon reduction benefits while aligning with sustainability goals.

PPAs in the 20–50 MW capacity range, though smaller in share, play a vital role in catering to mid-sized businesses, institutions, and localized energy needs. These contracts often support regional solar and wind farms that provide renewable electricity to specific clusters of commercial buildings, industrial parks, or municipalities.

The 20–50 MW range offers greater flexibility, faster project development timelines, and lower capital intensity, making it appealing for organizations that aim to demonstrate green leadership without committing to very large projects. This segment is helping expand renewable energy access to a broader set of buyers, strengthening the diversity of the overall PPA market.

By Application Analysis

By application, solar power purchase agreements are expected to dominate the segment, capturing 54.0% of the total share in 2025. The rapid growth of solar PPAs is supported by falling photovoltaic technology costs, shorter project development timelines, and the widespread availability of suitable land and rooftop spaces across Europe. Solar projects are also easier to scale across different regions, making them highly attractive for corporations and utilities aiming to secure long term renewable energy contracts. In addition, solar PPAs provide predictable generation during peak daylight hours, helping businesses reduce grid reliance and stabilize operational costs while advancing their sustainability targets.

Wind PPAs, while holding a smaller share, remain a crucial part of the application segment due to their ability to generate large volumes of clean electricity, particularly in Northern and Western Europe. Onshore and offshore wind projects are increasingly being tied to long term contracts with utilities and corporates seeking to lock in stable energy prices.

Offshore wind in particular is becoming a significant contributor, with large-scale projects in the North Sea and Baltic Sea attracting international investment and corporate offtakers. Wind PPAs offer strong potential for bulk renewable power procurement, complementing solar projects and ensuring year-round renewable energy supply within the PPA market.

By End-User Analysis

By end-user, commercial users are anticipated to dominate the segment, holding 45.0% of the market share in 2025. The growth of this segment is largely driven by corporations, retail chains, data centers, and industrial facilities that require consistent and large-scale electricity supply. Commercial users prefer power purchase agreements because they provide long-term cost predictability, hedge against electricity price volatility, and align with corporate sustainability commitments. These contracts also allow businesses to secure renewable energy certificates, enhance their green image, and comply with environmental regulations, which is becoming a critical factor for global brands operating in Europe.

Residential users, while representing a smaller portion of the market, are gradually adopting PPAs as interest in decentralized renewable energy grows. In this segment, rooftop solar and community-based renewable projects play a key role in giving households access to clean and affordable electricity.

Residential PPAs allow homeowners to benefit from renewable power without bearing the full upfront installation costs, making clean energy adoption more accessible. This model is also supported by government incentives and local energy cooperatives that encourage citizens to participate in the renewable transition, thereby fostering wider market participation at the grassroots level.

The Europe Power Purchase Agreement Market Report is segmented on the basis of the following:

By Type

- Physical Delivery PPA

- Virtual PPA

- Portfolio PPA

- Block Delivery PPA

- Others

By Location

By Category

- Corporate

- Government

- Others

By Deal Type

By Capacity

- Up to 20 MW

- 20-50 MW

- 50-100 MW

- Above 100 MW

By Application

- Solar

- Wind

- Geothermal

- Hydropower

- Carbon Capture and Storage

- Others

By End-User

- Commercial

- Residential

- Industrial

By Region

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Europe Power Purchase Agreement Market: Competitive Landscape

The competitive landscape of the Europe power purchase agreement market is shaped by a mix of major utilities, renewable energy developers, and corporate buyers actively securing long-term clean energy contracts. Leading players such as Iberdrola, RWE, Ørsted, Statkraft, Vattenfall, Engie, Enel Green Power, EDF Renewables, TotalEnergies, and Shell Energy Europe dominate the space by leveraging large-scale renewable portfolios and cross-border projects.

Independent producers and service providers including BayWa r.e., Axpo Holding, Encavis, MET Group, and RES are also strengthening their presence through innovative deal structures and regional partnerships. In addition, specialized firms like Pexapark, DLA Piper, Ecohz, and Bullfrog Power contribute by offering risk management, legal expertise, and sustainability solutions that support the rapid expansion of corporate and virtual PPAs. This highly competitive environment is driving continuous innovation, cost efficiency, and broader adoption of renewable energy contracts across Europe.

Some of the prominent players in the Europe Power Purchase Agreement market are:

- Iberdrola

- RWE

- Ørsted

- Statkraft

- Vattenfall

- Engie

- Enel Green Power / Enel Global Trading

- EDF Renewables

- TotalEnergies

- Shell Energy Europe

- BayWa r.e.

- Axpo Holding

- Pexapark

- DLA Piper

- Encavis

- MET Group

- Uniper

- RES (Renewable Energy Systems)

- Bullfrog Power

- Ecohz

- Other Key Players

Europe Power Purchase Agreement Market: Recent Developments

- July 2025: Saudi Arabia’s ACWA Power signed memoranda of understanding with several European energy firms—including France’s TotalEnergies, Italy’s Edison, and Germany’s EnBW—to facilitate the export of renewable energy and green hydrogen to Europe. These agreements also involve Siemens Energy and aim to build energy transmission corridors.

- June 2025: Sandoz announced a 10-year virtual PPA with Elawan Energy to cover nearly 90% of its electricity needs across European operations through a new 150 MW solar project in Spain.

- June 2025: The European Investment Bank (EIB) increased its 2025 financing ceiling to a record €100 billion. As part of this package, it allocated €500 million specifically to support corporate PPAs and €250 million for mid-sized green tech manufacturers.

- February 2025: LevelTen Energy, a leading clean energy marketplace, revealed it had closed a Series D funding round while scaling its transaction infrastructure and facilitating a record volume of PPA transactions globally.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 181.8 Bn |

| Forecast Value (2034) |

USD 2,560.2 Bn |

| CAGR (2025–2034) |

34.2% |

| Historical Data |

2019 – 2024 |

| Forecast Data |

2026 – 2034 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Type (Physical Delivery PPA, Virtual PPA, Portfolio PPA, Block Delivery PPA, Others), By Location (On-site, Off-site), By Category (Corporate, Government, Others), By Deal Type (Wholesale, Retail, Others), By Capacity (Up to 20 MW, 20-50 MW, 50-100 MW, Above 100 MW), By Application (Solar, Wind, Geothermal, Hydropower, Carbon Capture and Storage, Others), By End-User (Commercial, Residential, Industrial) |

| Regional Coverage |

Europe

|

| Prominent Players |

Iberdrola, RWE, Ørsted, Statkraft, Vattenfall, Engie, Enel Green Power / Enel Global Trading, EDF Renewables, TotalEnergies, Shell Energy Europe, BayWa r.e., Axpo Holding, Pexapark, DLA Piper, Encavis, MET Group

|

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |

Frequently Asked Questions

The Europe power purchase agreement market is projected to be valued at USD 181.8 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 2,560.2 billion in 2034 at a CAGR of 34.2%.

Some of the major key players in the Europe power purchase agreement market are Iberdrola, RWE, Ørsted, Statkraft, Vattenfall, Engie, Enel Green Power / Enel Global Trading, EDF Renewables, TotalEnergies, Shell Energy Europe, BayWa r.e., Axpo Holding, Pexapark, DLA Piper, Encavis, MET Group, and many others.