Market Overview

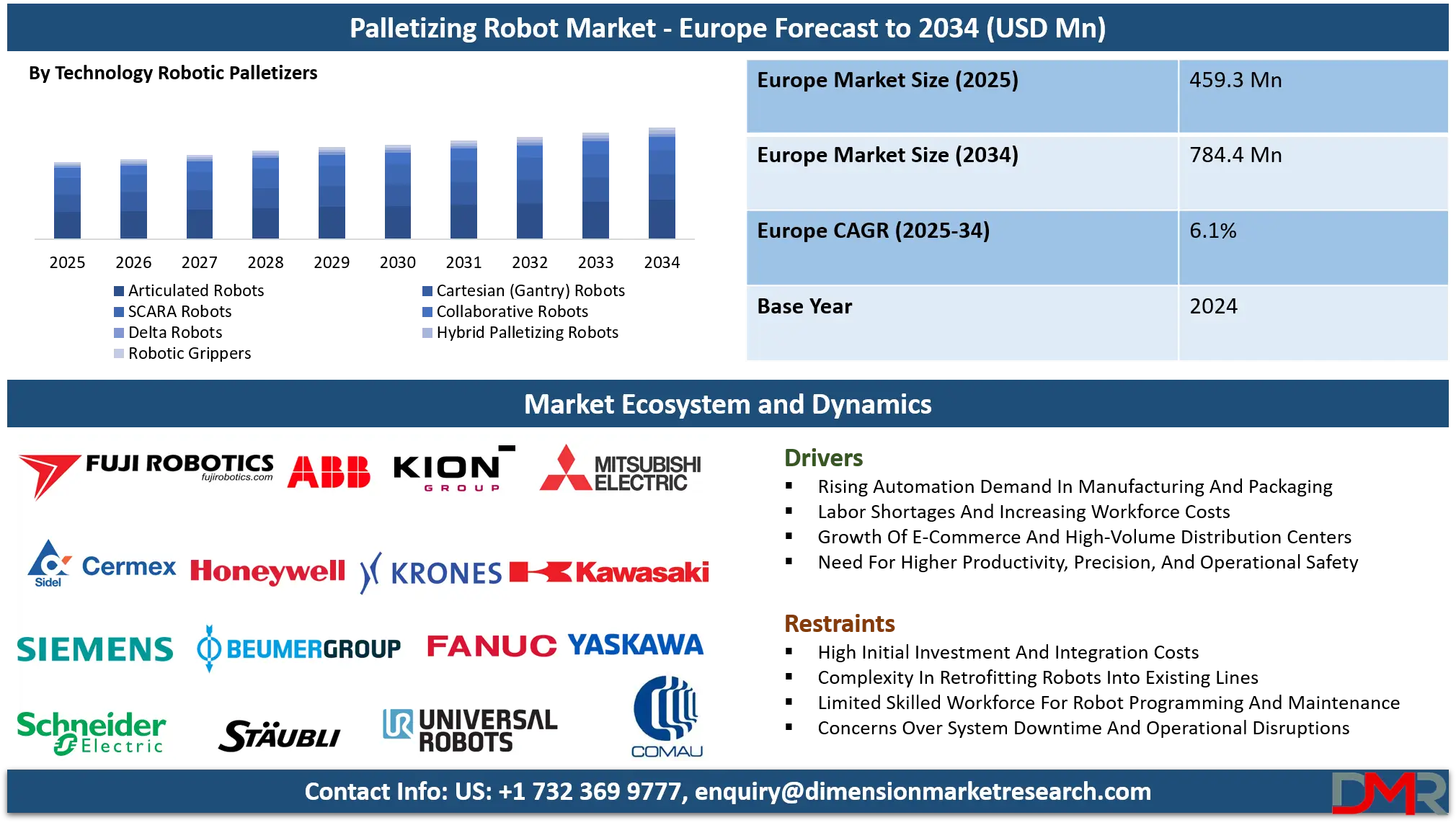

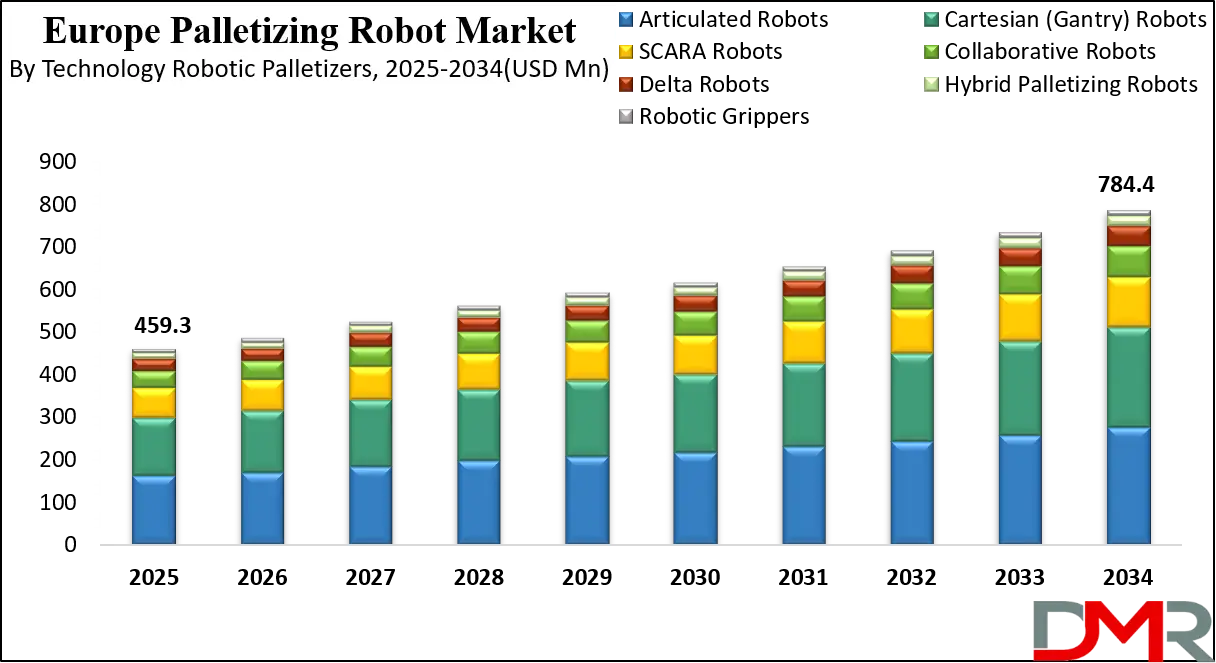

The Europe Robotic Palletizers Market is projected to be valued at USD 459.3 million in 2025 and is expected to reach USD 784.4 million by 2034, expanding at a CAGR of 6.1% over the forecast period.

This robust growth is fueled by the region's strong push toward industrial automation, Industry 4.0 adoption, and the pressing need to address labor shortages and improve supply chain resilience. Robotic palletizing systems are transforming material handling operations across manufacturing and logistics sectors, enabling European industries to maintain competitiveness through enhanced efficiency, flexibility, and workplace safety. Key drivers include stringent ergonomic regulations reducing manual handling, rising e-commerce demanding faster warehouse operations, and the need for adaptable production lines to handle increasing product variety and customization.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Europe stands at the forefront of robotic automation adoption, characterized by advanced manufacturing ecosystems, strong regulatory frameworks promoting worker safety, and a high concentration of global robotic OEMs and system integrators. The region's leadership in industries such as automotive, pharmaceuticals, and food processing sectors with demanding palletizing requirements creates substantial demand for sophisticated robotic solutions. Additionally, Europe's commitment to sustainability and

circular economy principles is driving investment in automation that reduces packaging waste, optimizes load stability for transportation efficiency, and enables efficient reverse logistics for recycling and returns processing.

The European market is distinguished by its emphasis on collaborative robotics (cobots), hybrid palletizing systems, and smart, connected solutions that integrate with broader factory and warehouse management systems. Unlike traditional fixed automation, modern European robotic palletizing solutions prioritize flexibility to handle mixed-SKU pallets, quick changeovers between products, and seamless integration with upstream packaging lines and downstream logistics. The growth of e-commerce fulfillment centers, particularly in Western Europe, is accelerating adoption of robotic systems capable of handling diverse product shapes and sizes with minimal reprogramming.

Significant opportunities are emerging from digital twin technology, AI-powered vision systems, and cloud-based robotic management platforms that enable predictive maintenance, remote monitoring, and continuous optimization of palletizing operations. Europe's strong industrial IoT ecosystem positions it to lead in developing connected palletizing solutions that provide real-time analytics on throughput, efficiency, and equipment health.

Furthermore, regulatory trends such as the EU's Machinery Directive updates and emphasis on human-robot collaboration safety standards are shaping product development toward safer, more intuitive systems that can work alongside human workers without extensive safety fencing.

However, the market faces challenges including high initial investment costs, integration complexity with legacy systems, and skilled labor shortages for programming and maintenance. European manufacturers, particularly SMEs, often require compelling ROI justifications and flexible financing models to adopt robotic palletizing. Additionally, the diversity of packaging formats across European markets driven by varying consumer preferences, languages, and regulatory requirements demands highly adaptable robotic systems capable of handling exceptional variability.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Despite these challenges, Europe's robotic palletizers market is poised for sustained growth driven by structural labor market trends, competitive pressures in manufacturing and logistics, and continuous technological advancement. Success will belong to providers offering not just hardware but complete solutions encompassing application engineering, integration services, and digital tools that maximize uptime and adaptability.

Europe Robotic Palletizers Market: Key Takeaways

- Strong Automation-Driven Growth: The European market is projected to grow from USD 459.3 million in 2025 to USD 784.4 million by 2034, achieving a CAGR of 6.1%. This is significantly higher than traditional automation equipment, reflecting rapid robotic adoption across material handling applications.

- Technology Leadership in Collaborative Systems: Collaborative Robots (Cobots) represent the fastest-growing segment, expanding at over high CAGR, driven by European safety regulations, SME adoption, and applications requiring human-robot interaction in flexible production environments.

- Food & Beverage as Dominant End-user: The Food & Beverage sector accounts for approximately 35% of the European market, driven by hygiene requirements, high throughput needs, seasonal product variations, and stringent traceability regulations that robotic systems effectively address.

- Payload Segmentation Shift: While Medium Payload robots (101–500 kg) dominate current installations, Low Payload systems (up to 100 kg) are growing fastest due to increasing e-commerce fulfillment applications handling smaller, lighter parcels and cases.

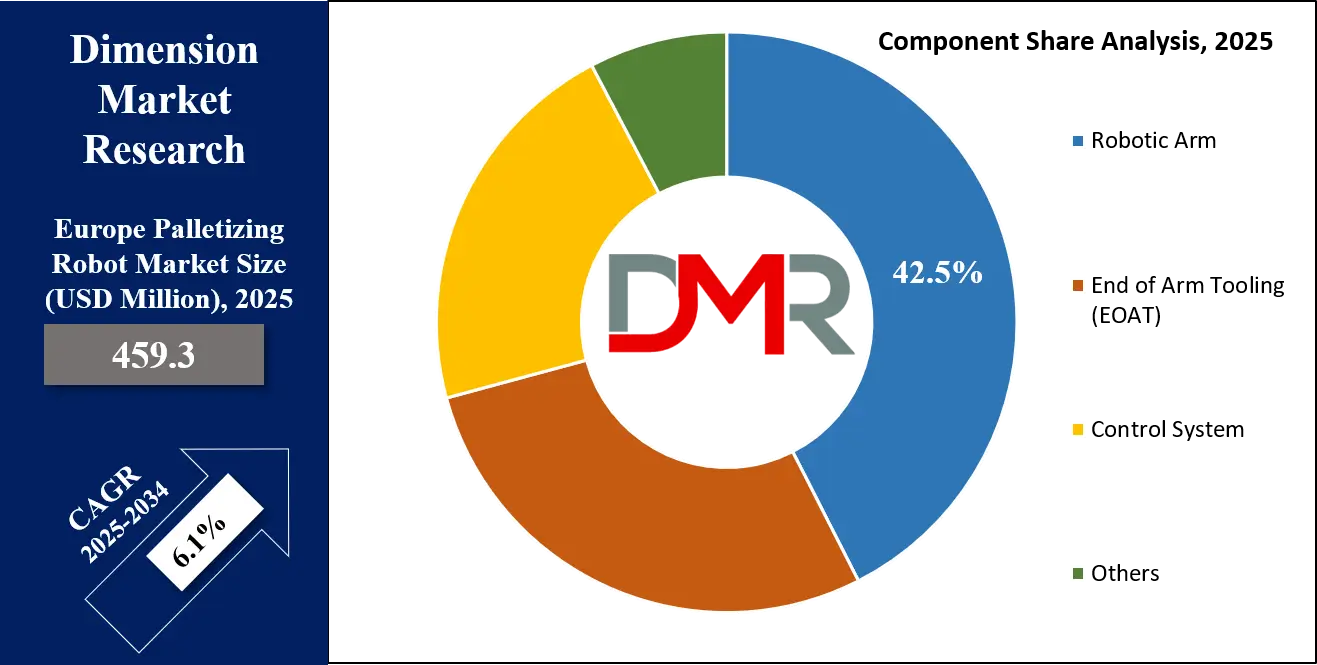

- Integration Over Hardware Focus: Competitive differentiation is increasingly shifting from robotic arms to complete system integration, with End of Arm Tooling (EOAT) and Control Systems representing growing value shares as customization for specific applications becomes critical.

Europe Robotic Palletizers Market: Use Cases

- Food & Beverage Mixed-Pallet Building: European food manufacturers use robotic palletizers with advanced vision systems and adaptive EOAT to build stable mixed-SKU pallets containing various package types (cases, trays, shrink-wrapped bundles) for distribution to retailers. Systems must handle delicate products (eggs, baked goods), comply with food safety standards (EHEDG, ISO 22000), and enable quick changeovers between production runs of different products, often integrating with upstream case packing and labeling systems.

- Pharmaceutical Batch Palletizing with Traceability: Pharmaceutical manufacturers employ robotic palletizers in cleanroom or controlled environments to handle cases of medicines, ensuring precise placement, minimal product stress, and full batch traceability. Systems integrate with serialization and aggregation software to track each case to pallet, complying with EU Falsified Medicines Directive requirements. Robots often feature sanitary designs with smooth surfaces and washdown capability for production areas requiring regular cleaning.

- E-commerce Fulfillment Center Parcel Sorting: Logistics providers deploy grids of collaborative robotic palletizers in e-commerce warehouses to sort and stack parcels of varying sizes and weights onto pallets or directly into outbound trailers. Systems use 3D vision to identify parcel dimensions and optimal stacking patterns, maximizing cube utilization and load stability for transportation. This application demands extreme flexibility to handle thousands of different SKUs daily with minimal reprogramming.

- Beverage Industry High-Speed Bottle & Can Palletizing: Breweries and soft drink manufacturers utilize high-speed delta or articulated robots to palletize bottles, cans, and multipacks at rates exceeding 100 cycles per minute. Systems handle full layer formation with layer pads or slip sheets, often integrating with downstream stretch wrapping and labeling. Reliability and uptime are critical in 24/7 production environments, with predictive maintenance systems monitoring component wear.

- Chemical Industry Drum & Intermediate Bulk Container Handling: Chemical manufacturers use heavy-payload articulated robots to palletize drums, IBCs, and sacks of raw materials or finished products. Systems feature specialized EOAT for secure handling of heavy, sometimes hazardous loads, with safety systems ensuring stable grip and controlled placement. Applications often include palletizing onto wooden pallets or slip sheets for export shipments, with robots capable of handling loads exceeding 500 kg.

Europe Robotic Palletizers Market: Stats & Facts

European Union & Industry Data Sources

- Eurostat: Reports on industrial automation investment under NACE codes for specialized machinery manufacturing. European investment in industrial robots reached USD 2.1 billion annually, with material handling representing the largest application segment.

- International Federation of Robotics (IFR): European chapter data shows Europe installed approximately 72,000 industrial robots in 2023, with Germany, Italy, and France as the top three markets. Palletizing remains among the top three applications by volume.

- European Automation Association (EUnited): Provides market analysis for robotics and automation components, indicating that over 40% of European manufacturers have implemented or plan to implement robotic palletizing solutions within three years.

- EU Machinery Directive 2006/42/EC: Sets essential health and safety requirements for robotic systems, including palletizers, with updates expected to further address collaborative robot safety standards.

- European Agency for Safety and Health at Work (EU-OSHA): Statistics show manual handling accounts for over 30% of workplace injuries in EU manufacturing and logistics, driving regulatory emphasis on automation solutions.

- VDMA (German Engineering Federation): Robotics and Automation division reports German robotic palletizer installations growing at 8.2% annually, with particularly strong demand from mid-sized enterprises (Mittelstand).

Production & Technology Leadership

- Europe is home to leading robotic OEMs including ABB (Switzerland), KUKA (Germany, now Chinese-owned but with strong European operations), and Bosch Rexroth (Germany), along with numerous specialized palletizing solution providers like Cermex (France) and Gebo Cermex.

- European system integrators and EOAT specialists maintain global leadership in customized palletizing solutions, particularly for complex applications in food, pharmaceuticals, and consumer goods.

Regional Adoption Patterns

- DACH region (Germany, Austria, Switzerland): Highest robotic density, driven by automotive and advanced manufacturing, with emphasis on high-speed, precision palletizing.

- Nordic Countries: Early adopters of collaborative robotics, with strong focus on human-robot collaboration in palletizing applications.

- Southern Europe (Italy, Spain): Strong in packaging machinery manufacturing, with integration of robotic palletizing into complete packaging lines for food and beverage.

- United Kingdom: Significant logistics and e-commerce demand, with growth in parcel sorting and fulfillment center automation.

- Eastern Europe: Rapid growth market as manufacturing expands, with increasing adoption driven by labor cost pressures and quality consistency requirements.

Regulatory & Economic Influences

- EU Green Deal and Packaging Waste Directive: Driving demand for palletizing optimization to reduce packaging material use and improve transportation efficiency (load stability, cube utilization).

- Circular Economy Action Plan: Encouraging automation in reverse logistics for sorting and palletizing returned goods and recyclable materials.

- Labor Market Dynamics: Aging workforce and difficulty filling repetitive manual jobs in many European countries creating structural demand for automation solutions.

Europe Robotic Palletizers Market: Market Dynamics

Driving Factors in the Europe Robotic Palletizers Market

Labor Market Constraints and Ergonomic Regulations

Europe faces significant demographic challenges with an aging workforce and declining working-age population in many countries. Simultaneously, younger workers increasingly avoid repetitive, physically demanding manual palletizing jobs. This has created chronic labor shortages in manufacturing and logistics, particularly for shift work and seasonal peaks. Regulatory frameworks such as the EU's Manual Handling Directive (90/269/EEC) place strict limits on repetitive lifting and carrying, pushing employers toward automation. Robotic palletizers address both issues replacing hard-to-find labor while ensuring compliance with ergonomic regulations and reducing workplace injury risks, providing strong ROI through reduced absenteeism and compensation claims.

E-commerce Growth and Supply Chain Complexity

The exponential growth of e-commerce, accelerated by pandemic-era shifts in consumer behavior, has fundamentally transformed European logistics operations. Where traditional palletizing involved uniform cases moving to stable retail destinations, e-commerce fulfillment requires handling infinite SKU variations in parcel sizes, building mixed pallets, and adapting to constantly changing order patterns. Robotic palletizers with advanced vision systems and AI-driven pattern optimization provide the flexibility to manage this complexity where fixed automation or manual labor fall short. The need for faster order fulfillment, 24/7 operation, and efficient use of expensive warehouse space further drives robotic adoption in logistics centers across Europe.

Restraints in the Europe Robotic Palletizers Market

High Initial Investment and Integration Complexity

Despite declining robot prices, complete robotic palletizing systems encompassing robots, EOAT, vision systems, safety equipment, and integration represent significant capital expenditure, particularly for small and medium-sized enterprises (SMEs) that dominate European manufacturing. The business case requires clear ROI calculations encompassing labor savings, quality improvements, and increased throughput.

Beyond hardware costs, integration with existing production lines, warehouse management systems, and material flow can be complex and disruptive, requiring specialized engineering expertise that adds to implementation costs and timeline. This creates inertia, particularly for companies with legacy systems or constrained capital budgets.

Technical Skill Shortages and Maintenance Requirements

Implementing and maintaining robotic palletizing systems requires specialized skills in robotics programming, vision system configuration, mechanical design (EOAT), and system integration. Europe faces a significant shortage of such technical talent, particularly outside major industrial regions. This skills gap increases dependency on external integrators and OEM support, raises operating costs, and can lead to extended downtime when issues arise.

Additionally, robotic systems require preventive maintenance and eventual component replacement, creating ongoing operational costs and requiring either in-house expertise or service contracts. For some organizations, these operational complexities outweigh the benefits of automation.

Opportunities in the Europe Robotic Palletizers Market

Digitalization and Data-Driven Optimization

The convergence of robotics with Industrial IoT, cloud computing, and AI creates opportunities for value-added services beyond hardware sales. Digital twin technology allows simulation and optimization of palletizing patterns before physical implementation. Cloud-connected robots enable remote monitoring, predictive maintenance (analyzing motor currents, vibration patterns), and performance benchmarking across fleets.

AI-powered vision systems can continuously improve pick-and-place decisions based on historical data. Providers that offer these digital services can create recurring revenue streams, improve customer stickiness, and differentiate from hardware-focused competitors. The European market, with its advanced digital infrastructure and Industry 4.0 initiatives, is particularly receptive to these solutions.

Collaborative Robotics for Flexible Automation

The rise of collaborative robots (cobots) specifically designed to work alongside humans without extensive safety fencing opens new application areas for palletizing. Cobots can be deployed in spaces where traditional industrial robots would be impractical for example, in small batch production areas, for loading/unloading machines, or for final manual touch-up alongside automated palletizing. They enable more flexible work cell designs where humans handle complex tasks (quality inspection, irregular items) while robots manage repetitive heavy lifting. The European market, with its strong emphasis on worker-centric automation and extensive research in human-robot interaction, presents particularly fertile ground for collaborative palletizing solutions.

Trends in the Europe Robotic Palletizers Market

Mobile Robotic Palletizing Systems

While most palletizing robots are fixed installations, there is growing interest in Autonomous Mobile Robots (AMRs) with integrated palletizing capabilities. These systems combine mobility with robotic manipulation, allowing them to pick up products from one location, build pallets, and transport finished pallets to staging areas all without fixed infrastructure. This is particularly relevant for warehouses with changing layouts, seasonal peak demands, or operations spanning multiple buildings. European logistics providers and manufacturers are piloting such systems to increase flexibility and reduce fixed conveyor investments.

Sustainable and Circular Economy Applications

European sustainability directives are driving innovation in palletizing for circular economy applications. Robots are increasingly used for depalletizing and sorting returned goods for repair, refurbishment, or recycling. They can efficiently handle varied, often damaged packaging that would challenge manual sortation.

Additionally, robotic palletizing systems are being optimized to minimize packaging material use through optimal stacking patterns that maximize load stability without excessive stretch wrap or corner boards. Some systems even integrate with packaging machines to adjust case sizes based on optimal pallet patterns, reducing void fill and material waste. These sustainability applications align with corporate ESG goals and EU regulatory priorities.

Europe Robotic Palletizers Market: Research Scope and Analysis

By Component Analysis

Robotic Arm are projected to form the core mechanical subsystem, with European manufacturers leading in precision engineering and reliability. Articulated robots (6-axis) dominate complex palletizing applications requiring dexterity to handle multiple package types and build stable mixed pallets. SCARA robots excel in high-speed applications with consistent package formats, particularly in electronics and pharmaceuticals. Delta robots achieve extreme speeds (up to 200 picks/minute) for light payloads like bottles and small packages. European robotic arms increasingly feature integrated force sensing for delicate product handling and collaborative capabilities for safe human interaction. The trend is toward easier programming through teach pendants with graphical interfaces or even hand-guiding for path recording.

End of Arm Tooling (EOAT) represents the critical interface between robot and product, and is where most application-specific customization occurs. Vacuum grippers dominate for handling boxes, cases, and flat items, with European suppliers leading in energy-efficient vacuum systems and adaptive suction cup arrays. Mechanical grippers using fingers or clamps handle irregular shapes, bags, and heavy items. Magnetic grippers serve niche applications with ferrous materials. Advanced EOAT systems feature quick-change mechanisms allowing one robot to handle multiple product types by swapping tools automatically, and integrated sensors confirming grip and monitoring tool health. The EOAT segment is experiencing strong growth as applications diversify and require more sophisticated tooling solutions.

Control Systems have evolved from proprietary robot controllers to open, PC-based platforms that integrate robot control, vision processing, and connectivity to factory networks. Modern systems support offline programming and simulation, allowing palletizing patterns to be developed without stopping production. Safety-rated controllers enable collaborative applications by monitoring forces and speeds to ensure safe human interaction. The integration of AI and machine learning at the control level enables adaptive palletizing that optimizes patterns based on real-time package dimensions and weights. European control system providers emphasize cybersecurity features and OPC UA compatibility for seamless Industry 4.0 integration.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

By Technology Analysis

Articulated Robots with 6 degrees of freedom are poised to represent the most versatile palletizing solution, capable of handling complex patterns, multiple incoming lines, and varied package types within a single work envelope. Their anthropomorphic design allows them to reach over, under, and around obstacles, making them ideal for retrofitting into existing production lines with space constraints. European manufacturers lead in developing high-speed articulated models specifically optimized for palletizing with enhanced wrist flexibility and reduced cycle times.

Cartesian/Gantry Robots provide high precision and stability for heavy payload applications, with linear motion along X, Y, and Z axes. They excel in applications requiring precise placement of heavy loads (drums, IBCs, automotive parts) or very large work envelopes covering multiple conveyor lines. European implementations often feature modular designs allowing customized work envelope dimensions and hybrid configurations combining linear axes with rotary wrist units for complex orientation requirements.

SCARA Robots offer exceptional speed for selective palletizing applications where packages arrive in consistent orientation. Their rigid vertical structure provides high stiffness for precise vertical placement, making them ideal for high-speed stacking of uniform packages in electronics, pharmaceuticals, and cosmetics. European SCARA designs increasingly incorporate collaborative features and integrated vision for simple alignment corrections.

Collaborative Robots (Cobots) represent the fastest-growing segment, designed to work alongside humans without traditional safety fencing. European cobot manufacturers lead in force-limited designs and intuitive programming interfaces (often hand-guiding or tablet-based). Cobots enable flexible deployment in small batch environments, hybrid manual/automated cells, and spaces where safety fencing is impractical. Their growth is particularly strong among SMEs and for applications requiring frequent human intervention for quality checks or irregular items.

By Payload Capacity Analysis

Low Payload Systems (up to 100 kg) handle the majority of parcel, case, and bag palletizing applications. This segment is growing rapidly due to e-commerce fulfillment expansion, pharmaceutical packaging, and consumer goods manufacturing. Robots in this range emphasize speed and flexibility over brute force, with advanced vision systems to handle diverse package sizes and shapes. Collaborative robots predominantly serve this payload range, enabling safe deployment alongside human workers. The trend is toward lighter, more energy-efficient designs with integrated intelligence for adaptive handling.

Medium Payload Systems (101–500 kg) represent the core of industrial palletizing for manufacturing sectors. This range handles full cases of packaged goods, bags of raw materials, and medium-sized industrial components. Robots in this category balance speed with strength, often featuring enhanced rigidity for precise heavy placement and advanced path optimization to minimize cycle times while handling substantial mass. European manufacturers lead in developing energy-recuperating systems that capture braking energy during deceleration, particularly important for frequently cycled palletizing applications.

High Payload Systems (above 500 kg) serve heavy industry applications including chemical drums, building materials, automotive components, and metal products. These robust systems prioritize stability and precision under load over speed, often incorporating dual-arm configurations for balanced handling of asymmetric loads. Safety is paramount, with redundant braking systems and load monitoring. While representing smaller unit volumes, high-payload systems command premium pricing and require sophisticated application engineering, a strength of European system integrators.

By Application Analysis

Case Palletizing is the largest application segment, encompassing corrugated boxes of finished goods across all manufacturing sectors. European implementations emphasize mixed-case palletizing for retail distribution centers, requiring sophisticated pattern generation algorithms that consider case dimensions, weight distribution, and retail store aisle placement sequences. Advanced systems incorporate weight checking and label verification during the palletizing process to ensure shipping accuracy.

Bag Palletizing handles flexible packaging of powders, granules, and agricultural products. This challenging application requires specialized EOAT that can securely grip bags without damage while accommodating bag shape deformation. European solutions often feature bag flattening and squaring systems upstream of the robot to create consistent stacking surfaces, and pattern stabilization techniques (interlocking patterns, adhesive application) to prevent load shifting during transport.

Bottle & Can Palletizing serves beverage, dairy, and personal care industries with extremely high-speed requirements. European systems excel in full layer handling using vacuum head arrays that pick entire layers simultaneously, achieving speeds exceeding 2000 containers per minute. Integration with upstream filling/capping lines and downstream stretch wrapping is seamless, with European packaging machinery manufacturers offering complete turnkey lines.

By End-user Analysis

Food & Beverage is the dominant end-user, driven by high throughput requirements, hygiene standards (requiring washdown-capable equipment), seasonal product variations, and retail compliance needs (pallet configuration for specific retailers). European food processors value systems that can handle delicate products (eggs, chips, baked goods) without damage and quickly change over between different package formats. Traceability from production lot to pallet is increasingly required.

Pharmaceuticals demand precision handling, cleanroom compatibility, and full serialization integration per EU Falsified Medicines Directive. Systems must accommodate small batch sizes with frequent changeovers and provide documented process validation. Collaborative robots are gaining traction for handling high-value, low-volume products where flexibility outweighs pure speed requirements.

Consumer Goods encompasses diverse products from electronics to household items. Requirements include handling multiple SKUs simultaneously (for e-commerce fulfillment), damage-free handling of retail-ready packaging, and efficient space utilization in shipping containers. European consumer goods manufacturers are adopting mobile robotic solutions that can be reconfigured for different product lines.

Chemical Industry applications prioritize safety (handling hazardous materials), heavy payload capability, and compatibility with various container types (drums, bags, IBCs). Systems often operate in harsh environments requiring corrosion-resistant construction and explosion-proof ratings for volatile substances.

Logistics & Warehousing represents the fastest-growing end-user segment, driven by e-commerce. Requirements include extreme flexibility to handle infinite SKU variations, integration with warehouse management systems, 24/7 operation reliability, and efficient use of expensive real estate. European logistics providers are implementing robotic palletizing grids with multiple robots serving shared work areas and autonomous mobile palletizing systems that combine transport and stacking.

The Palletizing Robot Market Report is segmented based on the following:

By Component

- Robotic Arm

- End of Arm Tooling (EOAT)

- Control System

- Others

By Technology Robotic Palletizers

- Articulated Robots

- Cartesian (Gantry) Robots

- SCARA Robots (Selective Compliance Assembly Robot Arm)

- Collaborative Robots (Cobots)

- Delta Robots

- Hybrid Palletizing Robots

- Robotic Grippers

- Vacuum Grippers

- Magnetic Grippers

- Mechanical Grippers

By Payload Capacity

- Low Payload (Up to 100 kg)

- Medium Payload (101–500 kg)

- High Payload (Above 500 kg)

By Application

- Case Palletizing

- Bag Palletizing

- Bottle Palletizing

- Drum Palletizing

By End User

- Food & Beverage

- Pharmaceutical

- Consumer Goods

- Chemical

- Logistics & Warehousing

By Region

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Impact of Artificial Intelligence on the Europe Robotic Palletizers Market

- AI-Optimized Pallet Pattern Generation: Machine learning algorithms analyze dimensions, weights, and center of gravity for mixed SKUs to generate optimal stacking patterns that maximize load stability, minimize packaging materials, and comply with transportation constraints. Systems continuously improve based on historical shipping data and damage reports, adapting patterns for specific carriers or routes common in European multimodal logistics.

- Predictive Quality Control Through Vision AI: Advanced computer vision using deep learning inspects packages for damage, correct labeling, and proper sealing during the palletizing process. AI identifies subtle defects human operators might miss and can automatically reject damaged items or flag pallets for manual inspection, ensuring quality compliance particularly important in European pharmaceutical and food safety regulated environments.

- Adaptive Gripping & Force Control: AI enables robots to adjust gripping strategy in real-time based on package material, weight distribution, and orientation. For delicate items (pastries, electronics) or variable items (deforming bags), AI modulates vacuum pressure or mechanical grip force to prevent damage while ensuring secure handling critical for European premium product manufacturers.

- Predictive Maintenance & Health Monitoring: AI algorithms analyze data from robot sensors (motor currents, vibration, temperature) to predict component failures before they cause unplanned downtime. Systems can schedule maintenance during planned breaks, order replacement parts automatically, and even adjust robot parameters to extend life of wearing components, maximizing uptime in Europe's high-utilization manufacturing environments.

- Dynamic Workcell Optimization: In multi-robot palletizing cells (common in European e-fulfillment centers), AI coordinates multiple robots to avoid collisions, balance workload, and optimize overall throughput. Systems dynamically reassign tasks based on real-time line speeds, robot availability, and order priorities, ensuring efficient operation of capital-intensive automation installations.

Competitive Landscape

The European robotic palletizers market features a multi-tier competitive structure with global robotic OEMs, specialized palletizing solution providers, and regional system integrators. The market is characterized by technology leadership, strong application expertise, and increasing convergence between robotics and traditional packaging machinery.

Global Robotic OEMs including ABB (Switzerland), KUKA (Germany), and Fanuc (Japan with strong European presence) dominate the robotic arm supply, offering palletizing-specific robot models with optimized kinematics and software packages. These companies compete on robot performance, reliability, and global service networks, often working through system integrators for complete solutions.

Specialized Palletizing Solution Providers like Cermex (France, part of the Sidel Group), Columbia/Okura, and Brenton offer turnkey palletizing systems with deep application expertise in specific industries (particularly food & beverage and pharmaceuticals). These companies differentiate through complete system integration, proprietary software, and industry-specific compliance (hygienic design, cleanroom compatibility).

Traditional Packaging Machinery Manufacturers such as Bosch Packaging Technology, Pro Mach, and IMA have expanded into robotic palletizing as part of complete packaging line offerings, leveraging their existing customer relationships and process knowledge.

System Integrators & EOAT Specialists form a vital layer, customizing solutions for specific customer needs. European leaders include FANUC Systempartner network members, Wemo, and numerous regional specialists who provide local engineering support and maintenance.

Some of the prominent players in the Europe Palletizing Robot Market are:

- ABB Ltd.

- KUKA AG

- Fanuc Corporation

- Yaskawa Electric Corporation

- Kawasaki Robotics

- Cermex (Sidel Group)

- Columbia/Okura LLC

- Brenton Engineering

- Bosch Packaging Technology

- ProMach

- FANUC Systempartner network members

- Wemo

- Gebo Cermex

- Von GAL

- Schmalz GmbH (EOAT specialist)

- Piab AB

- Other Key Players

Recent Developments

- April 2025: ABB launched its next-generation "PalletPack 4600" collaborative palletizing cell specifically designed for European SMEs, featuring integrated vision, AI-based pattern optimization, and a subscription-based pricing model that includes maintenance and software updates, lowering barriers to adoption.

- February 2025: The European Commission approved funding for the "AutoPack" consortium, bringing together robotic OEMs, packaging manufacturers, and research institutes to develop standardized interfaces for robotic palletizing systems, aiming to reduce integration costs and complexity by 30%.

- December 2024: KUKA and German logistics provider DHL unveiled a fully autonomous mobile palletizing system at a Nuremberg e-fulfillment center, featuring AMRs with integrated delta robots that sort and palletize parcels directly at packing stations, reducing manual handling by 80%.

- October 2024: French packaging leader Sidel introduced its "RoboPal Evo" series with carbon fiber robotic arms, reducing weight and energy consumption by 40% compared to previous models, specifically targeting European food processors with sustainability goals.

- July 2024: Bosch Rexroth launched a "Palletizing-as-a-Service" platform for European manufacturers, providing robotic palletizing capacity via cloud-connected systems with pay-per-pallet pricing, particularly targeting seasonal businesses and companies testing automation.

- May 2024: The European Federation of Pharmaceutical Industries and Associations (EFPIA) published new guidelines for robotic palletizing in GMP environments, standardizing requirements for cleanroom compatibility, validation documentation, and serialization integration, driving upgrade demand across the pharmaceutical sector.

- March 2024: Swedish robotics startup "FlexPal" secured USD 15 million in venture funding to scale production of its adaptive vacuum EOAT system that uses AI to optimize suction cup placement in real-time for mixed-case palletizing, with initial deployment at Scandinavian e-commerce companies.

- January 2024: German automotive supplier Continental implemented a network of collaborative palletizing robots across 12 European plants, using a centralized AI system to optimize pallet patterns across its supply chain, reducing transportation costs by 8% through better cube utilization.

- November 2023: The UK's largest online grocer Ocado deployed Europe's first fully robotic produce palletizing system, using soft robotics and computer vision to handle delicate fruits and vegetables without damage, addressing both labor shortages and food waste reduction goals.

- September 2023: Italian packaging machinery association UCIMA and German robotics association VDMA signed a cooperation agreement to develop joint standards for integrating robotic palletizing with traditional packaging lines, addressing a key interoperability challenge in European manufacturing.

- June 2023: Dutch beer giant Heineken completed a USD 50 million automation upgrade at its Amsterdam brewery, installing a robotic palletizing system that handles 120,000 bottles per hour while reducing energy consumption by 25% through regenerative braking and optimized movement patterns.

- April 2023: The European Union's "Factories of the Future" initiative funded 12 demonstration projects for circular economy robotic palletizing, focusing on depalletizing returned goods, sorting recyclable materials, and optimizing reusable packaging handling.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 459.3 Mn |

| Forecast Value (2034) |

USD 784.4 Mn |

| CAGR (2025–2034) |

6.1% |

| Historical Data |

2019 – 2024 |

| Forecast Data |

2026 – 2034 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Component (Robotic Arm, End of Arm Tooling (EOAT), Control System, and Others), By Technology Robotic Palletizers (Articulated Robots, Cartesian (Gantry) Robots, SCARA Robots (Selective Compliance Assembly Robot Arm), Collaborative Robots (Cobots), Delta Robots, Hybrid Palletizing Robots, and Robotic Grippers), By Payload Capacity (Low Payload (Up to 100 kg), Medium Payload (101–500 kg), and High Payload (Above 500 kg)), By Application (Case Palletizing, Bag Palletizing, Bottle Palletizing, and Drum Palletizing), By End User (Food & Beverage, Pharmaceutical, Consumer Goods, Chemical, and Logistics & Warehousing) |

| Regional Coverage |

Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe

|

| Prominent Players |

ABB Ltd, KUKA AG, FANUC Corporation, Yaskawa Electric Corporation, Kawasaki Heavy Industries Ltd, Mitsubishi Electric Corporation, Universal Robots A/S, Stäubli International AG, Comau S.p.A., Krones AG, KION Group AG, Honeywell International Inc., BEUMER Group GmbH & Co. KG, Schneider Electric SE, Siemens AG, Cermex, Fuji Robotics, Robopac, Inther Group, Columbia/Okura LLC., and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |

Frequently Asked Questions

How big is the Europe Palletizing Robot Market?

▾ The Europe Palletizing Robot Market size is estimated to have a value of USD 459.3 million in 2025 and is expected to reach USD 784.4 million by the end of 2034.

What is the growth rate in the Europe Robotic Palletizers Market?

▾ The market is growing at a Compound Annual Growth Rate (CAGR) of 6.1 percent over the forecast period from 2025 to 2034.

Which countries lead in robotic palletizer adoption in Europe?

▾ Germany is the largest market, followed by Italy, France, and the United Kingdom. The Nordic countries lead in collaborative robot adoption, while Central and Eastern Europe show the highest growth rates.