Market Overview

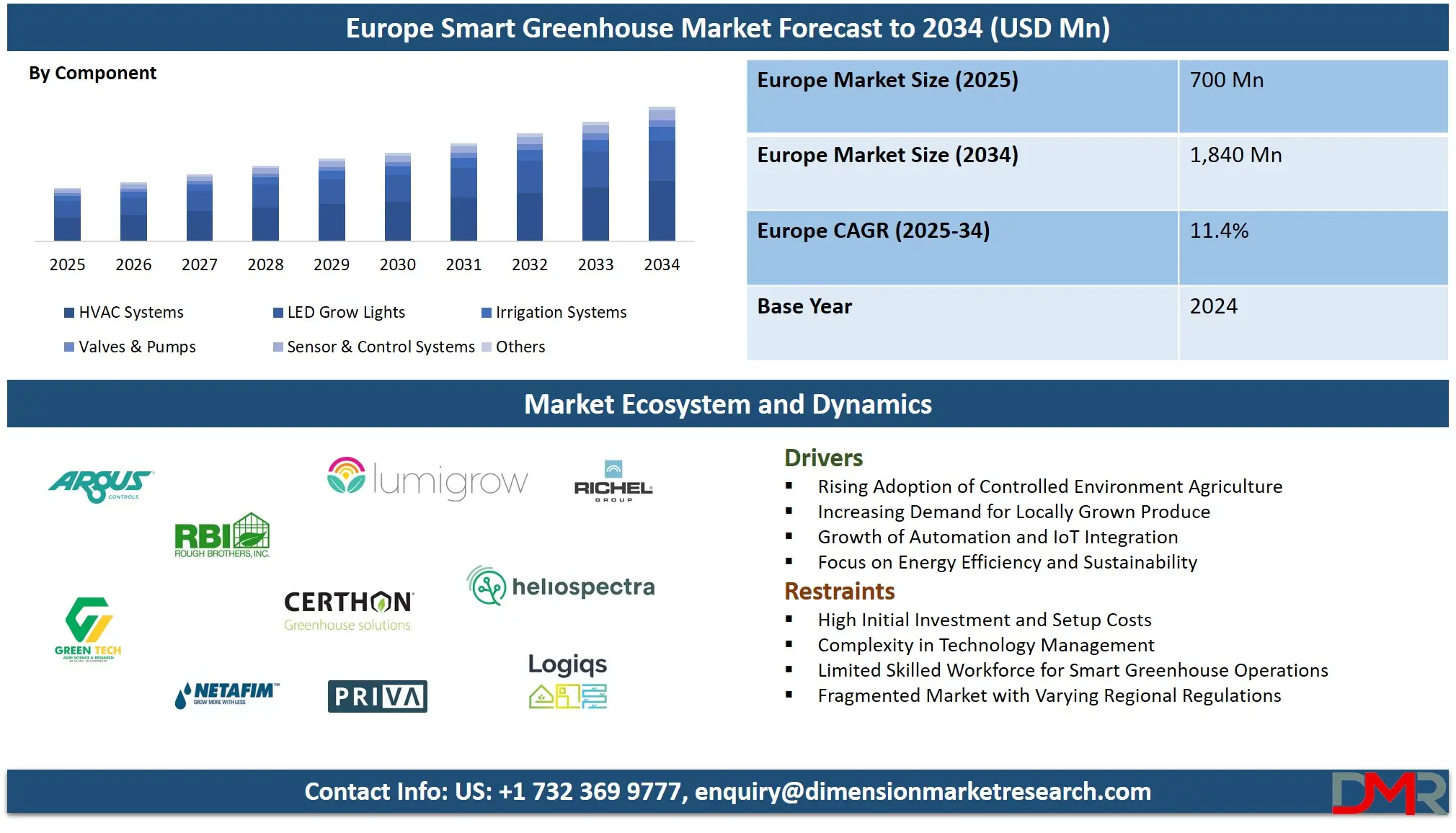

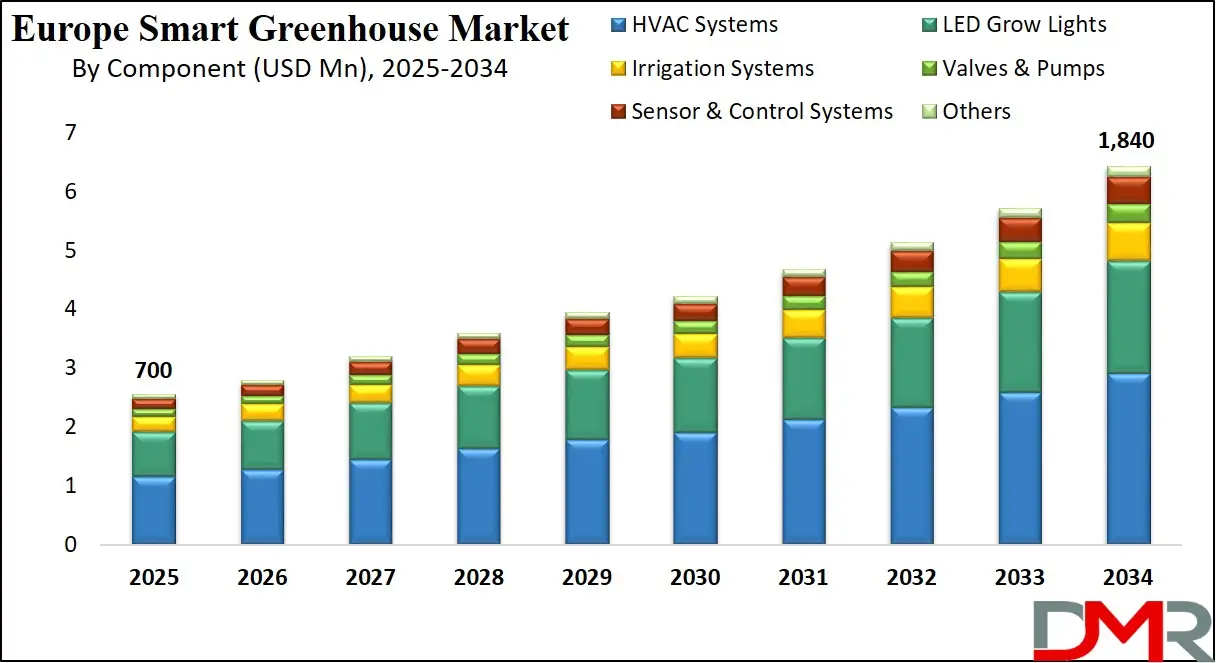

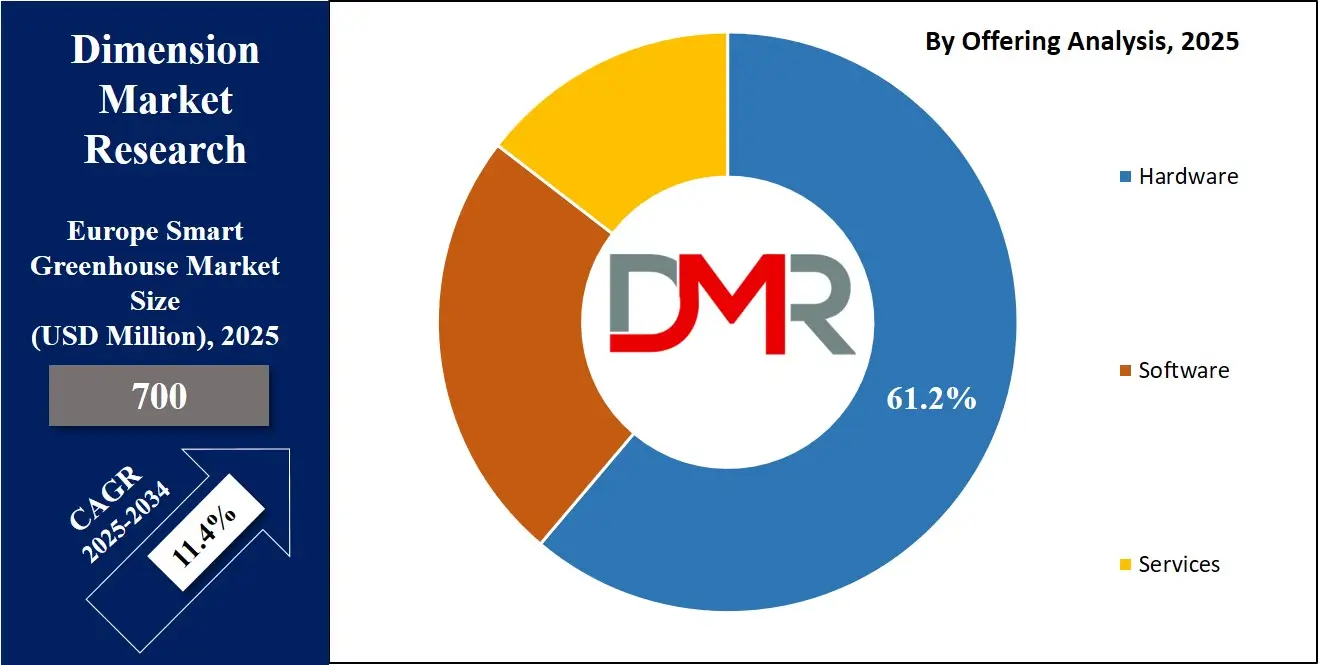

The Europe smart greenhouse market is expected to expand from USD 700 million in 2025 to USD 1,840 million by 2034, reflecting an 11.4% CAGR driven by increasing adoption of controlled environment agriculture, automation technologies, smart farming systems, and data-driven greenhouse solutions across key horticulture markets in the region.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

A smart greenhouse is an advanced growing structure that uses automated technologies such as climate control systems, IoT sensors, irrigation monitoring, and AI-based analytics to maintain optimal environmental conditions for plant growth with minimal human intervention. These systems continuously track variables like temperature, humidity, soil moisture, CO₂ levels, and light intensity, then automatically adjust ventilation, heating, shading, and fertigation to improve crop quality, reduce resource consumption, and enable year-round production. By integrating data-driven cultivation methods, smart greenhouses increase yield consistency, enhance operational efficiency, and support precision agriculture for both small growers and large commercial farms.

The Europe smart greenhouse market refers to the ecosystem of technologies, solutions, and greenhouse infrastructures deployed across the region to modernize horticulture and controlled environment agriculture. It includes climate automation systems, hydroponic solutions, LED grow lighting, greenhouse management software, and sensor networks adopted by growers to improve productivity and reduce labor dependency. European countries are rapidly embracing these technologies due to rising demand for locally grown produce, environmental sustainability goals, and strong governmental support for tech-enabled farming.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

In Europe, the smart greenhouse market is also shaped by the region’s focus on energy-efficient food production, advanced agritech innovation, and the adoption of greenhouse automation across nations such as the Netherlands, Spain, Italy, Germany, and France. The region benefits from high adoption of precision farming, a strong horticultural export industry, and strategic investments in sustainable crop production systems. The market continues to grow due to increasing integration of AI, robotics, and IoT platforms that help growers optimize crop cycles, minimize water usage, and improve profitability across diverse greenhouse operations.

Europe Smart Greenhouse Market: Key Takeaways

- Market Value: The Europe smart greenhouse market size is expected to reach a value of USD 1,840 million by 2034 from a base value of USD 700 million in 2025 at a CAGR of 11.4%.

- By Type Segment Analysis: Hydroponic is anticipated to dominate the type segment, capturing 62.0% of the total market share in 2025.

- By Offering Segment Analysis: Hardware is expected to maintain its dominance in the offering segment, capturing 63.0% of the total market share in 2025.

- By Component Segment Analysis: HVAC Systems will account for the maximum share in the component segment, capturing 45.0% of the total market value.

- By End User Segment Analysis: Commercial Growers will dominate the end user segment, capturing 53.0% of the market share in 2025.

- Key Players: Some key players in the Europe smart greenhouse market are Priva Holding BV, Ridder Group, Certhon Build B.V., Richel Group SA, Netafim Ltd., Heliospectra AB, Argus Control Systems Ltd., Logiqs B.V., GreenTech Agro LLC, LumiGrow Inc., Rough Brothers Inc., Agra Tech Inc., Hort Americas LLC, Sensaphone, Cultivar Ltd., Keder Greenhouse, Stuppy Greenhouse, Poly-Tex Inc., and Others.

Europe Smart Greenhouse Market: Use Cases

- Automated Climate Control for Year-Round Crop Production: Growers across Europe use smart greenhouse climate automation to stabilize temperature, humidity, light, and CO₂ levels throughout the year. This use case supports consistent crop cycles in regions with fluctuating weather, enabling higher yields, lower crop loss, and more efficient energy use. Intelligent sensors and IoT-based controls help optimize microclimates for tomatoes, cucumbers, leafy greens, and specialty crops, improving both quality and production efficiency.

- Precision Irrigation and Water Management: Smart greenhouses in Europe increasingly rely on automated fertigation systems and soil-moisture sensing to reduce water consumption and enhance nutrient delivery. This supports sustainability goals and aligns with EU water-efficiency regulations. Precision irrigation ensures plants receive the right amount of water at the right time, improving crop growth while minimizing waste and operational costs.

- Smart Lighting and Energy-Efficient Cultivation: LED grow lights integrated with real-time data analytics are widely used to control light intensity and photoperiods across European greenhouse farms. This use case helps optimize photosynthesis, accelerate plant growth, and improve uniformity in high-value crops. Energy-efficient lighting solutions also support the region’s decarbonization targets by lowering electricity usage and improving overall greenhouse energy management.

- Remote Monitoring and AI-Driven Crop Optimization: European growers use remote monitoring tools and AI-powered platforms to analyze plant health, detect early stress, and automate greenhouse operations from any location. This enhances labor efficiency and reduces manual dependency. Data-driven insights support predictive cultivation, enabling better decision-making, yield forecasting, and proactive management across large commercial greenhouses and vertically integrated horticulture operations.

Impact of Artificial Intelligence on the Europe Smart Greenhouse market

Artificial intelligence is significantly transforming the Europe smart greenhouse market by enabling more precise, autonomous, and data-driven cultivation. AI-powered systems analyze environmental data, crop patterns, and sensor inputs to automate decisions related to climate control, irrigation, fertigation, and energy management, reducing human intervention and improving operational efficiency.

Machine learning models help European growers predict plant stress, optimize growth cycles, and detect early signs of disease, resulting in higher yield stability and lower input costs. AI also supports predictive maintenance for greenhouse equipment, improving uptime and reducing manual monitoring. With Europe’s strong push for sustainable agriculture, AI-driven greenhouse automation enhances resource efficiency by reducing water use, optimizing LED lighting schedules, and minimizing energy consumption. This technological shift accelerates the adoption of controlled environment agriculture across regions like the Netherlands, Spain, Italy, and Germany, strengthening productivity, improving crop quality, and supporting large-scale commercial greenhouse expansion.

Europe Smart Greenhouse Market: Stats & Facts

- Statistics Netherlands (CBS)

- In 2023, the total area used to grow the four primary greenhouse vegetables (tomatoes, peppers, cucumbers, aubergines) in the Netherlands was 4.1 thousand hectares.

- The 2023 area was about 10% more than a decade earlier.

- In 2023 there were 625 farms growing greenhouse vegetables in the Netherlands — 29% fewer than a decade earlier.

- Among those farms, 35% still grew tomatoes, 30% peppers, and 29% cucumbers.

- In 2023 the gross yield of greenhouse vegetables from this group in the Netherlands was 1.63 million tonnes.

- Eurostat / EU‑level agricultural statistics

- In 2022 crop output accounted for 50.9% of the total value of the EU’s agricultural industry.

- In 2022 approximately 2.0 million hectares of land in the EU was used to produce fresh vegetables.

- Natural Resources Institute Finland (Luke) — 2023 / 2024 Finnish data (partial relevance)

- In 2023, total number of horticultural enterprises in Finland was 2,882. Greenhouse area was 350 hectares.

- In 2024, horticultural enterprises numbered 2,764; greenhouse area 375 hectares; greenhouse‑vegetable production was 101 million kilos (54 million kilos cucumber, 41 million kilos tomatoes).

Europe Smart Greenhouse Market: Market Dynamics

Europe Smart Greenhouse Market: Driving Factors

Rising Adoption of Controlled Environment Agriculture

European growers are increasingly shifting toward controlled environment agriculture to combat climate instability, labor shortages, and rising food demand. Smart greenhouse technologies enhanced with climate automation, IoT sensors, and precision irrigation enable year-round cultivation and reliable output. This growing need for stable production cycles drives investments in greenhouse automation and digital farming tools across key horticulture regions.

Focus on Energy Efficiency and Sustainable Food Production

Europe’s strong sustainability regulations and energy-efficiency targets encourage growers to deploy smart systems that reduce resource consumption. AI-guided climate control, LED grow lighting, and water-efficient fertigation systems help operators lower energy usage and minimize environmental impact. These sustainability-focused advancements accelerate the adoption of smart greenhouses in high-production countries like the Netherlands, Spain, and Italy.

Europe Smart Greenhouse Market: Restraints

High Initial Investment and Integration Costs

Installing smart greenhouse infrastructure demands substantial capital due to the need for advanced sensors, automation controllers, climate equipment, and AI-enabled platforms. Smaller growers often struggle with cost barriers and integration complexity. These financial constraints slow adoption in regions where traditional farming still dominates.

Complexity in Technology Management and Skill Gaps

Operating smart greenhouse systems requires technical knowledge related to data analytics, AI platforms, and remote monitoring tools. Many growers lack the digital skills needed to manage automated systems efficiently. Training requirements and system maintenance challenges become significant restraints, particularly for small and medium-scale farms.

Europe Smart Greenhouse Market: Opportunities

Expansion of AI-Driven Crop Optimization Platforms

There is a strong opportunity for AI-based greenhouse management tools that offer predictive analytics, real-time plant health insights, and automated climate adjustments. These platforms support precision agriculture by improving yield accuracy, reducing labor needs, and enabling data-driven cultivation. Europe’s growing agritech investment ecosystem strengthens this opportunity.

Rising Demand for Local, Pesticide-Free Produce

Consumers in Europe increasingly prefer locally grown, sustainably produced fruits and vegetables. Smart greenhouses allow growers to meet this demand by enabling pesticide-free cultivation and consistent supply. This creates expansion opportunities for high-tech greenhouse farms and vertically integrated horticulture companies focused on fresh, high-quality produce.

Europe Smart Greenhouse Market: Trends

Integration of IoT, Robotics, and Digital Twins

A major trend in Europe is the integration of IoT devices, autonomous robots, and digital twin simulations to boost productivity. These technologies support automated harvesting, climate modeling, and real-time growth simulations, enabling more efficient greenhouse operations and improved decision-making.

Growth of Energy-Optimized and Solar-Powered Greenhouses

European greenhouse developers are adopting solar panels, heat-recovery systems, and low-energy LED solutions to reduce operational costs. This trend aligns with the region’s renewable energy goals and drives the rise of energy-efficient smart greenhouses designed for sustainability and long-term cost savings.

Europe Smart Greenhouse Market: Research Scope and Analysis

By Type Analysis

Hydroponic smart greenhouses are expected to lead the type segment with a 62.0% share in 2025 because they offer higher productivity, better resource efficiency, and consistent crop quality compared to traditional cultivation. European growers prefer hydroponic systems due to their ability to operate with minimal soil dependency, optimize nutrient delivery, and significantly reduce water usage, which aligns with the region’s sustainability goals and controlled environment agriculture practices. These systems support stable year-round production for leafy greens, tomatoes, herbs, and high-value horticulture crops, making them ideal for markets with limited arable land and high demand for pesticide-free produce. The rising adoption of automation, IoT monitoring, and AI-driven fertigation further strengthens the dominance of hydroponics across Europe’s advanced greenhouse clusters.

Non-hydroponic smart greenhouses continue to hold relevance in regions where soil-based cultivation remains embedded in traditional horticulture practices or where growers prefer hybrid farming models. These setups combine natural soil cultivation with selective automation tools such as climate control systems, smart irrigation, and sensor-based environmental monitoring. While they typically offer lower yield intensity compared to hydroponics, non-hydroponic greenhouses are valued for their lower initial costs, compatibility with a wide range of crops, and ease of integration into existing farming operations. This segment primarily serves growers transitioning gradually toward full-scale automation, providing a flexible pathway for adopting smart farming technologies without completely shifting to soilless cultivation.

By Offering Analysis

Hardware is projected to dominate the offering segment with a 63.0% share in 2025 because smart greenhouses rely heavily on physical infrastructure and automation equipment to maintain controlled growing conditions. European growers invest extensively in climate control systems, LED grow lights, irrigation and fertigation units, HVAC systems, sensors, actuators, shading mechanisms, and automated ventilation setups to achieve stable year-round crop production. These hardware components form the core of controlled environment agriculture and are essential for optimizing temperature, humidity, CO₂ levels, nutrient distribution, and light management. The rising adoption of hydroponic and vertical farming structures across Europe further increases hardware demand, as advanced greenhouse setups require durable, high-precision equipment to support intensive cultivation, reduce labor dependency, and meet sustainability targets.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Software plays a crucial role in enhancing greenhouse intelligence by enabling real-time monitoring, data analytics, AI-based decision-making, and remote management. Although it represents a smaller share than hardware, software adoption is growing quickly as European farmers seek more accurate insights into crop performance, environmental fluctuations, and energy usage. Greenhouse management platforms integrate sensor data, automate climate adjustments, forecast crop yields, and detect early signs of stress or disease, allowing growers to make proactive decisions. Software solutions also support predictive maintenance, workflow scheduling, and resource optimization, helping farms operate more efficiently. As digital transformation accelerates across the region, software becomes an increasingly vital component for maximizing returns on greenhouse automation investments.

By Component Analysis

HVAC systems are expected to hold the largest share of the component segment with 45.0% in 2025 because climate stability is the foundation of smart greenhouse operations across Europe. These systems regulate temperature, humidity, ventilation, and air circulation, ensuring crops receive consistent environmental conditions even during extreme seasonal fluctuations. European growers rely on advanced heating and cooling units, dehumidifiers, air mixers, and automated ventilation to protect plants from stress, enhance nutrient uptake, and maintain optimal photosynthesis levels. With Europe’s colder climates in northern regions and heat-intensive conditions in southern regions, HVAC systems become essential for year-round production, energy efficiency, and precise climate control. Their integration with IoT sensors and AI-driven automation further strengthens their dominance, enabling real-time microclimate adjustments and improved operational reliability.

LED grow lights represent a crucial component in the smart greenhouse ecosystem by supporting photosynthesis and plant development during low-light periods, cloudy days, or winter seasons. They provide targeted wavelengths that enhance growth cycles, improve plant morphology, and increase yield uniformity while consuming less energy compared to traditional lighting systems. In Europe, LED lighting adoption is rising due to strict energy regulations, sustainability goals, and the increasing popularity of high-density cultivation such as hydroponics and vertical systems. Smart LEDs integrated with automation platforms allow growers to adjust light intensity, duration, and spectrum based on crop requirements, making them essential for optimizing production efficiency and maintaining consistent year-round output.

By End User Analysis

Commercial growers are projected to dominate the end user segment with a 53.0% share in 2025 because they require large-scale, high-efficiency production systems that ensure consistent yields and optimized resource use. These growers invest heavily in smart greenhouse technologies such as climate automation, hydroponic systems, IoT sensors, fertigation units, and AI-based monitoring to maximize productivity and reduce operational costs. Europe’s growing demand for locally produced, pesticide-free fruits and vegetables further drives commercial farms to adopt advanced controlled environment agriculture. The need for year-round cultivation, higher output per square meter, and energy-efficient operations strengthens the preference for fully automated greenhouse setups, making commercial growers the largest contributors to market expansion across major horticulture hubs.

Research and educational institutes use smart greenhouses to conduct scientific studies, crop physiology experiments, breeding trials, and technology validation projects. These institutions adopt controlled environment systems to test new plant varieties, evaluate climate responses, and develop sustainable cultivation practices. Smart greenhouses provide precise control over temperature, humidity, light, and nutrient delivery, helping researchers generate accurate, repeatable results. Universities and agricultural research centers across Europe increasingly integrate IoT platforms, AI analytics, and sensor-driven monitoring to study plant behavior, optimize resource use, and support innovation in modern horticulture. Although this segment is smaller, it plays a crucial role in advancing agritech development and driving long-term innovation in the region’s greenhouse industry.

Europe Smart Greenhouse Market Report is segmented on the basis of the following:

By Type

- Hydroponic

- Non-Hydroponic

By Offering

- Hardware

- Software

- Services

By Component

- HVAC Systems

- LED Grow Lights

- Irrigation Systems

- Valves & Pumps

- Sensor & Control Systems

- Others

By End User

- Commercial Growers

- Research & Educational Institutes

- Retail Gardens

- Others

Europe Smart Greenhouse Market: Regional Analysis

The Europe smart greenhouse market is expanding rapidly, driven by the adoption of controlled environment agriculture and advanced automation technologies across countries such as the Netherlands, Spain, Italy, Germany, and France. The region benefits from strong horticultural traditions, government incentives for sustainable farming, and increasing demand for locally grown, pesticide-free produce.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Investments in IoT-enabled sensors, climate control systems, hydroponics, LED grow lighting, and AI-driven management platforms are enabling growers to optimize yield, reduce water and energy consumption, and ensure year-round production. Northern European countries focus on energy-efficient greenhouse operations, while southern regions prioritize high-density crop cultivation and export-oriented production. The regional growth is further supported by technological collaboration between agritech startups, research institutions, and commercial growers, establishing Europe as a leading market for precision-controlled greenhouse solutions.

By Region

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Europe Smart Greenhouse Market: Competitive Landscape

The Europe smart greenhouse market is highly competitive, characterized by continuous technological innovation and increasing adoption of automation solutions across the horticulture sector. Market players focus on developing advanced climate control systems, IoT-enabled sensors, AI-driven analytics, and energy-efficient lighting to enhance crop yield, reduce resource consumption, and improve operational efficiency. Strategic initiatives such as partnerships, mergers, and collaborations with research institutes and technology providers are common to expand product portfolios and regional presence. Companies are also investing in R&D to introduce modular, scalable, and cost-effective greenhouse solutions that cater to both commercial growers and research institutions. This competitive environment drives innovation, accelerates adoption of precision agriculture technologies, and supports sustainable, year-round crop production across Europe.

Some of the prominent players in the Europe Smart Greenhouse market are:

- Priva Holding BV

- Ridder Group

- Certhon Build B.V.

- Richel Group SA

- Netafim Ltd.

- Heliospectra AB

- Argus Control Systems Ltd.

- Logiqs B.V.

- GreenTech Agro LLC

- LumiGrow Inc.

- Rough Brothers, Inc.

- Agra Tech, Inc.

- Hort Americas, LLC

- Sensaphone

- Cultivar Ltd.

- Keder Greenhouse

- Stuppy Greenhouse

- Poly-Tex Inc.

- The Glasshouse Company Pty Ltd

- Luiten Greenhouses B.V.

- Other Key Players

Europe Smart Greenhouse Market: Recent Developments

- November 2025: An Amsterdam-based startup scaling AI software for controlled environment agriculture raised €15.2 million in a Series B funding round to expand its greenhouse management platform across dozens of countries. The funds will accelerate product development and further promote data-driven cultivation across Europe.

- November 2025: A leading AgTech startup in Europe announced the commercial launch of its first autonomous plant lowering robot for greenhouse grown tomatoes and cucumbers. The system capable of handling 300 plants per hour begins rollout with growers in several European countries helping address labor shortages and increasing automation in controlled environment agriculture.

- June 2025: Another company unveiled a novel inverted greenhouse automation model that brings plants to stationary robots for scanning maintenance and harvesting. This approach promises higher yields and reduced labor dependency.

- May 2025: A UK based agritech firm secured about €3.9 million in funding to support deployment of a real-time crop health sensor and AI platform for greenhouse growers enabling improved resource efficiency early stress detection and yield optimization.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 700 Mn |

| Forecast Value (2034) |

USD 1,840 Mn |

| CAGR (2025–2034) |

11.4% |

| Historical Data |

2019 – 2024 |

| Forecast Data |

2026 – 2034 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Type (Hydroponic, Non-Hydroponic), By Offering (Hardware, Software, Services), By Component (HVAC Systems, LED Grow Lights, Irrigation Systems, Valves & Pumps, Sensor & Control Systems, Others), and By End User (Commercial Growers, Research & Educational Institutes, Retail Gardens, Others) |

| Regional Coverage |

Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe |

| Prominent Players |

Priva Holding BV, Ridder Group, Certhon Build B.V., Richel Group SA, Netafim Ltd., Heliospectra AB, Argus Control Systems Ltd., Logiqs B.V., GreenTech Agro LLC, LumiGrow Inc., Rough Brothers Inc., Agra Tech Inc., Hort Americas LLC, Sensaphone, Cultivar Ltd., Keder Greenhouse, Stuppy Greenhouse, Poly-Tex Inc., and Others. |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users) and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |

Frequently Asked Questions

How big is the Europe smart greenhouse market?

▾ The Europe smart greenhouse market size is estimated to have a value of USD 700 million in 2025 and is expected to reach USD 1,840 million by the end of 2034, with a CAGR of 11.4%.

Who are the key players in the Europe smart greenhouse market?

▾ Some of the major key players in the Europe smart greenhouse market are Priva Holding BV, Ridder Group, Certhon Build B.V., Richel Group SA, Netafim Ltd., Heliospectra AB, Argus Control Systems Ltd., Logiqs B.V., GreenTech Agro LLC, LumiGrow Inc., Rough Brothers Inc., Agra Tech Inc., Hort Americas LLC, Sensaphone, Cultivar Ltd., Keder Greenhouse, Stuppy Greenhouse, Poly-Tex Inc., and Others.