Market Overview

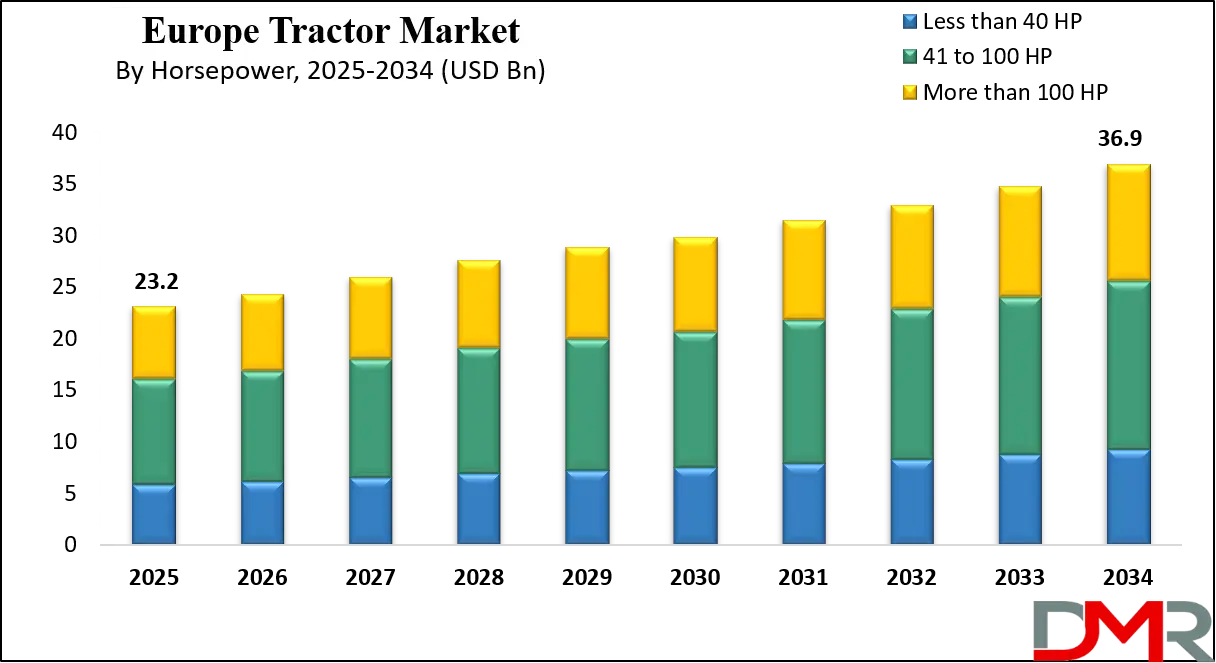

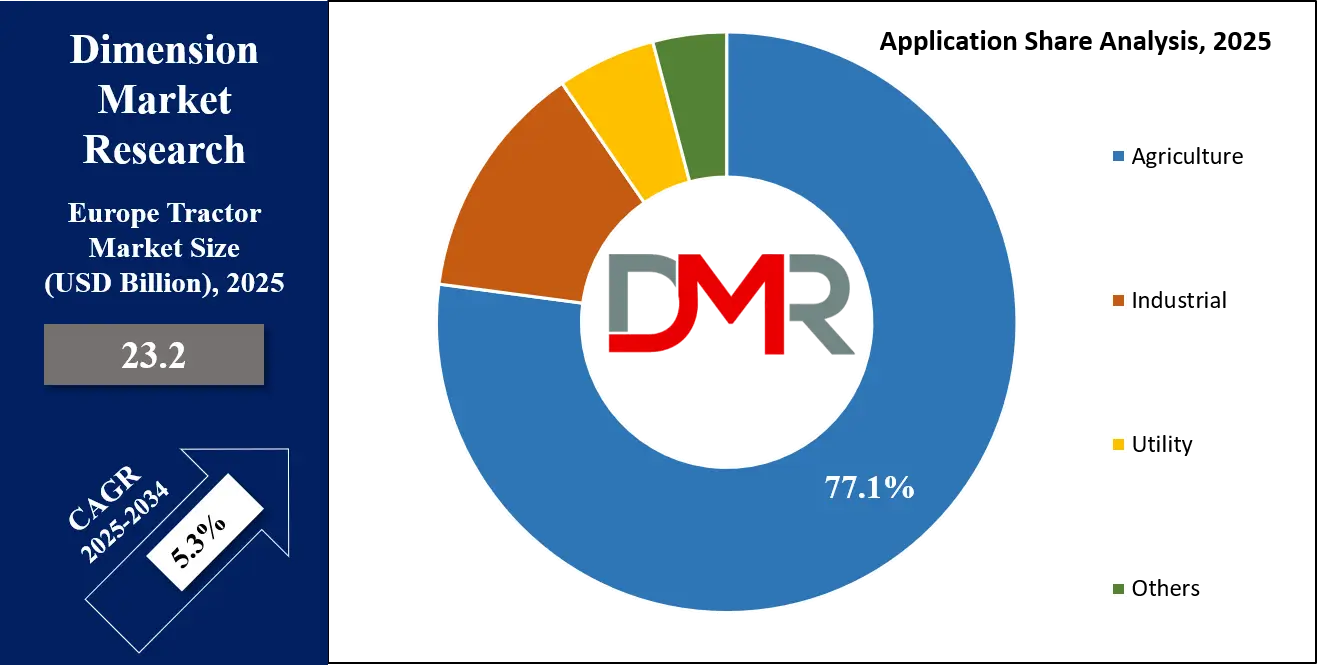

The Europe Tractor Market is projected to reach USD 23.2 billion in 2025, driven by rising mechanization in agriculture, government subsidies, and technological integration in farm equipment. The market is anticipated to expand at a compound annual growth rate (CAGR) of 5.3% from 2025 to 2034, ultimately reaching a valuation of USD 36.9 billion by 2034.

Growth will be fueled by increasing demand for efficient farming solutions, adoption of precision agriculture, and the transition toward sustainable and energy-efficient tractors, including electric and autonomous models. Additionally, large-scale farming in Western Europe and the modernization of small farms in Eastern Europe are set to create diverse opportunities for global and regional tractor manufacturers throughout the forecast period.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The Europe tractor market is poised for steady expansion as mechanization becomes central to enhancing agricultural productivity across the continent. Europe accounts for major portion of the global tractor industry, with strong demand driven by advanced farming practices in Germany, France, Italy, and the UK. The adoption of precision farming technologies and compact tractors for vineyard and orchard farming also adds significant value to the regional market.

One of the most visible trends shaping the European tractor industry is the rapid shift toward sustainable and smart farming equipment. Electrification, hybrid drivetrains, and autonomous tractor models are gaining traction as the EU tightens emissions regulations. The popularity of 2WD tractors in smaller farms contrasts with growing 4WD tractor demand for large-scale commercial farming. Moreover, tractors with horsepower segments above 100 HP are increasingly sought after for industrial and heavy-duty agricultural operations, signaling a move toward greater efficiency and productivity.

The market also presents promising opportunities as the European Union promotes modernization through subsidies and digital farming initiatives. Precision agriculture, data-driven equipment, and GPS-enabled tractors are creating new avenues for manufacturers. Additionally, the replacement of aging fleets in Central and Eastern Europe provides space for mid-sized tractor sales growth. Niche opportunities exist in utility tractors for forestry, landscaping, and municipal use, further broadening the scope of adoption beyond core agriculture.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Despite growth potential, the market faces restraints such as high machinery costs, fluctuating commodity prices, and farmer dependency on subsidies, which limit purchase decisions. Supply chain disruptions and increasing raw material costs have also added pressure on manufacturers. Nonetheless, as farming becomes more technology-driven, the Europe tractor market is set to evolve toward efficiency, sustainability, and digital integration over the forecast period.

Europe Tractor Market: Key Takeaways

- The Market Size Insights: The Europe Tractor Market size is estimated to have a value of USD 23.2 billion in 2025 and is expected to reach USD 36.9 billion by the end of 2034.

- The Market Growth Rate Insights: The market is growing at a CAGR of 5.3% over the forecasted period of 2025.

- Electrification and Hybrid Growth: European tractor manufacturers are rapidly advancing electric and hybrid tractors, supported by sustainability policies, stricter emission norms, and rising farmer interest in eco-friendly machinery.

- Precision Agriculture Integration: AI, IoT, and automation adoption in tractors is transforming farming, enabling data-driven decisions, reducing operational costs, and enhancing crop yield efficiency.

- High Demand for 4WD Tractors: Farmers increasingly prefer 4WD models for large-scale farming and heavy-duty tasks, driving growth in higher horsepower categories across Europe.

- France and Germany Lead: These countries are poised to dominate the market with strong agricultural bases, advanced mechanization, and homegrown tractor manufacturers like Fendt, CLAAS, and Deutz-Fahr.

- Investment in Manufacturing Facilities: Companies like AGCO and CNH Industrial are projected to expand European production capacities to meet rising demand for advanced tractors.

- Growing Utility and Industrial Use: Beyond agriculture, tractors are witnessing higher adoption in construction, forestry, and municipal applications, diversifying demand across sectors.

- Competitive Landscape Intensification: Global players (John Deere, Kubota, CNH) and regional brands (CLAAS, Zetor, Argo Tractors) are focusing on innovation, partnerships, and localized production to maintain market competitiveness.

Europe Tractor Market: Use Cases

- Precision Agriculture and Smart Farming: Tractors integrated with GPS, telematics, and IoT sensors optimize field mapping, seeding, and soil monitoring. Precision farming reduces input costs, maximizes crop yield, and promotes sustainability. Farmers worldwide adopt autonomous and 4WD tractors for efficient resource utilization, data-driven decisions, and compliance with carbon-neutral agricultural practices.

- Industrial and Construction Operations: Beyond farming, tractors serve critical roles in construction and industrial operations. High-horsepower tractors with attachments perform tasks such as earthmoving, hauling, and grading. In emerging economies, utility tractors support mining and infrastructure projects. Their adaptability across industrial sites strengthens the global market’s value beyond traditional agricultural usage.

- Landscaping, Forestry, and Municipal Applications: Compact and mid-sized tractors under 100 HP dominate landscaping, forestry, and municipal sectors. They handle mowing, clearing, and snow removal in urban areas. Forestry applications require durable 4WD driveline systems, while municipalities use tractors for road maintenance and waste management, highlighting their versatility across non-agricultural environments globally.

- Livestock and Dairy Farm Mechanization: Tractors are indispensable in livestock and dairy farming, where they manage feed distribution, manure handling, and silage preparation. Medium-horsepower tractors between 41–100 HP are preferred for barn operations. Increasing automation in livestock farming accelerates adoption, supporting efficient farm management and boosting output in regions with expanding dairy industries.

- Specialty Crop Farming and Orchards: Narrow and compact tractors are crucial for vineyards, orchards, and horticulture. Their maneuverability supports delicate tasks like spraying, pruning, and inter-row cultivation. In Europe, Asia, and North America, demand for specialty tractors is increasing as high-value crops expand. Electrification further enhances sustainability in orchard and greenhouse environments.

Europe Tractor Market: Stats & Facts

CEMA (European Agricultural Machinery Association)

- 204,500 tractors (all vehicle types) were registered across Europe in 2024; of these, about 144,400 were agricultural tractors.

- In 2024, 18% of agricultural tractors registered were ≤37 kW (50 hp) and 82% were ≥38 kW (above 50 hp).

- Nearly 230,000 “tractors” were registered across Europe in the full year 2021, the highest for at least a decade.

- Registrations of agricultural tractors were up 17% in 2021 compared to 2020 despite supply-chain constraints.

- In the first half of 2021, there were 115,146 tractor registrations across Europe; 32,353 were ≤50 hp and 82,793 were ≥38 kW.

European Commission / Eurostat

- The EU primary agricultural sector produced an estimated €234.1 billion gross value added in 2024.

- Agriculture contributed approximately 1.3% to EU GDP in 2024.

- The EU motorisation rate for lorries and road tractors was 78 lorries & road tractors per 1,000 inhabitants in 2023, up about 19.9% compared to 2013.

- Regional vehicle stock data at the NUTS2 level shows significant variation in tractor and utility vehicle density across EU regions.

European Commission — Common Agricultural Policy (CAP)

- The multiannual EU allocation for the Common Agricultural Policy (CAP) for 2021–2027 is €386.6 billion.

- Of that CAP envelope, roughly €270 billion is earmarked for direct payments to farmers in the 2021–2027 framework.

Germany: Federal Statistical Office (Destatis)

- Germany’s official vehicle stock tables list approximately 2.43 million road and agricultural tractors in the national register.

World Bank / Regional Agriculture Data

- Primary agriculture directly employs around 8.7 million people in the European Union region.

- Employment in agriculture averages about 4.3% of total employment across the EU, according to modeled ILO series (2022).

OECD (Tractor Codes and Standards)

- The OECD Tractor Codes program provides a global certification scheme for tractor safety and performance, recognized in 27 countries.

- The OECD maintains a global network of tractor testing stations ensuring compliance with international test procedures used by European regulators and importers.

FAO / FAOSTAT

- FAOSTAT maintains time-series data on the number of 4-wheel tractors in use by country and region.

- The FAO Statistical Yearbook and FAOSTAT provide official cross-country counts of tractors, harvesters, and other mechanisation indicators used by governments and researchers.

Agricultural Engineers’ Association (AEA) — UK

- UK tractor registrations have consistently ranged between 11,500 and 12,100 annually in six of the past seven years.

- AEA registration data serves as the main indicator of domestic demand for agricultural machinery in the UK market.

Eurostat: Road Freight and Vehicle Characteristics

- In 2023, road tractors and semi-trailers accounted for 78.3% of EU road freight transport measured in tonne-kilometres.

- They also accounted for 65.6% of total EU road freight measured in vehicle-kilometres.

Sectoral and Policy Indicators

- European tractor fleet composition shows a growing share of higher-horsepower (>100 HP) tractors for commercial farming, while compact and narrow tractors dominate specialty crops.

- Fleet renewal and replacement demand for aging tractors is a key driver of registration growth across Central and Eastern Europe.

- CAP remains roughly one third of the total EU budget in practice, strongly influencing farmers’ capital expenditure capacity for tractors and machinery.

- International trade and certification frameworks such as EU type-approval and OECD Tractor Codes materially impact imports and cross-border tractor trade in Europe.

Europe Tractor Market: Market Dynamic

Driving Factors in the Europe Tractor Market

Rising Global Food Demand and Agricultural Mechanization

The tractor market is strongly propelled by the growing global demand for food production amid expanding populations and urbanization. By 2050, the United Nations projects global food demand will increase by nearly 60%, requiring substantial yield improvements and farmland productivity gains. This necessitates large-scale mechanization, especially in emerging economies where labor-intensive farming remains dominant.

Tractors are the backbone of agricultural mechanization, providing the horsepower and versatility required for plowing, seeding, harvesting, and hauling. Nations in Asia-Pacific, Africa, and Latin America are experiencing rapid tractor adoption as governments promote modernization through subsidies and mechanization initiatives. For instance, India’s farm mechanization rate is below 50%, signaling vast growth potential in the under-penetrated tractor market.

In developed economies like the U.S., Germany, and France, the focus is on upgrading existing fleets with advanced, fuel-efficient, and connected tractors to boost precision agriculture. Global farm size consolidation further accelerates the adoption of high-horsepower tractors capable of handling larger fields. Thus, the dual need for higher productivity in developing regions and technologically advanced replacements in developed markets acts as a powerful growth driver for the global tractor market.

Government Policies, Subsidies, and Green Incentives

Government support and policy frameworks play a crucial role in stimulating tractor market growth by reducing acquisition costs and incentivizing sustainable farming. Subsidy programs such as the European Union’s Common Agricultural Policy (CAP), the U.S. Department of Agriculture’s machinery grants, and India’s PM-Kisan Yojana have created financial support systems enabling farmers to adopt mechanization.

In addition, green initiatives are catalyzing the adoption of electrified and low-emission tractors by providing purchase incentives, tax benefits, and research grants to manufacturers. For example, the EU’s Green Deal and CAP reforms explicitly encourage precision farming, digital integration, and low-carbon farm machinery. Such initiatives not only help farmers purchase modern tractors but also align industry transformation with sustainability goals.

Beyond subsidies, governments are also investing in rural infrastructure and digital connectivity, further expanding tractor utility in remote areas. Policy-driven adoption is particularly critical in emerging economies where smallholder farmers face cost constraints. With structured support mechanisms, tractors are increasingly affordable and accessible, creating a long-term positive cycle of mechanization. Thus, policy-driven financial assistance combined with eco-focused frameworks significantly strengthens global tractor market expansion.

Restraints in the Europe Tractor Market

High Initial Costs and Affordability Barriers

A major restraint on tractor adoption globally, particularly in developing economies, is the high initial acquisition cost of modern, technologically advanced tractors. Farmers in emerging markets often operate on narrow profit margins, making it difficult to afford tractors without subsidies or credit access.

Even in developed regions, advanced tractors with telematics, automation, and electrification carry premium prices, limiting their accessibility to small and medium-scale farmers. High machinery costs also discourage frequent fleet replacement, prolonging the lifecycle of older, less efficient tractors in use.

Financing constraints and limited availability of affordable credit further exacerbate this challenge, especially in rural and underbanked regions. While government subsidies ease some burden, they are not universally accessible and vary significantly across countries. Affordability challenges thus limit mechanization rates, particularly in smallholder-driven markets of Africa and Asia. The cost barrier remains one of the most critical restraints, hindering the global tractor market’s ability to penetrate lower-income segments despite strong mechanization demand.

Supply Chain Disruptions and Volatile Input Costs

The tractor industry faces significant challenges from global supply chain disruptions and fluctuating raw material prices. Key components such as semiconductors, hydraulic systems, and engines are vulnerable to shortages, as seen during the COVID-19 pandemic and the Russia-Ukraine war, which disrupted steel and energy supplies. Rising costs of essential raw materials like steel, aluminum, and rubber directly inflate tractor production costs, forcing manufacturers to raise prices and further straining affordability for end-users. Transport bottlenecks and logistic delays also affect timely deliveries, leading to backlogs in tractor orders.

Additionally, geopolitical tensions and trade restrictions continue to impact cross-border supply chains, particularly in Europe, where reliance on imported parts remains high. These uncertainties reduce manufacturers’ profit margins and undermine market stability. Supply chain volatility not only increases end-prices but also limits the timely adoption of innovative technologies in tractors. Without more resilient supply networks and localized sourcing strategies, the tractor market will remain exposed to unpredictable fluctuations, posing a serious restraint to consistent global growth.

Opportunities in the Europe Tractor Market

Expansion of Specialty Crop Farming and Compact Tractors

One of the strongest growth opportunities lies in specialty crop farming, where narrow, compact, and lightweight tractors are essential for orchards, vineyards, and horticultural operations. Europe, especially Italy, France, and Spain, has strong demand for vineyard tractors designed for maneuverability in narrow rows.

Similarly, Asia-Pacific countries like Japan and China have small and fragmented farmlands requiring compact, less than 40 HP tractors. With rising global demand for high-value crops such as fruits, vegetables, and wine grapes, specialty farming is set to expand rapidly. Compact tractors also find applications in landscaping, greenhouses, and municipal services, broadening their customer base beyond agriculture.

Electrification and hybridization further enhance their appeal by reducing operating costs and emissions. OEMs are heavily investing in developing dedicated product lines for specialty farming segments, signaling strategic growth diversification. This niche segment is poised to deliver substantial growth opportunities, particularly as farmers seek equipment tailored to specific crop requirements rather than general-purpose models. As crop diversification continues globally, compact and specialty tractors will command a growing share of market demand.

Digital Farming Ecosystems and Aftermarket Services

The evolution of tractors into digitally integrated machines opens vast opportunities for aftermarket services, fleet management, and subscription-based precision agriculture solutions. Manufacturers are no longer selling tractors solely as standalone machines but as part of digital farming ecosystems. Farmers can subscribe to advanced telematics, predictive maintenance, and data analytics services integrated with tractors.

This model not only generates recurring revenue streams for manufacturers but also ensures long-term engagement with customers. Aftermarket services, including retrofitting existing tractors with GPS guidance systems or upgrading software, create continuous growth prospects. Additionally, partnerships between OEMs and agri-tech companies are enabling innovations such as AI-driven decision support and blockchain-based crop traceability.

The digital farming ecosystem is expected to expand exponentially as farms integrate machinery, sensors, and analytics into cohesive platforms. OEMs that successfully position themselves as solution providers rather than just hardware suppliers stand to capture significant market share. With tractors at the center of precision farming, the convergence of equipment, software, and services creates enormous untapped opportunities for the future.

Trends in the Europe Tractor Market

Electrification and Autonomous Tractor Adoption

The tractor market is undergoing a major transformation with the emergence of electrified, hybrid, and autonomous tractor models designed to meet sustainability mandates and productivity demands. Governments across Europe, North America, and Asia are intensifying emissions regulations, pushing OEMs to develop eco-friendly alternatives. Electrified tractors not only reduce operating costs by cutting fuel dependency but also help farmers comply with green policies under frameworks like the EU Green Deal and U.S. EPA emission norms.

Moreover, autonomous tractors with AI, GPS guidance, and sensor-based systems are revolutionizing precision agriculture, allowing for unmanned operations, reduced labor dependency, and 24/7 productivity. This trend is particularly critical in regions facing acute farm labor shortages, where mechanization is the only feasible path forward.

As farmers seek to maximize efficiency and sustainability simultaneously, electrification combined with automation is becoming the cornerstone of next-generation farming. These advancements are no longer experimental; global leaders such as John Deere, Kubota, and CNH Industrial are scaling commercial production of semi- and fully-autonomous tractors, indicating that the industry is rapidly moving toward a digitally integrated, environmentally compliant era.

Integration of Digital Farming and Telematics

Another defining trend in the global tractor market is the rising integration of digital farming solutions, telematics, and IoT-enabled connectivity across tractor models. Modern tractors are increasingly being equipped with GPS-based auto-steering, real-time telematics, data analytics dashboards, and cloud-based monitoring systems, enabling farmers to optimize inputs such as seeds, fertilizers, and irrigation. By integrating digital platforms with traditional mechanical systems, tractors are becoming intelligent hubs for precision agriculture.

Manufacturers are collaborating with software providers to deliver value-added services like predictive maintenance, yield mapping, and machine-to-machine communication. The growing adoption of Industry 4.0 practices in agriculture is also accelerating tractor digitization, making fleets more efficient and reducing downtime.

Digitalization allows tractors to integrate seamlessly into farm management systems, where big data and AI deliver actionable insights. This is particularly relevant in Europe and North America, where high-tech farming is expanding rapidly, but demand is also growing in Asia-Pacific markets driven by large-scale farm modernization. With smart tractors providing both mechanical power and digital intelligence, the convergence of telematics and agricultural machinery is expected to reshape global farming practices over the next decade.

Europe Tractor Market: Research Scope and Analysis

By Horsepower Analysis

In the Europe tractor market, the 41 to 100 horsepower (HP) segment is projected to dominates due to its versatility across small, medium, and mixed farming operations. This range strikes the right balance between affordability, power, and adaptability, making it the most widely adopted choice among European farmers. Tractors in this category are ideally suited for plowing, seeding, harvesting, and transporting tasks across mixed farms, dairy operations, and small-to-medium crop holdings that are prevalent across the continent, particularly in France, Germany, Italy, and Eastern Europe.

The EU’s push for sustainable mechanisation through Common Agricultural Policy (CAP) subsidies encourages farmers to adopt fuel-efficient mid-range tractors that integrate precision farming tools such as GPS navigation and telematics. Unlike compact tractors under 40 HP, which are confined mostly to orchards, vineyards, and municipal applications, 41–100 HP models provide greater adaptability in both open-field farming and specialized agricultural use.

At the same time, they are more cost-effective and easier to operate than heavy-duty tractors above 100 HP, which are mainly used for industrial-scale arable farming. This makes the mid-range segment highly attractive for Europe’s fragmented agricultural landscape, where the average farm size is relatively small compared to North America. As a result, the 41–100 HP category continues to dominate Europe’s tractor market, contributing the largest share to revenues and registrations throughout the forecast period.

By Driveline Analysis

The 2WD tractor segment is anticipated to hold dominance in the Europe tractor market, reflecting the structure of the region’s agricultural practices and land distribution. Two-wheel-drive tractors remain the preferred choice among small and medium-sized farms, which represent a significant proportion of European agriculture. These tractors are more affordable, fuel-efficient, and require less maintenance compared to 4WD counterparts, making them accessible to farmers who operate within tight financial margins.

Additionally, 2WD tractors are highly effective for light-to-medium tasks such as mowing, hauling, and soil preparation, particularly in regions with smaller land parcels such as Italy, Poland, and parts of Central and Eastern Europe. Their compactness and maneuverability also make them ideal for vineyards, orchards, and livestock farms, where precision and agility are essential. While 4WD tractors are gaining traction due to their suitability for heavy-duty applications and large-scale farming in Northern and Western Europe, their higher costs and complexity limit widespread adoption.

EU subsidies often support sustainable and efficient mechanisation at the grassroots level, which aligns strongly with the affordability and adaptability of 2WD models. Furthermore, their compatibility with various attachments and ease of use in municipal and utility applications further cement their leadership. As European farming continues to modernize, the 2WD tractor segment remains dominant by volume, though 4WD tractors are expected to gradually expand their share in value terms due to growth in industrial-scale mechanisation.

By Application Analysis

Agriculture continues to dominate the Europe tractor market by application, capturing the largest share due to the sector’s central role in regional economies and policies. Tractors are indispensable for European farming, which includes arable crops, dairy, horticulture, vineyards, and orchards. The continent’s agricultural landscape is highly diverse, requiring a wide range of tractors tailored to different farm sizes and operations. From mid-range 41–100 HP tractors used in mixed farming to compact models for orchards, tractors remain critical to mechanisation and productivity improvements.

The dominance of agriculture is further reinforced by the European Union’s Common Agricultural Policy (CAP), which allocates billions in subsidies to support mechanisation, sustainability, and modernization across farms. Precision agriculture has also accelerated tractor adoption, with farmers increasingly integrating GPS, telematics, and autonomous features into their operations. Compared to industrial, utility, and other uses, agriculture accounts for the highest demand because it is directly tied to food production, resource efficiency, and labor productivity.

Industrial and utility applications such as construction, forestry, and municipal services are growing but remain secondary. The agricultural sector’s reliance on tractors for tillage, sowing, harvesting, and livestock management ensures it will remain the largest contributor to market revenue. As Europe balances food security with sustainability, agricultural applications will continue to dominate the tractor market, driving innovation and investment throughout the forecast period.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The Europe Tractor Market Report is segmented on the basis of the following:

By Horsepower

- Less than 40 HP

- 41 to 100 HP

- More than 100 HP

By Driveline

By Application

- Agriculture

- Industrial

- Utility

- Others

Impact of Artificial Intelligence in the Europe Tractor Market

- Autonomous and Driverless Tractors: Artificial intelligence has enabled the development of autonomous tractors that can operate with minimal human intervention. In Europe, where labor shortages in agriculture are persistent, AI-driven self-driving tractors reduce dependency on operators while improving efficiency. They navigate fields with precision, handle repetitive tasks, and allow farmers to focus on higher-value farm management.

- Precision Farming and Data Analytics: AI integrates with sensors, GPS, and IoT systems in tractors to analyze soil conditions, crop health, and weather patterns. In Europe’s fragmented farming structure, AI-powered tractors provide site-specific input applications, reducing fertilizer and pesticide use. This leads to sustainable resource management, higher yields, and compliance with EU environmental policies.

- Predictive Maintenance and Efficiency Optimization: AI algorithms monitor engine performance, fuel usage, and mechanical stress in real time. European tractor fleets, often aging, benefit from predictive maintenance alerts that minimize downtime and extend machine life. This reduces costs, enhances reliability, and ensures tractors remain operational during critical agricultural seasons such as sowing and harvest.

- Smart Connectivity and Fleet Management: AI-enabled tractors connect seamlessly with digital farm management platforms. Farmers in Europe use these systems to monitor multiple tractors, plan routes, and coordinate field operations. This connectivity ensures better resource allocation, reduces overlap in tasks, and supports collaborative farming models, particularly in cooperative-based agricultural regions.

- Sustainability and Carbon Footprint Reduction: With strict EU Green Deal and carbon neutrality targets, AI-equipped tractors support low-emission farming. Smart systems optimize fuel efficiency, reduce waste, and promote eco-friendly operations. By integrating AI with electrified or hybrid tractors, European farmers can align mechanization with sustainability goals, ensuring regulatory compliance and long-term competitiveness.

By Region

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Europe Tractor Market: Competitive Landscape

The Europe Tractor Market competitive landscape is shaped by a blend of global giants and regional manufacturers striving to capture demand across diverse applications. Leading players such as John Deere, CNH Industrial (Case IH and New Holland), AGCO Corporation (Massey Ferguson, Fendt), Kubota Corporation, and CLAAS dominate the market through extensive dealer networks, innovative tractor models, and strong aftersales services. These companies invest heavily in R&D to integrate artificial intelligence, telematics, and precision farming solutions, aligning with Europe’s sustainability and productivity goals.

Regional manufacturers such as SAME Deutz-Fahr, Argo Tractors, and Zetor maintain competitiveness by offering cost-effective tractors tailored to small and mid-sized farms, a segment still significant in Eastern and Southern Europe. The competitive rivalry is further intensified by emerging electric and hybrid tractor startups, including Monarch Tractor and Rigitrac, which cater to Europe’s growing preference for low-emission agricultural machinery.

Strategic alliances, technology partnerships, and acquisitions are common strategies adopted by market leaders to strengthen their innovation pipelines. For instance, collaborations with software firms and AI solution providers enable tractor manufacturers to deliver smart, connected, and autonomous tractors. Overall, competition is driven not only by horsepower and efficiency but also by digital integration, sustainability, and compliance with EU regulations, making the European tractor industry both technologically progressive and highly dynamic.

Some of the prominent players in the Europe Tractor Market are:

- John Deere

- CNH Industrial (Case IH & New Holland)

- AGCO Corporation (Fendt, Massey Ferguson, Valtra)

- CLAAS KGaA mbH

- Same Deutz-Fahr (SDF Group)

- Kubota Corporation

- Argo Tractors (Landini, McCormick)

- Zetor Tractors

- JCB (J.C. Bamford Excavators Ltd.)

- Antonio Carraro S.p.A.

- Lindner Traktorenwerke

- Kioti (Daedong Industrial Co. Ltd.)

- Belarus Tractor (MTZ)

- Lamborghini Trattori

- Valpadana Tractors

- Goldoni Keestrack

- Ursus Tractors

- Steyr Traktoren (part of CNH Industrial)

- Lovol Arbos Group

- Hattat Traktör

- Other Key Players

Recent Developments in the Europe Tractor Market

- July 2024: John Deere presented new electric and hybrid tractor models at EuroTier, Germany. These innovations emphasized sustainability, precision farming, and energy efficiency, demonstrating Deere’s commitment to future-ready agriculture across the European tractor industry.

- June 2024: CNH Industrial partnered with Bosch to develop autonomous tractor-driving solutions for Europe. This collaboration aims to enhance operational safety, efficiency, and productivity for farmers, aligning with Europe’s broader digital transformation and precision agriculture initiatives.

- May 2024: AGCO Corporation invested in expanding its Fendt tractor production facility in France. The initiative increases output capacity to meet rising demand for technologically advanced tractors in Europe, further strengthening AGCO’s regional agricultural machinery presence.

- April 2024: Kubota highlighted AI-integrated tractors at the Agritechnica Innovation Conference in Hannover. The company emphasized smart farming solutions that leverage automation, connectivity, and precision technologies to improve productivity and support sustainable European agriculture practices.

- March 2024: CLAAS launched its new high-horsepower tractor series in France, targeting large-scale farms. This innovation responds to rising European demand for machines with greater durability, performance, and advanced digital features supporting data-driven, sustainable farming operations.

- February 2024: SAME Deutz-Fahr (SDF) partnered with an Italian renewable energy consortium to create biofuel-compatible tractors. This collaboration focuses on alternative fuels, sustainability, and reducing emissions, advancing Europe’s transition toward cleaner, eco-friendly agricultural machinery solutions.

- January 2024: Valtra, under AGCO, inaugurated its European training and innovation center in Finland. The facility will focus on smart tractors, digital farming tools, and operator training, strengthening Valtra’s commitment to innovation and farmer empowerment.

- December 2023: New Holland Agriculture signed agreements with European universities to accelerate electrification and alternative fuel tractor research. The initiative supports Europe’s sustainability goals, enhancing New Holland’s leadership in green agricultural machinery development.

- November 2023: Zetor Tractors unveiled its latest utility tractor series during AGRITECHNICA 2023 in Germany. The models target small and medium farms, emphasizing affordability, durability, and efficiency, reinforcing Zetor’s role in serving diverse European farming operations.

- October 2023: Argo Tractors, owner of McCormick and Landini brands, expanded distribution networks in Spain and Eastern Europe. The strategy aims to increase accessibility of its tractors, strengthen competitiveness, and reinforce Argo’s long-term European market presence.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 23.2 Bn |

| Forecast Value (2034) |

USD 36.9 Bn |

| CAGR (2025–2034) |

5.3% |

| Historical Data |

2019 – 2024 |

| Forecast Data |

2026 – 2034 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Horsepower (Less than 40 HP, 41 to 100 HP, and More than 100 HP), By Driveline (2WD, and 4WD), By Application (Agriculture, Industrial, Utility, and Others) |

| Regional Coverage |

Europe |

| Prominent Players |

Deere & Company (John Deere), CNH Industrial N.V. (Case IH & New Holland), AGCO Corporation (Fendt, Massey Ferguson, Valtra), CLAAS KGaA mbH, Same Deutz-Fahr Group (SDF Group), Kubota Corporation, Argo Tractors S.p.A. (Landini, McCormick), Zetor Tractors a.s., J.C. Bamford Excavators Ltd. (JCB), Antonio Carraro S.p.A., Lindner Traktorenwerk GmbH, Daedong Industrial Co. Ltd. (Kioti), Minsk Tractor Works (Belarus/MTZ), Lamborghini Trattori S.p.A., Valpadana Tractors S.r.l., Goldoni Keestrack S.p.A., Ursus S.A., Steyr Traktoren GmbH, Lovol Arbos Group S.p.A., Hattat Traktör Sanayi ve Ticaret A.Ş., and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |