Market Overview

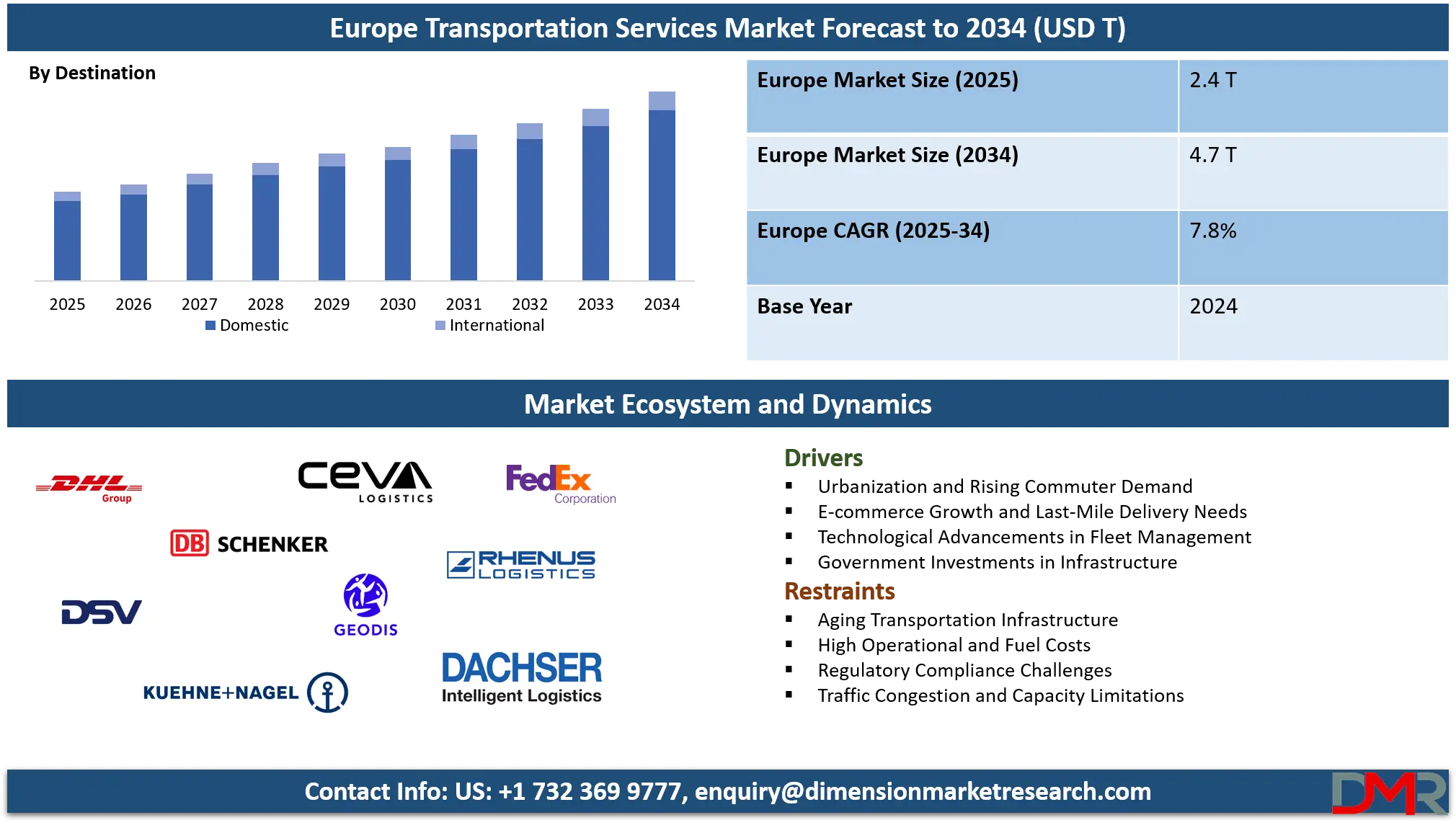

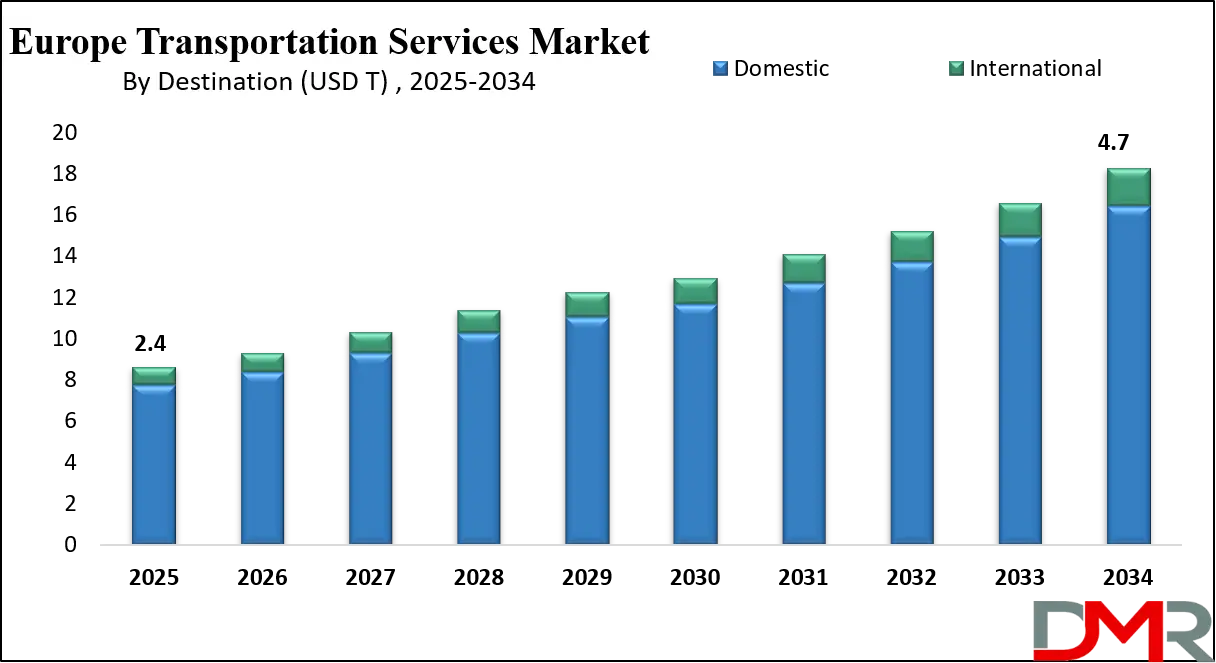

The Europe transportation services market is estimated at USD 2.4 trillion in 2025 and is forecast to reach USD 4.7 trillion by 2034, expanding at a CAGR of 7.8%, driven by growing logistics demand, freight mobility, and intermodal transport adoption across the region.

Transportation services encompass the organized movement of goods, commodities, and passengers from one location to another through various modes such as road, rail, air, and sea. These services include freight forwarding, logistics management, warehousing, distribution, and last-mile delivery, ensuring timely and efficient transit across domestic and international routes.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

They play a crucial role in supply chain optimization, reducing transit times, minimizing costs, and enhancing connectivity between producers, suppliers, and end consumers. Advanced technologies like route optimization, tracking systems, and automated logistics solutions have increasingly enhanced the reliability and efficiency of transportation services, making them a backbone of modern commerce and trade networks.

The Europe transportation services market refers to the structured ecosystem that facilitates the movement of goods and passengers across European countries, integrating multiple transportation modes with logistics and supply chain solutions. This market includes freight carriers, courier and express delivery services, public transport operators, and specialized logistics providers, catering to both intra-European and cross-border transit demands. Factors such as trade liberalization, infrastructure development, technological adoption, and environmental regulations heavily influence market operations and growth dynamics.

Over the past decade, the Europe transportation services market has evolved to accommodate increasing e-commerce volumes, changing consumer behavior, and the rising need for sustainable logistics solutions. Emphasis on intermodal transport, digital freight platforms, and efficient supply chain networks has transformed service delivery, enabling faster, cost-effective, and eco-friendly transportation options. The market remains highly competitive with key players leveraging innovation, strategic partnerships, and regional expertise to optimize service efficiency, enhance network coverage, and meet the dynamic demands of businesses and consumers across the continent.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Europe Transportation Services Market: Key Takeaways

- Market Value: The Europe Transportation Services market size is expected to reach a value of USD 4.7 trillion by 2034 from a base value of USD 2.4 trillion in 2025 at a CAGR of 8.2%.

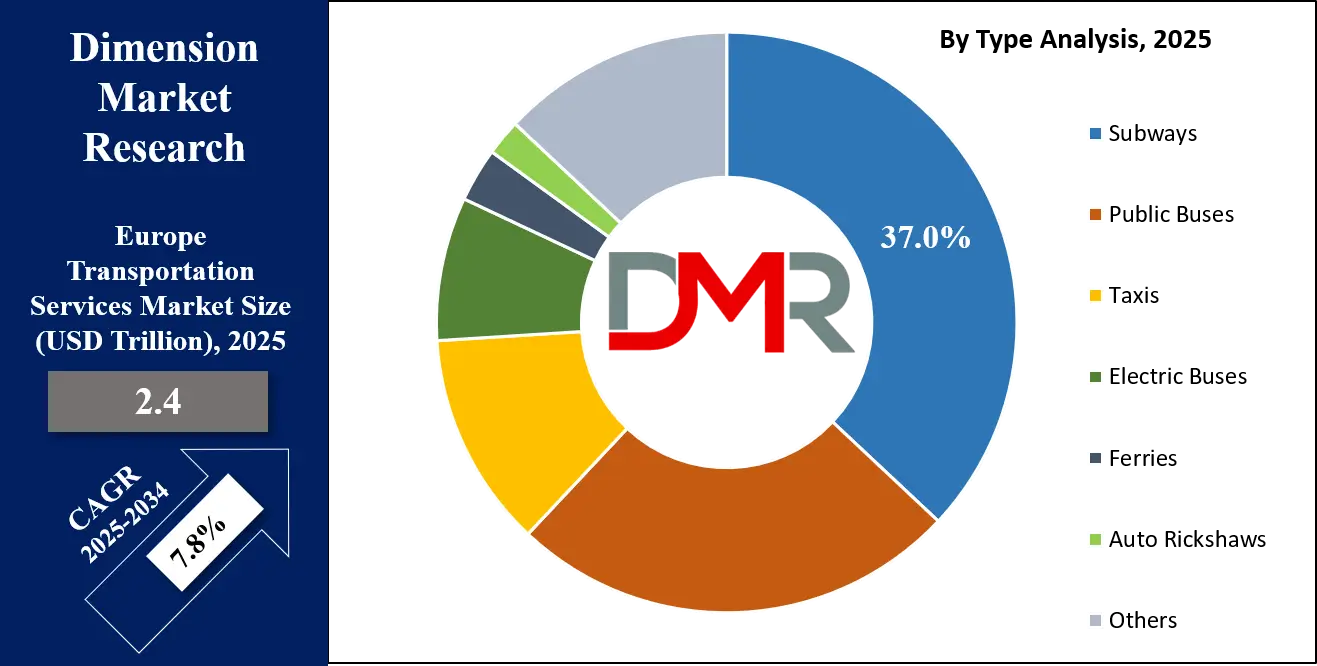

- By Type Segment Analysis: Subways are anticipated to dominate the type segment, capturing 37.0% of the total market share in 2025.

- By Destination Segment Analysis: Domestic destinations are expected to maintain their dominance in the destination segment, capturing 90.0% of the total market share in 2025.

- By Purpose Segment Analysis: Commuter Travel will account for the maximum share in the purpose segment, capturing 40.0% of the total market value.

- Key Players: Some key players in the Europe Transportation Services market are Deutsche Post DHL Group, DB Schenker, DSV, Kuehne + Nagel, CEVA Logistics, GEODIS, Rhenus Logistics, Dachser, Hellmann Worldwide Logistics, XPO Logistics Europe, Raben Group, Girteka Logistics, LKW Walter, Gefco, FedEx, and Others.

Europe Transportation Services Market: Use Cases

- E-commerce Fulfillment: E-commerce fulfillment relies on fast and reliable transportation services to ensure timely delivery of products across Europe, optimizing last-mile logistics and enhancing customer satisfaction.

- Cold Chain Logistics: Cold chain logistics uses specialized transportation solutions to move perishable goods like pharmaceuticals and food items, maintaining quality through temperature-controlled transit.

- Intermodal Freight Transport: Intermodal freight transport integrates road, rail, and sea networks to improve efficiency, reduce costs, and enable seamless cross-border supply chain operations across European trade corridors.

- Urban Mobility Solutions: Urban mobility solutions leverage public transport, ride-sharing, and smart transit systems to manage passenger flow, reduce congestion, and support sustainable city logistics.

Impact of Artificial Intelligence on the Europe Transportation Services market

The impact of artificial intelligence on the Europe transportation services market is reshaping efficiency, safety, and service quality across freight, logistics, and passenger transport sectors. AI-powered systems enable real-time route optimization, traffic prediction, and demand forecasting, reducing transit times, fuel consumption, and operational costs for carriers and logistics providers. In freight and supply chain management, machine learning enhances inventory planning, warehouse automation, and load allocation, improving accuracy and speed of deliveries.

Autonomous vehicles, AI-driven fleet management, and predictive maintenance are increasingly deployed to ensure safer, more reliable, and cost-effective operations. Additionally, AI-enabled platforms improve customer experience through real-time shipment tracking, predictive ETAs, and personalized logistics solutions, driving a more data-driven and sustainable transportation ecosystem in Europe.

Europe Transportation Services Market: Stats & Facts

Eurostat – Rail & Road Transport Statistics (2023–2024)

- In 2023, EU rail passenger kilometres reached 429 billion passenger kilometres, increasing from 386 billion in 2022 and marking the highest level since 2004.

- In 2024, EU rail passenger kilometres increased further to 443 billion passenger kilometres from 419 billion in 2023, showing a 5.8% annual rise.

- In 2024, rail freight transport by major undertakings in the EU totaled 375 billion tonne-kilometres compared to 378 billion tonne-kilometres in 2023.

- In 2024, metal ores accounted for 12.2% of total rail freight tonne kilometres, while coke and refined petroleum products accounted for 10.1% and basic metals accounted for 8.9%.

- In 2024, national rail passenger transport represented more than 90% of total rail passenger kilometres across most EU countries.

- In 2024, most EU countries recorded growth in rail passenger transport, with Hungary recording 60% growth, Latvia 13.9%, and Ireland 10%, while Romania and Bulgaria saw declines.

- In 2024, total EU road freight transport reached 1,869 billion tonne kilometres compared to 1,857 billion tonne kilometres in 2023.

- In 2024, total goods transported by road across the EU reached 13.075 billion tonnes, reflecting a 0.7% decline from 2023.

- In 2024, food products, beverages, and tobacco accounted for 312.2 billion tonne kilometres of EU road freight, followed by grouped goods at 236.5 billion and agricultural products at 207.6 billion.

- In 2024, international road freight represented 24.6% of total EU road freight activity, while national freight represented 61.4% and cross trade plus cabotage represented 14.1%.

- In 2024, Poland alone contributed 19.7% of total EU road freight tonne kilometres, while Germany contributed 15% and Spain 14.5%.

- In 2024, ten EU countries recorded declines in road freight transport while fifteen countries recorded growth, with Slovakia growing by 15.9%, Latvia by 12.9%, and Czechia by 8.5%.

- In 2024, road freight movements between 150 and 999 kilometres accounted for 1,126 billion tonne kilometres across the EU.

- In 2023, national rail journeys in the EU totaled 8.0 billion trips covering 407 billion passenger kilometres, while international rail journeys contributed 22.4 billion passenger kilometres.

Europe Transportation Services Market: Market Dynamics

Europe Transportation Services Market: Driving Factors

Advanced Digital Logistics Solutions

The Europe transportation services market is driven by the adoption of digital logistics platforms, including AI-powered route optimization, smart warehousing, and predictive analytics. These technologies streamline supply chain operations, enhance freight efficiency, and reduce delivery lead times, supporting the growing demand for timely and cost-effective transport services.

Rising Cross-Border Trade and E-commerce

Increasing cross-border trade within the European Union and the rapid growth of e-commerce are boosting demand for reliable transportation services. Businesses are investing in intermodal logistics, automated distribution centers, and last-mile delivery solutions to meet consumer expectations for faster and more efficient product transit.

Europe Transportation Services Market: Restraints

Regulatory Compliance and Environmental Restrictions

Stringent European regulations on emissions, road safety, and labor standards pose challenges for transportation providers. Compliance with these rules requires substantial investment in fleet modernization and operational adjustments, which can constrain growth and increase costs.

Infrastructure Bottlenecks and Urban Congestion

Limited capacity at major ports, congested highways, and aging rail infrastructure slow freight movement and passenger transport. These inefficiencies hinder scalability and reduce operational reliability, particularly in high-traffic urban and cross-border corridors.

Europe Transportation Services Market: Opportunities

Electric and Autonomous Vehicle Integration

The deployment of electric trucks, autonomous vehicles, and AI-driven fleet management presents opportunities to enhance sustainability and operational efficiency. Early adoption allows companies to reduce fuel costs, lower emissions, and gain a competitive advantage in the evolving European market.

Data-Driven Predictive Supply Chains

Leveraging big data, IoT sensors, and machine learning enables predictive logistics management, improving route planning, inventory forecasting, and shipment scheduling. This approach minimizes delays, optimizes resource allocation, and enhances service reliability across European transport networks.

Europe Transportation Services Market: Trends

Sustainable and Green Transport Initiatives

The European market is increasingly focusing on eco-friendly transportation solutions, including low-emission fleets, renewable fuels, and green logistics practices. Companies are prioritizing sustainability to comply with environmental regulations and meet the growing demand for responsible supply chains.

AI and IoT Integration in Operations

Artificial intelligence and Internet of Things technologies are being embedded into transportation systems for real-time monitoring, predictive maintenance, and smart asset management. These innovations drive operational efficiency, enhance fleet utilization, and improve transparency in logistics and passenger transport services.

Europe Transportation Services Market: Research Scope and Analysis

By Type Analysis

In the type segment of the Europe transportation services market, subways are expected to play a leading role, accounting for approximately 37.0% of the total market share in 2025. This dominance is driven by the high capacity, efficiency, and reliability of subway systems, particularly in densely populated urban areas where traffic congestion and environmental concerns are significant challenges. Subways provide rapid, frequent, and energy-efficient transit, making them a preferred choice for daily commuters and contributing to the reduction of road congestion.

Additionally, ongoing investments in subway infrastructure, modernization of metro lines, and the integration of smart ticketing and real-time monitoring systems further strengthen their position in the market.

Public buses also represent a key segment within the Europe transportation services market, serving as a flexible and widely accessible mode of urban and regional transport. Buses are crucial for first-mile and last-mile connectivity, complementing fixed-route systems like subways and trams. The segment benefits from innovations such as electric and hybrid buses, real-time tracking apps, and dedicated bus lanes that improve service efficiency, reduce emissions, and enhance passenger convenience. Public buses continue to be vital for daily commuting, intercity travel, and connecting smaller towns and suburban areas to major transport hubs, maintaining strong demand across the European market.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

By Destination Analysis

In the destination segment of the Europe transportation services market, domestic destinations are projected to dominate, accounting for approximately 90.0% of the total market share in 2025. This strong presence is driven by high demand for regional and intra-country travel, supported by well-developed road, rail, and urban transit networks across European countries. Domestic travel benefits from frequent commuting, business trips, and tourism within national borders, making it a consistent contributor to transportation service revenues. Investments in modern highways, high-speed rail lines, and regional transport connectivity further enhance the efficiency and appeal of domestic transit, allowing seamless mobility for passengers and freight alike.

International travel, while representing a smaller portion of the market, remains significant for cross-border trade, tourism, and business operations across Europe. This segment includes intercountry rail services, long-distance buses, air transport, and ferry operations that connect European nations and neighboring regions.

The growth of international travel is supported by policies promoting cross-border connectivity, free movement agreements within the European Union, and advancements in logistics and customs management. Although its market share is smaller compared to domestic travel, international transportation continues to drive innovation and investment in efficient, reliable, and sustainable cross-border transport solutions.

By Purpose Analysis

In the purpose segment of the Europe transportation services market, commuter travel is expected to hold the largest share, accounting for approximately 40.0% of the total market value. This is driven by the daily mobility needs of urban and suburban populations, where efficient and reliable public transport systems such as subways, buses, and trams play a crucial role. The high demand for commuter travel is supported by population density in major cities, growing urbanization, and initiatives to reduce road congestion and carbon emissions. Investments in smart transit systems, digital ticketing, and real-time tracking further enhance convenience and efficiency, making daily commuting a dominant driver of transportation service usage.

Shipping and delivery travel also represents a significant purpose segment, encompassing the movement of goods for e-commerce, retail, and industrial supply chains. This segment is increasingly important due to the surge in online shopping, demand for express deliveries, and the need for efficient freight transport solutions. Innovations such as automated warehouses, route optimization, and last-mile delivery technologies are enhancing speed, reducing costs, and improving reliability for shipping and delivery services. Although smaller than commuter travel in market share, this segment is crucial for supporting trade, business operations, and consumer expectations across Europe.

Europe Transportation Services Market Report is segmented on the basis of the following:

By Type

- Public Buses

- Electric Buses

- Subways

- Taxis

- Auto Rickshaws

- Ferries

- Others

By Destination

By Purpose

- Commuter Travel

- Cargo and Freight Travel

- Tourism and Leisure Travel

- Business Travel

- Shipping and Delivery Travel

Europe Transportation Services Market: Regional Analysis

The Europe transportation services market shows notable regional variations, with Western Europe, including Germany, France, and the United Kingdom, leading due to advanced public transit systems, well-developed road and rail networks, and strong intermodal connectivity. Investments in smart city initiatives, green transportation, and AI-enabled fleet management further drive efficiency and reliability.

Southern and Eastern Europe, including Italy, Spain, Poland, and the Czech Republic, are experiencing steady growth supported by expanding e-commerce, modernization of highways and rail networks, and increasing domestic trade. Cross-border freight and logistics demand, combined with opportunities in sustainable transport and digital logistics integration, position these regions as key growth areas within the European market.

By Region

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Europe Transportation Services Market: Competitive Landscape

The Europe transportation services market is highly competitive, characterized by strategic collaborations, mergers, and investments in technology-driven solutions to enhance efficiency and service quality. Companies are focusing on digital logistics platforms, AI-enabled fleet management, and intermodal transport integration to optimize routes, reduce costs, and improve delivery reliability.

Innovation in sustainable transportation, including electric and low-emission vehicles, is becoming a key differentiator, while customer-centric solutions such as real-time tracking, predictive ETAs, and last-mile delivery optimization strengthen market positioning. The competitive landscape is also shaped by continuous expansion into high-demand regions, modernization of infrastructure, and adaptation to evolving regulatory and environmental standards across Europe.

Some of the prominent players in the US Transportation Services market are:

- Deutsche Post DHL Group

- DB Schenker

- DSV

- Kuehne + Nagel

- CEVA Logistics

- GEODIS

- Rhenus Logistics

- Dachser

- Hellmann Worldwide Logistics

- XPO Logistics Europe

- Raben Group

- Girteka Logistics

- LKW Walter

- Gefco

- FedEx Express Europe

- Cargoline

- H.Essers

- Nagel Group

- Ziegler Group

- Transalliance

- Other Key Players

Europe Transportation Services Market: Recent Developments

- Dec 2025: Twiliner launched a luxury sleeper‑bus service between Amsterdam and Zurich, offering lie‑flat “business‑class” seats and a sustainable overnight alternative to flights.

- Dec 2025: Rail‑Flow secured €12.5 million in a Series A funding round led by investors including Trill Impact and Bonsai Partners to accelerate AI‑driven rail‑logistics tools and scale its intermodal freight platform.

- Dec 2025: Following its merger with Simply Deliver, Rail‑Flow officially announced the funding closure for its expanded platform, reinforcing investor confidence in digital transformation and sustainability trends in European rail freight.

- Nov 2025: The sleeper‑bus network operated by Twiliner began its first operations across Europe, aiming to reduce carbon emissions and improve passenger comfort.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 2.4 T |

| Forecast Value (2034) |

USD 4.7 T |

| CAGR (2025–2034) |

7.8% |

| Historical Data |

2019 – 2024 |

| Forecast Data |

2026 – 2034 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Type (Public Buses, Electric Buses, Subways, Taxis, Auto Rickshaws, Ferries, and Others), By Destination (Domestic, and International), By Purpose (Commuter Travel, Cargo and Freight Travel, Tourism and Leisure Travel, Business Travel, and Shipping and Delivery Travel) |

| Regional Coverage |

Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe

|

| Prominent Players |

Deutsche Post DHL Group, DB Schenker, DSV, Kuehne + Nagel, CEVA Logistics, GEODIS, Rhenus Logistics, Dachser, Hellmann Worldwide Logistics, XPO Logistics Europe, Raben Group, Girteka Logistics, LKW Walter, Gefco, FedEx, and Others. |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |

Frequently Asked Questions

How big is the Europe Transportation Services market?

▾ The Europe Transportation Services market size is estimated to have a value of USD 2.4 trillion in 2025 and is expected to reach USD 4.7 trillion by the end of 2034, with a CAGR of 7.8%.

Who are the key players in the Europe Transportation Services market?

▾ Some of the major key players in the Europe Transportation Services market are Deutsche Post DHL Group, DB Schenker, DSV, Kuehne + Nagel, CEVA Logistics, GEODIS, Rhenus Logistics, Dachser, Hellmann Worldwide Logistics, XPO Logistics Europe, Raben Group, Girteka Logistics, LKW Walter, Gefco, FedEx, and Others.