Market Overview

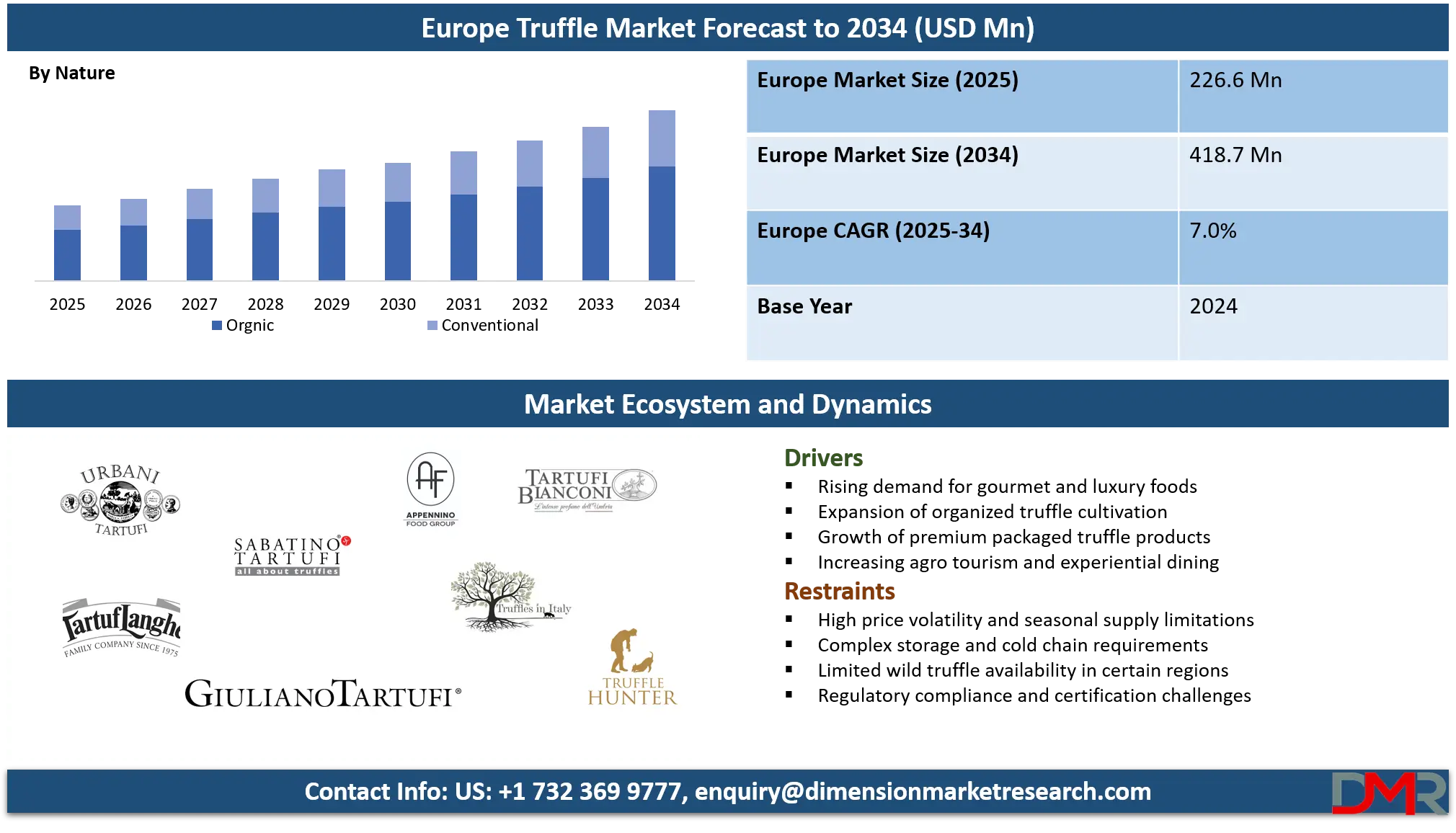

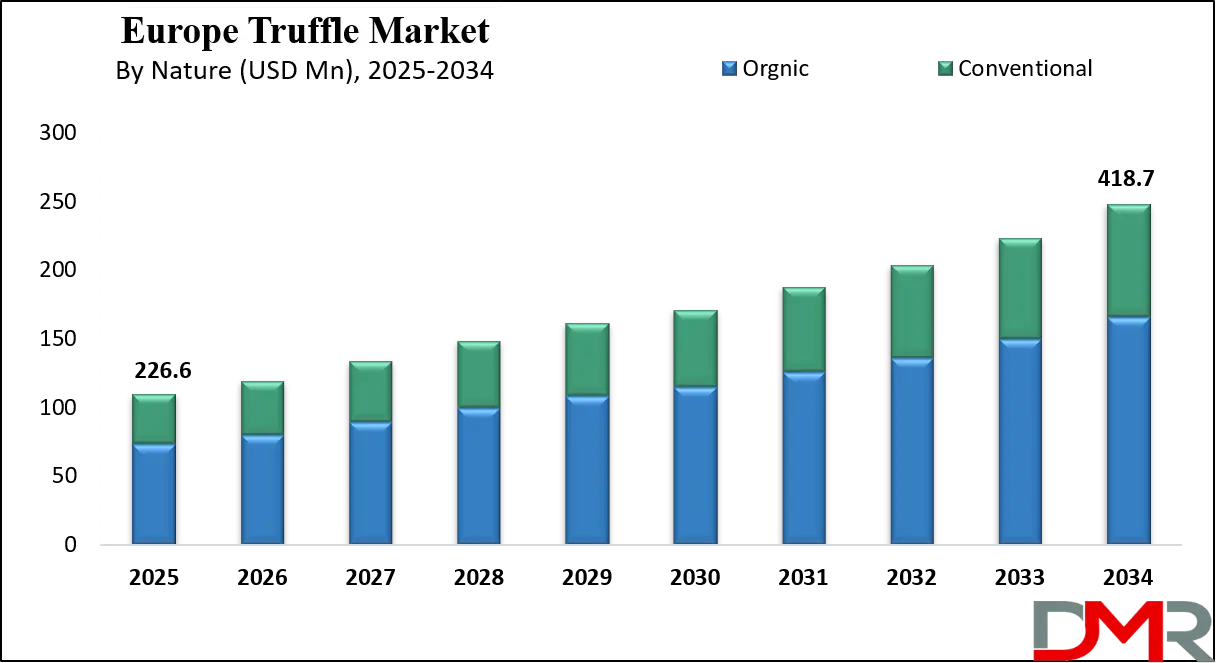

The Europe truffle market is projected to expand from USD 226.6 million in 2025 to USD 418.7 million by 2034, registering a CAGR of 7.0%, driven by rising demand for gourmet food, premium fungi, and luxury culinary ingredients.

A truffle is a rare and highly valued edible fungus that grows underground in symbiosis with the roots of specific trees such as oak, hazelnut, and beech. It is renowned for its intense aroma and complex earthy flavor, making it a premium ingredient in gourmet cuisine across the world. Truffles are primarily found using trained dogs or pigs due to their natural scent detection abilities, as they mature beneath the soil surface. The most prized varieties include black truffles and white truffles, each commanding high prices based on seasonality, origin, and quality. Beyond fresh consumption, truffles are also processed into oils, sauces, pastes, and preserved products that allow wider accessibility to this luxury food ingredient.

The Europe truffle market represents the largest and most mature regional landscape for truffle production, consumption, and export, supported by ideal climatic conditions and centuries old harvesting traditions. Countries such as France, Italy, Spain, and Croatia dominate both wild and cultivated truffle supply, with strong networks of growers, foragers, processors, and specialty food distributors. Growing demand from fine dining restaurants, gourmet retail, and premium food manufacturers continues to support market expansion, while agritourism and truffle hunting experiences further enhance consumer interest and brand value across the region.

The European truffle market is also shaped by rising investments in truffle farming, scientific inoculation techniques, and controlled plantation development to stabilize supply against climate variability. Increasing interest in natural flavors, organic foods, and luxury culinary ingredients among urban consumers is expanding demand beyond traditional hospitality users into home cooking and premium packaged food segments. Cross border trade within the European Union, along with exports to North America and Asia, strengthens the commercial ecosystem, while certification standards, geographic indication practices, and food safety compliance continue to enhance transparency and international competitiveness.

Europe Truffle Market: Key Takeaways

- Market Value: The Europe truffle market size is expected to reach a value of USD 418.7 million by 2034 from a base value of USD 226.6 million in 2025 at a CAGR of 7.0%.

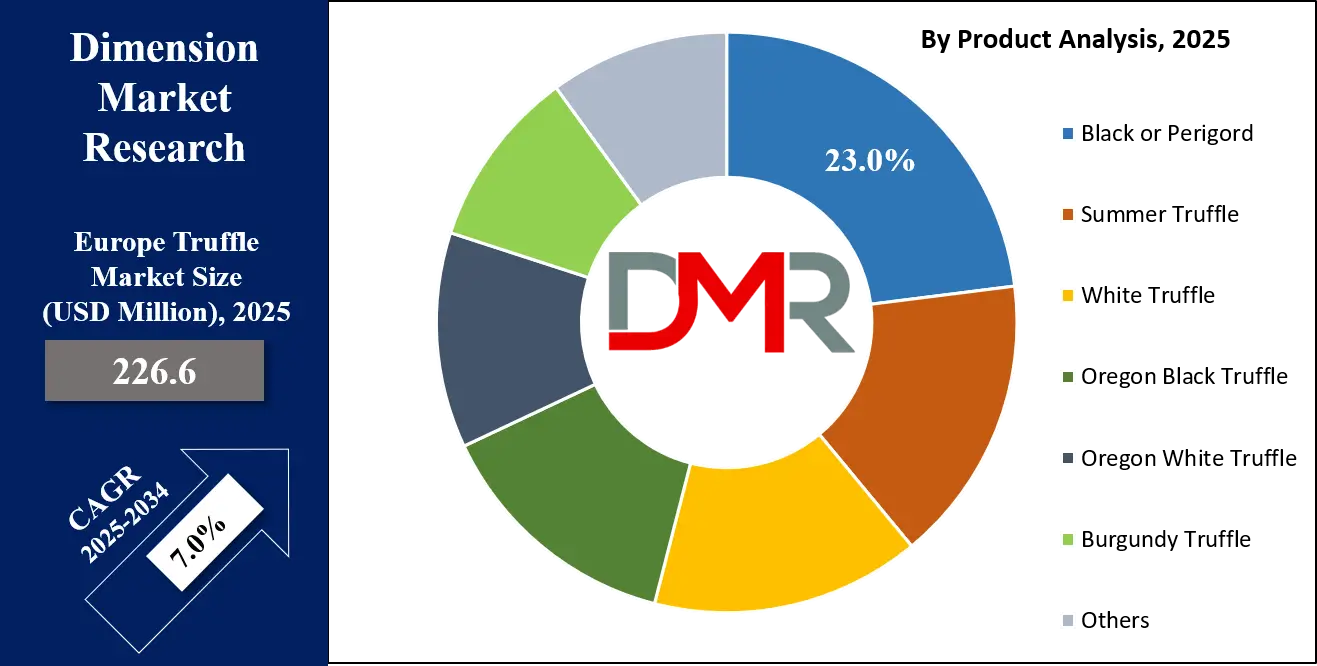

- By Product Type Segment Analysis: Black or Perigord products are anticipated to dominate the product type segment, capturing 23.0% of the total market share in 2025.

- By Nature Segment Analysis: Organic truffle is expected to maintain its dominance in the nature segment, capturing 67.0% of the total market share in 2025.

- By Form Segment Analysis: Fresh truffle will account for the maximum share in the form segment, capturing 42.0% of the total market value.

- By Distribution Channel Segment Analysis: B2B channels will dominate the distribution channel segment, capturing 22.0% of the market share in 2025.

- By End-User Segment Analysis: Food & Beverages will dominate the end-user segment, capturing 49.0% of the market share in 2025.

- Key Players: Some key players in the Europe truffle market are Urbani Tartufi, Sabatino Tartufi, TartufLanghe, Giuliano Tartufi, Appennino Food Group, Bianconi Tartufi, Truffles & More (Italy), TruffleHunter, Summer Truffles Ltd, La Maison Plantin, Pebeyre, Maison de la Truffe, Esprit Truffe, Terre de Truffes., and Others.

Europe Truffle Market: Use Cases

- Fine Dining and Gourmet Cuisine: Truffles are a signature ingredient in high end European gastronomy, widely used by Michelin star restaurants and luxury hotels to enhance flavor profiles of pasta, risotto, sauces, and meat dishes. The rising influence of experiential dining, seasonal tasting menus, and chef driven culinary innovations continues to drive consistent demand for fresh truffles and premium truffle products across France, Italy, and Spain.

- Premium Packaged Food and Condiments: Truffles are extensively used in the production of truffle oil, truffle butter, spreads, and ready to use gourmet sauces. European specialty food brands incorporate natural truffle extracts to cater to growing consumer interest in luxury food items, artisanal condiments, and flavor infused products positioned within premium retail and e commerce channels.

- Agro Tourism and Truffle Hunting Experiences: Truffle hunting tourism has become a high value niche across Southern Europe, particularly in Italy, France, and Croatia. Tour operators, truffle farms, and rural estates monetize guided hunting tours, culinary workshops, and direct farm-to-table sales, supporting the rural economy while increasing market visibility and consumer engagement.

- Cosmetics and Fragrance Applications: Truffle extracts are increasingly used in premium skincare, nutraceuticals, and fragrance formulations due to their antioxidant properties and luxury brand appeal. European cosmetic manufacturers integrate black truffle and white truffle derivatives into anti-aging creams, serums, and high-end perfumes to target affluent consumers seeking natural and exotic ingredients.

Impact of Artificial Intelligence on the Europe Truffle market

Artificial intelligence is steadily reshaping the Europe truffle market by improving cultivation efficiency, supply chain visibility, and demand forecasting across the value chain. AI powered soil analysis, climate monitoring, and predictive analytics are enabling truffle growers to optimize orchard conditions, improve spore inoculation success rates, and reduce crop losses caused by weather variability.

In processing and distribution, machine learning tools support quality grading, aroma profiling, and real time inventory management, helping premium truffle suppliers maintain consistent standards for fresh truffles and value added truffle products. On the commercial side, AI driven consumer analytics, dynamic pricing models, and e commerce personalization are enhancing market penetration for gourmet food brands, luxury food retailers, and specialty exporters across Europe, while also strengthening export competitiveness in high value international marketst.

Europe Truffle Market: Stats & Facts

Source: IndexBox — Europe’s Mushroom and Truffle Market Overview 2024‑2025

- In 2024, production of mushrooms and truffles in Europe reached approximately 1.3 million tonnes, marking a rebound after a prior multi‑year decline.

- The same report notes that 2024 production followed a relatively flat trend for harvested area and yield — indicating limited expansion in cultivation footprint or per‑hectare output.

- In 2024, the top producing countries by volume were Poland (≈ 256,000 t), the Netherlands (≈ 220,000 t), and Spain (≈ 165,000 t), together accounting for roughly 48–59% of total EU production.

- After three years of decline, the overall production volume increased by about 3% in 2024 compared to 2023.

- In 2024, imports of mushrooms and truffles into Europe reached 412,000 tonnes, ending a two‑year decline.

- The consumption (domestic + imported) of mushrooms and truffles across Europe rose in 2024 to reach ~1.3 million tonnes, reportedly the first such rise since 2020.

Europe Truffle Market: Market Dynamics

Europe Truffle Market: Driving Factors

Rising Demand for Gourmet and Luxury Foods

The growing preference for premium culinary ingredients across fine dining, luxury hospitality, and gourmet home cooking is a primary growth driver. Increasing consumer spending on exotic fungi, truffle infused products, and artisanal food items across Western and Southern Europe continues to strengthen demand for both fresh truffles and value added truffle derivatives.

Expansion of Organized Truffle Cultivation

Advancements in mycorrhizal inoculation, orchard management, and controlled truffle farming are boosting commercial production across Spain, France, and Italy. These modern cultivation practices are improving yield predictability, stabilizing supply, and reducing dependence on wild foraging, which directly supports long term market scalability.

Europe Truffle Market: Restraints

High Price Volatility and Limited Seasonal Availability

The Europe truffle market remains constrained by fluctuating prices driven by unpredictable harvest cycles, weather sensitivity, and limited seasonal supply of fresh truffles. This restricts mass market adoption and confines most demand to high income consumers and premium food service segments.

Complex Storage and Logistics Requirements

Truffles require precise cold storage, humidity control, and rapid transportation due to their short shelf life. These specialized logistics needs increase operational costs for exporters, distributors, and gourmet retailers, creating supply chain barriers for smaller market participants.

Europe Truffle Market: Opportunities

Growth of Premium Packaged Truffle Products

Rising consumption of truffle oil, truffle sauces, pastes, and ready to use gourmet condiments across retail and online platforms presents strong revenue opportunities. Consumers seeking luxury food experiences at home are driving steady growth in shelf stable truffle based offerings.

Expansion of Agro Tourism and Experiential Dining

Truffle hunting tourism, farm visits, and chef led culinary workshops are creating new income streams for growers and rural estates. These experiential formats strengthen brand storytelling, improve direct to consumer sales, and enhance regional visibility of European truffle producing zones.

Europe Truffle Market: Trends

Integration of Smart Farming and Precision Agriculture

Growers are increasingly adopting AI driven soil monitoring, climate analytics, and sensor based irrigation to optimize truffle orchard productivity. Precision agriculture is becoming a key trend to manage climate risk and improve long term yield consistency.

Rising Applications in Cosmetics and Nutraceuticals

European cosmetic and wellness brands are incorporating black truffle and white truffle extracts in anti aging skincare, functional supplements, and luxury fragrances. This shift is broadening market demand beyond food use into high margin personal care and health segments.

Europe Truffle Market: Research Scope and Analysis

By Product Type Analysis

Black or Perigord truffle products are anticipated to dominate the product type segment of the Europe truffle market, capturing around 23.0% of the total market share in 2025, primarily due to their superior aroma, intense flavor profile, and strong positioning in fine dining and luxury food applications. These truffles are highly preferred by Michelin star restaurants, premium hotels, and gourmet food manufacturers for use in sauces, oils, butters, and specialty packaged products.

Their strong demand is further supported by consistent consumption across France, Italy, and Spain, along with rising exports to global gourmet markets. The high price realization, strong brand association with authenticity, and frequent use in seasonal menus make Black or Perigord truffles the leading revenue contributor within the product type landscape.

The Summer Truffle also plays a significant role in this market segment by offering a more affordable alternative with broader accessibility across retail and food service channels. Although milder in aroma and flavor compared to Black truffles, Summer Truffles are widely used in everyday gourmet cooking, processed foods, flavored oils, and ready to use culinary preparations.

Their wider harvesting season and higher availability support stable supply for manufacturers focused on mass premium consumers. Growing demand from home chefs, specialty food stores, and mid scale restaurants is strengthening the commercial position of Summer Truffles across European markets, particularly in Italy and Spain.

By Nature Analysis

Organic truffles are expected to maintain their dominant position in the nature segment of the Europe truffle market by capturing around 67.0% of the total market share in 2025, driven by strong consumer preference for clean label, chemical free, and sustainably cultivated food products. The rising focus on organic certification, traceability, and eco friendly farming practices across France, Italy, and Spain is supporting higher adoption of organic truffles among gourmet food brands, fine dining restaurants, and specialty retailers.

Health conscious consumers associate organic truffles with superior quality, natural flavor intensity, and environmental responsibility, which allows producers to command premium pricing and maintain strong brand loyalty in both domestic and export markets.

Conventional truffles continue to play a complementary role in this market segment by ensuring consistent volume availability and broader affordability across food service and retail channels. Conventional cultivation supports higher yield stability, mechanized farming support systems, and controlled nutrient management, which benefit large scale processors and packaged food manufacturers.

These truffles are widely used in truffle oils, sauces, frozen truffle formats, and value oriented gourmet products where cost efficiency is a key purchasing factor. Demand remains strong among mid range restaurants, industrial food processors, and private label brands that prioritize scalability, supply reliability, and competitive pricing.

By Form Analysis

Fresh truffles are expected to account for the maximum share in the form segment of the Europe truffle market by capturing around 42.0% of the total market value, driven by their unmatched aroma, texture, and sensory appeal in high end culinary applications. Fine dining restaurants, luxury hotels, and gourmet chefs across France, Italy, and Spain strongly prefer fresh truffles for use in live shaving, seasonal tasting menus, and signature dishes due to their superior flavor release and visual presentation. The premium pricing, short supply window, and strong demand during peak harvesting seasons significantly elevate their revenue contribution, supported by robust exports to global gourmet destinations.

Processed truffles hold a vital position in the market by enabling year round availability and wider commercial scalability beyond seasonal limitations. Processed formats such as truffle oil, frozen truffles, preserved truffle slices, sauces, and pastes support consistent supply to packaged food brands, retail chains, and online gourmet platforms.

These products cater to consumers seeking convenience, longer shelf life, and affordability while retaining truffle flavor characteristics. The growing popularity of home gourmet cooking, premium ready to eat meals, and food gifting solutions continues to strengthen demand for processed truffle formats across European markets.

By Distribution Channel Analysis

B2B channels are expected to dominate the distribution channel segment of the Europe truffle market by capturing around 22.0% of the market share in 2025, supported by strong bulk procurement from restaurants, luxury hotels, gourmet food manufacturers, and specialty distributors. This channel benefits from long term supply contracts, consistent volume purchasing, and direct sourcing from truffle growers and cooperatives across France, Italy, and Spain. The dominance of B2B sales is further reinforced by rising demand from fine dining, premium catering services, and export oriented trading companies that require reliable year round supply of fresh and processed truffle products.

Food processing industries play a critical role within this market segment by driving large scale utilization of truffles in value added products such as truffle oils, sauces, frozen truffles, seasonings, and ready to use gourmet ingredients. These manufacturers rely on stable truffle inputs to support continuous production cycles for retail, private label, and food service brands. Growing demand for packaged gourmet foods, premium snacks, and flavor infused condiments across Europe is strengthening the importance of food processors as a key demand generator for both conventional and organic truffles.

By End-User Analysis

Food and beverages will dominate the end user segment of the Europe truffle market by capturing around 49.0% of the market share in 2025, driven by extensive usage of truffles across fine dining, gourmet restaurants, luxury hotels, and premium packaged food products. Truffles are widely incorporated into pasta, sauces, risottos, meat preparations, cheeses, butter, and specialty condiments, making them a core flavor enhancing ingredient in high value European cuisine. The expanding influence of gourmet ready meals, premium snacks, artisanal food brands, and home cooking trends is further amplifying truffle consumption across both food service and retail segments.

Cosmetics and personal care products represent a fast emerging application area within this market segment, supported by the growing use of black truffle and white truffle extracts in luxury skincare, serums, anti aging creams, and high end fragrance formulations. Truffle based ingredients are valued for their antioxidant properties, skin rejuvenation benefits, and premium brand positioning. European beauty brands are increasingly leveraging truffle derivatives to differentiate their product lines and cater to affluent consumers seeking natural, exotic, and performance driven cosmetic solutions.

Europe Truffle Market Report is segmented on the basis of the following:

By Product Type

- Black or Perigord

- Summer Truffle

- White Truffle

- Oregon Black Truffle

- Oregon White Truffle

- Burgundy Truffle

- Others

By Nature

By Form

- Fresh

- Processed

- Dried

- Oil

- Frozen

- Canned

- Others

By Distribution Channel

- B2B

- Food Processing Industries

- Food Service Restaurants

- Cosmetics and Personal Care Industry

- Pharmaceuticals

- B2C

- Store-Based Retailing

- Hypermarkets/Supermarkets

- Convenience Stores

- Independent Grocery Stores

- Specialty Stores

- Discounters

- Other Retailers

- Online Retailing

By End-User

- Food & Beverages

- Cosmetics & Personal Care Products

- Pharmaceuticals

Europe Truffle Market: Regional Analysis

The Europe truffle market shows strong regional concentration in Southern and Western Europe, with France, Italy, and Spain forming the core production and consumption hubs due to favorable climatic conditions, established truffle growing traditions, and advanced cultivation practices. Italy leads in white truffle production and export value, while France is widely recognized for its high quality black truffles and strong domestic gourmet demand.

Spain has emerged as a key volume producer supported by large scale commercial plantations and cost competitive cultivation. Eastern Europe, particularly Croatia and parts of the Balkans, is gaining momentum due to rising wild harvesting, agro tourism, and export oriented production. Northern Europe contributes primarily through imports, premium retail, and growing consumption in luxury food service and packaged gourmet segments.

By Region

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Europe Truffle Market: Competitive Landscape

The competitive landscape of the Europe truffle market is characterized by a mix of large organized producers, regional truffle cooperatives, specialty processors, and premium gourmet distributors operating across the value chain. Market competition is driven by factors such as product quality, geographic origin, seasonal availability, pricing strategies, and brand authenticity.

Players focus heavily on securing direct sourcing relationships with truffle farmers, investing in organic certification, and expanding processed product portfolios such as oils, sauces, and preserved truffles. Strategic priorities include strengthening export networks, enhancing cold chain logistics, and increasing digital commerce presence. Innovation in controlled cultivation, sustainable harvesting practices, and value added applications in packaged foods, cosmetics, and nutraceuticals is further intensifying competitive rivalry across the European landscape.

Some of the prominent players in the Europe truffle market are:

- Urbani Tartufi

- Sabatino Tartufi

- TartufLanghe

- Giuliano Tartufi

- Appennino Food Group

- Bianconi Tartufi

- Truffles & More (Italy)

- TruffleHunter

- Summer Truffles Ltd

- La Maison Plantin

- Pebeyre

- Maison de la Truffe

- Esprit Truffe

- Terre de Truffes

- Laumont

- Torres Truffles

- Trufas Alonso

- Trufbox

- Manjares de la Tierra

- Vicens Trufas

- Other Key Players

Europe Truffle Market: Recent Developments

- Apr 2025: A private equity firm invested in a fast growing premium gourmet food brand known for its truffle infused sauces, oils, and condiments to support retail expansion, e commerce scaling, and new product development across European markets.

- Mar 2025: A leading Italian luxury truffle brand launched a new range of 100% certified organic truffle products, including organic truffle oils, pâté, and carpaccio, targeting sustainability driven gourmet consumers and premium food retailers.

- Feb 2025: Industry outlook reports highlighted strong investor interest in the global truffle sector, driven by rising demand for fresh truffles, processed truffle products, and gourmet condiments, encouraging new funding activity across Europe.

- Jan 2025: A major European supplier introduced a new white truffle oil product line for fine dining restaurants and premium kitchens, featuring clean label formulation, enhanced aroma profiles, and upgraded luxury packaging.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 226.6 Mn |

| Forecast Value (2034) |

USD 418.7 Mn |

| CAGR (2025–2034) |

7.0% |

| Historical Data |

2019 – 2024 |

| Forecast Data |

2026 – 2034 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Product Type (Black/Perigord, Summer, White, Oregon Black/White, Burgundy, Others), By Nature (Organic, Conventional), By form (Fresh, Processed, Dried, Oil, Frozen, Canned, Others), By Distribution channel (B2B, B2C), and By End-use (Food & Beverages, Cosmetics & Personal Care, Pharmaceuticals) |

| Regional Coverage |

Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe

|

| Prominent Players |

Urbani Tartufi, Sabatino Tartufi, TartufLanghe, Giuliano Tartufi, Appennino Food Group, Bianconi Tartufi, Truffles & More (Italy), TruffleHunter, Summer Truffles Ltd, La Maison Plantin, Pebeyre, Maison de la Truffe, Esprit Truffe, Terre de Truffes., and Others., and Others. |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |

Frequently Asked Questions

The Europe truffle market size is estimated to have a value of USD 226.6 million in 2025 and is expected to reach USD 418.7 million by the end of 2034, with a CAGR of 7.0%.

Some of the major key players in the Europe truffle market are Urbani Tartufi, Sabatino Tartufi, TartufLanghe, Giuliano Tartufi, Appennino Food Group, Bianconi Tartufi, Truffles & More (Italy), TruffleHunter, Summer Truffles Ltd, La Maison Plantin, Pebeyre, Maison de la Truffe, Esprit Truffe, Terre de Truffes., and Others., and Others.