Market Overview

The

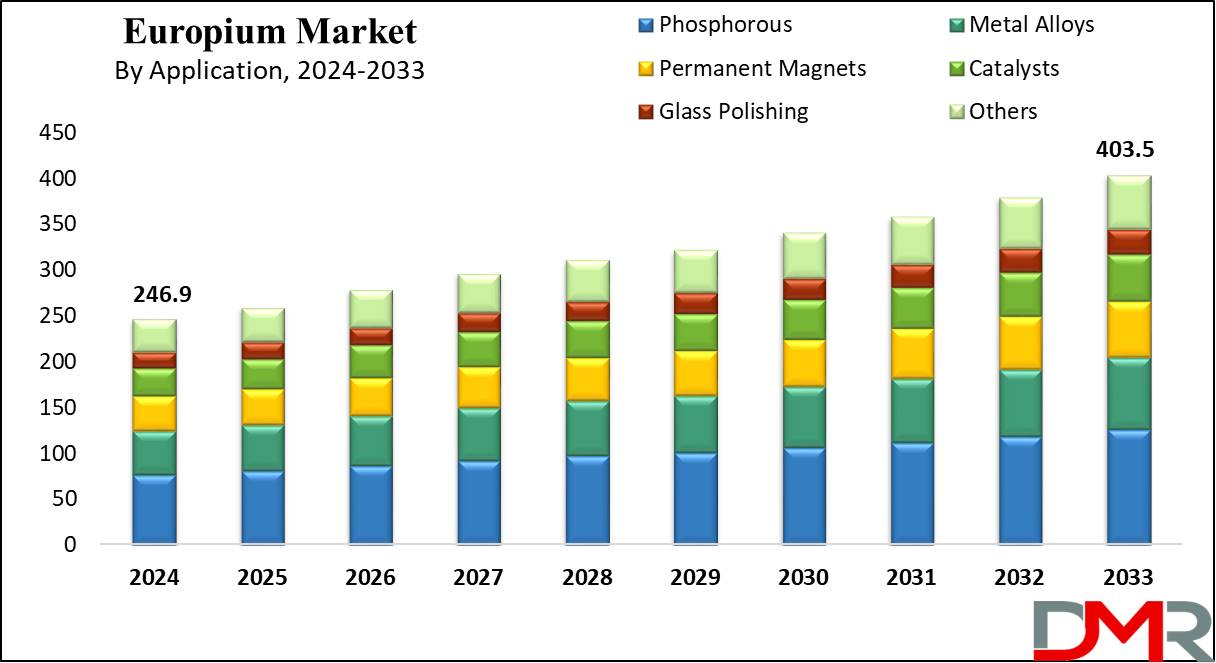

Global Europium Market is projected to

reach USD 246.9 million in 2024 and grow at a compound annual

growth rate of 5.6% from there until 2033 to reach a

value of USD 403.5 million.

Europium is a rare earth element with the symbol Eu and atomic number 63 on the periodic table. It is a soft, silvery-white metal and is part of the lanthanide series. It is known for its excellent ability to absorb and emit light, making it critical for producing bright colors in screens, LEDs, and fluorescent lamps. Despite being classified as a "rare" earth metal, europium is more abundant than gold or platinum in the Earth's crust, but it is difficult to extract in pure form, which adds to its value.

Also, the demand for europium has increased significantly in recent years owing to its role in modern technology, as its major uses are phosphor materials that produce light in displays like TVs, smartphones, and computer screens. It is also utilized in energy-efficient LED lighting and fluorescent lamps, which are in high demand worldwide as industries and households move toward sustainable energy solutions. In addition, europium is used in anti-counterfeiting measures for currency, which helps create unique fluorescent features. The growing dependency on these applications, mainly in the electronics and renewable energy sectors, has driven its market growth.

Further, the market is shifting toward sustainable and energy-efficient technologies. As governments push for lower carbon emissions, the demand for europium-based LED lighting is expected to rise. Another trend is the rise in the use of europium in smart devices and advanced display technologies like OLED (organic light-emitting diode) screens, which provide superior visual quality. In addition, recycling europium from electronic waste has gained attention to meet supply demands and minimize the environmental impact of mining. The trend of recycling rare earth elements is expected to play an even larger role in the future.

Moreover, a few important events have shaped the europium market in recent years. The ongoing global rare earth trade tensions, mainly including China, have created supply chain uncertainties. Countries like the United States and members of the European Union are constantly exploring ways to transform supply sources to reduce dependency on China. Mining projects in countries like Australia, Canada, and India have gained traction as a result. In addition, developments in extraction and recycling technologies have opened new opportunities to get europium from discarded electronics, reducing environmental concerns related to rare earth mining.

Further, with the growing demand, the europium market experiences several challenges. Its extraction process is complex and costly, as europium does not occur in pure form but is mostly found alongside other rare earth elements. In addition, geopolitical factors and trade restrictions continue to influence the market. The demand for stable and diversified supply chains is becoming majorly critical. But the investments in research and development are helping make extraction and recycling methods more efficient and sustainable. Recycling could ensure a steady supply while minimizing the environmental impact of mining.

The US Europium Market

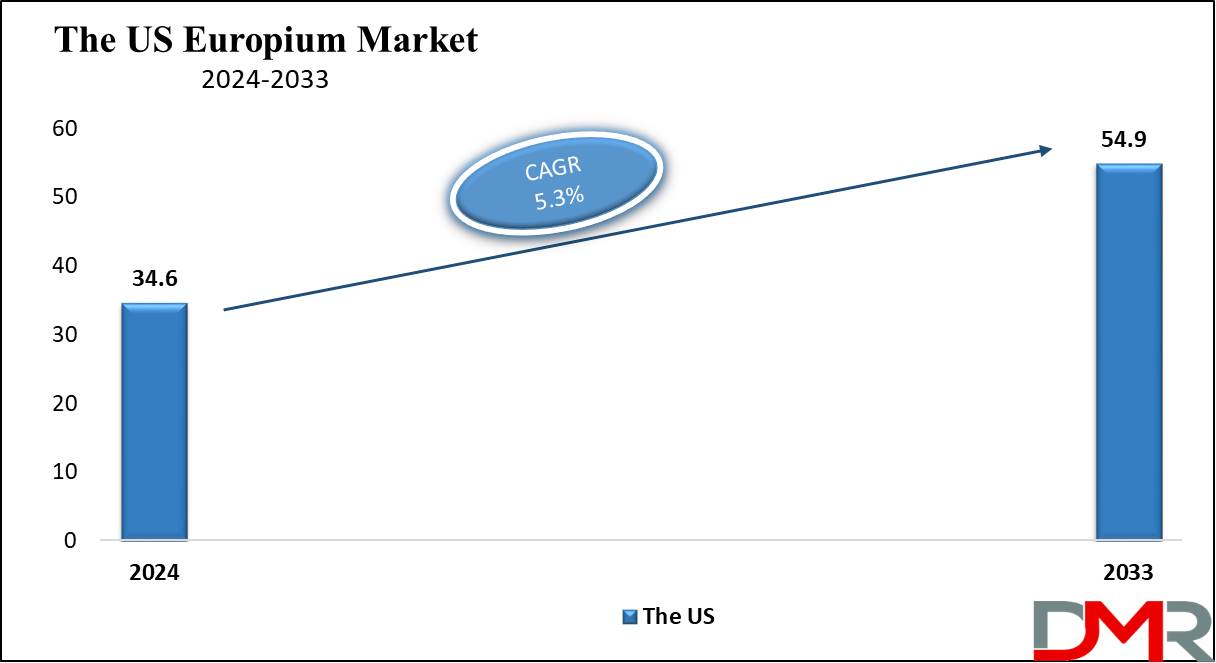

The

US Europium Market is projected to reach

USD 34.6 million in 2024 at a compound annual growth

rate of 5.3% over its forecast period.

The US has many growth opportunities in the europium market through domestic rare earth production expansion, primarily in collaboration with Canada, minimizing import dependency. Investments in recycling technologies and energy-efficient applications, like LED lighting and electric vehicles, can boost demand. In addition, focusing on R&D for advanced materials, like europium-based catalysts and anti-counterfeit technologies, could create significant market potential.

Further, it is driven by growing the need for energy-efficient technologies like LED lighting and rising adoption in electric vehicles and high-tech applications. However, growth is restrained by the lack of domestic production, reliance on imports, and high market prices. Limited refining and processing infrastructure further impacts the U.S. from achieving self-sufficiency in the europium market.

Key Takeaways

- Market Growth: The Europium Market size is expected to grow by 144.2 million, at a CAGR of 5.6% during the forecasted period of 2025 to 2033.

- By Application: The phosphorous segment is anticipated to get the majority share of the Europium Market in 2024.

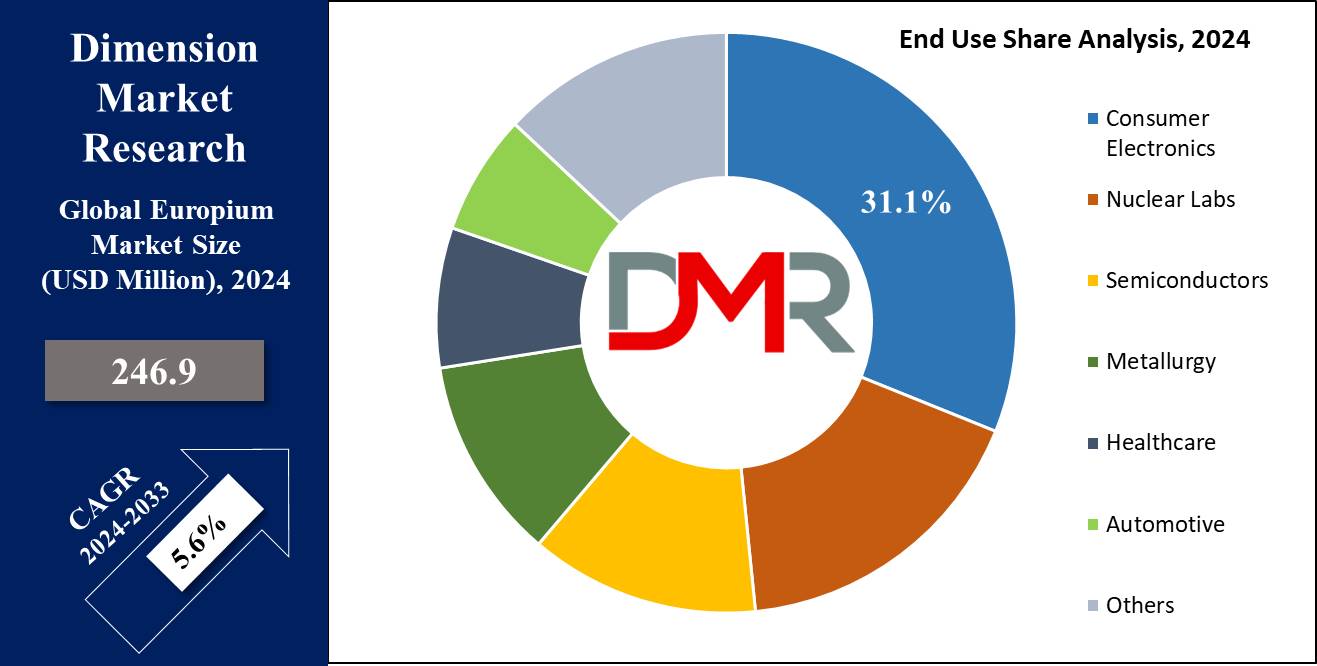

- By End User: The consumer electronics segment is expected to get the largest revenue share in 2024 in the Europium Market.

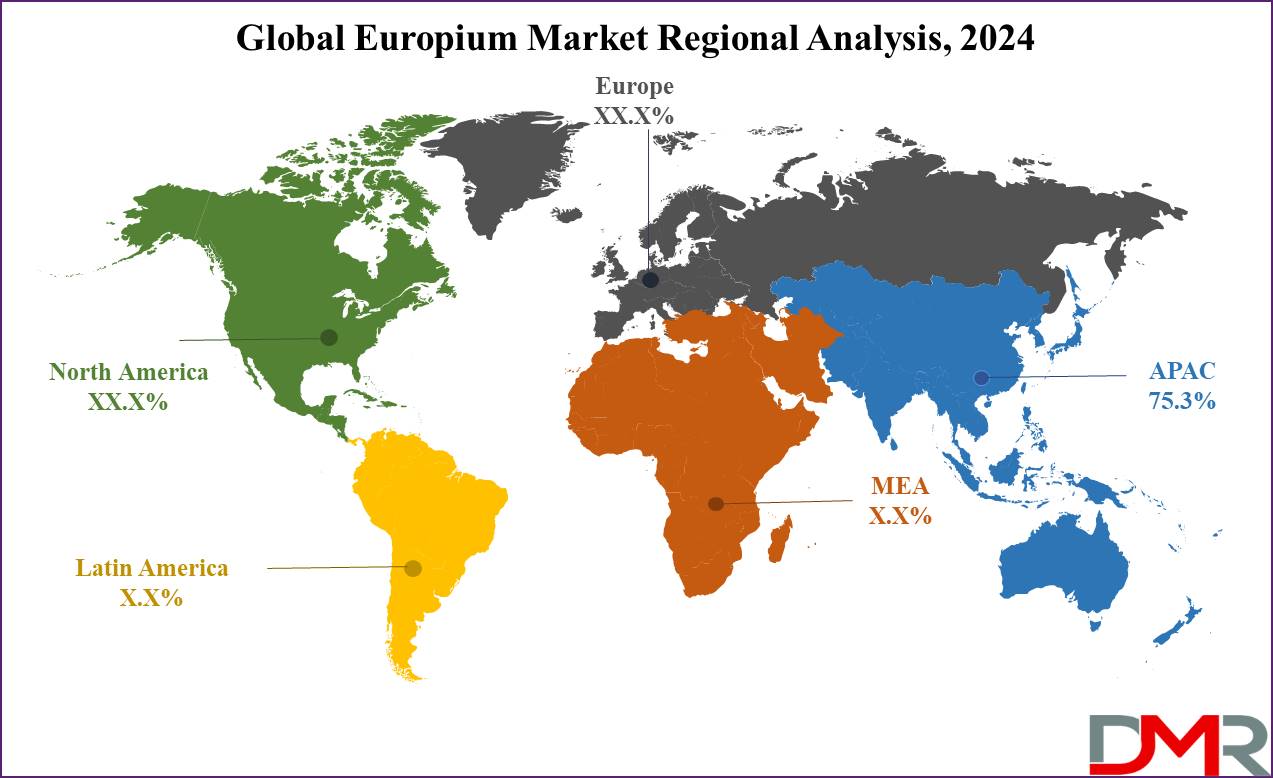

- Regional Insight: Asia Pacific is expected to hold a 75.3% share of revenue in the Global Europium Market in 2024.

- Use Cases: Some of the use cases of Europium include display technologies, anti-counterfeiting, and more.

Use Cases

- Display Technologies: Europium is utilized in phosphors to produce red and blue colors in TV screens, computer monitors, and smartphone displays, allowing vibrant visuals.

- LED and Fluorescent Lighting: Europium-based phosphors are vital in energy-efficient LED lights and fluorescent lamps, contributing to sustainable lighting solutions.

- Anti-Counterfeiting: Europium is used in currency security features to develop fluorescent marks that are visible under UV light, helping prevent counterfeiting.

- Nuclear Reactor Control: Europium is utilized in nuclear reactors as a neutron absorber, helping regulate nuclear reactions safely and effectively.

Stats and Facts

- As per Eurostat, in 2023, the European Union (EU) imported 18,300 tonnes of rare earth elements (REEs) worth EUR 123.6 million, creating a 0.5% decrease in volume and a 15.2% drop in value compared to 2022. At the same time, the EU exported 5,600 metric tons of REEs valued at EUR 102.3 million, showing declines of 18.7% in volume and 27.8% in value. The export price decreased by 11.2%, averaging €18.4 per kilogram.

- Further, China was the largest supplier of REEs to the EU, accounting for 39% of imports (7,100 metric tons), followed by Malaysia at 33.1% (6,100 metric tons) and Russia at 22% (4,000 metric tons). Rare earth elements, like europium, are classified as having a high supply risk and significant economic importance, used in various high-tech applications.

- According to Nature.com, Metal-organic frameworks (MOFs) made with europium demonstrate remarkable adaptability, capable of transforming from 3D to 2D structures (SLU-1 to SLU-2) and reassembling into new 3D forms (SLU-3) under specific solvent condition, which are are highly effective as biocatalysts due to their combination of hydrophilic and hydrophobic spots and their ability to incorporate large active species like horseradish peroxidase (HRP).

- In addition, the SLU-3 europium MOF, improved with a silica core-shell structure, exhibited increased stability, reusability, and the ability to degrade phenol effectively, showcasing its potential in biocatalysis applications.

- Lanthanide ions, like europium, are ideal for catalysis due to their hard Lewis acidity, fast ligand-exchange kinetics, high coordination preferences, and flexible geometry, and are mainly promising for small-molecule catalysts.

- As per IUCr Journal, a mutant enzyme, phosphotriesterase (PTE-R18), retained esterase activity even after binding a single europium (III) ion at its active sit, which was confirmed through X-ray crystallography at a resolution of 1.78 Å, highlighting europium's potential in stereoselective enzymatic reactions under gentle conditions.

Market Dynamic

Driving Factors

Rising Demand for Energy-Efficient LightingThe growth in the global shift toward sustainable and energy-efficient technologies is a major driver for the europium market. Europium-based phosphors are important in LED lighting and fluorescent lamps, which are substituting traditional lighting systems. Governments across the world are implementing regulations to encourage energy-saving solutions, further boosting the demand for europium in lighting applications.

Expansion of Display and Smart Device Industries

The rise in the demand for advanced display technologies, like LCD and OLED screens, in TVs, smartphones, and tablets is driving the europium market. Europium's distinctive ability to develop bright red and blue colors makes it vital for high-quality visuals. With the growth in the adoption of smart devices and 4K/8K displays, the demand for europium-based phosphors is set to rise steadily.

Restraints

Supply Chain Dependence and Geopolitical Risks

The europium market is highly dependent on China, which controls a major portion of global rare earth production, which creates vulnerabilities in the supply chain, mainly with the ongoing trade tensions and potential restrictions. Geopolitical issues can develop price volatility, supply disruptions, and challenges for countries looking for alternative sources of europium.

Complex Extraction and High Costs

Europium extraction is a complex and expensive process, as it is mainly found in trace amounts within other rare earth ores. The demand for advanced processing technologies and the environmental impact of mining contribute to the high costs linked with europium production. These challenges can impact its broad availability and market growth, especially in cost-sensitive applications.

Opportunities

Recycling of Rare Earth Elements

As the demand for europium grows, the demand for sustainable sourcing has led to an increased focus on recycling. Recovering europium from electronic waste and old lighting systems provides a major opportunity to meet market demand while minimizing environmental impact. Advanced recycling technologies are enhancing the efficiency of extracting europium from discarded electronics, providing a sustainable alternative to traditional mining.

Diversification of Mining Sources

With concerns over supply chain risks, there is an opportunity for countries outside of China to develop new mining projects for europium. Nations like Australia, Canada, and India are getting funded in the exploration and extraction of rare earth elements, which could reduce geopolitical risks and help stabilize the europium market, promoting growth opportunities in the global industry.

Trends

Growth in OLED and 4K/8K Display Technologies

A major trend in the europium market is the increased adoption of OLED and 4K/8K display technologies. Europium’s role in getting vibrant red and blue phosphors is vital for the high-quality visuals demanded by these advanced screens. As consumer electronics companies drive for more visually immersive experiences, the need for europium in these applications is growing steadily, driving market growth.

Shift towards Energy-Efficient Lighting

There is a major trend toward energy-efficient LED lighting and fluorescent lamps globally. As governments and industries prioritize sustainability, the need for lighting solutions that minimize energy consumption is growing. Europium-based phosphors are vital in these energy-efficient lighting systems, making it a crucial material in the transition to greener technologies, further boosting its market demand.

Research Scope and Analysis

By Application

Phosphors are expected to dominate the europium market in 2024, contributing the largest share of industry revenues, as europium is an important material for producing red and blue phosphors, which are broadly used in everyday technologies like smartphones, flat-panel displays, and televisions. The growing popularity of these devices is expected to drive major growth in demand for europium-based phosphors over the coming years.

These phosphors are vital for delivering the vibrant colors and high-quality visuals required in modern display technologies. With the increase in dependency on advanced screens in both consumer and industrial settings, the phosphor segment is set to remain the primary application for europium throughout the forecast period.

Further, applications like permanent magnets and catalysts are also expected to experience notable growth. The demand for europium in these areas is being driven by its growing use in industries like semiconductors, metallurgy, and automotive manufacturing. Permanent magnets, in general, are expected to steady growth due to their importance in renewable energy and electric vehicle applications.

Also, ongoing R&D efforts are creating europium's potential uses, mainly when combined with other rare earth elements like terbium and yttrium. These innovations are unlocking new opportunities in fields like energy, automotive, material science, and life sciences, which are expected to create new avenues for europium across various industries in the coming years.

By End Use

The consumer electronics sector is expected to lead the europium market in 2024, accounting for the biggest share of the European market's revenues, which is majorly driven by the rapid expansion of the global electronics industry, mainly in emerging economies in the Asia Pacific region, like India, China, South Korea, and Thailand. The growing sales of consumer devices like smartphones, wearables, and 4K televisions are major contributors to this trend.

As the need for high-performance and visually advanced electronics grows, so does the demand for europium, which plays a major role in producing vibrant colors in screens and displays. With the increase in the development of new electronic products and technologies, this segment is expected to grow steadily over the forecast period.

Moreover, another vital application of europium is in anti-counterfeiting technologies, where its distinctive luminescent properties are utilized. Europium is broadly used in electronic devices, currency, software, and consumer goods to develop anti-counterfeit measures that protect against fraud. Governments across the world are highly investing in the development of anti-counterfeiting products and services to safeguard consumers and combat counterfeit goods and currency, both domestically and internationally. This increase in the focus on consumer protection and security is anticipated to further drive the demand for europium in the coming years, making it a valuable resource in multiple sectors.

The Europium Market Report is segmented on the basis of the following

By Application

- Phosphorus

- Metal Alloys

- Permanent Magnets

- Catalysts

- Glass Polishing

- Others

By End Use

- Consumer Electronics

- Nuclear Labs

- Semiconductors

- Metallurgy

- Healthcare

- Automotive

- Others

Regional Analysis

The Asia Pacific region is expected to dominate the global europium market in 2024,

having about 75.3% of total industry revenues. This dominance is largely due to China’s position as the leading producer of europium, contributing the majority of the global supply. China holds the largest proven reserves of europium and operates as a monopolist in the market, playing a major role as a major exporter of rare earth elements worldwide.

The growth in the use of europium in key industries like consumer electronics, energy, automotive, and semiconductors is further driving the demand in the region. Quick industrialization and the booming consumer electronics sector in emerging economies like India, Indonesia, Vietnam, and Thailand are also driving growth. With the rise in domestic demand and a strong export market.

Further, the North American market is expected to experience slower growth owing to the current challenges in the rare earth industry. The United States, which is a net importer of europium and related products, is experiencing limitations in domestic production due to high costs and insufficient infrastructure for mining and processing. These factors, along with dependency on imports, have slowed growth in the region.

However, there is potential for steady progress in the future, as Canada is ramping up efforts to boost rare earth production. This massive production capacity in Canada may help North America strengthen its position in the europium market and reduce its dependence on imports over the forecast period.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The europium market is dominated by a few key players, particularly in regions like Asia Pacific, which leads global production and supply. Countries with large rare earth reserves, like China, hold significant control over the market due to their advanced mining and processing capabilities. Companies in this market aim for R&D to expand Europium's applications in technologies like consumer electronics, renewable energy, and anti-counterfeiting. The market is also influenced by supply chain challenges, regional policies, and the growing demand for sustainable and efficient materials across the globe.

Some of the prominent players in the Global Europium are

- China Minmetals

- Lynas

- Energy Fuels

- Molycorp

- Vital Metals

- Rhodia

- Iluka Resources

- Tasman Metals

- Avalon Advanced Materials

- Northern Minerals

- Other Key Players

Recent Developments

- In September 2024, India is a part of the Minerals Security Finance Network, a US-led initiative focused on strengthening cooperation among members to secure supply chains for critical minerals, which was made by the US State Department on the margins of the United Nations General Assembly included a pact entered by 14 countries and the European Union. The Minerals Security Finance Network (MSFN) is a new initiative that stems from the Minerals Security Partnership (MSP).

- In September 2024, The Department of Defense announced a USD 4.22 million award to Rare Earth Salts in Beatrice, Nebraska, for creating and expanding the production of terbium oxide from recycled fluorescent light bulbs. Terbium is a vital element for rare earth magnets in many key defense systems, which is funded through the Defense Production Act Investment (DPAI) office and aligns with the National Defense Industrial Strategy's priority of growing supply chain resilience by expanding domestic production and sustainment of critical production.

- In September 2024, Callinex Mines Inc. announced that it has completed the fully funded 2024 exploration campaign at the 100% owned Pine Bay Project located within the Flin Flon Mining District of Manitoba. Further, it includes 11,859 hectares and benefits from a mineral lease, water, hydroelectric power, historic shaft, and direct road access to an idle processing facility in Flin Flon, MB, located 16km away.

- In April 2024, Researchers at Oak Ridge National Laboratory (ORNL) created a new method for separating critical metals known as lanthanides, as the scientist designed an innovative ‘tug of war’ method that expertly separates and recovers precious lanthanides that are vital in a range of technologies. These metals are majorly used to manufacture clean energy technologies, like electric vehicles, wind turbines, and even cancer treatments.

Report Details

| Report Characteristics |

| Market Size (2024) |

USD 246.9 Mn |

| Forecast Value (2033) |

USD 403.5 Mn |

| CAGR (2024-2033) |

5.6% |

| Historical Data |

2018 – 2023 |

| The US Market Size (2024) |

USD 34.6 Mn |

| Forecast Data |

2025 – 2033 |

| Base Year |

2023 |

| Estimate Year |

2024 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Application (Phosphorus, Metal Alloys, Permanent Magnets, Catalysts, Glass Polishing, and Others), By End Use (Consumer Electronics, Nuclear Labs, Semiconductors, Metallurgy, Healthcare, Automotive, and Others) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA

|

| Prominent Players |

China Minmetals, Lynas, Energy Fuels, Molycorp, Vital Metals, Rhodia, Iluka Resources, Tasman Metals, Avalon Advanced Materials, Northern Minerals, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users) and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |

Frequently Asked Questions

The Global Europium Market size is expected to reach a value of USD 246.9 million in 2024 and is expected to reach USD 403.5 million by the end of 2033.

Asia Pacific is expected to have the largest market share in the Global Europium Market with a share of about 75.3% in 2024.

The Europium Market in the US is expected to reach USD 34.6 million in 2024.

Some of the major key players in the Global Europium Market are China Minmetals, Lynas, Energy Fuels, and others.

The market is growing at a CAGR of 5.6 percent over the forecasted period.