Market Overview

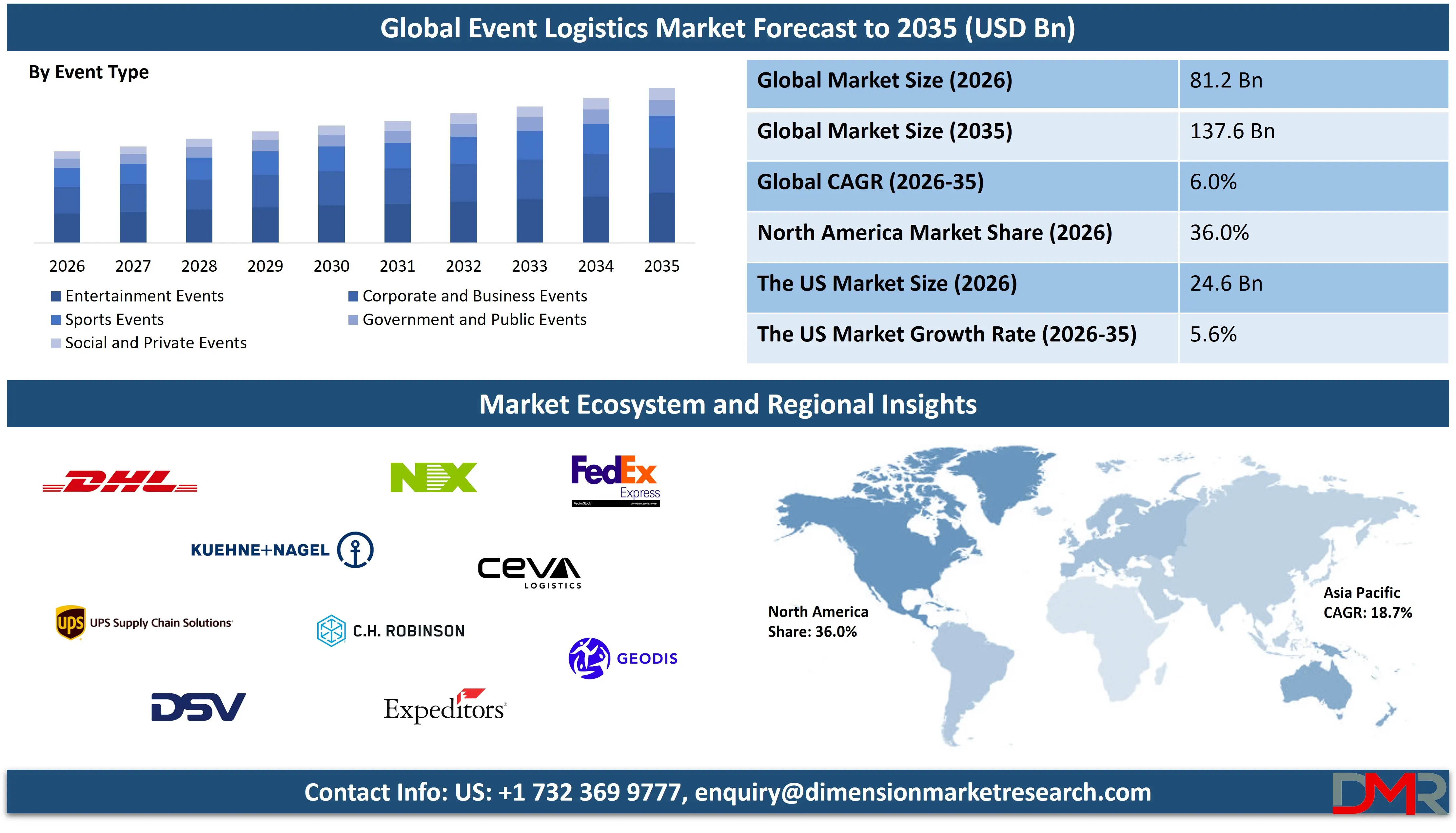

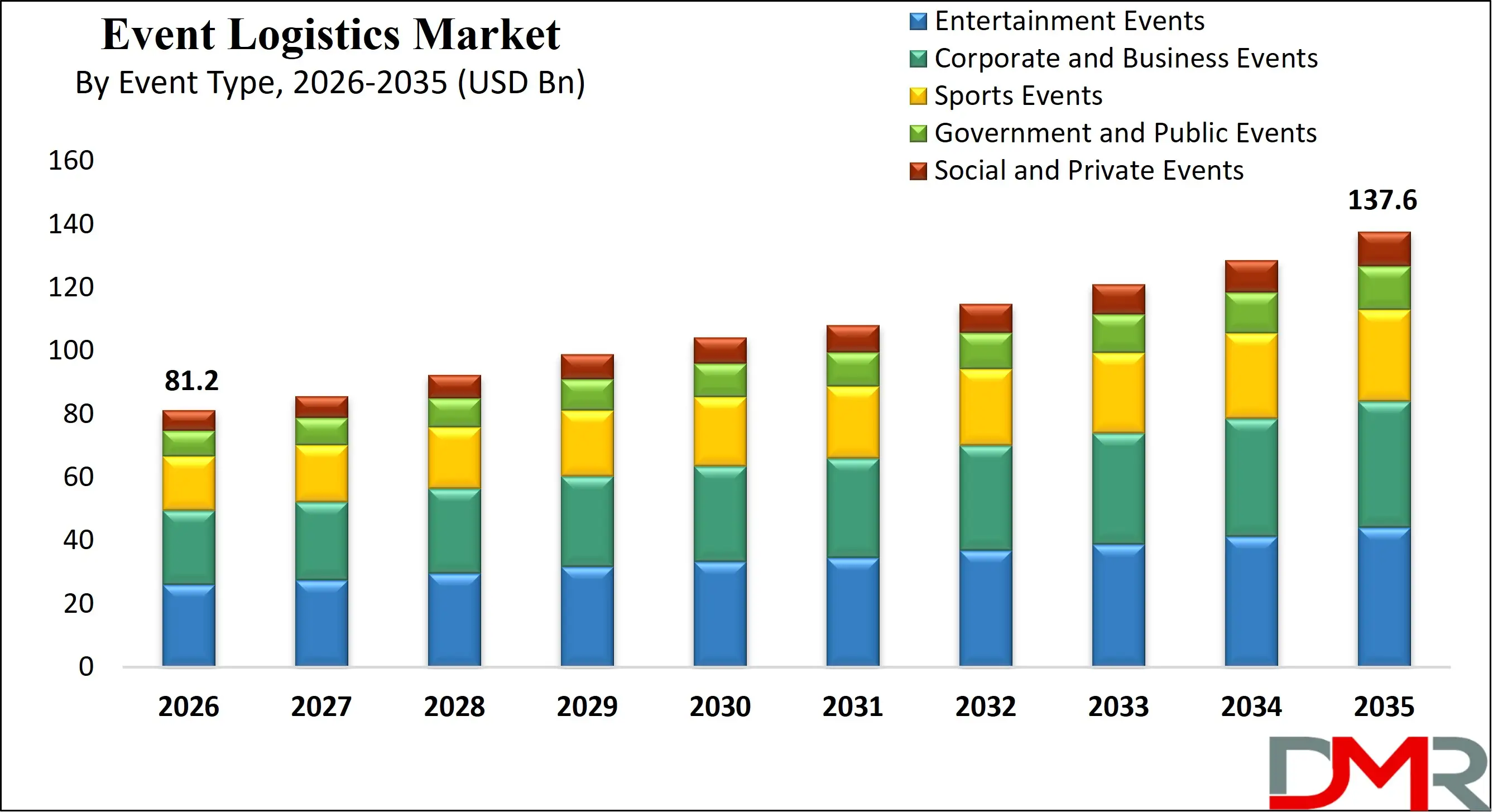

The Global Event Logistics Market is expected to reach USD 81.2 billion in 2026 and is projected to grow at a CAGR of 6.0% through 2035, reaching USD 137.6 billion, driven by rising demand for event transportation, venue logistics, freight forwarding, and integrated supply chain solutions.

Event logistics refers to the specialized process of planning, coordinating, transporting, storing, and managing all physical and operational resources required to deliver an event successfully, from small corporate gatherings to large scale exhibitions, concerts, and international sporting events.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

It includes activities such as freight movement, equipment handling, venue delivery scheduling, onsite material flow, inventory control, and post event removal, ensuring that every component arrives at the right place and time. Event logistics also involves regulatory compliance, customs documentation for cross border shipments, and risk management to prevent disruptions. By combining supply chain expertise with event production needs, event logistics creates a seamless flow of goods, technology, and infrastructure that supports smooth execution and high quality attendee experiences.

The global event logistics market represents the worldwide industry that provides integrated logistics and supply chain services specifically tailored for the events ecosystem, including exhibitions, trade fairs, live entertainment, sports tournaments, and government gatherings. This market encompasses a wide range of service providers such as freight forwarders, warehousing operators, venue logistics firms, and technology based logistics platforms that enable efficient coordination across multiple locations and time sensitive schedules. Growth in international tourism, global touring shows, and cross border trade exhibitions is increasing demand for reliable event logistics solutions that can handle complex routing, customs procedures, and real time visibility.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The global event logistics market is also being shaped by digital transformation and sustainability initiatives, as companies increasingly adopt logistics software, tracking systems, and data driven planning tools to improve efficiency and reduce costs. Advanced technologies such as cloud based management platforms, IoT enabled asset tracking, and automated inventory systems are improving accuracy and responsiveness across the event supply chain. At the same time, rising demand for eco-friendly events is driving the use of optimized transportation routes, reusable packaging, and low emission delivery options, positioning the market as a key enabler of both operational excellence and environmentally responsible event management.

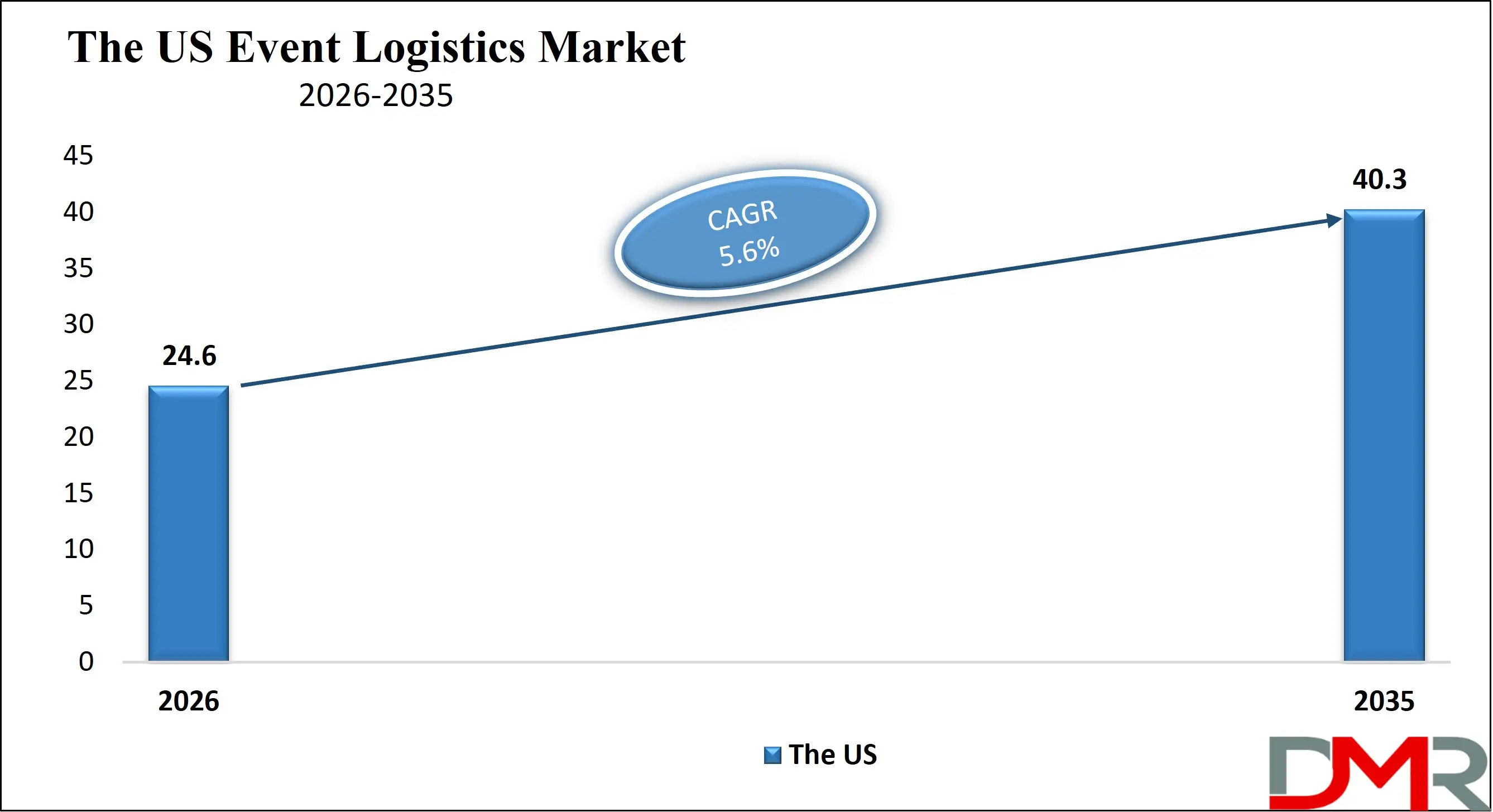

The US Event Logistics Market

The U.S. Event Logistics Market size is expected to reach at USD 24.6 billion in 2026. It is further expected to witness subsequent growth in the upcoming period, holding USD 40.3 billion in 2035 at a CAGR of 5.6%.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The US Event Logistics Market plays a critical role in supporting the country’s vast ecosystem of corporate exhibitions, trade shows, live entertainment, sports tournaments, and large scale public events. It includes a wide range of services such as freight forwarding, venue delivery coordination, warehousing, equipment handling, and onsite material movement. Strong demand from convention centers, touring production companies, and sports leagues drives continuous need for reliable logistics solutions. The presence of advanced transportation infrastructure and a high concentration of event venues allows logistics providers to offer fast turnaround times, real time tracking, and efficient distribution across major cities.

The market is further strengthened by increasing adoption of digital logistics platforms, automation, and data driven planning tools that enhance visibility and reduce operational risks. Event organizers are increasingly relying on integrated supply chain solutions that connect transportation, inventory management, and on site deployment into a single workflow. Sustainability is also shaping service strategies as companies focus on fuel efficient transport, route optimization, and reusable packaging. With growing investments in conventions, entertainment, and tourism, the US Event Logistics Market continues to expand as a key enabler of successful and cost effective event execution.

The Europe Event Logistics Market

The Europe Event Logistics Market is expected to reach USD 18.0 billion in 2026, supported by the region’s strong position as one of the world’s most active hubs for exhibitions, trade fairs, sports tournaments, cultural festivals, and international conferences. Countries such as Germany, France, the UK, Italy, and Spain host a high volume of large and mid-scale events that require complex logistics planning, multimodal transportation, and time critical delivery of equipment, staging, and promotional materials. The region’s dense transport infrastructure, including advanced road, rail, air, and port networks, supports smooth cross border movement, while harmonized customs procedures within the EU further improve operational efficiency for event logistics providers.

A CAGR of 6.1% indicates that Europe’s event logistics industry is benefiting from rising investments in live entertainment, corporate marketing events, and global exhibitions, alongside the recovery and expansion of international travel and tourism. Digital transformation is also strengthening the market as logistics firms adopt real time tracking, warehouse automation, and data driven scheduling to improve reliability and reduce delays. Sustainability requirements, including low emission transport and eco-friendly event operations, are pushing companies to modernize fleets and processes, making European event logistics more competitive and aligned with evolving regulatory and client expectations.

The Japan Event Logistics Market

The Japan Event Logistics Market is expected to reach USD 4.0 billion in 2026, driven by the country’s strong presence in hosting international exhibitions, technology expos, sports tournaments, cultural festivals, and large scale corporate events. Major cities such as Tokyo, Osaka, and Yokohama serve as key event hubs, supported by highly efficient transportation networks, modern warehousing facilities, and advanced freight forwarding services. Japan’s reputation for precision, reliability, and punctuality enables smooth handling of time sensitive equipment, high value exhibition materials, and complex event infrastructure.

A CAGR of 6.5% reflects the rising demand for professional event logistics services as Japan attracts more global brands, trade delegations, and entertainment productions. Increasing adoption of digital logistics platforms, real time shipment tracking, and automated inventory management is improving visibility and operational efficiency across the event supply chain. In addition, the growing focus on international tourism and business events is boosting requirements for specialized logistics solutions, further strengthening the long term growth outlook of Japan’s event logistics market.

Global Event Logistics Market: Key Takeaways

- Event Logistics Is Becoming a Fully Integrated Supply Chain Service: The market is shifting from basic freight movement toward fully integrated event supply chain management, combining transportation, warehousing, customs compliance, and onsite delivery into a unified service model that supports complex, multi-location events.

- Growth of Global Events Is Driving Time Critical Logistics Demand: The expansion of international exhibitions, sports tournaments, and touring entertainment is increasing the need for fast, reliable, and precisely coordinated logistics solutions that ensure equipment and materials arrive exactly when and where required.

- Digitalization and AI Are Redefining Operational Efficiency: Cloud platforms, real time tracking, and AI based planning tools are enabling event logistics providers to improve visibility, optimize routes, reduce disruptions, and manage inventory and venue deliveries with greater accuracy.

- Sustainability Is Becoming a Key Selection Factor: Event organizers are increasingly choosing logistics partners that offer low emission transportation, optimized routing, and eco-friendly packaging as sustainability becomes a central requirement in global event planning.

- Regional Hubs Are Strengthening Global Market Expansion: Strong demand from North America, Europe, and Asia Pacific is reinforcing the global nature of the market, as multinational companies and event organizers seek logistics partners capable of managing cross border transport, regulatory compliance, and localized venue execution.

Global Event Logistics Market: Use Cases

- International Trade Shows and Exhibitions: Global event logistics supports the movement of exhibition materials, booths, and promotional assets for international trade shows. Services such as freight forwarding, customs clearance, and venue delivery ensure exhibitors meet strict timelines while maintaining full visibility through tracking and inventory management systems.

- Live Entertainment and Touring Events: Concert tours and traveling shows depend on event logistics to transport stage equipment, lighting, and audio systems between venues. Logistics providers coordinate road, air, and onsite handling to enable fast changeovers and smooth event execution.

- International Sports Tournaments: Sports events rely on event logistics to manage the delivery of sports equipment, broadcast systems, and venue supplies. Warehousing, scheduling, and cross border transport ensure all materials reach stadiums and training locations on time.

- Government and Cultural Mega Events: Large public events and global summits use event logistics for transporting exhibits, technical infrastructure, and security related materials. Integrated logistics solutions help manage complex supply chains and ensure timely setup and dismantling.

Global Event Logistics Market: Stats & Facts

-

Eurostat (European Union Statistics Office)

- Total road freight transport in the European Union exceeded 13 billion tonnes in 2024, providing major capacity for moving event equipment and exhibition materials.

- International road freight represented nearly one quarter of total EU road freight activity in 2024, showing strong cross border logistics flows.

- EU air freight volumes increased by nearly 9 percent from 2023 to 2024, supporting time sensitive shipments for events and trade shows.

- Intra EU air cargo accounted for more than half of all air freight movements in 2024.

- Seaport cargo throughput in the EU increased in 2024 compared with 2023, supporting international shipment of staging, lighting, and heavy equipment.

- Rail freight volumes across the EU rose in 2024 as sustainable logistics solutions expanded.

- EU logistics performance improved in 2025 as infrastructure investments continued.

-

US Bureau of Transportation Statistics (BTS)

- Total freight moved in the United States increased from 2023 to 2024 across road, rail, air, and water modes.

- Air cargo volumes rose in 2024, supporting urgent delivery of event related materials.

- Trucking remained the dominant freight mode in 2024, carrying more than two thirds of all domestic freight.

- Rail freight supported bulk transport of exhibition structures and staging materials in 2024.

- US freight transportation activity continued rising into 2025 as business events and travel recovered.

-

Ministry of Tourism, Government of India

- More than 79 percent of international visitors to India arrived by air, supporting demand for air based event logistics.

- Business and conference travel increased between 2023 and 2024.

- International tourist arrivals continued to rise in 2025, supporting exhibition and convention logistics.

-

China Ministry of Commerce and CIFTIS Organizers

- China’s major international trade fairs recorded higher exhibitor participation in 2023 than in 2022.

- The number of international exhibitors increased again in 2024.

- Digital and hybrid participation at trade fairs expanded in 2025.

-

Japan Tourism Agency and MLIT (Ministry of Land, Infrastructure, Transport and Tourism)

- International arrivals to Japan increased significantly between 2023 and 2024.

- Air cargo throughput at major Japanese airports rose in 2024.

- Convention and exhibition attendance in Japan expanded in 2025.

Global Event Logistics Market: Market Dynamic

Driving Factors in the Global Event Logistics Market

Expansion of Global Events and Exhibitions

The rapid growth of international trade shows, music festivals, sports leagues, and corporate conventions is significantly driving demand for event logistics services. As more events are hosted across borders, organizers require professional freight forwarding, venue delivery coordination, and integrated supply chain management to handle complex schedules and multiple shipment points. Rising investments in business tourism and large scale entertainment are also increasing the need for specialized logistics providers that can manage time sensitive cargo, onsite equipment handling, and real time tracking.

Growth of Live Entertainment and Sports Industries

The global rise in touring concerts, streaming driven content promotion, and international sports tournaments has created strong demand for reliable event transportation and logistics solutions. These activities require fast and secure movement of stage equipment, broadcast systems, and technical infrastructure between venues. The increasing scale and frequency of these events are encouraging logistics companies to expand their networks, digital platforms, and warehousing capabilities.

Restraints in the Global Event Logistics Market

High Operational Complexity and Cost Pressures

Event logistics involves managing multiple suppliers, tight delivery windows, and last mile venue access, which significantly increases operational costs. Expenses related to fuel, labor, warehousing, customs clearance, and insurance can reduce profit margins for logistics providers. For event organizers, these high costs can limit spending on premium logistics services, especially for mid-sized and budget constrained events.

Regulatory and Cross Border Challenges

International events often require complex customs documentation, import permits, and compliance with local transport regulations. Delays caused by regulatory inspections, paperwork errors, or changing trade rules can disrupt event schedules. These uncertainties make global event logistics more difficult to manage, particularly for time critical shipments such as stage setups and broadcast equipment.

Opportunities in the Global Event Logistics Market

Rising Demand for Technology Driven Logistics Solutions

The adoption of digital logistics platforms, cloud based management systems, and IoT enabled tracking is creating new opportunities in the event logistics market. Event organizers increasingly prefer service providers that offer real time shipment visibility, automated inventory control, and predictive delivery planning. These technologies improve reliability and open up premium service offerings for large and complex events.

Growth of Sustainable and Green Event Logistics

Sustainability is becoming a major focus in the global events industry, creating opportunities for ecofriendly logistics services. Companies that provide route optimization, fuel efficient transportation, reusable packaging, and low emission delivery options are gaining preference among organizers. Green logistics solutions also help brands meet environmental goals while reducing operational waste.

Trends in the Global Event Logistics Market

Integration of End to End Event Supply Chain Management

Event organizers are moving toward integrated logistics models that combine transportation, warehousing, and onsite delivery into a single coordinated system. This trend allows better control over event materials, reduces delays, and improves cost efficiency. Logistics providers offering end to end event supply chain solutions are becoming key strategic partners rather than simple service vendors.

Increased Use of Real Time Tracking and Data Analytics

Real time tracking and data analytics are becoming standard features in event logistics operations. These tools allow logistics teams to monitor shipments, anticipate delays, and optimize routes during live events. Data driven planning is improving reliability, enhancing customer confidence, and supporting better decision making across the event management and logistics ecosystem.

Global Event Logistics Market: Research Scope and Analysis

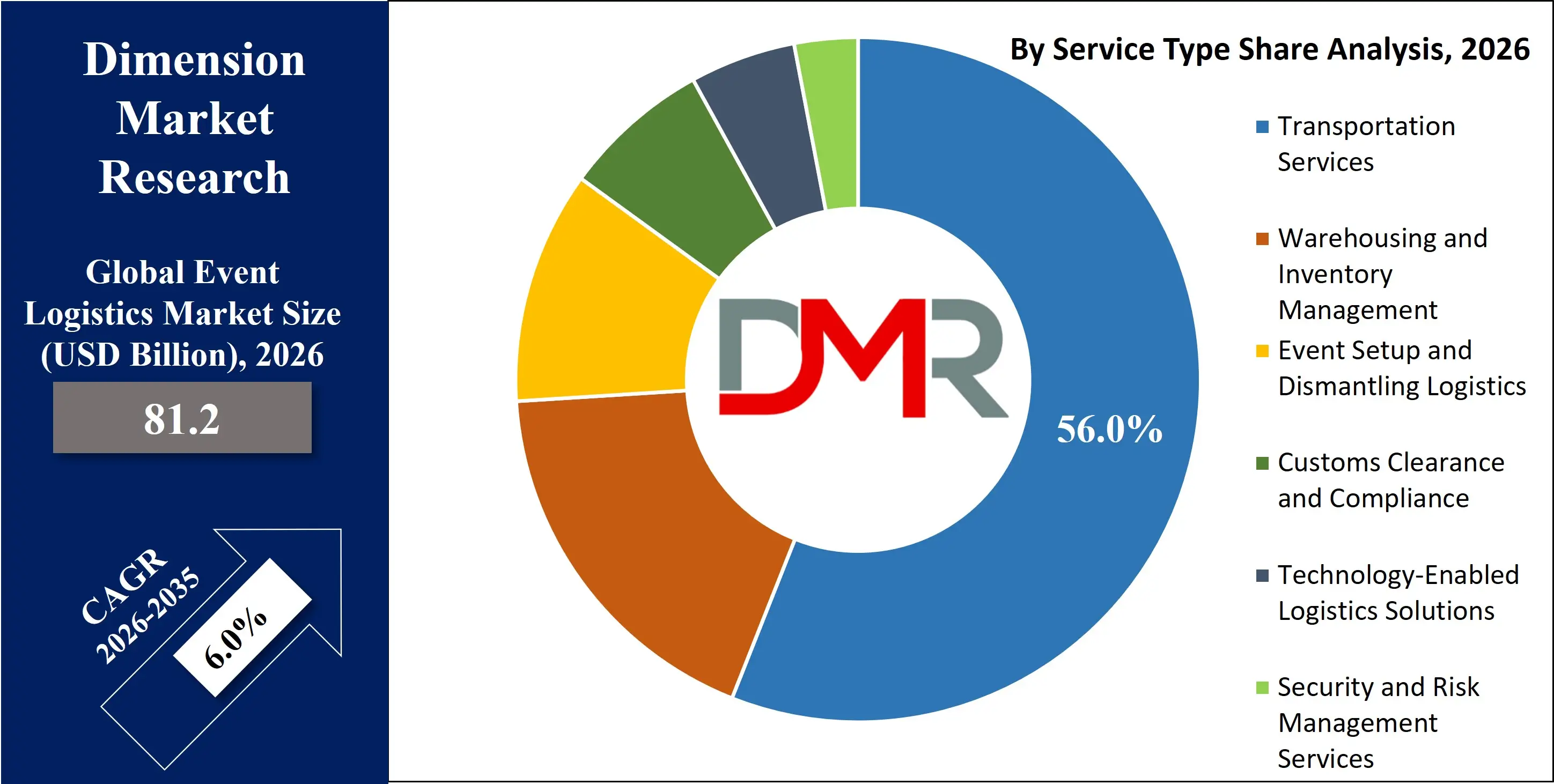

By Service Type Analysis

Transportation services are expected to dominate the service type segment of the global event logistics market by holding 56.0% of the total market share in 2026 because the physical movement of equipment, staging materials, audio visual systems, and exhibition assets is the most critical and cost intensive part of any event. Every concert, trade show, sports tournament, or cultural festival requires precise delivery of time sensitive cargo to venues, often across cities or countries. The growing number of international events, touring productions, and cross border exhibitions has increased reliance on road freight, air cargo, and sea transport to meet tight schedules and avoid disruptions. Event organizers prefer logistics providers that offer reliable transportation networks, real time tracking, and flexible routing, which further strengthens the dominance of this segment.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Warehousing and inventory management also play a vital role within the service type segment by supporting the storage, staging, and control of event assets before and after deployment. Many event organizers and production companies require temporary storage for equipment, exhibition materials, and promotional goods near major venues or transport hubs. Effective inventory management helps prevent loss, damage, and misplacement of high value items while enabling faster setup and dismantling during events. As the scale and complexity of global events increase, the demand for professionally managed event warehousing, cross docking, and asset tracking continues to rise, making this segment a key enabler of efficient and cost effective event logistics operations.

By Event Type Analysis

Entertainment events are expected to lead the event type segment with a 32.0% share in 2026 because of the high volume and operational intensity of concerts, music festivals, film productions, and touring shows held across the world. These events require large scale movement of stage structures, lighting systems, sound equipment, broadcast tools, and crew supplies between multiple venues, often within very tight timelines. The rapid growth of global touring, live performances, and content driven experiences has increased the need for specialized event transportation, on site logistics coordination, and real time shipment tracking. As entertainment companies continue to expand into international markets, their dependence on professional event logistics providers further strengthens this segment’s market dominance.

Corporate and business events also represent a significant portion of the event type segment as companies increasingly rely on trade shows, exhibitions, product launches, and conferences to engage customers and partners. These events demand precise delivery of exhibition booths, marketing materials, digital displays, and technical equipment to convention centers and meeting venues. With growing emphasis on brand presence, business networking, and experiential marketing, organizations are investing more in well-coordinated logistics to ensure smooth event execution. The expansion of global business travel and international trade fairs continues to support steady growth for logistics services dedicated to corporate and business events.

By Event Size Analysis

Medium scale events are expected to dominate the event size segment with a 34.0% share in 2026 because they represent the most frequent and commercially active category of global events. This segment includes regional trade shows, corporate conferences, music events, and industry exhibitions that occur regularly across major cities. These events require a balanced level of logistics support involving transportation, warehousing, on site material handling, and equipment coordination, making them highly attractive to event logistics providers. Their consistent scheduling and moderate complexity create steady demand for freight forwarding, inventory management, and venue delivery services, which drives their strong market share.

Large scale events also play a crucial role in shaping the event logistics market due to their higher operational intensity and larger shipment volumes. National exhibitions, major sporting events, and large entertainment shows require extensive movement of staging infrastructure, broadcasting equipment, and support facilities across multiple locations. These events depend on advanced logistics planning, route optimization, and time critical deliveries to ensure smooth execution. Although they occur less frequently than medium scale events, their high value contracts and large logistics budgets make them an important contributor to overall market revenue.

By Mode of Transportation Analysis

Road transportation is expected to dominate the mode of transportation segment with a 41.0% market share in 2026 because it provides the most flexible and cost effective way to move event equipment, staging materials, and technical infrastructure between venues, warehouses, and event sites. Most events require last mile delivery directly to convention centers, stadiums, and outdoor venues, which can only be efficiently handled by trucks and local fleet services. Road logistics also allows for flexible scheduling, rapid rerouting, and easier coordination with onsite teams, making it the preferred option for both domestic touring events and city based exhibitions.

Air transportation plays a critical supporting role in the event logistics market, particularly for international events and time sensitive shipments. High value equipment such as audio visual systems, broadcasting tools, and stage components often need to be moved quickly across long distances to meet tight event schedules. Air freight enables event organizers to reduce transit times and minimize the risk of delays, especially for global tours and international exhibitions. Although it is more expensive than road transport, its speed and reliability make it essential for premium and urgent logistics requirements.

By End-Use Industry Analysis

The corporate sector is expected to dominate the end use industry segment with a 31.0% share in 2026 as businesses increasingly rely on conferences, trade shows, product launches, and exhibitions to support marketing, networking, and brand positioning. These activities require extensive logistics support for transporting exhibition booths, digital displays, promotional materials, and technical equipment to multiple venues. Multinational companies and large enterprises often host events across different cities and countries, creating strong demand for freight forwarding, venue delivery coordination, and integrated event supply chain services that ensure smooth execution and professional presentation.

The entertainment industry also represents a major contributor to the event logistics market due to the continuous movement of touring productions, live performances, film shoots, and cultural shows. Concerts, theater productions, and media events depend on the timely transport of sound systems, lighting rigs, stage structures, and broadcast equipment. As live entertainment expands globally and audiences demand more immersive experiences, production companies increasingly rely on specialized logistics providers to manage complex schedules, international shipping, and onsite material handling, making this segment a strong and growing part of overall market demand.

The Global Event Logistics Market Report is segmented on the basis of the following:

By Service Type

- Transportation Services

- Warehousing and Inventory Management

- Event Setup and Dismantling Logistics

- Customs Clearance and Compliance

- Technology-Enabled Logistics Solutions

- Security and Risk Management Services

By Event Type

- Entertainment Events

- Corporate and Business Events

- Sports Events

- Government and Public Events

- Social and Private Events

By Event Size

- Medium-Scale Events

- Large-Scale Events

- Small-Scale Events

- Mega-Scale Events

By Mode of Transportation

- Road Transportation

- Air Transportation

- Sea Transportation

- Rail Transportation

By End-Use Industry

- Corporate Sector

- Entertainment Industry

- Sports Industry

- Government and Tourism Bodies

- Education and Cultural Institutions

Impact of Artificial Intelligence in the Global Event Logistics Market

Artificial intelligence is transforming the global event logistics market by enhancing efficiency, accuracy, and responsiveness across the event supply chain. AI-driven systems are increasingly used for real time route optimization, demand forecasting, and dynamic scheduling, enabling logistics providers to anticipate delays, allocate resources more effectively, and reduce transportation costs. Machine learning algorithms analyze historical shipment data, traffic patterns, and venue constraints to generate optimal logistics plans, improving on time deliveries for equipment, exhibition materials, and technical infrastructure. Natural language processing and AI-based chatbots are also improving customer support and communication between event organizers, carriers, and venue teams.

AI is also improving inventory management and asset tracking by enabling smart warehousing, automated scanning, and predictive stock control. Computer vision and sensor based monitoring help reduce loss, damage, and misplacement of high value event assets such as sound systems, lighting rigs, and staging equipment. Additionally, AI enhances decision making through predictive insights that help logistics managers respond quickly to disruptions such as weather impacts or customs delays. By integrating artificial intelligence into event logistics platforms and planning tools, companies can achieve higher operational visibility, greater scalability, and more cost effective delivery of complex global events.

Global Event Logistics Market: Regional Analysis

Region with the Largest Revenue Share

North America is expected to lead the global Event Logistics Market with a 36.0% share of total revenue in 2026 due to its strong concentration of corporate headquarters, large convention centers, entertainment hubs, and major sports leagues. The region hosts a high volume of trade shows, exhibitions, concerts, and international sporting events that require advanced logistics support, including freight forwarding, venue delivery, and on site material handling. Well-developed transportation infrastructure, widespread adoption of digital logistics platforms, and the presence of leading event logistics providers further strengthen North America’s dominant position in the global market.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Region with Significant Growth

Asia Pacific is emerging as the region with the most significant growth in the global Event Logistics Market due to the rapid expansion of business tourism, international exhibitions, and large scale entertainment events across countries such as China, India, Japan, and Southeast Asia. Rising investments in convention centers, sports infrastructure, and cultural festivals are increasing the demand for professional logistics services, including freight forwarding, warehousing, and venue delivery coordination. The growing presence of multinational brands and regional trade shows is also driving cross border event activity, making Asia Pacific a key growth engine for global event logistics providers.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Global Event Logistics Market: Competitive Landscape

The competitive landscape of the global Event Logistics Market is characterized by high fragmentation and the presence of both large integrated logistics providers and specialized event logistics firms offering tailored supply chain solutions. Companies are increasingly focusing on strategic collaborations, expansion of service portfolios, and adoption of digital technologies such as real-time tracking, AI driven planning, and analytics platforms to enhance operational efficiency and customer experience. Innovation in service delivery, emphasis on sustainability practices, and the ability to provide end-to-end logistics support across multiple regions are key factors influencing competitive positioning and market share within the industry.

Some of the prominent players in the Global Event Logistics Market are:

- DHL Supply Chain & Global Forwarding

- Kuehne + Nagel International AG

- UPS Supply Chain Solutions

- DSV A/S

- Nippon Express

- C.H. Robinson Worldwide

- FedEx Logistics

- CEVA Logistics

- Expeditors International

- GEODIS

- Sinotrans Ltd.

- Rock-it Cargo

- SOS Global Express

- GAC Group

- Freeman Company

- GES Global Experience Specialists

- EFI Logistics

- Rhenus Sports and Events Logistics

- Messe Frankfurt Exhibition Logistics

- Charles Kendall Group

- Other Key Players

Recent Developments in the Global Event Logistics Market

- February 2026: A leading logistics provider launched a new Event Logistics Solutions product line designed to deliver tailored, end-to-end support across trade shows, signature brand experiences, and sports events, enhancing seamless event execution around the world.

- February 2026: A leading logistics provider launched a new Event Logistics Solutions product line designed to deliver tailored, end-to-end support across trade shows, signature brand experiences, and sports events, enhancing seamless event execution around the world.

- January 2026: An accredited event logistics specialist achieved high-level industry recognition for sustainable logistics practices, reflecting growing investor interest in environmentally aligned logistics solutions within the events space.

Report Details

| Report Characteristics |

| Market Size (2026) |

USD 81.2 Bn |

| Forecast Value (2035) |

USD 137.6 Bn |

| CAGR (2026–2035) |

6.0% |

| The US Market Size (2026) |

USD 24.6 Bn |

| Historical Data |

2021 – 2025 |

| Forecast Data |

2027 – 2035 |

| Base Year |

2025 |

| Estimate Year |

2026 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

Material Type (Semi-Insulating GaAs, Semi-Conducting GaAs) Crystal Growth Technology (Liquid Encapsulated Czochralski (LEC), Vertical Gradient Freeze (VGF)) Wafer Diameter (6-inch GaAs Wafers, 4-inch GaAs Wafers, 8-inch GaAs Wafers) Manufacturing Role (GaAs Wafer Manufacturers, Device Manufacturers, Foundry & Contract Fabrication) Application (RF & Microwave Devices, Optoelectronics, Photovoltaic Devices, High-Speed & Digital Electronics) and End-Use Industry (Telecommunications, Consumer Electronics, Automotive, Aerospace & Defense, Industrial, Research & Others) |

| Regional Coverage |

North America – US, Canada; Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA |

| Prominent Players |

Sumitomo Electric Industries, AXT Inc., Freiberger Compound Materials, IQE plc, WIN Semiconductors, IntelliEPI, Wafer Technology, Vital Materials, Xiamen Powerway Advanced Material, Xinxiang Shenzhou Crystal Technology, Compound Semiconductor Technologies Global, LandMark Optoelectronics, San’an Optoelectronics, Qingdao Jiaying Semiconductor, and Others. |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |

Frequently Asked Questions

How big is the Global Event Logistics Market?

▾ The Global Event Logistics Market size is estimated to have a value of USD 81.2 billion in 2026 and is expected to reach USD 137.6 billion by the end of 2035.

What is the growth rate in the Global Event Logistics Market in 2026?

▾ The market is growing at a CAGR of 6.0% over the forecasted period of 2026.

What is the size of the US Event Logistics Market?

▾ The US Event Logistics market is projected to be valued at USD 24.6 billion in 2026. It is expected to witness subsequent growth in the upcoming period as it holds USD 40.3 billion in 2035 at a CAGR of 5.6%.

Which region accounted for the largest Global Event Logistics Market?

▾ North America is expected to have the largest market share in the Global Event Logistics Market with a share of about 36.0% in 2026.

Who are the key players in the Global Event Logistics Market?

▾ Some of the major key players in the Global Event Logistics Market are DHL Supply Chain & Global Forwarding, Kuehne + Nagel International AG, UPS Supply Chain Solutions, DSV A/S, Nippon Express, C.H. Robinson Worldwide, FedEx Logistics, CEVA Logistics, Expeditors International, GEODIS, Sinotrans Ltd., Rock it Cargo, SOS Global Express, GAC Group, Freeman Company, GES Global Experience Specialists, and many others.