An excavator is a powerful construction apparatus employed for a range of tasks, including trenching, excavation, and digging. It plays a major role in material handling, the lifting of heavy loads, construction projects, demolition work, canal digging, & hole excavation.

These machines are fueled by hydraulic systems, which are in turn driven by electric, diesel, or petrol engines, controlling the mechanical arm's movements. Components of an excavator typically have a digging bucket, operator's cabin, rear/back actor, arm, undercarriage, & a rotating platform.

One major advancement in modern excavator design is the placement of stabilizers within the track width during swinging motions, in contrast to earlier equipment. This innovation improves the machine's flexibility, while also securing the safety of construction operations.

The global heavy machinery market, including the Excavators Market, continues to experience exponential growth as demand for

construction equipment rental and machinery in construction, mining, and infrastructure development rises. Urbanization and industrialization in emerging economies is also driving this expansion; companies are also turning their focus toward technological innovations like AI-driven systems and

Machine Learning solutions that enhance machine efficiency and safety.

As sustainability becomes an increasing focus for governments and manufacturers alike, demand for electric and hybrid-powered excavators is growing significantly. Governments are mandating stricter emission standards, spurring manufacturers to create greener machines. This trend aligns with growing interest for fuel-efficient equipment in environmentally conscious construction projects, complementing other industrial technologies like

Vertical Roller Mill systems in large-scale projects.

Key opportunities in this market lie in leveraging smart technologies, such as IoT and GPS, to enhance operational efficiency. Mini-excavators for urban construction projects are also becoming increasingly sought-after; additionally, global supply chains have seen increased activity which has fuelled market expansion.

Key Takeaways

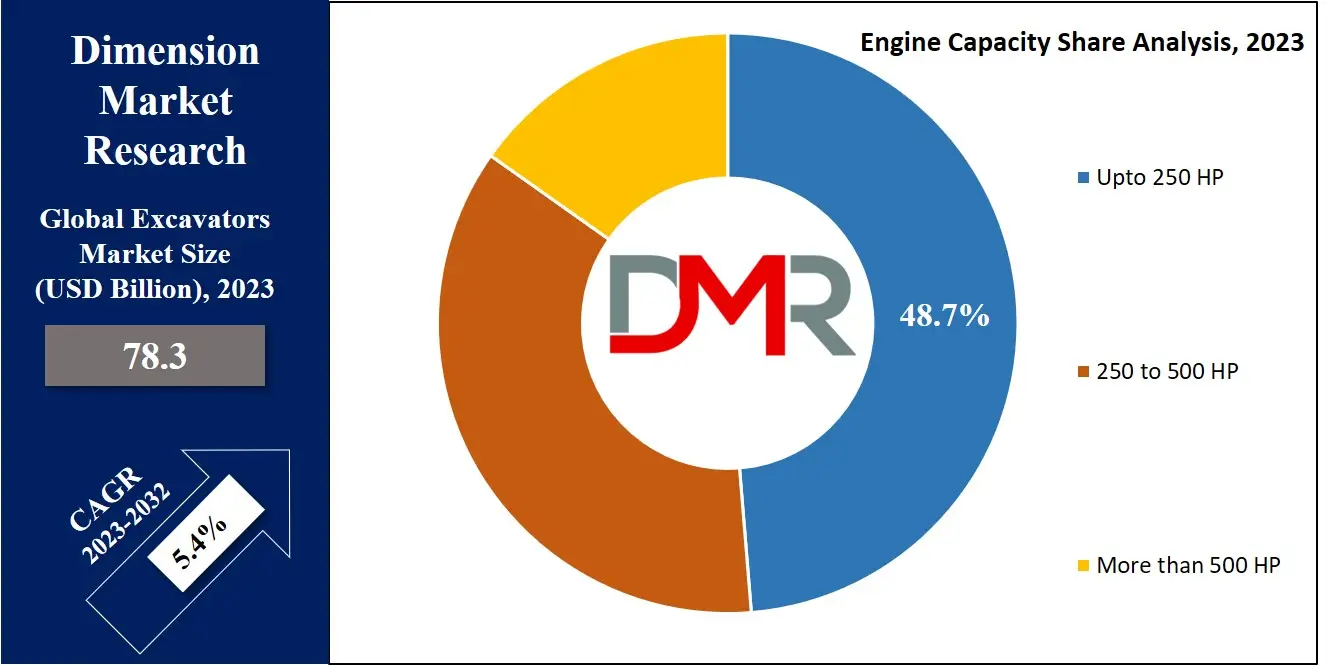

- Strong Market Growth: The Global Excavators Market is valued at USD 78.3 billion in 2023 and is projected to reach USD 125.8 billion by 2032, growing at a CAGR of 5.4%, driven by rising construction, mining, and infrastructure development activities.

- Product & Segment Insights: Excavators weighing over 46 metric tons dominate the market due to demand in large-scale construction and demolition projects, while mini/compact excavators (<10 MT) are expected to witness the fastest growth, supported by urbanization and small-space construction needs.

- Engine Capacity & Mechanism Trends: Excavators with up to 250 HP engines lead the market, favored for residential and commercial projects. Meanwhile, hydraulic-driven excavators remain the most widely adopted, with electric and hybrid models gaining traction amid sustainability and emission regulations.

- Technological Innovations: Integration of IoT, AI, GPS, and automation is enhancing machine performance, safety, and cost-efficiency. Additionally, fuel-efficient and electric-powered excavators are emerging as key growth drivers aligned with stricter emission policies and eco-friendly construction practices.

- Regional Leadership: Asia Pacific holds the largest share (35.8% in 2023), with strong growth expected in China, India, and South Korea due to rapid infrastructure projects and manufacturing expansion. North America and Europe also remain important markets, supported by ongoing smart infrastructure initiatives.

Use Cases

- Urban Infrastructure Development: Mini and compact excavators are widely used in urban construction projects, including roadworks, residential buildings, and utility installations, where maneuverability in tight spaces is critical.

- Mining & Quarrying Operations: Heavy-duty excavators above 46 MT are essential for large-scale mining and quarry projects, handling bulk earthmoving, material extraction, and overburden removal efficiently.

- Demolition & Waste Management: Long-reach and hydraulic excavators play a central role in demolition projects, as well as in waste recycling and landfill management, where precision and durability are required.

- Agriculture & Forestry Applications: Compact excavators are increasingly adopted for land clearing, trenching for irrigation, and tree planting, offering versatility and reduced fuel consumption for off-road environments.

- Smart Infrastructure & Green Projects: Electric and hybrid excavators, integrated with IoT and GPS technologies, are gaining traction in government-backed smart infrastructure and sustainable construction projects, meeting emission norms while improving efficiency.

Excavators Market Dynamic

Equipment manufacturers are acknowledging strict emission regulations by developing environmentally friendly machinery. They aim to deliver technologically advanced, efficient equipment that adheres to regulations & meets customer needs. Excavators are versatile tools engaged in compact spaces for different applications, like forestry, agriculture, & small-scale construction projects, strengthening faster construction processes & fueling the construction machinery industry.

Mini excavators are set to include cutting-edge hydraulic systems & electrification, lowering emissions. Moreover, government-backed smart infrastructure projects in underdeveloped nations, along with growth in consumer real estate investments & disposable income, are driving the need for hydraulic excavators in the construction sector.

Mini excavators are set to include cutting-edge hydraulic systems & electrification, lowering emissions. Moreover, government-backed smart infrastructure projects in underdeveloped nations, along with growth in consumer real estate investments & disposable income, are driving the need for hydraulic excavators in the construction sector.

However, the major challenge lies in the large upfront investment needed for acquiring large-scale equipment. To overcome this obstacle, many contracting firms are looking to lease excavators instead of making outright purchases. Despite growing stringent regulations that provide challenges for both manufacturers & consumers in terms of lowering environmental footprints, an expanding number of excavator manufacturers are embracing electric excavators to meet the change in demands of their services & clients.

Excavators Market Research Scope and Analysis

By Vehicle Weight

In 2023, excavators weighing over 46 metric tons dominate the market share, as these efficient excavators are designed for heavy-duty tasks & exceed 45 metric tons in weight. They are particularly compliments for large-scale demolition projects or large commercial construction endeavors, offering significant power & capability, as their utility extends to tasks such as earth-moving for civil engineering projects or excavation work for malls & residential building foundations.

While these heavy excavators may create challenges in terms of transportation & storage, they prove to be a valuable long-term investment, effectively handling significant excavation projects.

Further, excavators weighing less than 10 metric tons are anticipated to notice significant growth during the forecast period. Also referred to as mini excavators, these compact machines excel in limited workspaces. Mini excavators are adept at tasks like digging trenches for plumbing or tree planting, owing to their ability to fit into tight spaces.

Their advantage lies in their minimal or zero tail swing, enabling operators to work comfortably in close proximity to existing infrastructure. Furthermore, mini excavators provide improved maneuverability in comparison to bulkier excavation equipment, making them ideal for construction sites with various underground utilities such as pipes or gas lines. Additionally, their lower fuel consumption makes them easily transportable on trailers.

By Engine Capacity

The market is categorized by engine capacity into three segments, which are, up to 250 HP, 250-500 HP, & more than 500 HP. In 2023, the segment with engines up to 250 HP holds the largest market share & is expected to experience rapid growth during the forecasted period, which is largely driven by the demand generated from commercial & residential construction projects. Globally, the construction of ports, highways, & mining operations largely depends on excavators with engine capacities of up to 250 HP.

Furthermore, the segment's expansion is being driven by the growing adoption of automated excavators. These advanced excavators provide features such as remote operation monitoring, leading to lower labor costs. Additionally, many product developments, like the usage of excavator power derived from fuel cell-powered electric motors, are contributing to growth. Fuel cells are compact & more efficient in comparison to traditional diesel engines, resulting in the growth of the operator cabin space & increased overall machine performance.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

By Product

The market is classified by product type, which includes compact/mini excavators, crawler excavators, dragline excavators, long-reach excavators, and suction excavators. Excavators come in different sizes, with smaller ones suitable for tasks such as digging & trenching, while larger excavators are incorporated with versatile tools for projects requiring strong foundations.

The global market for mini/compact excavators is anticipated to the growth of the market as it significantly contributes to the overall revenue of the market in 2023, primarily driven by the growing demand for mini-excavators. This growing demand is majorly evident in the construction industry, where mini excavators are largely utilized for building & structural projects. In addition, the market's growth is firmly linked to the advantages presented by mini excavators & the ongoing trend of urbanization.

By Mechanism

The global hydraulic-driven excavators market is anticipated to notice significant growth, majorly driven by growing demand for hydraulic-powered excavators in sectors such as mining, waste management, & construction. Furthermore, manufacturers are constantly improving & innovating their mechanical designs in response to the growing demand for energy-efficient, affordable, & mobile hydraulic excavators. Further, this development is anticipated to boost the demand & contribute to the overall growth of the global heavy machinery market.

The Global Excavators Market Report is segmented on the basis of the following

By Vehicle Weight

- < 10 MT

- 11 – 45 MT

- > 46 MT

By Engine Capacity

- Up to 250 HP

- 250 – 500 HP

- More than 500 HP

By Product

- Compact / Mini Excavator

- Crawler Excavator

- Dragline Excavator

- Long Reach Excavator

- Suction Excavator

By Mechanism

- Electric

- Hybrid

- Hydraulic

Excavators Market Regional Analysis

The Asia Pacific region dominates the overall market with a significant market share,

commanding about 35.8% of the total revenue in 2023. Further, the region is also anticipated to experience a high growth rate which is expected to persist throughout the forecast period.

The construction industry is benefiting from enhanced economic conditions & fast infrastructure development in emerging economies like China, India, & South Korea. China, in particular, has taken the lead in the excavator sector, driven by the presence of key manufacturers who are vigorously expanding their manufacturing facilities.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Excavators Market Competitive Landscape

The global excavator market experiences strong competition, driving manufacturers to expand their product portfolios through strategic approaches like rental services, partnerships with component suppliers, & significant investments in R&D of their product and technology to enhance user experience.

Further, these initiatives are focused on gaining a competitive edge in the industry & meeting the evolving needs of customers while creating a strong market presence.

Like, in September 2022, Case Construction introduced a new lineup of the E-Series wheeled excavators comprising of four models. These excavators will be manufactured with the support of an established supply agreement with Hyundai Construction Equipment in South Korea.

Some of the prominent players in the Global Excavators Market are

- Caterpillar Inc

- Doosan

- Mitsubishi

- Terex Corp

- Volvo CE

- CNH Global NV

- Atlas Copco

- Komatsu Ltd

- Deere & Company

- JCB

- Other Key Players

Recent Developments