Market Overview

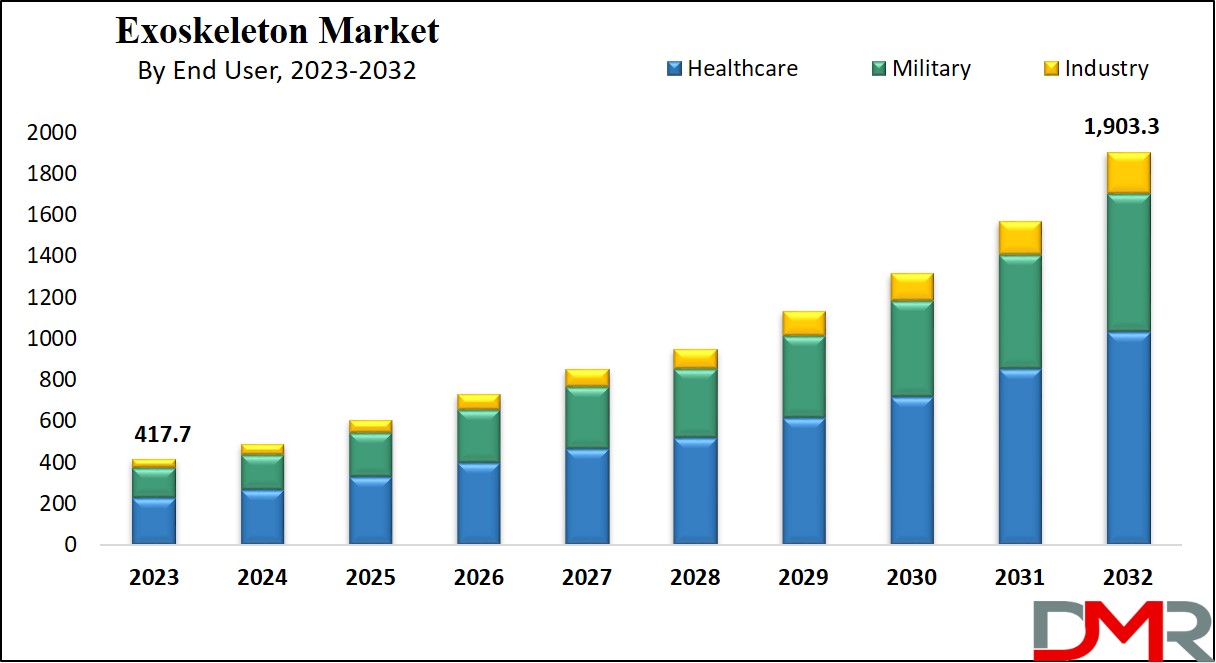

The Global exoskeleton Market is expected to reach a value of USD 417.7 million in 2023, and it is further anticipated to reach a market value of USD 1,903.3 million by 2032 at a CAGR of 18.4%. The market has seen significant growth in the past few years and is predicted to show significant growth during the forecasted period as well.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Exoskeletons are wearable robotic devices that are specifically designed to enhance the physical capabilities of the human body. These devices can be used across various sectors, including medical, military, industrial, and consumer applications.

With advancements in technology, the market is seeing a surge similar to trends in other related sectors, such as the medical robotic system market and the surgical robots market, both of which have experienced rapid innovation in recent years.

The global exoskeleton market includes the entire industry involved in the development, manufacturing, and commercialization of exoskeletons designed to improve the physical disability of individuals.

The global exoskeleton market has experienced growth due to increased awareness of the potential benefits of exoskeleton technology across different sectors, including insights seen in the wearable medical devices market and the advanced robotics market.

Key Takeaways

- The global exoskeleton market is projected to grow from USD 417.7 million in 2023 to USD 1,903.3 million by 2032, with a CAGR of 18.4%.

- Mobile exoskeletons dominate the market due to their versatility and adaptability across various environments.

- Powered exoskeletons lead the market with a 74.3% share in 2023 and are expected to grow significantly in the coming years.

- Lower body exoskeletons hold the largest market share in 2023 and are expected to see continued growth due to their mobility-enhancing benefits.

- Exoskeletons are transforming healthcare by improving the quality of life for individuals with mobility impairments, holding a 54.2% share in 2023.

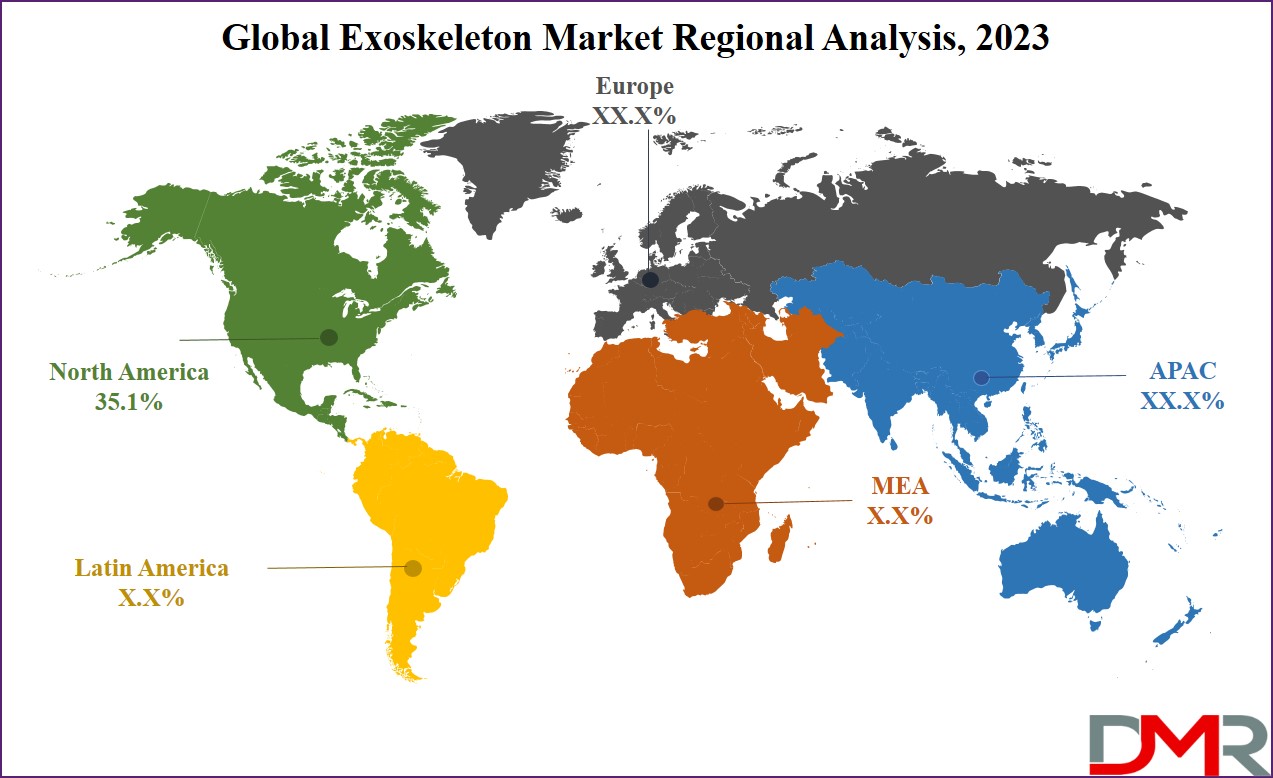

- North America leads the exoskeleton market with a 35.1% revenue share in 2023, driven by strong investments in R&D and technology.

Market Dynamic

Exoskeletons are extensively used in various sectors like healthcare, the military, and industry. In the healthcare sector, these devices assist individuals facing mobility challenges, while in the military, they enhance the strength and endurance capabilities of soldiers.

Industrial exoskeletons aim to reduce the risk of injuries and fatigue in the workplace, similar to trends in the logistics robotics market. Moreover, consumer-focused exoskeletons cater to recreational and personal use, much like innovations seen in the Wearable Fitness Technology Market.

The market involves extensive research and development efforts to advance technologies, improve materials, and refine design concepts. Manufacturing processes bring these innovations to life, and commercialization efforts drive sales through marketing, partnerships, and distribution channels.

Continuous technological advancements further propel market growth, making exoskeletons increasingly integral in addressing diverse human physical challenges across various industries, paralleling the evolution seen in the wearable technology market.

Research Scope and Analysis

By Product

Based on product, mobile exoskeletons dominate this market. Mobile exoskeletons represent a significant advancement in the global exoskeleton market, offering diverse versatility and applicability in various environments, catering to the dynamic needs of users who require enhanced mobility.

Mobile exoskeletons are designed for on-the-go use, providing users with improved mobility in various environments. This is particularly valuable for individuals with physical disability, as it allows them to move freely in both indoor and outdoor environments, which makes them well-suited for a wide range of activities, from walking in parks to maneuvering through crowded urban spaces.

Mobile exoskeletons contribute to community integration by enabling users to navigate public spaces, interact with others, & participate in social activities, which is crucial for users' overall quality of life & reducing the limitations imposed by mobility challenges.

Moreover, Mobile exoskeletons often use real-time data from users to develop more adaptive approaches, such as adjusting to the user's movements and intentions. This adaptability enhances the overall user experience, making the exoskeleton more responsive & intuitive during various activities.

By Technology

In terms of technology used in the production of the exoskeleton, this segment is divided into powered and non-powered exoskeletons. In which the powered exoskeleton dominates this market as it holds 74.3% of the market share in 2023 and is anticipated to show significant growth in the following years of 2023 to 2032.

Powered exoskeletons represent one of the most advanced versions of exoskeletons in wearable robotics, which offer enhanced mobility and strength augmentation. Powered exoskeletons incorporate electric motors & actuators to provide active assistance to the wearer.

This motorized assistance is especially beneficial for individuals with mobility impairments, as it enables them to move their limbs with reduced effort & fatigue. Powered exoskeletons are often equipped with sensors & control systems that can be customized to the user's specific needs. This adaptability allows for tailored support, making these devices suitable for a wide range of conditions and mobility challenges.

The incorporation of powered technology enables users to experience enhanced strength and endurance. This is particularly valuable in applications such as rehabilitation, where individuals can engage in more extended and intensive therapy sessions with the assistance of the exoskeleton.

By Body Part

Based on the body part the exoskeleton will be used on, the lower body dominates this segment as it holds the highest portion in this segment in 2023 and is expected to show subsequent growth in the forthcoming period as well. The dominance of lower-body exoskeletons in this market is mainly because of how they address the mobility challenges and enhance the overall physical capabilities of the user.

Lower body exoskeletons are specifically designed to provide support & assistance to individuals who are suffering from lower limb impairments. These devices make users capable of standing, walking, and performing activities that would otherwise be challenging or impossible due to their physical conditions, such as paralysis, spinal cord injuries, or muscle weakness.

Lower body exoskeletons also play a crucial role in rehabilitation, targeting the lower limbs to aid in the recovery process for patients with neurological disorders, orthopaedic injuries, or those who have undergone post-surgery rehabilitation. These devices contribute to muscle activation, joint flexibility, & overall gait improvement.

By End User

In the healthcare end-use sector, exoskeleton technology has emerged as a transformative solution with a focus on improving the quality of life for individuals with mobility impairments This is why it holds 54.2% of the market share in 2023 and is anticipated to show subsequent growth in the upcoming years as well.

The dominance of exoskeletons in the healthcare sector is primarily because of individuals who need rehabilitation, mobility assistance, neurological disability, and orthopaedic assistance. Healthcare-focused exoskeletons cater to patients with various neurological disorders, such as stroke survivors and those with multiple sclerosis.

The exoskeleton devices offer a customized approach according to the consumer's demand to address their specific mobility challenges associated with different health conditions, promoting recovery & enhancing their overall functionality.

Moreover, beyond rehabilitation, healthcare sector-oriented exoskeletons are extensively used for therapeutic purposes and wellness programs. These devices can be used in physical therapy sessions to enhance the overall strength, coordination, and physical fitness of the individual.

The Exoskeleton Market Report is segmented based on the following:

By Product

By Technology

By Body Part

- Lower Body

- Upper Body

- Full Body

By End User

- Healthcare

- Military

- Industry

Regional Analysis

North America dominates this market in terms of revenue share as it holds 35.1% in 2023 and is anticipated to show subsequent growth in the upcoming years of 2023 to 2032 as well. This region fosters a robust ecosystem for research and development, with significant investments in science & technology. The region foresees government funding and private investments contributing to the rapid advancement of exoskeleton technology.

Moreover, this region is also home to numerous research institutions, universities, and technical giants who are actively contributing to the growth of the global exoskeleton market. This innovation culture of North America oversees the development of cutting-edge solutions, giving it a competitive edge over other regions.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Furthermore, the healthcare sector in North America, particularly in the United States, places a strong emphasis on technological solutions to improve patient care and rehabilitation.

Medical exoskeletons, designed for rehabilitation and mobility assistance, have gained traction in the region's healthcare industry.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The competitive landscape of the global exoskeleton market is characterized by the presence of many established players such as Ekso Bionics, Cyberdyne, and Lockheed Martin, alongside emerging startups & technology firms that are continuously putting an effort into developing new products and gaining significant positions in the global exoskeleton market. In the medical exoskeleton segment, companies like ReWalk Robotics and Parker Hannifin Corporation have made notable strides, focusing on rehabilitation solutions & mobility assistance.

Industrial exoskeletons witness competition from firms like Sarcos Robotics and Hyundai, offering ergonomic solutions to workers who are engaged in various physically demanding tasks. Moreover, various companies in this market form collaborations and partnerships with other companies, research and academic institutes to leverage their complementary strengths and expand market reach as well as expand their product portfolio.

Some of the prominent players in the Global Exoskeleton Market are:

- ReWalk Robotics Ltd.

- Lockheed Martin Corporation

- Parker Hannifin Corporation

- Ekso Bionics Holdings Inc.

- Hyundai Motor Company

- Bionik Laboratories Corporation

- Myomo, Inc.

- Honda Motor Co. Ltd.

- Technoid. S.L.

- Gogoa Mobility Robots SL

- Suitx Inc.

- Other Key Players

Recent Developments

- In June 2025, Wandercraft raised $75 million in funding to advance the development of its self-balancing exoskeleton, aiming to revolutionize mobility solutions for individuals with physical disabilities. The company plans to use the funding to scale its technology and expand into new markets.

- In April 2025, exoskeleton technology startup HeroWear secured $5 million in Series-A funding to accelerate the growth of its wearable exoskeleton solutions. The investment will support the company's efforts to enhance productivity and safety in industrial environments through its innovative designs.

- In April 2024, medical robotics company Wandercraft received €25 million in financing from the European Investment Bank (EIB) to further develop its self-balancing exoskeleton technology. The funding will help the company enhance the mobility of patients with lower-limb disabilities, offering them greater independence.

- In June 2025, Renault Group finalized a strategic partnership with Wandercraft, a leader in next-generation robotics, to jointly develop cutting-edge technologies in robotics and mobility. The partnership is aimed at integrating advanced robotics into mobility solutions for both medical and industrial applications.

- In June 2025, Skelex acquired the rights for Ironhand from Bioservo, a move that strengthens Skelex's portfolio of wearable exoskeletons. This acquisition will enable Skelex to enhance its product offerings with Ironhand's innovative hand support technology for workers in physically demanding industries.

Report Details

| Report Characteristics |

| Market Size (2023) |

USD 417.7 Mn |

| Forecast Value (2032) |

USD 1,903.3 Mn |

| CAGR (2023-2032) |

18.4% |

| Historical Data |

2017 - 2022 |

| Forecast Data |

2023 - 2032 |

| Base Year |

2022 |

| Estimate Year |

2023 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Product (Mobile and Stationary), By Technology (Powered and Non-Powered), By Body Part (Lower Body, Upper Body and Full Body), By End User (Healthcare, Military and Industry) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA |

| Prominent Players |

ReWalk Robotics Ltd., Lockheed Martin Corporation, Parker Hannifin Corporation, Ekso Bionics Holdings, Inc., Hyundai Motor Company, Bionik Laboratories Corporation, Myomo, Inc., Honda Motor Co. Ltd., Technoid. S.L., Gogoa Mobility Robots SL, Suitx Inc., and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |

Frequently Asked Questions

What is the global exoskeleton market?

▾ Exoskeletons are wearable robotic devices that are specifically designed to enhance the physical

capabilities of the human body.

How big is the Global Exoskeleton Market?

▾ The Global Exoskeleton Security Market is expected to hold a market value of USD 417.7 million in 2023.

Who are the major key players in the Global Exoskeleton Market?

▾ The major key players in the Global Exoskeleton Market are ReWalk Robotics Ltd., Lockheed Martin

Corporation, Parker Hannifin Corporation, Ekso Bionics Holdings, Inc., Hyundai Motor Company, Bionik

Laboratories Corporation, Myomo, Inc., Honda Motor Co. Ltd., Technoid. S.L., Gogoa Mobility Robots SL,

Suitx Inc., and others.

Which region dominates the global exoskeleton market?

▾ North America dominate this market as it holds 35.1% of the market share in 2023.