Market Overview

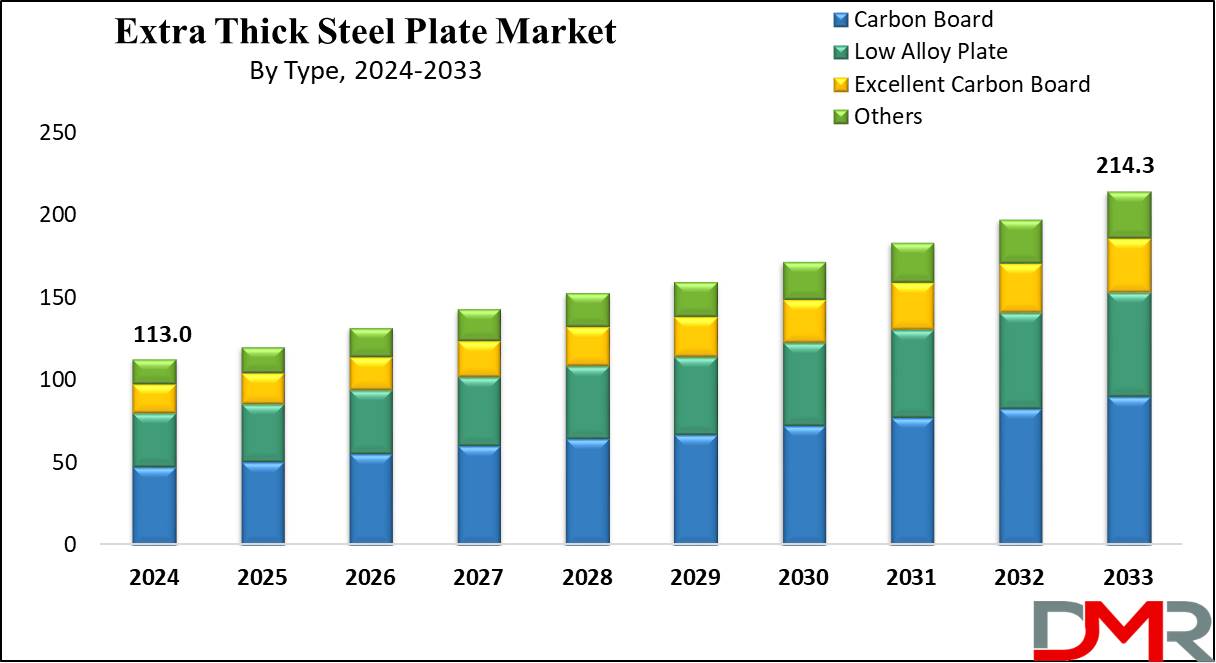

The

Global Extra Thick Steel Plate Market is projected to

reach USD 113.0 billion in 2024 and grow at a compound annual growth rate of 7.4% from there until 2033 to reach a

value of USD 214.3 billion.

Extra thick steel plates are steel sheets with thicknesses over standard ranges, often surpassing 50mm and going up to various hundred millimeters. These plates are known for their high tensile strength, durability, and ability to withstand extreme conditions. They are primarily used in sectors requiring robust materials, including construction, heavy machinery, shipbuilding, and defense. Their ability to endure high-stress and harsh environments makes them indispensable for critical structural applications.

Further, the demand for extra-thick steel plates is being driven by many factors. Rapid urbanization and infrastructure development, mostly in emerging economies, require durable materials for large-scale projects such as bridges, skyscrapers, and industrial facilities. The defense sector also depends highly on these plates for armored vehicles and protective structures. Moreover, the energy sector, like renewable energy projects like wind turbines and offshore platforms, highly uses thick steel plates for structural stability under extreme conditions.

Moreover, technological innovations in manufacturing processes, like precision hot rolling and advanced alloying techniques. These innovations improve the quality and performance of steel plates while optimizing production costs. Additionally, there is a major aim for sustainability, resulting in the development of eco-friendly steel with lower carbon footprints. Another major trend is the customization of plates to meet specific project needs, like customized thicknesses and grades for unique applications.

Moreover, the market is set for steady growth, assisted by growth in demand across multiple industries. However, challenges like high production costs and strict environmental regulations could impact market dynamics. Companies are looking to R&D to create more affordable and sustainable products, ensuring compliance with global environmental standards. As infrastructure projects and industrial applications expand, the role of extra-thick steel plates in ensuring safety and durability will remain crucial.

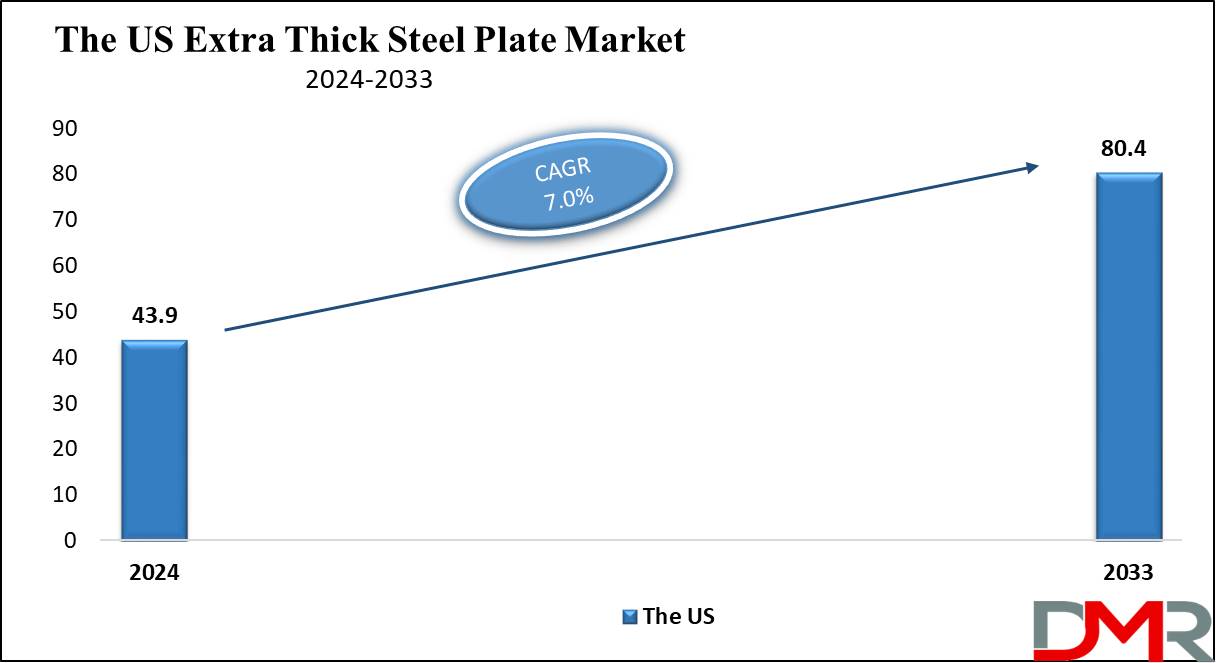

The US Extra Thick Steel Plate Market

The

US Extra Thick Steel Plate Market is projected to reach

USD 43.9 billion in 2024 at a compound annual

growth rate of 7.0% over its forecast period.

The US provides significant growth opportunities in the extra-thick steel plate market due to its large-scale infrastructure projects, defense requirements, and energy sector expansion. Increasing investments in renewable energy, shipbuilding, and heavy machinery provide a steady demand. Moreover, developments in steel production technology and a focus on sustainable construction further support the market's growth.

Further, the market is driven by the booming construction, infrastructure, and defense sectors, along with the need for renewable energy projects and offshore industries. However, high production costs, environmental regulations, and the need for sustainable materials act as restraints, making affordable, eco-friendly solutions a key challenge for market expansion.

Key Takeaways

- Market Growth: The Extra Thick Steel Plate Market size is expected to grow by 93.9 billion, at a CAGR of 7.4% during the forecasted period of 2025 to 2033.

- By Type: The carbon board segment is anticipated to get the majority share of the Extra Thick Steel Plate Market in 2024.

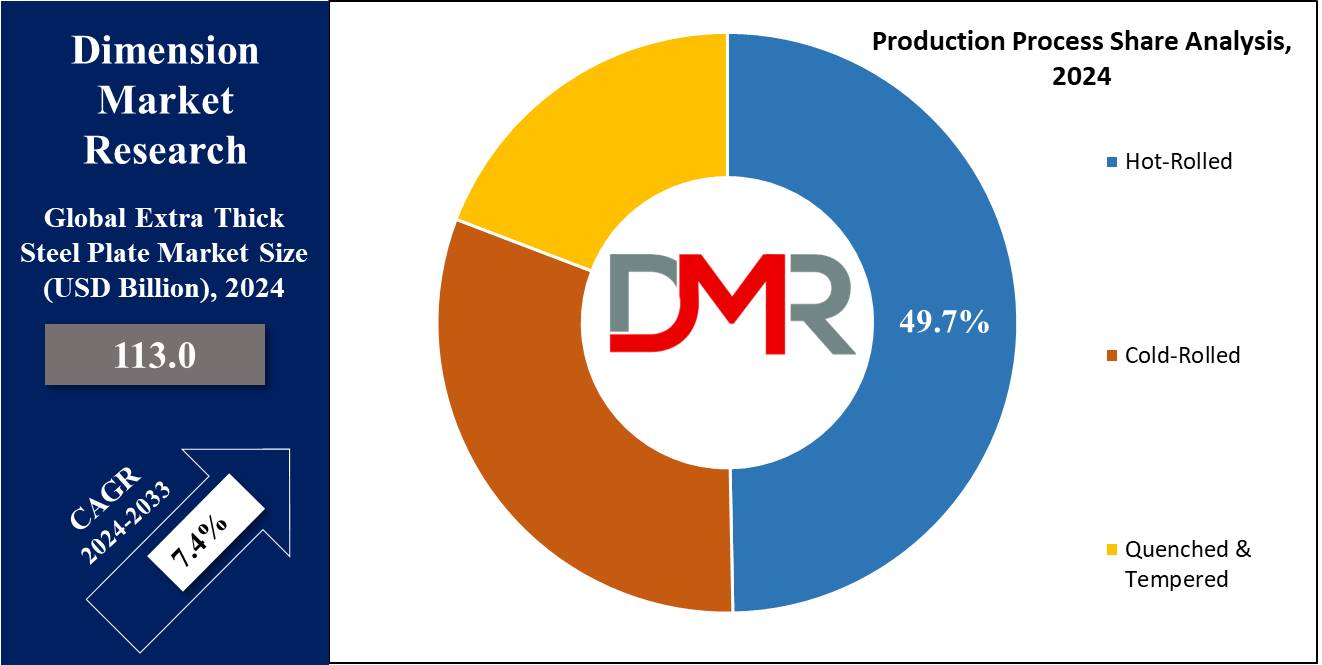

- By Production Process: The hot-rolled segment is expected to be leading the market in 2024

- By Application: The infrastructure segment is expected to get the largest revenue share in 2024 in the Extra Thick Steel Plate Market.

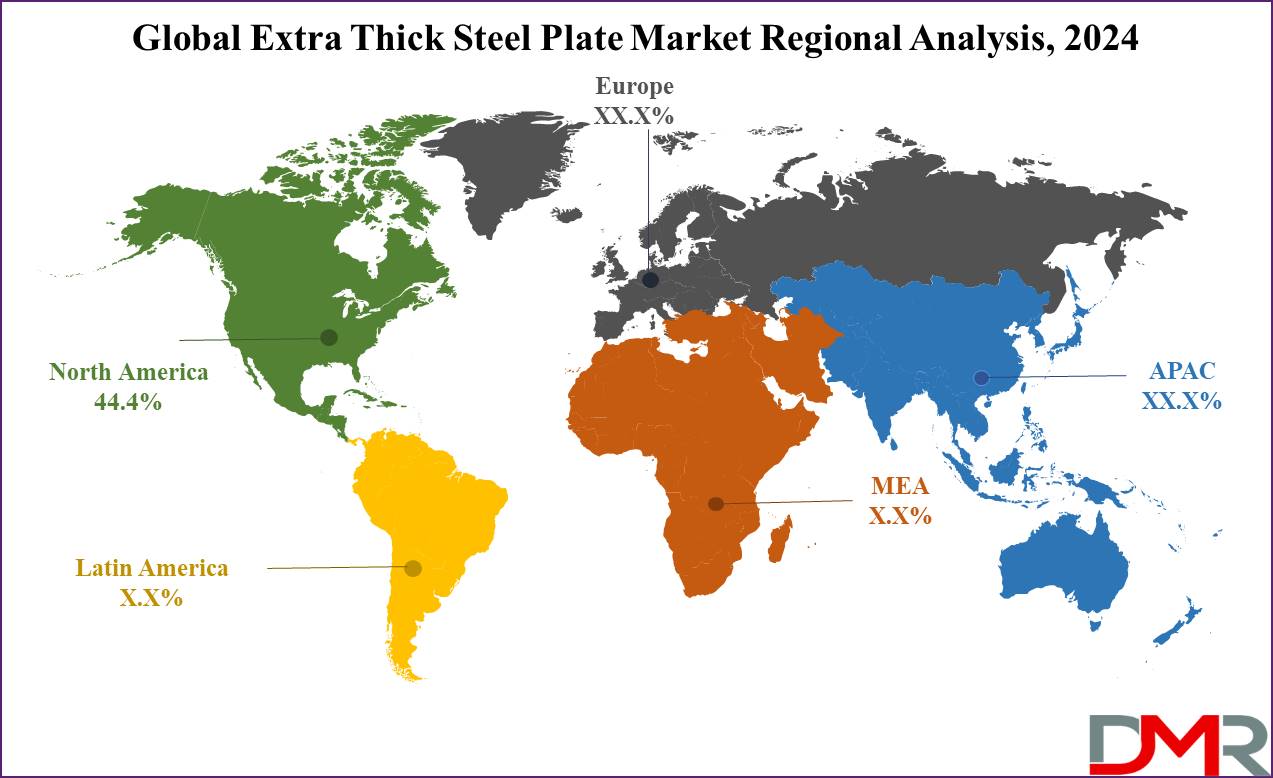

- Regional Insight: North America is expected to hold a 44.4% share of revenue in the Global Extra Thick Steel Plate Market in 2024.

- Use Cases: Some of the use cases of Smart Parking systems include structural applications in heavy industries, defense & military equipment, and more.

Use Cases

- Structural Applications in Heavy Industries: They are used in the construction of bridges, skyscrapers, and large industrial buildings where high load-bearing capacity is essential.

- Shipbuilding and Offshore Structures: They are important for hulls of ships, oil rigs, and other offshore platforms due to their durability and resistance to harsh marine environments.

- Defense and Military Equipment: They are used in the production of armored vehicles, bunkers, and ballistic protection systems due to their high strength and impact resistance.

- Machinery and Equipment Manufacturing: These are critical in heavy-duty machinery, like mining equipment, cranes, and presses, where components are subjected to extreme stress and wear.

Market Dynamic

Driving Factors

Rising Demand in Infrastructure DevelopmentThe global push for modern infrastructure, like bridges, highways, and large-scale industrial facilities, drives the need for thick steel plates. Their superior strength and durability make them ideal for critical structural applications in developed and emerging economies.

Expansion of Defense and Energy Sectors

Growth in defense budgets and the growing need for energy resources, like offshore oil rigs and renewable energy installations, fuel the need for extra thick steel plates. These sectors demand better materials capable of withstanding extreme conditions and ensuring long-term reliability.

Restraints

High Production and Material Costs

The manufacturing of extra-thick steel plates includes specialized processes and high-quality raw materials, leading to high production costs, which can limit affordability, majorly for small-scale industries or projects with tight budgets, constraining market growth.

Environmental Regulations and Sustainability Concerns

Steel production is energy-intensive and contributes highly towards carbon emissions. Stringent environmental regulations and the industry's push toward sustainable practices may increase operational costs or lesser production capacity, creating challenges to the growth of extra-thick steel plates.

Opportunities

Growing Renewable Energy Projects

The growth of renewable energy infrastructure, like wind farms and hydroelectric plants, provides many opportunities. Extra-thick steel plates are vital in constructing foundations and support structures for these projects, ensuring stability and longevity in harsh environments.

Technological Advancements in Steel Production

Innovations in manufacturing processes, like advanced casting and rolling techniques, improve the quality and affordability of extra-thick steel plates. These developments open new avenues in sectors like aerospace and automotive, where lightweight yet strong materials are increasingly in demand.

Trends

Adoption of Advanced Manufacturing Techniques

Manufacturers are highly using advanced production methods, like precision hot-rolling and advanced alloying, to enhance the structural integrity and performance of extra-thick steel plates. These innovations improve durability and reduce production costs, making these plates more viable for demanding applications like offshore platforms and heavy machinery.

Focus on Sustainable and High-Performance Materials

There is an increase in the need for steel plates that provide better performance while adhering to stricter environmental standards. Innovations in material science are creating the development of plates that not only have high load-bearing capacities but also lesser carbon footprints, aligning with global sustainability goals.

Research Scope and Analysis

By Type

Carbon board, a type of extra thick steel plate market is set to lead the market in 2024, as it plays a vital role in the market by providing high strength and excellent load-bearing capacity. It is highly used in heavy construction, machinery, and infrastructure projects, where durability and resistance to stress are critical. Its relatively lesser cost in comparison to alloy plates makes it a popular choice in budget-sensitive sectors. In addition, its versatility in applications ranging from bridges to industrial equipment support drives the overall demand for extra-thick steel plates, contributing highly to the market's growth and expansion.

Further Low alloy plates are expected to grow fastest in the extra thick steel plate market owing to their vitality for industries needing materials with better strength, toughness, and resistance to wear and corrosion. These plates are used in critical applications like bridges, heavy machinery, and energy infrastructure, where performance under extreme conditions is vital. Their balance of high performance and moderate cost makes them a preferred choice, driving demand and contributing significantly to the overall growth of the market.

By Production Process

Hot-rolled production is anticipated to dominate the extra thick steel plate market in 2024, as it allows efficient manufacturing of plates with high strength and uniform thickness, which includes rolling steel at high temperatures, making it easier to shape and produce thicker plates in large volumes. Hot-rolled plates are broadly used in construction, shipbuilding, and heavy machinery due to their durability and affordability. The ability to meet the growing demand for high-performance materials in many industries boosts the market's expansion.

Further Quenched and tempered (Q&T) steel plates are anticipated to grow significantly in the coming years due to their superior strength, toughness, and resistance to impact., as it enhance the mechanical properties of steel, making Q&T plates ideal for demanding applications like mining equipment, defense, and offshore structures. Their ability to perform well under extreme conditions drives demand in industries requiring reliable and high-performance materials, thus supporting the overall expansion of the market

By Thickness

Steel plates with a thickness of 50-100 mm are crucial in driving the growth of the extra-thick steel plate market, as this range strikes a balance between strength and versatility, making these plates suitable for numerous applications like industrial machinery, shipbuilding, and construction. They provide excellent load-bearing capacity and durability, essential for structures that demand reliable performance under heavy stress. The broad demand across infrastructure and energy projects contributes significantly to the expansion of the extra-thick steel plate market.

Further, steel plates with a thickness of 100-250 mm are vital for applications demanding extreme strength and durability, like in heavy construction, shipbuilding, and offshore platforms. Their ability to withstand intense pressure and harsh conditions makes them indispensable for critical infrastructure projects. As industries majorly require strong materials for specialized uses, the demand for plates in this thickness range significantly boosts the market.

By Application

Extra thick steel plates play a major role in infrastructure projects, providing the strength and durability needed for constructing bridges, high-rise buildings, and tunnels. Their ability to resist heavy loads and harsh environmental conditions ensures long-lasting performance in critical structures. As global infrastructure development accelerates, majorly in emerging economies, the demand for these plates grows, significantly contributing to the expansion of the extra-thick steel plate market.

In shipbuilding, extra-thick steel plates are vital for constructing the hulls and structures of large vessels, such as cargo ships, tankers, and naval ships. These plates provide the strength needed to withstand harsh marine environments, like high pressure, corrosion, and heavy loads.

The Extra Thick Steel Plate Market Report is segmented on the basis of the following

By Type

- Carbon Board

- Excellent Carbon Board

- Low Alloy Plate

- Others

By Production Process

- Hot-Rolled

- Cold-Rolled

- Quenched & Tempered

By Thickness

- Up To 10 mm

- 10 - 15 mm

- 50 – 100 mm

- 100 – 250 mm

- Above 250 mm

By Application

- Building

- Mechanical

- Automotive

- Shipbuilding

- Infrastructure

Regional Analysis

North America plays a vital role in the growth of the extra thick steel plate market and is

expected to have 44.4% of the total market share in 2024 due to its advanced industrial infrastructure and demand from sectors like construction, shipbuilding, and defense. The region's ongoing investment in infrastructure development, like bridges, highways, and energy projects, requires high-performance materials like extra-thick steel plates. In addition, North America's strong defense industry drives the demand for durable steel for military applications, including armored vehicles and structures. The region's economic stability and technological advancements in steel production further support the increasing demand for these plates.

Further, Asia Pacific is set to be the fastest-growing market, primarily due to rapid industrialization, infrastructure development, and the region’s strong manufacturing base. Countries like China, India, and Japan are major consumers, using these plates in construction, shipbuilding, and heavy machinery industries. The region's expanding urbanization and investment in large-scale infrastructure projects create a higher demand for durable materials like extra thick steel plates. In addition, the growth of the energy sector, like renewable energy and offshore oil projects, further fuels market expansion

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The competitive landscape of the extra-thick steel plate market is marked by a mix of established global players and regional manufacturers. Key companies compete by aiming at product quality, advanced manufacturing techniques, and customization to meet specific industry needs. As the need grows in sectors like construction, shipbuilding, and defense, players are also investing in sustainability and affordable production methods. Competition is driven by technological innovations, like precision steel rolling, and efforts to reduce environmental impacts while navigating challenges like fluctuating raw material costs and regulatory pressures

Some of the prominent players in the Global Extra Thick Steel Plate are

- JFE Steel

- Baowu Steel

- An Steel

- ONeal Industries

- Tisco

- Sha Gang Group

- ArcelorMittal

- Shou Gang Group

- Dillinger

- Wu Gang Group

- Other Key Players

Recent Developments

- In May 2024, China's Jiangyin Xingcheng Special Steel unveiled that it completed the development and production of steel plates needed for a major European offshore platform project. The last batch of extra-thick steel plates, S460MLO has been successfully departed. The S460MLO steel plates required for this project need to meet the technical demands of the Arctic 1st circle in the European offshore wind power steel standards.

- In January 2024, Tata Steel reported that the company will commence statutory consultation as part of its plan to transform and restructure its UK business, which is intended to reverse over a decade of losses and transition from the legacy blast furnaces to a more sustainable, green steel business.

- In January 2024, Vestas announced a partnership with ArcelorMittal to launch a low-emission steel offering that highly reduces lifetime carbon dioxide emissions from the production of wind turbine towers, which is also an initiative where Vestas continues to execute its sustainability strategy, which also includes addressing the materials we use to make wind turbines. Moreover, the low-emission steel is produced using 100% steel scrab which is melted in an electric arc furnace powered by 100% wind energy at the ArcelorMittal steel mill, Industeel Charleroi, in Belgium.

- In July 2023, ArcelorMittal launched a low carbon-emissions steel plate of up to 18 tonnes. We are the first producer in Europe able to manufacture low-carbon emissions steel plate in these dimensions. XCarb recycled and renewably produced Heavy Plates are manufactured utilizing slabs from ArcelorMittal Industeel, produced in an Electric Arc Furnace using almost 100% scrap steel and 100% renewable electricity.

Report Details

| Report Characteristics |

| Market Size (2024) |

USD 113.0 Bn |

| Forecast Value (2033) |

USD 214.3 Bn |

| CAGR (2024-2033) |

7.4% |

| Historical Data |

2018 – 2023 |

| The US Market Size (2024) |

USD 43.9 Bn |

| Forecast Data |

2025 – 2033 |

| Base Year |

2023 |

| Estimate Year |

2024 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Type (Carbon Board, Excellent Carbon Board, Low Alloy Plate, and Others), By Production Process (Hot-Rolled, Cold-Rolled, and Quenched & Tempered), By Thickness (Up To 10 mm, 10 - 15 mm, 50 – 100 mm, 100 – 250 mm, and Above 250 mm), By Application (Building, Mechanical, Automotive, Shipbuilding, and Infrastructure) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA

|

| Prominent Players |

JFE Steel, Baowu Steel, An Steel, ONeal Industries, Tisco, Sha Gang Group, ArcelorMittal, Shou Gang Group, Dillinger, Wu Gang Group, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users) and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |

Frequently Asked Questions

The Global Extra Thick Steel Plate Market size is expected to reach a value of USD 113.0 billion in 2024 and is expected to reach USD 214.3 billion by the end of 2033.

North America is expected to have the largest market share in the Global Extra Thick Steel Plate Market with a share of about 44.4% in 2024.

The Extra Thick Steel Plate Market in the US is expected to reach USD 43.9 billion in 2024.

Some of the major key players in the Global Extra Thick Steel Plate Market are Brain Corporation, IBM, Samsung, and others

The market is growing at a CAGR of 7.4 percent over the forecasted period.