Market Overview

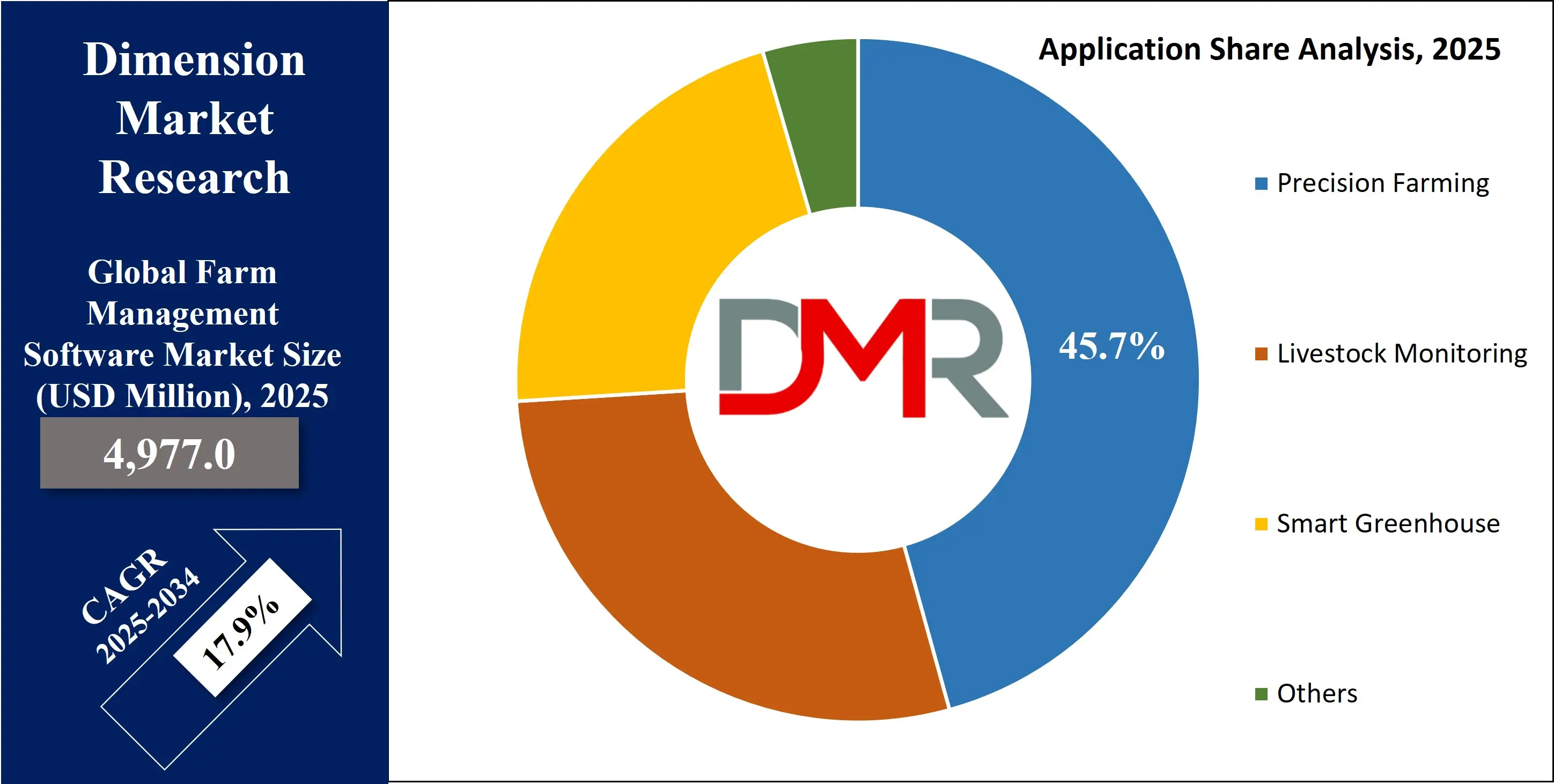

The Global

Farm Management Software Market is predicted to be valued at

USD 4,977.0 million in 2025 and is expected to grow to

USD 21,975.9 million by 2034, registering a compound annual growth rate

(CAGR) of 17.9% from 2025 to 2034.

Farm Management Software (FMS) is a digital tool designed to help farmers and agribusinesses plan, monitor, and analyze their agricultural activities. It streamlines farm operations by managing data related to crops, livestock, inventory, finances, and labor. FMS offers features like weather forecasting, precision farming, automated reporting, and real-time field monitoring, improving productivity and sustainability. Integrating data from various sources, enables better decision-making, resource optimization, and cost savings. Available as cloud-based or on-premise solutions, Farm Management Software supports small farms to large enterprises in maximizing yields, ensuring compliance, and enhancing overall operational efficiency.

The Farm Management Software (FMS) market is experiencing significant growth, driven by the increasing adoption of cloud computing and the integration of advanced technologies such as IoT, big data analytics, and artificial intelligence. These technologies enable real-time data collection, monitoring, and predictive analysis, allowing farmers to optimize resource use and boost productivity. The growing need to address critical challenges like labor shortages, water scarcity, and environmental sustainability is pushing the demand for smarter agricultural solutions, with FMS at the forefront.

A major driving force behind this growth is the rising implementation of site-specific crop management practices. These practices enable farmers to apply precise amounts of inputs such as fertilizers and pesticides, reducing waste, minimizing environmental impact, and increasing crop yields. Advanced FMS tools also leverage remote sensing technologies, such as GIS and drone-based imagery, to detect crop stress, monitor diseases, and assess soil conditions. Open-source platforms like Quantum GIS, Opticks, and the ORFEO toolbox are expanding access to such technologies, especially for cost-conscious users.

The demand for integrated farm management systems is also growing rapidly. These systems offer comprehensive solutions for crop planning, livestock monitoring, and supply chain optimization, enabling end-to-end farm management. Mobile applications and remote monitoring tools have made it easier for even remote farms to adopt and benefit from digital agriculture.

Looking ahead, the market holds immense opportunities with the continued advancement of AI-powered analytics, machine learning, and automation. These technologies are expected to enhance the accuracy and efficiency of farm operations, enabling predictive decision-making and resource optimization. However, challenges such as high initial costs, limited digital literacy, and data security concerns must be addressed. Despite these hurdles, the future of the farm management software market looks promising, playing a pivotal role in the global shift toward sustainable, technology-driven agriculture.

The Europe Farm Management Software Market

The Europe Farm Management Software Market is projected to be valued at USD 1244.3 million in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 4,580.6 million in 2034 at a CAGR of 15.0%.

The Europe farm management software market is driven by the increasing demand for precision agriculture to enhance productivity and sustainability. Governments across the region are actively supporting digital farming through subsidies and policy frameworks, especially under the EU’s Common Agricultural Policy (CAP). Rising labor costs and a strong emphasis on reducing environmental impact are prompting farmers to adopt data-driven solutions. Moreover, growing awareness of climate-smart agriculture and the need for real-time monitoring and decision-making tools are pushing adoption. Key players are investing in R&D and partnerships to offer scalable, user-friendly platforms tailored to diverse European farm sizes and practices.

Europe is witnessing rapid integration of AI, IoT, and big data analytics into farm management software. Cloud-based platforms are gaining traction due to their accessibility and scalability. There is a notable shift toward mobile applications that enable remote monitoring and control. Interoperability between machinery and software is becoming a key feature. Sustainability metrics and carbon tracking tools are being embedded to align with environmental goals. Additionally, the use of satellite imagery and drone data is expanding for crop health assessment. Startups and tech giants alike are exploring niche areas such as livestock management and vineyard optimization through smart software.

The Japan Farm Management Software Market

The Japan Farm Management Software Market is projected to be valued at USD 237.9 million in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 1,181.7 million in 2034 at a CAGR of 19.5%.

Japan’s farm management software market is propelled by an aging farming population and labor shortages, necessitating automation and efficient resource management. Government initiatives such as the Smart Agriculture policy support digital transformation in agriculture through subsidies and R&D funding. Japan’s focus on high-value crops and precision farming fuels demand for technology that ensures quality and yield. Furthermore, the integration of robotics, IoT, and AI in traditional farming practices is creating a strong pull for software solutions. Collaborations between tech companies and agricultural cooperatives are also playing a pivotal role in scaling adoption and customizing tools for Japanese farming systems.

Japan’s farm management software market is experiencing rapid innovation, driven by the adoption of AI-powered crop forecasting tools and precision irrigation systems. Smart greenhouses and vertical farms are increasingly using software for efficient climate control and resource optimization. Mobile-first applications with user-friendly interfaces are being developed to support the aging farming population.

Cloud-based platforms with real-time data analytics are becoming popular across rice, fruit, and vegetable cultivation. Government initiatives emphasizing traceability and food safety are encouraging the use of blockchain-integrated record systems. Collaborations with global tech firms are also bringing in advanced tools like pest detection and disease prediction.

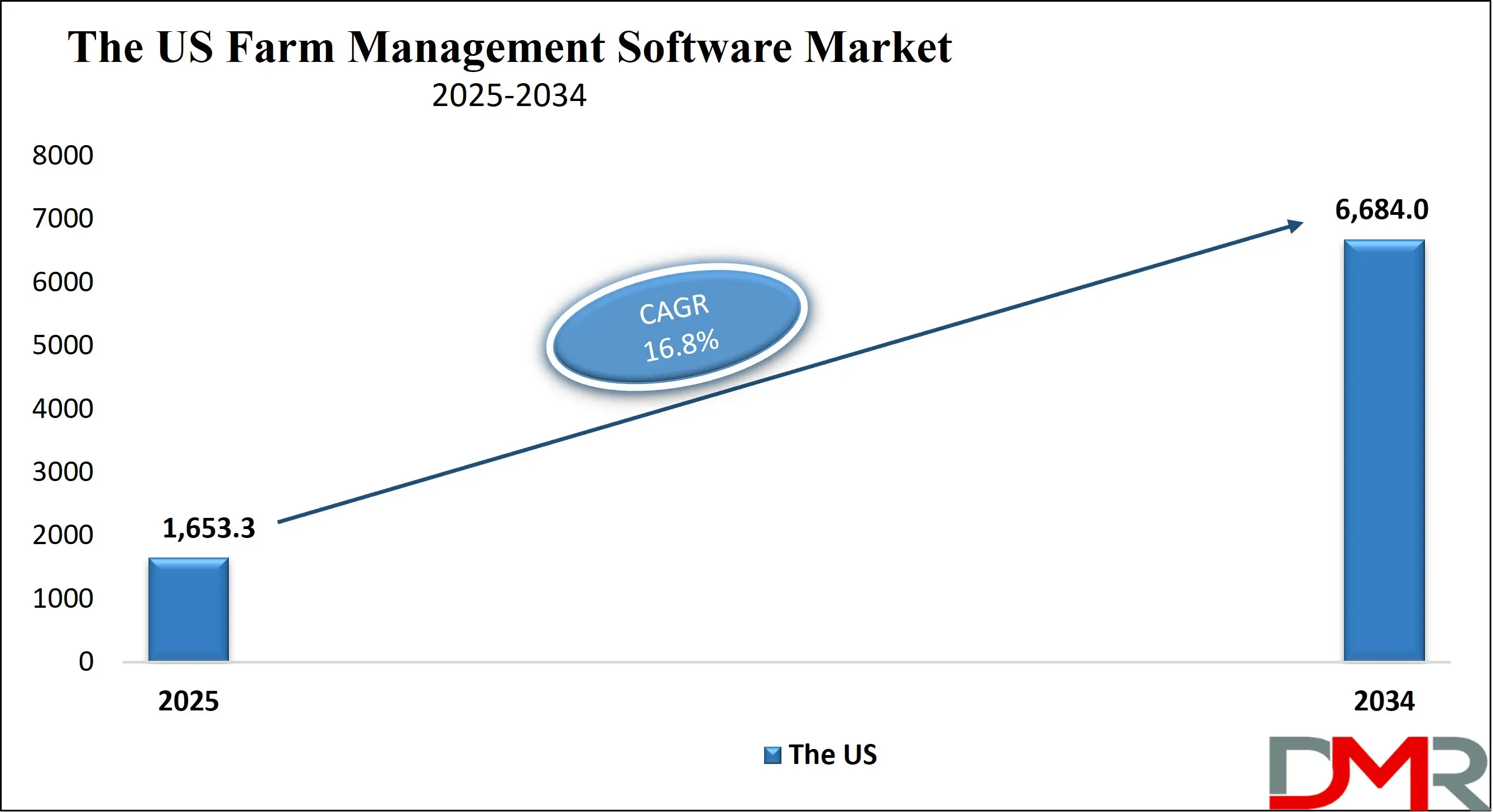

The US Farm Management Software Market

The US Farm Management Software Market is projected to be valued at USD 1,653.3 million in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 6,684.0 million in 2034 at a CAGR of 16.8%.

The U.S. farm management software market is propelled by the increasing adoption of precision agriculture technologies aimed at enhancing productivity and sustainability. Farmers are leveraging data-driven tools for real-time monitoring, resource optimization, and informed decision-making. The integration of cloud-based platforms facilitates centralized management of farm operations, from crop planning to financial tracking. Government initiatives supporting digital agriculture, coupled with the need to address labor shortages and environmental concerns, further drive market growth.

Cloud-based solutions are gaining traction, offering scalability and real-time data access. There's a notable shift towards mobile applications, enabling farmers to manage operations remotely. The adoption of smart greenhouse technologies is accelerating, providing controlled environments for optimized crop production. Additionally, the emphasis on sustainability and traceability is leading to the incorporation of blockchain for secure record-keeping. Collaborations between agritech firms and traditional agricultural stakeholders are fostering innovation, ensuring that software solutions meet the evolving needs of modern farming practices.

Farm Management Software Market: Key Takeaways

- Market Overview: The global Farm Management Software (FMS) market is forecasted to reach a valuation of USD 4,977.0 million by 2025 and is expected to surge to USD 21,975.9 million by 2034, exhibiting a robust compound annual growth rate (CAGR) of 17.9% throughout the forecast period from 2025 to 2034.

- Europe Market Insights: In Europe, the FMS market is anticipated to be worth USD 1,244.3 million in 2025. It is projected to grow significantly and hit USD 4,580.6 million by 2034, registering a CAGR of 15.0% over the forecast period.

- Japan Market Insights: The Japanese FMS market is expected to be valued at USD 237.9 million in 2025. It is poised for steady growth, reaching USD 1,181.7 million by 2034, growing at a CAGR of 19.5%.

- United States Market Insights: In the United States, the FMS market is projected to achieve a valuation of USD 1,653.3 million by 2025. It is forecasted to grow substantially, reaching USD 6,684.0 million by 2034, at a CAGR of 16.8%.

- Farm Size Segment Analysis: Large-scale farms are expected to lead the market in 2025, capturing the highest revenue share among all farm size categories.

- Deployment Mode Trends: Web-based deployment models are expected to dominate the FMS market due to their enhanced data security and ease of access. In 2025, these platforms are projected to account for over 55.0% of the total market share, fueled by increasing farmer confidence in cybersecurity technologies.

- Software Dominance in Offerings: Software solutions are set to comprise more than 68.0% of the market share in 2025, driven by features such as real-time monitoring, remote access, and automated data analysis.

- Critical Segment Performance: One key segment is expected to contribute over 45.7% of total industry revenue in 2025, underlining its essential role in modern agricultural operations.

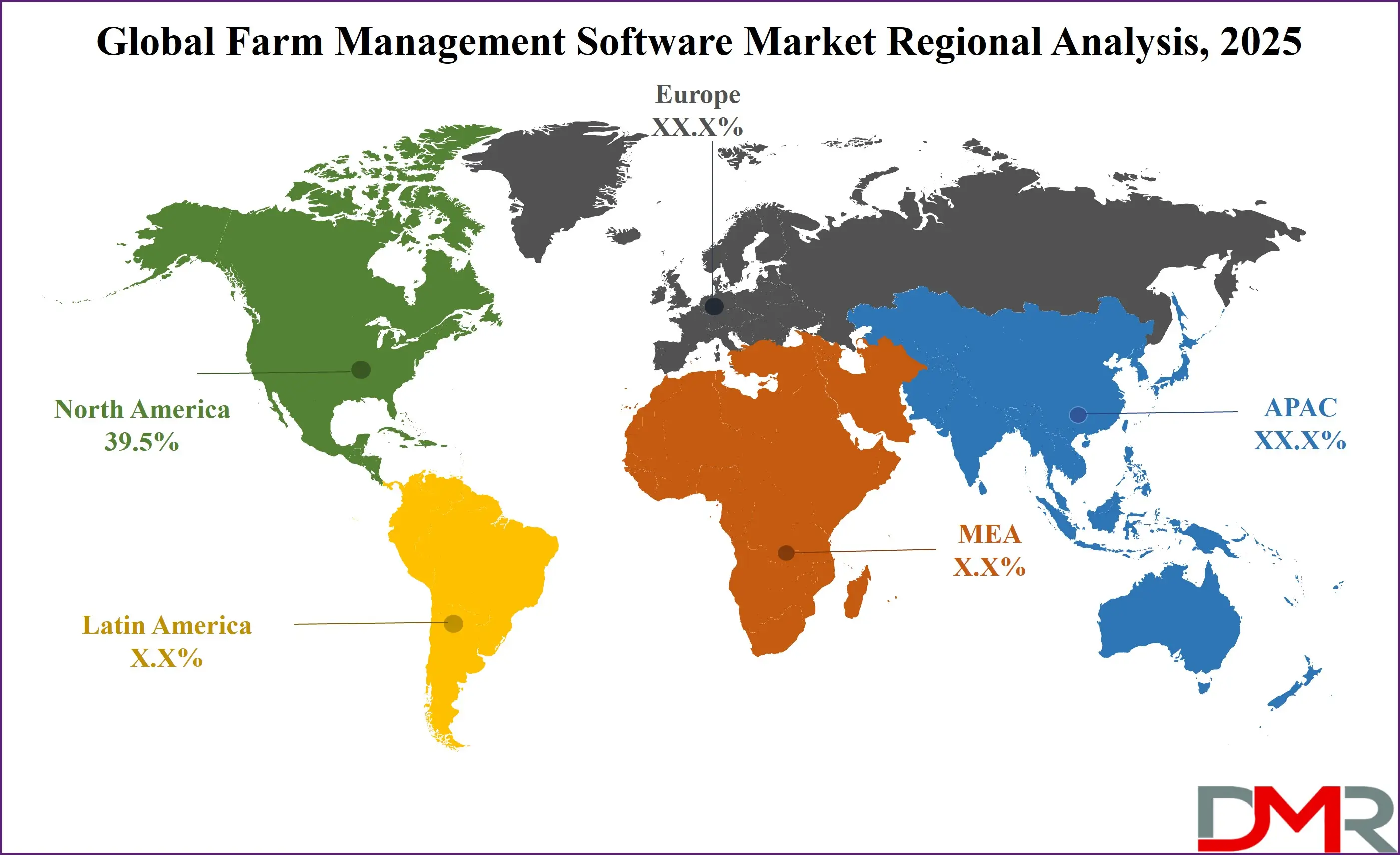

- Regional Leadership: North America is anticipated to retain the largest share of the global FMS market in 2025, commanding 39.5% of the total revenue.

Farm Management Software Market: Use Cases

- Crop Planning and Monitoring: Farm management software helps farmers plan and monitor crop cycles by providing data-driven insights on planting schedules, weather forecasts, and soil conditions to optimize yield.

- Inventory and Resource Management: It enables efficient tracking of farm inputs such as seeds, fertilizers, and equipment, ensuring timely procurement and reducing waste.

- Financial Tracking and Reporting: The software allows farmers to manage budgets, monitor expenses, and generate financial reports, improving overall farm profitability and decision-making.

- Compliance and Record-Keeping: Farm management software helps maintain accurate records for audits, certifications, and regulatory compliance, reducing paperwork and human error.

Farm Management Software Market: Stats & Facts

- According to the GSM Association’s Mobile Economy Asia Pacific 2023 report, mobile internet penetration is estimated to reach 70% by 2025, with 400 million new users added. According to India’s Department of Agriculture and Farmers Welfare, about 50 million farmers are registered on mobile-based agricultural platforms.

- The Asian Development Bank emphasizes that agricultural productivity must increase by 70% to meet demand. According to research published in the Journal of Cleaner Production, farm management software can increase agricultural yields by up to 25% while using fewer resources.

- According to the Centre for Economic Policy Research, the widespread adoption of AI technology in healthcare could result in annual savings ranging from USD 200 to USD 360 million over the next five years, constituting 5% to 10% of healthcare spending. This presents a huge financial opportunity while providing increased quality of patient care, highlighting the significant role of AI in reducing healthcare costs and elevating the overall value of healthcare.

- By 2019, eFishery operated around 3,000 smart feeders, helping 1,300 fish farmers reduce feed usage by 21% and cut cultivation time from 120 to 90 days. (Source: Farmfit 2019)

- AquaConnect automated 800 farm ponds and served 3,000 shrimp farmers in India through its ‘FarmMojo’ app, offering advisory support on feed, water quality, and shrimp health. (Source: Farmfit 2019)

Farm Management Software Market: Market Dynamics

Driving Factors in the Farm Management Software Market

Rise in Implementation of AI and Machine Learning The growing adoption of artificial intelligence (AI) and machine learning (ML) technologies in agriculture is a major driver for the farm management software market. These technologies enable real-time data collection, analysis, and application across various farming operations such as precision agriculture, livestock management, and greenhouse automation. By streamlining processes like crop planning, irrigation scheduling, inventory tracking, and harvesting, AI and ML optimize productivity and resource usage. These tools facilitate seamless data exchange between farm machinery and operators, significantly improving decision-making speed and accuracy.

The integration of sensors, GPS, and satellite imagery further enhances the ability of farm management systems to interpret environmental conditions and respond proactively. As farms increasingly rely on data-driven insights for profitability and sustainability, the demand for AI- and ML-powered software is expected to grow steadily, transforming traditional farming into more precise and efficient operations.

Supportive Government Policies and Technological Advancements

Government initiatives promoting smart farming practices have significantly contributed to the expansion of the farm management software market. These policies encourage farmers to adopt cutting-edge technologies such as cloud computing, IoT-enabled sensors, and precision tools, offering subsidies or support programs that make advanced agricultural solutions more accessible. In addition, ongoing advancements in the semiconductor and sensor industries have led to more affordable and efficient components, such as vibration, temperature, and load sensors, which further drive the integration of technology in farm operations.

Cloud-based software platforms enable centralized farm data management and facilitate remote monitoring and control, further enhancing operational efficiency. The combined effect of policy-driven incentives and rapid innovation in agri-tech is propelling adoption among farmers and agribusinesses globally. These advancements are making farm management software more scalable, reliable, and attractive for large-scale and smallholder farmers alike.

Restraints in the Farm Management Software Market

Lack of Technical Expertise among Farmers

Despite growing interest in digital farming solutions, the lack of technical knowledge among farmers remains a key barrier to the adoption of farm management software. Many users, especially in developing and rural regions, struggle with understanding how to operate such systems or interpret agricultural data for informed decision-making. The software often requires a certain level of technological literacy, including familiarity with smartphones, cloud-based tools, and data analytics. Even when farmers have access to financial resources, limited skills and awareness can prevent them from utilizing these tools effectively.

This challenge is particularly evident in aging farmer populations and areas with minimal access to training infrastructure. Although efforts are being made by governments and private stakeholders to provide education and support, the learning curve remains a significant hurdle. Without targeted training and hands-on guidance, many farmers remain hesitant to transition from traditional methods to digital platforms.

High Initial Cost and Infrastructure Requirements

The high initial investment required for implementing farm management software can deter widespread adoption, especially among small- and medium-scale farmers. Costs associated with software licenses, sensor installation, compatible hardware, and reliable internet connectivity can be prohibitively expensive in underdeveloped or remote areas. Additionally, the deployment of cloud-based solutions often depends on stable and high-speed internet infrastructure, which is still lacking in many agricultural regions.

This cost factor extends beyond software to include training, ongoing technical support, and system upgrades. Many farmers are reluctant to invest in these tools without clear, immediate returns on investment. While larger commercial farms may afford the technology, smallholders often view it as a financial risk. Although market players are working to offer scalable and cost-effective solutions, and some governments provide subsidies, affordability remains a major issue for broad market penetration.

Opportunities in the Farm Management Software Market

Enhanced Decision-Making through Predictive Analytics

Farm management software integrated with AI and advanced data analytics provides a major opportunity to revolutionize agricultural decision-making. By utilizing historical and real-time data, predictive models can be developed to forecast crop performance under various environmental conditions. This capability allows farmers to proactively adjust their strategies based on anticipated weather patterns, soil health, or pest outbreaks. With insights on crop health, nutrient deficiencies, and moisture levels, farmers can make more informed choices regarding fertilization, irrigation, and pesticide usage.

The resulting precision in agricultural operations reduces waste, enhances productivity, and ensures better resource allocation. As environmental variables continue to fluctuate due to climate change, predictive analytics becomes an invaluable tool in risk management and yield optimization. The integration of such intelligent features into farm management platforms is set to drive demand, opening opportunities for software developers to cater to both large-scale commercial farms and smallholder farmers seeking efficiency and resilience.

Remote and Scalable Farm Operations via Cloud Technology

The rapid adoption of cloud-based farm management software offers a significant opportunity to scale and decentralize agricultural operations. These solutions allow farmers to remotely access, store, and analyze farm data from virtually any location using mobile devices or computers. The scalability and cost-effectiveness of cloud services make them especially attractive for farms of varying sizes, enabling collaboration among farm workers and seamless integration with other digital tools. Cloud technology supports real-time monitoring, remote diagnostics, and automated data updates, simplifying complex farming processes.

Improvements in global internet infrastructure, coupled with the ubiquity of smartphones, further support the widespread use of these platforms. This accessibility enhances communication and coordination between farmers, agronomists, and supply chain stakeholders. Providers of farm management software can capitalize on this trend by offering customizable, subscription-based platforms with features tailored to regional or crop-specific needs, thus unlocking new markets and promoting digital inclusion in agriculture.

Trends in the Farm Management Software Market

Integration of AI, IoT, and Robotics for Precision Farming

One of the strongest trends in farm management software is the integration of Artificial Intelligence (AI), Internet of Things (IoT), and robotics to enable precision farming. These technologies work together to collect, analyze, and act on large volumes of data in real time. IoT devices such as sensors monitor field conditions including temperature, moisture, and nutrient levels. AI processes this data to identify patterns and predict outcomes, while drones and autonomous robots perform targeted interventions like spraying or harvesting.

This synergy allows for micro-level management of farmland, enabling site-specific crop management and reducing unnecessary use of inputs like water or pesticides. With these innovations, farmers can quickly detect anomalies, assess plant health, and respond accurately, improving both yield and sustainability. As technology continues to mature and costs decrease, the adoption of these smart solutions is expected to accelerate, becoming a core component of modern farm management software platforms.

Rise of Open-Source and Remote Sensing Tools in Agriculture

Another notable trend in farm management software is the growing use of open-source remote sensing tools and Geographic Information Systems (GIS) for agricultural analysis. Platforms like Quantum GIS SCP, ORFEO Toolbox, and Opticks provide cost-effective, accessible means to analyze high-resolution satellite and drone imagery. These tools allow farmers and agronomists to monitor crop health, detect water stress, classify vegetation, and assess soil properties across large areas with minimal physical presence. The democratization of such technology empowers even small and mid-sized farms to leverage advanced analytics without high financial investment.

Furthermore, integration of these tools into farm management systems enables the automation of decision-support functions such as crop disease monitoring or yield prediction. The ability to continuously gather and analyze field-level data in a non-invasive manner is transforming how farms are managed, making remote sensing an indispensable asset in data-driven agriculture.

Farm Management Software Market: Research Scope and Analysis

By Farm Size Analysis

Large farms are predicted to dominate the farm management software market with highest revenue share of 2025. This dominance is driven by their greater financial capacity to invest in advanced technologies that optimize operations and improve productivity. Large farms typically manage extensive land areas and diverse crop portfolios, which require sophisticated solutions for data management, precision farming, and real-time monitoring.

Moreover, large-scale agricultural enterprises often prioritize digitalization to stay competitive, comply with regulatory standards, and meet the growing demand for traceability and sustainability. The need to enhance efficiency, reduce operational costs, and maximize yields pushes large farms toward adopting comprehensive farm management software, positioning them as the leading contributors to the market’s growth over the coming years.

Medium farms are expected to emerge as the second-dominating farm management software market segment. These farms are increasingly adopting digital solutions to bridge the gap between traditional farming methods and modern agricultural practices. Medium-sized operations seek farm management software to improve crop planning, manage labor, monitor resources efficiently, and enhance profitability.

They often face pressure from rising operational costs and tighter margins, making technology adoption essential for survival and growth. Furthermore, the availability of affordable, scalable software solutions tailored to medium-sized farms is encouraging faster uptake. As medium farms modernize their operations and leverage data-driven decision-making, their role in driving market expansion is becoming increasingly significant.

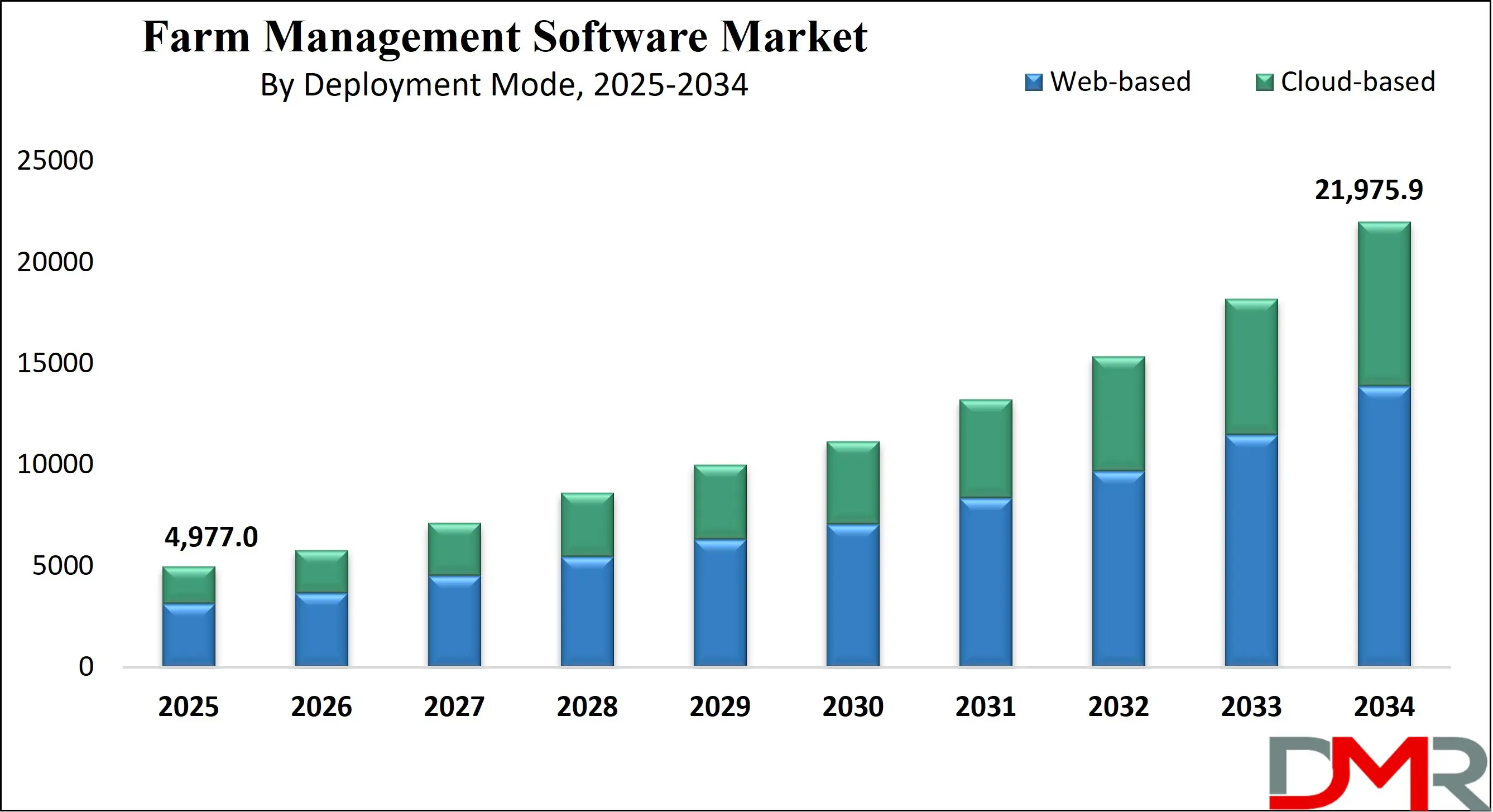

By Deployment Mode Analysis

Web-based deployment is predicted to dominate the Farm Management Software (FMS) market due to its strong emphasis on data security and accessibility. In 2025, web-based platforms captured over 55.0% of the market share, driven by farmers' growing trust in cybersecurity advancements. Web-based FMS ensures encrypted data storage and easy access across devices, offering real-time farm data management without high infrastructure costs. As farmers become increasingly concerned about protecting sensitive agricultural information, the reliability and familiarity of web-based solutions continue to appeal to them. Additionally, the ability to remotely manage operations while ensuring security positions web-based systems as the preferred choice for modern farm management.

The cloud-based deployment segment is emerging as the fastest-growing area in the FMS market, projected to expand rapidly from 2025 to 2030. The rise of precision agriculture technologies, which rely heavily on real-time data, fuels this growth. Cloud-based FMS integrates seamlessly with IoT devices, GPS systems, and drones, enabling farmers to gather critical information on soil health, weather patterns, and crop performance. This data-driven approach enhances decision-making, optimizes resource use, and supports sustainability efforts. The flexibility, scalability, and ability to process large volumes of data efficiently make cloud-based solutions increasingly attractive to forward-thinking farmers.

By Component Analysis

The software segment is predicted to dominate the farm management software (FMS) market due to the rapid adoption of advanced digital technologies such as IoT and cloud computing. In 2025, software accounted for over 68.0% of the market share, largely driven by its ability to offer real-time monitoring, remote access, and automated data analysis. IoT-enabled devices embedded in fields collect critical agricultural data like soil moisture, temperature, and nutrient levels. Farm management software processes this data, delivering actionable insights that help farmers optimize their operations, increase productivity, and make data-driven decisions.

Furthermore, cloud-based FMS solutions have significantly improved accessibility and collaboration across the agricultural value chain. Farmers, agronomists, and supply chain partners can access field data remotely, enabling faster response times and better resource management. The scalability of cloud platforms also allows farmers to expand their digital tools without major upfront investments, making software solutions more attractive than traditional methods.

Additionally, software offerings often integrate predictive analytics, artificial intelligence (AI), and machine learning (ML) models, which further enhance farm efficiency by forecasting weather patterns, pest outbreaks, and crop yields. With growing pressure to increase agricultural productivity sustainably, the versatility, scalability, and intelligence offered by farm management software firmly position it as the leading component in the FMS market.

By Application Analysis

Precision farming is expected to dominate the Farm Management Software (FMS) market due to the rising adoption of data-driven agricultural practices. In 2025, the segment accounted for over 45.7% of the industry revenue, reflecting its critical role in modern agriculture. Farmers increasingly rely on big data analytics to make informed decisions, moving away from traditional methods toward more accurate and efficient techniques. Precision farming leverages technologies like sensors, GPS, and remote sensing to collect real-time data on weather conditions, soil quality, and crop health. Integrating this data with farm management systems enables farmers to analyze patterns, forecast outcomes, and optimize operations to increase yield and resource efficiency.

This technological transformation is particularly important in addressing global food demand, climate variability, and resource scarcity. As environmental and economic pressures intensify, farmers are adopting precision tools to minimize waste, reduce input costs, and ensure sustainable farming practices. Moreover, the integration of artificial intelligence and IoT with FMS enhances automation and predictive insights, further solidifying precision farming’s dominance. The growing availability and affordability of these technologies, coupled with government support for smart agriculture, continue to accelerate adoption rates. As a result, precision farming remains at the forefront of innovation in the agricultural sector, making it the leading segment in the FMS market.

Among FMS application segments, the Smart Greenhouse segment is projected to grow at the fastest CAGR in the forecast period. This surge is driven by increasing consumer demand for fresh, locally grown, and pesticide-free produce. Smart greenhouses enable controlled, year-round crop production with minimal environmental impact, aligning with sustainability trends. Additionally, the Livestock Monitoring segment also experiences notable growth due to rising demand for real-time animal health tracking and productivity optimization. These segments benefit from technological advancements and growing awareness around food quality and sustainable farming, positioning them as high-growth areas within the FMS landscape.

The Farm Management Software Market Report is segmented on the basis of the following

By Farm Size

- Large Farm

- Medium Farm

- Small Farm

By Deployment Mode

By Component

- Software

- Services

- System Integration & Consulting

- Maintenance & Support

- Managed Services

- Data Services

- Analytic Services

- Farm Operation Services

- Assisted Professional Services

- Supply Chain Management Services

- Climate Information Services

By Application

- Precision Farming

- Livestock Monitoring

- Smart Greenhouse

- Others

Regional Analysis

Region with the largest Share

North America is expected to maintain the largest revenue share in the Farm Management Software (FMS) Market, reaching

39.5% in 2025, due to the widespread consolidation of farms and the prevalence of large-scale agribusiness operations. These enterprises require advanced digital tools to manage increasingly complex operations efficiently. The region's strong technological infrastructure, high internet penetration, and early adoption of precision agriculture further support the integration of sophisticated FMS platforms.

Government initiatives promoting sustainable farming practices and smart agriculture solutions also fuel market demand. In addition, North American farmers are more likely to invest in data-driven solutions for optimizing yields, managing resources, and enhancing profitability. The integration of IoT, AI, and cloud-based platforms into farm management practices enables real-time monitoring, predictive analytics, and automation, providing a competitive edge. As farms become more tech-enabled, the demand for comprehensive FMS solutions will continue to rise, cementing North America’s leading position in this market.

Region with Highest CAGR

Asia-Pacific is projected to witness the fastest growth in the Farm Management Software Market due to rising food demand, growing population, and increased smartphone penetration. The surge in mobile-based solutions allows smallholder farmers, who dominate agriculture in countries like India, China, and Southeast Asia, to access affordable and scalable farm management tools. Governments in the region are also investing in digital agriculture initiatives and rural connectivity, further encouraging adoption. As agricultural digitization gains traction and farmers seek more efficient, data-driven methods to enhance productivity and sustainability, the demand for cost-effective, mobile-friendly FMS solutions will continue to drive robust market growth across Asia-Pacific.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The global farm management software market is witnessing increasing competition as key players focus on technological innovation and strategic initiatives to strengthen their market positions. Prominent companies such as Trimble, Inc., Agrivi, and Granular are at the forefront, offering robust and comprehensive software solutions tailored to meet the evolving demands of precision and data-driven agriculture. These players are capitalizing on the growing need for advanced farm analytics, crop planning, and real-time monitoring to enhance farm productivity and operational efficiency.

To maintain their competitive edge, leading companies are actively pursuing strategic collaborations, mergers, and acquisitions. For instance, partnerships with agricultural input providers and equipment manufacturers enable seamless integration of hardware and software systems, improving the overall user experience for farmers. Moreover, continuous R&D investments help these players innovate and upgrade their platforms with AI, IoT, and cloud-based capabilities.

Emerging players and startups are also entering the market with niche offerings and localized solutions, intensifying the competition. However, established players continue to dominate due to their strong distribution networks, brand recognition, and comprehensive service portfolios. As digital agriculture becomes a key enabler of sustainable farming, companies that align with this trend and provide scalable, user-friendly software are expected to lead the market in the coming years.

Some of the prominent players in the Global Farm Management Software Market are

- Bushel Inc.

- Conservis

- Agworld Pty Ltd

- Farmbrite

- AGRIVI

- Croptracker

- AgriWebb

- Aegro

- xFarm Technologies

- AgriERP

- eAgronom

- Navfarm

- Trimble Inc.

- Granular Inc.

- Raven Industries, Inc.

- Topcon Corporation

- AgJunction LLC

- Agworld Pty Ltd

- Farmers Edge Inc.

- Climate LLC

- Other Key Players

Recent Developments

- In May 2025, xFarm Technologies partnered with Brazil-based AgTech firm Checkplant, strengthening its presence in Latin America and enhancing its role in global supply chain digitalization. The collaboration, covering over 12 million hectares globally, also enables Checkplant to expand its services and reach.

- In December 2024, xFarm Technologies teamed up with Syngenta France on a geospatial AI project for crop detection. This initiative leverages xFarm’s digital platform—used by 450,000 farms across 7 million hectares in over 100 countries—and aims to better support French farmers amid strict phytosanitary regulations.

- In September 2024, AGRIVI and the Barbados Agricultural Development and Marketing Corporation (BADMC) launched the world’s first national AI Agronomic Advisor. Accessible via WhatsApp, the platform offers 24/7 real-time advice, helping Barbadian farmers improve productivity and access key resources such as financing and government support.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 4,977.0 Mn |

| Forecast Value (2034) |

USD 21,975.9 Mn |

| CAGR (2025–2034) |

17.9% |

| Historical Data |

2019 – 2024 |

| The US Market Size (2025) |

USD 1,653.3 Mn |

| Forecast Data |

2025 – 2033 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Farm Size (Large Farm, Medium Farm, and Small Farm), By Deployment Mode (Web-based, and Cloud-based), By Component (Software, Services), By Application (Precision Farming, Livestock Monitoring, Smart Greenhouse, and Others) |

| Regional Coverage |

North America – US, Canada;

Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe;

Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC;

Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America;

Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA

|

| Prominent Players |

Bushel Inc., Conservis, Agworld Pty Ltd., Farmbrite, AGRIVI, Croptracker, AgriWebb, Aegro, xFarm Technologies, AgriERP, eAgronom, Navfarm, Trimble Inc., Granular Inc., Raven Industries, Inc., Topcon Corporation, AgJunction LLC., Agworld Pty Ltd, Farmers Edge Inc., Climate LLC., and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user),

Multi-User License (Up to 5 Users), and

Corporate Use License (Unlimited User) along with free report customization equivalent to

0 analyst working days, 3 analysts working days, and 5 analysts working days respectively.

|

Frequently Asked Questions

The Global Farm Management Software Market size is estimated to have a value of USD 4,977.0 million in 2025 and is expected to reach USD 21,975.9 million by the end of 2034.

North America is expected to be the largest market share for the Global Farm Management Software Market with a share of about 39.5% in 2025.

Some of the major key players in the Global Farm Management Software Market are Trimble Inc., Granular Inc., Climate LLC, and many others.

The market is growing at a CAGR of 17.9 percent over the forecasted period

The US Farm Management Software Market size is estimated to have a value of USD 1,653.3 million in 2025 and is expected to reach USD 6,684.0 million by the end of 2034.