Market Overview

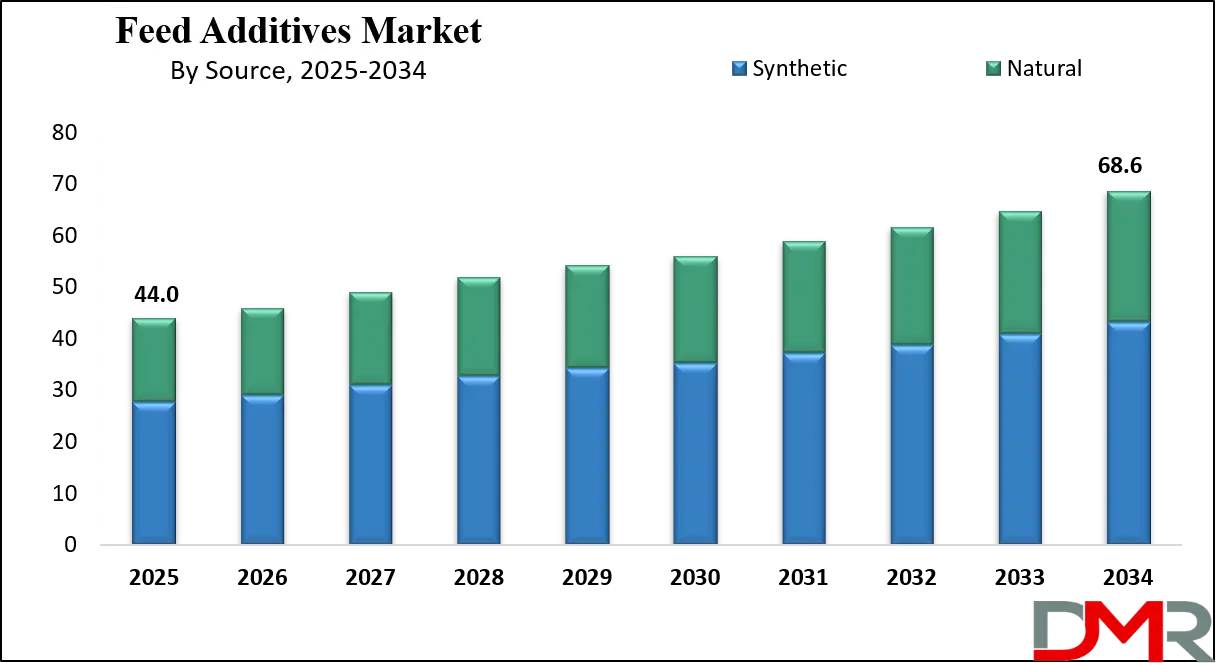

The Global Feed Additives Market size is projected to reach USD 44.0 billion in 2025 and grow at a compound annual growth rate of 5.1% from there until 2034 to reach a value of USD 68.6 billion.

The global feed additives market is growing strongly due to the growing demand for high-quality animal protein and more awareness regarding animal health and nutrition. As the world population is estimated to reach 9 billion by 2050, the demand for meat, eggs, and milk is growing sharply, leading to a need for effective livestock productivity. Due to this, farmers and producers are investing in feed additives that improve growth, immunity, and digestion in animals.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

One of the most prominent trends in the market is the growing use of natural and organic additives as a result of the worldwide move away from antibiotic growth promoters and rising fears over antibiotic resistance. This has driven demand for phytogenics, probiotics, enzymes, and essential oils. Another prominent trend is the growing application of precision nutrition and tailored feed formulations made possible by advances in animal genetics and health monitoring technologies.

But regulatory restrictions and fluctuations in raw material costs are holding back market growth. Regulatory regimes across the world are different, increasing the complexity of worldwide operations. Further, acquiring natural ingredients of good quality is expensive, and producers' margins will be hit by this.

Despite these issues, the market offers considerable growth prospects. Urbanization in developing economies, growing disposable income, and rising meat consumption in nations such as India, China, and Brazil are widening the scope for market participants. Investments in R&D and innovation will create new opportunities in sustainable and functional feed additive solutions.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The US Feed Additives Market

The US Feed Additives Market is projected to reach USD 10.4 billion in 2024 at a compound annual growth rate of 4.8% over its forecast period.

The U.S. feed additives industry is a significant source of revenues in the global industry, backed by a well-structured livestock industry, sophisticated farming methods, and stringent regulatory measures by organizations such as the FDA and USDA. The U.S. is a leading producer of beef, poultry, and pork in the world, and the demand for functional feed additives that enhance animal performance, health, and feed efficiency is rising steadily.

One of the driving forces in the U.S. market is the demographic strength of large commercial farms and agribusinesses, which are quick to adopt new feed technologies. Moreover, increased consumer awareness regarding antibiotic-free meat has triggered demand for natural additives like probiotics, phytogenics, and essential oils. With greater emphasis on sustainable agriculture, feed solutions with methane-reducing and environmentally friendly characteristics are in demand.

The market is also being driven by robust R&D strengths and investments by U.S.-based major players such as ADM, Cargill, and Elanco. These companies are leading the way with precision feeding systems and integrated nutrition programs. Livestock monitoring technologies are improving the targeted application of feed additives, enhancing productivity and animal health.

Despite these benefits, the U.S. market is subject to challenges such as volatile raw material prices and changing regulatory conditions about additive approvals and labeling. However, with increasing protein demand and demand for efficient meat production, the U.S. feed additives market is likely to experience steady growth, driven by innovation, sustainability efforts, and consumer-driven trends in animal nutrition.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Global Feed Additives Market: Key Takeaways

- The Global Market Size Insights: The Global Feed Additives Market size is estimated to have a value of USD 44.0 billion in 2025 and is expected to reach USD 68.6 billion by the end of 2034.

- The US Market Size Insights: The US Feed Additives Market is projected to be valued at USD 10.4 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 15.8 billion in 2034 at a CAGR of 4.8%.

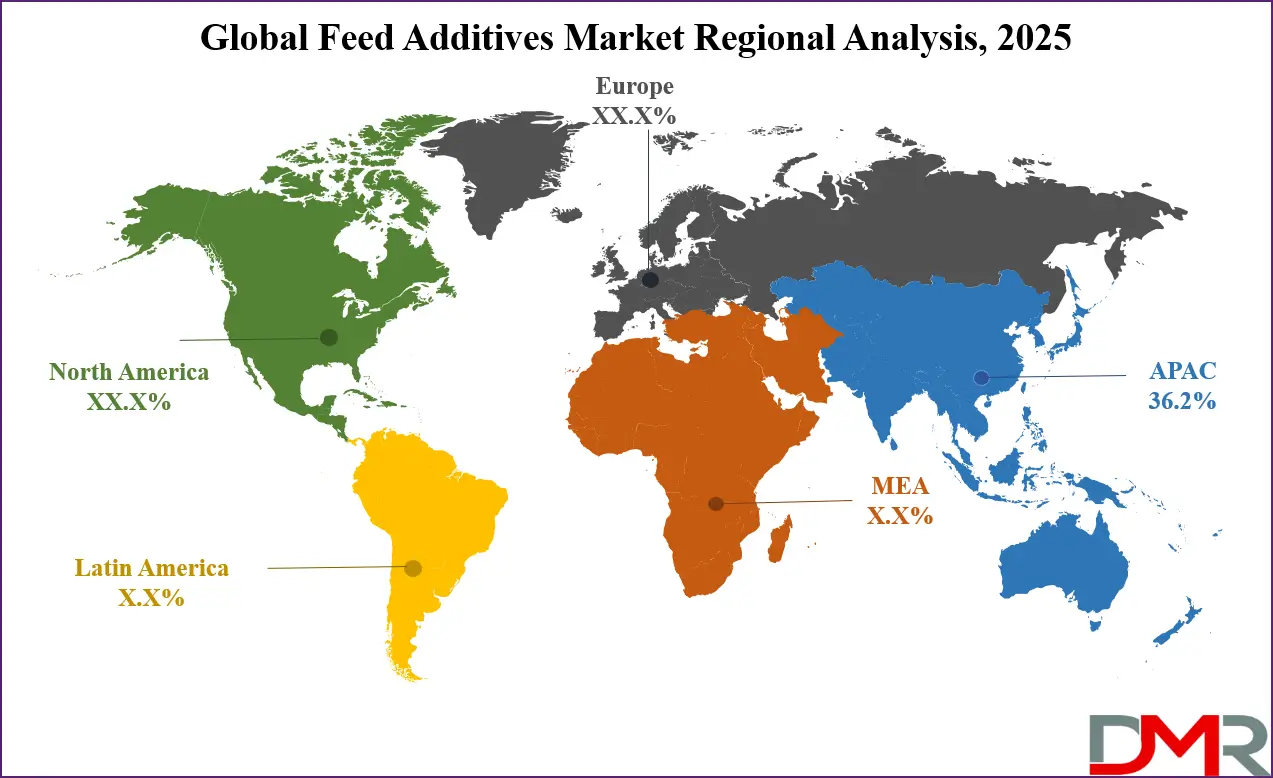

- Regional Insights: Asia Pacific is expected to have the largest market share in the Global Feed Additives Market with a share of about 36.2% in 2025.

- Key Players: Some of the major key players in the Global Feed Additives Market are Cargill, ADM, BASF, Evonik, DSM, Nutreco, and many others.

- The Global Market Growth Rate: The market is growing at a CAGR of 5.1 percent over the forecasted period of 2025.

Global Feed Additives Market: Use Cases

- Poultry Immunity Enhancement: Feed additives such as probiotics and essential oils are used in poultry feed to boost immunity, reduce antibiotic dependency, and improve resistance to diseases like avian influenza and Newcastle disease, ensuring consistent egg and meat production in broilers and layers.

- Aquafeed Efficiency: In aquaculture, acidifiers and enzymes are incorporated into feed to enhance nutrient uptake in shrimp and fish, supporting increased growth and less environmental waste, which improves sustainability in intensive aquafarming operations.

- Swine Growth Promotion: Lysine and methionine amino acids are utilized in swine diets to enhance lean muscle growth, lower feed conversion ratios, and ensure healthy weight gain in growers and finishers, improving overall production efficiency.

- Cattle Digestive Health: Probiotics and mycotoxin binders are applied to cattle feed to enhance rumen performance, avert digestive illness, and counteract mycotoxin poisoning, particularly in areas with high risk of feed spoilage through humidity.

- Pet Food Fortification: Vitamins, minerals, and antioxidants are being added to pet feed formulations more frequently to address the nutritional needs of companion animals, maintain joint health, immunity, and coat quality, and to attract health-aware pet owners.

Global Feed Additives Market: Stats & Facts

- The Food and Agriculture Organization (FAO) emphasizes the importance of feed additives in enhancing feed efficiency, thereby improving animal and environmental performance in livestock supply chains.

- The United States Department of Agriculture (USDA) reports that in 2018, the per capita consumption of animal meat in the U.S. was approximately 222.2 pounds, highlighting the significant role of feed additives in supporting meat production.

- According to FAOSTAT, global livestock production has been steadily increasing, necessitating the use of feed additives to meet the rising demand for animal protein.

- The FAO's Livestock Environmental Assessment and Performance (LEAP) Partnership has developed guidelines for assessing the environmental performance of feed additives, considering their impact on climate change, fossil energy use, acidification, and eutrophication.

- The FAO's Statistical Yearbook 2020 provides comprehensive data on the production, trade, and prices of commodities, including those related to feed additives, offering insights into market trends and dynamics.

Global Feed Additives Market: Market Dynamics

Driving Factors for the Global Feed Additives Market

Global Rise in Demand for Animal Protein

The global demand for animal proteins, like meat, milk, eggs, and fish, is a leading driver for the feed additives market. As per the FAO, meat production is expected to rise dramatically to serve a world population of over 9 billion by 2050. This growth is especially evident in developing economies in Asia, Africa, and Latin America, where rising economic growth is boosting purchasing power and protein intake. To satisfy this need, animal producers have to increase growth rates, feed efficiency, and overall health goals that can be optimally met through the judicious application of feed additives.

Feed supplements like amino acids, enzymes, and probiotics enable farmers to generate more output from an equal amount of feed input, which also enhances profitability. As consumers increasingly seek higher-quality and more sustainably produced animal products, feed additives have become the focus of contemporary animal production systems globally.

Increased Awareness of Animal Health and Nutrition

There is increasing global awareness of the important role that feed additives play in enhancing animal health, welfare, and productivity. Governments, industry associations, and veterinarians are stressing the need for balanced nutrition, particularly in disease prevention and minimizing antibiotic reliance. This has resulted in the growing use of health-promoting additives like probiotics, acidifiers, and antioxidants, which enhance animals' immune systems and minimize morbidity and mortality.

Marketing campaigns and training programs for effective feed management are also driving demand, especially in countries where livestock production is shifting from subsistence to commercial levels. Since the welfare of farm animals directly correlates with food safety and public health, more stakeholders now view feed additives as preventive tools to minimize risk in the supply chain. This increased awareness is anticipated to fuel steady growth in the market, particularly as regulators and customers increasingly want higher quality in animal welfare and nutrition.

Restraints in the Global Feed Additives Market

Strict Regulatory Frameworks and Delayed Approvals

The most notable hindrance to expansion in the global feed additives market is the highly regulated and complicated approval processes that oversee the launch of new products. Regulatory bodies like the European Food Safety Authority (EFSA) and the U.S. Food and Drug Administration (FDA) insist on strict testing to guarantee the safety, effectiveness, and environmental footprint of every additive. While these regulations are important for food safety and public health, they can also hinder market entry for a few years, raising R&D expenses and deterring innovation. Smaller businesses, especially, will find it difficult to absorb the cost of compliance.

Additionally, regulatory requirements are highly diverse among nations, further complicating companies' efforts to go global. As regulations continue to change, especially in terms of antibiotics and genetically modified materials, feed producers have to navigate a changing legal environment that can greatly slow down product launches and global expansion plans.

Volatility and High Cost of Raw Materials

Feed additives are dependent on a range of raw materials, such as vitamins, amino acids, enzymes, and minerals many of which are natural in origin or require complicated synthesis. Prices for these raw materials are extremely responsive to worldwide supply chain disruption, geopolitical events, weather, and energy prices. For instance, soybean and corn price volatility can have a major influence on the production cost of amino acids.

Equally, demand shortages of man-made vitamins caused by production interference in major producing nations such as China can disrupt global supply chains. Such price changes not only drive up the cost of operations for manufacturers of additives but also complicate maintaining stable prices for buyers. In competitive markets, a failure to pass on costs may deplete profit margins. Volatility also deters long-term planning and investment in manufacturing facilities, particularly in geographies with sparse domestic sourcing. This cost-constraint factor persists to affect scalability and sustainability for feed additives players.

Opportunities in the Global Feed Additives Market

Unexplored Potential in Emerging Economies

Emerging economies across Asia, Africa, and Latin America present gigantic growth opportunities for the global feed additives market. These are the areas where rapid urbanization, income, and population growth are all causing rising consumption of animal proteins. Yet, the adoption of modern feed practices and additives remains low in many of these nations, leaving a huge untapped market.

Governments are also making investments in agricultural modernization initiatives, encouraging commercial livestock rearing and consumption of scientifically developed feeds. Consequently, manufacturers of feed additives can grow through local formulation development, agriculturalist training, and distribution channels. Moreover, growth in cold chain logistics and regulatory consistency is allowing foreign firms to penetrate such markets. With proper partnerships and price models, companies can gain good market share while at the same time promoting food security and rural economic development in these high-potential countries.

Sustainable and Eco-Friendly Innovation of Additives

Increasing attention on sustainability in the agricultural sector is paving the way for creating sustainable, eco-friendly feed additives. Climate change and environmental pollution, issues becoming centerpieces for concerns at a global scale, have added urgency to require feed additives that increase efficiency while cutting down on methane emissions and waste nitrogen. For example, the application of some essential oils, plant extracts, and seaweed-derived compounds has been found to lower greenhouse gas emissions in ruminants without affecting productivity. Feed producers are also looking into biodegradable carriers and encapsulation methods that reduce resource consumption.

Consumers and governments alike are driving the sustainability push, with many governments introducing carbon footprint reduction targets in agriculture. Those companies investing in R&D of environment-friendly products are expected to have a competitive edge and gain green finance. This is an apparent way to drive innovation growth in the feed additives market because it aligns with global efforts in making agriculture carbon-neutral and adopting sustainable animal nutrition.

Trends in the Global Feed Additives Market

Increased Demand for Functional and Specialty Feed Additives

One of the key trends that is redefining the feed additives industry is the growing demand for functional and specialty additives that extend beyond fundamental nutrition. Additives like probiotics, enzymes, organic acids, and phytogenics are increasingly being sought after due to their well-documented capability to improve immunity, gut health, and growth rates in animals without resorting to antibiotics. The change is being influenced by consumer concerns regarding antibiotic resistance and residues in meat products.

Producers are reformulating feed to address these tastes and meet regulations prohibiting the use of antibiotic growth promoters, particularly in the EU and areas of Asia. Incorporation of precision nutrition has further enabled the ability to formulate feed that addresses specific animal physiological requirements, with optimized productivity and reduced waste. Consequently, functional feed additives are becoming strategic long-term investments in livestock performance, disease resistance, and sustainability objectives in the global animal husbandry industry.

Digitalization and Smart Livestock Farming

The use of digital technologies in livestock farming is another leading trend shaping the feed additives market. Technologies such as AI-based data analytics, precision feeding systems, and Internet of Things -based animal health monitoring are transforming the way farmers optimize feed formulations. This trend makes it possible to track animal growth, feed consumption, and health factors in real-time, permitting dynamic adjustments in additive dosages for optimal results.

Such developments are especially significant in large-scale commercial farming operations where maximizing feed efficiency and lowering the cost of production are foremost priorities. Intelligent farming technologies facilitate targeted application of feed additives to ensure that animals receive the precise nutrients they need at every growth phase.

In addition, digital solutions assist in regulatory compliance and traceability, which becomes all the more essential with increased examination of food safety. The trend is predicted to gain speed as livestock producers seek means of improving productivity and sustainability through data-driven, smart feed strategies.

Global Feed Additives Market: Research Scope and Analysis

By Type Analysis

Amino acids are expected to lead the feed additives market due to their importance for animal nutrition, health, and growth performance. As amino acids form the basis of proteins, amino acids like lysine, methionine, and threonine play an essential role in muscle growth, metabolic balance, and immune response in livestock.

Monogastric animals such as poultry and swine cannot produce sufficient essential amino acids on their own, necessitating supplementation with a diet. Amino acid additives have a dramatic impact on feed conversion ratios, helping animals achieve desired weight gains with reduced food consumption, increasing farm profitability while meeting environmental concerns and rising global feed costs. Such efficiency is particularly valuable given these challenges.

Strategic application of amino acids allows farmers to lower crude protein content in animal feed, thus decreasing nitrogen excretion and environmental load--an important goal of sustainable animal agriculture. With increasingly restricted access to antibiotic growth promoters, amino acids have emerged as trusted, natural alternatives that ensure animal performance is not diminished; their wide applicability across poultry, swine, ruminants, and aquaculture only further expands their market penetration.

Advances in microbial fermentation and synthetic biology have significantly decreased costs associated with production while improving amino acid purity, bioavailability, and cost-effective adoption on a large scale. This has made adoption attractively cost-effective, especially in developing countries where animal production is rising fast. Strategic advantages associated with increased productivity, regulatory compliance, and antibiotic-free development are driving long-term demand for amino acids, making them one of the primary feed additives worldwide and integral parts of precision animal nutrition.

By Livestock Analysis

Poultry is projected to dominate the feed additives market due to its fast growth cycles, global popularity, and cost-effective meat and egg production systems. Broilers reach market weight within two months while layers produce eggs daily--requiring high-efficiency nutrition for sustained productivity. Feed additives become indispensable tools for poultry producers seeking to maximize output while simultaneously protecting flock health: amino acids, enzymes, probiotics, and acidifiers are often added into poultry feed to promote gut integrity, enhance immunity, and optimize nutrient absorption.

China, India, Brazil, and Indonesia have seen rapid intensification of poultry farming as emerging economies develop, which has been one of the main drivers for growth in this sector. Urbanization and rising incomes in these regions have increased demand for poultry products due to their affordability and shorter religious/cultural barriers than with pork or beef products. Furthermore, intensive poultry systems can be highly vulnerable to nutritional imbalances that lead to lower feed efficiency and mortality; feed additives provide solutions by improving productivity while mitigating disease outbreak risks.

Poultry production has evolved into a "line scanning" model of production, where genetics, housing environment, and feed are optimized simultaneously. Within this system, feed additives act as an indispensable means of performance enhancement and disease prevention; regulatory pressures to phase out antibiotic growth promoters have further driven demand for natural solutions; given global production volumes of poultry production the need for reliable science-backed feed additive regimens is strong - keeping poultry as the top livestock segment in global feed additive market.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

By Source Analysis

Synthetic feed additives are poised to dominate the market by source due to their consistent efficacy, scalable manufacturing, and economic advantages over natural counterparts. While natural additives' quality and composition may fluctuate depending on factors like soil quality, climate conditions and seasonal changes; in comparison with synthetic alternatives produced under controlled conditions they guarantee high performance at consistent levels and ensure uniform feed formulation for industrial livestock operations requiring optimal growth, conversion ratios, efficiency gains and overall farm management efficiency.

Cost-effectiveness is a primary driver behind synthetic additives' widespread adoption. Large-scale production through chemical synthesis or microbial fermentation enables economies of scale, making these additives more affordable to commercial feed manufacturers and more readily accessible for birds, pigs, and ruminants alike. Synthetic amino acids, vitamins, antioxidants, and acidifiers have become staples in poultry, swine, and ruminant diets due to their high bioavailability, long shelf life, and minimal storage requirements; furthermore, their standardization streamlines their introduction onto global markets quickly.

Synthetic feed additives integrate seamlessly with automated feed processing systems, providing accurate dosing and efficient blending without the need for special handling. They also stand up better under high temperatures and moisture conditions--an essential factor when pelleting feed or other heat-intensive processes are involved in feed manufacturing. With global protein demand growing and livestock producers searching for ways to cut feed costs without compromising productivity, synthetic additives remain an attractive solution - their dominance further cemented through digital formulation technologies and precision nutrition, making synthetic feed additives the go-to choice for large-scale livestock operations worldwide.

By Form Analysis

Dry feed additives are anticipated to dominate the market due to their superior stability, ease of use, and logistical advantages over liquid counterparts. Commercial feed manufacturers prefer dry formulations in powder, granule, or premix form due to their long shelf life and resistance to environmental degradation; unlike liquid counterparts, which require refrigeration-like storage conditions for optimal use - making dry additives much more adaptable across diverse climates and geographies, especially regions with high humidity or limited infrastructure.

Feed manufacturers favor dry additives because of their seamless integration into automated blending and pelleting systems. Their flowability and uniform particle size enable even distribution throughout feed batches for consistent nutrient delivery to animals, especially important when dealing with large-scale feed mills where batch consistency can directly impact animal health and growth rates. In addition, bulk dry additives are easier to handle, transport, and store, reducing overhead costs while improving supply chain efficiencies.

Dry forms also offer greater biosecurity benefits. Thanks to lower water activity levels, dry additives are less prone to microbial contamination--an increasingly prevalent issue among high-density livestock production facilities. Dry additives are utilized across all major livestock segments--poultry, swine, and cattle alike--for purposes including growth enhancement, immunity support, and gut health support.

As global demand for high-quality compound feeds surges, particularly in developing markets, dry additives have become an increasingly attractive choice in animal nutrition systems. Their adaptability, processing efficiencies, and cost-cutting benefits have cemented their place as market leaders, underpinning modern industrialized animal nutrition systems with ease.

By Function Analysis

Growth boosters is anticipated to dominate the feed additives market by function, thanks to their direct impact on productivity, profitability, and feed efficiency in livestock production. These additives boost ADG, FCR, and nutrient utilization; three essential metrics in commercial animal farming. Key growth-promoting additives include amino acids, enzymes, probiotics, organic acids that collectively aid digestion, metabolic activity and immune resilience - essential ingredients in any feed additive formula.

Growth boosters offer a significant return on investment for any industry where feed accounts for 70% or more of total production costs, particularly intensive systems like poultry and swine farming, where rapid turnover and uniform growth are essential to meeting consumer demand.

Furthermore, as antibiotic growth promoters become less accessible due to regulatory and consumer pressures, they become even more valuable as alternative enhancers, particularly probiotics and enzymes, which provide clean-label solutions that align with sustainability and animal welfare goals.

Growth boosters also play a vital role in environmental sustainability by supporting lower protein diets with improved nitrogen retention, thus reducing waste output. They also support disease resistance and help to limit economic losses associated with poor animal health, with demand for animal protein on the rise in Asia-Pacific and Latin America especially driving adoption of growth boosters to improve production economics and meet tightening regulations; their functional benefits across multiple species combined with technological innovation make growth boosters the stand-out functional segment within feed additives industry.

The Global Feed Additives Market Report is segmented based on the following:

By Type

- Amino Acids

- Methionine

- Lysine

- Threonine

- Tryptophan

- Other Amino Acids

- Phosphates

- Dicalcium Phosphate

- Monocalcium Phosphate

- Mono-Dicalcium Phosphate

- Defluorinated Phosphate

- Tricalcium Phosphate

- Other Phosphates

- Vitamins

- Fat-Soluble Vitamins

- Water-Soluble Vitamins

- Acidifiers

- Propionic Acid

- Formic Acid

- Citric Acid

- Lactic Acid

- Sorbic Acid

- Malic Acid

- Benzoic Acid

- Other Acidifiers

- Carotenoids

- Astaxanthin

- Canthaxanthin

- Lutein

- Beta Carotene

- Other Carotenoids

- Enzymes

- Phytase

- Carbohydrase

- Protease

- Other Enzymes

- Mycotoxin Detoxifiers

- Flavors & Sweeteners

- Feed Flavors

- Feed Sweeteners

- Antibiotics

- Tetracycline

- Penicillin

- Other Antibiotics

- Minerals

- Potassium

- Calcium

- Phosphorus

- Magnesium

- Sodium

- Iron

- Zinc

- Copper

- Manganese

- Other Minerals

- Antioxidants

- Synthetic Antioxidants

- Natural Antioxidants

- Nonprotein Nitrogen

- Urea

- Ammonia

- Other Nonprotein Nitrogen

- Phytogenics

- Essential Oils

- Flavonoids

- Saponins

- Oleoresins

- Other Phytogenics

- Preservatives

- Mold Inhibitors

- Anticaking Agents

- Probiotics

- Lactobacilli

- Bifidobacteria

- Streptococcus thermophilus

- Yeast & Fungi

By Livestock

- Poultry

- Ruminants

- Calf

- Dairy

- Beef

- Other Ruminants

- Swine

- Aquatic Animals

- Fish

- Crustaceans

- Mollusks

- Other Aquatic Animals

- Other Livestock

By Source

By Form

By Function

- Gut Health

- Palatability Enhancers

- Growth Boosters

- Immune System Support

- Other Functions

Global Feed Additives Market: Regional Analysis

Region with the Highest Market Share

Asia-Pacific is expected to dominate the global feed additives market as it holds 36.2% of the market share in 2025 due to its large livestock population, rapid industrialization of animal farming operations, and increasing demand for meat, dairy products, and eggs. China, India, and Vietnam lead in poultry, swine, and aquaculture production, creating an insatiable demand for performance-boosting feed additives such as amino acids, vitamins, and enzymes. Urbanization and rising disposable incomes have transformed consumer preferences toward high-protein diets, fueling increased demand.

Government initiatives supporting safe meat production, reduced antibiotic use, and improved feed quality have seen additives being widely adopted into meat production processes. China, as the world's top feed producer, contributes significantly to regional development by investing heavily in animal nutrition R&D.

Additionally, this region benefits from an array of international and local feed manufacturers as well as an expansive distribution network that ensures scaleability and affordability. Asia-Pacific stands out as a manufacturing hub for feed additives thanks to cost-efficient production, access to raw materials, and favorable trade agreements. High demand, supportive policy frameworks, and an established industrial base underpin Asia-Pacific's leading position in this global industry.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Region with the Highest CAGR

North America is projected to experience the highest compound annual growth rate in terms of feed additives sales. This growth will be propelled by the rapid adoption of advanced animal nutrition technologies and an inclination toward antibiotic-free production systems. U.S. livestock industries are turning toward precision feeding solutions as an effective way to boost feed conversion ratios and ensure traceability, particularly within poultry and swine sectors.

Increased regulatory pressure to decrease antimicrobial usage has spurred producers to invest in natural growth promoters, probiotics, and enzymes as an antimicrobial alternative, increasing demand for these specialized additives. Consumer awareness surrounding animal welfare and food safety in North America is increasing, leading to improved feed choices that improve immunity and overall animal health.

As noted previously, robust research and development infrastructure, partnerships between agritech firms and universities, and investments in sustainable feed production are all contributing to speedier innovation. As organic and non-GMO meat consumption has surged, feed manufacturers are adapting their formulae using premium additives with added value - all factors which have combined to make North America an impressive market in the global feed additive sector.

While Europe’s market is expected to command over 26.5% of market share in 2025 due to its mature, driven by stringent regulations on feed safety, sustainability goals, and early bans on antibiotic growth promoters. Countries like Germany, France, and the Netherlands are investing in bio-based and functional additives to meet consumer demand for ethical and safe animal products.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Global Feed Additives Market: Competitive Landscape

The global feed additives market is highly competitive, featuring both multinational corporations and regional players that specialize in animal nutrition solutions. Cargill, ADM, BASF SE, Evonik Industries, DSM and Novozymes are leading players in feed additives; each offers a comprehensive portfolio of amino acids, enzymes and vitamins for use as feed additives. These firms invest heavily in research and development (R&D), in order to produce cutting-edge, sustainable, and antibiotic-free solutions that comply with evolving regulatory standards and consumer demands.

Mergers and acquisitions are often undertaken to expand geographic reach or product offerings. DSM's acquisition of Biomin strengthened their foothold in mycotoxin detoxifiers and gut health solutions, while regional firms in Asia-Pacific and Latin America are increasing market share through providing cost-effective options tailored specifically to local farming practices. Partnerships between feed manufacturers and livestock supply chains strengthen competitive positioning.

Furthermore, with precision feeding and digital livestock management becoming more widespread, players have responded by developing feed additive products designed with real-time performance monitoring in mind. Sustainability, traceability, and customization have become key differentiators within this competitive environment, making innovation, adaptability, and regulatory compliance essential components of market success.

Some of the prominent players in the Global Feed Additives Market are:

- Cargill, Incorporated

- ADM (Archer Daniels Midland Company)

- BASF SE

- Evonik Industries AG

- DSM (Koninklijke DSM N.V.)

- Nutreco N.V.

- Alltech, Inc.

- Novozymes A/S

- Kemin Industries, Inc.

- Chr. Hansen Holding A/S

- Adisseo

- Elanco Animal Health

- Zoetis Inc.

- Phibro Animal Health Corporation

- Novus International, Inc.

- Lallemand Inc.

- Neovia Group (ADM)

- Biomin Holding GmbH (part of DSM)

- DuPont (IFF – International Flavors & Fragrances Inc.)

- Bluestar Adisseo Company

- Other Key Players

Recent Developments in the Global Feed Additives Market

- December 2024: Nutreco N.V. expanded its animal feed additive production capacity across the Americas to address rising regional demand, enhancing its ability to serve the livestock sector with improved efficiency and meeting growing nutritional needs.

- November 2024: BASF SE collaborated with Evonik Industries AG to boost its biotechnology capabilities in feed additives, aiming to develop innovative and sustainable solutions for animal nutrition through advanced microbial and enzymatic technologies.

- October 2024: Cargill Inc. acquired Diamond V to reinforce its leadership in the animal nutrition space, leveraging Diamond V’s expertise in fermentation-based feed additives for better livestock health and performance.

- September 2024: DSM Nutritional Products AG introduced a new feed additive line for ruminants, focusing on enhancing productivity, immunity, and overall health in dairy and beef cattle under sustainable nutrition practices.

- August 2024: Novozymes A/S acquired Microbiome Labs to expand its microbial feed additive portfolio, aiming to strengthen its offerings in probiotics and gut health solutions for improved animal performance.

- July 2024: Biomin Holding GmbH formed a partnership with Chr. Hansen Holding A/S to co-develop innovative animal nutrition solutions, combining expertise in mycotoxin management and microbial technology.

- June 2024: Kemin Industries Inc. increased its feed additive production capacity in Europe to support growing market demand, ensuring faster delivery and supply of high-quality additives for regional livestock producers.

- May 2024: Alltech Inc. launched a new feed additive product line tailored for swine, designed to improve growth rates, feed conversion, and overall animal health through advanced nutritional formulations.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 44.0 Bn |

| Forecast Value (2034) |

USD 68.6 Bn |

| CAGR (2025–2034) |

5.1% |

| The US Market Size (2025) |

USD 10.4 Bn |

| Historical Data |

2019 – 2024 |

| Forecast Data |

2026 – 2034 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Type (Amino Acids, Phosphates, Vitamins, Acidifiers, Carotenoids, Enzymes, Mycotoxin Detoxifiers, Flavors & Sweeteners, Antibiotics, Minerals, Antioxidants, Nonprotein Nitrogen, Phytogenics, Preservatives, Probiotics), By Livestock (Poultry, Ruminants, Swine, Aquatic Animals, Other Livestock), By Source (Synthetic, Natural), By Form (Dry, Liquid), By Function (Gut Health, Palatability Enhancers, Growth Boosters, Immune System Support, Other Functions) |

| Regional Coverage |

North America – US, Canada; Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA |

| Prominent Players |

Cargill, ADM, BASF, Evonik, DSM, Nutreco, Alltech, Novozymes, Kemin, Chr. Hansen, Adisseo, Elanco, Zoetis, Phibro, Novus, Lallemand, Neovia, Biomin, DuPont (IFF), Bluestar Adisseo. , and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |

Frequently Asked Questions

How big is the Global Feed Additives Market?

▾ The Global Feed Additives Market size is estimated to have a value of USD 44.0 billion in 2025 and is expected to reach USD 68.6 billion by the end of 2034

What is the size of the US Feed Additives Market?

▾ The US Feed Additives Market is projected to be valued at USD 10.4 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 15.8 billion in 2034 at a CAGR of 4.8%.

Which region accounted for the largest Global Feed Additives Market?

▾ Asia Pacific is expected to have the largest market share in the Global Feed Additives Market with a share of about 36.2% in 2025.

Who are the key players in the Global Feed Additives Market?

▾ Some of the major key players in the Global Feed Additives Market are Cargill, ADM, BASF, Evonik, DSM, Nutreco, and many others.

What is the growth rate in the Global Feed Additives Market in 2025?

▾ The market is growing at a CAGR of 5.1 percent over the forecasted period of 2025.