Market Overview

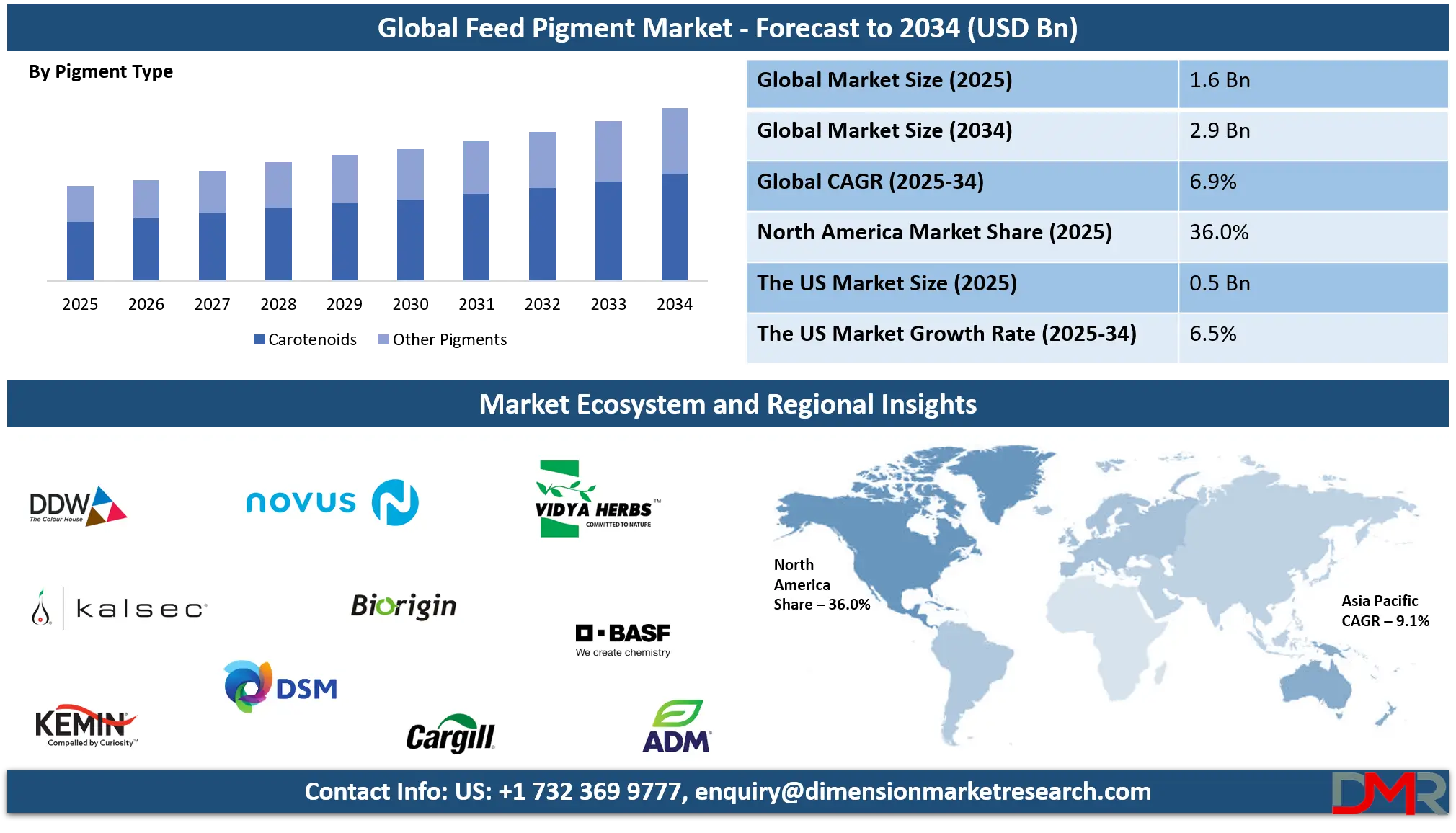

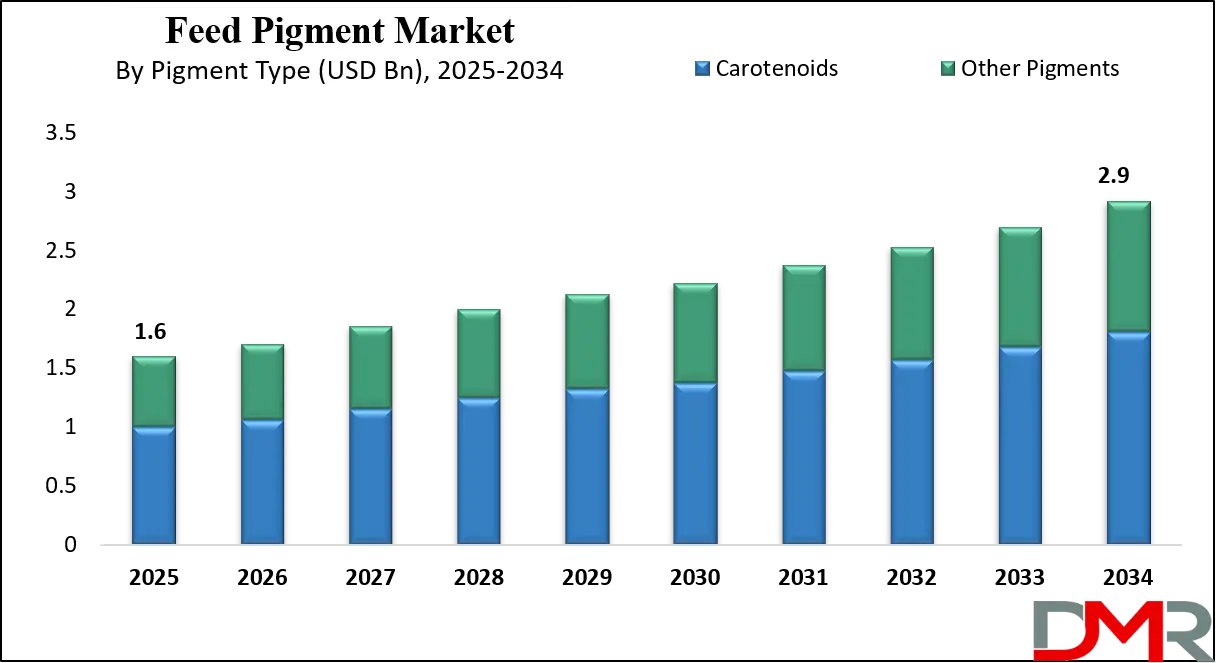

The Global Feed Pigment Market size is projected to reach USD 1.6 5billion in 2025 and grow at a compound annual growth rate of 6.9% to reach a value of USD 2.9 billion in 2034.

The feed pigment refers to the production and application of natural and synthetic color-enhancing compounds used in animal feed to improve the visual appeal, nutritional value, and marketability of livestock products. These pigments include carotenoids, chlorophyll, and anthocyanins, which are incorporated into feed for poultry, aquaculture, swine, and pet food. Feed pigments play a critical role in enhancing egg yolk color, fish flesh pigmentation, and overall animal health, making them an essential component of modern animal nutrition systems within the global feed industry.

The feed pigment market has gained importance due to increasing consumer preference for visually appealing and nutritionally superior animal-derived products. The shift toward intensification of livestock farming and the growing demand for high-quality meat, eggs, and aquaculture products are shaping the market landscape. Natural pigments are gaining attention as sustainability and clean-label trends influence purchasing decisions across the feed value chain.

Further, advancements in pigment extraction technologies, microbial fermentation, and formulation stability are driving innovation in the market. Regulatory acceptance of natural pigments, combined with the gradual phase-down of certain synthetic additives, is influencing product development strategies. The market is also witnessing a transition toward multifunctional pigments that provide antioxidant and health benefits beyond coloration, supporting long-term growth.

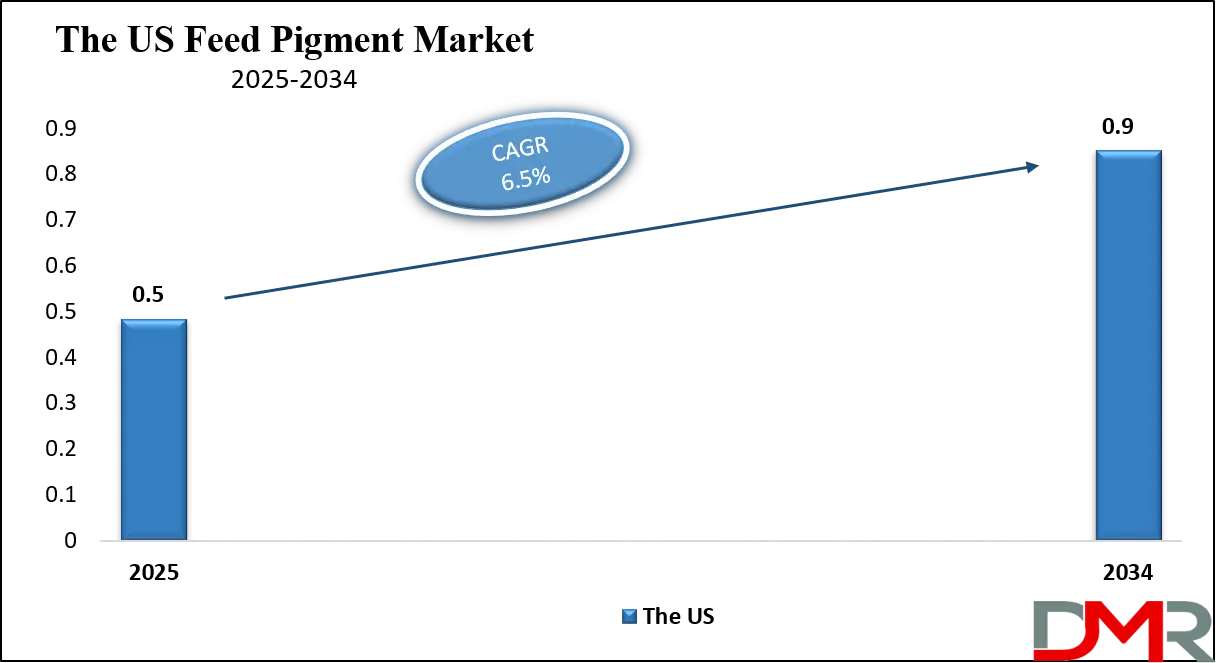

The US Feed Pigment Market

The US Feed Pigment Market size is projected to reach USD 500 million in 2025 at a compound annual growth rate of 6.5% over its forecast period.

The US feed pigment market is driven by large-scale livestock production, advanced feed manufacturing infrastructure, and strong demand from poultry and aquaculture sectors. Poultry feed accounts for a significant share due to consistent demand for uniform egg yolk and broiler skin coloration. Regulatory oversight by the FDA ensures product safety while allowing innovation in natural pigment formulations. Increasing adoption of natural and plant-based pigments is supported by rising consumer awareness regarding food quality and traceability. Additionally, strong R&D investments and the presence of multinational feed additive producers contribute to steady market expansion in the US.

Europe Feed Pigment Market

Europe Feed Pigment Market size is projected to reach USD 480 million in 2025 at a compound annual growth rate of 6.6% over its forecast period.

Strict regulatory frameworks and sustainability-focused policies such as the European Green Deal shape the European feed pigment market. There is a strong shift toward natural pigments, driven by bans and restrictions on certain synthetic additives. Poultry and aquaculture sectors dominate pigment consumption, particularly in countries such as Germany, France, and Spain. The region emphasizes clean-label animal products, encouraging innovation in plant-based and microbial pigments. High animal welfare standards and transparency requirements are accelerating the adoption of multifunctional pigments that offer both coloration and health benefits.

Japan Feed Pigment Market

Japan Feed Pigment Market size is projected to reach USD 80 million in 2025 at a compound annual growth rate of 7.4% over its forecast period.

Advanced aquaculture practices, high-quality livestock standards, and technological innovation influence Japan’s feed pigment market. Aquaculture, particularly for salmonids and shrimp, represents the fastest-growing application due to demand for premium seafood products. Urbanization and limited agricultural land have increased reliance on efficient feed solutions, including pigments that enhance productivity. Government initiatives supporting sustainable aquaculture and functional feed additives are strengthening market growth. However, high production costs and dependence on imported raw materials remain key challenges for local manufacturers.

Feed Pigment Market: Key Takeaways

- Market Growth: The Feed Pigment Market size is expected to grow by USD 1.2 billion, at a CAGR of 6.9%, during the forecasted period of 2026 to 2034.

- By Pigment Type: The carotenoids segment is anticipated to get the majority share of the Feed Pigment Market in 2025.

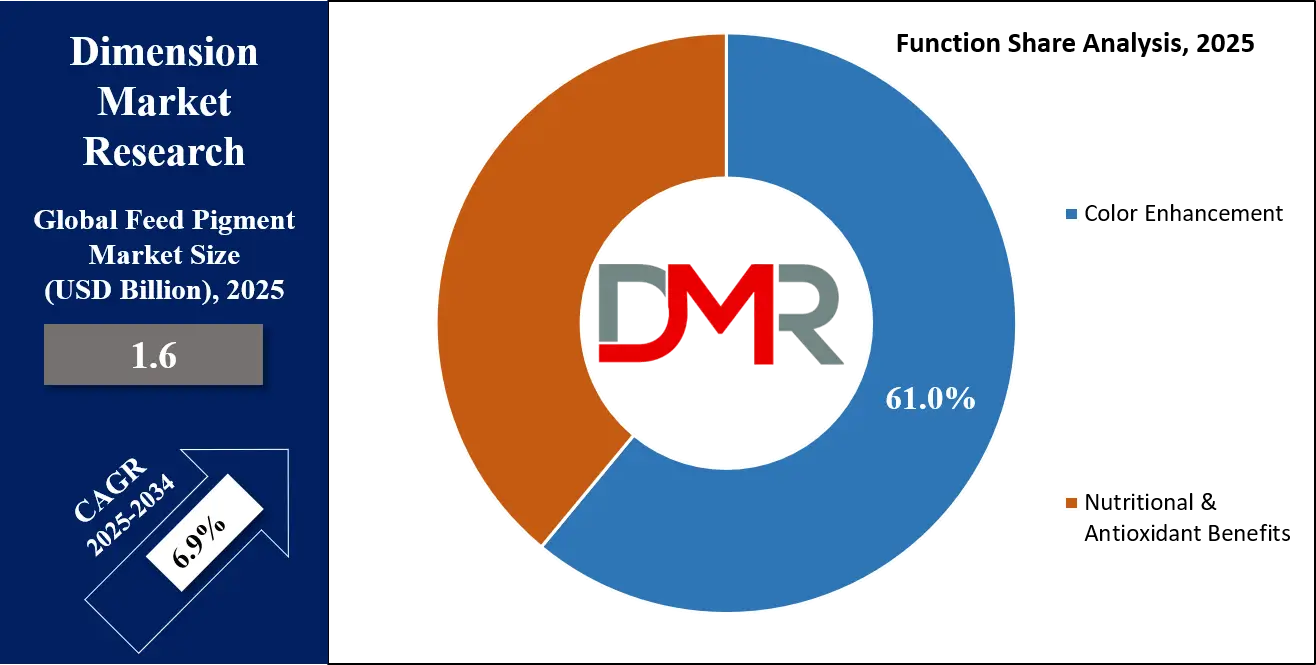

- By Function: The color enhancement segment is expected to get the largest revenue share in 2025 in the Feed Pigment Market.

- Regional Insight: North America is expected to hold a 36.0% share of revenue in the Global Feed Pigment Market in 2025.

- Use Cases: Some of the use cases of Feed Pigment include egg yolk color enhancement, nutritional fortification, and more.

Feed Pigment Market: Use Cases

- Egg Yolk Color Enhancement: Feed pigments are used in layer feed to achieve consistent and consumer-preferred yolk coloration, improving product appeal and brand differentiation.

- Fish Flesh Pigmentation: In aquaculture, pigments such as astaxanthin are added to enhance the natural pink or red color of salmonids and shrimp.

- Pet Food Appearance Improvement: Pigments improve the visual quality of pet food, aligning with premium branding and consumer expectations.

- Nutritional Fortification: Certain pigments provide antioxidant and immune-boosting properties, supporting animal health alongside coloration benefits.

Stats & Facts

- US Department of Agriculture reported that poultry feed production in the United States exceeded 240 million metric tons in 2024, supporting sustained demand for feed additives including pigments.

- European Commission indicated that over 60% of feed additives approved in 2025 were of natural origin, reflecting regulatory emphasis and shifting consumer preferences toward clean-label solutions.

- Food and Agriculture Organization stated that global aquaculture production surpassed 94 million tons in 2024, driving increased usage of feed pigments for fish and shrimp coloration.

- Japan Ministry of Agriculture reported aquaculture feed demand growth of 4.2% in 2025, contributing to higher pigment consumption in the country’s aquaculture sector.

- OECD noted that global compound feed output grew by 3.5% in 2024, reinforcing overall expansion of the feed additive market, including pigments.

Market Dynamic

Driving Factors in the Feed Pigment Market

Rising Demand for High-Quality Animal Products

The increasing consumer demand for visually appealing and nutritionally superior animal-derived products is a major driver of the Feed Pigment market. Color plays a crucial role in purchasing decisions for eggs, poultry meat, fish, and pet food. Retailers and food brands prioritize consistent coloration to maintain brand identity and consumer trust. As livestock producers respond to these expectations, the use of feed pigments becomes essential. Additionally, pigments that offer antioxidant and immune-support benefits align with the growing focus on animal health and productivity, further driving adoption across multiple livestock sectors.

Growth of Aquaculture and Poultry Industries

Rapid expansion of the global aquaculture and poultry industries is significantly driving demand for feed pigments. Aquaculture relies heavily on pigments such as astaxanthin to enhance flesh color and improve market value. Poultry producers depend on pigments to standardize egg yolk and skin coloration. Intensification of farming practices, coupled with rising protein consumption worldwide, has increased feed production volumes. This growth directly translates into higher consumption of functional feed additives, positioning pigments as a critical component of modern feed formulations.

Restraints in the Feed Pigment Market

High Cost of Natural Pigments

The high production and extraction costs associated with natural feed pigments present a key restraint for market growth. Plant-based and microbial pigments require advanced processing technologies, quality control, and stable supply chains, leading to higher prices compared to synthetic alternatives. Small and medium-sized feed manufacturers often struggle to absorb these costs, limiting adoption in price-sensitive markets. Additionally, fluctuations in raw material availability due to climate conditions can impact pricing stability, creating challenges for long-term procurement strategies.

Regulatory Complexity and Approval Delays

Regulatory frameworks governing feed additives vary significantly across regions, creating compliance challenges for pigment manufacturers. Approval processes for new pigment formulations can be lengthy and costly, particularly in Europe and Japan. Differences in permissible pigment types and usage limits restrict product standardization across markets. These regulatory complexities increase time-to-market and discourage innovation, especially for smaller companies with limited regulatory expertise and financial resources.

Opportunities in the Feed Pigment Market

Expansion of Natural and Clean-Label Feed Solutions

Growing demand for natural and clean-label animal products presents a significant opportunity for the Feed Pigment market. Consumers increasingly associate natural pigments with better quality, safety, and sustainability. This trend encourages feed manufacturers to replace synthetic pigments with plant-based and microbial alternatives. Advancements in extraction and fermentation technologies are improving yield and cost efficiency, making natural pigments more commercially viable. Emerging markets are also adopting clean-label standards, creating new growth avenues for pigment suppliers.

Technological Advancements in Pigment Formulation

Innovations in encapsulation, stabilization, and bioavailability enhancement offer strong growth potential for the market. Improved formulations increase pigment stability during feed processing and storage, enhancing effectiveness at lower inclusion rates. These advancements reduce overall costs for producers while improving performance outcomes. Technology-driven differentiation enables manufacturers to offer value-added products with multifunctional benefits, strengthening competitive positioning and long-term market expansion.

Trends in the Feed Pigment Market

Shift Toward Multifunctional Feed Pigments

The Feed Pigment market is witnessing a trend toward multifunctional products that combine coloration with nutritional and antioxidant benefits. Producers increasingly prefer pigments that support immune health, fertility, and stress resistance in animals. This trend aligns with the broader movement toward functional feeds that enhance productivity and reduce reliance on antibiotics. As a result, pigment suppliers are investing in R&D to develop formulations that deliver multiple performance benefits.

Increasing Adoption of Microbial Pigments

Microbial pigments are gaining traction due to their sustainability, scalability, and consistent quality. Produced through controlled fermentation processes, these pigments reduce dependence on agricultural raw materials and minimize environmental impact. Advances in biotechnology are improving pigment yield and cost efficiency, making microbial sources a competitive alternative to plant-based options. This trend is expected to reshape sourcing strategies within the Feed Pigment market.

Impact of Artificial Intelligence in Feed Pigment Market

- Formulation Optimization: AI models analyze feed composition data to optimize pigment inclusion rates for maximum color efficiency.

- Quality Control Automation: Machine learning improves consistency by detecting formulation deviations during production.

- Supply Chain Forecasting: AI predicts raw material availability and price fluctuations, improving procurement planning.

- R&D Acceleration: Artificial Intelligence-driven simulations speed up development of stable and bioavailable pigment formulations.

- Demand Prediction: Advanced analytics forecast livestock sector demand, supporting strategic capacity planning.

Research Scope and Analysis

By Pigment Type Analysis

Carotenoids dominate the Feed Pigment market, accounting for approximately 62% market share in 2025, primarily due to their extensive application in poultry and aquaculture feed. These pigments are highly effective in enhancing egg yolk coloration and improving the pink to red flesh tones of fish and shrimp, which directly influence consumer purchasing behavior. Beta-carotene, lutein, astaxanthin, and canthaxanthin are widely preferred because they deliver consistent pigmentation results while also providing antioxidant and immune-support benefits. Strong demand from commercial poultry farms and premium aquaculture producers sustains this segment’s leadership.

Additionally, continuous innovation in natural carotenoid extraction and microbial fermentation technologies is improving yield efficiency and cost control, further reinforcing the dominance of carotenoids across global feed formulations.

Other pigments, including chlorophyll and anthocyanins, represent the fastest-growing segment within the Feed Pigment market. Their expansion is driven by increasing demand for natural, plant-based feed additives that align with clean-label and sustainability trends. These pigments are gaining traction in niche livestock segments and pet food applications, where visual appeal is combined with perceived health benefits. Chlorophyll and anthocyanins are also valued for their antioxidant properties and contribution to animal wellness.

Technological advancements in stabilization, encapsulation, and formulation compatibility have significantly improved their shelf life and performance during feed processing. As regulatory support for natural additives increases, these pigments are expected to witness accelerated adoption across specialized and premium feed markets.

By Source Analysis

Natural pigments account for around 58% of the market share in 2025, supported by strong regulatory encouragement and growing consumer preference for clean-label animal products. Plant-based and microbial sources dominate this segment due to their renewable nature and lower environmental impact compared to synthetic alternatives. Livestock producers are increasingly incorporating natural pigments to comply with retailer standards, export regulations, and sustainability commitments.

Advancements in fermentation technology and extraction efficiency have improved pigment consistency and reduced production costs, enhancing commercial viability. Additionally, natural pigments are often associated with added nutritional and antioxidant benefits, further increasing their appeal among producers focused on animal health, welfare, and long-term productivity gains.

Synthetic pigments remain the fastest-growing source segment due to their cost-effectiveness, high color stability, and consistent performance. These pigments continue to be widely used in large-scale feed operations and price-sensitive markets, where cost control is a primary concern. Synthetic options offer superior resistance to heat, light, and oxidation during feed processing and storage, making them suitable for intensive farming systems.

Ongoing improvements in formulation safety and compliance with evolving regulatory standards are supporting their sustained relevance. While natural alternatives are gaining popularity, synthetic pigments retain strong demand where affordability, scalability, and predictable pigmentation outcomes are essential for maintaining competitive feed pricing.

By Form Analysis

Powdered feed pigments hold approximately 65% market share in 2025, largely due to their ease of handling, extended shelf life, and compatibility with conventional compound feed manufacturing processes. Powder forms integrate efficiently into dry feed formulations, ensuring uniform distribution and consistent coloration results. Their stability during transportation and storage reduces material losses and improves operational efficiency for feed mills. Large-scale feed manufacturers prefer powdered pigments because they align well with automated mixing systems and bulk handling infrastructure. Additionally, powdered pigments offer formulation flexibility across different livestock feed types, making them a cost-effective and reliable choice for high-volume production environments.

Liquid feed pigments are experiencing rapid growth, particularly in aquaculture and specialty feed applications. These pigments offer superior dispersion and bioavailability, enabling more precise dosage control and improved absorption by animals. Liquid formulations are especially valuable in fish and shrimp feed, where uniform pigmentation is critical for premium product positioning.

Advances in liquid stabilization and emulsification technologies have addressed earlier concerns related to shelf life and handling complexity. As feed producers increasingly adopt precision nutrition strategies, liquid pigments are gaining preference for their ability to deliver consistent performance in advanced and customized feed formulations.

By Livestock Application Analysis

Poultry applications account for approximately 44% market share in 2025, making this the leading livestock segment for feed pigment consumption. Demand is driven by the importance of egg yolk color and broiler skin pigmentation in influencing consumer perception and retail acceptance. High poultry production volumes, especially in commercial layer and broiler operations, ensure consistent pigment demand. Standardized quality requirements from retailers and foodservice providers further reinforce the need for reliable pigmentation solutions. Additionally, the integration of pigments that offer antioxidant and immune-support benefits enhances flock health and productivity, strengthening the long-term dominance of poultry within the Feed Pigment market.

Aquaculture represents the fastest-growing livestock application segment due to rising global demand for premium seafood products. Pigments such as astaxanthin are essential for achieving desirable flesh coloration in salmonids, shrimp, and other high-value species. Expansion of fish farming operations, particularly in Asia-Pacific and Latin America, is driving feed pigment consumption. Increasing consumer willingness to pay for visually appealing seafood further supports adoption. Moreover, advancements in aquafeed formulation and sustainability-focused aquaculture practices are encouraging the use of efficient, high-performance pigments to enhance product quality and market competitiveness.

By Function Analysis

Color enhancement accounts for approximately 61% market share in 2025, reflecting the primary role of feed pigments in improving the visual appeal of animal-derived products. Color consistency is critical for eggs, poultry meat, fish, and pet food, as it directly influences consumer trust and purchasing decisions. Producers rely on pigments to meet market-specific color standards and maintain brand differentiation. This functional requirement is particularly important in retail and export markets where visual quality is tightly regulated. As global protein consumption rises, color enhancement remains the dominant driver for pigment inclusion across all major livestock feed categories.

The nutritional and antioxidant benefits segment is growing rapidly as producers increasingly prioritize animal health and productivity. Certain pigments contribute to immune function, stress resistance, and overall metabolic health, reducing reliance on medicinal additives. This functional expansion aligns with the shift toward preventive nutrition strategies and antibiotic reduction initiatives. Feed manufacturers are integrating multifunctional pigments that deliver both coloration and health benefits, improving feed efficiency and animal performance. Rising awareness of animal welfare and sustainable production practices further supports growth in this function-focused segment.

By End User Analysis

Feed manufacturers account for approximately 68% market share in 2025, benefiting from large-scale operations, technical expertise, and integrated supply chains. These players incorporate pigments directly into compound feed formulations, enabling cost optimization and quality control. Their ability to source pigments in bulk and invest in advanced formulation technologies strengthens their market position. Feed manufacturers also play a critical role in innovation, collaborating with additive suppliers to develop customized pigment solutions. Strong relationships with livestock producers ensure steady demand, reinforcing this segment’s dominance within the Feed Pigment market.

Pet food producers represent the fastest-growing end-user segment, driven by premiumization trends and heightened focus on product aesthetics. Pet owners increasingly associate vibrant color with quality, freshness, and nutritional value. Pigments are used to enhance visual appeal while also delivering functional health benefits such as antioxidant support. Growth in premium and specialized pet food categories, including breed-specific and functional diets, is accelerating pigment adoption. As humanization of pets continues, demand for visually appealing and health-oriented pet nutrition products is expected to rise steadily.

The Feed Pigment Market Report is segmented on the basis of the following:

By Pigment Type

- Carotenoids

- Beta-carotene

- Lutein

- Astaxanthin

- Canthaxanthin

- Other Pigments

By Source

By Form

By Livestock Application

- Poultry

- Aquaculture

- Salmonids

- Shrimp

- Other Fish

- Swine

- Pet Food

By Function

- Color Enhancement

- Nutritional & Antioxidant Benefits

By End User

- Feed Manufacturers

- Integrated Livestock Producers

- Pet Food Producers

Regional Analysis

Leading Region in the Feed Pigment Market

North America leads the Feed Pigment market with an estimated 36% market share in 2025, supported by a well-established livestock industry and advanced feed production capabilities. The region benefits from large-scale poultry and aquaculture operations that require consistent and high-quality pigmentation solutions to meet consumer and retailer standards. Strong regulatory oversight ensures product safety while encouraging innovation in natural and sustainable feed additives. High adoption of plant-based and microbial pigments reflects growing consumer demand for clean-label animal products. Additionally, significant investments in research and development, coupled with the presence of technologically advanced feed manufacturers, enable continuous product innovation, reinforcing North America’s dominant position in the global Feed Pigment market.

Fastest Growing Region in the Feed Pigment Market

Asia-Pacific is the fastest-growing region in the Feed Pigment market, driven by rapid expansion of aquaculture, increasing meat and seafood consumption, and supportive government initiatives. Countries such as China, India, Vietnam, and Indonesia are witnessing significant growth in poultry and fish farming to meet rising protein demand from expanding populations. Governments across the region are promoting livestock productivity and feed quality through subsidies, modernization programs, and sustainability-focused policies. Increasing investments in commercial feed manufacturing and growing awareness of product quality and visual appeal are accelerating pigment adoption. The region’s large consumer base and improving supply chain infrastructure position Asia-Pacific as a key growth engine for the Feed Pigment market.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The Feed Pigment market is characterized by moderate entry barriers due to regulatory requirements and technical expertise needs. Market participants focus on innovation, cost optimization, and product differentiation to maintain competitiveness. Strategic investments in R&D, expansion of natural pigment portfolios, and long-term supply agreements are common strategies. Companies emphasize vertical integration and regional expansion to strengthen market presence. Sustainability and compliance capabilities increasingly define competitive advantage in this evolving market.

Some of the prominent players in the global Feed Pigment are:

- DSM - Firmenich / Royal DSM N.V.

- BASF SE

- Kemin Industries, Inc.

- Novus International, Inc.

- Nutrex NV

- D.D. Williamson & Co., Inc. (DDW)

- Behn Meyer Holding AG

- Guangzhou Leader Bio-Technology Co., Ltd.

- Synthite Industries Ltd.

- Chr. Hansen Holding A/S

- Biorigin

- Phytobiotics Futterzusatzstoffe GmbH

- Vitafor NV

- Innovad AD NV/SA

- E.I.D. Parry (India) Ltd.

- Vidya Herbs Pvt Ltd

- Zhejiang NHU Co., Ltd.

- Kalsec Inc.

- Cargill, Incorporated

- Archer Daniels Midland Company (ADM)

- Other Key Players

Recent Developments

- In November 2025, Copenhagen-based Chromologics, which uses precision fermentation to develop sustainable food colourings, raised USD 8 million in fresh funding from existing backers Novo Holdings and Danish state fund EIFO, along with its new investors Döhler Ventures, Collateral Good Ventures and Synergetic, whicj takes the startup’s all-time funding to USD 21.7 million, and will support it complete regulatory submissions for its bio-based food dye, Natu.Red, with the European Food Safety Authority (EFSA) and the US Food and Drug Administration (FDA).

- In January 2025, Godrej Agrovet Limited launched Godrej Pride Hog, a scientifically developed pig feed range designed to provide optimal nutrition at each stage of a pig’slifecycle. The range includes Starter, Grower, and Finisher variants, ensuring balanced nutrition for better health, immunity, and growth.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 1.6 Bn |

| Forecast Value (2034) |

USD 2.9 Bn |

| CAGR (2025–2034) |

6.9% |

| The US Market Size (2025) |

USD 0.5 Bn |

| Historical Data |

2019 – 2023 |

| Forecast Data |

2026 – 2034 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Pigment Type (Carotenoids and Other Pigments), By Source (Natural and Synthetic), By Form (Powder and Liquid), By Livestock Application (Poultry, Aquaculture, Swine, and Pet Food), By Function (Color Enhancement and Nutritional & Antioxidant Benefits), By End User (Feed Manufacturers, Integrated Livestock Producers, and Pet Food Producers) |

| Regional Coverage |

North America – US, Canada; Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA |

| Prominent Players |

DSM - Firmenich / Royal DSM N.V., BASF SE, Kemin Industries, Inc., Novus International, Inc., Nutrex NV, D.D. Williamson & Co., Inc. (DDW), Behn Meyer Holding AG, Guangzhou Leader Bio-Technology Co., Ltd., Synthite Industries Ltd., Chr. Hansen Holding A/S, Biorigin, Phytobiotics Futterzusatzstoffe GmbH, Vitafor NV, Innovad AD NV/SA, E.I.D. Parry (India) Ltd., Vidya Herbs Pvt Ltd, Zhejiang NHU Co., Ltd., Kalsec Inc., Cargill, Incorporated, Archer Daniels Midland Company (ADM), and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |

Frequently Asked Questions

The Global Feed Pigment Market size is expected to reach USD 1.6 billion by 2025 and is projected to reach USD 2.9 billion by the end of 2034.

North America is expected to have the largest market share in the Global Feed Pigment Market, with a share of about 36.0% in 2025.

The US Feed Pigment market is expected to reach USD 500 million by 2025.

Some of the major key players in the Global Feed Pigment Market include ADM, BASF, DSM and others

The market is growing at a CAGR of 6.9 percent over the forecasted period.