Market Overview

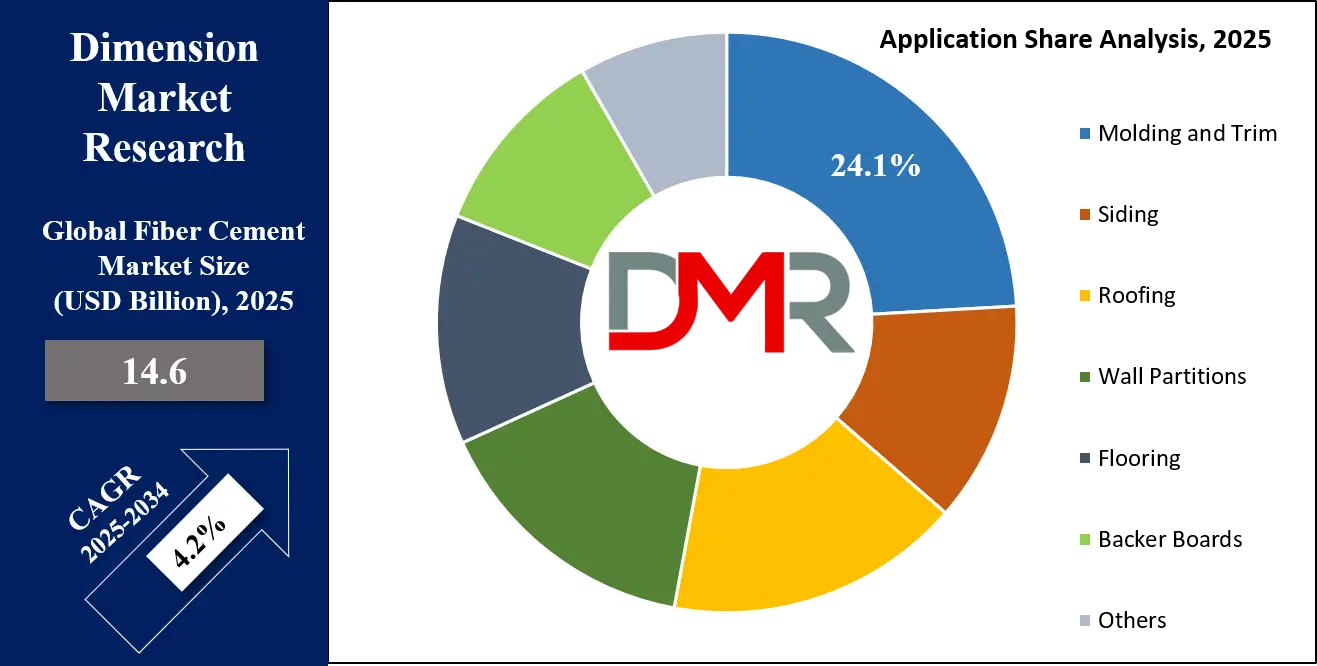

The Global Fiber Cement Market size is expected to be valued at USD 14.6 billion in 2025, and it is further anticipated to reach a market value of USD 21.1 billion by 2034 at a CAGR of 8.1%.

The fiber cement market maintains consistent growth globally because modern builders require performance-oriented, sustainable construction materials that combine durability with use flexibility. Fiber cement material has established itself as an important construction solution because its applications extend to cladding, roofing, and flooring within the industry. Fiber cement products continue gaining popularity due to their ability to resist weather elements and fire, as well as pest and termite attacks, thereby becoming suitable for residential and commercial buildings.

The market expands because sustainability has become a driving force in the construction industry. Building constructors are choosing fiber cement as their leading eco-friendly construction solution because it uses natural materials, including sand, cement, and cellulose fibers. The low-emission properties of fiber cement, together with its increasing demand for green materials in construction, support market expansion. Recycled materials introduced into fiber cement products enhance sustainability features that attract environmentally focused customers, together with businesses.

The fiber cement market shows exceptional growth potential in the Asian-Pacific and Latin American regions because these areas experience rapid urbanization, together with expanding infrastructure, along with growing disposable income levels, which drive up the need for durable building materials. The fiber cement market will expand because of increasing construction activities throughout China, India, Brazil, and Mexico.

Market expansion of fiber cement faces possible barriers from pricing volatility of raw materials and production expenses, and competition from other building materials, including plastics and metals. Construction Technology also plays a crucial role in driving this growth, as advancements in manufacturing processes and innovative installation methods enhance the quality, efficiency, and sustainability of fiber cement products.

Market demand for fiber cement is rising because manufacturers produce advanced products with stronger weather resistance, longer durability, and superior attractiveness. Fiber cement is gaining increasing adoption by commercial and residential buildings that fulfill the requirements for green building and sustainable development certifications.

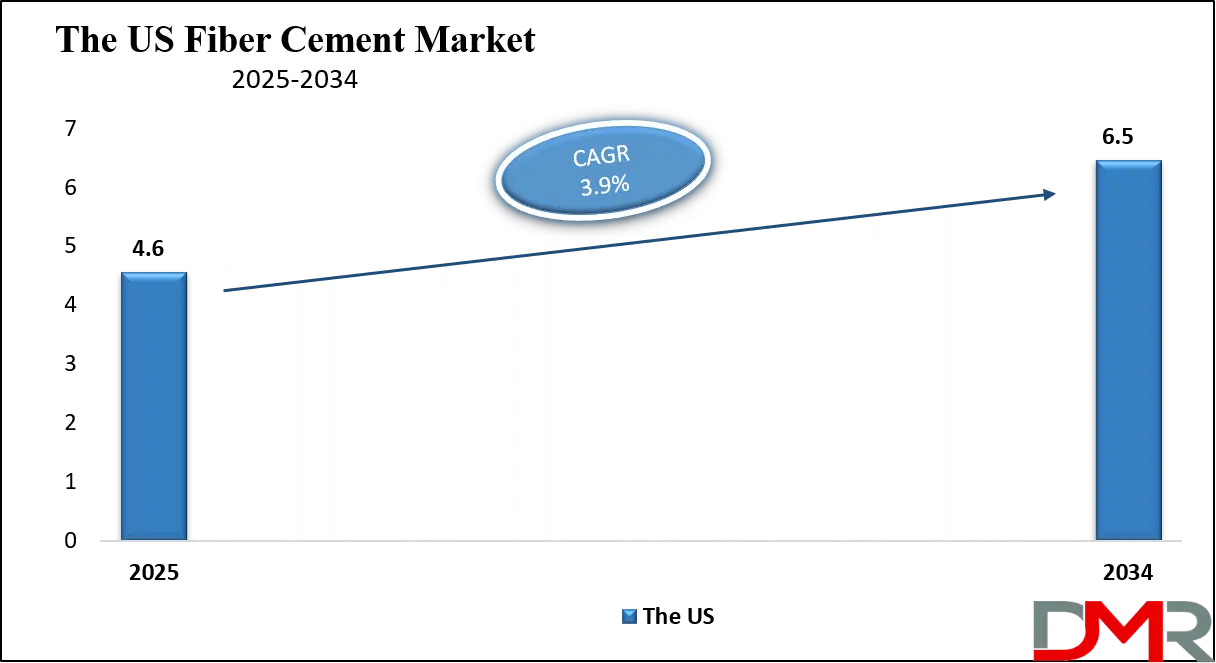

The US Fiber Cement Market

The US Fiber Cement Market is estimated to be valued at USD 4.6 billion in 2025, and projections suggest it will grow to USD 6.5 billion by 2034, at a steady CAGR of 3.9%.

The expansion of the US construction sector led manufacturers to choose fiber cement as their material of preference since it delivers enduring performance alongside fire defense and waterproof capabilities. The growing market preference for attractive, sustainable building materials drives the increased demand for these products. Fiber cement has become the top choice for homeowners and contractors who need siding and cladding materials and roofing elements because this material offers extended durability, together with maintenance-free operations.

Energy-efficient sustainable construction practices, together with growing demand, represent a major market movement in the United States construction sector. Fiber cement and ceramics prove suitable for green building standards because they come with minimal ecological consequences while simultaneously enabling homes to reach their energy efficiency goals. The materials’ resistance against fire and pests, and rot enables their usage in regions with high wildfire and hurricane risks and extreme climate conditions. Products made from fiber cement and ceramic panels, boards, and tiles have experienced increasing demand because modern buildings prioritize sustainable aesthetics with contemporary and clean lines in their designs.

Future US market expansion is expected to continue, but fluctuations in raw materials prices, together with supply chain complications and competition from alternative materials, including aluminum and vinyl, threaten future market development prospects. The fiber cement industry in the US is predicted to sustain a steady growth pattern because of the expanding green building certification movement within the national construction sector.

The European Fiber Cement Market

The European Fiber Cement Market size is estimated to be valued at USD 2.58 billion in 2025, and projections suggest it will grow to USD 3.44 billion by 2034, at a steady CAGR of 3.4%.

Fiber cement market expansion in Europe occurs through increased popularity for sustainable building materials because of rising environmental regulations alongside growing adoption of eco-conscious construction methods. The building sector increasingly relies on fiber cement products in residential applications and commercial ventures, and infrastructure constructions, owing to its strength and fireproof properties as well as its flexibility of use. The demand for fiber cement products continues to rise in Germany and the UK, as well as France and Italy, through their construction sectors, which implement the material for building cladding and roofs and floors, and partition walls.

The European fiber cement market expands because European nations have intensified their dedication to designing sustainable buildings that are also energy-efficient. Fiber cement wins popularity in green building projects because of its eco-friendly characteristics, which are supported by EU regulations such as the Energy Performance of Buildings Directive and the European Green Deal. Organizations commonly select this material due to its power to improve thermal insulation performance, together with its environmentally beneficial life cycle characteristics.

Fiber cement shows excellent performance against moisture exposure alongside its ability to withstand fire as well as weather conditions across the entire European climate spectrum, from cold northern regions to hot Mediterranean areas. European construction projects involving building renovations and refurbishments of historical buildings drive up demand for the market.

The market demand for sustainable building solutions and aesthetic modern design, along with fiber cement evaluation, has become a fundamental growth factors in this domain. The market advancement will occur through product development innovations that concentrate on enhancing thermal performance alongside durability and visual attractiveness of the material.

The Japan Fiber Cement Market

It is expected that the Japan Fiber Cement Market will be valued at USD 880 million in 2025 and is likely to grow to USD 1.20 billion by 2034, registering a CAGR of 4.0%.

Fiber cement commands a vital position in Japan's global market sector because its manufacturing meets both the strong building sector demands for durable, fireproof, and maintenance-free building materials. Fiber cement operates as the top choice for public and private building construction projects because builders use it across cladding systems and roofing elements as well as partition sections. Japan requires building elements able to resist harsh natural conditions because the nation frequently encounters earthquakes and typhoons. The reliability of Fiber cement increases because it withstands heat exposure and extended weather exposure, as well as defending against pest damage.

The construction industry in Japan adopted fiber cement because of its ability to look good with various aesthetic design options. Manufacturers create fiber cement in multiple textures and finishes with diverse colors to match various architectural design requirements from conventional to current styles. Environmental awareness initiatives in Japan’s construction sector have increased fiber cement market demand because the material stands as a favorable sustainable choice against traditional building materials, including wood and vinyl.

The demand for renovation and infrastructure upgrades in an aging Japanese society drives the growth of the fiber cement market. Building renovation projects increasingly use fiber cement because it provides modern building standards through materials with fire protection and extended maintenance-free operation. The Japanese fiber cement market will expand at a mild rate with an anticipated moderate compound annual growth rate during the upcoming years, despite its cost barriers and competition from substitute materials. Ongoing technologies support the market by helping manufacturers build improved fiber cement products with better strength and fire protection, as well as energy efficiency.

Global Fiber Cement Market: Key Takeaways

- The Global Market Share Insights: The Global Fiber Cement Market size is estimated to have a value of USD 14.6 billion in 2025 and is expected to reach USD 21.1 billion by the end of 2034.

- The US Market Share Insights: The US Fiber Cement Market is projected to be valued at USD 4.6 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 6.5 billion in 2034 at a CAGR of 8.0%.

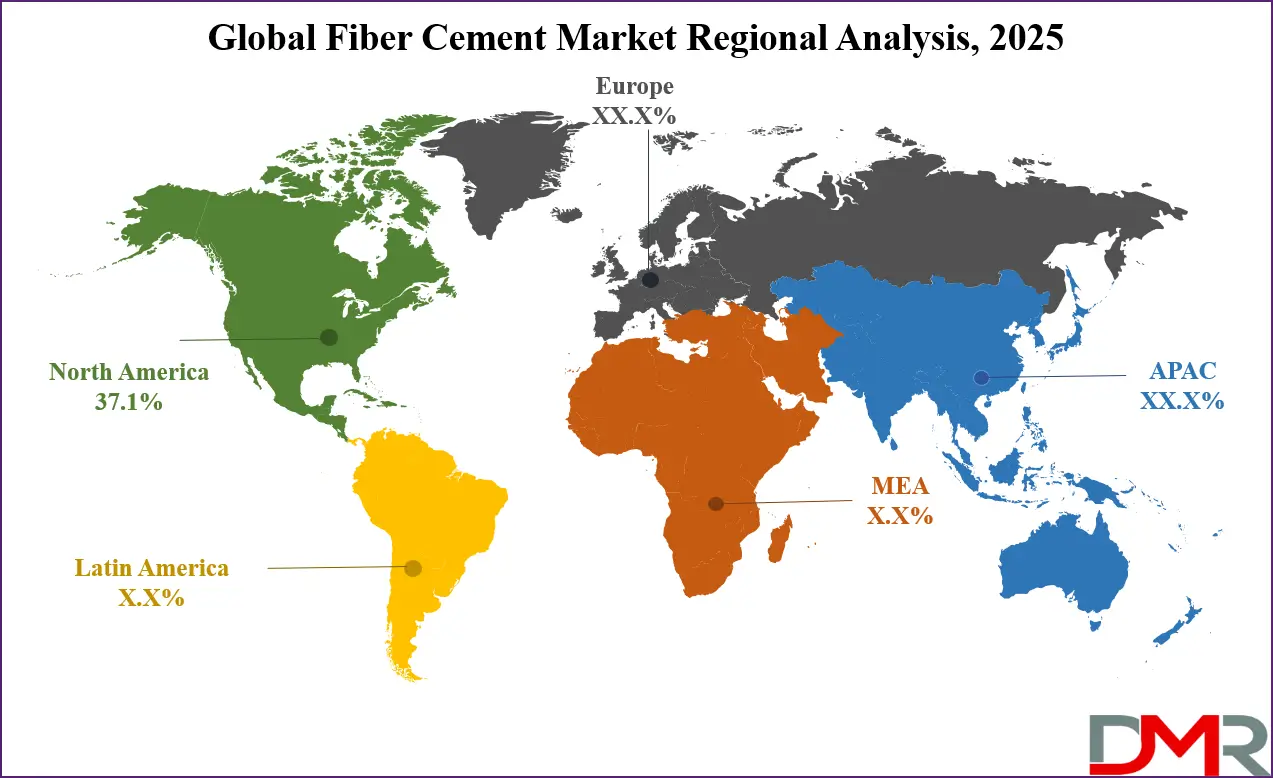

- Regional Insights: North America is expected to have the largest market share in the Global Fiber Cement Market with a share of about 37.1% in 2025.

- Regional Insights: Some of the major key players in the Global Fiber Cement Market are James Hardie, Cemex, Etex, Saint-Gobain, CSR, Nichiha, Allura, Mahaphant, Hume Cemboard, GAF, CNBM, USG, Boral, Pryda, Hindalco, Kraton Polymers, and many others.

- Global Market Growth Rate Insights: The market is growing at a CAGR of 4.2 percent over the forecasted period of 2025.

Global Fiber Cement Market: Use Cases

- Residential Housing: Homeowners apply fiber cement products to residential exterior walls and siding because they deliver durability combined with weather resistance and a choice of different aesthetics. Homeowners appreciate fiber cement because it duplicates wood and stone, and brick appearances with outstanding durability and simple upkeep alongside fireproof characteristics. The extreme climate areas benefit from using fiber cement as a siding material because wood and vinyl struggle to maintain performance in such severe conditions.

- Commercial Buildings: Fiber cement finds its use in commercial buildings for exterior cladding and facades, and partition systems. The material delivers fire protection and long-lasting performance as well as minimal care needs, which attracts builders to use it for public facilities such as offices and shops. The material allows builders to select from various aesthetic designs through color options and texture variations, and finish options, thus making it suitable for contemporary architectural designs.

- Roofing: Fiber cement roofing has become more popular for building roofs in weather-prone areas because it is lightweight yet durable. As an ideal structure material, it ensures complete water resistance and fire security, along with exceptional resistance to physical impacts, which makes it suitable for residential and commercial applications. Fiber cement roofs demonstrate exceptional tolerance to termite infestation and wood rot because of their longevity, together with their resistance to both these sources of damage.

- Industrial Applications: Industrial facilities depend on fiber cement because the material provides superior performance in floorings as well as wall partitions. Fiber cement serves as a dependable choice for factories and warehouses, together with processing plants, because it remains strong against water damage along with chemical exposure as well and physical abrasion. Harsh environmental conditions do not affect fiber cement materials because they offer both durability and low maintenance requirements, which are vital for industrial settings.

- Marine Infrastructure: The increasing use of fiber cement in marine applications has become common because it resists saltwater corrosion and moisture effects, making it suitable for constructing piers and docks as well as other marine elements. The material endures harsh environmental conditions, thereby extending the operational life of marine structures that need minimal maintenance or rebuilding operations.

Global Fiber Cement Market: Stats & Facts

U.S. Energy Information Administration (EIA)

- U.S. Construction Industry: The U.S. construction industry contributed over $1.4 trillion to the country’s GDP in 2020, and fiber cement products are widely used in the residential and commercial sectors.

- Building Materials in the U.S.: According to the U.S. EIA, fiber cement is one of the top materials used in exterior cladding due to its durability and energy efficiency.

European Commission - EU Green Deal

- Sustainability in Construction: The EU Green Deal aims to make Europe the first climate-neutral continent by 2050, promoting the use of sustainable building materials like fiber cement in construction projects.

- EU Renovation Wave: The EU has committed to renovating 35 million buildings by 2030, which will likely increase the demand for durable and eco-friendly materials, including fiber cement.

U.S. Census Bureau

- U.S. Construction Growth: The value of U.S. construction spending was $1.56 trillion in 2020, with fiber cement products becoming more prevalent in residential and commercial sectors due to their durability.

- Fiber Cement Demand: Fiber cement's share of exterior wall coverings in the U.S. has steadily grown, with projections showing it accounting for over 15% of the market by 2025.

U.S. Department of Energy (DOE)

- Energy-Efficient Materials: The DOE recognizes fiber cement as an energy-efficient material in sustainable building practices. It is praised for its insulation properties in reducing heating and cooling costs in residential buildings.

- Building Codes: DOE mandates that new construction projects use energy-efficient materials, and fiber cement complies with these stringent energy-saving regulations.

Australian Bureau of Statistics (ABS)

- Australian Construction Market: Fiber cement has become a preferred material in Australia due to its resilience to harsh weather conditions. The ABS reports a growth rate of 5% annually in the adoption of fiber cement for exterior cladding.

- Sustainable Building: Australia has been pushing for green building certifications, and fiber cement products are frequently used in sustainable projects due to their low environmental impact.

Japan’s Ministry of Land, Infrastructure, Transport, and Tourism (MLIT)

- Building Regulations: In Japan, fiber cement is increasingly adopted for earthquake-resistant building materials due to its durability and ability to withstand extreme weather conditions.

- Market Demand: Post-disasters, the Japanese government’s "Building Recovery and Reconstruction" initiative highlights the increasing use of fiber cement for construction and reconstruction purposes in affected areas.

World Green Building Council

- Sustainable Building Materials: The World Green Building Council advocates for the use of materials like fiber cement in green buildings. Fiber cement is acknowledged for contributing to LEED (Leadership in Energy and Environmental Design) and BREEAM certifications.

- Global Green Building Trends: The adoption of green building materials, including fiber cement, has surged globally, with over 40% of global buildings expected to be "green" by 2030.

U.S. Environmental Protection Agency (EPA)

- Low-Emission Building Materials: Fiber cement is classified as a low-emission material by the EPA due to its composition and minimal environmental impact during production and use.

- Fiber Cement Sustainability: The EPA’s Green Building Program recognizes fiber cement as an eco-friendly option that reduces the carbon footprint of buildings.

Global Cement and Concrete Association (GCCA)

- Sustainable Cement Use: The GCCA reports that fiber cement is increasingly seen as a sustainable alternative to traditional cement products in the construction sector, owing to its ability to lower carbon emissions in construction.

- Cement Production: Fiber cement is made using less energy-intensive materials compared to traditional cement-based products, making it a more sustainable option for the global construction industry.

National Association of Home Builders (NAHB)

- Fiber Cement in U.S. Housing: The NAHB reports that fiber cement is one of the top materials used in residential home exteriors in the U.S., with nearly 15% of new single-family homes in 2020 utilizing fiber cement siding.

- Siding Market Growth: Fiber cement’s share of the siding market in the U.S. has been growing steadily, with estimates indicating that it will surpass 30% by 2025.

U.S. International Trade Commission (USITC)

- Import and Export Trends: The U.S. has become a major importer of fiber cement products, with imports increasing by 10-15% annually due to the rising demand for exterior cladding.

- Global Export Market: U.S. manufacturers of fiber cement products have expanded to international markets, including Canada and Latin America, where demand for durable construction materials is rising.

U.S. Forest Service

- Wood Substitutes: The U.S. Forest Service has recognized fiber cement as an effective substitute for wood in construction, particularly in areas affected by timber shortages and wildfires.

Construction Industry Council of Hong Kong (CIC)

- Hong Kong Construction Trends: Hong Kong’s government has adopted fiber cement in public infrastructure projects due to its resistance to pollution, moisture, and high temperatures.

- Fiber Cement for High-Rise Buildings: Fiber cement is increasingly used in high-rise buildings and skyscrapers in Hong Kong, where fire resistance and material longevity are critical.

Ministry of Housing and Urban Affairs, India

- Housing for All: The Indian government’s "Housing for All" initiative is driving demand for affordable and durable building materials like fiber cement, which is gaining popularity due to its cost-effectiveness.

- Construction Growth: India’s construction industry is growing at a rate of 7-8% annually, with fiber cement being used in residential, commercial, and infrastructural projects.

U.S. Department of Housing and Urban Development (HUD)

- Affordable Housing Initiatives: HUD reports a significant increase in the use of fiber cement for affordable housing projects, given its cost-effectiveness and long-lasting qualities.

- Energy Efficiency in Housing: Fiber cement is used in HUD-funded energy-efficient housing projects due to its insulation and weatherproof properties.

South African Bureau of Standards (SABS)

- Fiber Cement in African Markets: Fiber cement is gaining popularity in South Africa due to its cost-effectiveness in both residential and commercial construction projects.

- Compliance with Standards: SABS certification ensures that fiber cement products meet South Africa's stringent quality and environmental standards.

Indian Ministry of Environment, Forest, and Climate Change (MoEFCC)

- Sustainable Building Materials: The MoEFCC promotes the use of fiber cement in construction due to its reduced environmental impact compared to traditional cement products.

Global Fiber Cement Market: Market Dynamics

Driving Factors in the Global Fiber Cement Market

Rapid Urbanization and Infrastructure Development in Emerging Economies

The regions of Asia-Pacific, Latin America, and Africa experience substantial urban growth in their emerging markets. Numerous urban migrations have resulted in rising requirements for building new housing and infrastructure. The governments of China, India, Brazil, alongside Mexico spend large amounts of money on urban developments to support their expanding populations.

The building markets choose fiber cement because it combines affordability and durability alongside flexible applications. The material serves well for creating housing at all scales while performing excellently for roads and bridges, and commercial building structures. The material stands out because it withstands both fire conditions and moisture intrusion, and harsh weather conditions, thereby making it an excellent option for environmentally challenging regions. Fiber cement stands to benefit from increased urbanization because builders actively seek sustainable construction materials, which will boost the market demand in the coming years.

Affordable housing initiatives launched by government agencies accelerate the adoption of fiber cement because this material offers exceptional reliability at reasonable rates. The market will develop through rising demand because of ongoing urban development and improved accessibility of fiber cement products to customers in developing nations.

Growing Preference for Low-Maintenance and Durable Building Materials

The rising expenses associated with commercial and residential property repairs, as well as replacements, have made business entities and home buyers choose durable and maintenance-free building materials. The building industry now relies on fiber cement as its preferred choice because of its durability properties.

The materials preferred by builders and homeowners who need exterior cladding, siding, roofing parts, or hygienic cladding, because fiber cement stands up to rot and pests, and warping without requiring frequent maintenance efforts. Fiber cement products maintain their value over many decades, past 50 years, which allows property owners to maximize their financial investment.

Fiber cement proves excellent performance across different climates because it demonstrates wide resistance against extreme temperatures and moisture, as well as UV radiation. The focus of consumers on valuable investments creates continuous growth in the fiber cement market demand. Because fiber cement materials enhance home aesthetics while needing minimal care, they continue gaining popularity in residential and commercial spaces. The expanding usage of fiber cement continues because builders and contractors now see long-term advantages in this material when specifying projects for new construction and renovation work around the world.

Restraints in the Global Fiber Cement Market

Volatility in Raw Material Prices

The global fiber cement market faces excessive price volatility as cement, as well as sand and cellulose fibers, exhibit market price fluctuations. The production cost of fiber cement materials is directly affected by price changes in the raw materials that make up the product combination. Market prices of cement as a fiber cement ingredient are affected by supply chain disruptions, along with changing regulatory policies for production and increasing energy costs. The costs of cellulose fibers will vary according to supply-demand dynamics because these fibers derive from wood or agricultural byproducts.

Manufacturers face challenges in estimating costs because of these price fluctuations, which lead to difficulties with setting competitive prices, thereby influencing their profit levels. Companies operating in the fiber cement sector need to establish effective supply chain management and explore different materials or production technologies as solutions to overcome unstable production expenses. The market faces continued hurdles from raw material price volatilities, even though these prices keep changing.

Competition from Alternative Materials

Despite its numerous advantages, the market of fiber cement makes space for competition with alternative construction materials, which include vinyl and aluminum alongside composite products. Due to its affordable nature, vinyl stands out as a suitable yet more budget-friendly substitute against fiber cement siding, while being preferred by those looking to save expenses. Even though vinyl costs less than fiber cement, it lacks the durability characteristics and fire resistance capabilities of this material.

Aluminum, as well as composite materials, find popularity because they are lightweight and easy to install, which brings down labor expenses. Engineering wood, along with manufactured stone materials, aims to deliver fiber cement appearances at reduced operating expenses and superior application performance. The construction industry accepts new materials and technologies, so fiber cement manufacturers need to promote their products through features like durability and low maintenance requirements, and sustainability benefits. The escalating availability of substitute building materials presents a primary market growth barrier that particularly affects cost-conscious geographical areas.

Opportunities in the Global Fiber Cement Market

Expansion in Emerging Markets

Rapid urbanization and industrialization in emerging economies open a substantial growth potential for the global fiber cement market because it establishes higher demands for construction materials. The continuous population increase throughout India, China, Brazil, and Southeast Asian nations enhances the demand for new infrastructure alongside residential and commercial developments. The properties of strength, combined with durability and cost-effectiveness of fiber cement, make it the ideal solution for current market requirements.

National governments throughout developing nations have established new policies that support sustainable construction practices using low-maintenance materials. These sustainability goals embrace the eco-friendly aspects of fiber cement, which include low carbon emissions and recyclability, thus presenting substantial opportunities to penetrate specific markets. Fiber cement stands out as an attractive construction choice in this context because it demonstrates excellent resistance to fire and performs well in extreme weather conditions. The use of fiber cement across various global regions creates substantial business prospects for supply-chain companies aiming to build their international footprint in this market sector.

Adoption of Fiber Cement in Non-Residential Applications

The primary residential applications of fiber cement are generating new growth potential because the material is now gaining momentum in commercial buildings and infrastructure projects, and industrial structures. The exterior cladding and facade, and interior finish requirements for commercial properties, including office buildings and shopping malls, and healthcare facilities, are being met by fiber cement as they find value in its combination of durability and versatility, and aesthetic potential.

Fiber cement becomes the preferred choice for nonresidential buildings because it successfully withstands fire conditions combined with wet conditions and temperature extremes. Major infrastructure projects like bridges alongside roads and tunnels are using fiber cement as their primary material because it offers excellent strength and durability against environmental threats. Urban development complexity brings forth substantial growth opportunities in commercial and industrial applications for which fiber cement suppliers are positioning themselves. Eyeing new markets becomes possible because fiber cement has proved both budget-friendly and suitable for various types of non-residential projects.

Trends in the Global Fiber Cement Market

Increased Demand for Sustainable and Eco-Friendly Construction Materials

The global construction business now adopts sustainable approaches with nature-friendly solutions. The combination of rising customer interest and strengthened building rules regarding carbon emissions pushes the market toward fiber cement usage. Fiber cement stands as the leading material in the environmentally friendly transition of construction materials. Fiber cement production utilizes natural, low-impact components made of cement, sand, along with cellulose fibers that minimize environmental impact better than traditional materials, including wood and vinyl.

Green construction projects find fiber cement appealing because this material enables complete recycling. Manufacturers dedicate their efforts to developing environmentally friendly fiber cement products that satisfy international environmental criteria. Green building certifications like LEED and BREEAM drive European and North American commercial and residential builders toward adopting fiber cement since it enables project requirements compliance. The growing demand for green construction projects selects fiber cement as an optimal choice because of its thermal properties that reduce building energy consumption.

Technological Advancements and Product Innovation

Fiber cement market maturity leads to changes in product development through technological advancements in the industry. The material's performance and usability, and visual appearance receive investments from manufacturers who develop new production methods. The main advancement has been a strengthening of fiber cement against fire damage, along with better protection against water and physical wear and tear.

The development of stronger cellulose fibers serves as an innovation that strengthens fiber cement by enhancing its ability to withstand environmental forces. The aesthetic potential of fiber cement products expanded through manufacturer efforts, which offer a selection of new textures combined with various finishes and colors that imitate natural building elements, including wood and stone, and brick. The product range expansion through innovations enables fiber cement products to meet the needs of modern design-oriented consumers.

The development of lightweight fiber cement solutions offers enhanced installation convenience to contractors and builders who need efficient construction methods. These technological developments, alongside rising market demand for high-performance, stunning, low-maintenance materials, will drive the fiber cement market expansion. Innovation-driven property enhancements keep fiber cement at the top of its competition with vinyl, metal, and composite materials.

Global Fiber Cement Market: Research Scope and Analysis

By Material Analysis

Portland cement is projected to continue to dominate the global fiber cement market as it holds the highest market share by the end of 2025. The global fiber cement market depends on Portland cement because its production foundation and its universal accessibility, along with economical costs, make it dominant. Fiber cement production requires Portland cement as its main binding component, which occupies a large share of material composition while establishing fiber cement durability and strength potential alongside adaptability in products.

Manufacturers find Portland cement appealing because it is easily available in large quantities while being affordable, which enables them to lower the production cost of fiber cement. The numerous applications of Portland cement arise from its ability to work effectively with sand, cellular fibers, and minerals for creating multiple fiber cement products suitable for diverse construction needs.

Portland cement continues its dominance in the industry of fiber cement industry because it has a proven track record in global construction activities. Market acceptance of Portland cement reaches its peak because of its established capability, proving its excellence when it comes to both compression strength capabilities and its ability to resist water damage and environmental conditions.

The reliability of Portland cement leads manufacturers to select it as their primary cement choice because they can produce fiber cement products that fulfill industry standards and customer requirements. Portland cement maintains its market-leading position globally because it creates essential bonding properties that keep fiber cement materials together and structurally sound. This makes Portland cement the dominant choice for residential and commercial building work projects internationally.

By Application Analysis

Molding and trim applications are expected to dominate the fiber cement market with the highest revenue share by the end of 2025. Molding and trim demand outpaces other applications in the fiber cement industry because builders continuously require these materials for their construction projects, both residential and commercial, for their combination of functionality and appearance. The material features that enable fiber cement to serve as an excellent solution for molding and trim applications include its robust performance capabilities with flexible design options.

Modern homes and buildings benefit from fiber cement trim because it protects against water damage, insect infestations, and temperature shocks while still providing attractive appearances that need little upkeep. Due to its strong environmental resistance features, the material needs fewer repairs and replacement cycles, thereby providing substantial long-term cost benefits to users.

Fiber cement gains dominance in molding and trim because homeowners and builders favor decorative architectural designs for their building exteriors. Through molding processes, fiber cement products acquire many realistic forms and surface textures that reproduce wood or stone appearances but provide better durability than these traditional materials. Homeowners, together with architects, find satisfaction in fiber cement designs because they achieve both design excellence and functional durability. The rising trend for decorative construction elements in both residential and commercial spaces effectively raises the market demand for fiber cement trim. The material needs to show resistance to weather conditions since exterior elements frequently affect these elements, which leads to its successful utilization throughout molding and trim applications.

By End Use Analysis

The construction and infrastructure sector is poised to be the dominant end use for fiber cement by the end of 2025. As a leading material choice in construction and infrastructure projects, fiber cement maintains its supremacy in performance and monetary efficiency alongside its wide application flexibility. Builders extensively employ fiber cement products for siding and cladding and roofing, and flooring components in residential and commercial, and public infrastructure projects because these materials showcase remarkable performance values. The product finds exceptional value in construction uses due to its strong ability to resist moisture alongside fire and rot, and pests, all vital features for extreme weather or high humidity environments. Fiber cement proves to be an ideal choice because it provides buildings with extended longevity for exterior walls and other exterior uses.

The multipurpose properties of fiber cement enable its utilization beyond facades by being employed for flooring systems and partition divisions, and various other interior construction parts. Builders favor fiber cement because they can create designs and functional elements of different forms and dimensions to match their project requirements.

Because it delivers both sustainability and environmental benefits over traditional building materials, such as wood or vinyl, fiber cement has gained dominance in sustainable construction. Fiber cement maintains due position as the building material of choice for environmental projects due to its recognition in LEED and BREEAM green standards. The market dominance of fiber cement in construction and infrastructure remains strong because it fits global sustainability objectives for durable, sustainable materials required in growing markets.

The Global Fiber Cement Market Report is segmented on the basis of the following:

By Material

- Portland Cement

- Sand

- Cellulosic Material (Fiber)

- Others

By Application

- Molding and Trim

- Siding

- Roofing

- Wall Partitions

- Flooring

- Backer Boards

- Others

By End Use

- Construction & Infrastructure

- Automotive

- Industrial Applications

- Marine Applications

Global Fiber Cement Market: Regional Analysis

Region with the Highest Market Share in the Global Fiber Cement Market

North America is expected to dominate the global fiber cement market as it commands 37.1% of the total market share in 2025. The fiber cement market leads globally in North America because of its powerful construction sector and continuous growth of sustainable building material usage, along with nationwide green building initiative backing. The United States leads the way as a major market for fiber cement usage because it proves ideal for both domestic and commercial spaces through its strong longevity and easy maintenance, and stylish versatility.

Fiber cement functions as an exceptional exterior building material because it stands up against fire and moisture while resisting pest infestations, which enables its use as cladding and roofing, and siding material in harsh weather environments. The manufacturing sector and distribution network of North America have matured to provide steady access to advanced, high-quality fiber cement products.

Building codes, along with eco-friendly construction practices, strengthen fiber cement market demand since they follow the regional emphasis on sustainable construction practices. The U.S. market is impacted by the rise in renovation projects since fiber cement provides durable and cost-efficient solutions for builders. North America leads as the principal market for fiber cement production globally, supported by these market-molding factors.

Region with the Highest CAGR in the Global Fiber Cement Market

The fiber cement market will experience its most significant advancement through compound annual growth rate (CAGR) in the Asia-Pacific region due to rapid urbanization and industrialization, along with increased infrastructure development across the region. Fiber cement stands out as an ideal choice for building materials among developing countries such as China, India and nations in Southeast Asia because these nations require durable yet cost-effective construction materials.

Fiber cement demonstrates excellent weather resilience while needing minimal upkeep which makes it a highly effective material across different climate zones and fast-growing urban markets throughout the region. The governments throughout India and China, along with other countries, are executing sustainable construction initiatives because fiber cement fits this direction. Green building certifications, along with energy-efficient building trends, strengthen the market expansion in this geographic area. The Asia-Pacific market will experience substantial fiber cement growth because of increasing infrastructure development and residential building requirements, which will give it the highest global expansion rate.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Global Fiber Cement Market: Competitive Landscape

Major established companies and emerging firms actively compete with each other to gain market position worldwide in the fiber cement industry. James Hardie Industries (Australia), together with Saint-Gobain (France) and Etex Group (Belgium), along with CSR Limited (Australia), dominate the market through their strong international reach and their extensive product range and technological advancements capabilities. These companies maintain extensive production facilities along with distribution systems and research and development operations, permitting them to satisfy rising fiber cement product requirements throughout developed economies and emerging markets.

Competitive forces remain strong throughout this market as businesses advance their products through innovative aspects while pursuing environmental excellence and affordable operations for market advantage. The competitive marketplace relies heavily on lightweight fiber cement materials alongside improved finishing capabilities and longer-lasting properties because these elements aid them in market distinction.

Strategic market expansion through mergers and acquisitions, as well as joint ventures and partnerships, represents common competitive methods adopted by major market players. James Hardie, together with Saint-Gobain, has acquired companies to expand their product presence in developing regions. The expanding fiber cement market will maintain its current dominance by leading companies who will also guide smaller businesses toward specialized market sectors and regional territories.

Some of the prominent players in the Global Fiber Cement Market are:

- James Hardie Industries PLC

- Cemex S.A.B. de C.V.

- Etex Group

- Saint-Gobain

- CSR Limited

- Nichiha Corporation

- Allura (Elementia)

- Mahaphant Fibre Cement Public Co. Ltd.

- Hume Cemboard Industries

- GAF Materials Corporation

- China National Building Material Group (CNBM)

- USG Corporation

- Boral Limited

- Pryda Australia

- Hindalco Industries

- Kraton Polymers

- Siam Cement Group

- UACJ Corporation

- Building Materials Corporation of China (BMCC)

- TeknoFiber

- Other Key Players

Recent Developments in the Global Fiber Cement Market

- April 2025: James Hardie Industries launched a new line of sustainable fiber cement siding products designed to meet the highest environmental standards. The new product range features enhanced durability and minimal environmental impact during production, reflecting the company’s commitment to green building practices. The launch also coincides with their push to meet increasing demand for eco-friendly construction materials, particularly in North America and Europe.

- February 2025: Etex Group completed the construction of a state-of-the-art manufacturing facility for fiber cement in India. This new plant is expected to increase production capacity by 25%, addressing the rising demand in the Asia-Pacific region. The facility will focus on producing eco-friendly fiber cement boards and panels, which align with India’s push for sustainable construction solutions.

- January 2025: Saint-Gobain announced the development of a new fiber cement technology that significantly enhances the fire resistance and thermal efficiency of the material. The breakthrough is expected to drive further adoption in both residential and commercial applications, particularly in fire-prone regions across Europe and the U.S. This technological advancement is a direct response to the growing need for resilient, fire-resistant building materials.

- December 2024: CSR Limited entered a strategic partnership with a major construction firm in Southeast Asia to jointly develop new fiber cement products designed specifically for the region’s humid tropical climates. This partnership will allow both companies to tap into the growing demand for sustainable building materials in rapidly urbanizing markets.

- November 2024: Knauf Gips expanded its product portfolio with the introduction of a new range of lightweight fiber cement panels designed for the commercial building sector. These panels are touted for their easy installation and exceptional resistance to environmental wear, making them ideal for high-traffic commercial spaces.

Investments in the Fiber Cement Market

- March 2025: James Hardie Industries announced an investment of $150 million to expand its fiber cement production capacity in North America. The investment will focus on advanced manufacturing technologies to improve efficiency and reduce carbon emissions in production. The move is aligned with the company’s goal to become the leading provider of sustainable construction materials in the region.

- January 2025: Etex Group invested $100 million in the construction of a fiber cement plant in Latin America. The plant will be one of the largest of its kind in the region and will significantly boost Etex’s supply capabilities for high-demand markets in Brazil and Argentina, addressing the growing trend of eco-conscious building in South America.

- October 2024: Saint-Gobain committed $200 million to expanding its fiber cement operations in Southeast Asia. The funds will be directed towards enhancing production capacity in Thailand and Indonesia, two markets seeing rapid urbanization and increasing demand for durable, sustainable building materials.

- July 2024: CSR Limited made a strategic investment of $80 million in developing a new line of advanced fiber cement panels tailored for the Australian market. The product line will focus on providing energy-efficient solutions for residential and commercial buildings in urban areas.

Collaborations in the Fiber Cement Market

- March 2025: Knauf Gips entered into a collaboration with a leading architectural firm in Europe to create a new range of fiber cement façade solutions for the growing commercial real estate sector. The collaboration aims to combine cutting-edge design with the sustainability and durability that fiber cement provides.

- February 2025: Etex Group formed a strategic alliance with an Australian renewable energy provider to launch a joint project aimed at reducing the carbon footprint of fiber cement manufacturing. The collaboration will focus on utilizing renewable energy sources for the production of eco-friendly fiber cement products.

- December 2024: Saint-Gobain partnered with a major North American green building certification organization to promote the use of sustainable fiber cement products in LEED-certified buildings. This collaboration will drive awareness and adoption of high-performance fiber cement solutions that meet stringent environmental standards.

Expos and Conferences in the Fiber Cement Market

- April 2025: The International Green Building Conference (IGBC) 2025 in New York featured a dedicated session on fiber cement’s role in sustainable construction. Industry experts from major manufacturers such as James Hardie and Etex Group discussed innovations in fiber cement technology, highlighting advancements in energy-efficient, fire-resistant, and low-maintenance products. The event attracted professionals from the architecture, construction, and sustainability sectors.

- February 2025: The Asia Pacific Construction Summit 2025 in Singapore saw an increased focus on fiber cement as a key material for green construction. Exhibitors like CSR Limited and Knauf Gips showcased their latest product innovations, including lightweight and energy-efficient fiber cement panels, to cater to the rapidly growing infrastructure needs in Southeast Asia.

- November 2024: The European Building Materials Conference 2024 in Berlin had fiber cement as a key theme, with top companies presenting their advancements in the material’s performance and sustainability. Attendees were introduced to fiber cement’s emerging applications in non-residential sectors, such as commercial and public infrastructure.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 14.6 Bn |

| Forecast Value (2034) |

USD 21.1 Bn |

| CAGR (2025–2034) |

4.2% |

| The US Market Size (2025) |

USD 4.6 Bn |

| Historical Data |

2019 – 2024 |

| Forecast Data |

2026 – 2034 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Material (Portland Cement, Sand¸Cellulosic Material (Fiber), and Others), By Application (Molding and Trim, Siding, Roofing, Wall Partitions, Flooring, Backer Boards, and Others), and By End Use (Construction & Infrastructure, Automotive, Industrial Applications, and Marine Applications) |

| Regional Coverage |

North America – US, Canada; Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA |

| Prominent Players |

James Hardie, Cemex, Etex, Saint-Gobain, CSR, Nichiha, Allura, Mahaphant, Hume Cemboard, GAF, CNBM, USG, Boral, Pryda, Hindalco, Kraton Polymers, Siam Cement, UACJ, BMCC, TeknoFiber, and Everest Industries., and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |

Frequently Asked Questions

The Global Fiber Cement Market size is estimated to have a value of USD 14.6 billion in 2025 and is expected to reach USD 21.1 billion by the end of 2034.

The US Fiber Cement Market is projected to be valued at USD 4.6 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 6.5 billion in 2034 at a CAGR of 8.0%.

North America is expected to have the largest market share in the Global Fiber Cement Market, with a share of about 37.1% in 2025.