Market Overview

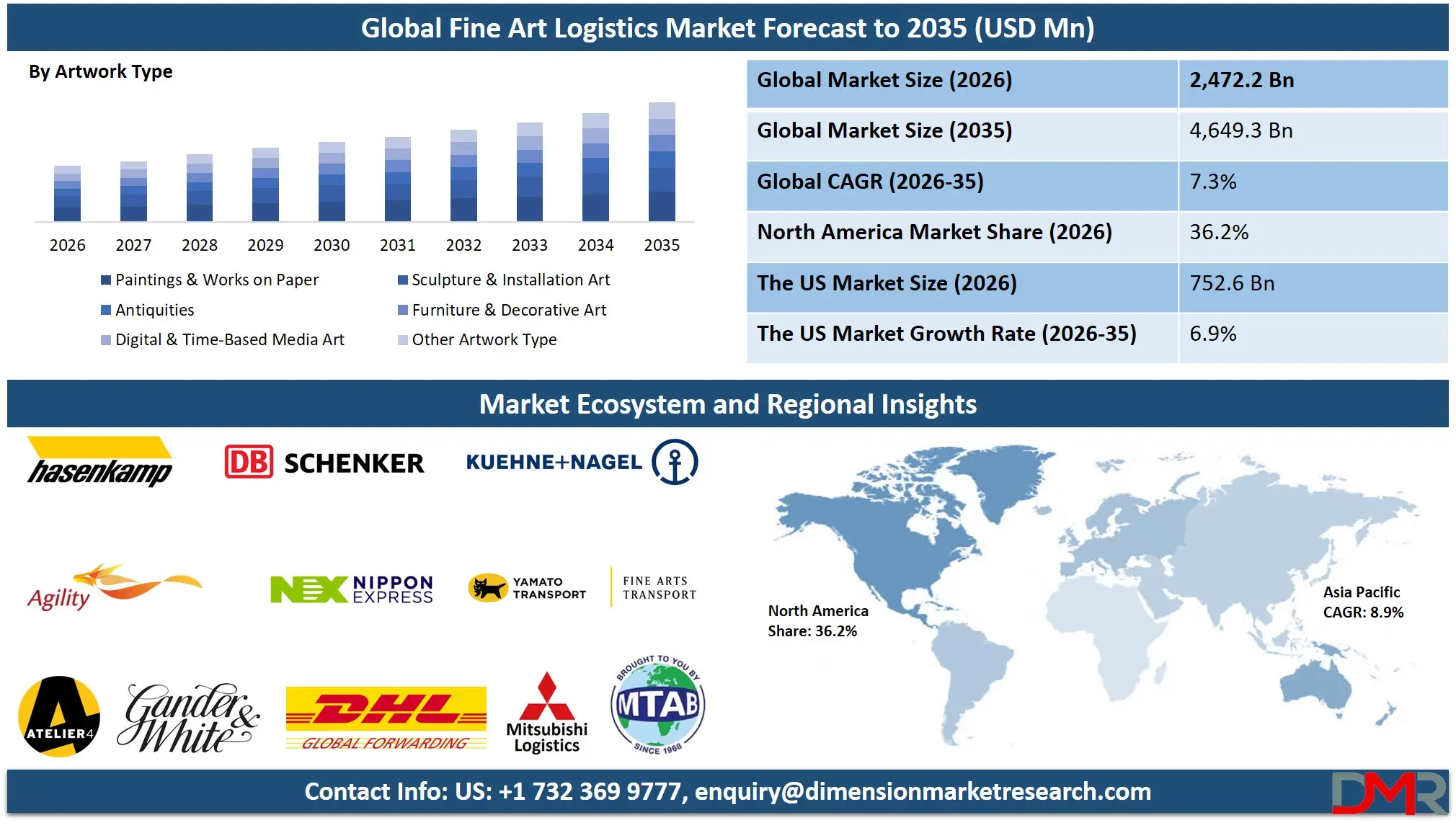

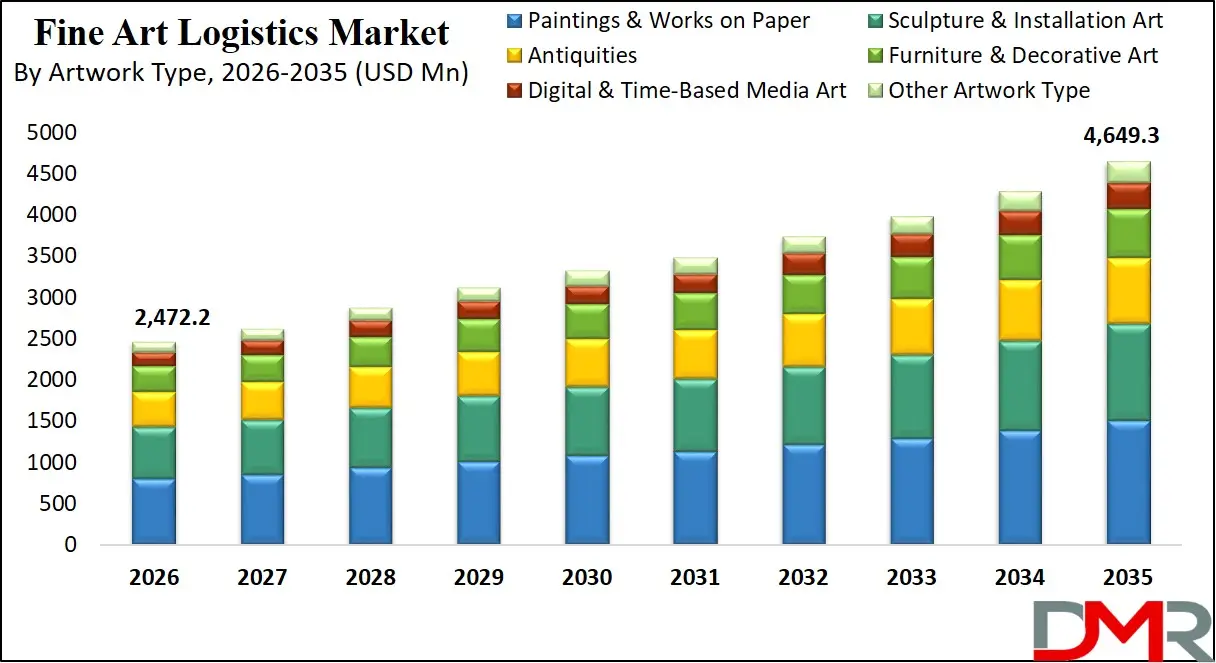

The Global Fine Art Logistics Market is projected to reach USD 2,472.2 million in 2026 and is expected to grow at a CAGR of 7.3% from 2026 to 2035, attaining a value of USD 4,649.3 million by 2035. The market's steady growth is driven by the expanding global art market, increasing number of international art fairs, museum exhibitions, and private collections, combined with the rising demand for specialized, secure, and climate-controlled handling of high-value artworks.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Fine art logistics enables the secure global movement of artworks through specialized climate-controlled transport, custom crating, real-time GPS tracking, and integrated security systems, supporting galleries, auction houses, and collectors in navigating complex international regulations. The model addresses global challenges related to artwork preservation, risk mitigation, and customs compliance, handling over millions of high-value items annually and helping reduce damage and loss through expert handling.

Technological advancements, including IoT-enabled environmental monitoring, blockchain for provenance tracking, AI-driven route optimization, shock and tilt detection sensors, and specialized art handling software, are transforming the market into a highly secure and efficient ecosystem. Integration of machine learning algorithms for risk assessment, insurance valuation, and customs documentation is reshaping operational accuracy.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Growing cultural exchange initiatives, increasing cross-border art loans for exhibitions, and the expansion of art storage facilities in freeports further accelerate global adoption. However, barriers such as high operational costs, stringent customs regulations, geopolitical instability, and specialized skill shortages remain. Despite these limitations, the convergence of digital tracking, security innovation, and sustainable logistics practices positions fine art logistics as a central enabler of global art market growth through 2035.

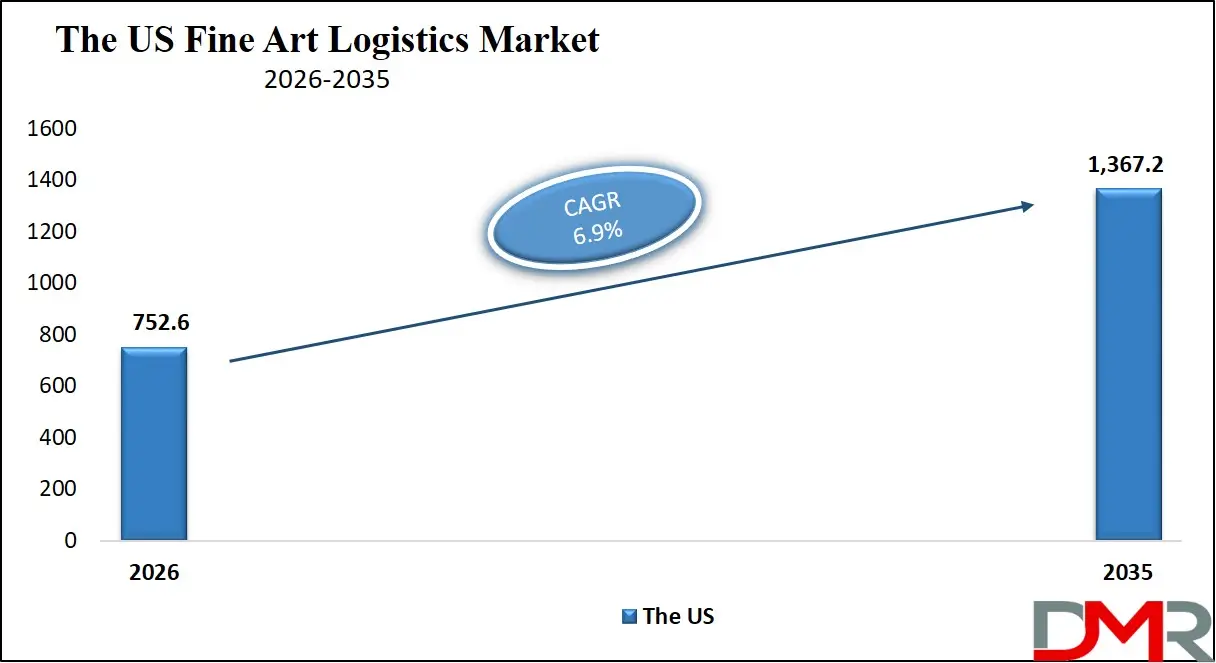

The US Fine Art Logistics Market

The U.S. Fine Art Logistics Market is projected to reach USD 752.6 million in 2026 and grow at a CAGR of 6.9%, reaching USD 1,367.2 million by 2035. The U.S. leads global adoption due to its major auction houses (Sotheby's, Christie's), dense network of museums and galleries, and a robust ecosystem of art fairs and biennales.

More than 40% of global art market sales occur in the U.S., fueling demand for secure transport, storage, and installation services. Institutions such as The Metropolitan Museum of Art, The Museum of Modern Art (MoMA), and The Getty rely on specialized logistics for international exhibitions and acquisitions. Major logistics providers have integrated GPS-tracked climate-controlled vehicles, fine art storage freeports, and white-glove installation teams.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

U.S. market growth is supported by strong insurance frameworks and established customs brokers specializing in art. Meanwhile, initiatives such as dedicated art handling facilities at major airports (JFK, LAX) and the rise of Miami and New York as art hubs reinforce the country's leadership in high-value logistics.

The rapid adoption of blockchain for provenance, AI for condition reporting, and sustainable packaging materials continues to redefine the U.S. fine art logistics landscape, positioning the country as a global leader in art market infrastructure.

The Europe Fine Art Logistics Market

The Europe Fine Art Logistics Market is projected to be valued at approximately USD 980 million in 2026 and is projected to reach around USD 2,850 million by 2035, growing at a CAGR of about 12.6% from 2026 to 2035. Europe's leadership is anchored by historic art trade centers, major museums, and a thriving calendar of international art fairs.

Countries such as the U.K., Germany, France, Switzerland, and Italy have widely adopted specialized logistics, driven by auction houses, museum networks, and tax-advantaged storage in freeports. The EU's cultural heritage regulations and streamlined customs processes for temporary exhibitions support cross-border movement.

Europe's high density of cultural institutions, coupled with the rise of art fairs like Art Basel, Frieze, and TEFAF, drives logistics uptake. Funding through EU cultural programs and national heritage grants supports investment in secure storage, climate-controlled transport, and digital inventory management.

Urban hubs increasingly deploy IoT-monitored storage vaults, dedicated art couriers, and integrated digital dossiers for each artwork. With strong regulatory frameworks, cultural infrastructure, and investment in heritage mobility, Europe remains one of the most advanced regions in fine art logistics.

The Japan Fine Art Logistics Market

The Japan Fine Art Logistics Market is anticipated to be valued at approximately USD 185 million in 2026 and is expected to attain nearly USD 520 million by 2035, expanding at a CAGR of about 13.8% during the forecast period. Japan's strong domestic art market, high density of museums, and growing collector base drive demand for premium handling and storage services.

The Agency for Cultural Affairs and major institutions like the National Art Center, Tokyo, and Mori Art Museum actively support international exhibitions, requiring sophisticated logistics for inbound and outbound masterpieces. Japan's leadership in precision engineering and technology accelerates innovation in vibration-dampened transport, hygrothermal monitoring, and secure packing solutions.

Japan's concept of "Omotenashi" (high-touch hospitality) in logistics, driven by companies like Nippon Express and Yamato Holdings, integrates meticulous handling with digital tracking. Urban regions such as Tokyo and Osaka are deploying dedicated art storage facilities, while regional museums use specialized services for touring exhibitions. Japan's cultural emphasis on preservation and precision, combined with technological advancement, positions the country as a high-growth innovator in fine art logistics.

Global Fine Art Logistics Market: Key Takeaways

- Strong Global Market Growth Outlook: The Global Fine Art Logistics Market is expected to be valued at USD 2,472.2 million in 2026 and is projected to reach USD 4,649.3 million by 2035, showcasing robust expansion supported by rising art market value and international cultural exchanges.

- Steady CAGR Driven by Art Market Expansion: The market is expected to grow at a CAGR of 7.3% from 2026 to 2035, fueled by increasing art fair activity, museum exhibition loans, collector mobility, and demand for secure, high-value transport.

- Strong Growth Trajectory in the United States: The U.S. Fine Art Logistics Market stands at USD 752.6 million in 2026 and is projected to reach USD 1,367.2 million by 2035, expanding at a CAGR of 6.9% due to its dominant art market and advanced logistics infrastructure.

- North America Maintains Regional Leadership: North America is expected to capture approximately 36.2% of the global market share in 2026, supported by its central role in the global art trade, dense museum network, and major auction and fair activity.

- Rapid Advancement in Logistics Technologies: Innovations including IoT environmental sensors, blockchain provenance tracking, AI route optimization, and specialized handling equipment are significantly enhancing the security, efficiency, and transparency of art logistics.

- Growing High-Net-Worth Collector Base Boosts Adoption: Rising global wealth, expansion of private museums, and increasing cross-border art acquisitions are driving sustained demand for specialized logistics, insurance, and storage services.

Global Fine Art Logistics Market: Use Cases

- International Museum Exhibitions: Coordinating the secure transport, customs clearance, and installation of loaned artworks between global institutions for blockbuster exhibitions.

- Art Fair Logistics: Managing the simultaneous movement, storage, and setup of gallery inventories for major international art fairs like Art Basel, Frieze, and TEFAF.

- Private Collector Services: Providing end-to-end solutions including acquisition transport, climate-controlled storage, collection management, and installation for private residences.

- Auction House Fulfillment: Handling pre- and post-sale logistics for auction houses, including collection from sellers, secure storage, viewing coordination, and delivery to buyers worldwide.

- Corporate Art Programs: Supporting corporations in the rotational logistics, installation, and conservation of corporate art collections across global offices.

Global Fine Art Logistics Market: Stats & Facts

UNESCO (United Nations Educational, Scientific and Cultural Organization)

- Global exports of cultural goods doubled in value between 2005 and 2019, reflecting increased cross-border movement of artworks and cultural objects.

- Developed economies accounted for approximately 95% of global cultural services exports.

- Least Developed Countries represented less than 0.5% of global cultural goods trade.

- Visual arts are one of the core categories measured under UNESCO’s cultural goods classification.

- UNESCO’s Framework for Cultural Statistics is used by governments to measure international trade in artworks and cultural objects.

World Customs Organization (WCO)

- In a single global enforcement operation (Operation Pandora), customs and law-enforcement agencies seized over 37,000 cultural objects in one year.

- The same operation involved 23 participating countries, highlighting the global scale of art movement and enforcement.

- Cultural property trafficking cases resulted in 80 arrests worldwide during that operation.

- The WCO identifies cultural goods trafficking as involving tens of thousands of objects annually.

- Cultural heritage seizures account for less than 0.2% of total global customs seizure cases, indicating high value but low volume shipments.

- The WCO operates a dedicated Cultural Heritage Programme to regulate cross-border movement of artworks.

- Export certification systems are recommended by the WCO for lawful movement of fine art and antiquities.

INTERPOL (International Criminal Police Organization)

- INTERPOL records thousands of stolen artworks in its international database at any given time.

- Art and cultural property trafficking is identified as one of the top five illicit trafficking categories by value globally.

- INTERPOL collaborates with customs authorities in over 190 countries on cultural property cases.

UNESCO 1970 Convention on Cultural Property

- The UNESCO 1970 Convention regulates the import, export, and transfer of ownership of cultural property.

- As of recent counts, over 145 countries are signatories to the Convention.

- Signatory countries require export permits for cultural objects, directly impacting fine art logistics procedures.

- The Convention forms the legal basis for customs inspections and repatriation of artworks.

Eurostat (Statistical Office of the European Union)

- Extra-EU exports of cultural goods increased by over 20% year-on-year in 2024.

- Works of art and antiques accounted for approximately 10% of the EU’s extra-EU cultural goods exports.

- The total value of EU extra-EU cultural goods exports exceeded USD 60,000 million equivalent in recent reporting years.

- Cultural goods represent roughly 1% of the EU’s total extra-EU merchandise exports.

- France, Italy, and the Netherlands are among the top EU exporters of works of art.

Global Fine Art Logistics Market: Market Dynamic

Driving Factors in the Global Fine Art Logistics Market

Expansion of the Global Art Market

The continuous growth in art sales, proliferation of art fairs, museum expansions, and rising number of high-net-worth individuals (HNWIs) collecting art are major drivers for fine art logistics. Markets in Asia, the Middle East, and North America are significantly increasing demand for secure international transport and storage. The rise of private museums and corporate collections further fuels need for rotational logistics, climate control, and installation services. Fine art logistics enables safe global mobility, ensuring works move seamlessly across borders with minimal risk. This reduces potential damage, loss, or regulatory delays, addressing critical pain points for galleries, auction houses, and collectors.

Technology and Security Innovation

Fine art logistics benefits heavily from advancements in IoT sensors, blockchain, AI, and specialized handling technologies. Climate and shock monitoring devices, GPS tracking, tamper-evident sealing, and digital condition reporting allow real-time oversight of artworks in transit. Blockchain-based provenance and documentation systems enhance transparency and streamline customs. AI optimizes routing, risk assessment, and resource allocation. These innovations greatly enhance security, accountability, and operational efficiency, making fine art logistics an indispensable component of the global art ecosystem.

Restraints in the Global Fine Art Logistics Market

High Cost and Specialization Barriers

The need for specialized equipment, trained personnel, insurance, and security measures results in significantly higher costs compared to standard freight. This can be prohibitive for smaller galleries, emerging artists, or institutions with limited budgets. Additionally, the limited global pool of certified art handlers and conservators creates capacity constraints during peak seasons like art fair circuits. Geopolitical instability, customs delays, and volatile fuel costs further elevate expenses and complexity, restraining market accessibility for some segments.

Regulatory and Customs Complexity

International art movement faces a patchwork of customs regulations, cultural heritage laws, import/export restrictions, and temporary admission procedures. Varying CITES (Convention on International Trade in Endangered Species) requirements for materials like ivory or rare woods, and differing VAT/tax treatments across jurisdictions create administrative burdens. Inconsistent enforcement and paperwork errors can lead to delays, storage fees, or even seizure. This regulatory maze requires expert brokerage and can slow market growth, especially for new entrants or in emerging art markets.

Opportunities in the Global Fine Art Logistics Market

Growth in Emerging Art Markets

Emerging markets represent major growth opportunities due to rising wealth, new museum projects, and growing collector bases in regions like Asia-Pacific, the Middle East, and Africa. Countries such as China, India, UAE, and Saudi Arabia are investing heavily in cultural infrastructure, driving demand for international art transport, storage, and installation services. Government-led cultural initiatives (e.g., Saudi Arabia's Vision 2030, China's museum boom) create sustained demand. The development of local fine art logistics expertise and freeport facilities in these regions will capture new revenue streams.

Sustainable Logistics Solutions

Increasing focus on environmental, social, and governance (ESG) criteria within the art world is driving demand for green logistics. Opportunities exist for providers offering carbon-neutral shipping options, sustainable packing materials, energy-efficient storage, and optimized multimodal transport to reduce emissions. Collectors and institutions are increasingly selecting partners based on sustainability practices, creating a competitive differentiation avenue for innovators in the sector.

Trends in the Global Fine Art Logistics Market

Digital Integration and Transparency

The sector is increasingly adopting digital platforms for end-to-track traceability. Integrated software solutions manage everything from initial quote and booking to real-time tracking, condition reporting, digital carnets, and electronic delivery proof. This provides unprecedented transparency for clients, reduces paperwork, and minimizes errors. Blockchain is being piloted for immutable provenance and customs documentation, enhancing trust and efficiency in the art supply chain.

Rise of Mega-Storage Facilities and Freeports

The demand for high-security, climate-controlled storage is leading to the development and expansion of dedicated fine art storage freeports and mega-facilities near major art hubs. These facilities offer tax-deferred storage, viewing galleries, conservation services, and logistical hubs for regional distribution. Growth in Geneva, Luxembourg, Singapore, Delaware, and Beijing reflects the trend towards centralized, ultra-secure storage ecosystems that support the holding and trading of high-value assets.

Global Fine Art Logistics Market: Research Scope and Analysis

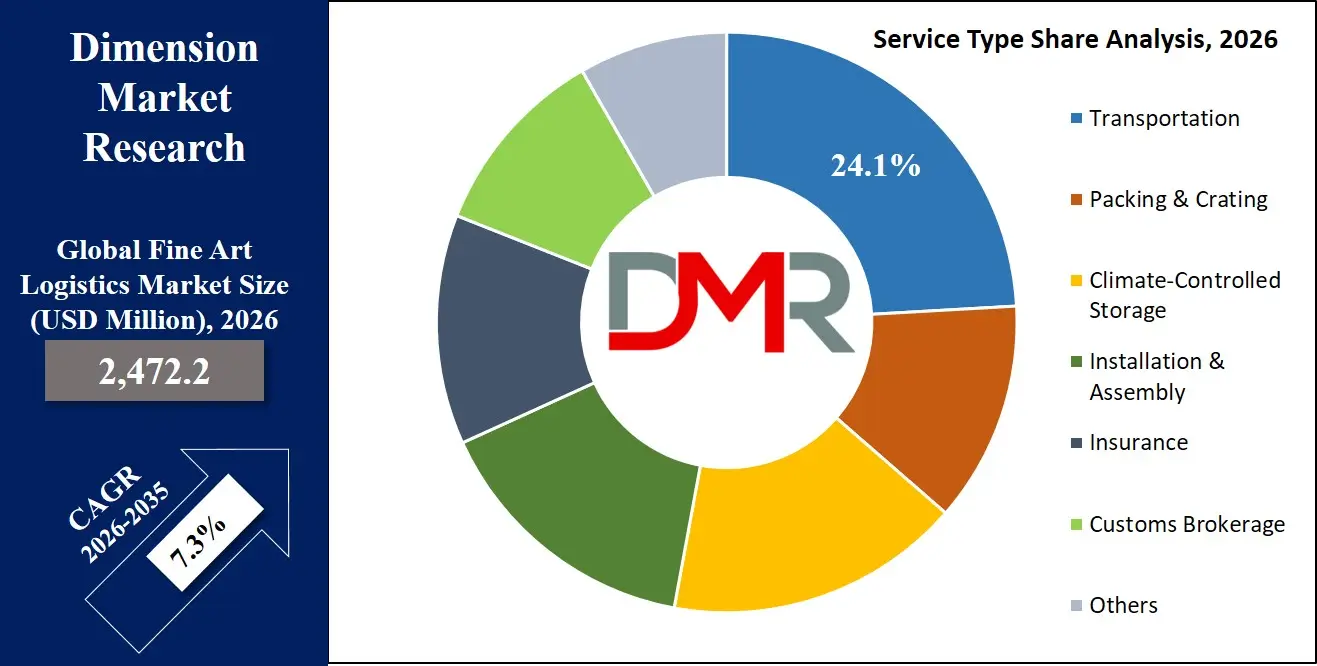

By Service Type Analysis

Transportation is projected to dominate the global market due to being the core, recurring revenue stream within the logistics chain. It encompasses specialized air, sea, road, and rail freight for artworks, requiring climate control, security, and careful handling. The growth of international exhibitions, art fairs, and cross-border sales makes transportation the largest and most essential segment. Multimodal solutions that combine different transport methods for optimal security, speed, and cost are increasingly prevalent. The segment is further strengthened by technological integration (tracking, monitoring) and the continuous globalization of the art market, ensuring its dominant share through 2035.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Packing & Crating ranks as the second-largest service segment due to the critical, non-negotiable requirement for bespoke, conservation-grade packing to prevent damage. Each artwork requires custom-built crates using inert materials, shock absorption, and climate buffering. This service is highly specialized, labor-intensive, and essential for both transit and long-term storage. The rising value of artworks and client risk-aversion drives investment in advanced packing solutions, making it a fundamental and consistently significant part of the market.

By Artwork Type Analysis

Paintings & Works on Paper are poised to be the largest and most dominant segment, accounting for the highest share globally. This category includes old masters, modern, and contemporary paintings, drawings, and prints the most commonly traded and exhibited art forms. Their relative portability (compared to large sculptures or installations) and high volume in the market generate the most frequent logistics demand. The segment's dominance is reinforced by major auction sales, museum loans of paintings, and their prevalence in gallery inventories. Logistics for these works focuses on flat packing, climate control to prevent cracking or fading, and secure framing, ensuring this category retains the largest market share.

Sculpture & Installation Art ranks as the second-largest segment due to the unique and complex handling challenges posed by three-dimensional, often heavy, fragile, or multi-part works. Transporting sculptures requires specialized rigging, custom cradling, and often disassembly/reassembly. The growth of large-scale contemporary installations in exhibitions and fairs drives demand for this niche expertise, making it a critical and high-value application within the market.

By End User Analysis

Museums & Cultural Institutions are anticipated to dominate the fine art logistics market because they are the primary organizers of international exhibitions, permanent collection loans, and new acquisitions. They operate with stringent conservation and security standards, requiring the highest level of logistics service. Museums function as the central hub for complex projects involving multiple artworks, customs carnets, and coordination with other institutions. Their long-term planning cycles and institutional budgets make them stable, high-value clients, cementing their position as the largest end-user segment.

Commercial Galleries & Auction Houses are the second-largest end-user segment due to their fast-paced, transactional nature. They require rapid, reliable logistics for art fairs, client viewings, pre- and post-sale movements, and inventory redistribution. Auction houses like Sotheby's and Christie's move billions in value annually, relying on a network of preferred logistics partners. This segment drives demand for flexible, scalable services and is highly sensitive to speed and discretion, ensuring its major role in the market.

The Global Fine Art Logistics Market Report is segmented on the basis of the following:

By Service Type

- Transportation

- Air Freight

- Sea Freight

- Road Freight

- Rail Freight

- Packing & Crating

- Climate-Controlled Storage

- Installation & Assembly

- Insurance

- Customs Brokerage

- Others

By Artwork Type

- Paintings & Works on Paper

- Sculpture & Installation Art

- Antiquities

- Furniture & Decorative Art

- Digital & Time-Based Media Art

- Other Artwork Type

By End User

- Museums & Cultural Institutions

- Commercial Galleries & Auction Houses

- Private Collectors

- Corporate Collections

- Artists & Estates

- Art Fairs & Biennials

Impact of Artificial Intelligence in the Global Fine Art Logistics Market

- IoT for Environmental Monitoring: IoT sensors continuously track and report temperature, humidity, light exposure, shock, and tilt within transit vehicles and storage units. This ensures artworks remain within conservation parameters, provides proof of care, and enables proactive intervention.

- Blockchain for Provenance & Customs: Blockchain creates immutable, shared records of an artwork’s ownership history, condition reports, and customs documentation. This streaminks clearance, enhances transparency, and reduces fraud, facilitating smoother international movements.

- AI for Route & Risk Optimization: AI algorithms analyze variables like weather, traffic, political stability, and carrier performance to recommend the safest, most efficient, and cost-effective transport routes. It also assesses overall shipment risk for pricing and insurance.

- Advanced Tracking & Security Systems: Integrated systems use GPS, RFID, and cellular connectivity for real-time location tracking, combined with tamper-evident seals and remote immobilization features on vehicles to prevent theft and ensure chain of custody.

- Digital Condition Reporting & Dossiers: Mobile apps and cloud platforms allow for detailed digital condition reports with high-resolution photos and notes at every handoff point. This creates a permanent, accessible record for all stakeholders, minimizing dispute.

Global Fine Art Logistics Market: Regional Analysis

Region with the Largest Revenue Share

North America is projected to dominate the Global Fine Art Logistics Market with 36.2% of the total market share by the end of 2026, driven by its position as a major hub for high-value art trade, world-leading auction houses, and a dense concentration of museums and private collectors. The United States, in particular, hosts globally influential institutions such as The Metropolitan Museum of Art, MoMA, and the Getty, which engage in continuous international loans and exhibitions, generating sustained demand for specialized logistics services.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The region benefits from highly developed networks of fine art logistics providers, advanced customs brokerage expertise, and secure storage facilities. North America’s leadership in art insurance, climate-controlled warehousing, and high-security transportation further strengthens its market position, while strong transatlantic trade links reinforce its global logistics dominance.

Region with the Highest CAGR

Asia-Pacific holds the highest CAGR and is poised to achieve significant market share growth in fine art logistics due to its explosive art market growth, rising number of HNWIs, and massive investment in cultural infrastructure. The region accounts for a rapidly growing share of global auction sales, with Hong Kong, Shanghai, and Singapore as key hubs.

Asia-Pacific faces a growing need for international-standard logistics to support its burgeoning museums, galleries, and fairs (e.g., Art Basel Hong Kong, Taipei Dangdai). Government cultural policies in China, Singapore, and South Korea are driving imports and exports of art. While local expertise is developing, the current reliance on international logistics partners and the sheer scale of market growth will propel the region to the highest CAGR during the forecast period.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Global Fine Art Logistics Market: Competitive Landscape

The Global Fine Art Logistics Market is moderately fragmented, featuring a mix of global freight forwarders with specialized art divisions, dedicated fine art logistics firms, and integrated service providers. Leading global logistics giants DB Schenker, Kuehne + Nagel, DHL (via its Specialty Logistics division), and Agility leverage their vast networks to offer art logistics, often through dedicated business units.

Dedicated fine art shipping leaders such as Crozier Fine Arts, Hasenkamp, Momart, Gander & White, and Atelier 4 dominate the high-touch, premium service segment with expertise in handling, packing, and installation. Storage specialists like Natural Le Coultre (Geneva Freeport) and Arcis are key players in the high-security storage segment.

Technology-focused innovators and service expanders such as CargoTec, 4ARTechnologies, and Convelio are influencing the market with digital platforms, blockchain solutions, and online quoting tools. The competitive landscape is defined by expertise, security reputation, global reach, and technological capability.

Some of the prominent players in the Global Fine Art Logistics Market are:

- DB Schenker Art Logistics

- Kuehne + Nagel Art Logistics

- DHL Global Forwarding (Specialty Logistics)

- Agility Logistics

- Crozier Fine Arts

- Hasenkamp

- Momart Ltd.

- Gander & White

- Atelier 4

- MTAB (Mitsubishi Logistics Art Transportation)

- Nippon Express Fine Arts Division

- Yamato Fine Art Transport

- Arcis

- Natural Le Coultre

- Transperfect Art Solutions

- Convelio

- 4ARTechnologies

- Other Key Players

Recent Developments in the Global Fine Art Logistics Market

- November 2026: Crozier Fine Arts opens mega-facility in New York

Crozier inaugurated a new 150,000 sq ft, state-of-the-art fine art storage and logistics hub in Brooklyn. The facility features high-density vaults, conservation studios, and dedicated packing areas, strengthening its service capacity for the North Eastern US art market.

- October 2026: DHL launches blockchain-based art tracking platform

DHL Global Forwarding unveiled a new blockchain platform in partnership with a major tech firm, providing end-to-end provenance tracking and digital documentation for fine art shipments, enhancing transparency and customs efficiency.

- September 2026: Hasenkamp secures major museum consortium contract

Hasenkamp was awarded a multi-year logistics contract by a consortium of major German museums to manage all international exhibition transports, highlighting the trend towards institutional outsourcing and partnership.

- August 2026: Arcis expands Singapore Freeport capacity

Arcis announced a 40% expansion of its high-security, climate-controlled vault space within the Singapore Freeport, responding to growing demand from Asian collectors and institutions for tax-efficient storage.

- July 2026: Convelio partners with major online auction platform

Convelio, a digital fine art logistics platform, formed an exclusive partnership with a leading online auction house to provide integrated, instant shipping quotes and booking for buyers, streamlining the post-purchase experience.

- June 2026: New EU regulations streamline art temporary import

The European Union implemented updated simplified procedures for the temporary import of artworks for exhibition, reducing bureaucracy and expected to boost intra-European fine art logistics volume by an estimated 15%.

- May 2026: Momart launches sustainable shipping initiative

Momart introduced a "Green Gallery" program, offering carbon-neutral shipping options and sustainable packing materials to gallery clients, aligning with the art world's increasing ESG focus.

Report Details

| Report Characteristics |

| Market Size (2026) |

USD 2,472.2 Mn |

| Forecast Value (2035) |

USD 4,649.3 Mn |

| CAGR (2026–2035) |

7.3% |

| The US Market Size (2026) |

USD 752.6 Mn |

| Historical Data |

2020 – 2025 |

| Forecast Data |

2027 – 2035 |

| Base Year |

2025 |

| Estimate Year |

2026 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Service Type (Packing & Crating, Climate-Controlled Storage, Installation & Assembly, Insurance, Customs Brokerage, And Others), By Artwork Type (Paintings & Works On Paper, Sculpture & Installation Art, Antiquities, Furniture & Decorative Art, Digital & Time-Based Media Art, And Other Artwork Types), and By End User (Museums & Cultural Institutions, Commercial Galleries & Auction Houses, Private Collectors, Corporate Collections, Artists & Estates, And Art Fairs & Biennials) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA |

| Prominent Players |

DB Schenker Art Logistics, Kuehne + Nagel Art Logistics, DHL Global Forwarding (Specialty Logistics), Agility Logistics, Crozier Fine Arts, Hasenkamp, Momart Ltd., Gander & White, Atelier 4, MTAB (Mitsubishi Logistics Art Transportation), Nippon Express Fine Arts Division, Yamato Fine Art Transport, Arcis, Natural Le Coultre, TransPerfect Art Solutions, Convelio, and 4ARTechnologies., and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users) and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |

Frequently Asked Questions

How big is the Global Fine Art Logistics Market?

▾ The Global Fine Art Logistics Market size is estimated to have a value of USD 2,472.2 million in 2026 and is expected to reach USD 4,649.3 million by the end of 2035.

What is the growth rate in the Global Fine Art Logistics Market?

▾ The market is growing at a CAGR of 7.3 percent over the forecasted period of 2026 to 2035.

What is the size of the US Fine Art Logistics Market?

▾ The US Fine Art Logistics Market is projected to be valued at USD 752.6 million in 2026. It is expected to reach USD 1,367.2 million in 2035 at a CAGR of 6.9%.

Which region accounted for the largest Global Fine Art Logistics Market?

▾ North America is expected to have the largest market share in the Global Fine Art Logistics Market with a share of about 36.2% in 2026.

Who are the key players in the Global Fine Art Logistics Market?

▾ Some of the major key players in the Global Fine Art Logistics Market are DB Schenker Art Logistics, Kuehne + Nagel Art Logistics, DHL Global Forwarding, Crozier Fine Arts, Hasenkamp, Momart Ltd., and many others.