Market Overview

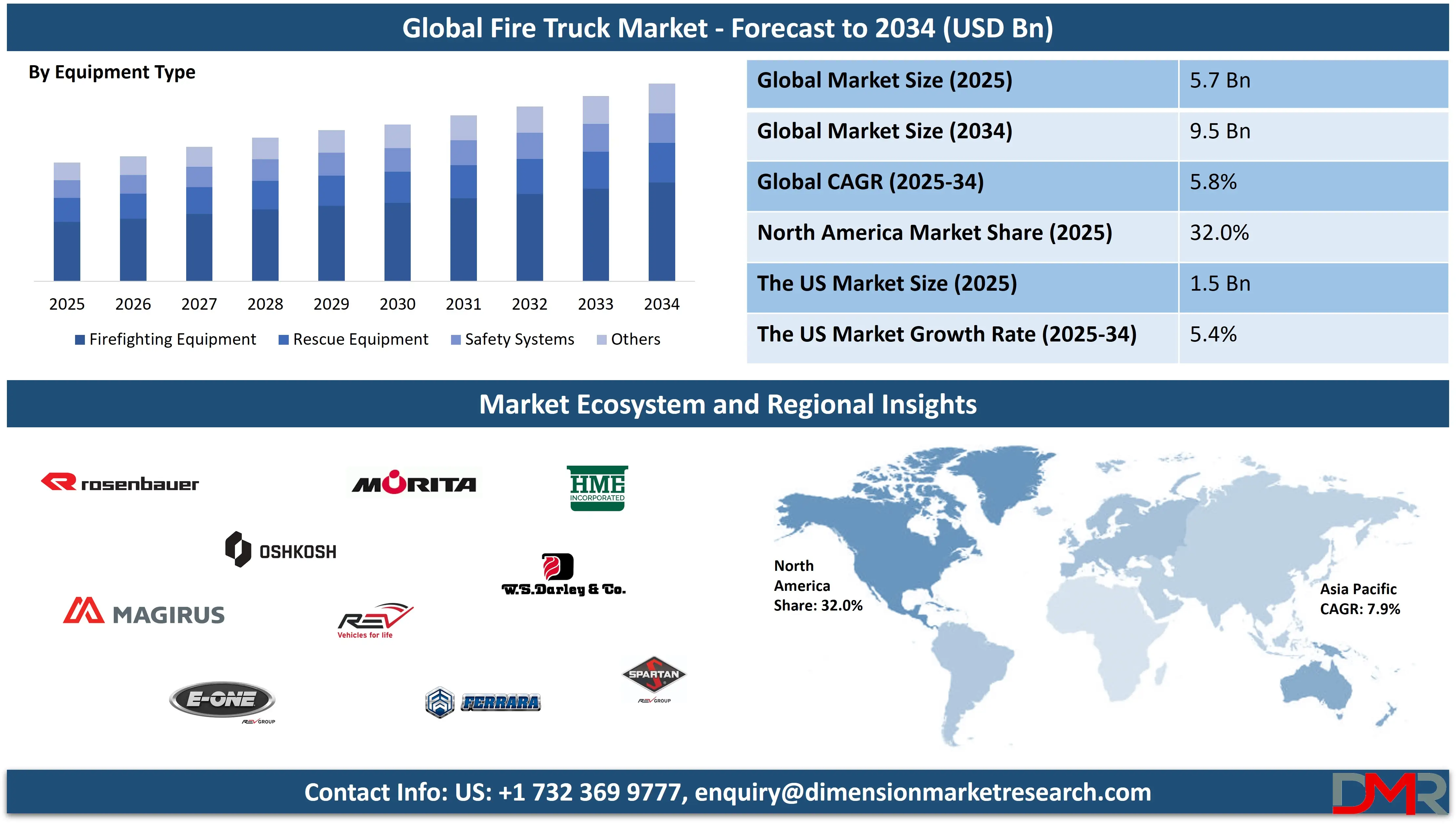

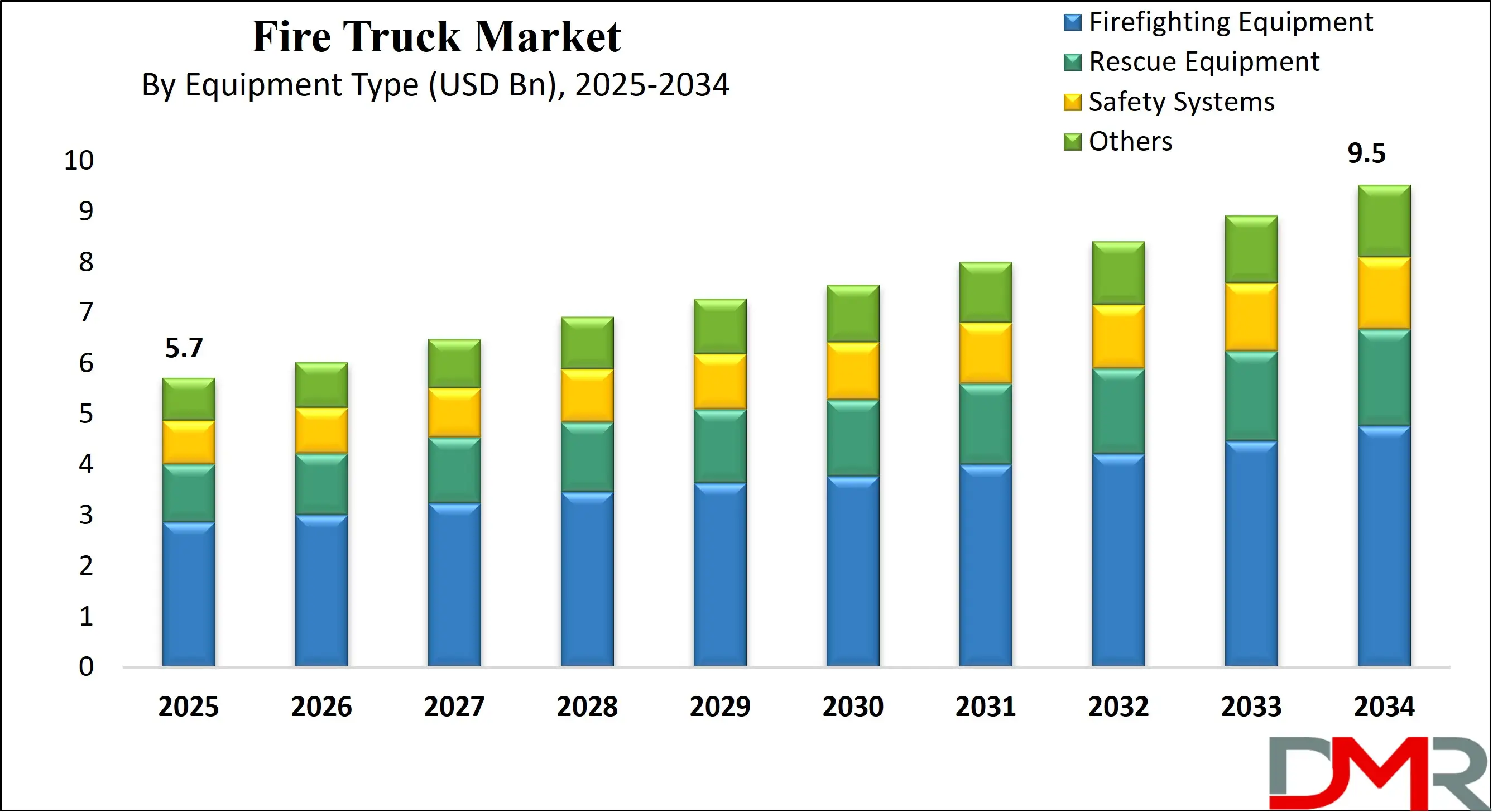

The Global fire truck market is projected to reach USD 5.7 billion by 2025 and is expected to grow to USD 9.5 billion by 2034, expanding at a CAGR of 5.8%. Growth is driven by rising demand for advanced firefighting vehicles, growing urban fire safety regulations, and modernization of emergency response fleets. Key trends include the adoption of electric fire trucks, integration of smart safety systems, and expanding deployment across municipal, industrial, and airport fire services.

A fire truck, also referred to as a fire engine or firefighting apparatus, is a specialized vehicle designed primarily for firefighting operations and emergency response. Equipped with water pumps, hoses, ladders, and various rescue tools, fire trucks serve as mobile command centers during emergencies.

Depending on the model and use case, these vehicles may also include onboard water tanks, foam systems, breathing apparatus, thermal imaging cameras, and hydraulic rescue equipment to support complex firefighting and rescue missions. Some fire trucks are configured for specific tasks such as aerial rescue, hazardous material handling, or wildland fire suppression, making them critical assets for municipal fire departments, industrial facilities, airports, and defense sectors.

The global fire truck market represents a crucial segment within the broader emergency response and public safety industry, driven by the rising incidence of fire-related emergencies, urbanization, and stricter safety regulations globally. Increasing infrastructure development and industrialization in emerging economies are prompting governments to invest in advanced firefighting fleets, while smart city initiatives are pushing the adoption of technologically advanced fire engines equipped with telemetry, GPS, and real-time communication tools. Municipalities across developed regions are also focusing on the replacement of aging fleets with eco-friendly and more efficient vehicles, further contributing to the market’s growth momentum.

In addition to growing urban risk factors, the market is being influenced by evolving vehicle technology, such as electric and hybrid fire trucks, which are gaining traction in Europe and North America due to sustainability mandates. Furthermore, innovations like high-reach aerial platforms, rapid intervention vehicles, and AI-enabled fire suppression systems are reshaping fleet procurement strategies across defense and industrial sectors.

Regional fire truck manufacturers are also expanding their global footprint by forming strategic partnerships and engaging in joint ventures, reflecting a more competitive and consolidated landscape. As a result, the global fire truck market continues to evolve, offering increased operational versatility and integration with modern emergency management systems.

The US Fire Truck Market

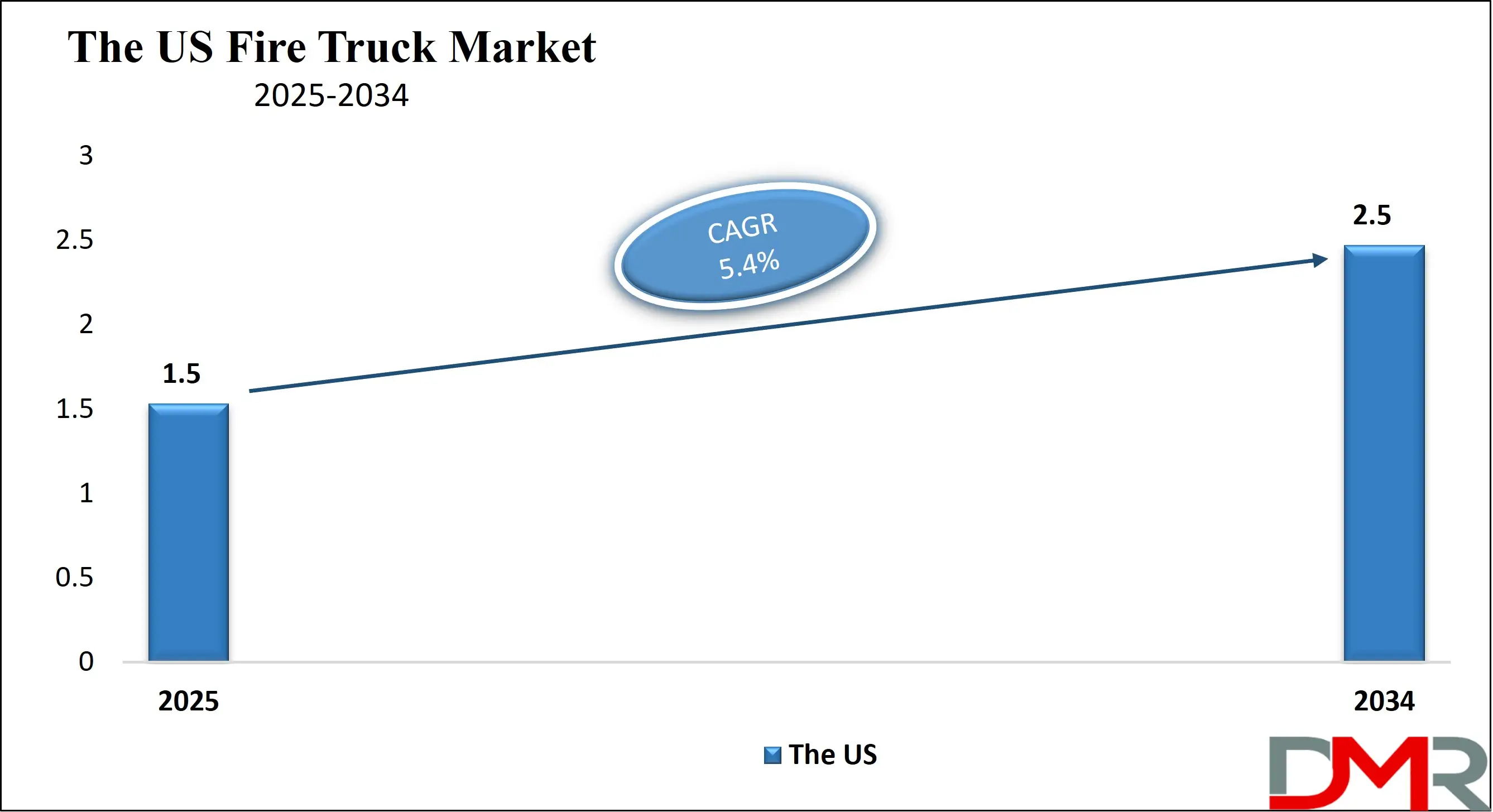

The U.S. Fire Truck Market size is projected to be valued at USD 1.5 billion in 2025. It is further expected to witness subsequent growth in the upcoming period, holding USD 2.5 billion in 2034 at a CAGR of 5.4%.

The United States fire truck market holds a dominant position in the global landscape, driven by a robust network of municipal fire departments, advanced infrastructure, and stringent fire safety regulations. With thousands of urban and rural fire stations across the country, the demand for high-performance firefighting vehicles remains consistently strong. American fire truck manufacturers focus on producing pumper trucks, ladder trucks, aerial platforms, and rescue apparatus tailored for specific emergency scenarios.

These fire engines are often equipped with cutting-edge features such as high-capacity water pumps, compressed air foam systems, thermal imaging technology, and NFPA-compliant safety systems. Fleet modernization efforts, along with federal and state funding for public safety infrastructure, continue to fuel the adoption of technologically advanced fire rescue vehicles across U.S. cities, suburbs, and industrial zones.

In recent years, the U.S. has also seen a shift toward incorporating electric fire trucks and hybrid drive systems, especially in eco-conscious municipalities like Los Angeles and New York. Demand is growing for multifunctional apparatus that can perform in congested urban environments, wildland firefighting operations, and hazardous material incidents. Specialty fire trucks such as ARFF (Aircraft Rescue and Firefighting) units are also gaining traction at major airports due to FAA safety mandates.

The presence of leading manufacturers like Pierce Manufacturing, E-ONE, and Spartan Emergency Response has enabled the U.S. to set high industry benchmarks in both equipment innovation and emergency vehicle design. As smart city initiatives expand, the integration of GPS tracking, real-time diagnostics, and digital communication systems in fire engines is expected to further enhance the effectiveness of the country’s emergency response capabilities.

The Europe Fire Truck Market

The Europe fire truck market is projected to be valued at approximately USD 1.4 billion in 2025, making it one of the key regions in the global firefighting vehicle industry. This substantial market size reflects the region's strong emphasis on public safety infrastructure, rigorous enforcement of fire safety regulations, and steady government investments in modernizing emergency response fleets.

Major countries such as Germany, France, the UK, and the Nordics are leading the charge with ongoing upgrades to municipal fleets, integration of smart technologies, and growing deployment of multifunctional fire apparatus. Additionally, Europe's advanced manufacturing base, with key players like Rosenbauer and Magirus GmbH, provides a competitive advantage in both innovation and localized supply.

With an estimated CAGR of 5.5% through 2034, the European fire truck market is expected to experience stable and sustained growth. This trajectory is largely supported by the region’s strong push toward sustainability, including the growing adoption of electric and hybrid fire trucks in urban centers. EU climate policies and carbon-neutral goals are further accelerating the shift toward eco-friendly emergency vehicles, particularly in cities with green mobility mandates.

Moreover, rising concerns over wildfire management in Southern and Eastern Europe, integrated with increased airport safety measures and industrial fire preparedness, are contributing to the demand for specialized fire apparatus. As a result, Europe continues to evolve as a forward-thinking and regulation-driven market for next-generation firefighting solutions.

The Japan Fire Truck Market

Japan’s fire truck market is projected to reach approximately USD 300 million in 2025, reflecting its steady position within the global emergency response vehicle landscape. While smaller in absolute terms compared to regions like North America or Europe, Japan’s market is characterized by its high standards of vehicle quality, technological innovation, and consistent replacement cycles.

The country’s dense urban infrastructure demands compact, maneuverable fire trucks equipped with precision technology to navigate tight spaces and high-rise environments. Japanese manufacturers, led by firms like Morita Holdings Corporation and Isuzu Motors, focus on building highly customized vehicles that meet stringent safety, operational, and environmental standards. Municipal fire departments across the nation routinely invest in new apparatus to maintain rapid response capabilities and uphold disaster preparedness in the face of risks such as urban fires, industrial accidents, and natural disasters like earthquakes.

With a projected CAGR of 4.8% through 2034, the Japanese fire truck market is expected to grow at a stable pace, driven by factors such as increased attention to aging fleet replacement and investments in smart firefighting solutions. As Japan continues to prioritize urban safety and resilience, there is a rising interest in integrating digital technologies, telematics, and eco-efficient propulsion systems into fire apparatus.

While electric fire trucks are still in their early adoption phase, Japan’s commitment to low-emission transportation aligns with the gradual shift toward more sustainable emergency vehicles. Furthermore, as the country expands its airport and industrial safety infrastructure, demand for specialized units like ARFF (Aircraft Rescue and Firefighting) trucks is expected to increase, supporting long-term growth in both public and private sector applications.

Global Fire Truck Market: Key Takeaways

- Market Value: The global fire truck market size is expected to reach a value of USD 9.5 billion by 2034 from a base value of USD 5.7 billion in 2025 at a CAGR of 5.8%.

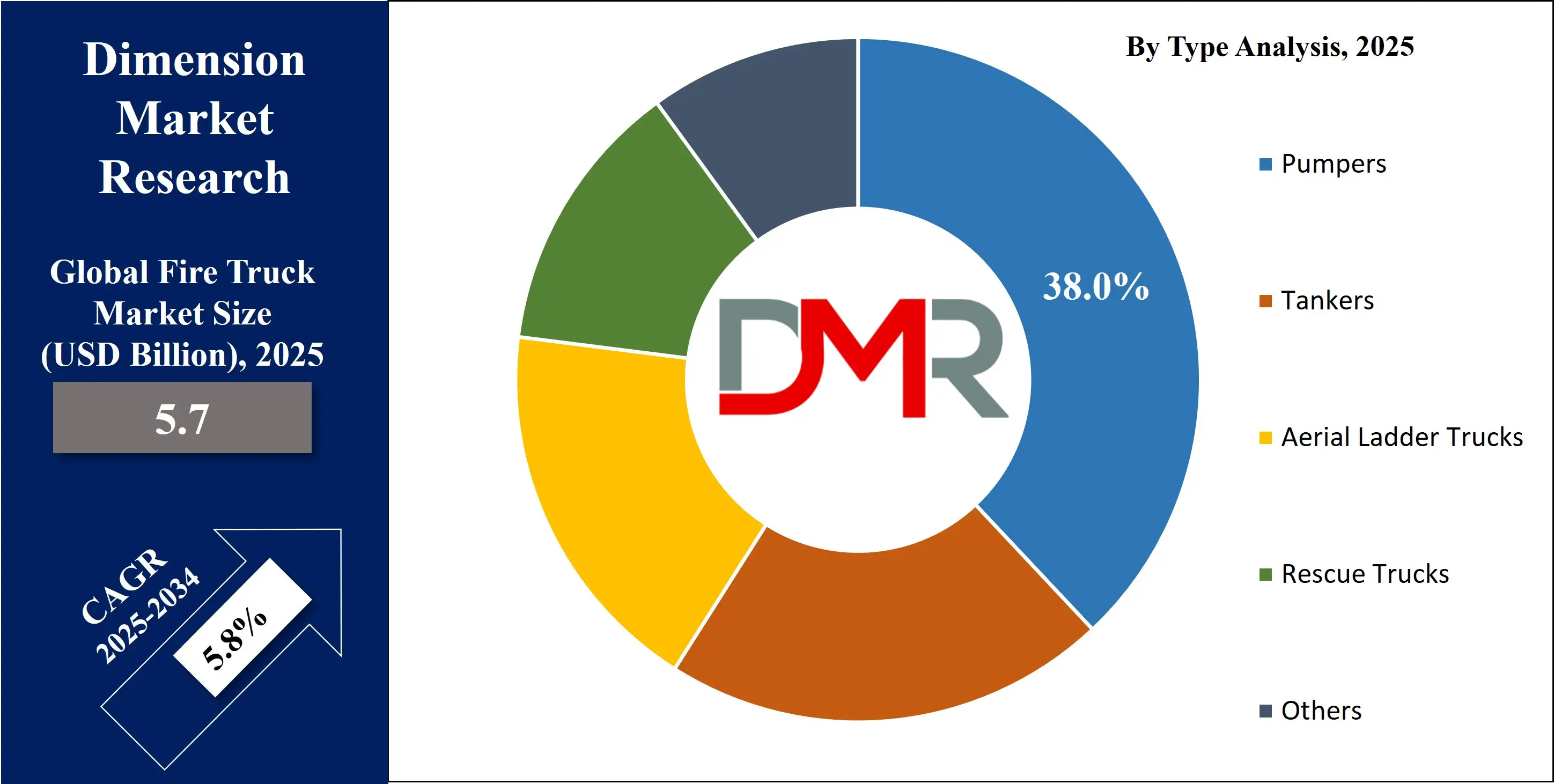

- By Type Segment Analysis: Pumpers are anticipated to dominate the type segment, capturing 38.0% of the total market share in 2025.

- By Drive Type Segment Analysis: 4x2 type is poised to consolidate its dominance in the drive type segment, capturing 39.0% of the total market share in 2025.

- By Power Output Segment Analysis: 250–500 HP trucks are expected to maintain their dominance in the power output segment, capturing 56.0% of the total market share in 2025.

- By Propulsion Type Segment Analysis: Diesel-powered type will lead in the propulsion type segment, capturing 88.0% of the market share in 2025.

- By Application Segment Analysis: Municipal Fire Departments will dominate the application segment, capturing 65.0% of the market share in 2025.

- By End-User Segment Analysis: Public Sector will dominate the end-user segment, capturing 72.0% of the market share in 2025.

- Regional Analysis: North America is anticipated to lead the global fire truck market landscape with 32.0% of total global market revenue in 2025.

- Key Players: Some key players in the global fire truck market are Rosenbauer, Oshkosh Corporation (Pierce Manufacturing), Magirus GmbH, E-ONE, Inc., Morita Holdings Corporation, REV Group, Ferrara Fire Apparatus, HME Incorporated, W.S. Darley & Co., Spartan Emergency Response, Isuzu Motors Ltd., Gimaex, Tatra Trucks, Scania AB, Bronto Skylift, Sutphen Corporation, and Others.

Global Fire Truck Market: Use Cases

- Urban Firefighting and Municipal Emergency Response: Municipal fire departments form the backbone of the global fire truck market, with urban firefighting representing the most prominent use case. Cities with dense populations and high-rise structures require reliable and versatile emergency response vehicles capable of handling structural fires, vehicular accidents, and medical emergencies. These departments heavily invest in pumper fire trucks, aerial ladder trucks, and combination fire engines equipped with high-pressure water pumps, foam systems, and thermal imaging tools. Advanced fire apparatus used in this setting often integrate GPS-based dispatch systems, real-time incident mapping, and onboard rescue equipment, enabling quick response to fire alarms in congested cityscapes. As urban areas expand, fire departments are also prioritizing fleet modernization, upgrading to eco-friendly hybrid or electric fire engines to comply with emissions regulations while maintaining operational efficiency.

- Industrial and Hazardous Facility Fire Protection: Another critical application of fire trucks lies within industrial zones, chemical plants, and energy facilities that face elevated fire and explosion risks. These environments demand heavy-duty fire trucks fitted with chemical suppression systems, high-capacity foam tanks, and advanced fire suppression monitors. Specialized industrial fire trucks are deployed for handling oil and gas fires, toxic spills, and complex industrial incidents, where conventional municipal fire engines may not suffice. Vehicles are often customized for Class B fire hazards and equipped with dry powder systems, air filtration units, and radiation-resistant materials. The deployment of tailored fire rescue apparatus in industrial fire safety strategies plays a vital role in preventing operational downtime and ensuring compliance with workplace safety laws.

- Airport Rescue and Firefighting Operations (ARFF): Airports represent a unique use case for fire trucks, requiring rapid-response vehicles designed to manage high-risk aviation incidents. Aircraft Rescue and Firefighting (ARFF) vehicles are equipped with high-reach extendable turrets, foam suppression systems, and onboard extinguishing agents for dealing with jet fuel fires and runway emergencies. These specialized fire engines are built to accelerate quickly, often reaching fire scenes within seconds of an incident, ensuring passenger safety and preventing escalation. International Civil Aviation Organization (ICAO) regulations mandate specific capabilities for airport fire trucks, including off-road maneuverability, thermal detection, and high-volume foam discharge. With global air travel rebounding, demand for ARFF vehicles is expected to surge, especially in emerging economies expanding their airport infrastructure.

- Wildland and Rural Fire Suppression: In regions prone to forest fires and rural blaze outbreaks, wildland fire trucks serve as essential tools in firefighting efforts. Unlike traditional fire engines, these vehicles are lightweight, off-road capable, and designed for agility in remote terrains. They typically feature smaller water tanks, high-clearance suspension, and brush protection, enabling access to mountainous and forested areas. With the growing frequency and intensity of wildfires in countries like the United States, Australia, and parts of Europe, the need for rapid-response wildland firefighting apparatus has grown considerably. These fire trucks support not only initial suppression but also logistical support, backburning, and perimeter control during large-scale fire rescue operations. Equipped with heat-resistant coatings, pump-and-roll capabilities, and fire shelters, they offer frontline protection in wildfire management scenarios.

Impact of Artificial Intelligence in the Fire Truck Market

- Predict, Don’t React: AI-Powered Fire Risk Detection: Fire trucks are no longer just reactive machines, they're becoming proactive warriors. With AI-driven predictive analytics, fire departments can now anticipate high-risk zones using historical fire data, weather patterns, and population density. The result is strategically positioned fleets, quicker dispatch decisions, and fewer seconds lost.

- Smarter Dispatch, Faster Response: Artificial Intelligence is transforming emergency dispatch systems. AI algorithms analyze call volumes, traffic conditions, and fire severity to automatically route the closest available fire truck. These real-time adjustments lead to faster response times and optimized resource allocation, especially during city-wide emergencies.

- AI + IoT = The Intelligent Fire Engine: Today's fire trucks are mobile data hubs. Integrated with IoT sensors and AI processors, they self-diagnose engine health, track equipment usage, and even monitor firefighter vitals inside the vehicle. AI flags maintenance issues before breakdowns occur, minimizing downtime and enhancing operational safety.

- Robotic Assistance and AI-Controlled Suppression: Some advanced firefighting vehicles now come with robotic arms or autonomous suppression systems guided by AI. These systems assess fire behavior in real time, adjusting water pressure or foam concentration automatically, particularly useful in hazardous industrial fires or chemical spills.

- Smart Navigation in Chaotic Environments: AI-enabled fire trucks can learn from traffic data, road closures, and local event patterns to find the best route. Combined with augmented reality dashboards, drivers receive guided navigation through smoke-obstructed zones, cutting critical minutes from the journey.

The Future is Not Just Fireproof—It's AI-Enabled

AI is not replacing firefighters, it’s becoming their most powerful ally. As cities grow denser and emergencies become more complex, AI-driven fire trucks will define a new era of intelligent, data-backed firefighting.

Global Fire Truck Market: Stats & Facts

-

United States – U.S. Fire Administration (USFA), FEMA, NIST, BLS, National Fire Academy

- NFIRS captures an estimated 44% of all fire incidents reported by U.S. fire departments.

- U.S. fire departments respond to approximately 6,200 fire-related deaths and 100,000 non-fatal fire injuries annually.

- As of 2025, the U.S. had an estimated 1,216,600 firefighters, 27,228 fire departments, and 58,150 fire stations.

- Fire departments respond to one fire every 23 seconds on average.

- The economic burden of firefighter injuries is monitored through USFA and BLS collaboration.

- NFPA 1710 provides benchmarks for staffing and response times for residential structure fires.

- The Maui wildfires of August 2023 caused over USD 5.5 billion in rebuilding costs and USD 16 billion in total economic losses.

- 56 nations participated in the formation of a global fire service leadership network in 2024.

- NIST has conducted over 50 years of fire safety research, beginning with the Federal Fire Prevention and Control Act of 1974.

- NIST highlights significant gaps in accurate fire loss reporting due to inconsistent NFIRS usage.

-

European Union – European Commission, European Parliament, European Environment Agency (EEA)

- The EU mandates that 100% of new urban buses sold by 2035 must be zero-emission.

- CO₂ emissions from heavy-duty vehicles (including fire trucks) must be reduced by 90% by 2040.

- Europe has approximately 290 million vehicles on its roads, of which only 6 million are zero-emission.

- About 96.8% of light commercial vehicles (including utility trucks and fire support vehicles) still run on diesel.

- Interim targets include CO₂ reductions of 45% by 2030 and 65% by 2035.

- The EU defines heavy-duty vehicles to include trucks, trailers, and buses under its emissions framework.

- The EEA manages environmental and transport data from 38 member and cooperating countries.

- Europe experienced significantly intensified wildfire activity in the spring–summer of 2022, especially in France and Spain.

-

Japan – Fire and Disaster Management Agency (FDMA), Tokyo Fire Department

- Japan had 894 fire headquarters, staffed by 155,000 career firefighters and operating 21,000 fire vehicles.

- There were also over 920,000 volunteer firefighters using an additional 51,000 fire trucks.

- The Tokyo Fire Department's 2019 fleet included 489 pumpers, 86 aerial ladder trucks, 40 rescue trucks, 259 ambulances, 10 fireboats, 93 command units, 7 helicopters, 20 motorcycles, and 12 firefighting robots.

Global Fire Truck Market: Market Dynamics

Global Fire Truck Market: Driving Factors

Stringent Fire Safety Regulations and Urban Expansion

One of the key drivers in the global fire truck market is the tightening of fire safety standards across residential, commercial, and industrial sectors. Governments and regulatory bodies are enforcing updated building codes and emergency response protocols, especially in high-density urban areas. This has led to increased procurement of advanced fire apparatus, including aerial ladder trucks and multipurpose fire engines, by municipal and industrial fire departments. As urban sprawl continues, the need for high-capacity firefighting vehicles that can navigate both congested cities and suburban regions is accelerating demand.

Modernization of Municipal Emergency Fleets

A significant driver is the global initiative to upgrade aging fire service fleets. Many cities, especially in North America, Europe, and parts of Asia, are replacing decades-old vehicles with modern fire rescue trucks that offer enhanced safety, telemetry, and integrated communication systems. These vehicles support rapid deployment and come equipped with smart controls, AI-assisted navigation, and enhanced cabin ergonomics. Fleet modernization programs are also being influenced by sustainability goals, which are pushing public agencies to consider low-emission or hybrid fire truck models.

Global Fire Truck Market: Restraints

High Capital Investment and Maintenance Costs

Fire trucks are capital-intensive assets, often requiring substantial upfront investment, especially for specialized units like airport crash tenders or hazmat containment vehicles. In addition to the procurement cost, ongoing maintenance, training, and upgrades add to operational expenses. Smaller municipalities and emerging economies may struggle to allocate sufficient budgets for advanced fire engine procurement, hindering broader market adoption.

Limited Infrastructure for Electric Fire Trucks

While electric fire trucks represent a growing segment, the lack of adequate charging infrastructure and range limitations restrict their deployment in many regions. Fire departments that operate around the clock and respond to emergencies in remote or industrial locations often find battery-powered engines unreliable for sustained operations. The slow pace of infrastructure development, especially in rural and developing areas, continues to constrain the adoption of sustainable firefighting vehicles.

Global Fire Truck Market: Opportunities

Rising Demand from Industrial and Petrochemical Sectors

The growing complexity and risk profiles of industrial facilities such as oil refineries, chemical plants, and mining sites are creating a strong demand for high-performance fire trucks. These sectors require firefighting vehicles with foam systems, specialized nozzles, and chemical-resistant materials. As emerging markets expand their industrial output, manufacturers of industrial fire apparatus have a significant opportunity to supply customized solutions that go beyond standard municipal equipment.

Expansion in Airport Rescue and Firefighting (ARFF) Vehicles

With growing global air traffic and new airport developments in Asia Pacific, the Middle East, and Africa, there is a surging need for ARFF vehicles. These fire trucks are designed specifically for aviation emergencies and are required to meet strict international regulations. Features such as high-reach turrets, foam suppression systems, and off-road mobility provide unique selling points. This demand opens up significant export opportunities for OEMs specializing in aviation safety solutions.

Global Fire Truck Market: Trends

Integration of Artificial Intelligence and IoT

A leading trend reshaping the fire truck market is the incorporation of AI and IoT(Internet of Things) technologies into emergency response systems. Smart fire engines can now track fleet performance, monitor equipment status, and support predictive maintenance through real-time data analysis. AI-enabled fire trucks enhance coordination during large-scale incidents, making them highly effective in disaster-prone urban regions. This digital transformation is shifting the market from hardware-centric to software-integrated solutions.

Emergence of Hybrid and Electric Fire Engines

Sustainability initiatives and decarbonization mandates are pushing fire departments toward hybrid and fully electric firefighting vehicles. Manufacturers are introducing electric fire engines with fast-charging capabilities, energy-efficient powertrains, and low-noise operation for urban deployments. Cities like Berlin and Los Angeles have already begun pilot projects with electric fire apparatus, setting the stage for broader adoption shortly. As battery technology advances and range increases, this trend is expected to gain significant momentum.

Global Fire Truck Market: Research Scope and Analysis

By Type Analysis

In the fire truck market, pumpers are expected to lead the type segment, accounting for approximately 38.0% of the total market share in 2025. This dominance is largely attributed to their versatility and widespread use in municipal firefighting operations. Pumper trucks, also known as engine trucks, are equipped with onboard water tanks, high-capacity pumps, hoses, and essential rescue equipment, making them the primary response vehicle for most fire departments globally.

Their ability to handle structural fires, respond to vehicular accidents, and perform basic rescue operations makes them indispensable, especially in urban and suburban settings where immediate access to water sources and rapid deployment are critical. The integration of advanced features such as foam systems, modern control panels, and GPS-assisted routing further enhances their operational efficiency, reinforcing their position as the most commonly procured fire apparatus by public safety agencies.

Tankers, also referred to as water tenders, play a crucial supporting role in fire suppression, particularly in rural and semi-urban areas where access to water sources is limited or nonexistent. Unlike pumpers, tankers are primarily designed to transport large volumes of water to the scene of a fire, serving as a mobile reservoir for engine trucks operating in remote locations.

These vehicles are essential for maintaining a continuous water supply in areas with poor hydrant infrastructure or during large-scale fire events that exceed the onboard water capacity of pumpers. Tankers are often deployed alongside other units and can be equipped with features like quick-dump valves, portable tanks, and even moderate pumping capabilities to assist during emergency scenarios. Their importance is growing in regions affected by wildfires, expanding residential zones, and agricultural belts, where water logistics are as vital as the suppression effort itself.

By Drive Type Analysis

In the fire truck market, the 4x2 drive type is set to maintain its dominance, capturing around 39.0% of the total market share in 2025. This drive configuration is particularly favored for its cost-efficiency, simpler maintenance, and suitability for urban and suburban environments where most firefighting operations occur. Fire trucks with a 4x2 configuration offer adequate traction and maneuverability on paved roads and are commonly used by municipal fire departments for daily emergency response.

Their lighter chassis and straightforward drivetrain allow for better fuel efficiency and lower ownership costs, making them a practical choice for cities with extensive road infrastructure and relatively stable driving conditions. Moreover, 4x2 fire engines are often customized as pumper trucks or rescue vehicles and are typically deployed in high-frequency dispatch areas due to their quick handling and operational agility.

On the other hand, 6x4 and 6x6 drive types are designed for heavy-duty performance and are predominantly used in challenging terrains, industrial zones, and off-road environments. These vehicles are built to carry heavier loads, such as larger water tanks, foam systems, and specialized rescue equipment. The 6x4 configuration offers better traction and load distribution than the standard 4x2, making it suitable for semi-rural and industrial applications where conditions may vary.

The 6x6 configuration, with power delivered to all three axles, provides superior off-road capability and is often used in airports, military bases, and forested regions where rugged performance is essential.These drive types are critical for large-scale firefighting efforts, such as wildland fire suppression or industrial plant emergencies, where durability, stability, and access to difficult terrain are crucial. Though not as widely deployed as 4x2 units, 6x4 and 6x6 fire trucks hold a significant niche within the overall market, supporting specialized use cases that demand higher power and resilience.

By Power Output Analysis

In the fire truck market, vehicles with a power output range of 250–500 horsepower are projected to lead the power output segment, accounting for approximately 56.0% of the total market share in 2025. This power range strikes a balance between performance and efficiency, making it ideal for a wide range of firefighting applications, particularly in urban and suburban settings.

Fire trucks within this category offer sufficient engine strength to support rapid acceleration, maneuverability, and the operation of onboard systems such as pumps, ladders, and rescue tools. They are commonly used for municipal fire engines, including pumper trucks, aerial ladder trucks, and rescue vehicles. The 250–500 HP segment is also preferred due to its compatibility with standard road regulations, lower fuel consumption compared to higher-powered units, and the ability to customize vehicles for multipurpose tasks without compromising on power or agility.

Fire trucks with power outputs exceeding 500 horsepower are typically used for specialized and high-demand operations where additional strength and durability are critical. These include airport rescue and firefighting vehicles, industrial fire trucks, and wildland units that need to carry heavy payloads, such as large foam tanks, hydraulic equipment, and extended reach platforms.

The additional horsepower allows these trucks to navigate difficult terrains, manage intense fire suppression tasks, and maintain consistent performance under extreme conditions. While these trucks represent a smaller portion of the market, their importance is growing in sectors that require robust, high-capacity emergency response solutions. Their higher cost and more complex maintenance requirements limit their use primarily to large-scale industrial facilities, defense operations, and emergency services in geographically challenging areas.

By Propulsion Type Analysis

Diesel-powered fire trucks are expected to maintain a commanding lead in the propulsion type segment, accounting for approximately 88.0% of the total market share in 2025. Diesel engines have long been the standard in fire apparatus due to their high torque output, durability, and reliability under demanding operational conditions. These engines are well-suited for the heavy-duty nature of firefighting vehicles, which often require substantial power to operate onboard water pumps, hydraulic systems, and rescue tools.

Diesel-powered trucks also offer the extended range and fueling convenience needed for emergency response vehicles that must be ready for deployment at any time. Their proven performance in diverse environments, from dense urban areas to remote rural zones, continues to make them the preferred choice for most municipal and industrial fire departments globally.

Electric-powered fire trucks, while still emerging, represent a growing segment driven by environmental regulations and sustainability goals. These vehicles are being adopted primarily in urban areas where emissions standards are stricter and operational routes are shorter. Electric fire trucks offer benefits such as reduced noise, zero tailpipe emissions, and lower long-term maintenance costs. Several cities in Europe and North America have already introduced electric models into their fleets, particularly for roles that require frequent starts and stops, such as downtown response units or support vehicles.

However, limitations such as high upfront costs, limited range, and the lack of charging infrastructure continue to restrain widespread adoption. As battery technology improves and more governments invest in green public safety initiatives, the adoption of electric fire engines is expected to gradually increase, especially in regions with strong environmental policies.

By Application Analysis

Municipal fire departments are projected to dominate the application segment of the fire truck market, capturing around 65.0% of the total market share in 2025. This dominance stems from the extensive need for fire protection services across cities and towns, where fire departments are responsible for a broad range of emergency response activities. These include structural fires, vehicle accidents, medical emergencies, and natural disaster response.

To meet these demands, municipalities invest heavily in a variety of fire apparatus such as pumpers, ladder trucks, rescue units, and multi-functional emergency vehicles. The growing urban population, growing infrastructure density, and enforcement of stricter fire safety regulations continue to drive consistent procurement and fleet modernization efforts by local governments. Municipalities are also integrating digital communication systems, AI-enabled navigation, and eco-friendly technologies into their firefighting fleets, further expanding their role in shaping the market.

Airport and industrial applications represent a vital but more specialized segment within the fire truck market. These settings require customized firefighting vehicles equipped to handle high-risk scenarios such as aircraft fires, chemical spills, and hazardous material incidents. In airports, fire trucks must comply with international aviation safety standards and are designed with high-speed response capabilities, large foam tanks, and advanced suppression systems.

In industrial environments like oil refineries, manufacturing plants, and power stations, fire trucks are built to withstand extreme temperatures and deliver precise firefighting performance using dry chemical systems, specialized nozzles, and thermal imaging tools. While these vehicles are fewer in number compared to municipal fleets, their technical sophistication and essential role in safeguarding critical infrastructure make them a key area of investment, especially in regions undergoing industrial expansion and airport development.

By End-User Analysis

The public sector is anticipated to dominate the end-user segment in the global fire truck market, accounting for approximately 72.0% of the total market share in 2025. This segment includes government-run fire departments, municipal emergency services, and national firefighting agencies that are responsible for protecting residential, commercial, and public infrastructure.

Public sector agencies typically operate large fleets and require a diverse range of fire trucks including pumpers, aerial ladder trucks, and rescue vehicles to address multiple types of emergencies. The strong dominance of this segment is driven by government mandates for public safety, regular budget allocations for fleet upgrades, and the expansion of urban firefighting capabilities. In addition, public sector organizations often implement standardization and compliance with regional safety regulations, making them consistent buyers of technologically advanced and regulation-compliant firefighting apparatus.

The private sector, although smaller in comparison, plays a significant role in specific high-risk industries such as oil and gas, aviation, mining, manufacturing, and private security services. Companies in these industries invest in specialized fire trucks that cater to their unique operational needs, such as foam tenders, rapid intervention vehicles, and hazmat units. These fire trucks are equipped with industry-specific firefighting and rescue systems, designed to handle flammable materials, hazardous chemicals, and large-scale equipment fires.

Airports, in particular, are a major contributor to this segment, as they are required to maintain ARFF (Aircraft Rescue and Firefighting) vehicles in compliance with international aviation safety standards. With industrialization growing across emerging markets and more private operators managing critical infrastructure, the private sector’s demand for customized and high-performance fire apparatus is expected to steadily increase.

The Fire Truck Market Report is segmented on the basis of the following

By Type

- Pumpers

- Tankers

- Aerial Ladder Trucks

- Rescue Trucks

- Others

By Drive Type

By Power Output

- <250 HP

- 250-500 HP

- >500 HP

By Propulsion Type

- Diesel Powered

- Electric Powered

- Hybrid

By Application

- Municipal Fire Departments

- Airport & Industrial

- Military & Defense

- Others

By End-User

- Public Sector

- Private Sector

Global Fire Truck Market: Regional Analysis

Region with the Largest Revenue Share

North America is anticipated to lead the global fire truck market landscape in 2025, accounting for 32.0% of the total global market revenue. This regional dominance is supported by well-established municipal fire departments, consistent public safety investments, and the presence of major fire truck manufacturers such as Pierce Manufacturing and E-ONE.

The region's focus on fleet modernization, integration of advanced firefighting technologies, and adherence to strict fire safety standards further boost market growth. Additionally, growing demand for electric fire trucks, airport rescue vehicles, and AI-enabled emergency response systems across the United States and Canada reinforces North America's leadership position in the global market.

Region with significant growth

The Asia Pacific region is expected to witness significant growth in the fire truck market over the coming years, driven by rapid urbanization, industrial expansion, and growing investments in emergency response infrastructure. Countries such as China, India, and Southeast Asian nations are ramping up fire safety regulations and upgrading outdated municipal fleets to address rising fire risks in densely populated cities and industrial hubs.

The growth is further fueled by government initiatives to improve disaster preparedness, the construction of new airports, and the development of smart cities that require technologically advanced fire apparatus. Additionally, the growing presence of regional manufacturers and favorable trade policies are making fire trucks more accessible to emerging economies, positioning Asia Pacific as a key growth engine in the global fire truck industry.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Global Fire Truck Market: Competitive Landscape

The global competitive landscape of the fire truck market is characterized by the presence of both established international players and emerging regional manufacturers, each striving to enhance technological capabilities and expand their market footprint. Leading companies such as Rosenbauer, Oshkosh Corporation (Pierce Manufacturing), Magirus GmbH, Morita Holdings, and E-ONE dominate through innovation, extensive product portfolios, and strategic partnerships with municipal and industrial clients.

These players focus heavily on integrating advanced technologies like AI, telematics, and electric propulsion into their offerings to meet the evolving demands of modern firefighting. Meanwhile, regional competitors in Asia, the Middle East, and Eastern Europe are gaining momentum by offering cost-effective, customized fire apparatus tailored to local needs. The market remains moderately consolidated, with ongoing competition centered on product innovation, after-sales service, and adherence to evolving global safety standards.

Some of the prominent players in the global fire truck market are

- Rosenbauer

- Oshkosh Corporation (Pierce Manufacturing)

- Magirus GmbH

- E-ONE, Inc.

- Morita Holdings Corporation

- REV Group

- Ferrara Fire Apparatus

- HME Incorporated

- W.S. Darley & Co.

- Spartan Emergency Response

- Isuzu Motors Ltd.

- Gimaex

- Tatra Trucks

- Scania AB

- Bronto Skylift

- Sutphen Corporation

- Zhongtong Bus Holding Co., Ltd.

- Weihai Guangtai Airport Equipment Co., Ltd.

- MAN SE

- NAFFCO (National Fire Fighting Manufacturing FZCO)

- Other Key Players

Global Fire Truck Market: Recent Developments

- June 2025: Frederick County’s fire department secured funding through a Maryland Energy Administration grant to purchase its first electric fire engine as part of a broader sustainability-driven fleet modernization initiative.

- June 2025: Frederick County (Maryland) placed an order for a Pierce Volterra electric fire truck, part of a mixed fleet expansion funded partly by a Maryland Energy Administration grant, underscoring the regional move toward sustainable emergency response vehicles.

- April 2025: Denton, Texas, debuted the state’s first electric fire truck, a Pierce Volterra model, funded with approximately USD 1.8 million in municipal investment, marking a significant shift toward cleaner, modern emergency response fleets.

- April 2025: Pierce Manufacturing showcased its next-generation fire apparatus complete with advanced safety features and fully integrated systems at FDIC 2025, highlighting innovations designed to enhance firefighter performance and operational efficiency.

- April 2025: Reliant Fire Apparatus acquired Halt Fire, Inc., expanding its exclusive Pierce dealership territory to include Michigan alongside Wisconsin and Iowa, strengthening service and support infrastructure in the Midwest.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 5.7 Bn |

| Forecast Value (2034) |

USD 9.5 Bn |

| CAGR (2025–2034) |

5.8% |

| Historical Data |

2019 – 2024 |

| The US Market Size (2025) |

USD 1.5 Bn |

| Forecast Data |

2025 – 2033 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Type (Pumpers, Tankers, Aerial Ladder Trucks, Rescue Trucks, Others), By Drive Type (4x2, 4x4, 6x4 and 6x6), By Power Output (<250 HP, 250–500 HP, >500 HP), By Propulsion Type (Diesel Powered, Electric Powered, Hybrid), By Application (Municipal Fire Departments, Airport & Industrial, Military & Defense, Others), and By End-User (Public Sector, Private Sector) |

| Regional Coverage |

North America – US, Canada; Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA |

| Prominent Players |

Rosenbauer, Oshkosh Corporation (Pierce Manufacturing), Magirus GmbH, E-ONE, Inc., Morita Holdings Corporation, REV Group, Ferrara Fire Apparatus, HME Incorporated, W.S. Darley & Co., Spartan Emergency Response, Isuzu Motors Ltd., Gimaex, Tatra Trucks, Scania AB, Bronto Skylift, Sutphen Corporation, and Others |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |

Frequently Asked Questions

The global fire truck market size is estimated to have a value of USD 5.7 billion in 2025 and is expected to reach USD 9.5 billion by the end of 2034.

The US fire truck market is projected to be valued at USD 1.5 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 2.5 billion in 2034 at a CAGR of 5.4%.

North America is expected to have the largest market share in the global fire truck market, with a share of about 32.0% in 2025.

Some of the major key players in the global fire truck market are Rosenbauer, Oshkosh Corporation (Pierce Manufacturing), Magirus GmbH, E-ONE, Inc., Morita Holdings Corporation, REV Group, Ferrara Fire Apparatus, HME Incorporated, W.S. Darley & Co., Spartan Emergency Response, Isuzu Motors Ltd., Gimaex, Tatra Trucks, Scania AB, Bronto Skylift, Sutphen Corporation, and Others.

The market is growing at a CAGR of 5.8 percent over the forecasted period.