Market Overview

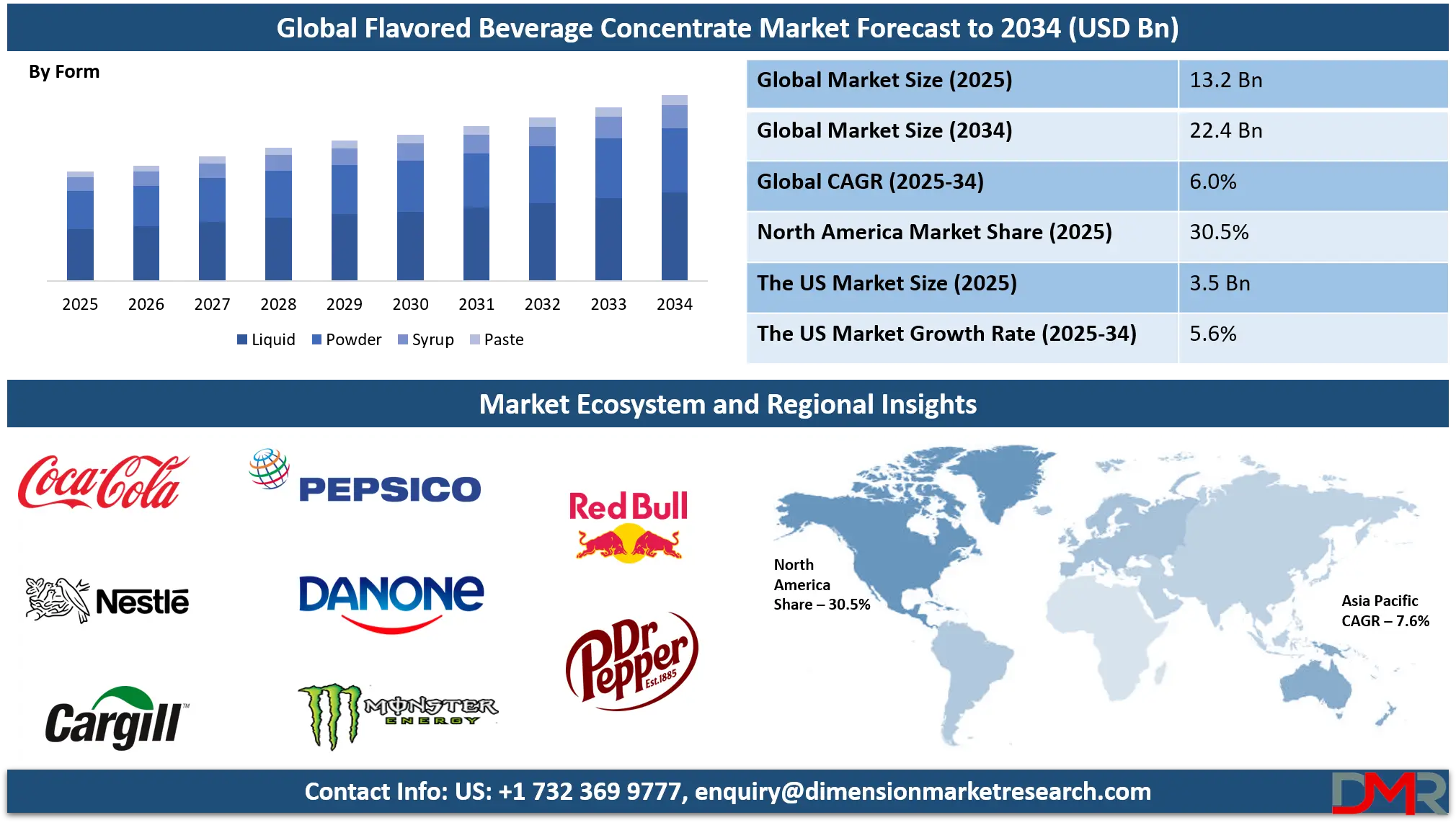

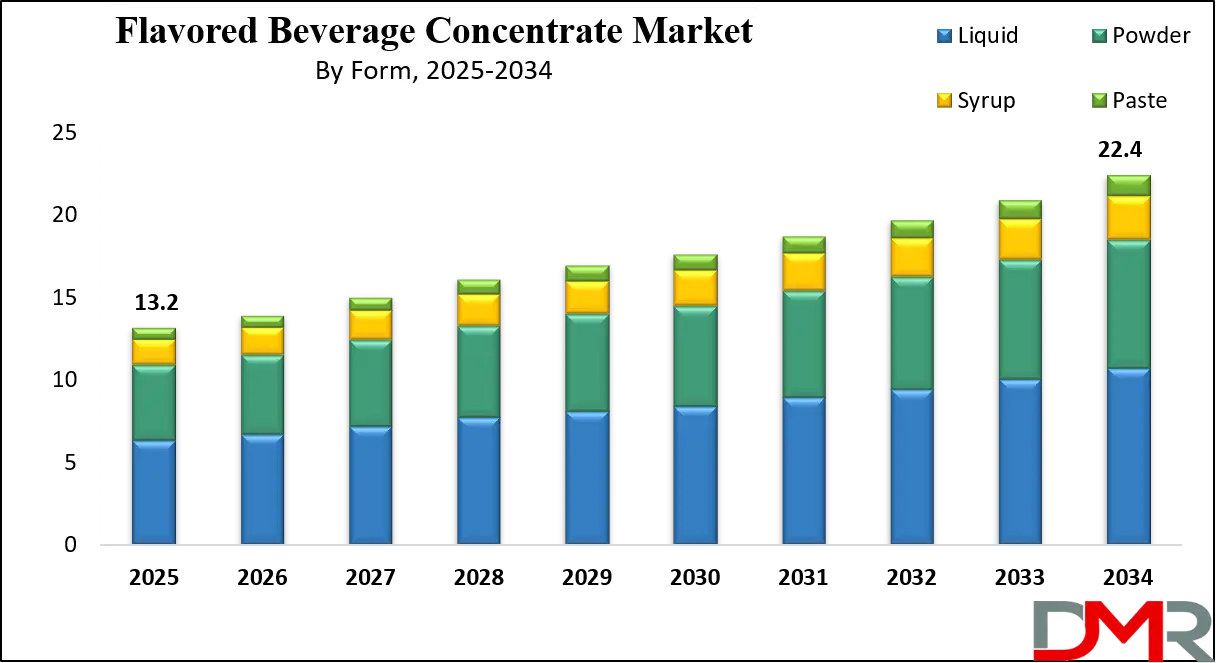

The Global Flavored Beverage Concentrate Market size is projected to reach USD 13.2 billion in 2025 and grow at a compound annual growth rate of 4.6% from there until 2034 to reach a value of USD 22.4 billion.

Flavored beverage concentrate is a liquid or powder that contains concentrated flavors, colors, sweeteners, and other ingredients. It is designed to be mixed with water or another base to create a ready-to-drink beverage. These concentrates are commonly used in the food and beverage industry, especially in the production of soft drinks, energy drinks, and fruit-flavored beverages. They are also used in homes and restaurants where bulk mixing is needed. The main advantage of using concentrates is that they are easy to store, transport, and use, making them a cost-effective solution for beverage production.

Over the past few years, there has been a noticeable increase in demand for flavored beverage concentrates, which is mainly driven by changing consumer preferences, particularly the desire for customizable drinks. Many people now prefer beverages that can be adjusted in flavor and sweetness. The rise of at-home beverage machines has also contributed to this trend, as concentrates can be used to create personalized drinks.

In addition, health-conscious consumers are looking for low-sugar or natural options, prompting manufacturers to develop concentrates with fewer artificial ingredients. One major trend in flavored beverage concentrates is the shift toward natural ingredients. Consumers are increasingly avoiding synthetic flavors, colors, and preservatives, which has led manufacturers to explore natural sources like fruit extracts, herbs, and plant-based sweeteners.

Another key trend is the growing popularity of functional beverages. These are drinks that provide health benefits beyond basic hydration, such as energy boosts, immune support, or added vitamins. Concentrates with added nutrients or herbal ingredients are now commonly seen in this category.

In recent years, several beverage companies have expanded their product lines to include flavored concentrates. Some have launched new concentrate-based drink dispensers for commercial and home use. Others have invested in eco-friendly packaging to appeal to environmentally aware consumers. There have also been partnerships between concentrate manufacturers and tech companies to develop smart beverage systems. These systems allow users to control and customize their drinks using mobile apps, reflecting the integration of technology and beverage preparation.

While the flavored beverage concentrate market is growing, it does face challenges. Concerns over artificial additives and sugar content have caused some consumers to be cautious. There are also regulatory concerns in some regions about ingredient labeling and marketing claims. However, these challenges have created opportunities for innovation. Brands that offer clean-label, organic, or low-calorie concentrates are gaining attention. Companies that focus on sustainability and transparency are also better positioned to win consumer trust.

The flavored beverage concentrate market is expected to continue evolving as consumer preferences shift. Convenience, health, and sustainability will likely remain key drivers. More personalized options, such as concentrates tailored to individual taste and dietary needs, are expected to emerge. The use of digital technology and smart appliances will also play a role in how consumers interact with these products. Overall, flavored beverage concentrates are becoming an important part of modern beverage consumption due to their flexibility, variety, and ease of use.

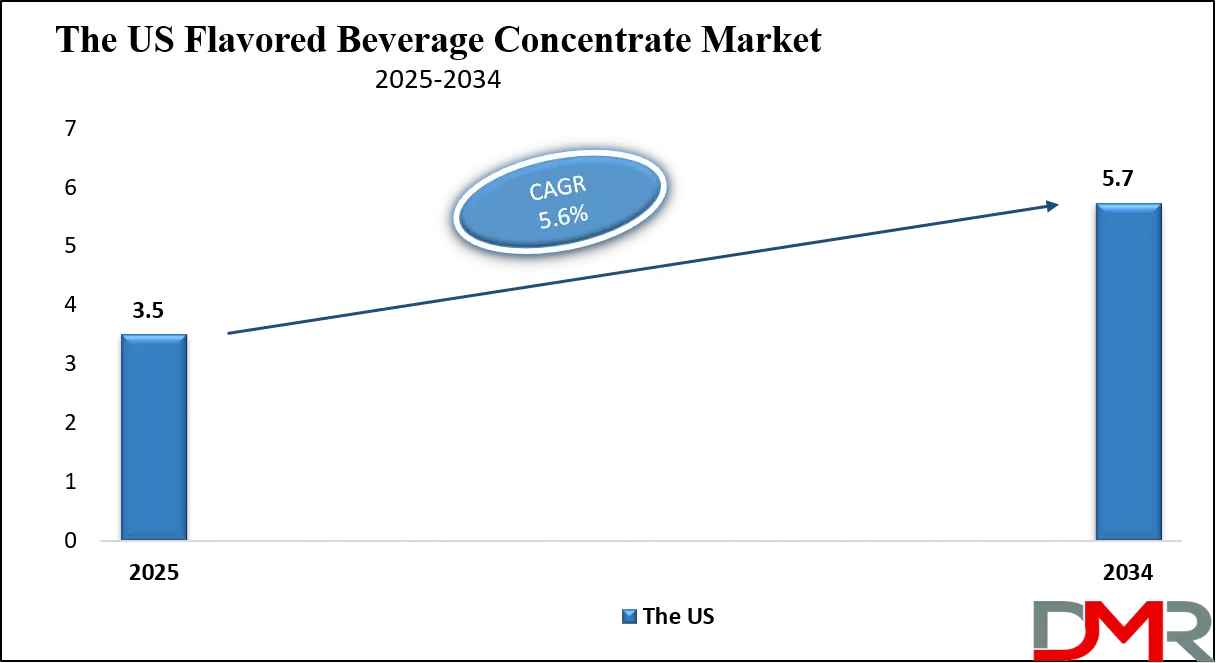

The US Flavored Beverage Concentrate Market

The US Flavored Beverage Concentrate Market size is projected to reach USD 3.5 billion in 2025 at a compound annual growth rate of 5.6% over its forecast period.

The US plays a key role in the flavored beverage concentrate market due to its large and diverse consumer base that drives demand for a wide variety of flavors and product types. Innovation and health trends often start in the US, pushing companies to develop natural, low-sugar, and functional concentrates that appeal to health-conscious consumers. The country also has a well-established manufacturing and distribution infrastructure, making it easier to produce and deliver concentrates efficiently.

Additionally, strong regulatory frameworks in the US ensure high-quality standards, which influence global market practices. With consumers seeking convenience and customization, the US market continues to lead in adopting new beverage technologies, such as smart dispensers and on-demand mixing systems, shaping the future direction of the flavored beverage concentrate industry worldwide.

Europe Flavored Beverage Concentrate Market

Europe Flavored Beverage Concentrate Market size is projected to reach USD 3.3 billion in 2025 at a compound annual growth rate of 5.5% over its forecast period.

Europe plays an important role in the flavored beverage concentrate market, driven by its diverse cultures and strong demand for natural and healthy products. European consumers are very focused on clean-label ingredients and sustainability, which encourages manufacturers to develop concentrates made with organic and natural flavors. Strict food safety and labeling regulations in Europe also ensure high product quality, pushing companies to innovate responsibly.

The region’s growing interest in functional beverages, such as those with added vitamins or herbal extracts, is expanding the market further. Europe’s emphasis on environmental concerns leads to increased adoption of eco-friendly packaging and sustainable production methods. Overall, Europe’s combination of health awareness, regulatory oversight, and sustainability focus shapes the flavored beverage concentrate market with unique opportunities and challenges.

Japan Flavored Beverage Concentrate Market

Japan Flavored Beverage Concentrate Market size is projected to reach USD 0.7 billion in 2025 at a compound annual growth rate of 7.0% over its forecast period.

Japan plays a significant role in the flavored beverage concentrate market through its strong consumer preference for unique and high-quality flavors. Japanese consumers value innovation and are open to trying new, sophisticated taste profiles, which encourages companies to develop a wide range of specialty concentrates. The country also emphasizes health and wellness, leading to demand for low-calorie, natural, and functional beverage options with added benefits like vitamins or herbal extracts. Japan’s advanced technology and manufacturing capabilities support efficient production and quality control of flavored concentrates.

Additionally, Japan’s commitment to sustainability influences packaging and ingredient sourcing practices. Together, these factors make Japan a key market for innovation, quality, and health-focused flavored beverage concentrates in the global industry.

Flavored Beverage Concentrate Market: Key Takeaways

- Market Growth: The Flavored Beverage Concentrate Market size is expected to grow by USD 8.5 billion, at a CAGR of 6.0%, during the forecasted period of 2026 to 2034.

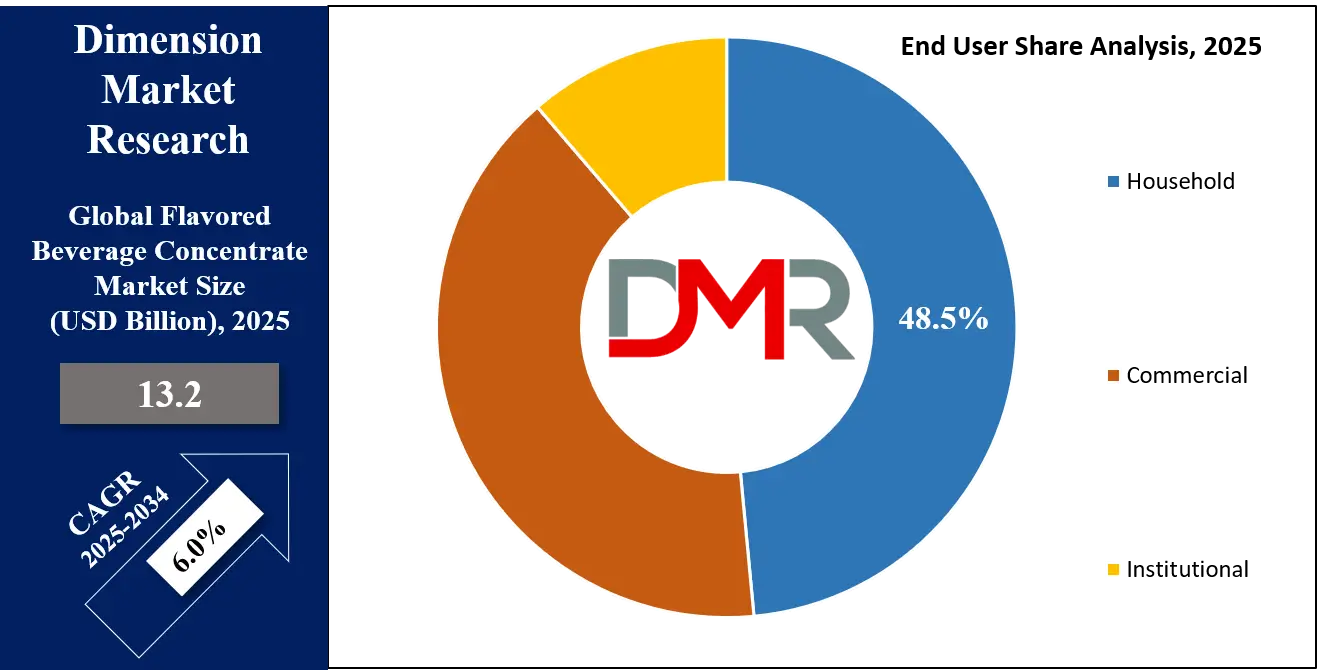

- By End User: The household segment is anticipated to get the majority share of the Flavored Beverage Concentrate Market in 2025.

- By Form: The liquid segment is expected to get the largest revenue share in 2025 in the Flavored Beverage Concentrate Market.

- Regional Insight: North America is expected to hold a 30.5% share of revenue in the Global Flavored Beverage Concentrate Market in 2025.

- Use Cases: Some of the use cases of Flavored Beverage Concentrate include home beverage customization, health & wellness products, and more.

Flavored Beverage Concentrate Market: Use Cases

- Home Beverage Customization: Flavored beverage concentrates are widely used at home to create customized drinks. Consumers can control sweetness, strength, and flavor based on personal preference. This is especially popular with at-home soda makers and drink dispensers.

- Food Service and Hospitality: Restaurants, cafes, and hotels use concentrates to prepare large batches of flavored drinks quickly. It helps save storage space and reduces waste, as concentrates are easier to handle than ready-made beverages. They also allow a broader flavor menu without needing extensive inventory.

- Health and Wellness Products: Many health-focused drinks like vitamin-infused waters and electrolyte beverages use flavored concentrates. These products cater to consumers looking for functional benefits such as hydration, energy, or immune support. The concentrates can be formulated with added nutrients and low sugar.

- Vending and Dispensing Machines: Flavored beverage concentrates are commonly used in vending machines and commercial drink dispensers. These systems mix the concentrate with water on-demand, offering a fresh drink with each serving. It's a cost-effective solution for high-volume settings like offices, gyms, or schools.

Stats & Facts

- According to Electro IQ, Coca-Cola’s Q3 2024 net revenues declined by 1% to USD 11.9 billion, while organic revenues rose by 9%, reflecting a solid underlying performance despite top-line pressure. The company also saw a 7% drop in earnings per share (EPS) to USD 0.66, while comparable EPS grew 5% to USD 0.77, highlighting the impact of adjustments like the Fairlife acquisition charge of USD 919 million that pressured operating margins.

- Based on Coca-Cola Statistics, North America remained a strong performer for the company with a 12% increase in revenues in Q3 2024, in contrast to a 7% revenue decline in the Europe, Middle East, and Africa region, signaling varied regional dynamics and demand environments.

- As reported by Coca-Cola Statistics, Coca-Cola Zero Sugar posted an 11% increase in sales during Q3 2024, showcasing growing consumer interest in reduced sugar offerings and aligning with broader health-conscious trends in the global beverage market.

- Electro IQ reports that Coca-Cola’s operating income for Q3 2024 was USD 2.5 billion, down 23% year-over-year, attributed largely to a significant charge stemming from adjustments related to the Fairlife acquisition, impacting overall quarterly profitability.

- According to Coca-Cola Statistics, the company held a commanding 44.9% share of the U.S. carbonated soft drink market in 2024, reaffirming its leadership despite evolving consumer preferences and intensifying competition in the beverage industry.

- As noted in Electro IQ, unit case volume dropped by 1% in Q3 2024, and concentrate sales fell 2%, mainly due to shipment timing issues, pointing to operational timing challenges affecting short-term performance indicators.

- Coca-Cola Statistics reveal that Coca-Cola’s global brand valuation reached USD 106.45 billion in 2024, marking substantial international brand equity growth and reinforcing its position as one of the most valuable and recognized brands worldwide.

- According to Electro IQ, Coca-Cola’s Q3 2024 operating cash flow stood at USD 2.9 billion, while free cash flow amounted to USD 1.6 billion, indicating strong underlying financial health and liquidity despite operating income headwinds.

- Per Coca-Cola Statistics, daily consumption of Coca-Cola beverages reaches 1.9 billion servings globally, with more than 10,000 Coca-Cola soft drinks consumed every second, demonstrating the company's unparalleled scale and global consumer reach.

- Coca-Cola Statistics also indicate that the company spent USD 5.01 billion on advertising in 2023, up from USD 4.319 billion in 2022, showcasing an aggressive marketing strategy to maintain its brand dominance and visibility in over 200 countries and territories.

- According to Coca-Cola Statistics, the company had 79,100 employees worldwide in 2024, a notable decline from 100,000 in 2016, suggesting strategic workforce optimization over time while maintaining operations across a vast international footprint.

- Based on Electro IQ, the company’s product portfolio by the end of 2024 will encompass over 500 brands and 3,500 beverages, illustrating its diversification and adaptability in meeting a wide range of consumer preferences in more than 200 global markets.

Market Dynamic

Driving Factors in the Flavored Beverage Concentrate Market

Rising Consumer Demand for Healthier and Natural Products

One of the main growth drivers in the flavored beverage concentrate market is the increasing consumer focus on health and wellness. More people are seeking beverages made with natural ingredients, free from artificial flavors, colors, and preservatives. This shift is pushing manufacturers to develop concentrates using fruit extracts, organic sweeteners, and plant-based additives.

Additionally, consumers want low-sugar or sugar-free options that still offer great taste. As awareness about the health risks of excessive sugar consumption grows, demand for such healthier alternatives rises. This trend encourages innovation and broadens the market, attracting new buyers who want flavorful but nutritious beverage choices.

Convenience and Customization Trends Boosting Market Growth

Convenience and personalization are also powerful drivers for the flavored beverage concentrate market. Busy lifestyles lead consumers to prefer quick and easy solutions for making their favorite drinks at home or on the go. Concentrates provide a simple way to create a variety of beverages without purchasing multiple ready-made products.

Furthermore, at-home beverage machines and smart dispensers allow users to tailor flavors and sweetness to their liking, adding to the appeal. The ability to customize drinks based on individual taste or dietary needs is a major factor pushing demand. This growing consumer desire for both convenience and personalization is expanding the market rapidly.

Restraints in the Flavored Beverage Concentrate Market

Concerns Over Artificial Ingredients and Sugar Content

A significant restraint in the flavored beverage concentrate market is growing consumer awareness about the negative health effects of artificial additives and high sugar levels. Many consumers are cautious about consuming products that contain synthetic flavors, colors, and preservatives, which can limit the appeal of some concentrates.

Additionally, sugary beverages face criticism due to links with obesity and other health issues, causing some buyers to avoid flavored concentrates altogether. This skepticism can slow market growth as companies work to reformulate products or develop cleaner-label options. Until more natural and low-sugar alternatives become widely available and accepted, this concern remains a barrier.

Regulatory Challenges and Labeling Requirements

The flavored beverage concentrate market also faces restrictions due to strict regulations around ingredient use and labeling standards in various regions. Governments and health authorities increasingly demand transparency about product contents, nutritional information, and health claims. Compliance with these rules can be costly and time-consuming for manufacturers, especially those operating globally with different regulatory environments. Mislabeling or misleading claims may lead to penalties and loss of consumer trust, creating a risk for companies. These regulatory hurdles can slow down product launches and innovation, limiting market expansion and affecting profitability.

Opportunities in the Flavored Beverage Concentrate Market

Expansion into Functional and Health-Boosting Beverages

One of the biggest opportunities for the flavored beverage concentrate market lies in the growing demand for functional beverages that offer health benefits beyond basic hydration. Consumers are increasingly interested in drinks that provide added vitamins, minerals, antioxidants, or support for immunity and energy. Manufacturers can capitalize on this by developing concentrates infused with natural herbs, botanicals, and nutrients. This trend allows brands to diversify their product lines and attract health-conscious buyers looking for convenient, flavorful ways to improve their well-being. As the wellness market grows, functional flavored concentrates can tap into new consumer segments and drive market expansion.

Adoption of Sustainable Packaging and Eco-Friendly Solutions

Sustainability presents a significant growth opportunity for flavored beverage concentrate producers. With rising environmental awareness, consumers prefer brands that use recyclable, biodegradable, or reduced-plastic packaging. Concentrates already offer an eco-friendly advantage by reducing the need to transport bulky ready-to-drink beverages, which lowers carbon emissions. Companies can enhance this benefit by investing in innovative, sustainable packaging technologies that appeal to green-minded customers. Emphasizing sustainability in marketing and product development can help companies build stronger brand loyalty and open up markets where environmental concerns influence buying decisions.

Trends in the Flavored Beverage Concentrate Market

Rise of Functional and Wellness-Oriented Beverages

The flavored beverage concentrate market is experiencing a significant shift towards functional and health-focused products. Consumers are mainly looking beverages that offer more than just refreshment, opting for options that provide added health benefits such as improved energy, hydration, or immunity support. This trend has led to the development of concentrates enriched with vitamins, minerals, and herbal ingredients, catering to the growing demand for functional beverages. Manufacturers are responding by innovating their product lines to include these health-boosting concentrates, aligning with the broader wellness movement and attracting health-conscious consumers.

Emphasis on Natural and Clean-Label Ingredients

Another notable trend in the flavored beverage concentrate market is the increasing consumer preference for natural and clean-label products. As awareness about the health implications of artificial additives and preservatives grows, consumers are gravitating towards beverages made with natural ingredients and minimal processing. This shift is prompting manufacturers to reformulate their concentrates, using natural sweeteners, flavors, and colors to meet consumer expectations. The demand for transparency in ingredient sourcing and production processes is reshaping the market, encouraging brands to adopt cleaner labeling practices and invest in sustainable sourcing to build consumer trust and loyalty.

Research Scope and Analysis

By Product Type Analysis

Fruit concentrates as a product type are set to dominate the flavored beverage concentrate market in 2025, holding an estimated share of 44.8%. Their popularity comes from the growing consumer preference for natural and healthy beverage options. Fruit concentrates offer rich, authentic flavors that appeal to people looking for refreshing and nutritious drinks. They are widely used in juices, smoothies, and flavored waters, which are gaining traction worldwide. The natural sweetness and vibrant taste of fruit concentrates make them a favorite choice for manufacturers aiming to reduce artificial ingredients.

Additionally, increasing awareness about clean-label products and wellness trends further drives demand for fruit-based concentrates. With expanding applications in both commercial and home beverage segments, fruit concentrates are expected to play a key role in market growth over the coming years.

Herbs and spices as a product type are expected to experience significant growth in the flavored beverage concentrate market over the forecast period. These natural flavor enhancers are gaining attention as consumers seek unique and exotic taste profiles in their drinks. Herbs and spices add depth and complexity to beverages while aligning with the growing preference for clean-label and plant-based ingredients. They are increasingly used in functional beverages that promote health benefits such as digestion and immunity. The rise in demand for innovative flavors in teas, energy drinks, and wellness beverages is also driving this growth..

By Form Analysis

Liquid as a form in the flavored beverage concentrate market will be a leading choice in 2025, with an estimated share of 47.6%. This format is favored for its ease of use, quick mixing ability, and strong flavor retention, making it popular among both manufacturers and consumers. Liquid concentrates provide a smooth and consistent taste, which appeals to those looking for high-quality beverage experiences. They are widely used in various applications such as soft drinks, energy drinks, and flavored waters. The convenience of liquid concentrates for commercial production and home use, including beverage dispensers, further supports their growth.

Additionally, ongoing innovation in packaging and formulation helps maintain freshness and extend shelf life. These advantages contribute to the expected rise in demand for liquid flavored concentrates over the coming years.

Powdered flavored beverage concentrates are expected to see significant growth during the forecast period due to their long shelf life and ease of transport. This form is popular in regions with limited refrigeration and markets focusing on convenience. Powders are lightweight, reducing shipping costs and environmental impact, which appeals to manufacturers looking for sustainable options.

They also allow consumers to control the intensity of flavor and sweetness by adjusting the powder-to-water ratio. Powder concentrates are commonly used in powdered soft drinks, instant teas, and other dry mix beverages. Their flexibility in packaging sizes, from single-serve sachets to bulk containers, supports wide-ranging applications.

By Flavor Analysis

Citrus as a flavor is set to play a major role in the growth of the flavored beverage concentrate market in 2025, with an estimated share of 24.2%. The refreshing and tangy taste of citrus flavors like lemon, lime, and orange appeals widely to consumers seeking vibrant and uplifting beverages. Citrus concentrates are popular in soft drinks, flavored waters, and energy drinks due to their natural, zesty profile and ability to blend well with other flavors.

The demand for clean-label and natural ingredients also boosts the appeal of citrus concentrates, as they are often perceived as fresh and healthy. Their versatility in creating both sweet and savory beverages adds to their popularity. As consumers continue to favor bold and refreshing tastes, citrus flavors are expected to remain a key driver in the market’s expansion.

Berries as a flavor segment are expected to experience notable growth in the flavored beverage concentrate market during the forecast period. The sweet and slightly tart profiles of flavors such as strawberry, blueberry, and raspberry attract consumers who enjoy fruity and flavorful drinks. Berry concentrates are commonly used in juices, smoothies, and functional beverages, offering both taste and potential antioxidant benefits.

The rise in health-conscious consumers looking for natural and nutrient-rich ingredients contributes to the increased demand for berry flavors. Their ability to pair well with other fruit and herbal flavors makes them versatile for innovative product development. With ongoing interest in fresh and unique taste experiences, berry flavored concentrates are set to become an important segment by 2025.

By Application Analysis

Carbonated beverages as an application are expected to hold a leading position in the flavored beverage concentrate market in 2025, with an estimated share of 39.6%. The popularity of fizzy drinks continues to drive demand for flavored concentrates that can deliver refreshing and varied taste experiences. Carbonated beverages appeal to a wide range of consumers looking for both classic and innovative flavors. Manufacturers use flavored concentrates to create unique blends that cater to changing preferences, including low-sugar and natural options.

The growing trend of ready-to-drink sparkling waters and flavored sodas further supports this segment’s growth. Convenience, along with the ability to customize flavor intensity in carbonated drinks, makes flavored concentrates a preferred choice in this application. This strong consumer base is expected to fuel steady market expansion in the coming years.

Sports and energy drinks as an application are set to experience significant growth in the flavored beverage concentrate market over the forecast period. These beverages are popular among active consumers who seek hydration and energy boosts during workouts or daily activities. Flavored concentrates help manufacturers create tasty drinks that also deliver essential electrolytes, vitamins, and caffeine. The rising awareness of health and fitness is driving demand for functional beverages with appealing flavors.

Additionally, innovation in natural and low-calorie formulations is attracting a broader audience. Sports and energy drinks’ growing popularity in both developed and emerging markets supports this segment’s expansion. The flexibility and convenience of using flavored concentrates make them ideal for producing these beverages, positioning the category for strong growth through 2025.

By Distribution Channel Analysis

Supermarkets and hypermarkets as a distribution channel are set to dominate the flavored beverage concentrate market in 2025, with an estimated share of 34.8%. These large retail spaces offer a wide selection of products, allowing consumers to compare different brands and flavors in one place. The availability of flavored concentrates in various pack sizes and price ranges makes them accessible to a broader audience. In-store promotions, product sampling, and attractive displays in supermarkets encourage impulse purchases and boost visibility.

Consumers also value the convenience of picking up concentrates along with their regular grocery shopping. The ability to physically inspect the product and get immediate access contributes to strong consumer trust and preference. As supermarkets continue to dominate the retail landscape in many regions, they remain a key channel for flavored beverage concentrate sales.

Online retail as a distribution channel is expected to witness significant growth in the flavored beverage concentrate market during the forecast period. With more consumers turning to e-commerce for convenience, flavored concentrates are gaining popularity on digital platforms. Online retail allows shoppers to explore a wide variety of flavors, read reviews, and compare prices from the comfort of their homes.

Subscription models and personalized product recommendations enhance the customer experience, making online shopping even more appealing. The ease of home delivery and access to niche or premium products not found in stores also contribute to the channel’s expansion. As mobile apps and digital payment methods become more common, online retail is set to become a strong driver for the flavored beverage concentrate market.

By End User Analysis

Household as an end user is projected to lead the flavored beverage concentrate market in 2025, with an estimated share of 48.5%. Families and individuals are highly choosing beverage concentrates at home for their cost-effectiveness, convenience, and customizable flavor options. With busy lifestyles, consumers prefer easy-to-make drinks that allow them to control sweetness and portion size. The rise of at-home beverage machines and the availability of single-serve concentrates have made it simpler for households to enjoy a wide variety of drinks without needing bulky packaging.

Health-conscious buyers are also opting for natural and sugar-free options, which are widely available in concentrate form. As more consumers focus on healthier living and reducing their consumption of packaged sodas, flavored concentrates continue to gain popularity as a flexible and economical alternative for daily hydration and refreshment.

Commercial as an end user is expected to show significant growth in the flavored beverage concentrate market over the forecast period. Food service providers, restaurants, and cafes increasingly rely on beverage concentrates to offer a diverse menu of drinks without the need for large storage or prep time. These concentrates help businesses reduce waste, improve consistency, and speed up service.

Their long shelf life and cost-efficiency are key benefits in fast-paced commercial environments. From soda fountains to self-serve drink machines, flavored concentrates allow customization and a steady supply of beverages. As demand rises for on-the-go drinks and dine-in experiences that offer unique flavors, commercial end users will continue expanding their use of concentrates to meet evolving customer preferences efficiently and profitably.

The Flavored Beverage Concentrate Market Report is segmented on the basis of the following:

By Product Type

- Fruit Concentrates

- Vegetable Concentrates

- Coffee & Tea Concentrates

- Herbs & Spices Concentrates

- Others

By Form

- Liquid

- Powder

- Syrup

- Paste

By Flavor

- Citrus

- Berries

- Apple

- Tropical Fruits

- Cola

- Coffee

- Mint

- Mixed Flavors

- Others

By Application

- Carbonated Beverages

- Non-Carbonated Beverages

- Alcoholic Beverages

- Sports & Energy Drinks

- Flavored Water

- Others

By Distribution Channel

- Supermarkets/Hypermarkets

- Convenience Stores

- Online Retail

- Foodservice Providers

- Specialty Stores

By End User

- Commercial

- Institutional

- Household

Regional Analysis

Leading Region in the Flavored Beverage Concentrate Market

The flavored beverage concentrate market in North America is estimated to lead globally in 2025, holding a significant share of around 30.5%. This region’s strong growth is driven by increasing consumer interest in convenient, customizable, and health-conscious beverage options. People in North America are shifting toward natural, low-sugar, and functional drinks, which encourages manufacturers to offer a wide variety of flavored concentrates to meet these demands. The presence of advanced technology and well-developed infrastructure supports the efficient production and distribution of concentrates.

Additionally, the rise of at-home beverage machines and smart dispensers is making it easier for consumers to create personalized drinks, further boosting demand. North America’s regulatory environment also helps ensure product safety and quality, fostering consumer trust. As health trends and innovation continue to shape the market, North America is expected to maintain its leadership position in the flavored beverage concentrate industry through 2025 and beyond.

Fastest Growing Region in the Flavored Beverage Concentrate Market

Asia Pacific is showing significant growth in the flavored beverage concentrate market over the forecast period, driven by rising consumer demand for diverse and innovative beverage options. The region’s large and young population is increasingly seeking convenient, flavored drinks that cater to local tastes and preferences. Rapid urbanization and growing disposable incomes are also fueling demand for functional and healthy beverages.

Additionally, expanding retail and foodservice sectors make flavored concentrates more accessible across the region. Manufacturers are focusing on natural ingredients and sustainable packaging to meet the preferences of health-conscious consumers. With ongoing investments in production capabilities and technology..

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The flavored beverage concentrate market is highly competitive, with many players offering a wide range of products to meet changing consumer tastes. Companies compete by focusing on flavor innovation, health-conscious options, and natural ingredients. There's also a growing trend toward low-sugar and sugar-free concentrates, as people look for healthier choices. The market includes both large global producers and smaller niche brands, each trying to stand out with unique blends, packaging, and sustainability practices.

Innovation in packaging, such as recyclable or eco-friendly materials, is also a key focus. As consumers seek convenience and customization, companies are investing in smart dispensers and at-home mixing solutions to stay ahead. The fast-changing preferences and demand for quality keep the competition strong and ongoing.

Some of the prominent players in the global Flavored Beverage Concentrate are:

- The Coca-Cola Company

- PepsiCo

- Nestle

- Unilever

- Danone

- Cargill

- Kerry Group

- F&N Foods

- BioTropic

- Stur Drinks

- HInt

- Hydrant

- Red Bull

- Monster Beverage Corp

- Keurig Dr Pepper Inc.

- Symrise

- Dohler

- Other Key Players

Recent Developments

- In April 2025, HTeaO, the nation’s top iced tea franchise, is expanding its offerings with the launch of HTeaO Refreshers, a new line of fruit-forward drinks crafted for a naturally energizing refreshment. Available at all HTeaO locations starting April 11, these vibrant beverages blend Monin Glacier Clear, premium fruit syrups, and a splash of lemonade for a bold, thirst-quenching experience. Two Refreshers also include HTeaO’s signature tea, giving fans a familiar twist in this flavorful new evolution of the brand’s drink lineup.

- In April 2025, Nescafé has launched its new Espresso Concentrated range, marking its entry into the premium iced coffee market. This liquid coffee is crafted for making barista-style iced drinks at home, available in three flavors: vanilla, caramel, and classic. Each bottle offers 16 servings and is perfect for cold coffee lovers. To enjoy, just shake the bottle, pour your preferred flavor into 150ml of milk with ice, and sip away. It’s a simple three-step way to enjoy refreshing iced coffee anytime.

- In February 2025, Spindrift Beverage Co., Inc., known for drinks made with real squeezed fruit, has introduced its latest creation: Spindrift® SODA. This new line redefines soda with a cleaner, better-for-you option, free from added sugar, stevia, or prebiotics. Launching in five indulgent flavors—Concord Freeze, Ginger Ale, Orange Cream Float, Shirley Temple, and Strawberry Shortcake—each variety contains 20% not-from-concentrate juice for rich, natural flavor. Spindrift SODA offers a modern twist on soda, delivering bold taste without unnecessary ingredients.

- In February 2025, Jamba is stirring things up with its first major menu launch since 2019, introducing the new Over Ice beverages. These refreshing iced drinks are crafted with a mix of fruit juices and topped with fruit purée or fresh fruit. Perfect for mornings, midday boosts, or anytime cravings, Over Ice drinks are now available nationwide. Whether you're on the go or enjoying a quick bite, they’re a delicious, year-round treat that pairs perfectly with your favorite bowl or snack from Jamba.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 13.2 Bn |

| Forecast Value (2034) |

USD 22.4 Bn |

| CAGR (2025–2034) |

6.0% |

| The US Market Size (2025) |

USD 3.5 Bn |

| Historical Data |

2019 – 2024 |

| Forecast Data |

2026 – 2034 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Product Type (Fruit Concentrates, Vegetable Concentrates, Coffee & Tea Concentrates, Herbs & Spices Concentrates, and Others), By Form (Liquid, Powder, Syrup, and Paste), By Flavor (Citrus, Berries, Apple, Tropical Fruits, Cola, Coffee, Mint, Mixed Flavors, Others), By Application (Carbonated Beverages, Non-Carbonated Beverages, Alcoholic Beverages, Sports & Energy Drinks, Flavored Water, and Others), By Distribution Channel (Supermarkets/Hypermarkets, Convenience Stores, Online Retail, Foodservice Providers, and Specialty Stores), By End User (Commercial, Institutional, and Household) |

| Regional Coverage |

North America – US, Canada; Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA |

| Prominent Players |

The Coca-Cola Company, PepsiCo, Nestle, Unilever, Danone, Cargill, Kerry Group, F&N Foods, BioTropic, Stur Drinks, Hint, Hydrant, Red Bull, Monster Beverage Corp, Keurig Dr Pepper Inc., Symrise, Dohler, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |

Frequently Asked Questions

The Global Flavored Beverage Concentrate Market size is expected to reach a value of USD 13.2 billion in 2025 and is expected to reach USD 22.4 billion by the end of 2034.

North America is expected to have the largest market share in the Global Flavored Beverage Concentrate Market, with a share of about 30.5% in 2025.

The Flavored Beverage Concentrate Market in the US is expected to reach USD 3.5 billion in 2025.

Some of the major key players in the Global Flavored Beverage Concentrate Market are The Coca-Cola Company, PepsiCo, Nestle, and others

The market is growing at a CAGR of 6.0 percent over the forecasted period