Market Overview

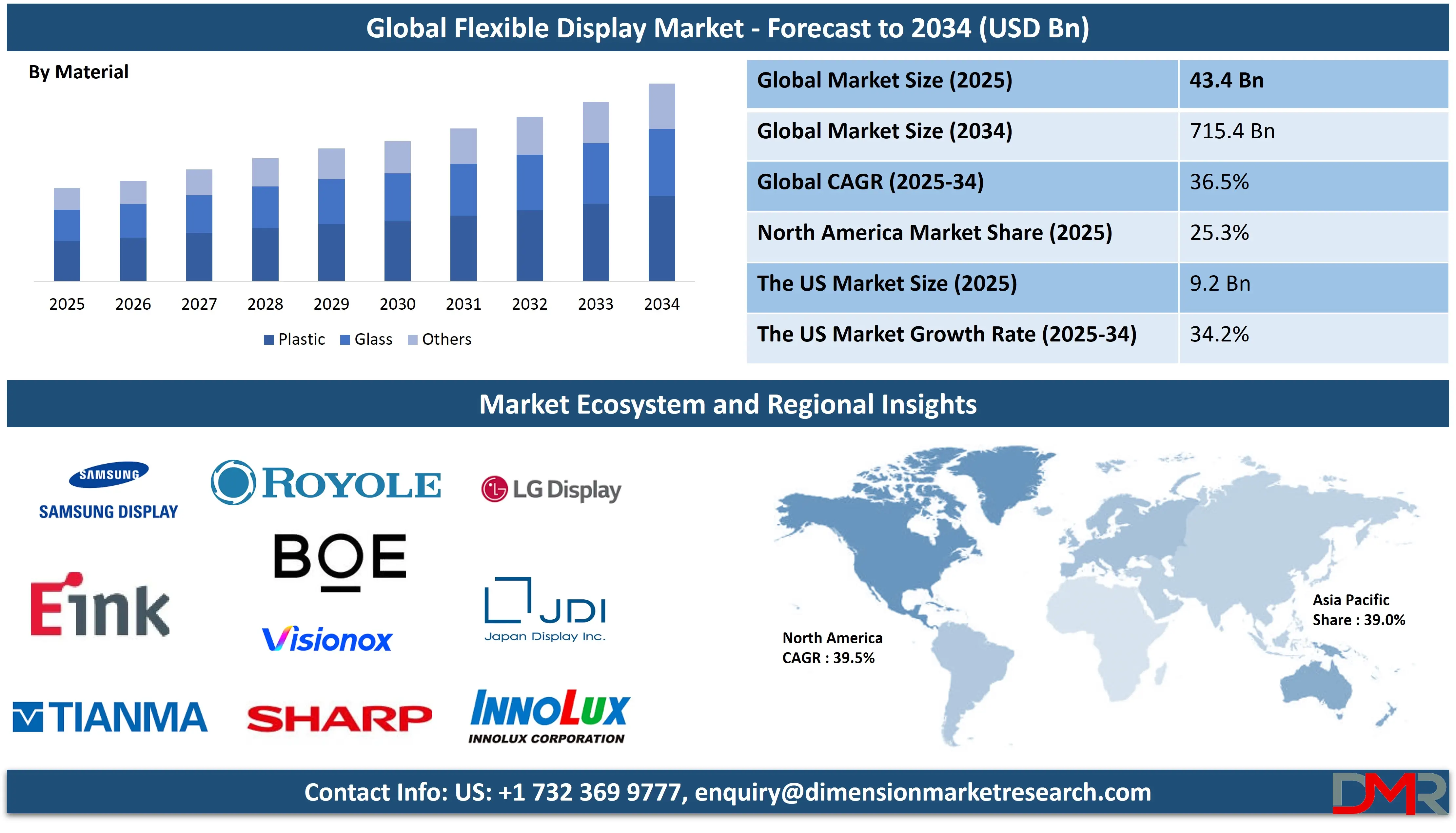

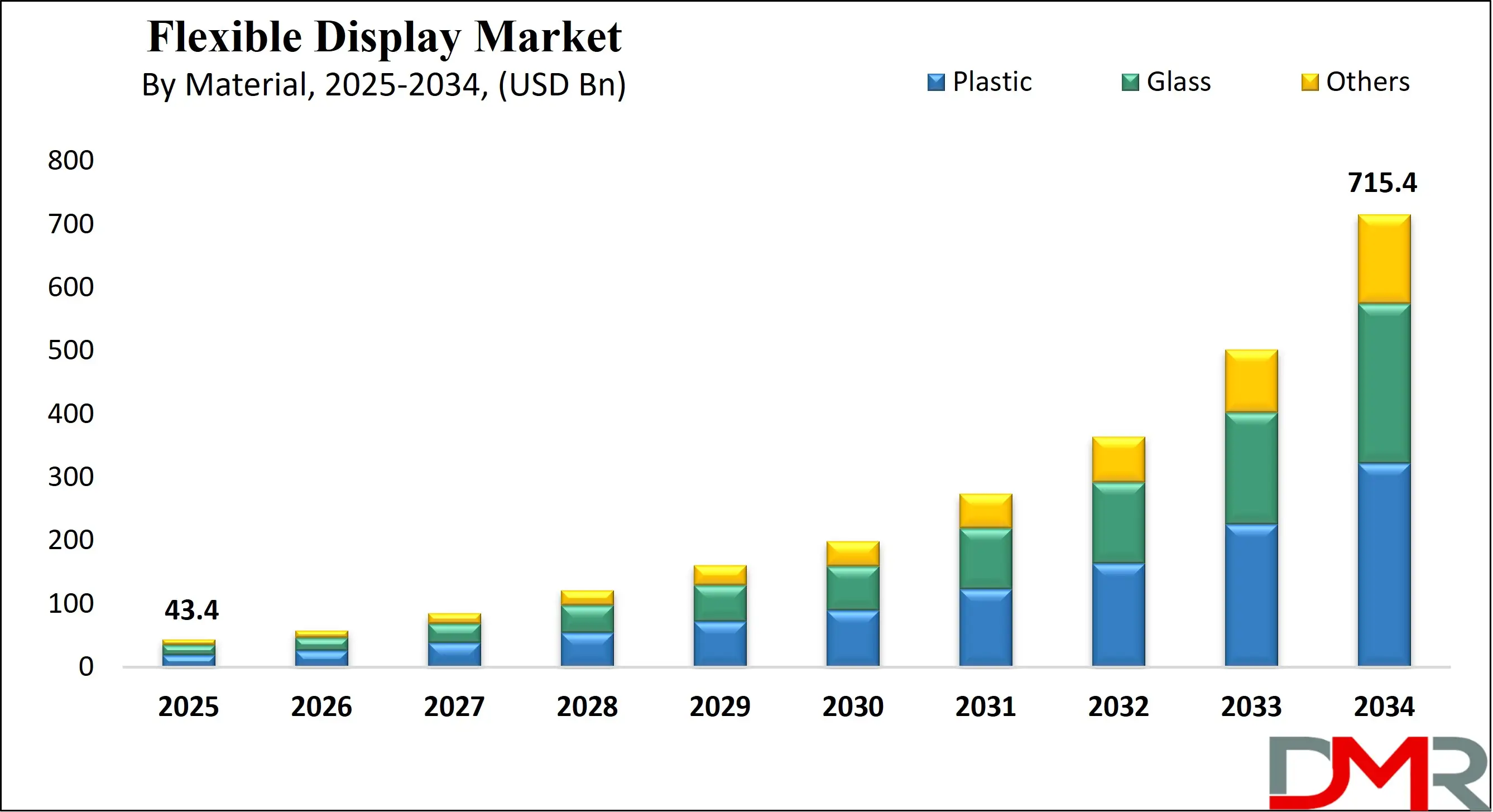

The Global Flexible Display Market is predicted to be valued at USD 43.4 billion in 2025 and is expected to grow to USD 715.4 billion by 2034, registering a compound annual growth rate (CAGR) of 36.5% from 2025 to 2034.

A flexible display is a type of electronic visual display that is bendable, foldable, or rollable without breaking or losing functionality. Unlike traditional rigid screens, flexible displays use advanced materials like organic light-emitting diodes (OLEDs), electronic paper displays (EPDs), or flexible LCDs layered on substrates such as plastic, metal foil, or flexible glass.

These displays maintain image quality while allowing for greater durability, lightweight design, and versatility in shape. They are widely used in next-generation devices like foldable smartphones, wearable technology, curved TVs, and automotive dashboards, enabling innovative designs and user experiences in consumer electronics and industrial applications.

The global flexible displays market is experiencing significant transformation, driven by rapid advancements in display technologies and growing demand for innovative consumer electronics. Flexible displays are reshaping product design across multiple industries, thanks to their lightweight, bendable, and shatter-resistant properties.

These next-generation display panels are predominantly based on organic light-emitting diode (OLED) and electronic paper display (EPD) technologies, offering high-resolution visuals, energy efficiency, and superior durability. Key applications of flexible display technology include foldable smartphones, curved televisions, smart wearables, tablets, and automotive dashboards.

The proliferation of smart devices and the need for compact, portable screens have fueled the integration of flexible screens into everyday gadgets. Flexible OLED displays are particularly prominent due to their self-emissive nature, vibrant colors, and ultra-thin form factor. Additionally, the shift toward sustainable and lightweight components in electronic devices supports the adoption of plastic-based substrates in flexible display manufacturing.

Major players in the market are focused on research and development to enhance display brightness, reduce production costs, and improve flexibility and screen longevity. The automotive and healthcare sectors are also emerging as promising end-use industries for flexible display panels, particularly in heads-up displays and wearable medical monitors. Furthermore, the increasing adoption of flexible touchscreens in smart home appliances and industrial applications signifies expanding commercial potential.

As consumer preferences evolve toward immersive and dynamic visual experiences, the flexible display industry is expected to witness continued innovation, strategic partnerships, and expansion into new markets, positioning it as a critical component of future digital interfaces and smart device ecosystems.

The US Flexible Display Market

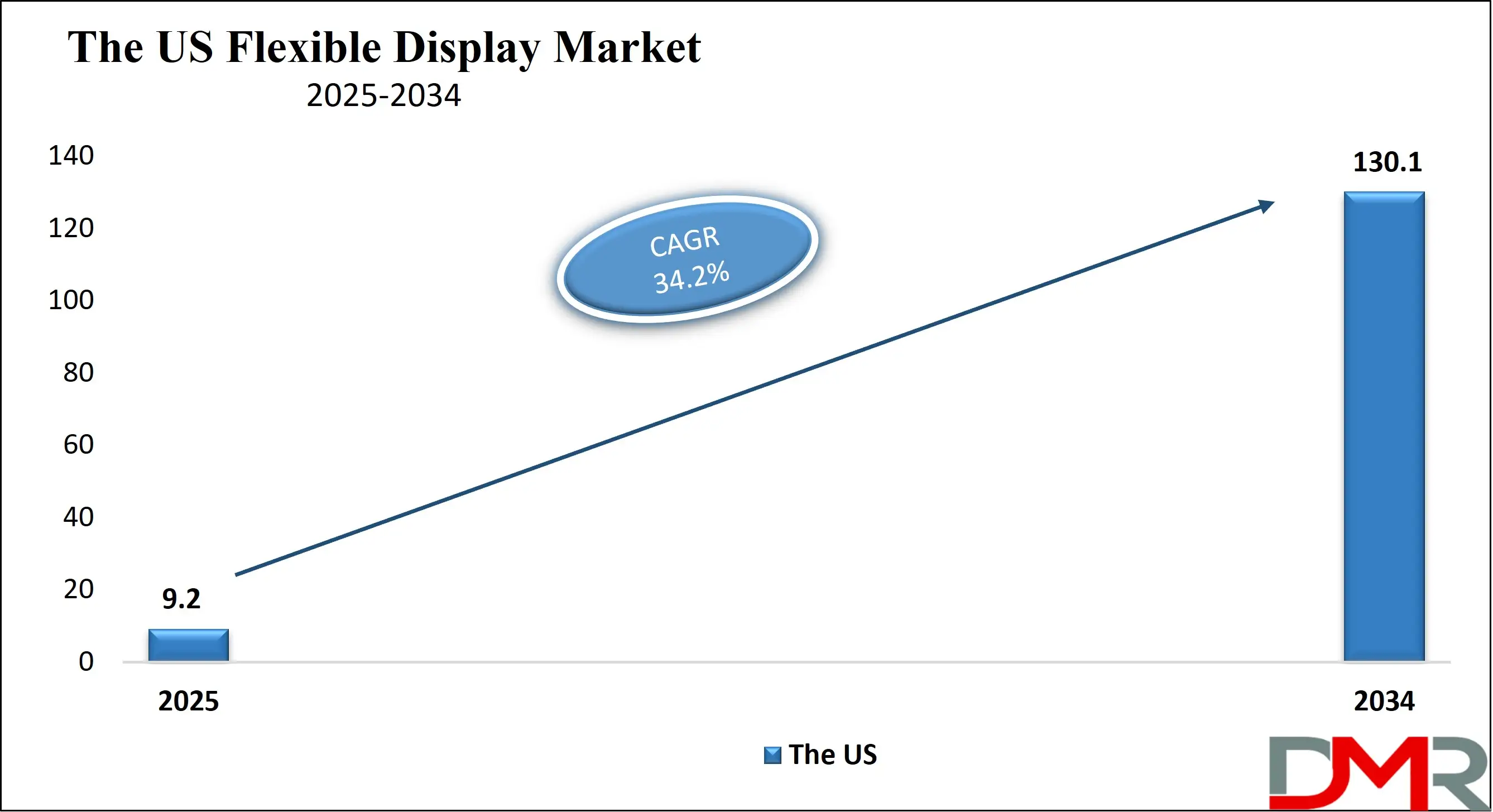

The US Flexible Display Market is projected to be valued at USD 9.2 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 130.1 billion in 2034 at a CAGR of 34.2%.

The US flexible displays market is driven by the rapid adoption of innovative consumer electronics, particularly foldable smartphones, wearables, and curved TVs. Strong demand for advanced display technologies among tech-savvy consumers, coupled with a robust ecosystem of manufacturers and R&D institutions, supports market expansion.

Government initiatives encouraging domestic semiconductor and display manufacturing further boost production capabilities. Additionally, collaborations between tech giants and startups are accelerating the integration of flexible OLED and e-paper displays in automotive, defense, and medical sectors. The increasing emphasis on portability, energy efficiency, and user-friendly interfaces also contributes significantly to the adoption of flexible display solutions.

In the US, a major trend shaping the flexible displays market is the growing use of foldable OLED screens in next-generation smartphones and tablets. There's rising experimentation with rollable and stretchable display formats in premium product categories. Display makers are also prioritizing sustainability, exploring recyclable materials and low-power displays.

Smart home devices and automotive infotainment systems are seeing a shift toward curved and bendable screens. Augmented reality (AR) and virtual reality (VR) devices featuring lightweight, flexible panels are gaining momentum. Moreover, the integration of flexible displays into clothing and accessories indicates growing interest in wearable display technology and human-machine interfaces.

The Japan Flexible Display Market

The Japan Flexible Display Market is projected to be valued at USD 3.0 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 43.5 billion in 2034 at a CAGR of 32.8%.

Japan’s flexible displays market is driven by the country’s strong legacy in electronics manufacturing and its continued investment in next-generation display technologies. Companies in Japan are leveraging their expertise in semiconductors and materials science to develop highly durable and compact flexible displays. Demand from domestic electronics brands for innovative smartphone and TV panels is a key growth driver.

The miniaturization trend in consumer electronics and robotics further fuels interest in bendable, lightweight displays. Government support for advanced manufacturing and digital transformation reinforces R&D initiatives. Additionally, Japan’s aging population is spurring demand for flexible medical displays in assistive and diagnostic devices.

A notable trend in Japan’s market is the development of ultra-thin, foldable screens for compact electronics and wearable gadgets. Japanese firms are pioneering hybrid display technologies that combine the benefits of OLED and microLED for flexible applications. There's a rising interest in transparent and holographic displays for retail and public information systems.

Robotics and automation, prominent in Japan’s industrial sector, are increasingly utilizing curved and adaptable displays. Flexible electronic paper is being introduced in education and publishing sectors. Furthermore, collaborations between tech firms and fashion brands are pushing innovations in wearable displays embedded in smart clothing and accessories.

The Europe Flexible Display Market

The Europe Flexible Display Market is projected to be valued at USD 7.8 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 114.8 billion in 2034 at a CAGR of 35.1%.

Europe’s flexible displays market is fueled by the continent’s strong emphasis on sustainable and energy-efficient electronics. Government policies promoting circular economy practices encourage the development of recyclable and durable flexible screens. Major automotive manufacturers in Germany and France are increasingly integrating curved and flexible displays into infotainment and dashboard systems.

The expanding smart healthcare sector, with a growing demand for lightweight diagnostic and monitoring devices, also supports growth. European R&D centers and universities actively collaborate with display technology firms to pioneer innovations. Additionally, the region’s focus on digital transformation across sectors is driving demand for interactive and portable display solutions.

In Europe, the shift toward flexible OLED panels for automotive applications is a key trend, especially in luxury vehicle interiors. The adoption of e-paper displays in smart retail and signage is also growing due to their low energy consumption and readability. Consumer preferences are shifting toward compact, foldable electronics for travel and remote work.

Another emerging trend is the development of stretchable displays for healthcare wearables and smart textiles. Manufacturers are experimenting with biodegradable materials in display fabrication to align with the region’s environmental goals. Additionally, Europe is witnessing increased interest in flexible AR displays for industrial and training applications.

Flexible Display Market: Key Takeaways

- Market Overview: The global flexible display market is projected to reach a value of USD 43.4 billion in 2025 and is anticipated to expand significantly to USD 715.4 billion by 2034, growing at a compound annual growth rate (CAGR) of 36.5% during the forecast period from 2025 to 2034.

- By Type Analysis: OLED (Organic Light Emitting Diode) technology is expected to lead the flexible display market by 2025, capturing approximately 54.2% of the overall revenue share.

- By Material Analysis: Plastic materials are set to dominate the market by 2025, accounting for an estimated 68.4% of the total market share, due to their lightweight and bendable properties.

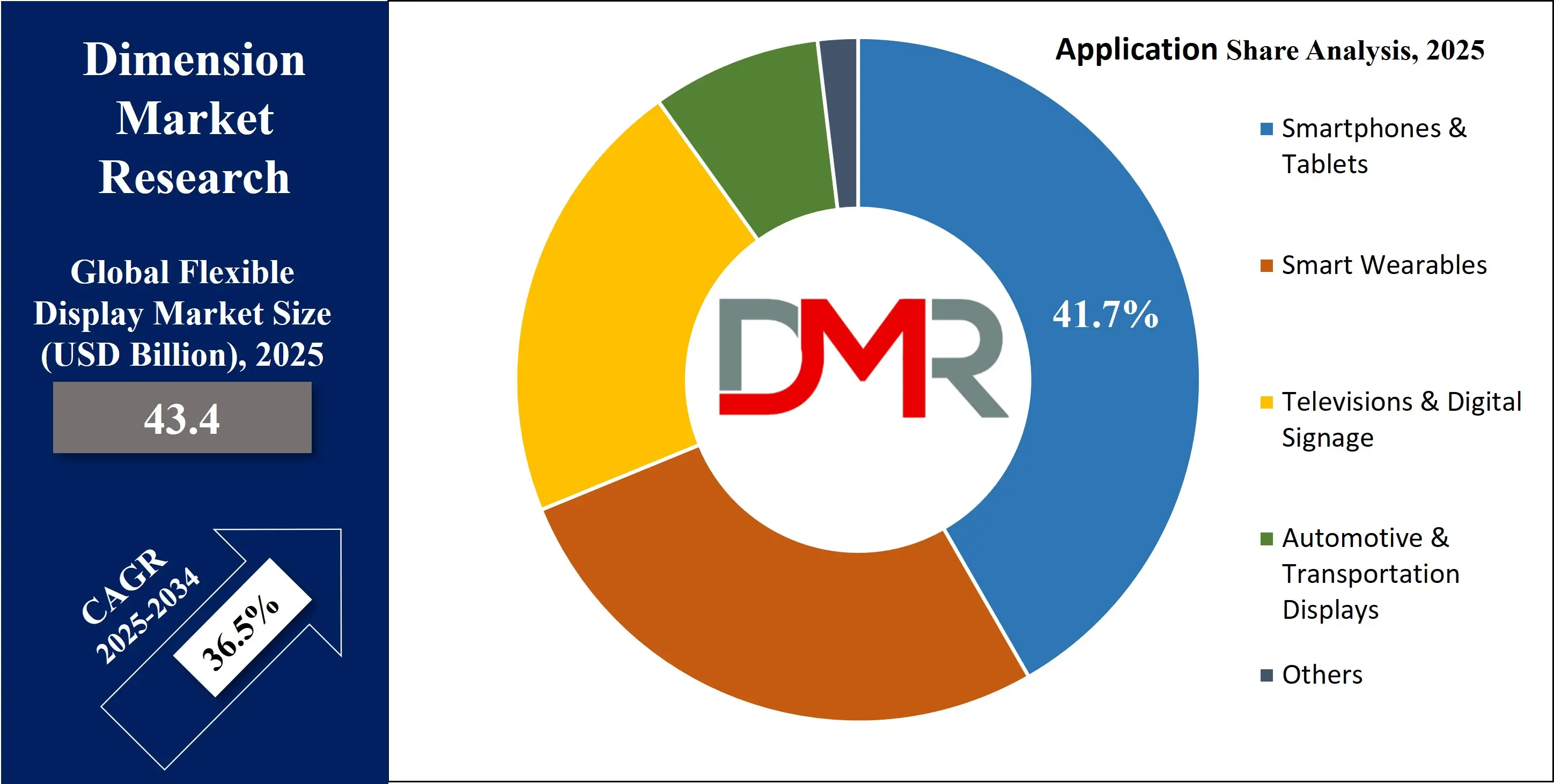

- By Application Analysis: Smartphones and tablets are predicted to be the leading application segment in 2025, contributing about 41.7% of the market revenue.

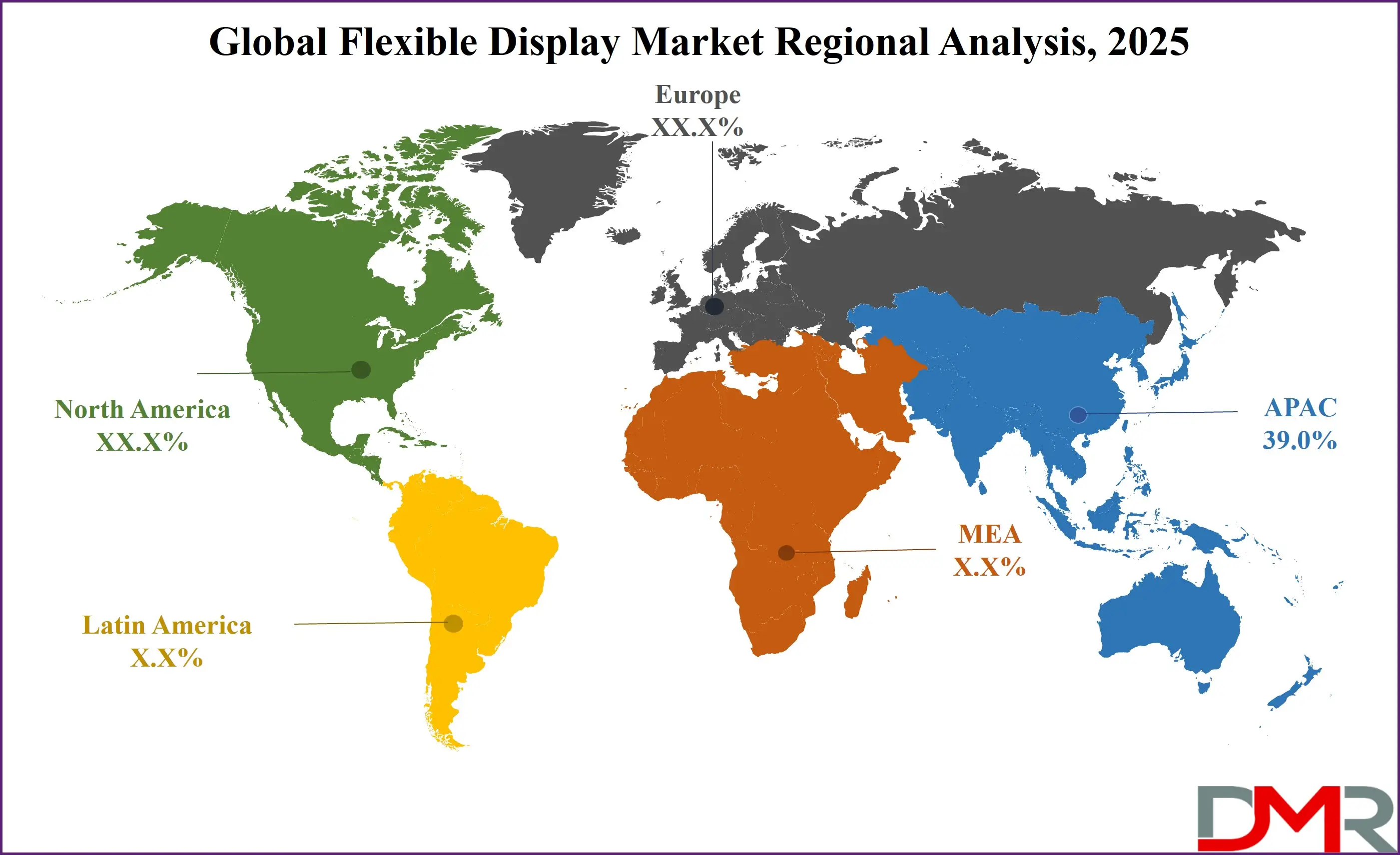

- Region with the Largest Share: The Asia Pacific region is projected to be the top contributor to the global flexible display market, holding a 39.0% share in terms of revenue by the end of 2025.

Flexible Display Market: Use Cases

- Foldable Smartphones: Flexible displays enable smartphones with foldable screens, allowing users to expand the screen size without increasing the device’s footprint. This innovation supports multitasking, immersive media experiences, and enhanced portability, meeting consumer demand for compact yet large-screen mobile devices in the premium smartphone segment.

- Wearable Health Devices: Flexible OLED displays are integrated into fitness trackers and smartwatches, offering lightweight, bendable screens that conform to the body. These wearables continuously monitor health metrics such as heart rate and oxygen saturation while maintaining comfort and visual clarity in dynamic environments like workouts or sleep.

- Automotive Dashboards: Curved and bendable displays are being adopted in vehicle interiors for instrument clusters and infotainment systems. These flexible panels provide seamless integration into dashboard contours, enhancing aesthetics, driver visibility, and touch interactivity, while enabling customizable digital cockpit experiences across various automotive models.

- Retail Digital Signage: Retailers use large-format flexible displays to create eye-catching, space-saving digital signage that wraps around shelves, pillars, or curved surfaces. These dynamic installations enhance customer engagement with real-time promotions, interactive advertising, and immersive product showcases in modern retail environments.

Flexible Display Market: Stats & Facts

- Samsung Display reported in 2023 that its foldable OLED panel shipments surpassed 20 million units globally, driven by growing demand for foldable smartphones like the Galaxy Z Fold and Flip series.

- LG Display disclosed in its annual report that it had invested over KRW 3 trillion (approx. USD 2.3 billion) into OLED and flexible display infrastructure by the end of 2023.

- DSCC (Display Supply Chain Consultants) noted that foldable display panels are projected to grow at a CAGR of 27% from 2022 to 2027, with smartphones and notebooks being the primary drivers.

- BOE Technology Group stated that it shipped over 15 million flexible AMOLED panels in 2023, making it one of the top global suppliers.

- Apple Inc. has been granted over 20 patents related to flexible and foldable display technologies by the USPTO since 2018, indicating growing R&D interest in this domain.

- IDC reported that foldable devices represented 1.2% of total smartphone shipments in 2023, but this share is projected to cross 3.5% by 2026.

- Google Trends data shows that search interest in the term “foldable display” increased by more than 300% globally between 2020 and 2023.

- University of Tokyo researchers published a paper in Nature Electronics demonstrating stretchable displays with up to 70% elongation, suggesting next-gen applications beyond foldables.

Market Dynamic

Driving Factors in the Flexible Display Market

Rising Adoption of OLED Technology

The increasing integration of OLED displays in smartphones, wearables, and televisions is a major driver of the flexible displays market. OLEDs are thinner, lighter, and more energy-efficient compared to traditional LCDs, making them ideal for bendable and foldable display applications.

Consumer demand for immersive and curved screen experiences has led companies like Samsung and LG to expand investments in flexible AMOLED panels. Additionally, the growing need for space-saving display solutions in next-generation devices continues to accelerate innovation. As OLED technology matures, its scalability and durability enhance its appeal across consumer electronics, automotive dashboards, and smart signage.

Surge in Foldable and Wearable Devices

The explosion in demand for foldable smartphones, smartwatches, and wearable healthcare devices is propelling the flexible displays market forward. Flexible display panels allow for innovative industrial designs that offer greater portability and functionality.

As brands strive to differentiate in a saturated mobile market, bendable screens and rollable displays have become central to next-gen user experiences. Wearable technology manufacturers are increasingly opting for flexible OLED and EPD (electronic paper display) screens for better ergonomics and aesthetic appeal. This shift is further supported by advances in materials like plastic substrates and flexible glass.

Restraints in the Flexible Display Market

High Manufacturing Costs

Despite growing interest, the high cost of manufacturing flexible displays poses a significant restraint. Producing bendable screens involves complex processes, including organic material deposition, encapsulation, and handling ultra-thin substrates. These advanced steps result in expensive production setups and lower yield rates, especially for large-scale flexible OLED displays.

In addition, the limited availability of skilled labor and proprietary technologies further elevates costs. Consequently, this financial burden limits market penetration, particularly among small- and medium-sized electronics manufacturers aiming to adopt flexible display technology in their products.

Durability and Reliability Concerns

Although flexible displays offer design versatility, concerns regarding their long-term durability remain a key challenge. Issues like screen creasing, pixel degradation, and reduced impact resistance hinder widespread adoption. Foldable smartphone displays are especially prone to damage along the hinge area after repeated folding.

Environmental factors such as moisture and temperature fluctuations can also compromise flexible AMOLED and EPD performance over time. These limitations raise skepticism among consumers and enterprise users regarding product longevity, slowing down the uptake of flexible display solutions in mainstream electronics.

Opportunities in the Flexible Display Market

Expanding Applications in Automotive and IoT Devices

The integration of flexible displays in automotive infotainment systems and IoT-based devices offers significant market growth opportunities. Curved dashboards, flexible control panels, and smart mirrors are becoming standard in luxury vehicles, driving demand for rugged and adaptive displays.

Similarly, smart home appliances and connected IoT gadgets are increasingly adopting flexible OLED and e-paper screens for sleek, user-friendly interfaces. With the automotive sector leaning towards digital cockpits and HUDs (Heads-Up Displays), flexible screen technology is well-positioned to capitalize on this transformation.

Advancements in Substrate Materials and Printing Technologies

The development of advanced substrates such as ultra-thin glass, polyimide, and graphene is unlocking new possibilities in the flexible displays market. These materials enhance mechanical strength, flexibility, and thermal resistance, overcoming key barriers to mass adoption.

Moreover, innovations in roll-to-roll printing and inkjet printing of OLED displays are streamlining production processes and lowering costs. Such technological strides are enabling manufacturers to scale up production of foldable displays, transparent screens, and stretchable panels, particularly for applications in healthcare wearables, e-readers, and next-gen tablets.

Trends in the Flexible Display Market

Rise of Foldable Smartphones and Tablets

Foldable smartphones are transforming from niche innovations into mainstream consumer electronics, marking a major trend in the flexible displays industry. Tech giants like Samsung, Huawei, and Motorola are launching multiple foldable models equipped with flexible AMOLED panels.

These devices combine portability with multitasking features, offering dual-screen modes and extended viewing. As flexible display durability improves, foldable designs are anticipated to become standard in premium smartphones and tablets. This trend is reinforcing demand for organic light-emitting diode (OLED) and plastic-based screen solutions.

Growing Use of Flexible Displays in Smart Wearables

The expanding popularity of smart wearables such as fitness trackers, AR/VR headsets, and health-monitoring devices is contributing to the adoption of flexible display technology. Flexible OLED and e-paper displays offer superior readability, ultra-lightweight construction, and comfortable wearability—key factors in wearable device design.

Brands are leveraging curved, rollable, and stretchable displays to introduce sleeker products with enhanced functionality. As wearable technology becomes more integral in daily life and healthcare monitoring, flexible screens are expected to dominate this segment, driving continuous innovation in the market.

Impact of AI in the Flexible Display Market

Artificial Intelligence (AI) is reshaping the flexible display market by enhancing manufacturing precision, predictive maintenance, and end-user experiences. In production, AI-driven quality control systems use machine vision and deep learning to detect micro-defects, wrinkles, or inconsistencies in flexible substrates like OLED and EPD. This boosts yield rates and minimizes material wastage, critical in high-cost display fabrication.

AI also accelerates the design and simulation of new flexible display architectures by predicting material behaviors and optimizing component layouts for performance and durability. In smart devices, AI enhances the usability of flexible displays through adaptive interfaces that respond to user context, gestures, and folding states, improving the interactive experience.

Moreover, AI is used to forecast demand trends based on consumer behavior analytics, helping manufacturers align R&D with emerging applications such as foldable gaming consoles, rollable TVs, and curved AR/VR headsets. It also supports supply chain optimization by analyzing real-time data for efficient sourcing of rare materials like indium and gallium.

As AI becomes more integrated into flexible electronics ecosystems, it is expected to drive further innovation, reduce production costs, and unlock new use cases across consumer electronics, automotive, and medical wearables, establishing a strong synergy between AI and display technologies.

Research Scope and Analysis

By Type Analysis

OLED (Organic Light Emitting Diode) displays are projected to dominate the global flexible display market by the end of 2025, accounting for 54.2% of the total revenue share. Their ultra-thin construction, superior contrast ratios, and ability to produce vibrant visuals on bendable and curved surfaces have made them a preferred choice in high-end consumer electronics.

OLEDs are increasingly used in foldable smartphones, curved TVs, and next-gen wearable tech due to their flexibility and self-emissive technology. Their growing integration in premium display panels and consumer preferences for sleeker designs are accelerating adoption. Additionally, manufacturers are heavily investing in organic light-emitting diode innovations to improve energy efficiency and production scalability, giving OLEDs a competitive advantage over other flat-panel technologies.

EPD (Electronic Paper Display) is anticipated to register the highest CAGR in the flexible display market by 2025, driven by increasing demand in e-readers, electronic shelf labels, and low-power signage. These displays consume minimal power and offer superior readability in bright ambient light, making them ideal for portable, energy-efficient applications.

The expanding use of EPDs in logistics and smart retail infrastructure further fuels growth. Additionally, their lightweight and bendable nature make them suitable for integration into foldable and rollable devices. As industries shift towards sustainable and power-saving technologies, EPDs are becoming increasingly relevant in industrial IoT devices and smart tags, boosting their overall market momentum.

By Material Analysis

Plastic are expected to dominate the global flexible display market by 2025, holding a market share of 68.4%. These materials offer greater bendability, durability, and lightweight advantages compared to glass-based alternatives. Their use in rollable OLEDs and flexible LCD panels is accelerating, especially in foldable smartphones and wearable devices.

Plastic substrates enable thinner designs and greater resilience, allowing electronics manufacturers to innovate new form factors. Additionally, advancements in flexible polymer substrates and improved thermal resistance are enhancing production yields and durability in consumer electronics. As demand grows for shatter-resistant, compact displays, plastic continues to be the foundational material in next-generation flexible screen innovations.

Glass is predicted to grow at the highest CAGR in the flexible display materials segment by 2025, primarily due to the emergence of ultra-thin, flexible glass solutions. These substrates combine the clarity and scratch resistance of traditional glass with the flexibility required for foldable and curved screens.

As display manufacturers demand more durable alternatives to plastics without sacrificing visual quality, ultra-thin glass is becoming increasingly favored. Innovations in chemically strengthened and thermally treated glass formulations are expanding its application in smartphones, automotive dashboards, and premium wearable tech. This surge in demand is transforming glass from a rigid component into a flexible enabler of futuristic display architectures.

By Application Analysis

Smartphones & tablets are forecasted to dominate the global flexible display market by 2025, with a market share of 41.7%. The rapid shift toward foldable devices and edge-to-edge screen designs is significantly contributing to this segment’s leadership. Flexible display integration allows smartphone brands to introduce larger screens without increasing device size, enhancing user experience.

In addition, the demand for bezel-less and curved screens is rising across mid-range and flagship models. The increased use of AMOLED panels in mobile devices and growing consumer interest in innovative, portable technology drive this trend. Mobile OEMs are heavily investing in flexible screen R&D to gain competitive edges, reinforcing this segment's dominance.

Automotive & transportation displays are projected to record the highest CAGR in the flexible display market by 2025. The surge in demand is attributed to the rise of smart cockpits, curved infotainment screens, and digital dashboards in electric and autonomous vehicles. Flexible panels allow seamless integration into non-linear surfaces, providing manufacturers greater design freedom.

These displays offer enhanced durability, thermal stability, and wide viewing angles—critical for modern automotive interfaces. As automotive OEMs prioritize next-gen driver-assistance systems and in-car connectivity, flexible display technologies are becoming pivotal in human-machine interaction. The evolution of the smart mobility ecosystem is a key factor driving accelerated adoption in this segment.

The Flexible Display Market Report is segmented on the basis of the following:

By Type

By Material

By Application

- Smartphones & Tablets

- Smart Wearables

- Televisions & Digital Signage

- Automotive & Transportation Displays

- Others

Regional Analysis

Region with the largest Share

Asia Pacific is expected to hold the largest share in the global flexible display market with a revenue share of 39.0% by the end of 2025. This dominance is primarily driven by the presence of leading display manufacturers such as Samsung Display, LG Display, and BOE Technology in countries like South Korea, China, and Japan.

The region is a major hub for consumer electronics production, with high demand for smartphones, wearables, and OLED TVs. Additionally, government initiatives supporting advanced display technologies and robust investments in R&D and manufacturing infrastructure contribute to regional growth. With a strong supply chain, growing exports, and early adoption of cutting-edge displays, Asia Pacific continues to lead the global market in both volume and innovation.

Region with Highest CAGR

North America is projected to register the highest CAGR in the flexible display market by 2025. This growth is fueled by rapid technological innovation, increasing investments in next-gen consumer electronics, and expanding applications in automotive and healthcare sectors. The presence of tech giants and display solution providers in the U.S., along with rising adoption of foldable smartphones and advanced infotainment systems in vehicles, is accelerating market expansion.

Additionally, growing interest in flexible OLED and microLED displays for AR/VR and wearables is creating new demand. With strong consumer purchasing power, strategic collaborations, and a focus on smart display integration, North America is emerging as a key driver of high-growth opportunities in the industry.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Impact of Artificial Intelligence in the Flexible Display Market

- Accelerated Material Innovation: Artificial Intelligence is transforming material development in the flexible display market by predicting optimal material compositions and structural properties. Machine learning models simulate molecular behavior under stress, flexibility, and temperature variations, enabling the discovery of high-performance substrates and conductive materials that enhance durability, foldability, and screen clarity.

- Process Optimization and Smart Manufacturing: AI streamlines the flexible display manufacturing process by analyzing real-time production data. It regulates variables like coating thickness, curing time, and alignment to minimize defects and improve yield. This intelligent automation reduces material waste, energy consumption, and downtime, ensuring cost-effective, consistent, and scalable production of next-generation displays.

- Advanced Quality Control Systems: AI-powered vision systems conduct real-time inspections to detect micro-defects, inconsistencies, or alignment errors that human eyes may miss. Deep learning algorithms identify patterns from past defects, enabling predictive quality control. This ensures the reliability and visual integrity of flexible displays used in smartphones, wearables, and automotive applications.

- Enhanced Customization and User Experience: AI enhances user interaction with flexible displays by enabling adaptive interfaces based on touch behavior, usage habits, and environmental context. It supports personalized display adjustments and content delivery, improving user experience across consumer electronics, foldable devices, and smart environments through intelligent, responsive visual output.

Competitive Landscape

The competitive landscape of the global flexible display market is characterized by rapid innovation, strategic collaborations, and intense R&D investments among key players. Major companies such as Samsung Display, LG Display, BOE Technology, AU Optronics, and Royole Corporation are at the forefront, driving technological advancements in foldable screens, bendable OLEDs, and rollable displays. These firms are increasingly focused on expanding production capacities and enhancing display resolution, brightness, and durability to cater to evolving consumer electronics trends.

Emerging companies and startups are also entering the market with unique innovations in flexible e-paper, wearable displays, and transparent screen technology. Partnerships between display manufacturers and smartphone OEMs are accelerating commercialization, especially in the premium mobile and automotive display systems segment. Additionally, companies are exploring applications in digital signage, smart home devices, and AR/VR headsets, further intensifying competition.

Intellectual property rights, material science innovations, and investments in organic semiconductors and flexible substrate technologies are crucial differentiators. The market is witnessing a shift toward sustainable, lightweight, and energy-efficient solutions, prompting firms to develop eco-friendly flexible display panels. As the industry matures, competition will likely intensify, particularly in high-growth regions like Asia Pacific and North America, where demand for next-gen display interfaces continues to rise.

Some of the prominent players in the Global Flexible Display Market are:

- Samsung Display

- LG Display

- BOE Technology Group Co., Ltd.

- AU Optronics Corp.

- Royole Corporation

- E Ink Holdings Inc.

- Visionox Technology Inc.

- Japan Display Inc.

- Tianma Microelectronics Co., Ltd.

- Sharp Corporation

- Innolux Corporation

- China Star Optoelectronics Technology (CSOT)

- FlexEnable Ltd.

- Universal Display Corporation

- Kateeva, Inc.

- Merck Group

- Corning Incorporated

- Cambrios Technologies Corporation

- Truly International Holdings Limited

- TCL Technology Group Corporation

- Other Key Players

Recent Developments

- In March 2025, Samsung Display unveiled its Flex Hybrid OLED panel, combining foldable and slidable features, designed for next-generation mobile devices, offering enhanced versatility for smartphones, tablets, and hybrid gadgets.

- In February 2025, BOE Technology showcased a new 14-inch flexible OLED screen at MWC 2025, targeting foldable laptops and rollable tablets, emphasizing durability, thinness, and improved visual performance.

- In August 2024, Royole Corporation introduced its third-generation FlexPai foldable smartphone featuring a 7.8-inch ultra-thin AMOLED display, designed for improved portability, multitasking, and immersive media experiences.

- In May 2024, Visionox launched a high-brightness foldable OLED panel optimized for outdoor readability, targeting premium smartphones and automotive dashboard applications with a focus on energy efficiency and vivid color accuracy.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 43.4 Bn |

| Forecast Value (2034) |

USD 715.4 Bn |

| CAGR (2025–2034) |

36.5% |

| Historical Data |

2019 – 2024 |

| The US Market Size (2025) |

USD 9.2 Bn |

| Forecast Data |

2025 – 2033 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Type (OLED, LCD, EPD, Others), By Material (Plastic, Glass, Others), By Application (Smartphones & Tablets, Smart Wearables, Televisions & Digital Signage, Automotive & Transportation Displays, Others) |

| Regional Coverage |

North America – US, Canada; Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA |

| Prominent Players |

Samsung Display, LG Display, BOE Technology Group Co., Ltd., AU Optronics Corp., Royole Corporation, E Ink Holdings Inc., Visionox Technology Inc., Japan Display Inc., Tianma Microelectronics Co., Ltd., Sharp Corporation, Innolux Corporation, China Star Optoelectronics Technology (CSOT), FlexEnable Ltd., Universal Display Corporation, Kateeva, Inc., Merck Group, Corning Incorporated, Cambrios Technologies Corporation, Truly International Holdings Limited, TCL Technology Group Corporation, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |

Frequently Asked Questions

The Global Flexible Display Market size is estimated to have a value of USD 43.4 billion in 2025 and is expected to reach USD 715.4 billion by the end of 2034.

Asia Pacific is expected to be the largest market share for the Global Flexible Display Market with a share of about 39.0% in 2025.

Some of the major key players in the Global Flexible Display Market are Samsung Display, LG Display, BOE Technology Group Co. Ltd., and many others.

The market is growing at a CAGR of 36.5% over the forecasted period.

The US Flexible Display Market size is estimated to have a value of USD 9.2 billion in 2025 and is expected to reach USD 130.1 billion by the end of 2034.