Market Overview

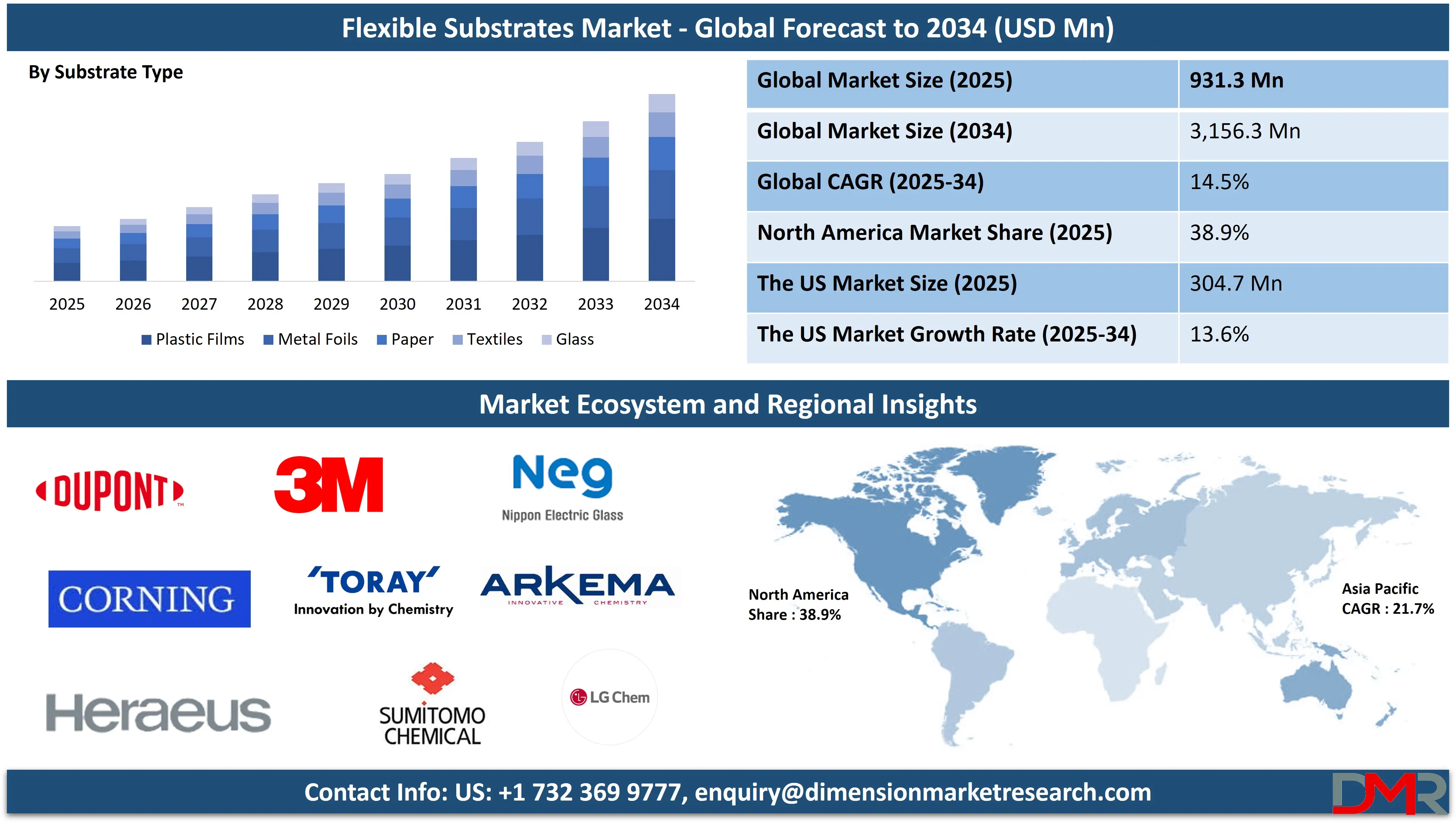

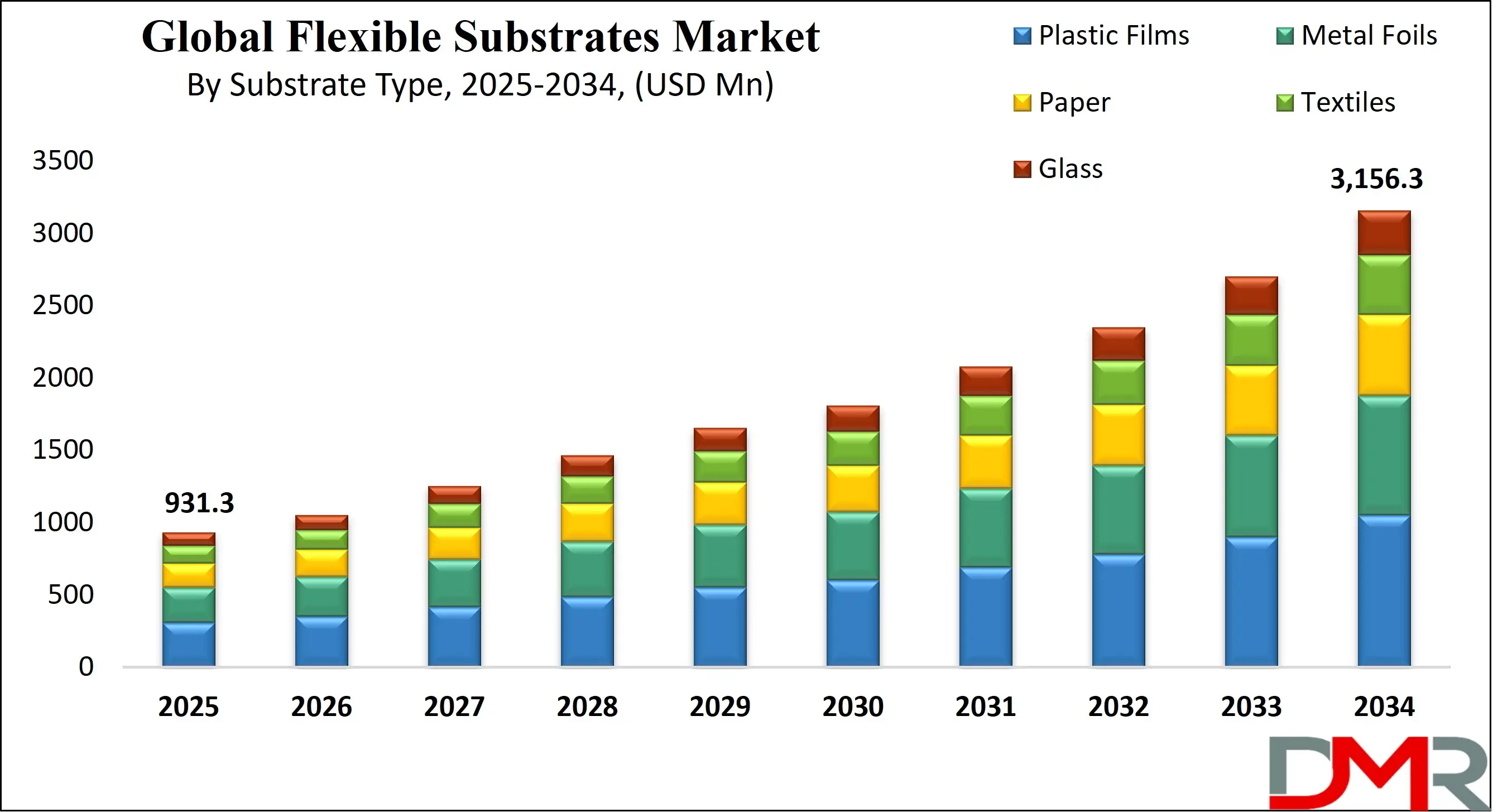

The Global Flexible Substrates Market is predicted to be valued at USD 931.3 million in 2025 and is expected to grow to USD 3,156.3 million by 2034, registering a compound annual growth rate (CAGR) of 14.5% from 2025 to 2034.

Flexible substrates are thin, bendable base materials used to support electronic circuits, displays, solar cells, sensors, and other devices. Unlike rigid substrates like glass or silicon, they offer mechanical flexibility, lightweight properties, and the ability to conform to curved surfaces. Common materials include plastic films (like PET and polyimide), metal foils, paper, and flexible glass.

These substrates enable roll-to-roll processing, which enhances cost efficiency and scalability in manufacturing. Widely used in flexible electronics market applications such as wearable devices, Flexible Display panels, packaging, and medical equipment, flexible substrates are crucial for next-generation technologies that require durability, portability, and adaptability without compromising electronic performance.

The global flexible substrates market is witnessing significant momentum, propelled by the increasing demand for lightweight, durable, and adaptable materials across multiple sectors. These substrates, which include plastic films, metal foils, textiles, and specialty papers, serve as foundational layers for printed electronics and flexible devices. Their compatibility with roll-to-roll processing enhances production efficiency, making them highly suitable for mass manufacturing in consumer electronics and wearable technology.

In the consumer electronics segment, the need for thinner, foldable, and more robust displays in smartphones, tablets, and e-readers is accelerating the adoption of flexible substrates. Similarly, in the healthcare sector, the integration of flexible sensors into medical devices and wearable health monitors supports continuous patient monitoring, personalized treatments, and broader Health and Wellness applications. The automotive industry is also embracing flexible substrates for advanced driver-assistance systems and smart dashboards, leveraging their ability to conform to unconventional shapes and surfaces.

Sustainability trends and environmental regulations are further influencing the market, with manufacturers focusing on recyclable and biodegradable flexible substrates. The rise in solar panel deployment and energy harvesting applications underscores the material's utility in flexible photovoltaic cells. Additionally, the packaging sector benefits from flexible substrates due to their barrier properties, light weight, and adaptability for custom shapes and designs.

However, challenges such as mechanical stability under repeated bending, cost constraints in advanced manufacturing processes, and material compatibility continue to test market players. Despite these hurdles, innovation in coating, laminating, and printing technologies, coupled with evolving end-user demands and regulatory pressures for eco-friendly solutions, is poised to shape a dynamic and progressive market landscape.

The US Flexible Substrates Market

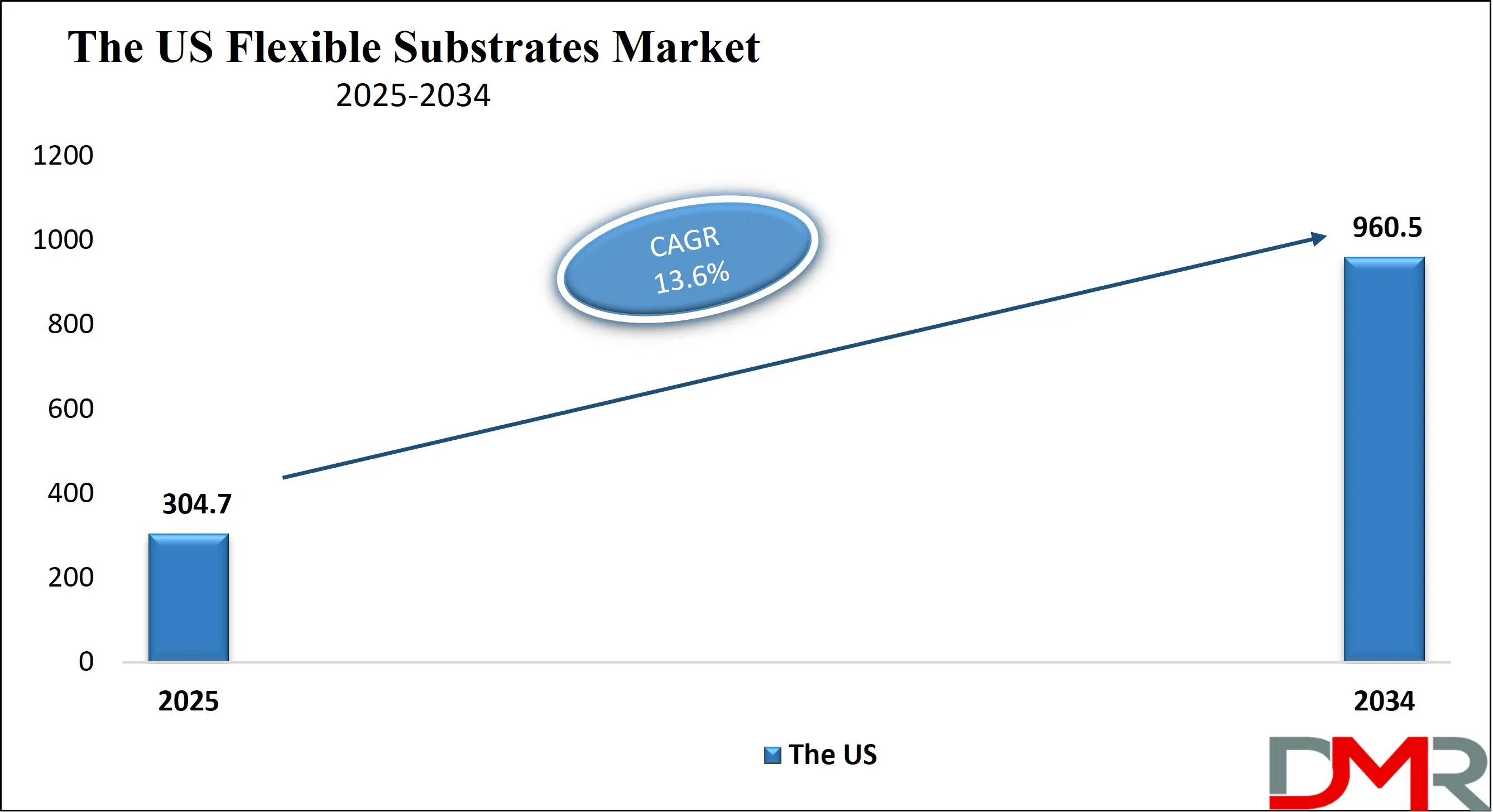

The US Flexible Substrates Market is projected to be valued at USD 304.7 million in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 960.5 million in 2034 at a CAGR of 13.6%.

The US flexible substrates market is being driven by robust demand from the consumer electronics sector, particularly for flexible displays, wearable devices, and foldable smartphones. The region's strong innovation ecosystem, including the presence of major tech companies and research institutions, accelerates material science development and manufacturing process advancements. Additionally, the push toward lightweight and energy-efficient components in the aerospace, automotive, and medical device industries supports broader adoption.

Applications in Aerospace Telemetry Systems are also expanding, highlighting the role of flexible substrates in lightweight, high-reliability communication systems. Government support for sustainable technologies and renewable energy, especially in solar applications, further encourages the use of flexible substrates. High investment in R&D and increased commercialization of next-gen electronics are fueling market expansion.

A key trend in the US flexible substrates market is the integration of advanced materials such as flexible glass and high-performance polymers to enhance thermal resistance and durability. There is growing interest in roll-to-roll manufacturing for cost-effective, large-scale production of flexible electronics. The rise of Internet of Things (IoT) devices is influencing the design of bendable sensors and circuit boards using flexible substrates.

In medical applications, the demand for skin-conformal and implantable devices is driving innovation. Collaborations between tech firms and material developers are leading to breakthroughs in multi-functional flexible films, enabling stretchable and transparent electronic components.

The Japan Flexible Substrates Market

The Japan Flexible Substrates Market is projected to be valued at USD 126.1 million in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 408.3 million in 2034 at a CAGR of 14.1%.

Japan’s flexible substrates market is primarily driven by its advanced electronics manufacturing ecosystem, which demands miniaturized, lightweight, and high-performance materials. The country is a global leader in display technologies, and its early adoption of OLED, foldable screens, and wearable devices fuels demand for highly flexible and durable substrates.

Strong government support for innovation, alongside corporate R&D investments, is catalyzing breakthroughs in flexible printed circuits and thin-film technologies. Additionally, Japan's aging population is contributing to rising demand for healthcare wearables, sensors, and diagnostic patches, all of which benefit from the integration of flexible, biocompatible substrate materials.

Japan is witnessing a trend toward ultra-thin, transparent, and high-thermal stability substrates for use in next-generation flexible electronics. The market is exploring advanced polymers and hybrid materials that offer better mechanical flexibility without compromising electrical performance. Increased collaboration between electronics giants and material science companies is spurring innovation in stretchable electronics and roll-to-roll fabrication methods.

The integration of flexible substrates in robotics, particularly in soft robots and sensor-embedded exteriors, is gaining traction. Furthermore, Japan is promoting eco-conscious production, leading to a rise in interest in recyclable and low-carbon-emission materials for use in printed electronics and display technologies.

The Europe Flexible Substrates Market

The Europe Flexible Substrates Market is projected to be valued at USD 223.5 million in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 733.4 million in 2034 at a CAGR of 14.2%.

Europe’s flexible substrates market is propelled by the region’s commitment to green energy initiatives, with growing integration of flexible solar cells in building-integrated photovoltaics and portable energy systems. The automotive industry's push for in-car flexible displays, printed sensors, and lightweight components aligns with the EU’s focus on reducing vehicle emissions.

Additionally, advancements in healthcare electronics and increasing demand for wearable diagnostics are supporting the adoption of biocompatible and stretchable substrates. Strong regulatory frameworks, funding for clean tech startups, and collaborations between academia and industry further drive innovation in flexible materials and fabrication techniques across the continent.

A rising trend in Europe is the convergence of sustainability with electronics manufacturing, leading to the development of biodegradable and recyclable flexible substrates. The region is seeing increasing deployment of organic and printed electronics in consumer goods and smart packaging.

Printed flexible sensors are gaining momentum in automotive and industrial applications for real-time monitoring and diagnostics. The adoption of sheet-to-sheet and hybrid printing technologies is enabling more precise and complex circuitry on flexible substrates. Additionally, the integration of flexible displays into home automation systems and the proliferation of e-paper applications in retail are contributing to diversified demand.

Flexible Substrates Market: Key Takeaways

- Market Overview: The Global Flexible Substrates Market is projected to reach a valuation of USD 931.3 million in 2025 and is expected to expand significantly to USD 3,156.3 million by 2034, reflecting a robust CAGR of 14.5% during the forecast period from 2025 to 2034.

- Substrate Type Analysis: Plastic films are set to dominate the market landscape, contributing 46.2% of the global share by 2025. Their flexibility, lightweight nature, and compatibility with advanced electronic applications drive this leadership position.

- Form Factor Evaluation: The roll-to-roll configuration is forecasted to lead this category, capturing 52.7% of the market by 2025. Its efficiency in high-volume production and suitability for continuous manufacturing play a pivotal role in its dominance.

- Manufacturing Process Overview: Coating is expected to be the most prominent process type, holding a 39.8% share in the market by 2025. This is attributed to its ability to enhance substrate performance and compatibility with various functional materials.

- Application Outlook: Displays are projected to be the leading application segment, accounting for 35.6% of the market share by the end of 2025. The growing demand for flexible and foldable displays in consumer devices significantly boosts this trend.

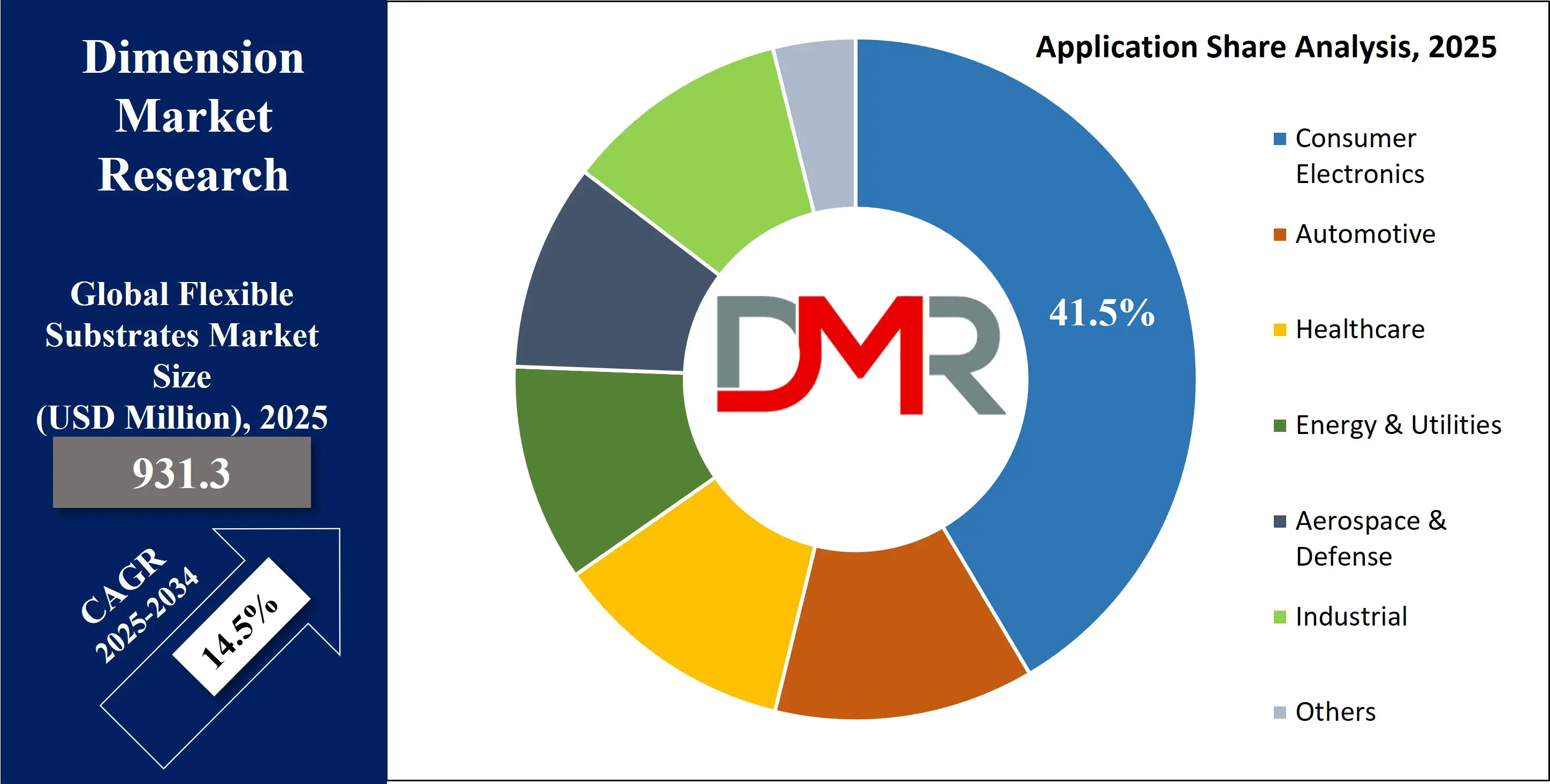

- End User Insight: Consumer electronics are anticipated to be the largest end-use sector, with an estimated market share of 41.5% by 2025. The rise in wearable devices, smartphones, and flexible displays contributes to this strong demand.

- Regional Share Assessment: North America is expected to emerge as the dominant regional market, commanding 38.9% of the global flexible substrates market by 2025.

Flexible Substrates Market: Use Cases

- Flexible Displays: Flexible substrates are widely used in OLED and e-paper displays for smartphones, wearables, and foldable screens. Their bendable, lightweight nature enables ultra-thin, rollable, or foldable electronics, enhancing portability and durability without compromising visual quality or touchscreen responsiveness in consumer electronics.

- Wearable Electronics: In wearable devices, flexible substrates support the integration of sensors and circuits into textiles and fitness gear. They allow for continuous health monitoring and biometric data collection due to their conformability to the human body, enabling innovation in smart clothing and medical-grade wearable patches

- Solar Panels: Flexible substrates enable the production of lightweight, portable, and durable solar cells. These panels can be rolled or curved for installation on irregular surfaces like vehicle roofs or backpacks, offering off-grid power solutions for remote locations, disaster relief, and mobile charging applications.

- Flexible Sensors: It is used in healthcare and industrial monitoring, flexible substrates allow sensors to be embedded in curved or dynamic surfaces. Applications include biosensors for patient vitals tracking, pressure sensors in robotics, and environmental sensors, providing real-time data while maintaining device flexibility and mechanical integrity.

Flexible Substrates Market: Stats & Facts

- IEEE Xplore reports that flexible substrates enable next-generation electronics such as foldable displays, wearable sensors, and smart packaging due to their lightweight and bendable nature.

- Nature Communications highlights that flexible organic solar cells on plastic substrates can achieve power conversion efficiencies exceeding 13%, showing promise for portable and wearable energy devices.

- ScienceDirect reveals that polyimide is among the most widely used flexible substrate materials in flexible electronics due to its high thermal stability and excellent mechanical properties.

- ACS Nano notes that advances in roll-to-roll processing techniques for flexible substrates are significantly reducing manufacturing costs while enabling large-area production of flexible electronic devices.

- MDPI Sensors states that flexible substrates have facilitated the rapid development of flexible biosensors capable of continuous health monitoring, such as glucose and hydration sensors integrated into skin patches.

- Journal of Materials Chemistry C shows that flexible substrates are crucial in developing stretchable electronics, particularly for applications in soft robotics and implantable devices.

- Science Advances reports that graphene-based flexible substrates have demonstrated exceptional conductivity and flexibility, making them suitable for next-gen flexible and transparent electronics.

- IEEE Transactions on Electron Devices explains that flexible substrates combined with printed electronics allow for the integration of sensors, circuits, and antennas in unconventional form factors like clothing and bandages.

- Nature Energy states that flexible perovskite solar cells on plastic substrates have achieved power conversion efficiencies of over 20%, rivaling those of rigid silicon-based cells.

- IEEE Xplore reports that flexible AMOLED displays, primarily using polyimide substrates, support bending radii of less than 1.5 mm, enabling foldable and rollable smartphone designs.

- ScienceDirect indicates that polyethylene terephthalate (PET) films used as flexible substrates in RFID tags can withstand up to 10,000 bending cycles without significant loss in conductivity.

- Journal of Micromechanics and Microengineering finds that flexible pressure sensors based on PDMS substrates can detect pressures as low as 0.5 Pa, making them ideal for tactile sensing in robotics and medical diagnostics.

- ACS Applied Materials & Interfaces shows that flexible substrates used in electronic skin (e-skin) can maintain electrical performance at up to 50% strain, enabling use on dynamic human body surfaces.

- MDPI Polymers reports that polyimide-based flexible substrates can withstand continuous operating temperatures of over 300°C, suitable for high-temperature processing in semiconductor applications.

- Science Advances reveals that silver nanowire-based flexible conductors on PET substrates can achieve sheet resistances as low as 10 Ω/sq while maintaining over 90% optical transparency.

- National Renewable Energy Laboratory (NREL) data indicates that flexible thin-film solar modules made using substrates like stainless steel or plastic can weigh as little as 1.5–2 kg/m², compared to 10–20 kg/m² for conventional glass modules.

- Advanced Functional Materials documents that organic field-effect transistors (OFETs) on flexible substrates can achieve charge carrier mobilities up to 10 cm²/V·s, suitable for flexible display backplanes.

- U.S. Department of Energy notes that roll-to-roll manufacturing on flexible substrates can reduce production costs of flexible electronics by up to 30–40% compared to traditional batch processes.

Flexible Substrates Market: Market Dynamic

Driving Factors in the Flexible Substrates Market

Rising Demand from Wearable Electronics and Flexible Displays

The growing popularity of wearable electronics and flexible displays is a major driver of the flexible substrates market. These devices require lightweight, bendable, and durable materials that can conform to non-traditional shapes, boosting the adoption of flexible films and foils. The surge in smartwatches, fitness bands, foldable smartphones, and OLED panels is further accelerating market demand.

The flexibility, thinness, and compatibility with roll-to-roll manufacturing processes make substrates like polyimide, PET, and PEN ideal choices. As consumer electronics trend toward miniaturization and multifunctionality, flexible substrates provide key performance benefits that rigid counterparts cannot offer, positioning them as critical components in next-generation electronic device design and development.

Advancements in Printing and Coating Technologies

Ongoing innovation in coating, printing, and laminating techniques is significantly propelling the flexible substrates market. Enhanced printing technologies such as inkjet, gravure, and screen printing allow precise deposition of conductive and functional materials on flexible surfaces. These advancements ensure higher resolution, better adhesion, and compatibility with various substrate types like plastic films, metal foils, and paper.

Moreover, progress in thin-film deposition and vacuum coating techniques enables cost-efficient production of flexible electronics and photovoltaic cells. These manufacturing improvements not only reduce production costs but also expand the scope of flexible substrates in applications like medical devices, flexible solar panels, and RFID tags—boosting commercial scalability and market penetration.

Restraints in the Flexible Substrates Market

High Cost of Raw Materials and Processing

Despite their advantages, flexible substrates often face challenges due to the high cost of raw materials like polyimide, specialty coatings, and conductive inks. These advanced materials are essential for performance but increase the overall production expense compared to conventional substrates. Moreover, the fabrication processes such as etching, laminating, and vacuum deposition require capital-intensive equipment and skilled labor, further raising operational costs.

These cost constraints hinder the adoption of flexible substrates in cost-sensitive markets, especially in developing regions. This economic limitation affects their application in large-scale consumer electronics, packaging, and solar energy, where cost efficiency is a critical determinant for mass-market acceptance.

Mechanical and Thermal Stability Limitations

Flexible substrates, especially plastic-based ones, often have inferior mechanical strength and thermal stability compared to rigid materials like glass. Under high-stress conditions or elevated temperatures, they may deform, shrink, or delaminate, affecting device reliability. These limitations pose challenges for applications requiring long-term durability or high-precision performance, such as flexible PCBs or automotive sensors.

Additionally, achieving compatibility with high-temperature processing methods used in semiconductor or photovoltaic manufacturing remains a barrier. Such performance constraints restrict flexible substrates from being used in critical or harsh environment applications, thus limiting their versatility despite advancements in polymer engineering and barrier film technologies.

Opportunities in the Flexible Substrates Market

Expanding Role in Flexible Solar Panels and Smart Packaging

Flexible substrates are finding expanding opportunities in emerging applications like flexible solar cells and smart packaging solutions. In flexible photovoltaics, substrates like PET and polyimide serve as lightweight, bendable backplanes for solar films, allowing installation on irregular surfaces such as tents, vehicles, and wearables. In smart packaging, these substrates support printed sensors and RFID tags, enhancing supply chain transparency and consumer engagement.

As industries adopt energy-efficient and interactive packaging solutions, flexible substrates serve as enablers. This trend creates new demand from the renewable energy sector and the packaging industry, where sustainability, flexibility, and real-time data capabilities are driving innovation and growth potential.

Growing Adoption in Healthcare and Medical Devices

Flexible substrates are gaining momentum in the healthcare sector, particularly in wearable medical devices, biosensors, and diagnostic patches. These substrates enable the development of conformable, skin-friendly electronics that can monitor vital signs, glucose levels, or hydration in real-time. Their flexibility, biocompatibility, and ability to integrate with soft surfaces make them ideal for continuous health monitoring.

As the global healthcare industry shifts toward personalized and remote patient care, the demand for reliable, lightweight, and flexible materials increases. Innovations in stretchable electronics and printed healthcare sensors are further opening avenues for flexible substrates in medical diagnostics and therapeutic monitoring devices.

Trends in the Flexible Substrates Market

Shift toward Eco-Friendly and Recyclable Substrates

Sustainability is becoming a prominent trend in the flexible substrates market, leading to increased research in eco-friendly and recyclable alternatives. Companies are exploring biodegradable films, cellulose-based substrates, and recyclable plastic substrates to reduce the environmental footprint of electronic and packaging applications.

This shift is especially relevant in consumer packaging and electronics, where brands are facing pressure to meet environmental regulations and corporate sustainability goals. The demand for green materials aligns with broader circular economy strategies and offers a competitive edge to manufacturers that adopt low-impact substrates. This trend is fostering innovation in material science and sustainable flexible substrate development.

Integration with IoT and Smart Systems

As the Internet of Things (IoT) ecosystem grows, flexible substrates are playing a crucial role in enabling smart systems integration. From flexible sensors in industrial IoT to smart textiles and intelligent labels, these substrates allow seamless embedding of electronics in non-traditional formats. Roll-to-roll and printed electronics technologies make it feasible to produce low-cost, high-volume flexible components for IoT use cases. The demand for ultra-thin, lightweight, and wireless-compatible substrates is rising as industries seek scalable solutions for automation, asset tracking, and condition monitoring. This trend positions flexible substrates as fundamental building blocks in the evolution of smart infrastructure and connected devices.

Flexible Substrates Market: Research Scope and Analysis

By Substrate Type Analysis

Plastic films are expected to dominate the global flexible substrates market by 2025, accounting for 46.2% of the total share. Their excellent flexibility, lightweight nature, and cost-effectiveness make them the preferred choice across multiple sectors. The rising demand in wearable electronics, foldable smartphones, and flexible OLED displays is propelling their adoption.

In addition, plastic films exhibit strong barrier properties and high optical clarity, which enhances their application in smart packaging and advanced optoelectronic devices. Manufacturers are increasingly favoring these materials due to their ease of integration with thin-film transistors and organic semiconductors, reinforcing their position in the supply chain. Continuous innovation in polymer composites is further expanding their applicability in high-performance flexible circuitry.

Metal foils are projected to grow at the highest CAGR in the global flexible substrates market by the end of 2025. Their exceptional conductivity, thermal stability, and robustness under extreme conditions make them indispensable in high-frequency flexible circuits and power-intensive flexible electronics. Demand is surging in electric vehicles and compact medical devices, where miniaturization and performance reliability are critical.

Aluminum and copper foils are increasingly being used in energy storage systems, particularly flexible lithium-ion batteries and solar cells. Technological advancements in roll-to-roll vacuum deposition on metal foils are unlocking new frontiers in manufacturing efficiency and product durability, boosting growth potential across industrial, automotive electronics, and aerospace systems.

By Form Factor Analysis

Roll-to-roll processing is anticipated to lead the global flexible substrates market with a 52.7% share by 2025. This method allows continuous, large-scale fabrication, reducing production costs and improving throughput in the manufacture of flexible printed electronics. It enables integration of multiple layers on thin, bendable surfaces, ideal for flexible displays, RFID tags, and sensors.

Its compatibility with various substrate materials, including polymers and foils, increases its utility across wearable tech and photovoltaic modules. The scalability of roll-to-roll systems, paired with reduced material wastage and high-speed operation, makes it a go-to method for mass production in sectors demanding lightweight, durable, and ultra-thin electronic assemblies.

Stackable form factor is expected to exhibit the highest CAGR in the flexible substrates market by 2025. As multi-layer architectures gain traction in flexible electronics, especially in sensor integration and compact device design, stackable substrates offer superior component density and system reliability. This configuration is key in modern applications such as 3D-ICs, smart patches, and biomedical implants, where vertical interconnects and space optimization are crucial.

Enhanced thermal management, EMI shielding, and improved electrical connectivity make stackable substrates ideal for miniaturized, high-performance flexible electronic systems. Ongoing R&D in stackable multilayer circuits is driving its application in next-gen smart packaging and microelectromechanical systems (MEMS).

By Manufacturing Process Analysis

Coating processes are expected to dominate the flexible substrates market by 2025, with a projected share of 39.8%. Coating enhances surface properties such as moisture resistance, conductivity, and adhesion, crucial for flexible solar modules, smart sensors, and touch-responsive films. Techniques like slot-die, gravure, and spray coating allow uniform deposition of active materials on flexible carriers.

Coating is extensively used in developing anti-reflective and anti-static layers for flexible display panels and barrier layers in packaging films. The push toward high-performance, wear-resistant flexible electronics across consumer and industrial sectors continues to drive demand for advanced coating technologies that ensure functional stability under mechanical stress.

Printing processes are predicted to register the fastest CAGR by 2025 in the flexible substrates space. This includes inkjet, screen, and gravure printing, methods that offer precise material deposition on bendable surfaces. Printing enables low-cost, scalable production of organic thin-film transistors, printed photovoltaics, and flexible antennas.

As interest in printed flexible circuits grows, especially for disposable medical electronics and smart textiles, printing is emerging as a sustainable and customizable manufacturing alternative. It supports compatibility with biodegradable substrates and conductive inks, facilitating innovations in green electronics and environmentally conscious applications. Moreover, the digital adaptability of printing processes fosters rapid prototyping and mass customization.

By Application Analysis

Displays are projected to dominate the flexible substrates market with a 35.6% share by the end of 2025. The shift toward foldable and rollable screens in smartphones, TVs, and tablets is fueling this trend. Flexible substrates offer lightweight and bendable platforms, supporting innovations in OLED panels, electronic paper displays, and curved screens.

Their durability and ability to withstand frequent mechanical stress make them ideal for wearable and automotive infotainment systems. With leading electronics brands investing in ultra-thin display technology, the demand for high-transparency, heat-resistant substrate materials is surging. The increasing integration of displays into smart devices and industrial HMI interfaces is driving this application segment’s leadership.

Medical devices are expected to register the highest CAGR by the end of 2025 in the flexible substrates market. The adoption of bendable, skin-conformable electronics in health monitoring wearables, biosensors, and smart bandages is accelerating. Flexible substrates enable lightweight, non-invasive medical technologies that offer continuous data capture and patient comfort.

With rising chronic diseases and aging populations, there is an increasing push toward remote health diagnostics and personalized treatment solutions. Biocompatible, stretchable substrates integrated with microfluidics and printed biosensors are advancing new forms of medical diagnostics. Their role in disposable diagnostic strips, implantable systems, and electronic skin patches underpins rapid growth in this healthcare-driven segment.

By End User Analysis

Consumer electronics are predicted to lead the flexible substrates market with a 41.5% market share by the end of 2025. The rise in adoption of flexible and foldable smartphones, wearable fitness devices, and smartwatches is fueling demand for flexible substrates. These substrates enable compact form factors and increased device durability, essential in next-generation electronics.

Their role in touch-sensitive surfaces, flexible batteries, and printed circuit boards enhances device functionality and user experience. With increasing investments in flexible display development, coupled with the proliferation of smart gadgets, consumer electronics remain the primary innovation driver for flexible substrates, emphasizing their versatility and seamless integration into compact product architectures.

The healthcare sector is expected to grow at the fastest CAGR in the flexible substrates market by 2025. Driven by the surge in wearable biomedical devices, the segment is witnessing rapid innovation in flexible biosensors, diagnostic tools, and electronic skin applications. These substrates offer skin compatibility, stretchability, and real-time sensing capabilities, key for chronic disease monitoring and elderly care.

Integration with point-of-care diagnostics, mobile health platforms, and telemedicine ecosystems further supports growth. Additionally, R&D in flexible implants and therapeutic electronics is expanding use cases in drug delivery and neuro-monitoring. The demand for minimally invasive, patient-friendly technologies continues to drive exponential market expansion.

The Flexible Substrates Market Report is segmented on the basis of the following:

By Substrate Type

- Plastic Films

- Metal Foils

- Paper

- Textiles

- Glass

By Form Factor

- Roll-to-Roll

- Sheet-to-Sheet

- Stackable

By Manufacturing Process

- Coating

- Printing

- Laminating

- Etching

By Application

- Displays

- Sensors

- Solar Cells

- Packaging

- Medical Devices

By End user

- Consumer Electronics

- Automotive

- Healthcare

- Energy & Utilities

- Aerospace & Defense

- Industrial

- Others

Regional Analysis

Region with the largest Share

North America is projected to hold the largest share of the global flexible substrates market, accounting for 38.9% by 2025. This dominance stems from the region's well-established electronics and semiconductor industries, particularly in the U.S. and Canada. Technological advancements, high adoption of flexible electronics, and strong presence of key players like DuPont, 3M, and Rogers Corporation further enhance market growth.

The demand is driven by increasing use in applications such as OLED displays, photovoltaic cells, sensors, and medical devices. Additionally, government initiatives supporting advanced manufacturing technologies and substantial R&D investments create a favorable environment. The region’s mature infrastructure and early adoption of cutting-edge materials give it a strategic edge in flexible substrate innovation and commercialization.

Region with Highest CAGR

Asia Pacific is expected to witness the highest CAGR in the flexible substrates market through 2034. This growth is fueled by rapid industrialization, expanding consumer electronics manufacturing, and increasing investments in flexible displays and wearable technologies across countries like China, Japan, South Korea, and India.

The region benefits from a strong electronics supply chain, competitive labor costs, and supportive government policies encouraging innovation and domestic production. Furthermore, rising demand for lightweight and durable materials in sectors like automotive, healthcare, and energy drives flexible substrate adoption. Local players are also ramping up production capabilities to meet export demand. The thriving renewable energy sector, particularly in flexible solar panels, and a booming IoT ecosystem further accelerate regional market expansion.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Impact of Artificial Intelligence in the Flexible Substrates Market

- Advanced Material Design and Simulation: AI accelerates the development of flexible substrates by predicting material behavior under various stress, temperature, and bending conditions. Machine learning models simulate complex interactions at molecular levels, enabling researchers to design substrates with enhanced flexibility, conductivity, and durability tailored for electronics, solar cells, and wearable devices.

- Smart Manufacturing and Process Optimization: AI enables real-time monitoring and control of flexible substrate production lines. By analyzing sensor data, it identifies defects, optimizes printing or coating parameters, and predicts equipment maintenance needs. This results in higher yields, lower waste, and greater consistency in substrate thickness, texture, and performance during mass production.

- Enhanced Quality Assurance and Inspection: Computer vision and AI algorithms are used to inspect substrates for microscopic cracks, alignment issues, and irregularities. These systems ensure defect-free production with greater accuracy than manual inspections. AI also helps in adaptive quality control by learning from historical data to flag potential failures before they occur.

- Innovation in Application Development: AI facilitates the integration of flexible substrates in emerging technologies like flexible displays, sensors, and biomedical devices. It assists in designing application-specific substrates based on functionality, user behavior, and performance metrics. This accelerates product innovation and customization across industries such as electronics, healthcare, automotive, and smart packaging.

Competitive Landscape

The global flexible substrates market is characterized by intense competition, with key players focusing on innovation, strategic partnerships, and technological advancements to strengthen their market position. Major companies such as 3M, DuPont, Sumitomo Electric, LG Chem, and KOLON Industries dominate the landscape, offering a diverse portfolio of high-performance materials suited for flexible displays, wearable electronics, and photovoltaic applications. These firms are heavily investing in R&D to develop next-generation substrates that provide enhanced thermal resistance, optical clarity, and mechanical durability.

Emerging players from Asia Pacific are increasingly entering the market, leveraging cost-effective manufacturing and expanding their global footprint. Strategic mergers, acquisitions, and collaborations with electronics OEMs and solar panel manufacturers are commonly adopted to enhance production capabilities and expand application reach. Companies are also exploring sustainable substrate materials to align with global environmental mandates.

The market exhibits dynamic growth in segments such as plastic films, metal foils, and specialty papers, driven by advancements in roll-to-roll processing, etching, and printing technologies. With growing demand across displays, sensors, and medical devices, the competitive environment remains robust, and innovation continues to be the key differentiator. Firms that adapt quickly to material science trends and application-specific customization are likely to maintain a competitive edge.

Some of the prominent players in the Global Flexible Substrates Market are

- DuPont

- 3M

- Nippon Electric Glass Co., Ltd.

- Corning Incorporated

- Teijin Limited

- Toray Industries, Inc.

- Arkema Group

- Heraeus Holding

- Sumitomo Chemical Co., Ltd.

- LG Chem

- Kolon Industries Inc.

- Toppan Inc.

- Fujikura Ltd.

- SCHOTT AG

- FlexEnable Limited

- Polyonics, Inc.

- Rogers Corporation

- Covestro AG

- Avery Dennison Corporation

- Mitsubishi Chemical Corporation

- Other Key Players

Recent Developments

- In April 2025, SEMI launched a flexible hybrid electronics consortium to promote standardization and strengthen supply chains, with participation from key players including DuPont, LG Display, and Corning, aiming to accelerate commercialization in flexible sensors, OLEDs, and smart packaging applications.

- In March 2025, LG Display expanded production of stretchable substrates for automotive displays and signed an agreement with Mercedes-Benz to supply flexible OLED panels for in-car entertainment systems, strengthening its position in the automotive flexible electronics market.

- In December 2025, Samsung collaborated with Dowoo Insys to mass-produce polyimide films for foldable smartphones, enhancing durability and transparency, supporting Samsung’s goal to lead the global foldable display segment with innovative flexible substrate materials.

- In July 2024, DuPont showcased new flexible barrier films at the SNEC PV Power Expo in Shanghai, highlighting their application in solar cells and advanced displays with improved moisture resistance and optical clarity.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 931.3 Mn |

| Forecast Value (2034) |

USD 3,156.3 Mn |

| CAGR (2025–2034) |

14.5% |

| Historical Data |

2019 – 2024 |

| The US Market Size (2025) |

USD 304.7 Mn |

| Forecast Data |

2025 – 2033 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Substrate Type (Plastic Films, Metal Foils, Paper, Textiles, Glass), By Form Factor (Roll-to-Roll, Sheet-to-Sheet, Stackable), By Manufacturing Process (Coating, Printing, Laminating, Etching), By Application (Displays, Sensors, Solar Cells, Packaging, Medical Devices), By End User (Consumer Electronics, Automotive, Healthcare, Energy & Utilities, Aerospace & Defense, Industrial, Others) |

| Regional Coverage |

North America – US, Canada; Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA |

| Prominent Players |

DuPont, 3M, Nippon Electric Glass Co., Ltd., Corning Incorporated, Teijin Limited, Toray Industries, Inc., Arkema Group, Heraeus Holding, Sumitomo Chemical Co., Ltd., LG Chem, Kolon Industries Inc., Toppan Inc., Fujikura Ltd., SCHOTT AG, FlexEnable Limited, Polyonics, Inc., Rogers Corporation, Covestro AG, Avery Dennison Corporation, Mitsubishi Chemical Corporation, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |

Frequently Asked Questions

The Global Flexible Substrates Market size is estimated to have a value of USD 931.3 million in 2025 and is expected to reach USD 3,156.3 million by the end of 2034.

North America is expected to be the largest market share for the Global Flexible Substrates Market with a share of about 38.9% in 2025.

Some of the major key players in the Global Flexible Substrates Market are DuPont, 3M, Nippon Electric Glass Co. Ltd., and many others.

The market is growing at a CAGR of 14.5% over the forecasted period.

The US Flexible Substrates Market size is estimated to have a value of USD 304.7 million in 2025 and is expected to reach USD 960.5 million by the end of 2034.