Market Overview

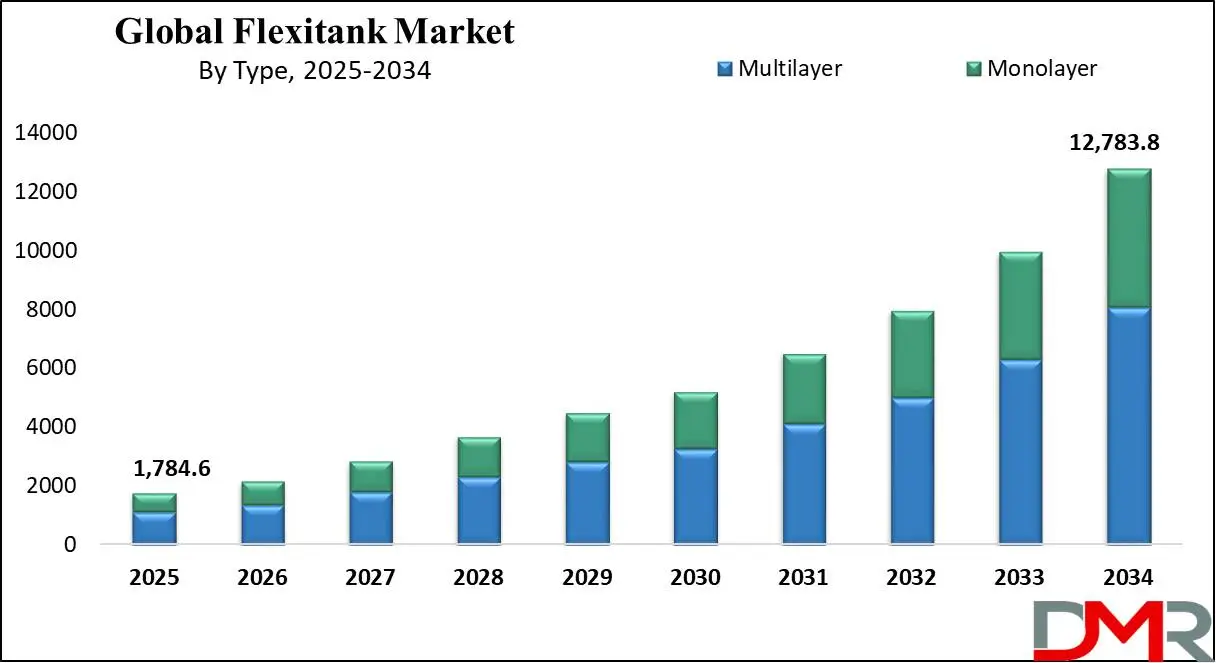

The

Global Flexitank Market was

valued at USD 1,784.6 million in 2025 and is expected to grow to

USD 12,783.8 million by 2034, registering a

CAGR of 24.5% from 2025 to 2034.

A Flexitank is a flexible, lightweight, and cost-effective bulk liquid storage container designed for transportation in standard 20-foot shipping containers. Made from multiple layers of polyethylene with an outer protective layer of polypropylene, it can hold 16,000 to 24,000 liters of non-hazardous liquids like edible oils, wine, juices, and industrial chemicals. Flexitanks maximize container capacity, reduce packaging costs, and minimize contamination risks compared to traditional drums or IBCs. They are single-use, eliminate cleaning costs, and offer easy installation and disposal. Their adoption has revolutionized bulk liquid logistics by improving efficiency, reducing shipping weight, and enhancing sustainability in global trade.

The Flexitank market is primarily driven by the growing demand for cost-effective and efficient bulk liquid transportation. Compared to traditional drums, IBCs, and tank containers, Flexitanks offer a higher payload capacity, reducing overall shipping costs.

The increasing global trade of liquid products such as food-grade liquids, industrial chemicals, and pharmaceutical liquids has further accelerated market growth. Additionally, the shift towards sustainable packaging solutions has encouraged industries to adopt Flexitanks, which are recyclable and reduce carbon emissions by minimizing the need for return shipments. The rapid expansion of the e-commerce sector and the increased consumption of edible oils and beverages have also contributed to the rising demand for Flexitanks.

Flexitanks have grown increasingly popular within the wine and fruit juice industries as a cost-efficient method for maintaining product quality during shipping. Technological innovations, including multi-layered Flexitanks featuring enhanced durability and leakproof designs are expected to create new avenues for market players; government initiatives promoting sustainable packaging methods further support market expansion.

Manufacturers have developed temperature-controlled Flexitanks to accommodate temperature-sensitive liquids like pharmaceuticals and specialty chemicals, while non-hazardous chemical transport with Flexitanks has seen significant gains thanks to digital supply chain solutions and real-time tracking systems ensuring better quality control, customer satisfaction, and better cost efficiency.

Flexitank market growth will likely be driven by cost efficiency, sustainability, and increasing demand across various industries. Material innovation, improved safety features, and shifting logistics practices towards eco-friendlier operations is predicted to fuel its development further over time. Emerging markets and increasing trade activities will further bolster adoption rates - becoming essential solutions for bulk liquid transportation needs in their own right. Companies investing in innovation or strategic partnerships could gain competitive advantages that ensure sustained expansion within this dynamic marketplace.

The US Flexitank Market

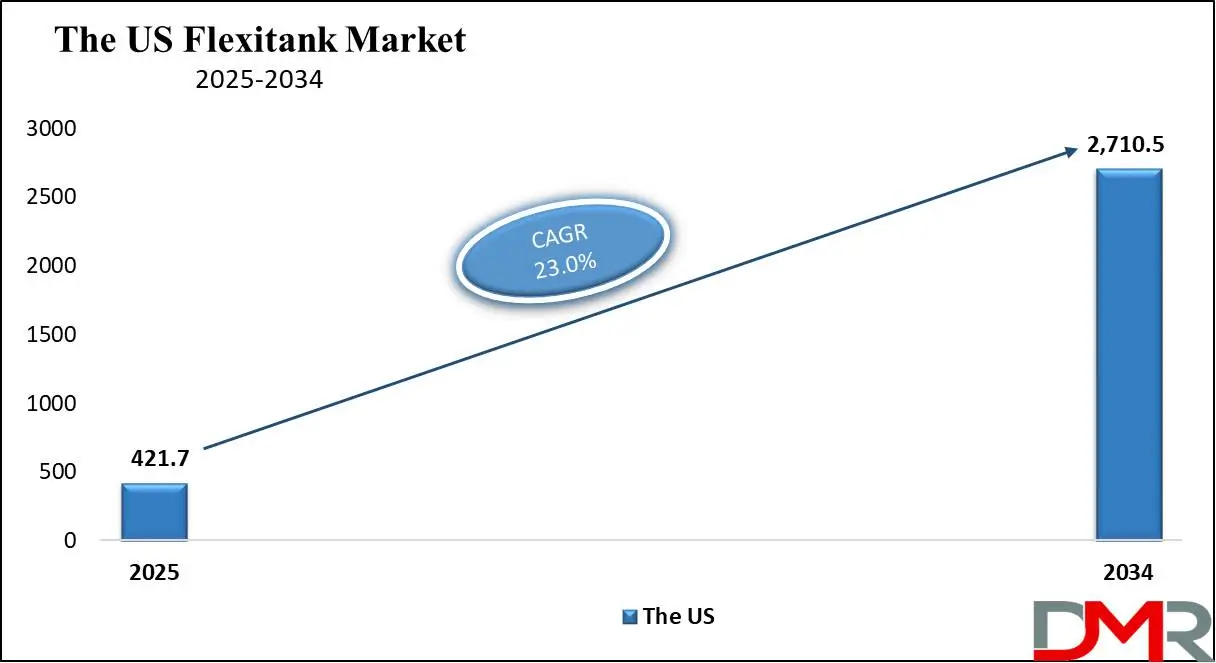

The US Flexitank market is projected to be valued at USD 421.7 million in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 2,710.5 million in 2034 at a CAGR of 23.0 %.

The U.S. flexitank market is driven by the expanding food & beverage and pharmaceutical industries, which require cost-effective bulk liquid transportation. High per capita income and increasing global trade also fuel demand. Additionally, the presence of major manufacturers like Environmental Packaging Technologies, Inc. and Techno Group USA enhances supply availability. Shipping companies increasingly prefer flexitanks over traditional tank containers due to their cost efficiency, lightweight design, and ease of disposal.

Technological advancements in flexitank materials improve durability and safety. The rising preference for flexitanks in industries such as chemicals and pharmaceuticals is also notable. Furthermore, increased international trade and e-commerce-driven logistics demand are accelerating the transition from traditional tank containers to flexitanks for liquid cargo transportation.

Flexitank Market: Key Takeaways

- Market Growth: The global Flexitank market is anticipated to expand by USD 10,607.1 million, achieving a CAGR of 24.5% from 2026 to 2034.

- Type Analysis: Multilayer flexitanks are projected to dominate the global flexitank market, with the highest revenue share of 57.3% by the end of 2025.

- Loading Type Analysis: Bottom loading is likely to dominate in the global flexitank market, with the largest revenue share by the end of 2025.

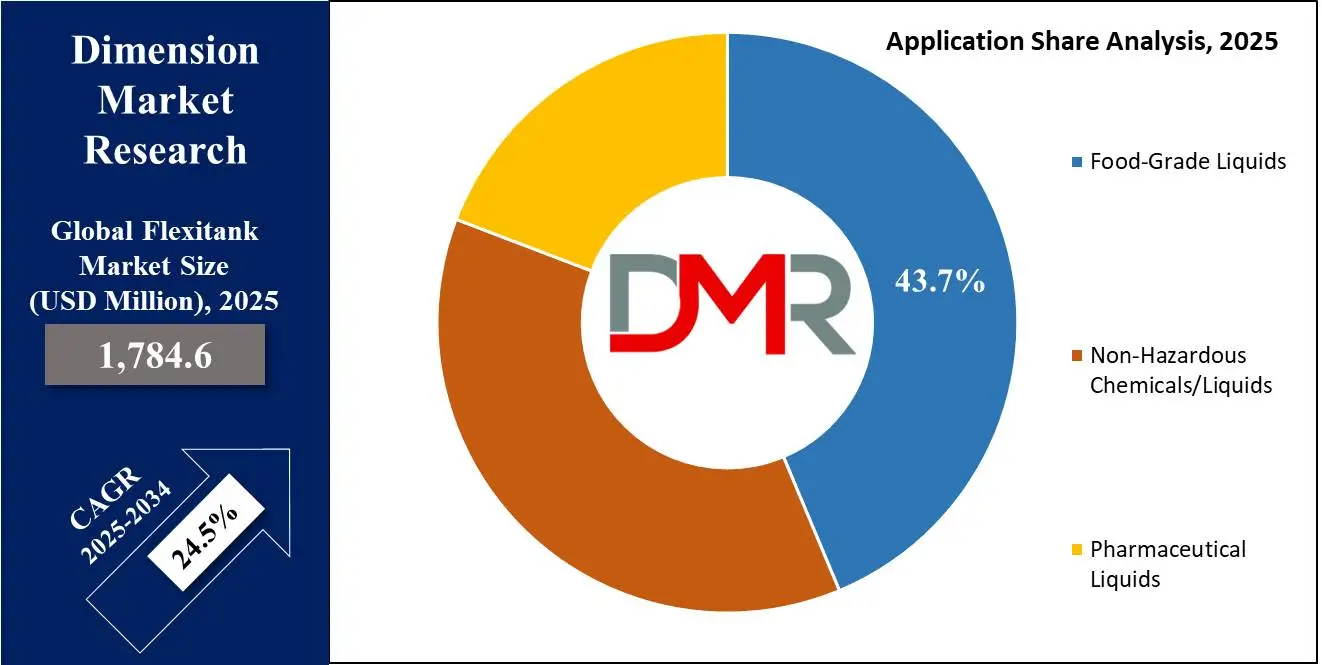

- Application Analysis: Food-grade liquids are expected to dominate the global flexitank market with the highest revenue share in 2025.

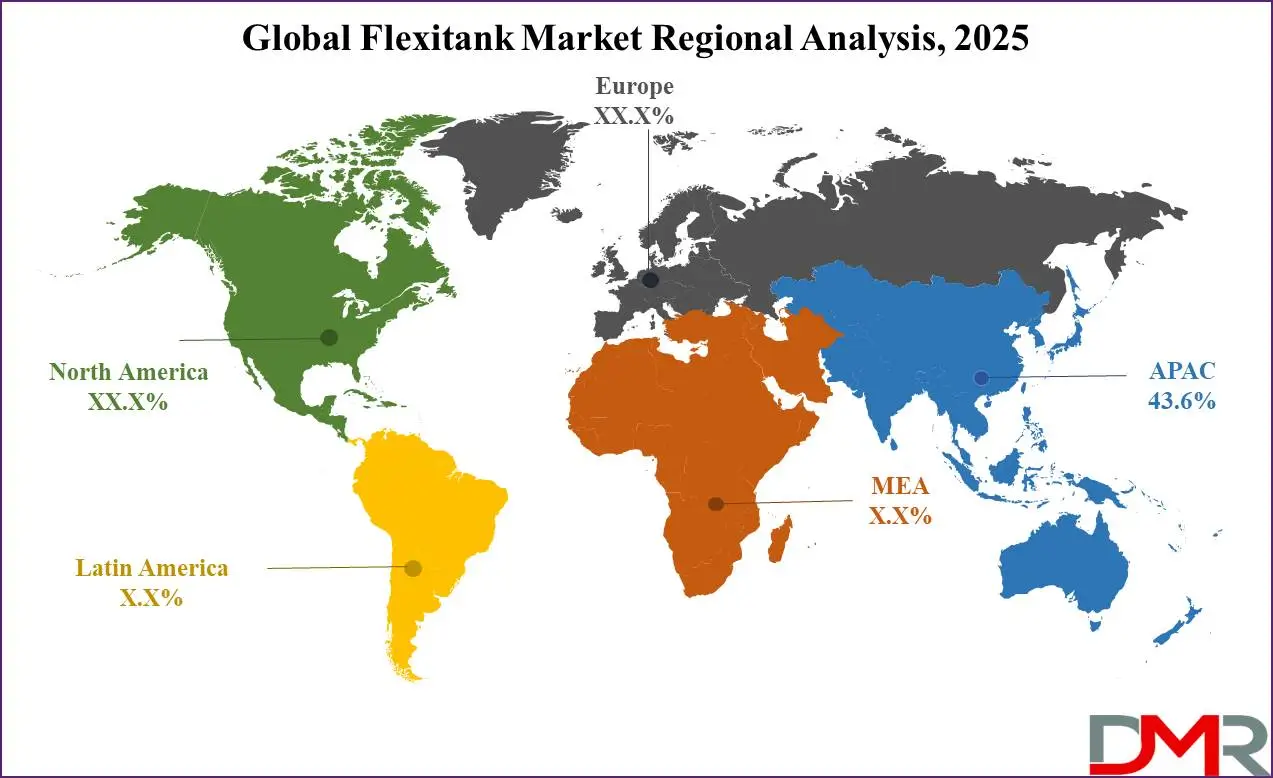

- Regional Analysis: Asia Pacific is projected to dominate the global market, holding a market share of 43.6% by 2025.

- Prominent Players: Some of the major key players in the Global Flexitank Market are SIA Flexitanks, Flexitank Group, and Trans Ocean Bulk Logistics.

Flexitank Market: Use Cases

- Bulk Liquid Transportation: Flexitanks are widely used for the cost-effective transportation of bulk liquids such as edible oils, fruit juices, and non-hazardous chemicals. Their lightweight and flexible design reduces shipping costs and maximizes payload capacity compared to traditional containers.

- Pharmaceutical and Healthcare Industry: In the pharmaceutical sector, flexitanks are used to transport liquid medicines, syrups, and other medical-grade fluids in a hygienic and contamination-free manner. The single-use design helps prevent cross-contamination, ensuring product safety and quality.

- Food and Beverage Industry: Flexitanks provide a safe and efficient solution for transporting food-grade liquids such as wine, molasses, and dairy products. Their sterile, leak-proof, and FDA-approved materials make them a preferred choice for maintaining product integrity during long-distance shipping.

- Agricultural and Chemical Industry: Farmers and chemical manufacturers use flexitanks for transporting fertilizers, pesticides, and liquid latex. The tanks' ability to handle large volumes while preventing leakage and contamination makes them an ideal choice for agricultural and industrial chemical logistics.

Flexitank Market: Stats & Facts

- According to Sia Flexitanks, Flexitanks or Flexibags can hold up to 24,000 liters (6,500 gallons) in a 20 ft shipping container. They provide a cost-effective alternative to ISO Tank containers for transporting juices, oils, food-grade liquids, and non-hazardous chemicals.

- The increase in production and export of palm oil from Malaysia and Indonesia is further contributing to the market statistics of Asia Pacific. According to the Malaysian Palm Oil Council, Malaysia accounted for 25.8% share of the global palm oil production and 34.3% of the global palm oil export in 2020. Malaysia also held a 9.1% and 19.7% share of the total production and export of oils and fats, respectively, in the world.

- Flexitanks enable shippers to transport up to 44% more liquid compared to using drums and 15% more than Intermediate Bulk Containers (IBCs). A single Flexitank can hold 24,000 liters, equivalent to 85 barrels, each of which typically holds 207 liters. By streamlining the loading process and reducing handling time, Flexitanks significantly lower transportation costs and improve overall efficiency.

- Flexitanks were initially used during World War II in aircraft like the Spitfire for fuel storage. By the 1990s, they were manufactured using thermoplastics (PVC and polyurethane), with an Oxygen Transmission Rate (OTR) of 100-200 cc/m²/24hr. In 2001, SIA's CEO Damien McClean patented the Multilayer Flexitank using polyethylene film, a design now replicated by over 80% of the global market.

- According to a report by the World Trade Organisation, the export of manufactured goods increased by 22% in 2021 after a decline of 5% in 2021.

- According to SIA Flexitanks, standard flexitanks can hold up to 24 tons of payload, about 15% more than IBCs and 40% more than drums. This facilitates the reduction of transportation costs.

Flexitank Market: Market Dynamic

Drivers in the Flexitank Market

Increase in Transportation of Commodity Products Increasing global interdependence among countries is driving a surge in the transportation of diverse commodity products, thus elevating the demand for flexitanks. These versatile containers are highly favored for shipping liquid products such as food items, chemicals, petroleum, and pharmaceuticals. Their ease of loading and unloading reduces handling risks and minimizes potential losses, ensuring the safe delivery of sensitive e cargo. As international trade continues to expand, industries seek efficient, secure, and cost-effective storage solutions. Flexitanks meet these needs by offering enhanced protection and streamlined operations, making them an attractive option for modern logistics and transportation challenges across various sectors globally.

Cost Effectiveness

Flexitanks offer a cost-effective alternative to traditional bulk liquid transportation methods such as IBCs and drums. Despite higher manufacturing expenses, their rapid installation requires significantly less time and labor, resulting in overall savings. Additionally, these containers incur lower demurrage costs at unloading ports, further reducing transportation expenses. This economic advantage makes flexitanks attractive for transporting liquid commodities efficiently. By streamlining logistics processes and minimizing handling complications, flexitanks drive operational efficiency. As businesses seek to optimize cost and performance, the adoption of flexitanks is likely to grow, reinforcing their role as an innovative solution in the competitive transportation market and globally.

Restraints in the Flexitank Market

Risk of Contamination

Flexitanks pose risks of contamination if they aren't regularly cleaned and maintained properly, which compromises their efficacy in transporting liquids. Residue from previous shipments can mix with new loads, potentially impacting sensitive products such as food and pharmaceuticals, which is especially detrimental. Even minor residues could compromise quality or spoilage and cargo degradation, leading to financial losses from compromised quality or spoilage of cargo, with potentially serious financial ramifications as a result.

Due to contamination risks, operators and users alike must undergo thorough cleaning protocols and quality controls that require diligent work in flexitank usage, ultimately burdening operators while diminishing confidence in using it for international trade purposes. Thus, cross-contamination acts as an impediment to market growth and the adoption of flexitank usage within global trade markets.

Limited Reuse Options

Flexitanks were intended for single use only, setting them apart from more reusability alternatives like ISO tanks or drums. Unfortunately, their one-off nature leads to significant waste generation and disposal expenses with each shipment, as companies must purchase new tanks each time for shipping purposes. While recyclable, their limited reuse potential poses challenges to sustainability initiatives. Furthermore, frequent disposal burdens and subsequent expenses associated with repeated shipments deter businesses from seeking long-term, cost-efficient, eco-friendly solutions; hence, flexitanks' limited reuse options act as a significant restraint upon market growth and adoption by businesses alike.

Opportunities in the Flexitank Market

Liquid Transport

Flexitanks present considerable market opportunities because of their adaptability in transporting an assortment of nonhazardous liquids. Products like oils, chemicals, and beverages such as wine can easily fit within these adaptable containers, making them appealing to industries of various industries with different shipping needs by eliminating the need for dedicated containers that may incur higher operational costs while streamlining logistics. Companies using Flexitanks as liquid transport containers have found they can optimize supply chains and quickly respond to market needs by efficiently handling different liquid types in one container, streamlining supply chains. Cost-efficient transport solutions emerge as compelling options compared to more traditional methods - driving market growth and innovation worldwide. Flexitanks have gained international acceptance.

Eco-Friendly and Safety-Driven Growth

Rising environmental consciousness combined with stringent safety requirements present opportunities for eco-friendly liquid transport tanks (flexitanks). Companies are turning more frequently to flexitanks as safer and eco-friendly shipping containers for their goods, which allows them to reduce carbon emissions and waste materials and comply with evolving regulations more easily.

This trend is being led by their desire to lower carbon footprints while minimizing waste products as a result of regulations changing frequently. Flexitanks provide enhanced safety features while simultaneously lowering environmental impacts by optimizing container space utilization and decreasing fuel consumption. Their sustainable benefits attract industries seeking responsible shipping practices, driving market expansion and innovation across global supply chains and logistic networks while solidifying Flexitanks' competitive edge.

Trends in the Flexitank Market

Enhanced Durability and Safety

Recent Innovations in Material Science Have Revolutionized Flexitank Market Advancements in material science have revolutionized flexitank markets worldwide, offering multilayered designs with improved durability, capacity, recyclability, and chemical resistance for enhanced reliability in leak prevention as well as chemical resistance. Technology innovations make safer transportation of liquids such as hazardous chemicals to meet increasingly stringent regulatory standards, while enhanced materials reduce contamination risk and accidents while guaranteeing cost-effective and dependable shipping solutions.

As more companies seek eco-friendly logistic solutions, advanced flexitank designs have quickly gained acceptance within the global liquid transport industry. Not only is their acceptance increasing market potential, but environmental objectives, as well as operational excellence goals, are being supported, and innovation continues.

Food and Beverage Exports

Global food and beverage exports have seen dramatic increases, leading to greater adoption of flexitanks across global supply chains. Flexitanks provide a reliable, cost-effective method of transporting liquids such as oils, wines, and juices without risk of contamination and waste production. Their capacity to lower packaging waste costs while simultaneously cutting logistics expenses makes Flexitanks popular with agricultural and beverage industries alike.

As consumer demand for quality food products surges, efficient liquid transportation becomes ever more crucial. Flexitank's versatile yet economic advantages play an invaluable role in meeting this market trend, making them transformative solutions that respond to modern export market needs while fuelling further expansion. Growth drives this expansion forward.

Flexitank Market: Research Scope and Analysis

By Type

Multilayer flexitanks are projected to dominate the global flexitank market, with the highest revenue share of 57.3% by the end of 2025 due to their superior performance features over monolayer counterparts. Multi-layer flexitanks, primarily made from polyethylene (PE), are recognized for their lightweight and flexible properties. With an average thickness of approximately 1mm, these flexitanks offer a dependable solution for transporting various industrial liquids, including chemicals, liquid fertilizers, and select food products.

Multilayers boast enhanced durability and strength, making them suitable for transport in older containers where additional protection may be required; their multiple layers act as an efficient barrier against contamination for food-grade and pharmaceutical liquid transportation, with superior oxygen/moisture resistance properties to preserve cargo quality.

Monolayer flexitanks are projected to become the second-largest segment in the global market due to their cost-efficiency and suitability for specific liquid transportation requirements. Although lacking multilayer options' enhanced durability, monolayer options provide an easier, cheaper way of moving non-sensitive liquids like industrial oils and chemicals while their lightweight design and ease of use make them popular choices among companies seeking to lower logistics costs while their limited protection from oxygen or moisture exposure makes them unsuitable for food-grade applications.

By Loading Type

Bottom loading is likely to dominate in the global flexitank market, with the largest revenue share by the end of 2025 due to its high efficiency, reduced spillage danger, and ease of use. It permits rapid and controlled filling and discharge, with reduced danger of contamination and loss of goods. It is best utilized for bulk transportation of food-grade liquids, chemicals, and drugs, for which purity and accuracy become most important. The labor expense is reduced, and security is enhanced with less contact with perilous chemicals through its use. Common use in industries with high demand for efficient and affordable carriage makes it a first-rate alternative, and its position in the marketplace will dominate.

Top loading is predicted to experience the largest CAGR in the global market due to its growing use in shipping thick and high-density liquids, such as edible oils and chemicals, in industries. It excludes entrapped air in cargo and maintains its integrity with minimum contact with contaminating factors. It is even utilized in regions with poor infrastructure, and in such a scenario, bottom loading will not function. High demand for shipping bulk liquids with specific requirements and efficiency improvement in top loading in new and developed types of flexitanks will boost its high growth.

By Application

Due to rising consumer spending on grocery products and the expansion of retail chains in emerging economies, food-grade liquids are expected to dominate the global flexitank market with the highest revenue share in 2025. This segment includes consumables like fruit juices, vegetable oils, edible oils, malt extract, confectionary products, and much more. Flexitanks provide cost-effective transportation of these liquids while guaranteeing safety, hygiene, and extended shelf life; their lightweight yet high-capacity design reduces shipping costs, further cementing their dominance in this niche market.

Non-hazardous chemical industry projections anticipate compound annual compound annual compound

growth of 24.4% due to the increasing adoption of Flexitanks within chemical firms. Flexitanks offer chemical manufacturers cost-efficient yet eco-friendly transport alternatives, drums or IBCs; their lightweight but sturdy structure reduces shipping costs while guaranteeing safe transportation; plus, many are made from recycled materials, supporting sustainability initiatives and environmental standards. With chemical manufacturers seeking cost-efficient yet reliable transport solutions for their product portfolios, Flexitank demand keeps rising; it now stands as the second-largest market segment.

The Global Flexitank Market Report is segmented based on the following

By Type

By Loading Type

- Top Loading

- Bottom Loading

By Application

- Food-Grade Liquids

- Non-Hazardous Chemicals/Liquids

- Pharmaceutical Liquids

Regional Analysis

Region with the largest ShareAsia Pacific is likely to lead the global flexitank market with its high

revenue share of 43.6% by the end of 2025, due to agricultural output and growing demand for bulk shipping of chemicals. With India and China, key agricultural producers, demand for flexitanks in sectors such as food and pharmaceuticals is high in Asia Pacific. With less production cost, North American and European companies outsource production to countries such as India and China, and with a robust infrastructure in its ports, a developing chemical sector, and an increased demand for non-hazardous chemicals in general, Asia Pacific will become a key player in its demand for flexitanks.

Region with Highest CAGRNorth America is expected to experience the highest CAGR in the flexitank market due to rising demand for food products such as fresh produce, cheese, and wine that require efficient transportation solutions. Increased bulk liquid consumption is driving an increased need for single-layer flexitanks designed specifically to transport these bulk liquids efficiently and cost-effectively. Additionally, e-commerce companies entering the North American market may further contribute as they require cost-effective and sustainable methods of shipping a diverse selection of goods; all factors together position North America for rapid flexitank market growth.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The concentration of market power provides established players with considerable leverage in terms of pricing, technological advancements, and global reach. The key players invest heavily in research, infrastructure, and strategic acquisitions to strengthen their presence in multiple regions, thus maintaining their dominant positions. Their large-scale operations enable them to benefit from economies of scale, further reinforcing their market leadership.

At the same time, the attractive growth opportunities in the flexitank sector have paved the way for new entrants. These emerging players are keen to capitalize on the rising demand for efficient and eco-friendly liquid transport solutions. While they may lack the extensive resources of established firms, their innovative approaches and flexible business models allow them to target niche markets and rapidly adapt to evolving customer needs.

Companies in the market are diversifying their logistics strategies by exploring alternative transportation routes, such as railways and roadways. This strategic move not only enhances operational efficiency but also mitigates risks associated with dependency on maritime routes alone. By integrating these multimodal transportation solutions, players can offer more reliable and cost-effective services, which in turn contributes to a more competitive and dynamic market environment.

Some of the prominent players in the global Flexitank Market are

- Bulk Liquid Solutions

- Environmental Packaging Technologies

- SIA Flexitanks

- Trans Ocean Bulk Logistics

- AutoPot Global Ltd.

- BeFlexi

- BLT Flexitank Solution

- BORNIT S.R.O.

- Buscherhoff Packaging Solutions GmbH

- Deutsche Post AG

- Flexible World Co., Ltd.

- Flexitank Group

- Flexitank LiquA

- Other Key Players

Recent Developments

- In November 2023, ASF Logistics, a leading provider of personalized and proactive global shipping solutions, announced the expansion of its flexitanks unit. ASF provides complete end-to-end flexitank logistics and transportation solutions, including traditional single tanks and innovative 3-tank systems.

- In June 2022, Mediterranean Shipping Company expanded its service offerings by introducing Flexibag, an in-house solution for liquid cargo. This innovation enables the shipment of up to 24,000 liters of non-hazardous liquids—ranging from wine and edible oils to petroleum products and chemicals—providing a more cost-effective and secure alternative to traditional bulk liquid transport.

- In March 2022, SIA Flexitanks unveiled its groundbreaking Trinity Tank, a three-pod reefer flexitank system that allows shippers to load multiple units within a single container. With a total capacity of 27,000 liters, each pod holds 9,000 liters, enhancing flexibility and efficiency in bulk liquid transportation.

Report Details

| Report Characteristics |

| Market Size (2024) |

USD 1,784.6 Mn |

| Forecast Value (2033) |

USD 12,783.8 Mn |

| CAGR (2024-2033) |

24.5% |

| Historical Data |

2018 – 2023 |

| The US Market Size (2024) |

USD 421.7 Mn |

| Forecast Data |

2025 – 2033 |

| Base Year |

2023 |

| Estimate Year |

2024 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Type (Multilayer, and Monolayer), By Loading Type (Top Loading, and Bottom Loading), By Application (Food-Grade Liquids, Non-Hazardous Chemicals/Liquids, and Pharmaceutical Liquids) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA

|

| Prominent Players |

Bulk Liquid Solutions, Environmental Packaging Technologies, SIA Flexitanks, Trans Ocean Bulk Logistics, AutoPot Global Ltd., BeFlexi, BLT Flexitank Solution, BORNIT S.R.O., Buscherhoff Packaging Solutions GmbH, Deutsche Post AG, Flexible World Co., Ltd., Flexitank Group, Flexitank LiquA, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users) and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |

Frequently Asked Questions

The Global Flexitank Market size is estimated to have a value of USD 1,784.6 million in 2025 and is expected to reach USD 12,783.8 million by the end of 2034.

Asia Pacific is expected to be the largest market share for the Global Flexitank Market with a share of about 43.6% in 2024.

Some of the major key players in the Global Flexitank Market are SIA Flexitanks, Flexitank Group, Trans Ocean Bulk Logistics, and many others.

The market is growing at a CAGR of 24.5 percent over the forecasted period.

The US Flexitank Market size is estimated to have a value of USD 421.7 million in 2025 and is expected to reach USD 2,710.5 million by the end of 2033.