Foldable drones are developed with portability & convenience in mind, characterized by their folding arms and propellers which allow them to be compacted into smaller sizes for easy transportation.

Foldable Drone Market has seen significant advancements in design and functionality over recent years. These portable drones, easily folded for portability, have gained immense popularity across sectors including aerial photography, surveying, inspection and travel inspection. Furthermore, demand for lightweight travel-friendly drones is driving innovation with new models offering features like increased battery life or advanced stabilization systems, aligning with the growing interest in compact UAVs.

Recent developments indicate an increasing interest in foldable drones for both personal and commercial use. Companies are offering foldable drones with more advanced camera capabilities, longer flight times, and stronger durability aimed at consumers, hobbyists, and businesses requiring efficient yet easy-to-carry drones for applications such as aerial mapping, inspections, recreational uses or mapping projects.

Foldable drone demand is driven by industries such as agriculture, construction and filmmaking that rely heavily on drone technology for work purposes. Because foldables offer ease of transport and improved maneuverability in tight spaces, these foldables have quickly become the go-to option for professionals working in challenging environments or needing portability during fieldwork, boosting the relevance of the travel-friendly drones market.

Foldable Drones Market opportunities lie in the increased adoption of drone technology for commercial and industrial uses. Businesses continue to find innovative uses for foldable drones, creating opportunities for customization and development of specialized models. Furthermore, advancements in battery life and AI-driven automation technology will likely open up additional market prospects for manufacturers as well as users.

Foldable Drone Market Is Expected to Expand Rapidly As of 2023, foldable drones made up 18% of total global drone market and annually over 1.5 Million foldable drone units were sold annually primarily due to photography, agriculture and inspection industries.

The US Foldable Drones Market

The US Foldable Drones Market is projected to reach USD 1.1 billion in 2024 at a compound annual growth rate of 10.2% over its forecast period.

The U.S. foldable drone market presents strong growth opportunities across sectors such as agriculture, infrastructure inspection, public safety, and delivery services. Advancements in drone technology, combined with favorable FAA regulations, are encouraging broad adoption. Emerging applications in areas like emergency response, logistics, and

Public Safety and Security are creating new avenues for market expansion, driving further innovation and increasing demand for foldable drones across industries.

Moreover, a key growth driver for the U.S. foldable drone market is development in technology, including better flight times, high-resolution cameras, and autonomous features, assisted by favorable FAA regulations. However, the market faces restraints like privacy concerns, strict airspace regulations, and the high cost of advanced drones, which can limit widespread adoption in certain industries and consumer segments.

Key Takeaways

- Market Growth: The Foldable Drones Market size is expected to grow by 4.7 billion, at a CAGR of 10.9% during the forecasted period of 2025 to 2033.

- By Type: The Quadcopters type is expected to lead in 2024 with a majority & is anticipated to dominate throughout the forecasted period.

- By Application: The film and photography segment is expected to be leading the market in 2024

- By End Use Industry: The consumer/civil segment is expected to get the largest revenue share in 2024 in the Foldable Drones Market.

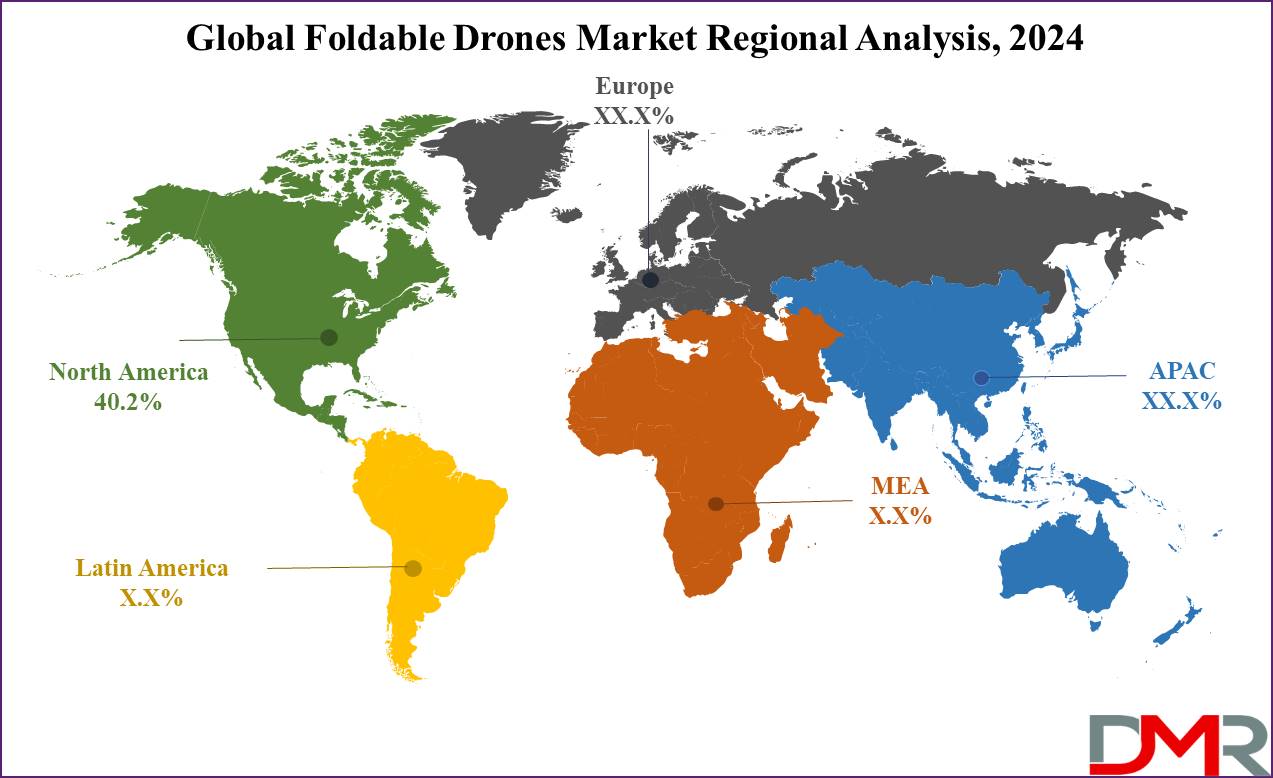

- Regional Insight: North America is expected to hold a 40.2% share of revenue in the Global Foldable Drones Market in 2024.

- Use Cases: Some of the use cases of Foldable Drones include portability, consumer convenience, and more.

Use Cases

- Portability: Foldable drones can be easily taken in backpacks or small cases, making them ideal for travelers, hikers, or outdoor enthusiasts.

- Rapid Deployment: Their compact design allows for easy setup and launch in emergencies, like search and rescue missions.

- Space-Saving Storage: Foldable drones take up less storage space, making them suitable for use in compact environments like ships, submarines, or small offices.

- Consumer Convenience: They serve casual drone users who value convenience & ease of transport, improving their appeal for recreational photography and videography.

Market Dynamic

Driving Factors

Rising Demand for Compact and Portable Gadgets

As consumers highly prioritize portability in their tech devices, the need for foldable drones is increasing, driven by their convenience for travel and outdoor activities.

Advancements in Drone Technology

Enhancements in battery life, camera quality, and AI-based features are making foldable drones more appealing to a wide audience, from hobbyists to professional users, thus driving market expansion.

Restraints

High Cost of Advanced Models

The advanced technology & materials utilized in foldable drones mostly lead to higher prices, which can limit accessibility for budget-conscious consumers and slow market adoption.

Regulatory and Legal Challenges

Strict regulations on drone usage, mainly in urban and restricted areas, can impact the widespread use of foldable drones, impacting market growth.

Opportunities

Expansion into Commercial Applications

Foldable drones have major potential in industries like agriculture, real estate, and logistics for tasks like crop monitoring, property inspections, and package deliveries, opening new revenue streams and market segments.

Integration with Emerging Technologies

Integrating foldable drones with advanced technologies like

Artificial Intelligence,

machine learning, and 5G connectivity can improve their capabilities, performance, and appeal, creating higher adoption and innovative use cases.

Trends

Enhanced Camera Capabilities

There is a major trend toward foldable drones equipped with high-resolution cameras, like 4K and even 8K video recording, appealing to content creators and professionals who prioritize image quality.

Increased Focus on Autonomous Features

Recent models of foldable drones are largely incorporating autonomous flight features like obstacle avoidance, automated flight paths, and intelligent tracking, making them more user-friendly and capable for both recreational and professional use.

Research Scope and Analysis

By Type

Quadcopters are anticipated to lead the foldable drone market in 2024 due to their versatility and ease of use. These drones have four rotors, which provide better stability and control, making them ideal for both beginners and professionals.

Further, the foldable design enhances portability, allowing users to carry them easily for recreational or professional purposes, like photography, surveillance, and inspections. The ability to easily fold and unfold the arms also supports in protecting the drone during transport, reducing wear and tear.

As the demand for compact, travel-friendly drones grows, quadcopters dominate by offering a perfect balance of performance, affordability, and convenience, making them highly popular among drone enthusiasts. Further, octocopters, with their eight rotors, play a vital role in the foldable drone market and are expected to grow significantly in coming years by providing superior power and stability compared to smaller models.

Their foldable design adds portability, making them easier to transport for professional tasks like aerial photography, mapping, and heavy lifting. Octocopters are preferred for more demanding operations, as they can carry large payloads and perform better in challenging weather conditions.

By Application

Film and photography play a major role in driving the foldable drone market and are expected to have the majority of revenue share in 2024 as these drones have become important tools for capturing stunning aerial shots. Their compact, foldable design enables photographers and filmmakers to easily transport them to various locations, making them ideal for shoots in remote or challenging areas.

With high-resolution cameras, stable flight capabilities, and intelligent features like automated flight paths and obstacle avoidance, foldable drones have revolutionized the way visual content is created. They also provide creative professionals the ability to get distinctive perspectives that were difficult or expensive to achieve in the past. As demand for high-quality visual content grows, mainly on social media, foldable drones are increasingly popular for both amateur and professional film and photography projects.

Further, surveillance and monitoring are also applications in the foldable drone market that are driving the market, offering better security and observation capabilities. These compact drones can easily be installed for tasks like monitoring large areas, inspecting hard-to-reach locations, or providing real-time footage in emergencies. With features like high-resolution cameras and GPS tracking, foldable drones are valuable tools for law enforcement, disaster management, and industrial inspections, improving efficiency and safety.

By End User Industry

The Consumer/Civil segment is set to be the most dominant in the foldable drone market in 2024, holding the majority of the market share, as it is mainly driven by individuals and hobbyists who use foldable drones for fun, aerial photography, and videography. The growth of social media and the demand for engaging visual content have boosted the popularity of consumer applications.

With enhancements in drone technology, like better stability, longer flight times, and high-resolution cameras, foldable drones are now more accessible and attractive to a wider audience. Their increase in affordability and availability have drawn in many enthusiasts, helping expand the market. Further, the convenience and compactness of foldable drones make them ideal for activities like hiking, camping, and outdoor events.

The integration of smart features, like obstacle avoidance, automated flight modes, and real-time video streaming, has enhanced the overall user experience, further driving demand. Besides entertainment, foldable drones have found better use in civilian industries like agriculture, construction, and inspections. Their ability to reach difficult locations & capture detailed imagery has proven useful for tasks like crop monitoring, site surveys, and infrastructure inspections, leading to greater efficiency and cost savings in these fields.

The Foldable Drones Market Report is segmented on the basis of the following

By Type

- Quadcopters

- Hexacopters

- Octocopters

By Application

- Filming & Photography

- Mapping & Surveying

- Inspection & Maintenance

- Surveillance & Monitoring

- Precision Agriculture

- Others

By End User Industry

- Consumer / Civil

- Commercial

- Military

Regional Analysis

North America is expected to become the leading region in the foldable drone market, accounting for

over 40% of the market share, which is due to the presence of many key players, including manufacturers, technology developers, and service providers. The region has a strong ecosystem for drone research and development, which has majorly boosted market growth.

There is a growing demand for foldable drones in sectors like filmmaking, agriculture, infrastructure inspection, and public safety. Advances in drone technology, like better camera systems, longer flight times, and improved autonomous features, have further driven the adoption of foldable drones in North America. In addition, favorable government initiatives and regulations have supported the integration of drones into various industries.

Like, the Federal Aviation Administration (FAA) in the US has established clear guidelines for commercial drone use, encouraging businesses to take advantage of foldable drones. Also, North America is expected to maintain its lead in the foldable drone market.

The region’s strong technological base, supportive regulations, and increase in the adoption of drones in industries like delivery services and emergency response will likely continue to fuel market growth, creating new expansion opportunities.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The foldable drone market is highly competitive, with a mix of established players & new entrants driving innovation. Companies are aiming to improve drone features like camera quality, battery life, autonomous flying capabilities, and ease of portability to stay ahead.

Further cost competitiveness is also a key factor, as manufacturers provide a range of drones catering to both hobbyists and professionals. In addition, partnerships with industries like agriculture, filmmaking, and public safety are helping businesses expand their market reach and applications.

Some of the prominent players in the Global Foldable Drones are

- Intellisystem Technologies

- Skydio

- DJI

- EMOTION

- Eachine

- Zero Robotics

- Heliceo

- Hubsan

- Parrot

- ONYXSTAR

- Other Key Players

Recent Developments

- In August 2024, Zero Zero launched the HOVERAir X1 PRO and PROMAX. Both drones have the same innovative design, which enables them to track and record the user at up to 26 miles per hour. Further, they help SmoothCapture 2.0 with electronic image stabilization (EIS).

- In February 2024, Garuda Aerospace launched a nano drone, Droni, which is being sold on e-commerce site Amazon, Droni is a small-sized foldable quadcopter weighing 250 gm and is integrated with 11 intelligent flight modes, like follow-me features, fading, circling soaring, time-lapse, tail flicking, and broad and straightforward shooting. Further, it is integrated with target management, level-7 wind resistance, and an intelligent voice somatosensory control that makes way for one-hand control when required. Its three-axis mechanically stabilized pan-tilt ensures perfect stable shots.

- In January 2024, DJI launched FlyCart 30 (FC30) to join the growing ranks of package-toting multicopters, which feature eight motor/propeller units distributed between four arms with two units per arm. In its standard dual-battery configuration, the drone is capable of carrying a 30-kg payload up to a distance of 10 miles at a speed of 45 miles per.

- In September 2023, Skydio unveiled its new Skydio X10 drone, which is designed for enterprise and public safety applications, and features new data capture cameras, and AI-powered autonomy, along with a small and easy-to-manipulate form to make for simple use and transport.

- In February 2022, The U.S. Army announced that it has chosen American drone manufacturer Skydio for its Short Range Reconnaissance (SRR) program, which looks to field a low-cost, rapidly deployable scout drone that can be carried by individual soldiers. As Skydio is assigned a USD 20.2 billion per year contract to deliver their X2D drones to the Army’s SRR program.