Market Overview

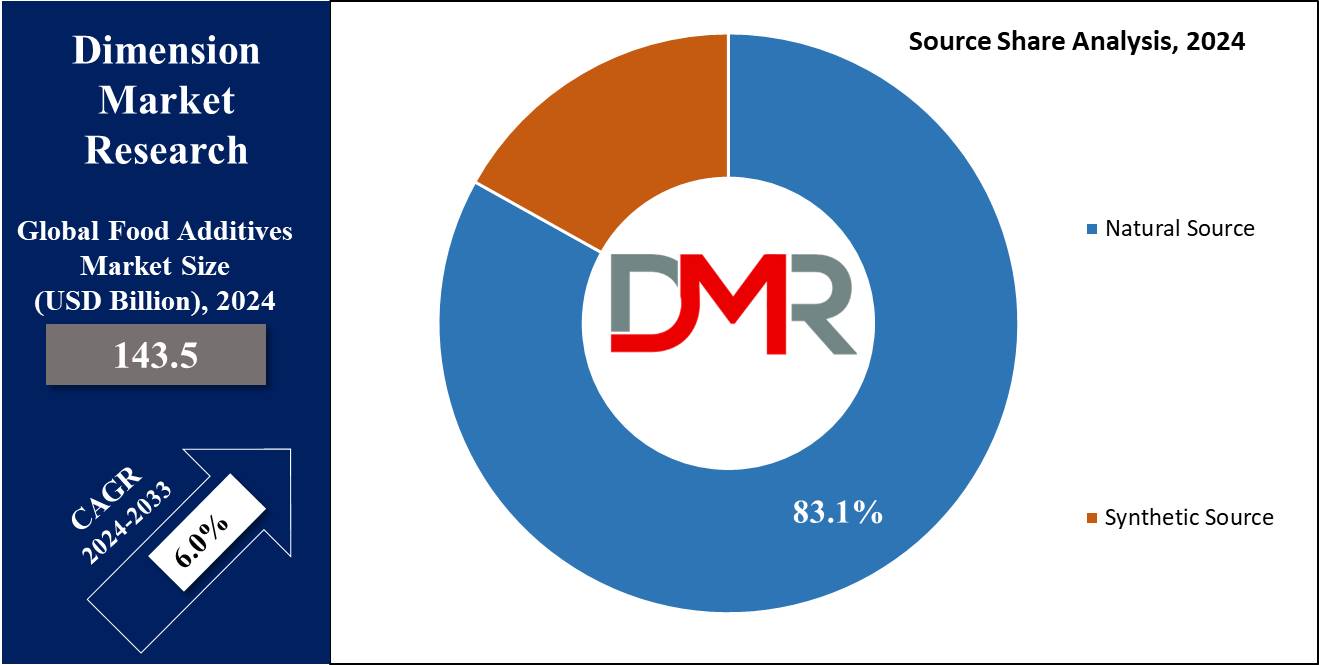

The Global Food Additives Market is expected to be valued USD 143.5 billion in 2024 and is anticipated to reach USD 242.9 billion by 2033 at a CAGR of 6.0%.

This market offers chemical additives to the food industry that improve the aroma, consistency, taste, color texture, and shelf life of foods. This market provides a variety of products according to consumer requirements like sweeteners, enzymes, emulsifiers, flavors & and enhancers which can be natural or synthetic and are used for various purposes, extending from fresh Bakery Product to long-life

Frozen Food.

Furthermore, there are direct and indirect food additives which are classified into two groups, in the market. Direct additives are added to change the characteristics of food like taste, which is crucial in segments like

Dairy Products to maintain consistency and appeal, while indirect additives are added which function as helpers to maintain, store, and pack the food product. This is especially relevant for innovative sectors like

Plant-based Meat, where additives ensure texture and stability mimic traditional meat.

As per Brandon Gaille, 80% of European consumers prefer foods without artificial additives, reflecting a strong demand for clean-label products. North America leads in natural flavor launches, accounting for 61% of new products, while 74% of Latin American launches contain artificial flavors. In the U.S., over 10,000 additives are approved, with Americans consuming 9 lbs of additives yearly, contributing to 1 billion lbs of annual consumption. Despite 90M acres of U.S. corn production, under 1% is for direct consumption, with most used in additives. Subsidies exceeding $50B support this industry, impacting affordability, with processed foods driving significant intake.

Key Takeaways

- The Global Food Additives Market is anticipated to grow to USD 143.5 billion in 2024 and is further predicted to grow to USD 242.9 billion by 2033 at a CAGR of 6.0%.

- The sweeteners category is expected to dominate the market in 2024, accounting for the largest share of revenue at 57.6%.

- Based on source, the natural segment is anticipated to dominate the market, accounting for the largest share of revenue at 83.1% in 2024.

- The bakery and confectionery segment are predicted to emerge as the market leader in terms of application, accounting for the largest revenue share at 32.2% in 2024.

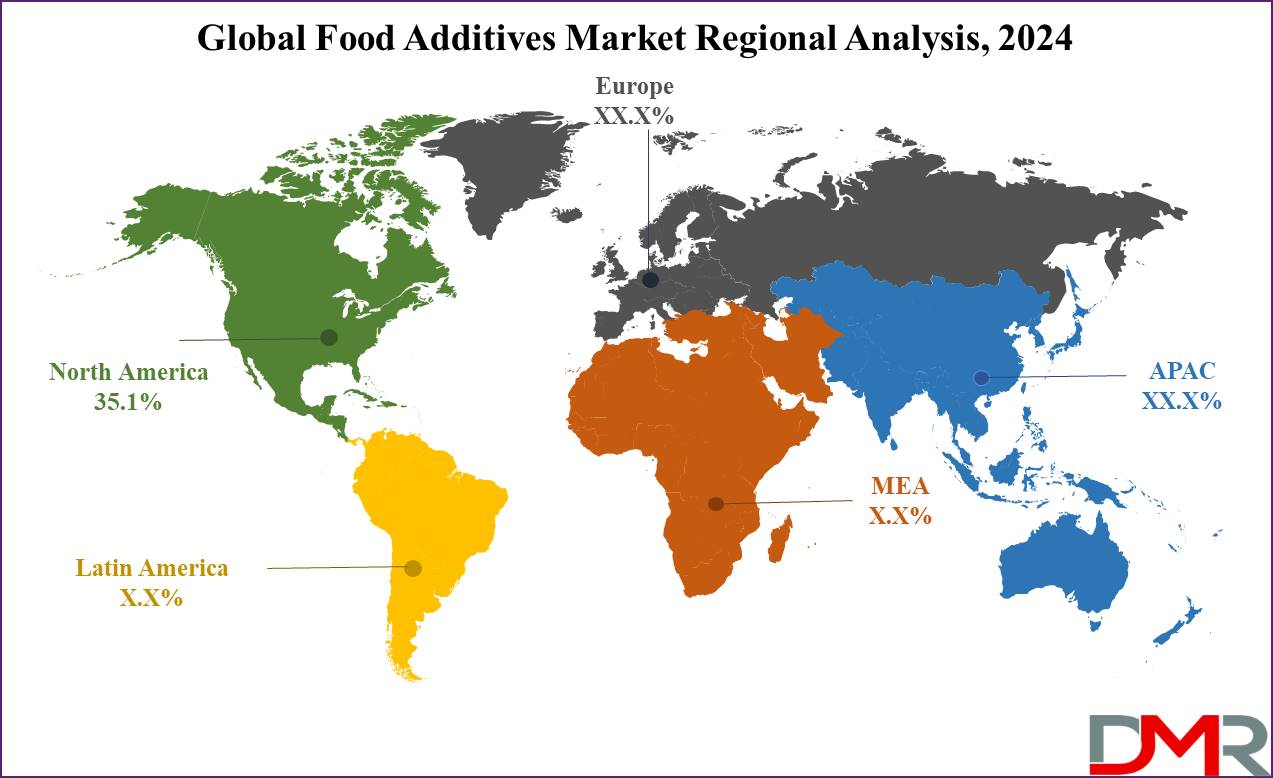

- North America is expected to emerge as the market leader, capturing a revenue share of 35.1% in 2024.

Use Cases

- Food additives help to prevent spoilage of food and extend the life of food products by hindering the growth of bacteria, fungi, and other microorganisms.

- Antioxidants like vitamin C, vitamin E, butylated hydroxy anisole, and butylated hydroxytoluene prevent food from oxidizing and becoming rancid, thereby extending shelf-life and maintaining the quality of the product.

- Food color additives like tartrazine, cochineal extract, and caramel color enhance or maintain the color of food products, compensating for color loss during processing or providing an attractive appearance.

- These additives are used to control and adjust the acidity or alkalinity of food products, which is important for both taste and preservation.

- Additives like silicon dioxide (silica), calcium silicate, and magnesium stearate prevent powdered or granulated foods from forming lumps or clumps, improving flowability and ensuring consistent dosing.

Market Dynamic

The fact that the consumption of ready-eat goods intensifies and hence the use of chemical additives in food processing to keep the preservation longer is considered to be one of the primary reasons for the growing demand for food additives.

This purpose is also to improve the consumer satisfaction, safety, & overall attractiveness of the eating goods. The boom is powered by the increased adoption in the areas such as bakeries, beverages, dairy, and quick service restaurants that sell convenience foods as well as a continuous growth in the number of consumers of these additives in retail and online shops, which pushes the market further.

Consequently, specialty food ingredients are used in products to make them more delicious, attractive, longer-lasting, and also beneficial to health which opens the doors to the market. Along with that, the demand for sugars and fats analogs, calorie and sugar-free products is gaining pace; functioning as market drivers for fat substitutes and high-intensity sweetener segments. However, there are concerning health issues from high-calorie sweeteners which are expected to hamper the demand of this market.

Research Scope and Analysis

By Product

Based on product, sweeteners are expected to dominate this market in 2024, accounting for the largest share of revenue at 57.6%. Their projected dominance is due to the growing demand for food additives in products like confections & soft drinks. The demand for chocolates, candies, baked goods, & non-alcoholic beverages is rising among the young population globally which further drives the growth of this market.

Additionally, the rising awareness among consumers, particularly youngsters, for healthier and more natural food options is anticipated to further drive the demand for sweeteners in the upcoming years which includes various agents like flavorings, enhancers, and more, that are used to improve the taste of food and beverages. Moreover, flavors derived from essential oils or oleoresins are extracted from naturally occurring plant sources such as fruit pulp, peels, leaves, and seeds.

By Source

The natural source segment is expected to dominate the market, accounting for the largest share of revenue at 83.1% in 2024. The growth of this segment is due to increasing consumer awareness of natural and organic products. Also, the natural segment includes additives derived from various natural sources, including plant parts like fruit peels, animal sources such as milk or egg proteins, and microorganisms like probiotic strains such as lactic acid bacteria.

Further, the increasing popularity of veganism is anticipated to boost the demand for plant-based ingredients globally, forcing market players to introduce numerous plant-based meat products to provide this trend. Furthermore, the synthetic segment includes additives that are chemically made from raw materials. In addition, various food additives are produced through distinct chemical reactions using different raw materials.

By Application

The bakery and confectionery segment is expected to dominate as the market leader in terms of application, with the largest revenue share at 32.2% in 2024 due to the increasing consumption of items like bread, cakes, biscuits, tortillas, and various sugar and chocolate.

Commonly used additives in this segment are sweeteners, flavors, fat replacers, and shelf-life stabilizers, which drive the growth of this market. Furthermore, there is growing use of enzymes to improve dough stability and extend the shelf life of bakery products, which is expected to fuel the market growth.

Additionally, cellulose is mainly used in bakery items such as tortillas and bread to increase the fiber content which is expected to increase bread-related product consumption in various regions. The beverage industry is projected to grow as the second sector in this market due to a global increase in the consumption of both alcoholic and non-alcoholic beverages which is further pushed due to the increasing millennial population where alcohol consumption is high.

The Food Additives Market Report is segmented based on the following:

By Product

- Sweeteners

- Flavors & Enhancers

- Enzymes

- Emulsifiers

- Prebiotics

- Probiotics

- Dietary Fibers

- Others

By Source

By Application

- Bakery & confectionery

- Beverages

- Convenience Foods

- Dairy & Frozen Desserts

- Sauces & Dressings

- Others

Regional Analysis

It is expected that in 2024 North America will take the largest share of revenue among all regions

at 35.1%. It is because of higher chemical use in various industries like industries, pharmaceuticals, and foods and beverages.

In addition to this, the increase in additives demand due to increasing consumption of quick meals including breakfast items and ready-to-cook foods is also surging up. Furthermore, busy lifestyles among consumers will push the growth of this market in the food industry further.

Europe has the biggest revenue potential in 2024 because of a notable number of foreign players, most noticeable in food, cosmetics and pharmaceutical manufacturing. Alongside the expected rise in demand for food additives, cosmetics companies are believed to be present in this locality to further increase the demand.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

Manufacturers in the food additive market are innovating to develop novel solutions, including to use of natural sweeteners and food coloring agents, food thickening agents, and high fructose corn syrup. They are focusing on quality, and matching customer preferences to stay ahead of the competition.

Companies in this market are actively engaged in strategic activities such as new product launches, contractual agreements, mergers and acquisitions, higher investments, and collaboration with other organizations to expand their footprint and enhance their market presence. Furthermore, several companies are concentrating on getting product approval from regulatory bodies. Some of the key market players are ADM, BASF SE, DSM.

Some of the prominent players in the global food additives market are

- ADM

- Chr. Hansen Holding A/S

- Ingredion Incorporated

- Novozymes A/S

- Tate & Lyle Plc

- DSM

- Ajinomoto Co., Inc

- Cargill, Incorporated

- BASF SE

- Givaudan

- Others

Recent Development

- In November 2023, Chr. Hansen introduces NEER Poly and NEER punch strains, which offer a great variety of flavors to consumers looking for nonalcoholic options.

- In October 2023, ADM announced its investment plan for the Guadalajara Production Line, investing USD 33 million to enhance its presence in the Human Nutrition and Animal Care sector.

- In August 2023, BASF SE boosted its production capacity for medium-molecular weight poly isobutanes by 25% at its Ludwigshafen, Germany facility.

- In June 2023, CP Kelco partnered and Shiru announced a partnership to accelerate the transition to a sustainable food system through the discovery and development of next-generation, plant-based proteins using precision fermentation technology.

Report Details

| Report Characteristics |

| Market Size (2024) |

USD 143.5 Bn |

| Forecast Value (2033) |

USD 242.9 Bn |

| CAGR (2023-2032) |

6.0% |

| Historical Data |

2018 – 2023 |

| Forecast Data |

2024 – 2033 |

| Base Year |

2023 |

| Estimate Year |

2024 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Product (Sweeteners, Flavors & Enhancers, Enzymes, Emulsifiers, Others), By Source (Natural, Synthetic), By Application (Bakery & confectionery, Beverages, Convenience Foods, Dairy & Frozen Desserts, Sauces & Dressings, Others) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA |

| Prominent Players |

ADM, Chr. Hansen Holding A/S, Ingredion Incorporated, Novozymes A/S, Tate & Lyle Plc, DSM, Ajinomoto Co., Inc, Cargill, Incorporated, BASF SE, Givaudan, ADM, Chr. Hansen Holding A/S, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |

Frequently Asked Questions

The Global Food Additives Market size is estimated to have a value of USD 143.5 billion in 2024 and is

expected to reach USD 242.9 billion by the end of 2033.

Asia Pacific has the largest market share for the Global Food Additives Market with a share of about 35.1

% in 2024.

Some of the major key players in the Global Food Additives Market are ADM, BASF SE, Chr. Hansen

Holding A/S and many others.

The market is growing at a CAGR of 6 percent over the forecasted period.