Food & Beverage Nitrogen Generators Market encompasses the design and installation of on-site nitrogen generation systems designed to increase food preservation and extend shelf life. These systems produce high-purity nitrogen gas essential for packaging processes which minimize oxidation, prevent spoilage, and preserve product integrity - thus decreasing operational costs while assuring consistent supplies of this critical component. The demand for Nitrogen Generator For Food And Beverage applications continues to rise as manufacturers seek improved food safety, longer shelf life, and packaging integrity.

This market's expansion is being propelled by several interlinked factors. Rising consumer interest in fresh, minimally processed foods has fueled an increasing need for packaging solutions that utilize nitrogen to prevent oxidation and spoilage - aligning perfectly with stringent regulatory requirements as well as rising expectations regarding food quality and safety. Meanwhile, advances in nitrogen generator technology are improving system efficiency while decreasing energy usage, making these solutions more economically viable across a variety of applications. Nitrogen Generator For Beverage Factory setups are increasingly integrating AI and IoT tools to ensure seamless, on-demand nitrogen supply with minimal waste.

Key Takeaways

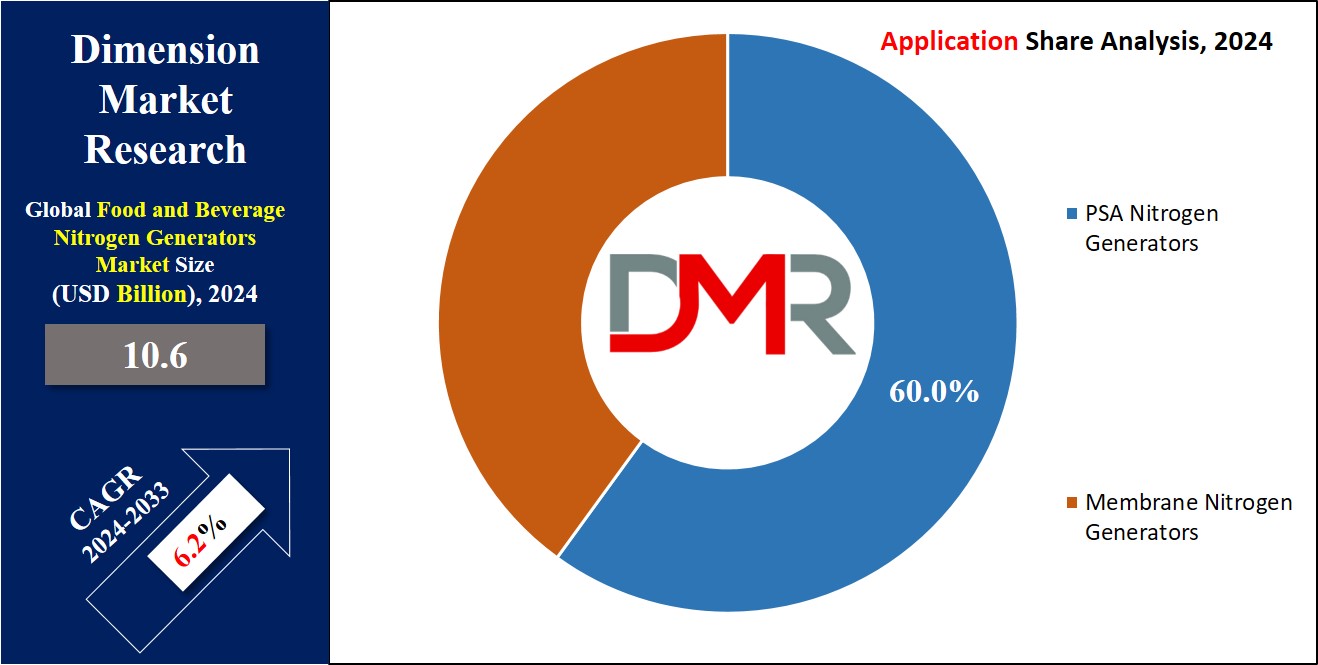

- Market Growth and Forecast: The Food & Beverage Nitrogen Generators Market is expected to grow from USD 11.3 billion in 2024 to USD 19.6 billion by 2033, with a CAGR of 6.2% during the forecast period.

- Dominant Segment: Pressure Swing Adsorption (PSA) Nitrogen Generators are the leading technology in the market, holding a 55% share by value, which equates to approximately USD 300 million in 2023.

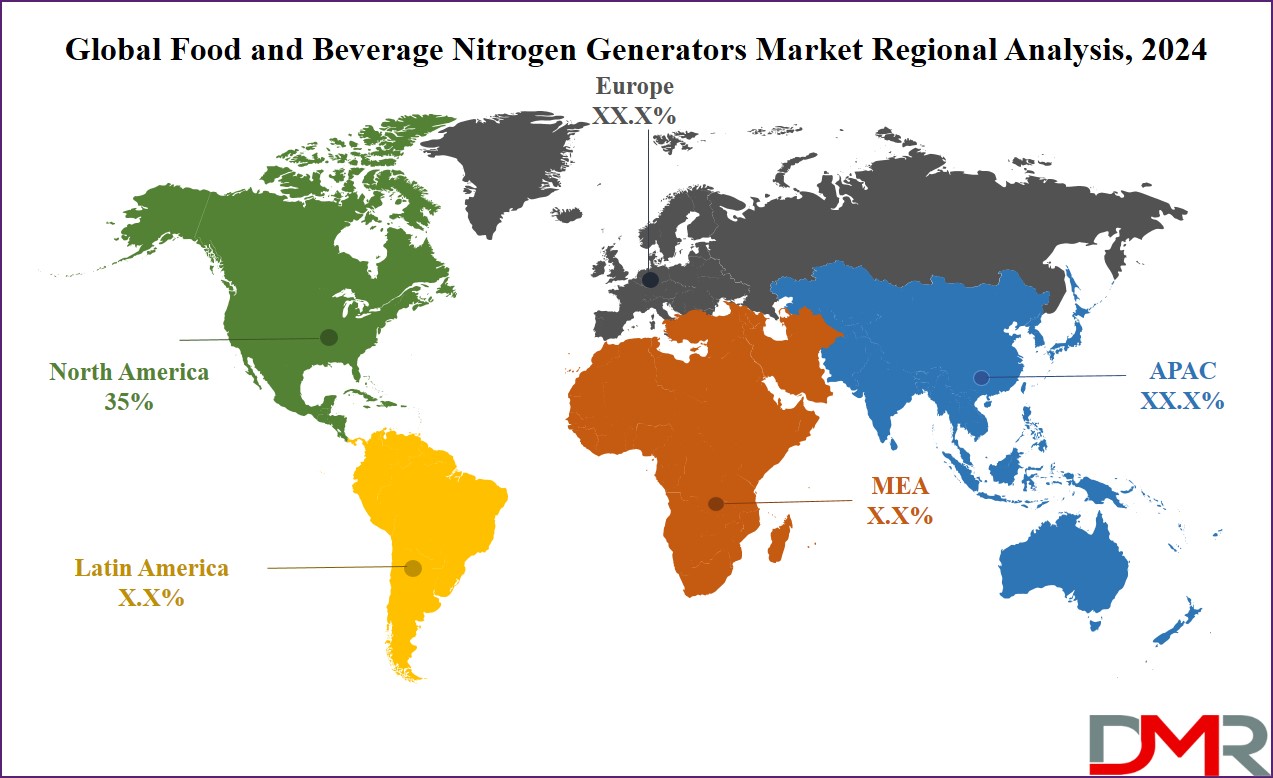

- Regional Leadership: North America dominates the market with a 35% share, valued at roughly USD 210 million, driven by its advanced food processing sector and emphasis on high-quality standards and sustainability.

- Key Trends: The market is experiencing significant growth due to the rise in packaged food consumption, the popularity of nitrogen-infused beverages, and increasing demand for sustainable packaging solutions.

- Growth Opportunities: Integration with smart technologies and increased investment in food processing facilities present major growth opportunities, with advancements in nitrogen generation technology improving efficiency and reducing energy usage.

Use Cases

- Packaged Food Preservation: Improves shelf life and quality of packaged foods. This is done by reducing spoilage and oxidation of the products through what is known as Modified Atmosphere Packaging.

- Nitro Beverage Production: Infuses nitrogen into beverages such as coffee and craft beers. The aim is to make them more palatable in terms of both flavor and texture— thus meeting the high demand for nitrogen-infused drinks.

- Cost Efficiency: In addition to on-site nitrogen generation, there are further benefits. These include reduced transportation and storage costs, therefore supporting sustainability goals that see a reduction in greenhouse gas emissions as well.

- Smart Technology Integration: IoT-enabled nitrogen generators. It offers real-time monitoring and predictive maintenance schedules for increased operational efficiencies.

- Urbanization and Convenience Foods: This is in connection with the demand for high-quality, long-shelf-life convenience food items that are created by urban way of living life plus increase income which leads to disability.

Driving Factors

Shifting toward On-Site Nitrogen Generation

Food & Beverage Nitrogen Generators Market has seen tremendous advancement thanks to on-site nitrogen generation, which offers more streamlined solutions that address operational and cost-efficiency concerns in this sector. Food companies historically relied on bulk nitrogen supply methods involving the transportation of

liquid nitrogen requiring storage facilities requiring costly logistical costs; on-site nitrogen generation provides a more streamlined alternative by producing it closer to where it is needed, eliminating transportation needs while cutting associated expenses significantly.

This shift has been driven by technological innovations in nitrogen generation systems, particularly membrane and pressure swing adsorption (PSA) technologies. These advances have produced more reliable nitrogen generators capable of producing high-purity nitrogen at reduced operational costs; modern systems also boast increased energy efficiency and reduced maintenance requirements that help decrease the total cost of ownership; on-site nitrogen generation also aids the industry's sustainability goals by cutting carbon footprint associated with logistics of supply.

Rise in Packaged Food Consumption

Food & Beverage Nitrogen Generators Market. As consumer preferences shift toward convenience and longer shelf lives, demand has surged for advanced packaging solutions which preserve product freshness while protecting quality and taste. Nitrogen is vital in modified atmosphere packaging (MAP), an innovative technique widely employed for protecting foods against oxidation, spoilage, and microbiological contamination of their contents.

The global packaged food market is experiencing rapid expansion due to factors including busy lifestyles, rising disposable incomes, and an ever-increasing desire for convenience foods. According to market reports, packaged food sector is projected to experience strong growth with expected increases in both market value and packaging solutions for its market segment. Nitrogen generators play a vital role in maintaining the freshness of packaged foods throughout their shelf lives ensuring freshness for longer.

Urbanization and Demographic Shift

Urbanization and shifting demographics play a pivotal role in shaping the Food & Beverage Nitrogen Generators Market. As urban areas expand and populations rise, there is greater demand for efficient food distribution and preservation methods to meet consumers' rising appetite for convenient yet high-quality food products. Furthermore, urbanization often drives an increase in convenience meals due to busy lifestyles; consequently increasing consumption of packaged or processed products like packaged dinners.

Demographic changes such as single-person households and dual-income families contribute to increased demand for packaged food products, specifically convenience items with extended shelf lives and high quality. Consumers increasingly rely on advanced packaging technologies like nitrogen generators to preserve freshness and safety when purchasing packaged meals.

Growth Opportunities

Demand for Convenience Foods Is Growing Rapidly

Nitrogen generators market stands to benefit greatly from the growing consumer preference for convenience foods, which has increased significantly in recent years due to busy lifestyles and their need for quick meal solutions. As more consumers opt for ready-to-eat and prepackaged meals for ease of eating and quick meal solutions, their packaging solutions must extend shelf life while protecting food quality effectively; modified atmosphere packaging (MAP) plays a key role here, preserving freshness while protecting shelf life; modified atmosphere packaging using nitrogen generators is used extensively as well, helping preserve food quality through modified atmosphere packaging (MAP). This growing consumer preference is expected to boost demand for advanced nitrogen generation systems capable of meeting the rapidly expanding packaged food sector.

Integration with Smart Technologies

Integration of nitrogen generators with intelligent technologies represents another opportunity. Industry 4.0 and Internet of Things (IoT) adoption in food and beverage production has revolutionized operational efficiencies and data management; smart nitrogen generators equipped with IoT capabilities offer real-time monitoring, predictive maintenance, and enhanced operational control - creating an attractive value proposition for market players.

Increased Investment in Food Processing Facilities

Investment in food processing technologies also represents an attractive market opportunity. Companies are investing significantly in upgrading their facilities to increase efficiency, product quality and meet changing consumer demands. Modernized facilities utilize advanced nitrogen generation systems as integral parts of packaging and preservation innovations. Focusing on advanced techniques while meeting packaging and preservation innovations will boost market growth through 2023.

Key Trends

Growth of Packaged Food Market

The nitrogen generator industry continues to experience considerable expansion with the expansion of the packaged food market. Consumers increasingly desire the convenience and extended shelf life offered by packaged foods; as consumers seek effective packaging solutions like modified atmosphere packaging (MAP). Nitrogen generators play an essential part in maintaining product freshness for longer, and this growth in the packaged

food sector requires advanced nitrogen generation technologies capable of meeting this increasing need for high-quality, preserved foods.

Nitro Beverages

Nitro beverages - including nitrogen-infused coffee and craft beers - have become an increasing market trend, thanks to nitrogen infusion. Nitrogen enhances both the texture and flavor profiles of beverages like these for an enhanced drinking experience, creating smoother texture profiles than their predecessors. As more beverage companies adopt nitrogen injection as a differentiator to differentiate their offerings from competitors' offerings, there has been an upsurge in demand for specialty nitrogen generators; further demonstrating their growing role as innovators within this sector.

Increased Demand for sustainable solutions

Sustainability in food and beverage production has rapidly become an area of great focus, as companies prioritize environmentally-friendly practices while seeking solutions that minimize their carbon footprint. Nitrogen generators play an integral part of sustainability by offering on-site production of nitrogen gas; eliminating bulk deliveries associated with emissions while helping decrease food waste - both goals being aligned with larger sustainability objectives. As the market shift towards more eco-friendly options increases so does the adoption of nitrogen generation technology solutions like nitrogen generation technologies.

Restraining Factors

Recurrent Maintenance Needs

Nitrogen generators, an essential element in food and beverage processing today, require regular servicing to guarantee optimal performance and longevity. Maintenance costs can be an obstacle for smaller operations with limited technical resources or budget restrictions, especially those without regular service contracts in place. Unexpected downtime caused by maintenance issues can reduce production efficiency while simultaneously increasing operational costs. Complex maintenance procedures and potential equipment malfunctions may incur additional expenses and cause disruptions that limit market growth by discouraging small or less technologically advanced businesses from adopting nitrogen generators - leading them to look for alternative solutions with reduced maintenance demands instead.

Lack of Awareness Regarding Benefits of Health Software

A lack of awareness regarding to the benefits of nitrogen generators may hinder market expansion as potential users may not fully appreciate what these systems can offer them. Nitrogen generators offer many significant benefits, including cost savings on bulk nitrogen purchases, improved food preservation, and decreased contamination risks. Due to a lack of understanding, many companies continue to rely on traditional methods or outsourced nitrogen supplies. Educational initiatives and targeted marketing strategies must address this gap in awareness; showing off both the operational and financial benefits of nitrogen generators may help overcome barriers to wider adoption within the food and beverage industry.

Alternative Technologies Available Today (Updated September 2018)

Alternative technologies pose a further hurdle to the expansion of the nitrogen generators market. Vacuum packaging, modified atmosphere packaging (MAP) systems, and other gas-based preservation methods offer unique benefits that may compete with nitrogen generators for market share. Some businesses might prefer MAP systems for their greater flexibility and lower initial investment requirements compared to nitrogen generators that require significantly more capital outlays. Additionally, advancements in alternative preservation technologies could offer enhanced features or cost efficiencies that might appeal to certain segments of the market. Such developments create a competitive environment by giving businesses other viable options than nitrogen generators alone.

Research Scope Analysis

By Type

PSA (Pressure Swing Adsorption) Nitrogen Generators were the market leaders in 2023's Product Type segment of the Food & Beverage Nitrogen Generators Market, representing 55% by value (or an estimated $300 Million). PSA systems have become popular due to their efficiency in producing high-purity nitrogen on-site, meeting industry requirements for consistent and reliable supplies of nitrogen. Their growth can also be attributed to offering cost-effective and scalable solutions that enhance food safety while simultaneously increasing product shelf life.

Membrane Nitrogen Generators may comprise only a smaller segment of the market, yet still play a critical role. As of 2023, Membrane Nitrogen Generators accounted for 25% market share equating to approximately $135 million. Membrane nitrogen Generators are valued for their ease of use, low maintenance requirements, and suitability for applications requiring moderate purity nitrogen purity levels. Their increased adoption can particularly be seen among smaller-scale operations or applications with limited space and cost requirements making membrane technology an attractive solution.

Hot Catalyst and Cryogenic Nitrogen Generators account for the remaining market share; both technologies play a necessary role in food and beverage manufacturing operations, with Hot Catalyst systems noted for their efficiency in specific industrial applications while Cryogenic systems are preferred by larger operations that demand extremely high purity levels. As technology advances further, the food & Beverage Nitrogen Generator Market continues to change and adapt accordingly; providing solutions tailored specifically for different industry requirements.

By Application

Food held a dominant market position within the Food & Beverage Nitrogen Generators Market in 2023, accounting for approximately 60% of its value and totaling an estimated $350 million. This significant share demonstrates how nitrogen generators play an essential role in food processing operations where they are utilized for packaging, preservation, and shelf-life extension - not forgetting to ensure product freshness without spoilage and upholding high-quality standards that meet consumer expectations and regulatory regulations.

Beverages accounted for roughly 30% of the market in 2023, accounting for an estimated total revenue of roughly $175 million. Nitrogen generators employed within this sector include carbonation machines used for carbonating beverages as well as packaging and quality preservation equipment used to preserve product integrity during distribution and storage processes. Nitrogen also helps avoid oxidation while maintaining desired taste and texture resulting in a consistently satisfying customer experience.

The remaining market share consists of niche applications within the food and beverage industry, such as niche culinary innovations or packaging requirements. Overall, nitrogen usage in food applications dominates due to extensive applications and high demand; beverage use of nitrogen continues to evolve along with consumer preferences and technological advancements in its use.

The Food & Beverage Nitrogen Generators Market Report is segmented based on the following:

By Type

- PSA Nitrogen Generators

- Membrane Nitrogen Generators

By Application

Regional Analysis

North America emerged as a dominant region in the Food & Beverage Nitrogen Generators Market, accounting for 35% of its value - valued at roughly $210 million - due to its extensive food and beverage sector that includes major manufacturing, packaging and processing operations. Adoption of nitrogen generators was spurred by an emphasis on food safety improvements through modified atmosphere packaging (MAP), modified atmosphere drinks consumption has increased exponentially since their launch and the growing popularity of nitrogen-infused drinks; also, North America's emphasis on high-quality standards and sustainability make North America a leading market.

Europe accounted for roughly 30% of the market, or an estimated $180 million, by 2023. Europe was notable for its early adoption of advanced technologies and stringent regulations regarding food safety and quality, which drove nitrogen generator demand, particularly in MAP applications. Their robust regulatory framework as well as commitment to innovation in food processing and packaging contributed significantly to their strong market presence.

Asia Pacific is the fastest-growing region, accounting for approximately 25% of the global nitrogen generator market and valued at $150 million. This growth can be attributed to rapid industrialization, urbanization, and expansion of food and beverage sectors in countries like China and India; increasing demand for packaged and convenience foods coupled with advances in food processing technologies is fuelling the adoption of nitrogen generators in this region.

By Region

North America

Europe

- Germany

- U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

C-level executives in 2023 will play an increasingly pivotal role in steering the strategic direction and growth of the global Food & Beverage Nitrogen Generators Market. These leaders play a pivotal role in setting long-term goals while aligning themselves with industry trends like rising convenience food demand and smart technology integration. Their focus on innovation and sustainability drives investment in advanced nitrogen generation technologies while building partnerships to enhance market competitiveness. Strategic decisions taken at this C-level level are vital in capitalizing on emerging opportunities while navigating through a complex regulatory landscape that governs food safety standards.

Marketing and Brand Managers play an essential part in shaping the market presence and consumer perception of nitrogen generators. Their efforts in market segmentation, targeting, and positioning are essential in meeting the diverse needs of the food and beverage industries such as beverage. Through data-driven insights and customer feedback analysis, Marketing Managers can effectively promote the benefits of nitrogen generators such as extended product shelf life and packaging integrity improvement. Brand Managers focus on differentiating their company offerings in competitive landscapes while Product Managers oversee development and enhancement of nitrogen generation technologies to meet market requirements.

On the operational front, Sales Managers, Procurement Managers, and Technical Personnel play an invaluable role in driving sales growth and ensuring efficient deployment of nitrogen generators. Sales Managers and their teams focus on building client relationships, meeting market needs, and closing deals, while Procurement Managers work to secure high-quality materials at cost and manage supply chains to ensure timely deliveries. Production Managers oversee manufacturing processes to ensure product quality and meet safety standards, while Technical Personnel provide invaluable support in terms of installation, maintenance and troubleshooting - essential services that ensure systems operate effectively and efficiently - and Distributors play an essential role by reaching nitrogen generators to end-users for increased market penetration and service availability. Together these roles contribute significantly towards the success and expansion of the Food & Beverage Nitrogen Generators Market.

Some of the prominent players in the Global Food & Beverage Nitrogen Generators Market are:

- C-Level Executives

- Marketing Manager, Brand Manager, Product Manager

- Sales Manager, Sales Officer, Regional Sales Manager, Country Manager

- Procurement Manager

- Production Manager

- Technical Personnel

- Distributors

Recent developments

- In 2024, August: Nitrogen generation systems saw integration with AI and machine learning, predictive maintenance, and real-time optimization further reducing operational costs and downtime.

- In 2023, November: Energy-efficient technology achieved sharp reductions in energy consumption for nitrogen generators. These were realized on a large scale.

- In 2023, May: There was an increasing demand for hybrid nitrogen generation systems (PSA/Membrane)- owing to enhanced flexibility and efficiency.

- In February 2022: Nitrogen-infused drinks such as craft beers and nitro coffee have increased the need for nitrogen generators, driving directed investments in specialized systems.

- In February 2022: There was an introduction of small modular nitrogen generators that brought about cost-effective solutions for small-scale operations further widening market accessibility.

Report Details

| Report Characteristics |

| Market Size (2023) |

USD 11.3 Billion |

| Forecast Value (2032) |

USD 19.6 Billion |

| CAGR (2023-2032) |

6.2% |

| Historical Data |

2018 – 2023 |

| Forecast Data |

2024 – 2033 |

| Base Year |

2023 |

| Estimate Year |

2024 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Type(PSA Nitrogen Generators, Membrane Nitrogen Generators), By Application(Food, Beverage) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA

|

| Prominent Players |

C-Level Executives, (Marketing Manager, Brand Manager, Product Manager), (Sales Manager, Sales Officer, Regional Sales Manager, Country Manager), Procurement Manager, Production Manager, Technical Personnel, Distributors |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |