Market Overview

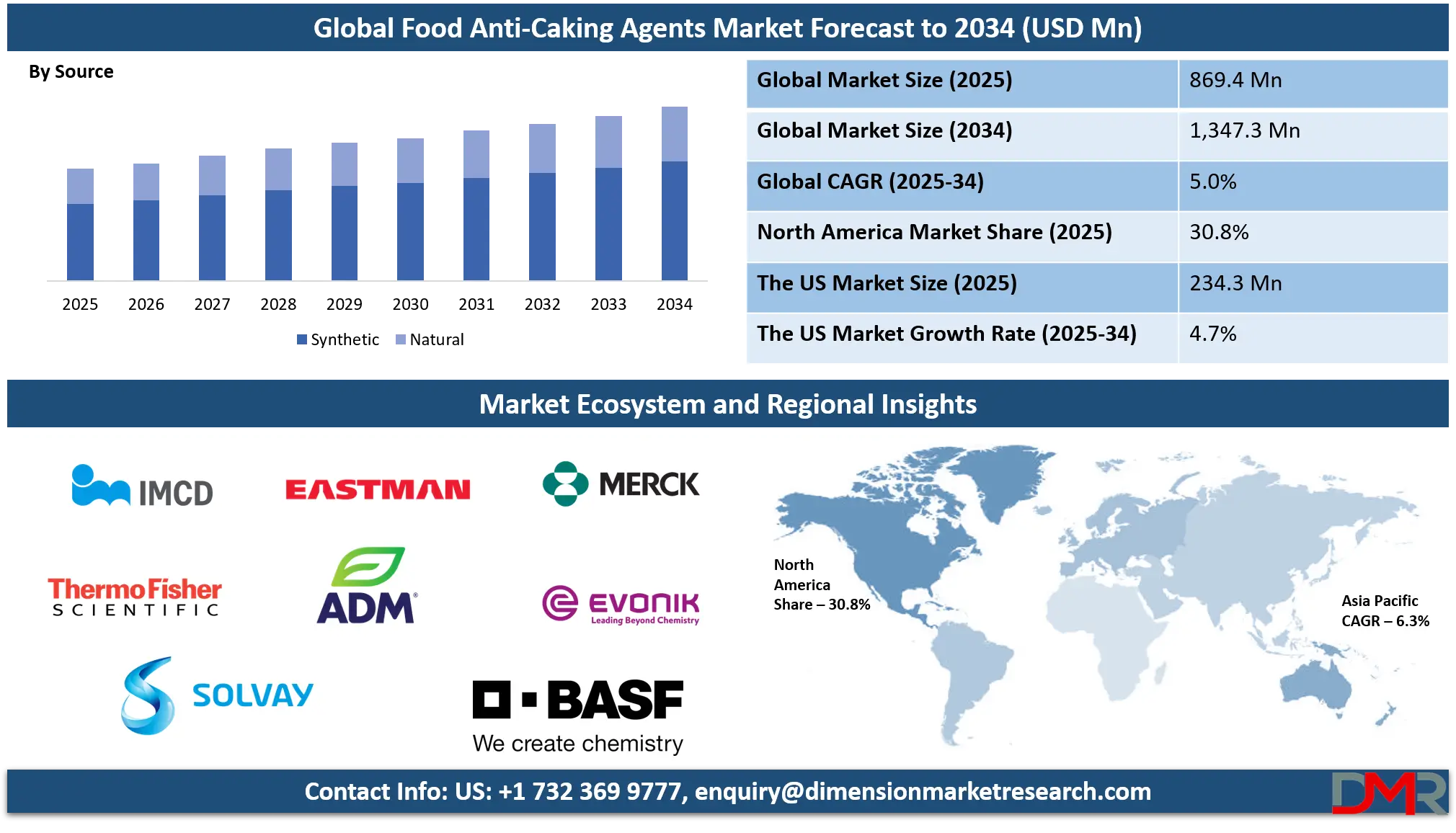

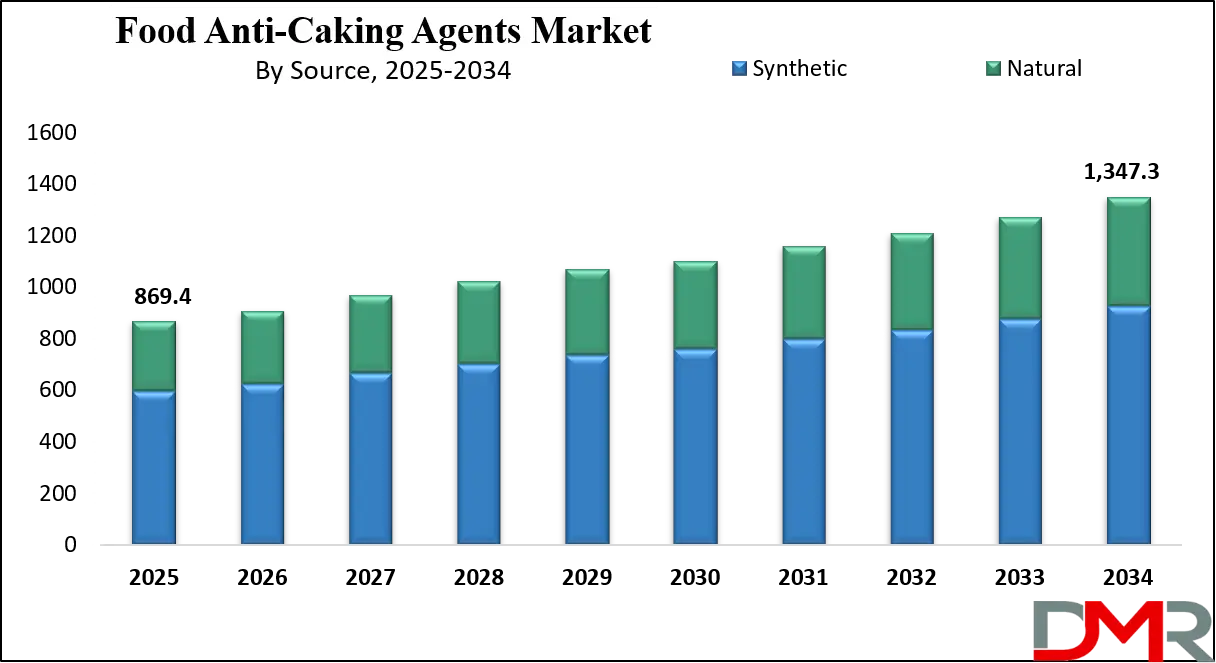

The Global Food Anti-Caking Agents Market size is projected to reach USD 869.4 million in 2025 and grow at a compound annual growth rate of 5.0% from there until 2034 to reach a value of USD 1,347.3 million.

Food anti-caking agents are ingredients added to powdered or granulated food products to prevent them from sticking together or forming lumps. These agents help maintain the texture, flow, and usability of food items like salt, coffee, flour, spices, and powdered milk. Without these agents, products could absorb moisture from the air and become clumpy or hard, making them difficult to use. Anti-caking agents work by either absorbing moisture themselves or by coating particles to stop them from sticking together.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

In recent years, the demand for food anti-caking agents has grown steadily. One major reason is the rise in packaged and convenience foods. As more people turn to ready-to-eat meals and long-shelf-life products, food manufacturers are using more anti-caking agents to keep these items fresh and easy to use. Another driver is the growth of the food service industry, where large amounts of bulk powders are stored and used daily, making flowability essential for smooth operations.

A noticeable trend is the shift towards natural and plant-based anti-caking agents. As consumers become more health-conscious and concerned about artificial ingredients, companies are exploring options like rice flour, tricalcium phosphate from natural sources, and other plant-based solutions. This trend also aligns with the clean-label movement, where food labels with fewer and simpler ingredients are preferred. Manufacturers are working to balance functionality with consumer expectations for transparency and simplicity.

Technological advancements are also influencing the development of anti-caking agents. Researchers are studying micro-sized particles and using food-grade nano-technology to improve the efficiency of these additives. Innovations in formulation are allowing anti-caking agents to perform better in extreme conditions such as high humidity or cold storage. These improvements are especially helpful for global food supply chains, where products may travel long distances under varying climate conditions.

In the past few years, several food safety and labeling regulations have impacted the use of anti-caking agents. Some countries are placing stricter limits on the types and amounts of agents allowed, while others are encouraging clearer labeling to help consumers make informed choices. This regulatory push is pushing manufacturers to be more cautious and selective about which agents they use and how they declare them on packaging.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Overall, food anti-caking agents continue to play a vital role in modern food production and distribution. As global food systems become more complex and consumer preferences evolve, these additives are being adapted to meet new challenges. Whether through cleaner ingredients, better performance, or stricter regulations, anti-caking agents are being reshaped to serve both industry needs and consumer expectations in a changing market.

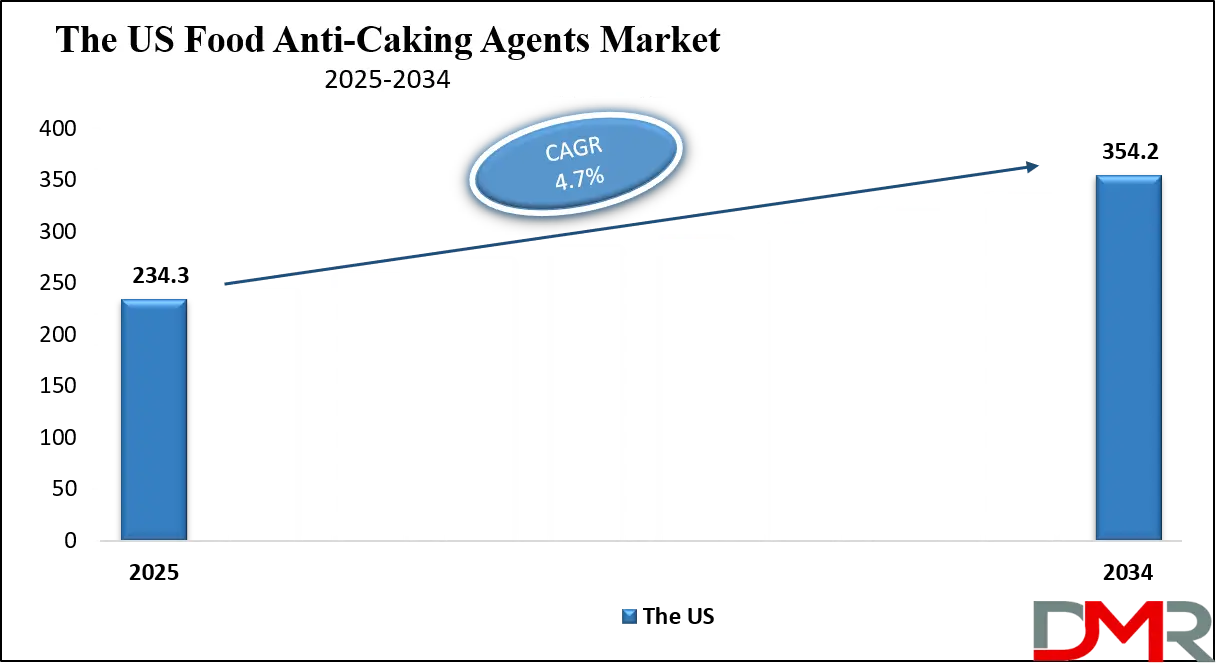

The US Food Anti-Caking Agents Market

The US Food Anti-Caking Agents Market size is projected to reach USD 234.3 million in 2025 at a compound annual growth rate of 4.7% over its forecast period.

The US plays a significant role in the food anti-caking agents market as both a major consumer and innovator. With a large and diverse food processing industry, the US drives strong demand for anti-caking agents to maintain product quality in powdered and granulated foods like spices, baking mixes, and drink powders. The country’s strict food safety regulations push manufacturers to develop high-quality, safe, and effective additives.

Additionally, the US market shows a growing preference for natural and clean-label ingredients, encouraging innovation in plant-based and organic anti-caking solutions. US companies also invest heavily in research and technology to improve the performance of these agents, helping to set global trends. Overall, the US remains a key market influencing product development and regulatory standards worldwide.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Europe Food Anti-Caking Agents Market

Europe Food Anti-Caking Agents Market size is projected to reach USD 229.5 million in 2025 at a compound annual growth rate of 4.8% over its forecast period.

Europe plays a crucial role in the food anti-caking agents market by emphasizing high standards for food safety and clean-label products. European consumers are increasingly demanding natural, organic, and transparent ingredients, pushing manufacturers to innovate with plant-based and non-synthetic anti-caking agents. Strict regulations across the region ensure that only safe and well-tested additives are used, which encourages the development of high-quality products. Europe also has a strong food processing industry that relies heavily on these agents to maintain the texture and shelf life of powders and granulated foods.

Additionally, sustainability and environmental concerns are driving research into eco-friendly and biodegradable anti-caking solutions. As a result, Europe influences global trends through its regulatory framework and consumer preferences.

Japan Food Anti-Caking Agents Market

Japan Food Anti-Caking Agents Market size is projected to reach USD 86.9 million in 2025 at a compound annual growth rate of 5.7% over its forecast period.

Japan plays an important role in the food anti-caking agents market by focusing on high-quality and innovative food products. With its advanced food manufacturing sector, Japan demands anti-caking agents that ensure consistent texture and long shelf life, especially for powdered foods like spices, instant soups, and drink mixes. Japanese consumers often prefer products with clean labels and natural ingredients, which encourages the development of safer and plant-based anti-caking solutions.

Strict food safety regulations in Japan also drive manufacturers to meet rigorous standards, fostering innovation and quality improvements. Additionally, Japan’s role as a major importer and exporter of food products means its standards and preferences influence global suppliers, making it a key player in shaping the market for food anti-caking agents worldwide.

Food Anti-Caking Agents Market: Key Takeaways

- Market Growth: The Food Anti-Caking Agents Market size is expected to grow by USD 439.0 million, at a CAGR of 5.0%, during the forecasted period of 2026 to 2034.

- By Source: The Synthetic segment is anticipated to get the majority share of the Food Anti-Caking Agents Market in 2025.

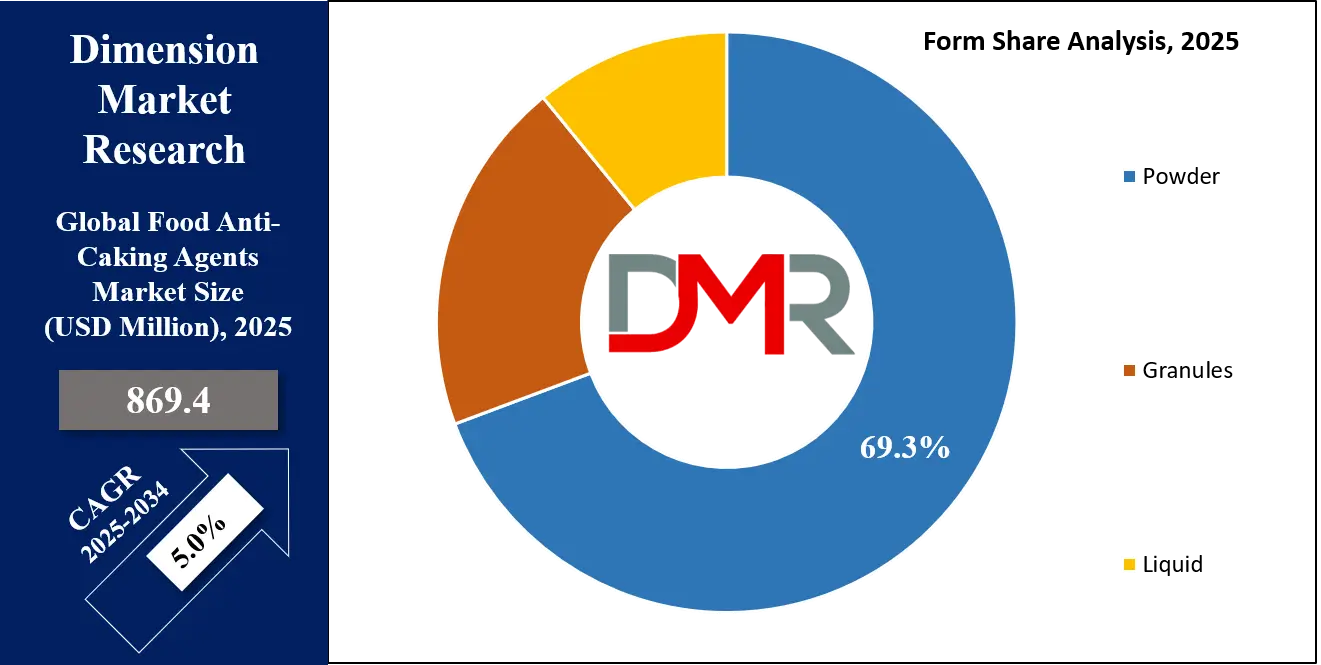

- By Form: The powder segment is expected to get the largest revenue share in 2025 in the Food Anti-Caking Agents Market.

- Regional Insight: North America is expected to hold a 30.8% share of revenue in the Global Food Anti-Caking Agents Market in 2025.

- Use Cases: Some of the use cases of Food Anti-Caking Agents, salt & sugar products, baking mixes & flours, and more.

Food Anti-Caking Agents Market: Use Cases

- Powdered Spices and Seasonings: Food anti-caking agents are added to powdered spices like chili powder, garlic powder, and seasoning blends to keep them free-flowing. Without these agents, the spices could absorb moisture and clump together. This helps maintain consistency and ease of use in both household and commercial kitchens.

- Baking Mixes and Flours: In baking products such as flour, cake mixes, and pancake mixes, anti-caking agents prevent lump formation during storage. This ensures smooth mixing and accurate measurements. They are especially useful in humid environments where powders tend to stick.

- Instant Soups and Drink Powders: Products like instant soup mixes, powdered coffee, and flavored drink powders include anti-caking agents to maintain even texture. These agents allow the powders to dissolve easily in water without forming clumps. It enhances user convenience and product quality.

- Salt and Sugar Products: Table salt and powdered sugar often include anti-caking agents to stop them from hardening over time. This keeps them pourable and easy to sprinkle or scoop. These agents are essential for both everyday use and large-scale food processing.

Stats & Facts

- According to Eximpedia, India's salt exports reached an impressive 13.73 million kilograms in 2023, making it the world’s leading salt exporter by quantity—far ahead of countries like Canada (3.9 million kg) and Germany (3.69 million kg). India’s dominance is evident in both scale and market reach.

- As per Eximpedia, India saw a substantial 36% growth in salt exports between 2023 and 2024. This sharp uptick underscores India's rising prominence in the global salt market and reflects increased demand from Asian and Gulf nations.

- Based on Eximpedia data, India exported salt to more than 100 nations in the latest cycle, highlighting the country's vast and diversified trade network for this essential mineral commodity.

- Eximpedia indicates that China alone accounted for 37% of India’s salt exports, making it the largest single destination. This suggests a strong bilateral trade linkage and dependence on Indian salt for Chinese industrial or consumption needs.

- India recorded 2,519 salt export shipments between March 2023 and February 2024, as per Eximpedia, reflecting a consistent and active trade flow throughout the fiscal year.

- According to Eximpedia figures, India has 298 registered salt exporters and 597 international buyers, illustrating a highly engaged domestic supply base with a broad global customer network.

- Per Eximpedia, Korea emerged as the second-largest importer of Indian salt, accounting for 13.1% of total exports, followed by Japan at 7.92%, indicating the significance of Northeast Asia in India’s salt trade strategy.

- Vietnam and Indonesia each represented more than 5% of India’s salt exports, according to Eximpedia. This emphasizes Southeast Asia’s growing demand and proximity-based logistical advantages in Indian salt procurement.

- Other Asian regions not classified separately, noted by Eximpedia as “Other Asia, nes,” contributed 4.56% to Indian salt exports, suggesting the mineral’s widespread utility across lesser-known but emerging markets.

- Eximpedia ranks India as the top salt exporter globally by volume, far outpacing the USA, which exported just 2.31 million kg—less than one-fifth of India’s total exports in the same year.

- According to Eximpedia, even countries geographically closer to major salt deposits—such as Namibia (1.75 million kg) and Kazakhstan (0.81 million kg)—lag significantly behind India in salt export volumes.

- Bangladesh and Nepal, both sharing land borders with India, imported 4.82% and 3.39% of Indian salt respectively in 2023-24, as per Eximpedia, underscoring strong regional demand for Indian salt within South Asia.

Market Dynamic

Driving Factors in the Food Anti-Caking Agents Market

Rising Demand for Processed and Packaged Foods

A major growth driver for the food anti-caking agents market is the increasing consumption of processed and packaged foods. As busy lifestyles and urbanization push more people toward convenient meal options, there is a higher demand for products like powdered soups, spice mixes, coffee creamers, and instant beverages. These products require anti-caking agents to maintain their texture and flow during storage and transport.

In addition, the growing food service industry—especially fast food chains, bakeries, and catering services—relies heavily on bulk powders that need to stay free-flowing for efficient use. The expanding reach of retail chains and online food delivery platforms also fuels the production of shelf-stable food items, further boosting the need for anti-caking solutions.

Shift Toward Clean Label and Natural Ingredients

Another strong growth driver is the increasing consumer preference for clean-label and naturally sourced food ingredients. People are paying closer attention to food labels, looking for transparency and simplicity in what they eat. This shift has encouraged manufacturers to explore plant-based or naturally derived anti-caking agents, such as rice flour and natural starches, which are perceived as safer and healthier.

As the clean-label movement grows, companies are reformulating their products to remove synthetic additives without compromising on quality or shelf life. This demand for natural alternatives is not just limited to health food markets but is spreading into mainstream food products. The trend is expected to keep expanding as regulatory bodies and health organizations promote awareness around food additives and encourage simpler ingredient lists.

Restraints in the Food Anti-Caking Agents Market

Strict Regulatory Policies and Compliance Challenges

One major restraint for the food anti-caking agents market is the increasing regulatory scrutiny around food additives. Many countries have strict rules on the types and amounts of anti-caking agents allowed in food products to ensure consumer safety. These regulations vary widely across regions, making it difficult for manufacturers to maintain consistent formulations for global markets.Compliance requires extensive testing and documentation, which can increase costs and slow down product launches.

Additionally, stricter labeling requirements demand transparency, which may discourage the use of certain synthetic agents. This regulatory complexity can limit innovation and restrict the introduction of new anti-caking agents, posing challenges for market growth.

Consumer Concerns Over Synthetic Additives

Growing consumer awareness and skepticism about synthetic food additives present another significant restraint. Many buyers prefer foods with fewer artificial ingredients, pushing manufacturers to reduce or eliminate synthetic anti-caking agents. However, natural alternatives may not always provide the same level of effectiveness, stability, or cost-efficiency, leading to formulation challenges.

The demand for “clean label” products also creates pressure on producers to invest in research and development for natural options, which can be expensive and time-consuming. This cautious consumer attitude towards additives can slow market expansion, especially in regions where natural and organic food trends are dominant.

Opportunities in the Food Anti-Caking Agents Market

Expansion in Emerging Markets

Emerging markets present a significant opportunity for the food anti-caking agents industry as rising incomes and urbanization boost demand for processed and packaged foods. Countries in Asia, Africa, and Latin America are seeing rapid growth in their food processing sectors, along with increasing consumer preference for convenience foods. As these regions develop, the need for anti-caking agents to maintain product quality and shelf life becomes more critical.

Additionally, improved cold storage and transportation infrastructure support the expansion of food trade, increasing the volume of powders and granulated products requiring anti-caking solutions. This expanding customer base offers manufacturers a chance to introduce tailored products that meet local preferences and regulatory requirements.

Innovation in Natural and Clean-Label Solutions

There is a growing opportunity to develop innovative natural anti-caking agents that cater to health-conscious consumers seeking cleaner food labels. With rising demand for plant-based and organic foods, companies can invest in researching new, effective natural ingredients such as rice flour, calcium salts, and plant starches that serve as alternatives to synthetic additives.

Innovations in extraction and processing technologies also allow for improved functionality of natural agents, bridging the gap between performance and consumer expectations. By focusing on sustainable sourcing and transparent labeling, manufacturers can tap into premium markets and build stronger brand loyalty, opening new revenue streams in both developed and developing countries.

Trends in the Food Anti-Caking Agents Market

Shift Toward Natural and Clean-Label Ingredients

A significant trend in the food anti-caking agents market is the growing consumer preference for natural and clean-label products. Consumers are increasingly seeking transparency in food labeling, favoring products with minimal and recognizable ingredients. This shift is prompting manufacturers to innovate and expand their product offerings to include natural anti-caking solutions that meet these evolving consumer expectations.

Natural anti-caking agents, derived from plant-based sources, are gaining popularity as they align with the demand for cleaner, more sustainable food products. Companies are investing in research and development to create effective and sustainable natural alternatives, responding to the need for ingredients that are both functional and acceptable to health-conscious consumers.

Technological Advancements in Anti-Caking Agent Formulation

The market is witnessing technological advancements in anti-caking agent formulation and production processes. Innovative techniques, such as encapsulation and microencapsulation, are being utilized to enhance the functionality and stability of anti-caking agents. These advancements allow for more efficient delivery and performance of anti-caking agents in various food products.

Additionally, the development of non-nano anti-caking solutions, like Omyafood 120, offers high porosity and moisture-binding capabilities, providing alternatives to traditional flow aids. Such innovations are enabling manufacturers to improve product quality and meet the evolving demands of the food industry.

Research Scope and Analysis

By Type Analysis

Silicon dioxide as a type of food anti-caking agent is set to lead the market in 2025, with an estimated share of 34.8%. It is widely used because of its excellent moisture-absorbing properties, which help keep powdered and granulated foods free-flowing and prevent clumping. Silicon dioxide is commonly found in products like spices, baking mixes, and powdered beverages, making it a versatile and essential additive. Its effectiveness in improving product shelf life and maintaining texture drives its demand across the food processing industry.

Additionally, silicon dioxide is considered safe and compatible with many food formulations, which supports its strong presence in the market. As consumer demand for convenience foods continues to grow, silicon dioxide will remain a key ingredient in ensuring product quality and ease of use.

Magnesium compounds as a type of food anti-caking agent are expected to see significant growth over the forecast period due to their strong moisture control and anti-clumping abilities. These compounds, such as magnesium carbonate and magnesium stearate, are commonly used in powdered food products to improve flowability and prevent sticking during storage and transportation. Their effectiveness in maintaining product stability under humid conditions makes them highly valuable, especially in regions with challenging climates.

Additionally, magnesium compounds are favored for their relatively natural origin and safety profile, aligning with the growing clean-label trend. As the processed food sector expands, the demand for magnesium-based anti-caking agents is likely to increase, supporting the overall growth of the food anti-caking agents market.

By Source Analysis

Synthetic sources of food anti-caking agents are projected to dominate the market in 2025, with a substantial share of around 68.7%. These agents are widely favored due to their consistent quality, strong moisture absorption, and effective performance in preventing clumping across various powdered foods. Synthetic anti-caking agents are cost-effective and offer reliable functionality in large-scale food processing, which supports their widespread use in products like spices, baking mixes, and instant beverages.

The ability to tailor these agents to meet specific food safety standards and regulatory requirements further drives their adoption. Despite growing interest in natural alternatives, the efficiency and affordability of synthetic sources will continue to make them a leading choice for manufacturers aiming to maintain product quality and extend shelf life.

Natural sources of food anti-caking agents are set to experience significant growth over the forecast period, fueled by rising consumer demand for clean-label and plant-based ingredients. These agents, derived from materials like rice flour, calcium carbonate, nano calcium carbonate, and other plant starches, offer an attractive alternative to synthetic additives. Their appeal lies in being perceived as safer and more environmentally friendly, aligning with the global shift towards healthier and sustainable food choices.

Although natural anti-caking agents may have some limitations in performance compared to synthetic ones, ongoing research and development are improving their effectiveness. As more food manufacturers aim to meet consumer preferences and stricter labeling regulations, the natural segment is expected to expand steadily in the food anti-caking agents market.

By Form Analysis

Powder forms of food anti-caking agents are anticipated to hold a dominant position in the market in 2025, capturing an estimated share of 69.3%. Powders are widely used because they easily blend with powdered food products like spices, baking mixes, and instant drink powders, helping to prevent clumping and improve flowability. Their fine texture allows uniform distribution, which enhances the overall product quality and shelf life.

The convenience of using powdered anti-caking agents in large-scale food manufacturing also supports their strong demand. As the consumption of processed and packaged powdered foods continues to rise globally, the need for effective powder-form anti-caking agents will grow, reinforcing their importance in maintaining product consistency and consumer satisfaction in the food industry.

Granules as a form of food anti-caking agents, are expected to experience notable growth over the forecast period, driven by their effectiveness in maintaining product flow and preventing moisture absorption. Granular agents are preferred in certain food applications where slower release and better handling properties are required, such as in salt, sugar, and some spice blends. Their larger particle size helps reduce dust generation and improves ease of use in manufacturing and packaging processes. With increasing demand for diverse food textures and improved shelf life, granules offer a practical solution for many food producers.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

By Function Analysis

Moisture absorption as a function in food anti-caking agents is set to play a major role in the market’s growth in 2025, with an estimated share of 57.7%. This function is crucial because moisture is the main cause of clumping and spoilage in powdered and granulated foods. Anti-caking agents that effectively absorb moisture help keep these products dry, free-flowing, and easy to handle during storage and transportation.

This ability extends the shelf life and maintains the quality of items like spices, baking powders, and instant beverages. As demand for packaged and processed foods rises globally, the need for moisture-absorbing agents grows in tandem. Their role in preserving product texture and preventing lumps makes them indispensable for food manufacturers focused on maintaining high standards and customer satisfaction.

Flow conditioning as a function is expected to see significant growth in the food anti-caking agents market over the forecast period. This function helps improve the flow properties of powdered foods, ensuring smooth processing, packaging, and usage. By reducing friction and clumping, flow conditioning agents make it easier to handle products like spices, salt, and powdered milk, especially in large-scale manufacturing and foodservice operations. Enhanced flowability also supports consistent product quality and accurate portion control. With the increasing demand for convenient, ready-to-use food products, flow conditioning agents are becoming essential to meet production efficiency and consumer expectations.

By Application Analysis

Bakery and confectionery as an application segment in the food anti-caking agents market is projected to hold a significant share of 28.5% in 2025. These products often involve powdered ingredients like flour, sugar, and cocoa, which require anti-caking agents to prevent clumping and ensure smooth mixing. The use of these agents helps maintain product consistency, texture, and appearance, which are critical for consumer satisfaction.

As demand for baked goods and sweets continues to rise globally, especially with increasing urbanization and busy lifestyles, manufacturers are relying more on anti-caking agents to improve shelf life and processing efficiency. The growth of packaged bakery and confectionery items in retail and foodservice sectors will further drive the need for reliable anti-caking solutions, supporting the expansion of this application segment.

Ready-to-eat foods as an application in the food anti-caking agents market are expected to experience notable growth over the forecast period. These foods often contain powdered ingredients such as seasoning blends and instant mixes, which require anti-caking agents to maintain free flow and prevent clumping during storage and use. With busy lifestyles and rising demand for convenient meal options, the ready-to-eat segment is expanding rapidly.

Anti-caking agents help improve product texture and shelf stability, ensuring consistent quality. As more consumers turn to ready-to-eat meals for quick nutrition, the market for anti-caking agents in this segment is set to grow steadily through 2025, driven by the need for convenience and extended shelf life.

By End Use Industry Analysis

Food manufacturing as an end-use industry is expected to lead the growth of the food anti-caking agents market in 2025, with an estimated share of 71.8%. This sector uses large volumes of anti-caking agents to ensure powdered and granulated ingredients like spices, salt, and baking mixes remain free-flowing and easy to handle during production. The growing demand for processed and packaged foods drives the need for these agents to maintain product quality, prevent clumping, and extend shelf life.

Food manufacturers also focus on improving efficiency and consistency, making anti-caking agents essential in their operations. As the global food industry expands and consumer preferences shift toward convenience and ready-to-cook products, the reliance on anti-caking agents in food manufacturing is set to increase, supporting the market’s steady growth through 2025.

Foodservice as an end-use industry is expected to experience significant growth in the food anti-caking agents market over the forecast period. This sector requires reliable anti-caking agents to maintain the quality and flowability of powdered ingredients like seasonings, sauces, and instant mixes used in restaurants, cafes, and catering services.

The demand for convenience and consistent taste in foodservice drives the use of these agents, helping to prevent clumping and improve product handling during preparation. With the growth of quick-service restaurants and ready-to-eat meal options, foodservice providers increasingly depend on anti-caking agents to ensure efficient operations.

The Food Anti-Caking Agents Market Report is segmented on the basis of the following:

By Type

- Silicon Dioxide

- Calcium Compounds

- Calcium Silicate

- Calcium Carbonate

- Sodium Compounds

- Sodium Ferrocyanide

- Sodium Aluminosilicate

- Magnesium Compounds

- Magnesium Carbonate

- Magnesium Stearate

- Others

- Microcrystalline Cellulose

- Talc

By Source

By Form

By Function

- Moisture Absorption

- Flow Conditioning

By Application

- Bakery & Confectionery

- Dairy Products

- Seasonings & Condiments

- Soups & Sauces

- Beverages

- Meat Products

- Ready-to-Eat Food

- Others

By End Use Industry

- Food Manufacturing

- Foodservice

- Household/Retail

Regional Analysis

Leading Region in the Food Anti-Caking Agents Market

North America is leading the growth of the food anti-caking agents market in 2025, holding an estimated share of 30.8%. This region’s strong food processing industry and high consumption of packaged and convenience foods drive the steady demand for anti-caking agents. Consumers in North America increasingly prefer products that are easy to use and maintain quality over time, making these agents essential for powdered spices, baking mixes, and drink powders.

Additionally, rising awareness about clean-label and natural ingredients is pushing manufacturers to develop safer, plant-based anti-caking solutions that meet consumer expectations. Strict food safety regulations in North America also play a key role by encouraging innovation and ensuring the use of effective, compliant additives. With ongoing investments in research and growing demand across retail and foodservice sectors, North America continues to be a major driver in the global food anti-caking agents market throughout 2025.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Fastest Growing Region in the Food Anti-Caking Agents Market

Asia Pacific is showing significant growth in the food anti-caking agents market over the forecast period, driven by rising urbanization and changing food habits. Increasing demand for processed and packaged foods in countries like India, China, and Southeast Asia is boosting the use of anti-caking agents to improve product quality and shelf life. The expanding food processing industry and growing middle-class population are creating a larger consumer base for convenient powdered products such as spices, instant drinks, and baking mixes.

Additionally, greater awareness of food safety and clean-label trends is encouraging manufacturers to adopt natural and effective anti-caking solutions. With ongoing investments and improving supply chains, Asia Pacific is becoming a key region contributing to the global market’s growth in 2025.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The food anti-caking agents market is quite competitive, with many players offering a wide range of products to meet the growing needs of the food industry. Companies compete by focusing on innovation, improving product performance, and developing natural or clean-label solutions that appeal to health-conscious consumers. There is also competition based on pricing, product quality, and the ability to meet food safety regulations in different countries.

Manufacturers are investing in research to create more efficient and versatile anti-caking agents that work well in various food types and storage conditions. As demand rises globally, especially in processed and packaged foods, the market continues to see new entrants and product upgrades, making it an active and evolving space with strong global participation.

Some of the prominent players in the global Food Anti-Caking Agents are:

- BASF SE

- Solvay

- Evonik Industries

- ADM

- Thermo Fisher Scientific

- Merck

- Eastman Chemical Company

- Clariant AG

- ABITEC Corp

- Kemira Oyj

- Triveni Chemicals

- Aarti Industries

- DFE Pharma

- Wacker Chemie AG

- Hawkins Inc

- Tate & Lyle PLC

- Ferro Corporation

- IMCD Group

- Cargil Inc

- Other Key Players

Recent Developments

- In May 2025, PyroGenesis Inc. announced that independent analysis has confirmed the material produced during recent Fumed Silica Reactor (FSR) system testing is indeed fumed silica. This development follows its May 15, 2025 update and aligns with a release by its client HPQ Silicon Inc. PyroGenesis is developing the FSR for HPQ's subsidiary, HPQ Silica Polvere Inc. (“Polvere”).

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 869.4 Mn |

| Forecast Value (2034) |

USD 1,347.3 Mn |

| CAGR (2025–2034) |

5.0% |

| The US Market Size (2025) |

USD 234.3 Mn |

| Historical Data |

2019 – 2024 |

| Forecast Data |

2026 – 2034 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Type (Silicon Dioxide, Calcium Compounds, Sodium Compounds, Magnesium Compounds, and Others), By Source (Natural and Synthetic), By Form (Powder, Granules, and Liquid), By Function (Moisture Absorption and Flow Conditioning), By Application (Bakery & Confectionery, Dairy Products, Seasonings & Condiments, Soups & Sauces, Beverages, Meat Products, Ready-to-Eat Food, and Others), By End Use Industry (Food Manufacturing, Foodservice, and Household/Retail) |

| Regional Coverage |

North America – US, Canada; Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA |

| Prominent Players |

BASF SE, Solvay, Evonik Industries, ADM, Thermo Fisher Scientific, Merck, Eastman Chemical Company, Clariant AG, ABITEC Corp, Kemira Oyj, Triveni Chemicals, Aarti Industries, DFE Pharma, Wacker Chemie AG, Hawkins Inc, Tate & Lyle PLC, Ferro Corporation, IMCD Group, Cargil Inc, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |