Market Overview

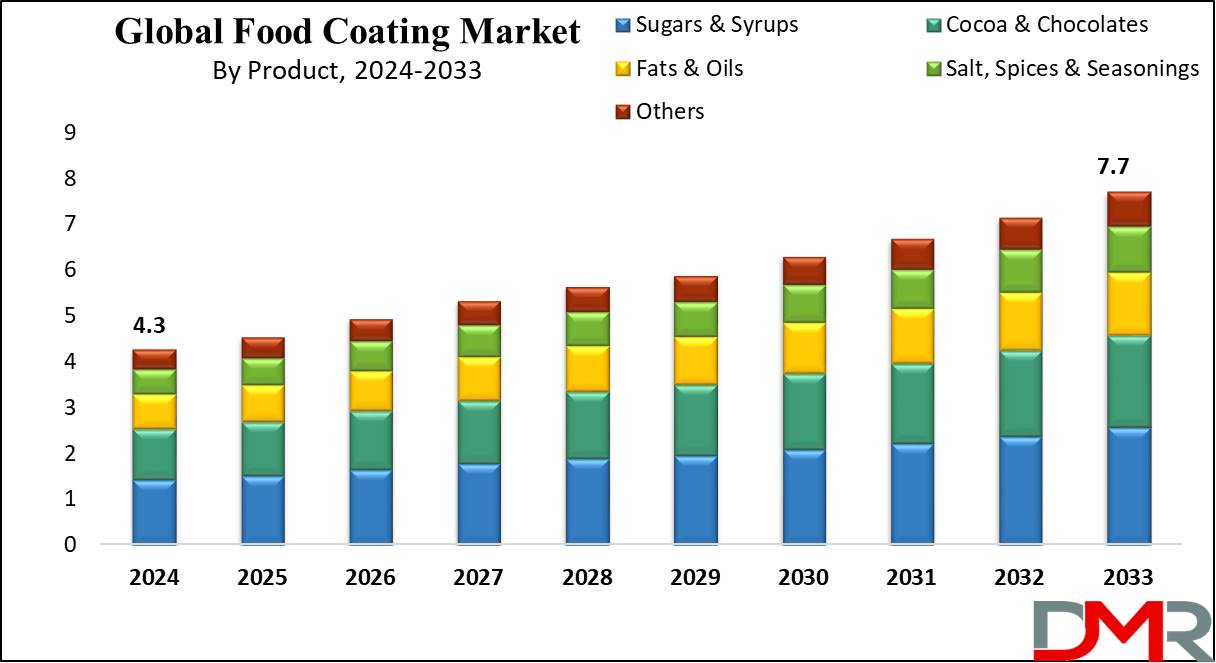

The Global Food Coating Market is anticipated to be valued at USD 4.3 billion in 2024 and is further predicted to reach USD 7.7 billion by 2033, at a CAGR of 6.8 %.

Food coating is a process of applying different layers of ingredients to food items to enhance the texture, taste, & presentation of dishes. This process is used for the coating of various food dishes like meat, seafood, vegetables, snacks, and bakery products as these items need specific coating solutions to obtain the desired qualities.

These coatings can also provide flavor, add texture, enhance appearance, & provide a protective barrier. Different Ingredients like spices, oils, flour, batters, marinades fats, sugars, and chocolate are used for coating purposes. Different types of food coating equipment must be adopted to fulfill the demand of this market.

The food coating market is experiencing a surge due to factors like evolving lifestyles, changes in the taste of consumers, urbanization, & increased disposable incomes. This coating can be used during frying, baking, or grilling to obtain diverse taste results.

Increasing preference and popularity of convenience foods, outdoor dining, and rising consumption of ready-to-eat foods are driving the market growth. This coating is also essential in the food processing industry as it reduces waste, time, and cost. Growing adoption of innovative solutions from the food additives, food packaging, and AI in food processing is further strengthening industry growth.

Key Takeaways

- Market size: The global food coating market is expected to grow by 3.2 billion, at a CAGR of 6.8 % during the forecasted period of 2025 to 2033.

- Market Definition: Food coating is a method of applying diverse layers of ingredients on food items to improve the texture & flavor, retain moisture, control oil absorption, and improve visual appeal.

- Product Segment Analysis: The Sugar & Syrup segment is projected to be the dominant force in the food coating market, capturing the largest revenue share of 33.2% in 2024.

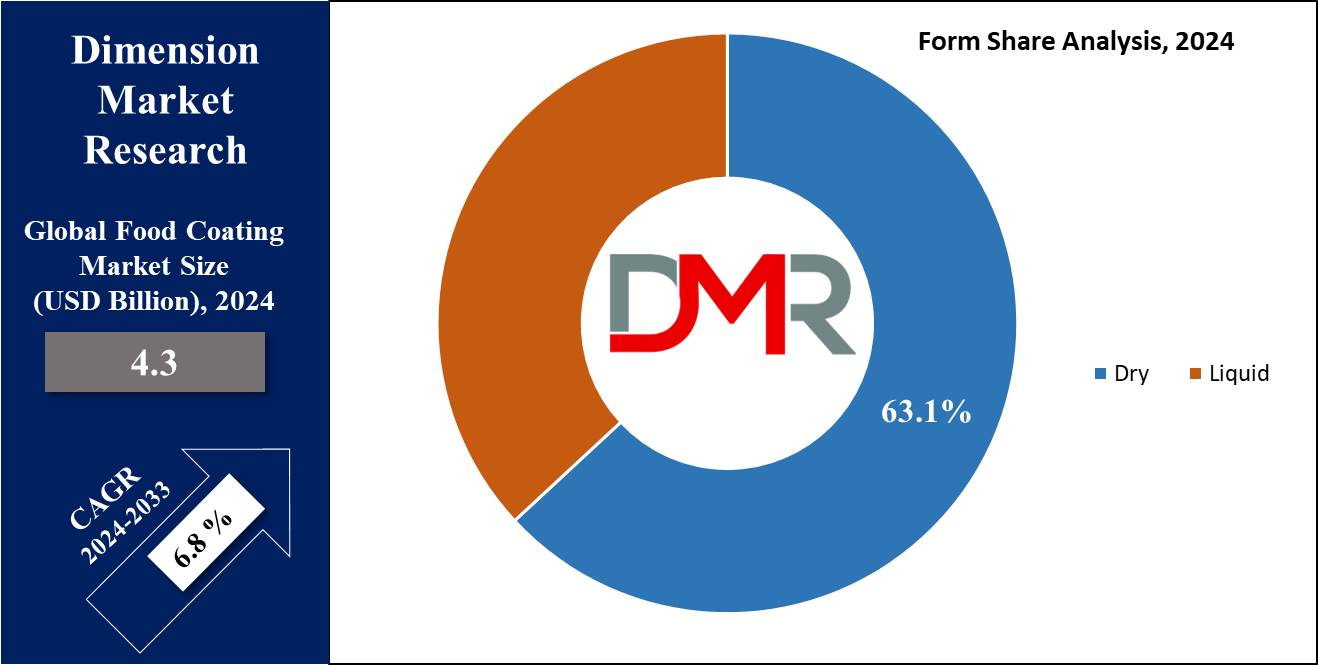

- Form Segment Analysis: In terms of forms, the liquid segment is expected to take the lead with the highest market share in the global food coating market by the end of 2024.

- Application Analysis: Confectioneries & bakery products are forecasted to hold the largest market share of 28.3% and dominate the food coating market in 2024.

- Equipment Type: The market is segmented into Coaters and Applicators and enrobers based on equipment type. Coaters and Applicators are expected to witness significant growth among equipment types throughout the forecast period.

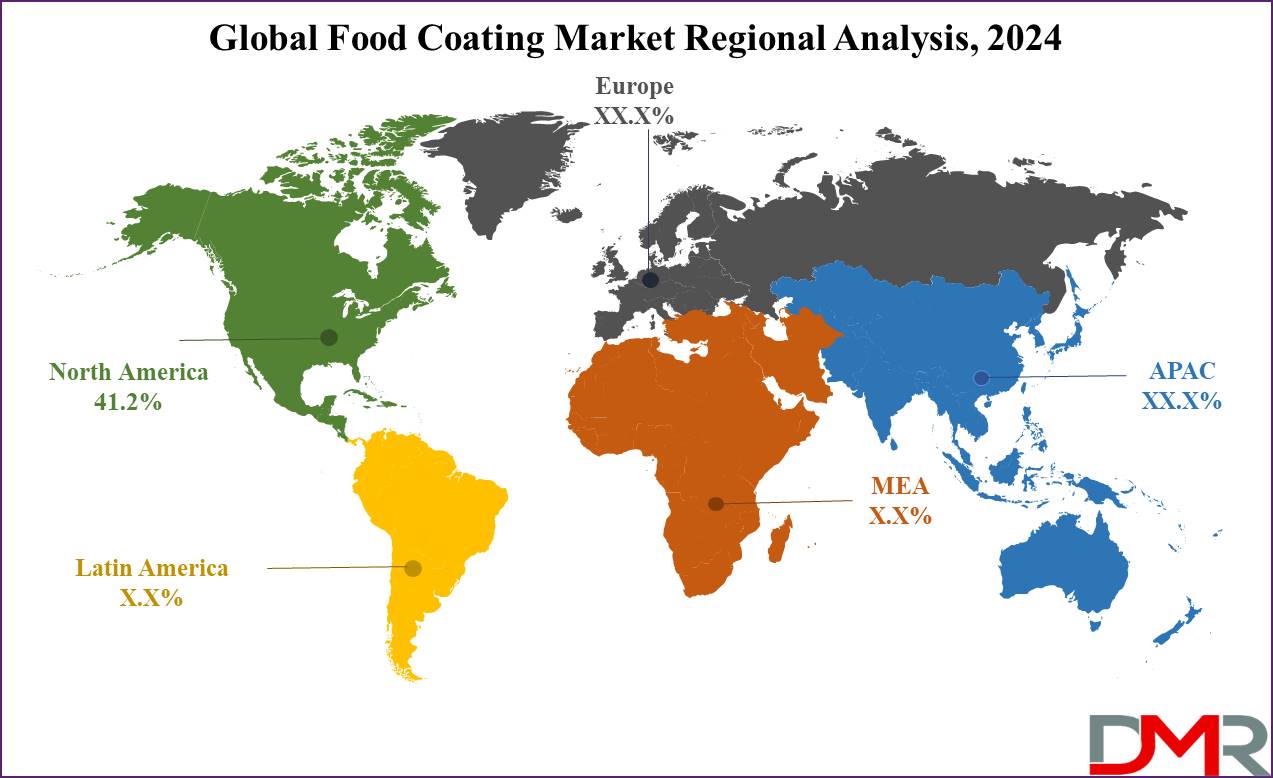

- Regional Analysis: North America is anticipated to dominate the market, capturing a revenue share of 41.2% in 2024.

Use Cases

- Physical Appearance: Crispy and golden-brown coating can improve the visual appearance of dishes and create an attractive presentation, which makes the food look more appetizing.

- Infusion of flavor: These coatings are available in the form of herbs, spices, and other natural flavors to impart additional taste to the dish, which is commonly used in fried foods to significantly increase the overall flavor.

- Moisture retention: This coating helps to remove moisture, particularly in chicken or fish during the cooking process, which prevents food from getting dry and results in a juicier end product.

- Innovation and Customization: This coating provides different opportunities in the market for chefs and home cooks to explore diverse ingredients and flavors. Inventive options breadcrumbs, crushed nuts, cornflakes, and flavored powders, are used as coatings for making distinctive dishes. The rising trend of clean-label products also aligns with the demand for organic pet food and healthier human food options, promoting innovation across the board.

Market Dynamic

The food coating market is rising due to shifting consumer tastes and increasing demand for unique culinary experiences. The use of these coatings in confectionery products, bakery items, and ready-to-eat and ready-to-cook food is gaining popularity as it offers ease of preparation, longer shelf life, and nutritional value.

In addition, this market is influenced by increasing demand for protein-based foods, rising consumption of frozen foods, and growing snacking habits, as it requires food coatings to improve the quality, which fuels the growth of this market. This trend aligns closely with the expansion of the healthy snacks market.

Consumers are increasingly interested in these coatings due to the popularity of crunchy snacks, spreads, and visually attractive confectionery items, which contribute to the growth of the food coating market.

Further, the expansion of food service sectors, particularly the growth of e-commerce food delivery applications and quick-service restaurants, is the key driver of the food coating market.

These online food outlets depend on various food products that are coated to create diverse menus and attract consumers. Simultaneously, stricter

food safety testing protocols are shaping the formulations used in coatings, ensuring regulatory compliance and consumer safety.

However, the cost of this product depends on the availability of raw materials like flour, starches, fats, and oils, which influence the overall production of these coated items. The high cost of raw materials due to fluctuations in agricultural output, geopolitical issues, and disruptions in the supply chain can obstruct the growth of this market.

Moreover, increasing health concerns among consumers due to its high-calorie coating can restrain the growth of the market. Related industries, such as powder coating for equipment and concrete floor coating in processing plants, also affect the overall ecosystem by contributing to hygienic food processing environments.

Research Scope and Analysis

By Product

Sugar & Syrup segment is expected to dominate the food coating market with the largest revenue share of 33.2% in 2024. This segment is highly demanded in the market due to its ability to improve taste, texture, and color, as it has been used as a coating ingredient in food processing for a very long time.

Increasing demand for convenient & processed food products and the growing trend of clean & natural food leads to the development of new sugar and syrups-based coating. These coatings are widely used in the food industry and services due to their known functional properties like moisture preservation, texture enhancement, and the process of caramelization.

The flour segment is expected to grow significantly as it is the main coating ingredient for bakery & confectionery, fried meats, and fast food, driving the growth of this segment. The cocoa and chocolate segment will also show steady growth in the market due to rising demand for chocolate coating in convenience food items, bakeries, & confectionery, as well as the increasing popularity of cocoa and chocolate products as a gift.

Further, Manufacturers are developing new products by mixing chocolate coating with dry food, which is driving the growth of cocoa and chocolate-based coatings. Moreover, the ability to improve the sensory experience of baked goods, desserts, & snack items, and rising consumer interest in high-quality nutritional products are driving the growth of the global food coating market.

By Application

Food coating finds its application across various sectors, which include confectioneries & bakery products, R.T.E. cereals, snacks & nutritional bars, meat & poultry products, and Others. Confectionery & bakery products are expected to dominate the food coating market with the largest revenue share of 28.3 %in 2024.

Consumers are searching for rich and flavorful treats, which leads to an increase in the demand for coated confectionery items. The ongoing emergence of diverse coating, which also improves the texture and taste of these items, is attracting a larger consumer, increasing the demand for coated confectionery items.

There is a growing popularity of bakery products like cakes, pastries, and cookies, which significantly contributes to the expansion of the market. The rising trend of fast food in developed nations and the growing popularity of many food outlets like KFC and McDonald's are driving the demand for the coated meat and poultry segment in the food coating market.

Meat and poultry products are coated with ingredients like bread crumbs, flour, batters, and spices to improve their texture, taste, & visual appeal. There is a growing shift towards choosing healthier coating alternatives, which has fueled the market expansion.

By Form

The liquid segment is expected to dominate the food coating market with the highest revenue share in 2024. The growth of the liquid segment in the food coating market is due to factors like increasing demand for processed and convenient food options, the development of new liquid coating ingredients, and the accelerating preference for clean labels and natural food components.

A versatile liquid coating, like oils, dairy-based coating, and fats, are used in various food processes as they offer functional benefits, such as improving flavor & texture and retaining moisture level. In addition, the rising popularity of vegan and plant-based food is opening new opportunities for the growth of the liquid segment.

Dry forms are also showing notable growth in the food coating market due to cost-effectiveness, ease of use, and longer shelf life associated with these ingredient forms. Also, dry forms are considerably easier to store and transport, and they can deliver consistent results in food processing, driving the growth of the dry form segment in the food coating industry.

By Equipment Type

Coaters and Applicators segment is anticipated to experience notable growth based on equipment type throughout the forecasted period due to the increasing demand for crispy products, the requirement for efficient and accurate coating application methods, and the global expansion in consumption of bakery and poultry foods.

This equipment is adopted for the smooth production of coating foods, focused mainly on consistent and even coating application, which contributes to the growth of this segment within the food coating market. Further, manufacturers are constantly focused on improving the visual appearance and taste of traditional food items by using advanced coaters and applicators.

Enrober's equipment is highly demanded within the food coating market due to the increasing sales of processed food among the meat, bakery, and confectionery industries, along with new advancements in food coating equipment, which are aimed at evolving consumer preferences.

Further, the increase in the market of convenience food, the expansion of the food industry in developing markets, and the rising demand for healthier and sustainable food coatings contribute to the segment's growth.

By Operational Mode

Automatic mode of operation is expected to dominate the food coating market with the highest revenue share in 2024. There is increasing adoption of automation in the food industry due to rising technological advancements in food, which allows for higher output and reduced labor costs, and is particularly advantageous for large-scale food production facilities.

The automatic mode of operation is equipped with modern technology and offers accurate and consistent coating application, which leads to improved product quality of food and reduced wastage.

Meanwhile, a semi-automatic mode of operation is anticipated to show significant growth in the food coating market due to its flexibility and low cost of operation. This mode of operation allows for great control and customization as well as some level of automation. It is mostly used by smaller food manufacturers as it is easy to operate and maintain compared to fully automated ones, and accessible to wider businesses.

The Global Food Coating Market Report is segmented based on the following:

By Product

- Sugars & Syrups

- Flour

- Cocoa & Chocolates

- Fats & Oils

- Others

By Application

- Confectioneries & Bakery Products

- R.T.E. Cereals

- Snacks & Nutritional Bars

- Meat & Poultry Products

- Others

By Form

By Equipment Type

- Coater & Applicators

- Enrobers

By Operational Mode

Regional Analysis

North America is expected to dominate the food coating market with a revenue share of 41.2% in 2024, due to the growing trend of natural food ingredients as a coating, the presence of established food processing companies, & rising demand for convenience foods.

Increasing exports of fruits, vegetables, cereals, and snacks, along with a large consumer base in this region further drive the growth of the food coating market. In addition, consumers are demanding clean labels and organic food products due to the growing trend of eating healthy and natural food ingredients, which will also influence the growth of the market in this region.

Consumers in this region are searching for ready-to-eat food products and easy-to-prepare food options due to their busy schedules, which is expanding the convenience food and coating market, as this coating improves the taste, appearance, and shelf-life of these foods. Adoption of Coatings like oils and polyvinyl alcohol is widely used for preserving food-coating ingredients, which is quite popular in this region.

Following North America, Asia-Pacific is experiencing notable growth due to rising disposable income, growing global population, & higher demand for processed food.

India and China are projected to be the fastest-growing regions in this market due to the high investment made by multinational businesses, support of local government, and low labor costs. Many global companies are focusing on the South Asian market by setting up manufacturing plants, R&D centers, and distribution facilities.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

Key market players are focusing on the introduction of new products, the development of new partnerships, and the expansion of production facilities to increase the company's revenue and market share.

Companies are actively expanding their product portfolios to gain a competitive advantage, particularly in fast-growing regions such as the Asia Pacific. Food coating manufacturers and suppliers are focusing on logistical improvements and strengthening distribution channels as part of their business growth strategies.

These initiatives are improving the product adoption rates among global consumers. Key participants include Bowman Ingredients, Ashland Inc., E. I. DuPont de Nemours, and Company.

The food coating market is highly fragmented, with prominent firms playing a significant role. This market is shaped by continuous research and development initiatives by key players, changing consumer preferences, and global food industry trends.

Some of the prominent players in the global food coating market are:

- Bowman Ingredients

- Ashland Inc.

- E. I. DU Pont DE Nemours and Company

- Archer Daniels Midland Company (ADM)

- PGP International, Inc.

- Sensory Effects Ingredient Solutions

- Tate & Lyle PLC

- Agrana Beteiligungs-AG

- Ingredion Inc.

- Cargill Inc. Newly Weds Foods

- Kerry Group PLC

- Dohler

- Others

Recent Development

- In March 2024, Flint Group introduced a detailed whitepaper highlighting the significance of inks and coatings in ensuring the safety of food packaging by addressing the complexities associated with food contact materials and focusing on the pivotal role of top-notch inks and coatings in reducing potential risks.

- In February 2024, Lucent BioSciences introduced a product named Nutreos, an innovative seed coating that is plant-based, biodegradable, and free from toxins, offering an environmentally friendly alternative.

- In September 2023, Saveggy entered into a collaboration with odlarna.se, a Swedish cucumber and tomato producer, to develop production and packaging systems, as well as application technology, for its plant-based, edible coating which aims to replace traditional fossil-based plastic wrapping for cucumbers.

- In July 2023, Melodea, Ltd., a prominent provider of sustainable barrier coatings for packaging, launched its latest advancement, MelOx Ngen which is designed as a high-performing barrier solution that enables the recycling of plastic food packaging and other materials.

- In June 2023, CSM Ingredients revealed the launch of its Hi-Food division in the United States. Hi-Food, based in Parma, focuses on the research, development, and manufacturing of natural value-added ingredients for the food sector.

Report Details

|

Report Characteristics

|

| Market Size (2024) |

USD 4.3 Bn |

| Forecast Value (2033) |

USD 7.7 Bn |

| CAGR (2024-2033) |

6.8% |

| Historical Data |

2018 – 2023 |

| Forecast Data |

2024 – 2033 |

| Base Year |

2023 |

| Estimate Year |

2024 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Product (Sugars & Syrups, Cocoa & Chocolates, Fats & Oils, Salt, Spices & Seasonings, and Others), By Application (Confectioneries, Bakery Products, R.T.E. Cereals, Snacks & Nutritional Bars, and Others), By Form (Dry, and Liquid), By Equipment Type (Coater & Applicators, and Enrobers), By Operational Mode (Automatic, and Semi-Automatic) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA |

| Prominent Players |

Bowman Ingredients, Ashland Inc., E. I. DU Pont DE Nemours and Company, Archer Daniels Midland Company (ADM), PGP International, Inc., Sensory effects Ingredient Solutions, Tate & Lyle PLC, Agrana Beteiligungs-AG, Ingredion Inc., Cargill Inc., Newly Weds Foods, Kerry Group PLC, and Dohler, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |

Frequently Asked Questions

The Global Food Coating Market size is estimated to have a value of USD 4.3 billion in 2024 and is expected to reach USD 7.7 billion by the end of 2033.

North America is expected to be the largest market share for the Global Food Coating Market with a share of about 41.2 % in 2024.

Some of the major key players in the Global Food Coating Market are Bowman Ingredients, Ashland Inc., E. I. DU Pont DE Nemours, and Company, and many others.

Market grows at a CAGR of 6.8 percent over the forecasted period.