Market Overview

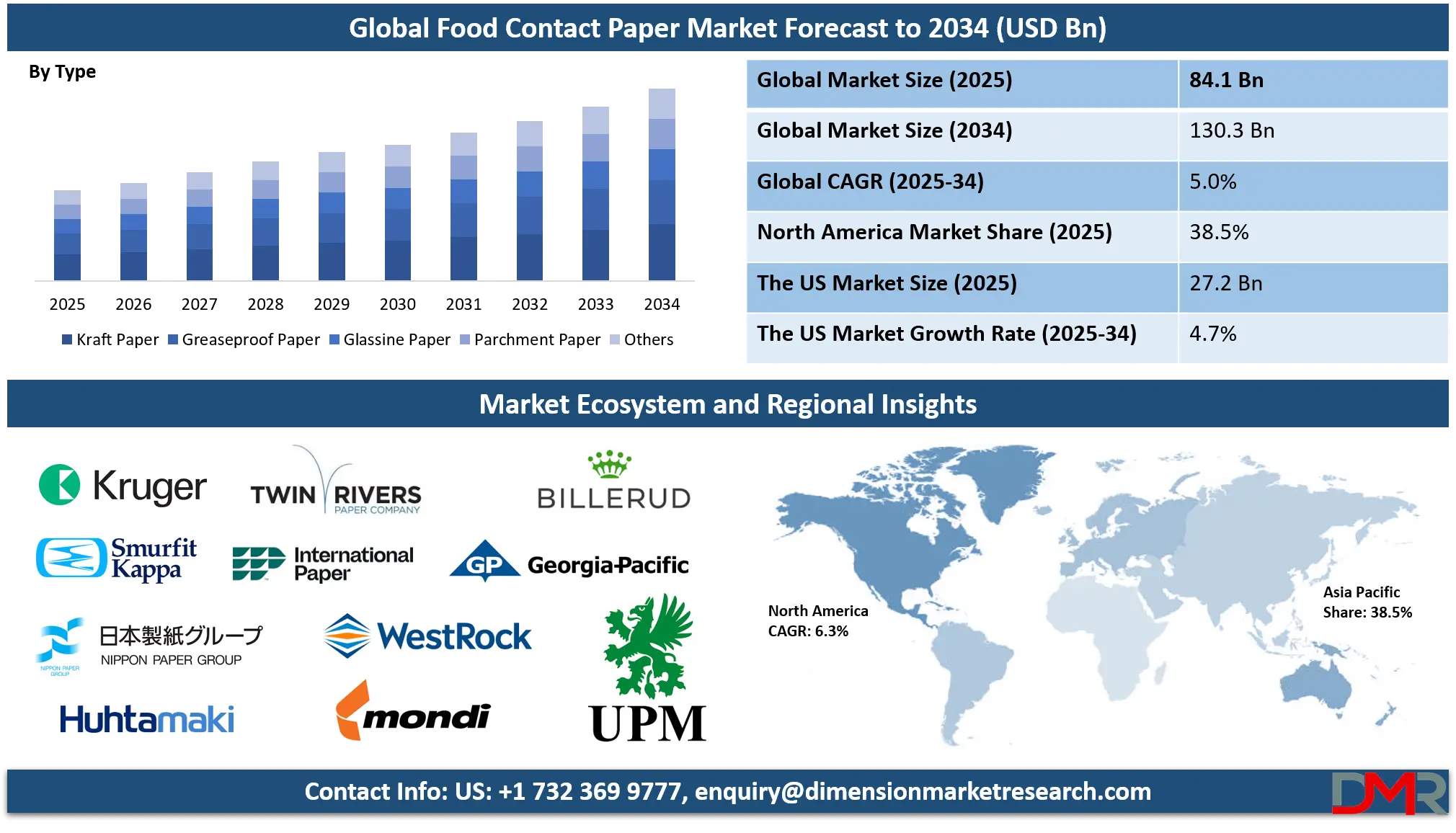

The Global Food Contact Paper Market is projected to reach USD 84.1 billion in 2025 and grow at a compound annual growth rate of 5.0% from there until 2034 to reach a value of USD 130.3 billion.

The global food contact paper market is undergoing dynamic transformation due to the shift toward eco-conscious consumption and regulatory pressure to reduce plastic use. Food-grade paper products are being increasingly used across packaging chains for bakery items, fast food, dairy, frozen foods, and more. This demand is primarily fueled by heightened environmental awareness, evolving food safety concerns, and the preference for biodegradable and compostable materials. The rising use of recycled fibers and natural barrier coatings is a defining trend that supports the sustainability goals of manufacturers and food service providers.

Opportunities lie in developing economies where urbanization, fast food culture, and organized retail are booming. Countries in Asia-Pacific, Africa, and Latin America are witnessing a rapid rise in demand for food contact materials that align with safety and hygiene standards while also supporting eco-efficiency. Furthermore, advancements in water- and grease-resistant coatings that do not compromise recyclability present room for technical innovation and market differentiation.

However, the market encounters limitations related to material performance and cost fluctuations. Paper packaging, although sustainable, may not always match the durability and insulation properties of plastic, especially in moisture-intensive environments. Raw material costs, primarily pulp and cellulose-based products, can be volatile, impacting production economics.

Statistical estimates point to a healthy compound annual growth rate (CAGR) nearing 4.9% through 2032, driven by regulatory mandates, rising health consciousness, and packaging innovation. With food safety protocols tightening and the circular economy model becoming mainstream, paper-based packaging solutions are poised to dominate the future of food packaging. The market’s growth outlook remains resilient, particularly for manufacturers focusing on compostable coatings, barrier innovations, and regulatory compliance.

The US Food Contact Paper Market

The US Food Contact Paper Market is projected to reach USD 27.2 billion in 2025 at a compound annual growth rate of 4.7% over its forecast period.

The U.S. food contact paper market is characterized by a strong regulatory framework, changing consumer behaviors, and a robust infrastructure supporting sustainable packaging innovation. Governed by the U.S. Food and Drug Administration (FDA), food contact papers must adhere to rigorous standards that ensure consumer health and environmental safety. These regulations, combined with growing public awareness around plastic waste, have encouraged restaurants, manufacturers, and retailers to switch to paper-based packaging.

The demographic structure of the U.S. supports rapid market expansion. With over 330 million people, a significant percentage of whom prioritize convenience foods and takeout, the need for food-safe, disposable, and compostable packaging is growing. Urbanization and dual-income households further drive reliance on pre-packaged foods. Additionally, the rise of meal kit services, third-party delivery apps, and fast casual dining adds to the demand for versatile food contact materials.

Federal and state policies promoting sustainable practices—such as bans on polystyrene foam and single-use plastics in California, New York, and Washington—are also steering the packaging industry toward fiber-based alternatives. U.S. agencies, including the Environmental Protection Agency (EPA), promote the development of recyclable and reusable materials in the packaging supply chain.

The country’s manufacturing ecosystem is well-equipped with paper mills, specialty coating suppliers, and distribution networks, enabling the swift adoption of food contact paper solutions. Looking ahead, the U.S. market will continue evolving as more businesses embrace zero-waste initiatives, and innovations in barrier coatings and compostable inks improve the functionality of paper-based food packaging.

The European Food Contact Paper Market

The European Food Contact Paper Market is estimated to be valued at USD 11.43 billion in 2025 and is further anticipated to reach USD 16.44 billion by 2034 at a CAGR of 4.3%.

Europe remains at the forefront of the global food contact paper movement due to stringent environmental policies, strong consumer preferences for sustainable products, and widespread regulatory enforcement. The European Union mandates that all food contact materials, including paper and board, meet the requirements of Regulation (EC) No. 1935/2004. This ensures that materials used in food packaging are safe, inert, and traceable throughout their lifecycle.

Consumer behavior in European countries increasingly favors sustainable and health-conscious choices. Shoppers are inclined to choose products with biodegradable or compostable packaging, especially in France, Germany, Sweden, and the Netherlands. The demand for clean-label and organic food products, often sold in minimalistic and eco-friendly paper packaging, reflects this shift. European retailers and food chains are also under pressure to adopt circular packaging practices, influencing supply chain decisions.

European demographic trends such as urbanization, aging populations, and increased per capita income support the rise in ready-to-eat food consumption. These trends directly fuel demand for food contact papers that are both functional and compliant with food safety regulations. High per capita paper consumption and advanced recycling systems further enable widespread use of paper-based solutions in both retail and foodservice sectors.

Initiatives such as the European Green Deal and Circular Economy Action Plan aim to reduce packaging waste and promote innovation in sustainable materials. Consequently, there is growing investment in advanced barrier coatings, recyclable multilayer papers, and digital printing technologies that support traceability. Europe’s market is well-positioned to grow through eco-conscious innovation and strong policy alignment.

The Japan Food Contact Paper Market

The Japan Food Contact Paper Market is projected to be valued at USD 5.05 billion in 2025. It is further expected to witness subsequent growth in the upcoming period, holding USD 7.34 billion in 2034 at a CAGR of 4.6%.

Japan’s food contact paper market is shaped by its cultural emphasis on hygiene, presentation, and minimal waste, all of which influence packaging preferences. The Ministry of Health, Labour and Welfare (MHLW) enforces food safety standards that require food contact materials, including paper, to be free of harmful substances and manufactured under clean, traceable conditions. Compliance with such standards is essential for all food packaging used in commercial and retail food sectors.

Culturally, Japanese consumers value packaging that reflects quality, cleanliness, and simplicity. Paper is widely used in convenience stores (konbini), which are a central part of daily life, for wrapping bento boxes, snacks, pastries, and deli items. Aesthetic appeal and functionality are balanced in Japan’s packaging solutions, making paper a natural fit for wrapping fresh or prepared food items. There is also a long-standing preference for single-portion and elegantly wrapped foods, further boosting the role of food contact paper.

Demographically, Japan’s aging population and increasing number of single-person households are pushing demand for ready-to-eat meals and portion-controlled packaging. This has led to a rise in foodservice and convenience-based food retailing, where hygienic and disposable paper packaging is essential. Additionally, with rising environmental consciousness, many consumers prefer recyclable and biodegradable materials over plastic.

Japan’s commitment to waste reduction is reflected in its Containers and Packaging Recycling Law, which promotes material recovery and reduced packaging volumes. Local paper manufacturers are innovating with moisture-resistant, microwave-safe, and compostable food contact paper to meet consumer and regulatory demands, positioning Japan as a leading market for advanced food-safe paper packaging.

Global Food Contact Paper Market: Key Takeaways

- Global Market Size Insights: The Global Food Contact Paper Market size is estimated to have a value of USD 84.1 billion in 2025 and is expected to reach USD 130.3 billion by the end of 2034.

- The US Market Size Insights: The US Food Contact Paper Market is projected to be valued at USD 27.2 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 41.2 billion in 2034 at a CAGR of 4.7%.

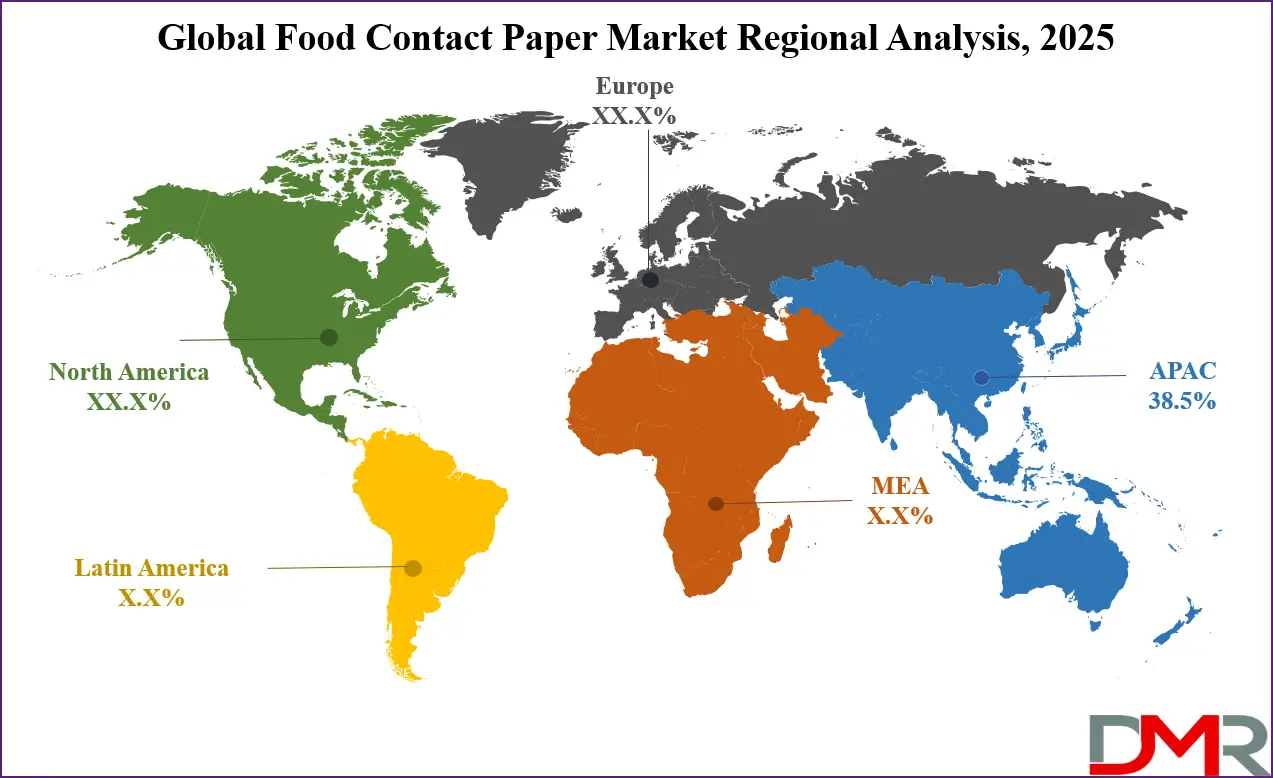

- Regional Insights: Asia Pacific is expected to have the largest market share in the Global Food Contact Paper Market with a share of about 38.5% in 2025.

- Key Players: Some of the major key players in the Global Food Contact Paper Market are Mondi Group, WestRock Company, International Paper Company, Smurfit Kappa Group, Georgia-Pacific LLC, Stora Enso Oyj, UPM-Kymmene Corporation, Huhtamaki Oyj, Billerud AB, Twin Rivers Paper Company, and many others.

- The Global Market Growth Rate: The market is growing at a CAGR of 5.0 percent over the forecasted period of 2025.

Global Food Contact Paper Market: Use Cases

- Fast Food Wrapping: Grease-resistant Kraft paper is commonly used to wrap burgers, fries, and sandwiches. It prevents leakage, preserves texture, and allows for direct food contact without contamination risks. This solution provides branding flexibility while offering a compostable, recyclable alternative to plastic wrappers in fast-paced food service environments.

- Bakery and Confectionery Packaging: Wax-coated or silicone-treated food contact papers are ideal for muffins, croissants, and cookies. These materials withstand oil and moisture seepage while maintaining freshness and hygiene. They also allow for printed branding, enhancing visual appeal and consumer trust while meeting food safety standards.

- Frozen Food Wraps: Parchment or laminated paper with moisture barriers is used for wrapping frozen meat, seafood, or microwave-ready meals. It withstands cold-chain logistics and supports freezer-to-oven applications without compromising food quality. Such papers improve shelf life and are often preferred by eco-conscious consumers.

- Produce Bags: Breathable, uncoated paper bags are employed for packing fruits and vegetables in grocery stores. These allow ethylene gas release and airflow, extending the shelf life of fresh produce. With increasing bans on plastic produce bags, this use case is witnessing strong growth in retail and farmer markets.

- Dairy Product Liners: Butter and cheese are often packaged in waxed or laminated food-grade paper to prevent moisture loss and microbial exposure. These papers provide excellent shape retention and odor protection, enhancing shelf stability. They’re suitable for wrapping both artisanal and industrial dairy products.

Global Food Contact Paper Market: Stats & Facts

European Commission & EFSA (European Food Safety Authority)

- Food contact materials (FCMs) in the EU must comply with Regulation (EC) No 1935/2004, which ensures that these materials do not transfer substances to food that could endanger human health.

- Manufacturing processes for FCMs must follow Good Manufacturing Practices under Commission Regulation (EC) No 2023/2006.

- Specific EU legislation exists for certain FCMs like plastics, ceramics, and regenerated cellulose film, while other types, such as paper and board, are governed by national provisions.

- EFSA regularly evaluates the safety of substances used in FCMs based on toxicological and migration data.

- In April 2023, EFSA published a new scientific opinion lowering the tolerable daily intake of bisphenol A (BPA) due to emerging health concerns.

Food Safety and Standards Authority of India (FSSAI)

- FSSAI bans the use of recycled plastics and newspapers for packaging food due to risks of ink and chemical contamination.

- Plastic food contact materials in India must not exceed an overall migration limit of 60 mg/kg or 10 mg/dm².

- FSSAI mandates that packaging materials must comply with Bureau of Indian Standards (BIS) specifications for safety and food-grade quality.

- From July 2024, food labels must display information on total sugar, salt, and saturated fats in bold and larger font sizes.

- FSSAI has fixed July 1 of each year as the uniform compliance date for new labeling and packaging regulations.

United States Food and Drug Administration (FDA)

- The FDA regulates food contact substances under the Federal Food, Drug, and Cosmetic Act to ensure they are safe for use.

- Manufacturers in the U.S. have voluntarily phased out the use of PFAS in fast-food packaging and paper wrappers since 2020, completing the phase-out by 2023.

- Studies have revealed that over 3,600 chemicals are used in food packaging materials, some of which, such as phthalates and bisphenols, are detected in human tissue.

- The FDA requires pre-market approval for new food contact substances through the Food Contact Notification (FCN) process.

- Recent concerns about the cumulative exposure to multiple food contact chemicals have led to increased scrutiny of packaging used in direct food contact.

Canadian Food Inspection Agency (CFIA)

- CFIA enforces strict regulations on food contact packaging to ensure materials do not migrate harmful substances into food.

- Canada requires that packaging does not impart taste, odor, or toxic contaminants to food products under its Food and Drugs Act.

- CFIA coordinates with Health Canada to conduct safety evaluations on new food contact materials before approval.

- All packaging materials in contact with food in Canada must be manufactured in sanitary conditions and must not compromise food safety.

Australian Government Department of Health

- Food contact paper and packaging must not transfer harmful substances to food in Australia under the Food Standards Code.

- Australia prohibits the use of inks and adhesives that could migrate from packaging to food unless proven safe.

- The Department of Health and FSANZ collaborate on chemical risk assessments of food packaging materials.

- Biodegradable and compostable food contact papers are promoted as safer and more sustainable options in public procurement programs.

China National Center for Food Safety Risk Assessment

- China has introduced a "positive list" system for permitted additives and base materials in food contact products.

- The center conducts regular risk assessments to ensure domestic and imported packaging materials meet national food safety standards.

- China has standardized testing methods for paper-based food contact materials to monitor overall and specific migration levels.

- China’s national standard GB 4806.8-2016 applies specifically to paper and paperboard materials, ensuring limits on heavy metals and residues.

Food Standards Australia New Zealand (FSANZ)

- FSANZ develops and maintains the Food Standards Code, including packaging safety requirements for both countries.

- Food packaging must not cause physical or chemical contamination, and manufacturers must maintain quality assurance records.

- FSANZ ensures that materials used in contact with food are non-toxic, stable, and suitable under typical storage and usage conditions.

- The code prohibits the use of any packaging that could pose a risk to human health, including poor-quality recycled paper with chemical residues.

Global Food Contact Paper Market: Market Dynamics

Driving Factors in the Global Food Contact Paper Market

Increasing Regulatory Push for Plastic Reduction and Compostable Alternatives

Global governments are intensifying efforts to phase out single-use plastics, creating a regulatory tailwind for the food contact paper market. The European Union’s directive on single-use plastics, Canada’s plastic ban framework, India's prohibition of non-recyclable food packaging, and U.S. state-level bans on PFAS-laced containers are compelling food manufacturers and service providers to adopt safer, compliant alternatives.

These policy shifts are not merely suggestive but are often tied to fines, product recalls, or import restrictions, elevating the urgency of compliance. Food contact paper, especially those made from virgin fibers or approved recycled grades, is gaining favor due to its natural composition, proven biodegradability, and the absence of synthetic polymers.

Moreover, new eco-labeling standards and Extended Producer Responsibility (EPR) policies require brands to transparently report the environmental performance of their packaging, indirectly favoring renewable and easily recyclable materials. Governments are also offering incentives such as tax breaks and subsidies for companies adopting sustainable packaging solutions, further strengthening this growth vector. As such, regulatory enforcement is not only shaping compliance but actively directing procurement and packaging design strategies, driving consistent demand for food-safe, eco-conscious paper formats across markets.

Rising Demand from Quick Service Restaurants (QSRs) and Food Delivery Platforms

The explosive growth in food delivery services and quick service restaurants (QSRs) worldwide is significantly boosting demand for food contact paper. These sectors rely heavily on disposable packaging that is cost-effective, scalable, and compliant with hygiene standards.

As consumer dining habits shift towards convenience foods, takeaways, and on-the-go snacking, food chains are increasing their consumption of paper wraps, sandwich pouches, burger boxes, beverage cups, and liners. With brands like McDonald’s, Starbucks, and KFC committing to fully recyclable or compostable packaging by the end of this decade, paper-based alternatives are emerging as the material of choice.

In developing economies, where online food aggregators like Zomato, Grab, and Meituan are expanding rapidly, localized paper packaging vendors are experiencing record orders. The COVID-19 pandemic further normalized contactless dining, reinforcing the need for single-use yet safe packaging.

Moreover, consumer scrutiny over packaging has heightened, compelling brands to invest in certified food contact papers that offer both brand appeal and regulatory conformity. As the foodservice and delivery ecosystems scale globally, particularly in urban regions, food contact paper consumption is projected to mirror this expansion trajectory.

Restraints in the Global Food Contact Paper Market

Limited Functional Capabilities Compared to Plastic and Multilayer Alternatives

Despite technological progress, food contact paper still faces performance limitations that restrain its widespread substitution for plastic in many food categories. Moisture resistance, gas barrier properties, and structural rigidity—especially under refrigeration or prolonged storage—remain challenging for paper-based packaging.

Applications involving carbonated drinks, long-shelf-life dairy products, oily foods, and bulk liquid containment often necessitate multilayer laminates or synthetic barriers, which may not be fully recyclable or compostable. Additionally, paper packaging is susceptible to deformation, tearing, and contamination if exposed to excessive moisture or temperature variations.

While biodegradable coatings like PLA and PVOH offer partial solutions, they still struggle to match the cost-performance ratio of fossil-fuel-based polymers. In high-performance packaging scenarios like vacuum sealing or modified atmosphere packaging (MAP), paper remains a supplementary material rather than a primary medium. This functional gap limits the penetration of food contact paper into specialized and industrial-scale food processing sectors, thus restraining its full commercial potential.

Volatility in Raw Material Supply and Pricing Pressures

The food contact paper market is highly susceptible to fluctuations in raw material supply, especially pulp and virgin fiber, which directly impact manufacturing costs and supply chain stability. Climate-driven disruptions in timber production, geopolitical trade tensions affecting pulp exports, and rising energy costs are compounding procurement challenges for paper manufacturers. In recent years, Europe and North America have faced fiber shortages, causing price spikes that affected downstream food packaging providers. Recycled paper grades suitable for direct food contact are also limited due to safety restrictions, further constraining material availability.

Additionally, converting mills and coating facilities require capital-intensive upgrades to ensure food safety compliance, adding to operational costs. For SMEs and emerging market suppliers, the financial burden of adopting certified food contact paper can be prohibitive. These pricing and sourcing challenges erode profit margins and restrict scalability, especially in regions where cost competitiveness is a key purchasing criterion. Without strategic supply chain interventions and raw material diversification, the market’s ability to sustain consistent growth may face structural bottlenecks.

Opportunities in the Global Food Contact Paper Market

Emergence of Fiber-Based Packaging in Frozen and Moist Food Segments

One of the most promising growth opportunities lies in extending the application of food contact paper to moisture-prone and frozen food categories traditionally dominated by plastic. With the help of high-barrier coatings derived from natural waxes, polymers like PVOH, and mineral-based lamination, food-grade paper is now being engineered to resist freezer burns, oil seepage, and humidity-induced degradation.

Companies involved in seafood, processed meat, frozen vegetables, and ice cream packaging are beginning to transition toward recyclable and compostable fiber-based containers. This transition is driven by supermarket chains demanding alternatives to expanded polystyrene trays and multilayer plastic films.

There’s also a growing demand for microwaveable and oven-safe paper containers that allow both heating and preservation without chemical leaching. As the technology matures, costs associated with barrier paper production are expected to decline, making these applications viable even in cost-sensitive markets.

Moreover, regulatory authorities are likely to update standards to explicitly support such eco-friendly alternatives, unlocking widespread adoption in institutional catering, frozen food exports, and retail-ready meal segments—sectors with previously limited paper compatibility.

Untapped Potential in Emerging Markets and Local Food Industries

Emerging economies in Asia-Pacific, Latin America, and Africa present substantial untapped potential for the food contact paper market. As these regions experience urbanization, rising disposable incomes, and improved access to processed and packaged food, the demand for hygienic, safe, and affordable food packaging is surging. Local bakeries, snack vendors, street food outlets, and even traditional markets are beginning to modernize their packaging standards in response to hygiene regulations, consumer expectations, and environmental concerns.

In markets like India, Indonesia, and Nigeria, food contact paper is replacing newspaper wrapping and single-use plastics, especially in tier-2 and tier-3 cities. Furthermore, small and medium enterprises (SMEs) involved in food retail and hospitality are increasingly sourcing low-cost, locally manufactured food-grade paper solutions that meet basic safety and environmental criteria.

Governments and NGOs are also promoting awareness about safer food packaging practices, which is expected to unlock new demand layers in these rapidly digitizing food economies. The combination of rising consumption, regulatory transitions, and cultural shifts toward packaged convenience food creates a long-term growth funnel for food contact paper manufacturers entering these developing markets.

Trends in the Global Food Contact Paper Market

Surge in Demand for Sustainable Packaging Alternatives Across Food Sectors

The global market is witnessing a decisive transition from plastic-based food packaging to sustainable alternatives like food contact paper, driven by increasing consumer preference for eco-friendly products. Fast-food chains, bakery outlets, ready-to-eat food manufacturers, and beverage providers are actively integrating recyclable and compostable paper packaging to align with corporate sustainability goals and environmental mandates. Innovations in barrier coating technology have enabled paper packaging to be grease-resistant, water-resistant, and heat-sealable without relying on non-biodegradable plastic films or PFAS.

Regulatory bans on single-use plastics across regions like the EU, India, and select U.S. states have further accelerated this trend, creating a structural shift in demand. As zero-waste food retailing and plastic-free aisles expand, paper-based wrappers, cups, cartons, and trays are becoming industry standards.

This trend is further magnified by changing consumer behavior, where the packaging's sustainability is now considered a value proposition influencing purchase decisions. The evolving legislative environment, combined with public awareness, is setting the tone for long-term adoption of paper-based solutions in food service and grocery segments.

Technological Advancements in Barrier Coatings and Bio-based Laminates

A significant trend shaping the food contact paper market is the rapid evolution of high-performance bio-coatings that enhance functional attributes without compromising environmental safety. Traditionally, plastic laminates or fluorochemicals were added to paper to ensure moisture resistance or grease protection, but concerns over their migration into food and environmental toxicity have led to research into plant-based polymers, aqueous dispersion coatings, and clay-based solutions. Manufacturers are now developing multi-layered paperboards that combine biodegradable barriers and recyclable structures for applications in frozen food, fast food, dairy, and bakery packaging.

This has also enabled the expansion of food contact paper into previously unfeasible categories such as high-moisture or heat-sensitive foods. The use of polylactic acid (PLA), starch blends, and cellulose-based films is gaining commercial traction as brands seek to meet both functional and regulatory demands. These innovations reduce the need for secondary plastic layers and help meet compostability or recyclability certifications, thus improving circularity. The result is a growing trend of tailor-made food contact papers offering high performance, printability, food safety, and sustainability—all at once.

Global Food Contact Paper Market: Research Scope and Analysis

By Type Analysis

Kraft paper is projected to dominate the global food contact paper market due to its superior strength, recyclability, cost-effectiveness, and widespread suitability across a broad range of food packaging applications. Derived from the chemical pulping process, kraft paper retains a high level of lignin, resulting in greater tensile strength and durability, making it ideal for wrapping and containing both dry and semi-moist food products. Its robustness allows it to withstand tears, grease, and moisture to a certain extent, without compromising the integrity of food safety or hygiene.

The natural brown variant of kraft paper is especially favored in eco-conscious markets due to its unbleached, chemical-free nature, aligning with the increasing consumer preference for sustainable packaging. White kraft paper, produced through controlled bleaching processes, is also widely used in food applications where visual appeal and branding are essential, such as bakery bags, sandwich wraps, and premium produce sleeves.

In addition, Kraft paper serves as an effective base for barrier coatings, such as PLA, wax, or aqueous layers, enabling it to be adapted for applications involving oily, frozen, or moist foods. Its excellent printability also makes it ideal for food service branding, regulatory labeling, and product differentiation.

Cost competitiveness further boosts Kraft Paper’s dominance. It offers an optimal balance between functionality, environmental performance, and affordability, making it the go-to option for both developed and emerging markets. As the demand for food-safe, compostable, and biodegradable packaging continues to rise globally, kraft paper’s natural properties and adaptability position it as the most preferred type in the food contact paper market.

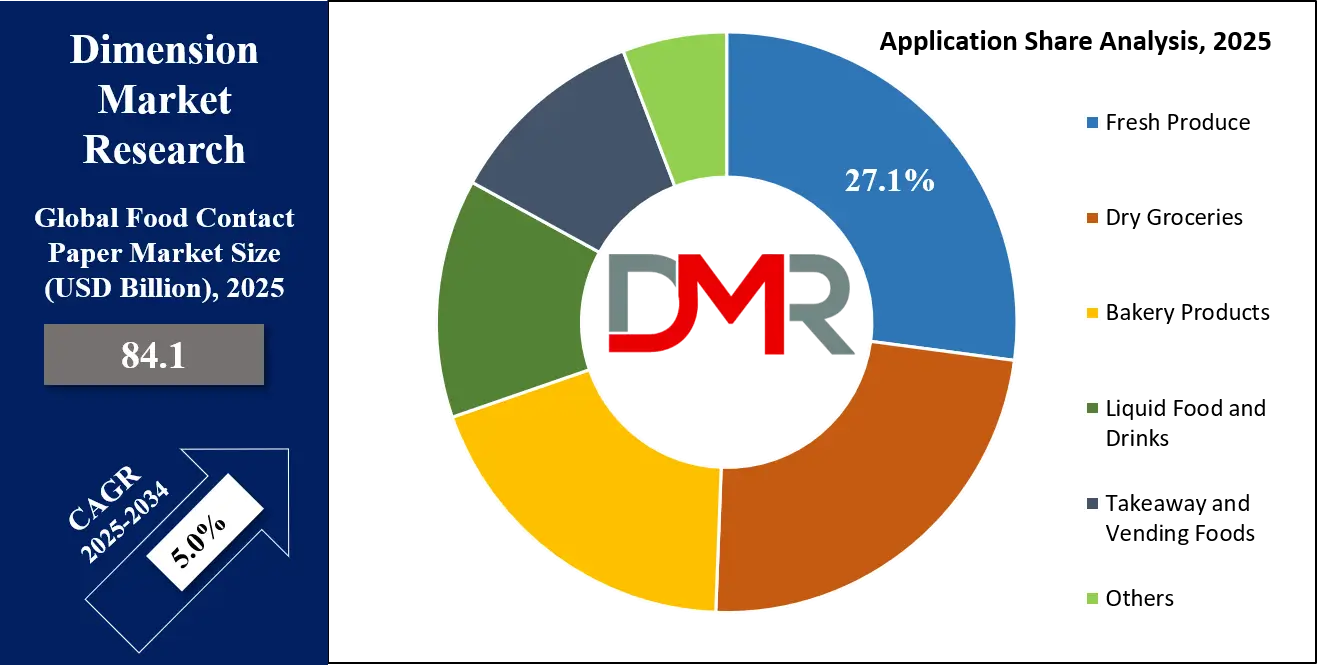

By Application Analysis

Fresh produce is projected to dominate the application segment of the global food contact paper market due to the rising demand for breathable, sustainable, and hygienic packaging solutions in fruit and vegetable distribution. As global consumption of fresh produce increases, driven by health-conscious lifestyles and plant-based dietary shifts, retailers and suppliers are under pressure to offer eco-friendly packaging that preserves product freshness without contributing to plastic pollution.

Food contact paper offers a breathable structure that helps extend shelf life by reducing condensation and microbial growth, key issues in the packaging of fruits and vegetables. Kraft paper wraps, perforated paper bags, and wax-coated papers are increasingly replacing polyethylene-based produce bags across supermarkets, farmers' markets, and direct-to-consumer platforms. These paper solutions allow for adequate air circulation while minimizing bruising and contamination.

Moreover, regulatory frameworks in Europe and North America, such as bans on single-use plastics in produce packaging, are accelerating the transition to fiber-based formats. Paper packaging is easily adaptable for organic certification, biodegradable labeling, and recyclable waste streams, which enhances its appeal for fresh produce brands aiming to improve their sustainability credentials.

In addition, food contact paper is lightweight, customizable, and printable, allowing fresh produce vendors to incorporate branding, traceability barcodes, and QR codes for consumer engagement. With innovations like compostable water-resistant coatings and anti-bacterial paper treatments, paper-based solutions are expanding into high-moisture produce categories like berries, leafy greens, and mushrooms.

As the fresh produce supply chain increasingly emphasizes low-impact, compostable packaging, food contact paper is emerging as the most scalable and environmentally aligned solution, cementing its dominance in this high-growth application segment.

The Global Food Contact Paper Market Report is segmented on the basis of the following:

By Type

- Kraft Paper

- Greaseproof Paper

- Glassine Paper

- Parchment Paper

- Others

By Application

- Fresh Produce

- Dry Groceries

- Bakery Products

- Liquid Food and Drinks

- Takeaway and Vending Foods

- Others

Global Food Contact Paper Market: Regional Analysis

Region with the Largest Revenue Share

Asia-Pacific is projected to dominate the global food contact paper market as it holds 38.5% of market share by the end of 2025, owing to its vast population base, rapidly expanding food processing industry, and increasing consumer awareness about sustainable packaging. Countries like China, India, Japan, and South Korea have witnessed significant growth in urbanization, disposable income, and demand for convenient, eco-friendly food packaging solutions. The region’s strong agricultural sector and burgeoning fresh produce export markets also fuel demand for biodegradable and food-safe paper packaging to maintain product quality during transit.

Moreover, stringent regulations in countries such as Japan and China, aimed at reducing plastic waste and promoting sustainable materials, have accelerated the adoption of food contact paper. The widespread presence of small- and medium-sized food businesses in Asia-Pacific, coupled with increasing government support and investments in the circular economy, further enhances market penetration.

Additionally, consumer trends favoring organic, natural, and minimally processed foods increase demand for paper-based packaging that aligns with these preferences. All these factors contribute to Asia-Pacific maintaining a commanding market share and setting global standards for sustainability in food contact materials.

Region with the Highest CAGR

North America’s food contact paper market is witnessing the highest compound annual growth rate (CAGR) due to stringent environmental regulations, increasing consumer demand for sustainable packaging, and innovation in paper materials. The U.S. and Canada have implemented aggressive policies targeting single-use plastics, driving rapid adoption of biodegradable and recyclable paper-based alternatives in food packaging. C

onsumers in North America are highly aware of environmental impacts and actively seek brands with green packaging credentials, pushing food manufacturers and retailers to switch to food contact paper. Technological advancements in coating and barrier properties make paper packaging viable for a wide range of food products, enhancing its appeal. The growing organic food segment, coupled with strong retail and foodservice sectors, further propels market growth.

Additionally, investments in research and development for food safety compliance and improved paper performance foster rapid product innovation. These factors collectively contribute to North America’s robust market expansion and its position as the fastest-growing regional market for food contact paper.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Global Food Contact Paper Market: Competitive Landscape

The global food contact paper market is highly competitive, with several key players focusing on innovation, sustainability, and expanding their production capacities to capture larger market shares. Leading companies are investing in developing eco-friendly, biodegradable, and compostable paper solutions that meet evolving regulatory standards and consumer expectations for sustainability. Strategic partnerships and collaborations with food manufacturers and retailers enable customized packaging solutions tailored to diverse food types, enhancing product differentiation.

Key players also prioritize technological advancements such as improved barrier coatings, grease resistance, and water repellency, ensuring that food contact papers maintain product integrity while reducing environmental footprint. Geographic expansion, particularly into emerging markets in Asia-Pacific and Latin America, is a common strategy to leverage growing demand in these regions. Additionally, mergers and acquisitions enable companies to strengthen their product portfolios and streamline supply chains.

Market leaders like Mondi Group, International Paper Company, and WestRock Company emphasize transparency and certifications such as FSC and compostability labels to boost consumer trust. Competitive pricing combined with superior quality helps them maintain customer loyalty. Overall, the competitive landscape is characterized by a focus on sustainable innovation, regulatory compliance, and market expansion to address global trends toward environmentally responsible food packaging.

Some of the prominent players in the Global Food Contact Paper Market are:

- Mondi Group

- WestRock Company

- International Paper Company

- Smurfit Kappa Group

- Georgia-Pacific LLC

- Stora Enso Oyj

- UPM-Kymmene Corporation

- Huhtamaki Oyj

- Billerud AB

- Twin Rivers Paper Company

- Nippon Paper Industries Co., Ltd.

- Ahlstrom

- Sappi Limited

- Nordic Paper

- Glatfelter Corporation

- SCG Packaging Public Company Limited

- PT. Indah Kiat Pulp & Paper Tbk

- Asia Pulp & Paper (APP)

- Seaman Paper Company

- Kruger Inc.

- Other Key Players

Recent Developments in the Global Food Contact Paper Market

- April 2025: Mondi Group entered a strategic partnership with OrganoClick AB, a Swedish green chemistry firm, to co-develop fully compostable food contact paper with water- and grease-resistant barrier coatings. This alliance supports EU directives on plastic reduction and enhances Mondi’s fiber-based packaging portfolio for bakery and takeaway segments.

- March 2025: At the Interpack Expo 2025 in Düsseldorf, Stora Enso, Sappi, and Nippon Paper Industries showcased next-generation food-grade papers with recyclable coatings. Attendees included food processors and regulatory officials discussing sustainable alternatives to polyethylene-laminated substrates.

- January 2025: WestRock Company completed a $120 million investment to expand its Covington, Virginia, facility, focused on food-grade kraft and uncoated papers for QSR (quick service restaurant) packaging. The plant upgrade incorporates renewable energy systems and FSC-certified fiber sourcing protocols.

- November 2024: Graphic Packaging Holding Company and AR Packaging finalized a merger, creating one of the largest global suppliers of sustainable food contact board and paper packaging. The combined entity expands market coverage in Europe, North America, and Asia, targeting applications in frozen food and produce packaging.

- September 2024: International Paper Company launched a collaborative R&D project with the University of Georgia’s College of Agricultural and Environmental Sciences to develop antimicrobial food contact paper to extend shelf life for produce and meat products.

- July 2024: At the Tokyo Sustainable Packaging Summit 2024, Oji Holdings Corporation, Seaman Paper, and Twin Rivers Paper Company unveiled sustainable greaseproof papers aligned with Japanese Food Sanitation Law (FSL) compliance. Presentations focused on bio-barrier innovations and the shift away from fluorochemicals.

- May 2024: UPM Specialty Papers announced a €80 million investment to expand production of recyclable kraft-based food papers at its Kymi mill in Finland. The expansion aims to meet demand from European food exporters following new plastic packaging bans under the EU Green Deal framework.

- March 2024: DS Smith acquired Shree Krishna Paper Mills, an India-based food-grade paper producer, to strengthen its Asia-Pacific footprint. The deal enhances DS Smith’s access to cost-effective raw materials and helps meet India's FSSAI food packaging compliance requirements.

- January 2024: During the Food Packaging Sustainability Expo 2024 in New York, Smurfit Kappa, Clearwater Paper Corporation, and Billerud demonstrated new uncoated food wrapping solutions featuring starch-based coatings, compostability certifications, and cold-chain resistance for meat and seafood packaging.

- November 2023: Amcor, in partnership with Walmart, piloted the rollout of compostable food contact paper bags across 200 stores in the U.S. The initiative supports Walmart’s plastic waste reduction goals and promotes consumer trust through transparency in environmental labeling.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 84.1 Bn |

| Forecast Value (2034) |

USD 130.3 Bn |

| CAGR (2025–2034) |

5.0% |

| The US Market Size (2025) |

USD 27.2 Bn |

| Historical Data |

2019 – 2024 |

| Forecast Data |

2026 – 2034 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Type (Kraft Paper, Greaseproof Paper, Glassine Paper, Parchment Paper, and Others) By Application (Fresh Produce, Dry Groceries, Bakery Products, Liquid Food and Drinks, Takeaway and Vending Foods, and Others) |

| Regional Coverage |

North America – US, Canada; Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA |

| Prominent Players |

Mondi Group, WestRock Company, International Paper Company, Smurfit Kappa Group, Georgia-Pacific LLC, Stora Enso Oyj, UPM-Kymmene Corporation, Huhtamaki Oyj, Billerud AB, Twin Rivers Paper Company, Nippon Paper Industries Co., Ltd., Ahlstrom, Sappi Limited, Nordic Paper, Glatfelter Corporation, SCG Packaging, Indah Kiat Pulp & Paper, Asia Pulp & Paper (APP), Seaman Paper Company, and Kruger Inc., and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |

Frequently Asked Questions

he Global Food Contact Paper Market size is estimated to have a value of USD 84.1 billion in 2025 and is expected to reach USD 130.3 billion by the end of 2034.

The US Food Contact Paper Market is projected to be valued at USD 27.2 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 41.2 billion in 2034 at a CAGR of 4.7%.

Asia Pacific is expected to have the largest market share in the Global Food Contact Paper Market with a share of about 38.5% in 2025.

Some of the major key players in the Global Food Contact Paper Market are Mondi Group, WestRock Company, International Paper Company, Smurfit Kappa Group, Georgia-Pacific LLC, Stora Enso Oyj, UPM-Kymmene Corporation, Huhtamaki Oyj, Billerud AB, Twin Rivers Paper Company, and many others.

The market is growing at a CAGR of 5.0 percent over the forecasted period of 2025.