Market researchers predict the Food Deaerators Market is set for significant expansion due to growing consumer demands for better food preservation and extended shelf life. With global food supply chains evolving further and maintaining product quality becoming ever more critical, food deaerators play a vital role in mitigating oxidative spoilage by extracting oxygen from packaging environments that contain food products thereby protecting freshness, flavor, and nutritional values in finished goods.

Technological innovation is a driving factor of market expansion in this space, as advances in beverage deaeration technology improve efficiency while cutting operational costs, accommodating an expanded variety of food products, and meeting diverse customer requirements. High-efficiency deaeration machines with automated material-compatible deaerators set new industry standards while meeting food and beverage industry requirements for diverse food applications.

In today's competitive landscape, established players and new innovators coexisting side by side. Companies increasingly engage in strategic alliances or collaborations to capitalize on complementary strengths and expand market presence - indicative of an industry in which technological progress and partnerships remain paramount to maintaining an edge and staying profitable.

Key Takeaways

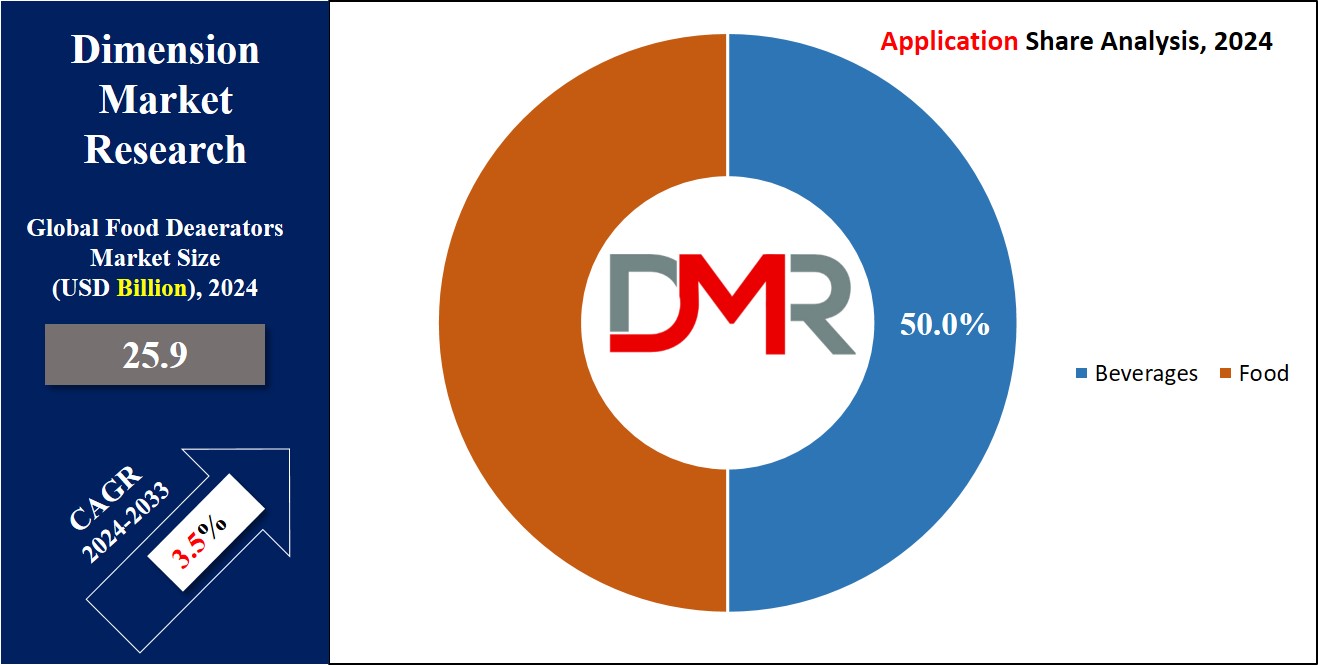

- Market Growth: The Food Deaerators Market is poised to grow from USD 25.9 billion in 2024 to USD 34.8 billion by 2033, with a CAGR of 3.5% during the forecast period.

- Dominant Segment: Beverage applications lead the market, holding nearly 50% of the total market share due to their critical need for gas removal to maintain flavor and shelf life.

- Regional Leadership: North America dominates the market with a 40% share, driven by a robust food processing industry and high consumer demand for premium quality products.

- Technological Advancements: Innovations in deaeration systems, such as high-efficiency machines and automated solutions, are driving market expansion by improving efficiency and accommodating diverse food products.

- Growth Drivers: Rising consumer demand for longer-lasting food products, urbanization, and increased disposable income are key factors propelling market growth.

- Competitive Landscape: Major players include GEA Group AG, SPX FLOW, Inc., and Pall Corporation, who are advancing the market through strategic acquisitions and technological developments.

Use Cases

- Beverage Shelf Life Extension: Deaerators remove oxygen from beverage packaging, preserving flavor and nutrition, which is crucial for maintaining quality in juices, soft drinks, and health-oriented beverages.

- Packaged Food Quality Maintenance: By eliminating oxygen, deaerators prevent spoilage and preserve taste and nutrition in packaged foods like snacks and ready-to-eat meals, meeting consumer demand for longer-lasting products.

- Dairy Product Stability: Deaerators are used in dairy processing to prevent off-flavors and maintain the consistency of products such as milk, cheese, and yogurt, ensuring high quality and extended shelf life.

- Meat Processing Preservation: In meat processing, deaerators extend the shelf life of products like sausages and deli meats by preventing spoilage and discoloration through effective oxygen removal.

- Customized Solutions for Food Processing: Deaerators are tailored to specific food types and packaging needs, addressing unique processing challenges and driving innovation across various food applications.

Driving Factors

Reducing Disdispable Income

Rises in disposable income have been one of the main drivers of Food Deaerators Market growth. When consumers' purchasing power increases, they become more willing to spend on premium and high-quality food products. Food deaerators provide solutions that enable consumers to purchase foods with longer shelf lives and superior freshness - these attributes have increased significantly as consumer spending power has increased.

With more disposable income available to them, consumers are now more able to afford higher-quality packaged goods and more likely to opt for products with extended freshness, prompting advanced preservation technologies to be adopted by food industry companies and benefiting the deaerator market.

Urbanization and Demographic Trends

Urbanization and demographic shifts are altering consumption patterns and food processing needs. As urban populations increase and lifestyles become faster-paced, there is an ever-increasing demand for convenience foods and ready-to-eat products; as this demand rises so do food processing technologies - such as deaerators - required to keep these fresh and safe for consumption over extended periods.

Furthermore, demographic changes such as the aging population and reduced household sizes also alter eating habits, driving a strong need for preservation solutions that cater to the evolving preferences of urban consumers across demographic groups.

Expanding Food Process Industry

Food processing industry growth is one of the primary drivers for growth of the Food Deaerators Market. As the global food processing sector expands--driven by innovations, increased production capacities, and an emphasis on efficient food management--there is an increased need for advanced deaeration technologies.

Food processors are increasingly turning to deaerators as an efficient way of increasing product shelf life, maintaining quality standards, and adhering to stringent safety requirements. Growth of this market is further enabled by technological innovations that use deaeration systems to streamline operations and increase overall efficiency, creating a sustained demand for sophisticated deaeration solutions - driving market expansion even further.

Growth Opportunities

Health and Wellness trends

Food Deaerators Market. As consumer interest in

health and wellness surges, deaerators present an enormous opportunity. As more consumers opt for products free from preservatives that preserve the nutritional integrity of foods without diminishing shelf life or shelf life extensions without losing their freshness, deaerators play a vital role in maintaining the nutritional integrity of products - thus catering to a growing market segment that values both quality and wellness.

Customization and Application-Specific Solutions

Another opportunity lies in the creation of tailored and application-specific deaeration solutions. Food processors are increasingly seeking technologies tailored to their particular needs, such as deaerators designed for specific food types or packaging requirements. Offering tailored solutions that address unique processing challenges can set market players apart and capture more market share; customization also increases product efficiency while meeting all the diverse requirements across sectors from beverages to packaged snacks.

Diversified Application Areas

Expanding into diverse application areas has broadened market potential even further. Deaerators are used in multiple sectors such as dairy, meat, and convenience food production; companies can leverage this diversification by entering new markets and applications that drive overall market growth. By meeting individual segment needs with customized solutions tailored specifically for them, this industry can uncover new opportunities while spurring innovation.

Key Trends

Rising Beverage Consumption

Food Deaerators Market growth is being propelled by global consumer appetite for beverages ranging from soft drinks and juices to health-oriented options, particularly non-alcoholic segments like soft drinks.

Consumers seek beverages with extended shelf lives and consistent quality; thus deaeration technologies become essential in maintaining freshness throughout their shelf lives and preventing flavor degradation or nutritional loss from occurring, keeping drinks fresh-tasting long after purchase. Furthermore, as healthier and functional drinks become more popular these needs for advanced deaeration solutions only increase.

An Expansion Strategy in Emerging Markets

Emerging markets are emerging as significant growth areas for the Food Deaerators Market. As these regions experience economic development and urbanization, consumption increases substantially; leading to a surge in food preservation technologies like deaeration systems. India, China and Brazil all boast growing middle classes which drive demand for processed and packaged food which demands efficient deaeration systems; companies that can penetrate these markets with tailored solutions can capitalize on this growing need for high-quality long-lasting foods products.

Food processing infrastructure investment

Government and private entities alike are making substantial investments in food processing infrastructure to drive market expansion and meet rising consumer expectations. Part of this investment includes adopting advanced deaeration systems which further boost processing capabilities and product quality; enhanced infrastructure supports this innovation which in turn promotes market growth and technological progress.

Restraining Factors

Competition from Alternate Technologies Harm Market Growth

Food deaerators market faces numerous hurdles due to intense competition from alternative technologies. As food processing technologies advance, various strategies such as vacuum packaging, inert gas flushing, and modified atmosphere packaging all provide similar advantages in terms of extending product shelf life and upholding quality.

Food manufacturers may turn to alternative deaeration technologies for cost savings or added advantages, like improved convenience or product protection. When faced with this competitive pressure, traditional deaeration systems could lose out. As such, continuous innovation and differentiation in deaeration technology must occur to maintain market share while appealing to a broader array of applications.

Cost Stability Is At Stake Due to Raw Material Price Variability

Food Deaerators Market growth may also be limited by fluctuations in raw material prices. Metals, polymers and other specialized components used in deaerator manufacture can fluctuate due to factors like supply chain disruptions, geopolitical tensions, or changes in global demand causing fluctuation in their costs; leading to an increase in production costs that ultimately pass onto end-users as higher prices for them; food processors may subsequently hesitate to invest in new deaeration systems if these costs appear prohibitive or unpredictable; manufacturers must work effectively at managing and mitigating these variations effectively so as not hindering market expansion growth

High Capital Investment Limits with Market Expansion

Food deaeration systems often require substantial capital investments. Implementing advanced deaeration technologies requires substantial initial expenses related to equipment, installation, and maintenance costs - this large financial outlay may present barriers for smaller food processing companies or those operating in cost-sensitive markets; as a result of its prohibitive initial costs it may prevent smaller food processing firms or those in emerging markets with limited budgets from adopting deaerators; therefore limiting market growth overall while limiting deaerators to reach more potential users.

Research Scope Analysis

By Type

Spray-Tray Deaerators held the leading market position within the Food Deaerators Market by product type segment in 2023, commanding approximately 45%. Their success can be attributed to their efficiency in extracting dissolved gases from liquid food products for improved shelf life and quality, and for consistent operation in large-scale processing environments that demand consistent performance.

Vacuum Type Deaerators represented roughly 35% of the market share within their segment. These deaerators are widely recognized for creating vacuum environments to remove unwanted gases efficiently and are often preferred when maintaining the integrity of sensitive ingredients is crucial.

Spray-Tray and Vacuum Type Deaerators play an integral part in assuring food product quality and stability by mitigating gas dissolution issues. Their unique strengths satisfy varying operational needs, contributing to their growing role within the Food Deaerators Market.

By Application

Beverage applications were the clear leader in the Food Deaerators Market during 2023, accounting for nearly 50% of total market share in terms of Product Type segment. This dominance can be explained by their critical need for gas removal in beverage production; as presence of dissolved gases can greatly impact flavor, shelf life, and overall quality. Furthermore, high demand for beverages with ideal clarity and stability drives advanced deaeration technologies forward.

Conversely, the Food segment represented around 30% of market share. Deaerators play an essential role in maintaining product quality and consistency by eliminating gases that affect texture, taste, or preservation of various food items. Although Food shows considerable potential growth prospects compared to Beverage due to specialized requirements and different processing scales for different applications of deaerators.

Both segments demonstrate the significance of effective deaeration for maintaining product quality across different types of consumables, with Beverages leading in terms of market share due to its greater need for gas removal.

The Food Deaerators Market Report is segmented based on the following:

By Type

- Spray-Tray Type Deaerators

- Spray Type Deaerators

- Vacuum Type Deaerators

By Application

Regional Analysis

Food Deaerators Market dynamics varied considerably across regional boundaries in 2023, with North America taking approximately 40% of global market share due to an advanced food processing industry and robust consumer demand for premium quality food and beverage products driving the need for effective deaeration solutions. North America also saw significant investments made into technological advancement and infrastructure development which further cemented their dominance within this niche industry.

Europe held approximately 30% of the market, thanks to an advanced food and beverage sector coupled with stringent quality regulations driving demand for deaeration systems that meet those regulations. Europe was notable for exhibiting a rapid adoption rate of innovative technologies as well as a strong focus on maintaining product integrity and shelf life, giving rise to its impressive 30% share.

Asia Pacific has quickly established itself as an explosively expanding region, accounting for approximately 20% of the total market share. Asia Pacific's expansion can be attributed to two main drivers - increased food and beverage production along with rising consumer expectations of higher quality standards; as well as significant investments made towards modernizing processing facilities and optimizing production efficiencies.

By Region

North America

Europe

- Germany

- U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

In 2023, the global Food Deaerators Market was strongly impacted by leading players such as GEA Group AG and SPX FLOW, Inc. Their dominance is attributable to their extensive portfolio and innovative process engineering which have established them as market leaders for high-efficiency deaeration solutions. They integrate advanced technologies into their systems that improve product quality and operational efficiencies; similarly SPX FLOW Inc has employed its engineering expertise to offer custom solutions tailored specifically for food and beverage industry requirements, furthering its competitive edge within this market.

Pall Corporations and JBT Corporation both played pivotal roles in shaping the market. Pall's expertise in filtration and separation technologies enabled it to develop highly effective deaerators that meet stringent quality standards while improving product stability, while JBT Corporation provided integrated food processing technologies including advanced deaeration systems aimed at meeting industry requirements for efficient processing technologies. Both companies contributed innovative solutions that improved both food product quality and safety - two hallmarks of success within any market.

Companies such as Tetra Pak International S.A., ALFA LAVAL AB, Zenith Spray & Aerosols Pvt Ltd. Ltd. Parkson Corporation Mitsubishi Heavy Industries LTD HRS Heat Exchangers LTD, and Bucher Unipektin AG have also added significant value to the market through their specialized offerings.

Tetra Pak and ALFA LAVAL are known for their advanced food processing and packaging technologies while Zenith Spray & Aerosols, Parkson Corporation Mitsubishi Heavy Industries LTD HRS Heat Exchanger Integration as well as robust processing solutions from HRS Heat Exchangers LTD, and Bucher Unipektin AG further diversifies and strengthen the overall capabilities of food deaeration systems.

Some of the prominent players in the Global Food Deaerators Market are:

- GEA Group AG

- SPX FLOW, Inc.

- Pall Corporation

- JBT Corporation

- Tetra Pak International S.A.

- ALFA LAVAL AB

- Zenith Spray & Aerosols Pvt. Ltd.

- Parkson Corporation

- Mitsubishi Heavy Industries, Ltd.

- HRS Heat Exchangers Ltd.

- Bucher Unipektin AG