Market Overview

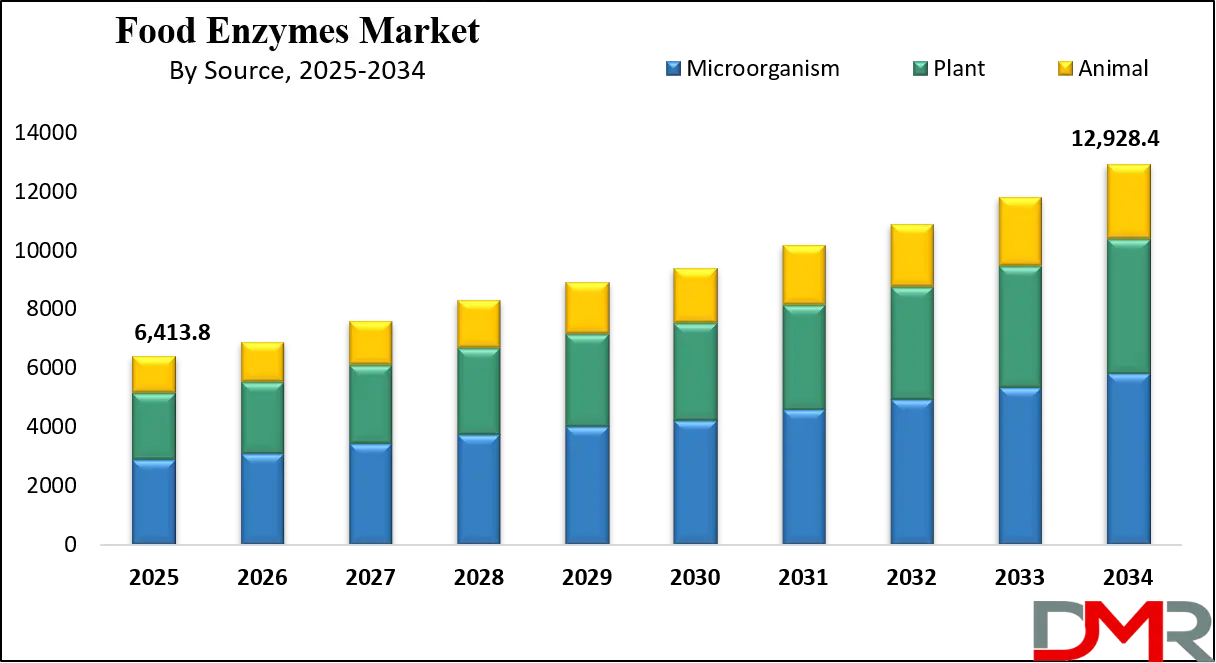

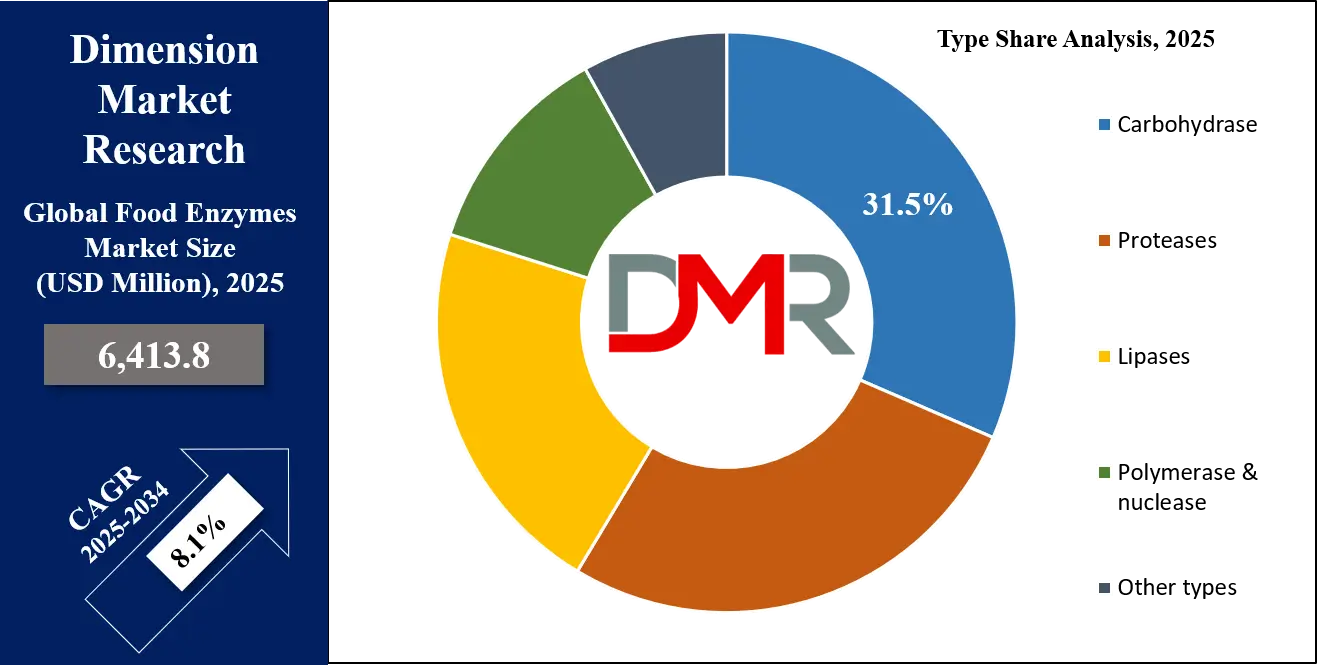

The Global Food Enzymes Market size is expected to be valued at USD 6,413.8 million in 2025, and it is further anticipated to reach a market value of USD 12,928.4 million by 2034 at a CAGR of 8.1%.

Over the recent years, the food enzymes market has experienced substantial expansion because increasing consumer interest in processed food products combined with beverage and functional ingredient needs stemming from changing demands that seek sustainable and cleaner food alternatives. Enzymes serve as biological catalysts through different food processing operations to develop food products with improved flavor alongside better texture and enhanced nutritional characteristics, together with increased shelf life.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The clean-label movement has gained momentum since consumers show interest in products without artificial preservatives and additives, thus leading the food industry to transition to natural enzyme-based processing methods. The food industry utilizes enzymes primarily because of expanding consumer interest in plant-based food products. Proteases, together with cellulases and amylases, represent essential enzymes for developing dairy as well as meat substitute products.

The global food enzyme market follows sustainability trends because consumers and industry players actively work on decreasing waste production. Through enhanced food yield and more efficient production processes, enzymes decrease food waste and enhance resource management capabilities. The market encounters difficulties because enzyme production costs remain high, especially when it comes to making specialized enzymes.

Mandatory regulations together with public fear regarding GMO organisms utilized in enzyme manufacturing occasionally restrict market expansion, mainly within regions that emphasize non-GMO and organic product adoption. Even though several obstacles exist, the market presents noteworthy growth prospects. Research and development into enzyme manufacturing leads to future market expansion because scientists create enzymes from non-genetically modified source materials. The consumer preference for functional foods containing supplementary health advantages beyond basic nutritional components strengthens the market need for enzymes, particularly in nutraceuticals and probiotics.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The US Food Enzymes Market

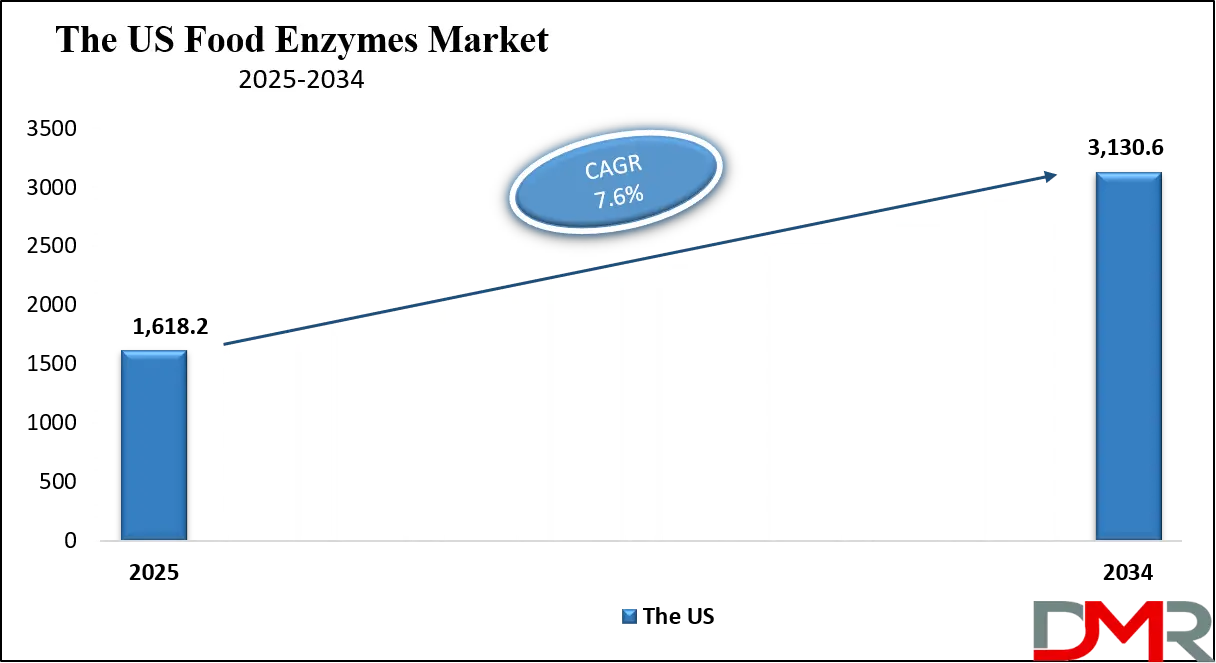

The US Food Enzymes Market is estimated to be valued at USD 1,618.2 million in 2025, and projections suggest it will grow to USD 3,130.6 million by 2034, at a steady CAGR of 7.6%.

The United States maintains one of the world's biggest and most technologically sophisticated food enzymes markets due to its highly developed and always innovating food processing sector, which delivers nutritious, sustainable food alternatives to consumers. U.S. food enzymes market performance expands through two main trends: increasing consumer interest in simple and ready-to-use foods, together with the growing popularity of foods designed to benefit health. Food manufacturers now choose enzyme-based solutions because consumers prefer natural ingredients and clean-label products while also seeking to eliminate artificial additives from their food and improve product quality.

The Food and Drug Administration (FDA), together with the U.S. Department of Agriculture (USDA), maintains government programs that ensure food enzyme product safety and quality, which boosts both manufacturer and consumer trust. The United States harbors both a large number of citizens and dietary diversity that support a substantial market demand for enzymes required to manufacture plant-based food products and organic meat-alternative items.

The aging U.S. population produces higher demand for digestive health items, which now incorporate enzyme supplements as an essential component. The United States Census Bureau found that senior citizen numbers keep increasing, thereby driving the need for enzyme-based products that support gastrointestinal health and avoid lactose.

The market receives additional strength from three leading enzyme producers, Novozymes, DuPont, and DSM, operating in the U.S. The U.S. food enzyme market continues its growth trajectory because of substantial enzyme technology research efforts and existing skilled professionals, and technological infrastructure. The market shows an active expansion trend because manufacturers continue to align their products with sustainability standards and ethical dietary needs.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The European Food Enzymes Market

The European Food Enzymes Market size is estimated to be valued at USD 1,128.43 million in 2025, and projections suggest it will grow to USD 1,971.18 million by 2034, at a steady CAGR of 6.5%.

The European food enzyme market represents the biggest and most established market segment because leading food manufacturing sectors depend on enzyme utilization across diverse applications. The food enzyme market flourishes under stringent regulatory procedures established through the European Food Safety Authority (EFSA) to maintain safety and effectiveness in enzymatic food processing applications. European consumers actively seek functional, healthier foods together with natural, clean-label items because of their growing food preferences. Enzymes applied during dairy and meat and bakery, and brewing production workflows enhance the quality of resulting food products and their storage duration as well as nutritional values.

The European Union established sustainability goals that boosted enzyme utilization throughout food production operations and waste reduction, and nutritional improvement in food items. Bakery production uses enzymes because they improve dough structure and delay expiration dates, thus supporting the EU goal of reducing food waste. Plant-based product adoption in Europe keeps driving the enzyme market expansion mostly through dairy and meat substitute production.

The aging population in the EU drives food enzyme market expansion because people are looking for digestive health products and functional food solutions that address specific health issues. The European market demonstrates strong growth potentials in the enzyme-based sector and shows rising demand for plant-based and functional foods thus leading to a positive market trend. European businesses spend significant funds to develop better and sustainable enzyme solutions which respond to modern consumer preferences.

The Japan Food Enzymes Market

It is expected that the Japan Food Enzymes Market will be valued at USD 384.83 million in 2025 and is likely to grow to USD 672.78 million by 2034, registering a CAGR of 7.2%.

The global food enzymes market values Japan as a significant contributor because its highly advanced food processing sector has fully adopted enzyme-based technologies across multiple applications. Japanese consumers focus on health because they seek functional food products designed to enhance digestion capability while strengthening immunity and improving their overall wellness. Enzymes have found their essential place within Japanese food manufacturing specifically for fermentation processes and dairy products and various sauces and beverages and snack production.

The food enzymes market in Japan develops under strong governmental control. Through its implementation, the Ministry of Health, Labour and Welfare (MHLW) verifies all enzymes utilized in food production that meet their established safety guidelines. The age-related population growth in Japan drives market demand for digestive health products and other functional food ingredients among Japanese consumers. The long life span and growing senior citizen population in Japan create an extensive market for enzyme-based products that promote gut health while improving nutritional value.

The Japanese emphasis on food sector research and development work has produced targeted enzyme solutions matching both traditional local food preferences and region-specific tastes. Japanese food manufacturers dedicate their research efforts toward developing enzymes that enhance fermentation, as this process forms a vital element in Japanese food preparations. Plant-based diets and sustainable practices, along with Japanese dedication to health, have expanded the need for enzymes in food processing operations. The Japanese market for food enzymes will grow because the nation maintains its active adoption of nutritious and environmentally friendly food items.

Global Food Enzymes Market: Key Takeaways

- Global Market Size Insights: The Global Food Enzymes Market size is estimated to have a value of USD 6,413.8 million in 2025 and is expected to reach USD 12,928.4 million by the end of 2034.

- The US Market Size Insights: The US Food Enzymes Market is projected to be valued at USD 1,618.2 million in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 3,130.6 million in 2034 at a CAGR of 7.6%.

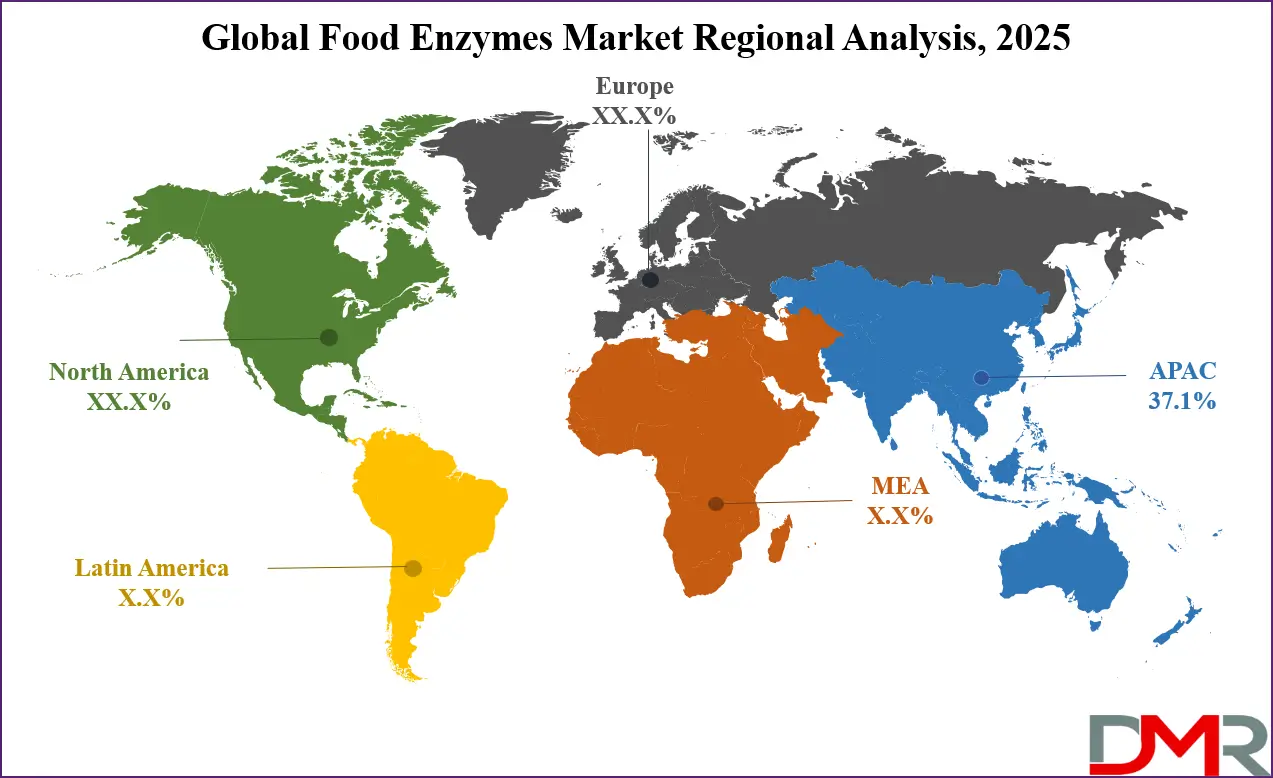

- Regional Insights: Asia Pacific is expected to have the largest market share in the Global Food Enzymes Market with a share of about 37.1% in 2025.

- Key Players: Some of the major key players in the Global Food Enzymes Market are Novozymes, DuPont (Danisco), DSM, BASF, Chr. Hansen, AB Enzymes, Advanced Enzyme Technologies, Kerry Group, Syngenta, Lesaffre, Amano Enzyme, and many others.

- The Global Market Growth Rate Insights: The market is growing at a CAGR of 8.1 percent over the forecasted period of 2025.

Global Food Enzymes Market: Use Cases

- Baking Industry: In baking, enzymes like amylases break down starch into simpler sugars, improving dough consistency, texture, and flavor. They help in achieving better fermentation and reduce the need for additional processing steps, making the process more efficient and cost-effective.

- Dairy Processing: Enzymes such as lactase are used to break down lactose in dairy products, making them suitable for lactose-intolerant individuals. This enzymatic process helps in producing lactose-free milk, cheese, and yogurt, expanding the product range for health-conscious consumers.

- Fruit Juice Processing: Pectinases and cellulases are used in juice production to enhance extraction from fruits, improve clarity, and break down pectin, which increases the yield and quality of juice while reducing waste. This process improves flavor and visual appeal.

- Brewing: Enzymes such as amylases and proteases play a critical role in brewing by breaking down complex starches into fermentable sugars, enhancing fermentation. This not only improves beer quality but also accelerates production, reducing brewing time and cost.

- Animal Feed: Enzymes are widely used in animal feed to improve nutrient digestibility, helping livestock absorb more nutrients from their feed. Enzymes such as xylanase and cellulase break down fibrous plant materials, making it easier for animals to digest and boosting overall health.

Global Food Enzymes Market: Stats & Facts

- USDA (United States Department of Agriculture): The USDA highlights that enzymes are essential in improving the efficiency of food processing, such as in the production of beer, cheese, and bread. The enzymatic process in brewing helps reduce production time by approximately 20%.

- EFSA (European Food Safety Authority): EFSA reports that food enzymes used in processing must meet rigorous safety standards, with over 60 enzymes currently authorized for use in food production within the European Union.

- Food and Agriculture Organization (FAO): The FAO estimates that the use of enzymes in food processing has led to a significant reduction in food waste, particularly in bread production, where enzymes improve dough yield by up to 10%.

- FDA (U.S. Food and Drug Administration): The FDA notes that enzymes used in the food industry are typically classified as "generally recognized as safe" (GRAS), with more than 100 enzymes approved for use in food products.

- US Census Bureau: By 2030, the U.S. population aged 65 and older is projected to exceed 70 million, increasing demand for health-related food products, including those with enzymes aimed at improving digestion.

- European Commission (EC): The EC’s report on food safety indicates that the use of enzymes in food products is expected to grow as European consumers demand more sustainable, plant-based foods, driving demand for enzymes in dairy and meat alternatives.

- USDA National Agricultural Library: The USDA reports that enzymes have played a critical role in reducing energy consumption in the food industry, particularly in areas like brewing, where enzymatic processes replace energy-intensive steps.

- United Nations (UN): According to the UN’s Sustainable Development Goals (SDGs), enzymes contribute to reducing food waste and improving sustainability in food production, especially in sectors like baking and juice production.

- Japan Ministry of Agriculture, Forestry and Fisheries (MAFF): Japan's MAFF reports a significant rise in the use of enzymes in the production of functional foods, with enzymes playing a key role in producing low-calorie, low-sugar products.

- FDA (Food and Drug Administration): The FDA’s guidelines for enzyme use in food processing indicate that enzymes are essential in the production of lactose-free dairy products, addressing the needs of over 30 million Americans who are lactose intolerant.

- European Union (EU): According to the EU, over 45% of European consumers actively seek clean-label products, driving the adoption of enzymes in food manufacturing to replace synthetic chemicals.

- National Institute of Food and Agriculture (NIFA): The NIFA supports research on food enzymes, noting that enzymes in meat processing can reduce sodium and fat content by up to 20%, improving the nutritional profile of products.

- Food and Drug Administration (FDA): The FDA has approved over 50 enzyme preparations for use in food processing, each evaluated for safety, quality, and efficacy.

- UK Department for Environment, Food & Rural Affairs (DEFRA): DEFRA reports that the demand for enzymes in the food and beverage industry in the UK has grown by over 10% in recent years, driven by the rising popularity of plant-based diets.

- World Health Organization (WHO): WHO highlights the importance of enzymes in improving the digestibility and nutritional value of foods, particularly in the production of probiotics and functional foods that enhance gut health.

Global Food Enzymes Market: Market Dynamic

Driving Factors in the Global Food Enzymes Market

Health and Wellness Trends

The increasing consumer focus on health and wellness is a primary driver of the global food enzymes market. Consumers are becoming more aware of the importance of functional foods that contribute to overall well-being, beyond just basic nutrition. As a result, there is a growing demand for enzymes that improve digestion, enhance nutrient absorption, and provide health benefits.

Digestive enzymes, such as lactase, proteases, and amylases, are increasingly being added to various food products, including dairy, baked goods, and beverages, to aid in digestion and support gut health. This trend is especially noticeable in the aging population, where there is a heightened focus on maintaining digestive health and overall vitality. With the rise in digestive disorders such as lactose intolerance and celiac disease, consumers are turning to enzyme-fortified foods that offer solutions to these health issues.

Furthermore, enzymes are also used to improve the nutritional profile of food products, such as increasing the bioavailability of vitamins and minerals. As health-conscious consumers continue to prioritize well-being, food enzymes that offer functional health benefits are expected to see continued demand, driving market growth.

Food Waste Reduction and Sustainability Initiatives

Another important driver for the global food enzymes market is the increased emphasis on sustainability and food waste reduction. Enzymes contribute significantly to more efficient food processing, which in turn helps reduce waste during production. By using enzymes, food manufacturers can improve the yield and quality of their products, ensuring that fewer raw materials are wasted in the production process. For example, enzymes are used to extract more juice from fruits and vegetables, resulting in less waste and maximizing the use of raw materials.

In baking, enzymes can enhance dough yield, ensuring that more bread is produced with less input. Enzyme applications in the food industry also support sustainability goals by improving the utilization of plant-based ingredients, reducing the need for artificial preservatives, and lowering energy consumption during food production.

As environmental concerns grow and both consumers and governments push for more sustainable practices, the adoption of enzyme technology in food processing is seen as a critical strategy for reducing the carbon footprint of the food industry. This trend is likely to gain momentum as businesses adopt more sustainable practices, leading to further growth in the global food enzymes market.

Restraints in the Global Food Enzymes Market

Regulatory Challenges and Safety Concerns

One of the significant restraints for the global food enzymes market is the complex regulatory landscape governing enzyme use in food production. Different countries have different regulatory bodies and requirements, which can make it difficult for enzyme manufacturers to ensure compliance with all standards. In some regions, the approval process for new enzymes or enzyme preparations is lengthy and complicated, which can delay market entry and limit the ability to introduce innovative products quickly.

Additionally, while enzymes are generally recognized as safe (GRAS) by regulatory authorities, there are concerns related to the use of genetically modified enzymes or enzymes derived from non-traditional sources, such as fungi or bacteria. Public perception and concerns about the safety of genetically modified organisms (GMOs) can limit the acceptance of certain enzyme products in the market, especially in countries with strict regulations on GMOs. These regulatory challenges can hinder market growth by making it more difficult and costly for manufacturers to navigate the approval process and introduce new enzyme-based solutions.

High Production Costs and Price Sensitivity

The high production costs associated with enzymes are another restraint limiting the growth of the global food enzymes market. Enzyme production involves complex processes that require specialized equipment, skilled labor, and raw materials, which contribute to the high costs of enzyme-based products.

Furthermore, the extraction and purification of enzymes from natural sources can be expensive, especially for specialized enzymes that are in high demand. While the food industry is increasingly adopting enzyme-based solutions for their efficiency and quality-enhancing benefits, there is still significant price sensitivity in many regions, particularly in developing markets.

Food manufacturers, particularly small- and medium-sized enterprises (SMEs), may find it challenging to afford the higher cost of enzyme-based ingredients compared to traditional alternatives. As a result, some companies may opt for less expensive, synthetic ingredients or delay the adoption of enzyme-based products, which can slow the market's growth. The high cost of enzyme production also limits the ability of manufacturers to pass on the benefits of enzymes in terms of cost savings to consumers, which could affect the overall adoption rate.

Opportunities in the Global Food Enzymes Market

Innovation in Enzyme-Based Food Products

Innovation in enzyme-based products offers significant growth opportunities for the food enzymes market. As the demand for specialized food products grows, there is a notable shift towards enzymes that can cater to specific dietary preferences and health needs. For instance, the growing prevalence of gluten intolerance has created opportunities for gluten-free products that are enriched with enzymes to improve texture and taste. Similarly, as the plant-based food market expands, there is a need for enzymes that can enhance the flavor, mouthfeel, and nutritional value of plant-based proteins, dairy alternatives, and other products.

This trend of targeted innovation is expected to continue, with enzyme manufacturers developing products tailored to specific food categories, including low-sugar, high-protein, and functional foods. The market is also witnessing increasing innovation in enzyme formulations that offer higher stability, better performance at varying temperatures, and greater cost-effectiveness. These innovations enable food manufacturers to streamline production processes and meet consumer demands for higher-quality and more sustainable food products. The ability to create enzyme solutions that address unique consumer preferences and emerging food trends presents significant growth opportunities in the global food enzymes market.

Expansion in Emerging Markets

Emerging markets, especially in Asia-Pacific, Latin America, and the Middle East, present significant growth opportunities for the global food enzymes market. These regions have seen rapid industrialization, an expanding middle class, and a growing demand for processed and packaged foods, all of which are driving the need for food enzymes. The adoption of Western dietary patterns in countries like China and India, combined with increased disposable incomes, is contributing to a higher demand for enzyme-based products in sectors such as baking, dairy, and beverages.

Additionally, emerging markets are also experiencing a rise in awareness of food safety, health, and nutrition, encouraging consumers to seek out foods with added health benefits, such as those fortified with enzymes. This shift in consumer preferences is creating opportunities for enzyme manufacturers to expand their product offerings in these markets. Furthermore, many developing countries are working towards improving food security and reducing food waste, and enzyme-based solutions play a critical role in achieving these goals. As the demand for more efficient and sustainable food production grows in these regions, the global food enzymes market is poised to expand significantly in emerging markets.

Trends in the Global Food Enzymes Market

Rising Demand for Clean-Label Products

One of the major trends driving the global food enzymes market is the increasing demand for clean-label products. Consumers are becoming more conscious about the ingredients in their food, preferring natural, unprocessed, and minimally modified ingredients. This shift in consumer preference toward clean-label products is significantly impacting the food industry, especially in terms of the ingredients used in production.

Enzymes, being naturally derived biological catalysts, are considered a key component in meeting the clean-label trend. They play a crucial role in enhancing the flavor, texture, and shelf life of food products without the need for synthetic additives or preservatives. The clean-label trend is prevalent across various sectors, including bakery, dairy, beverages, and meat processing.

In response to this demand, many food manufacturers are increasingly opting for enzyme-based solutions to replace artificial ingredients, thereby boosting the global food enzymes market. This trend is further fueled by consumer demands for transparency and sustainability in food production, pushing brands to offer products that align with the clean-label movement.

Adoption of Enzymes in Plant-Based Food Products

Another significant trend in the food enzyme market is the growing use of enzymes in the production of plant-based food products. With an increasing number of consumers turning to plant-based diets for health, ethical, and environmental reasons, the demand for plant-based alternatives to traditional animal products is rapidly increasing.

Enzymes are widely used in the formulation of plant-based dairy and meat alternatives to improve taste, texture, and nutritional value. For instance, enzymes are employed in the production of dairy substitutes such as plant-based milks, cheeses, and yogurts to improve their creaminess and mouthfeel, mimicking the texture of traditional dairy products.

Similarly, enzymes are used in the production of plant-based meat alternatives to enhance their flavor and texture, making them more appealing to consumers. The rise of plant-based eating habits has been further driven by sustainability concerns, with consumers opting for food choices that have a lower environmental impact. As a result, food manufacturers are increasingly turning to enzymes to optimize the quality and processing of plant-based food products, which is expected to continue as the market grows.

Global Food Enzymes Market: Research Scope and Analysis

By Type Analysis

Carbohydrases are projected to dominate the global food enzymes market due to their critical role in improving the texture, quality, and yield of various food products. These enzymes are involved in breaking down complex carbohydrates like starches, sugars, and fibers into simpler, more digestible components. The widespread application of carbohydrases, particularly amylases, in industries like bakery, beverages, dairy, and brewing contributes significantly to their market dominance. In bakery products, amylases improve dough handling and texture, leading to better bread volume and crumb structure. Similarly, in brewing, amylases facilitate the conversion of starches into fermentable sugars, optimizing the fermentation process for consistent alcohol production.

The increasing consumer demand for healthier, low-calorie, and low-sugar foods is also driving the demand for carbohydrases. For instance, carbohydrases like lactase are essential in the production of lactose-free dairy products, catering to the growing population of lactose-intolerant individuals. Moreover, as the global focus on sustainable food production intensifies, carbohydrases offer an eco-friendly alternative to synthetic chemicals by enhancing the efficiency of food processing, reducing waste, and lowering energy consumption.

The versatility of carbohydrases in various food sectors, combined with their proven ability to improve product quality and nutritional profile, cements their position as the dominant type in the food enzyme market. As trends toward health-consciousness and sustainability continue to grow, carbohydrases are likely to remain at the forefront of the food enzymes market.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

By Source Analysis

Microorganisms, including bacteria, fungi, and yeasts, are anticipated to dominate the global food enzymes market because they offer a sustainable, cost-effective, and reliable source of enzymes. Microbial enzymes are produced through fermentation, a natural and scalable process that allows for the mass production of enzymes without the need for complex agricultural resources. This makes them widely available and affordable compared to enzymes derived from plants or animals, where sourcing can be more limited and costly. Microorganisms can be cultured rapidly and under controlled conditions, allowing for high yields and uniform enzyme production, which is crucial for consistent performance in food processing applications.

The versatility of microbial enzymes is another factor driving their dominance. These enzymes can be used across various food sectors, including bakery, beverages, dairy, and meat, due to their wide range of functional properties, such as breaking down carbohydrates, proteins, and fats. For example, enzymes like amylases and proteases derived from bacteria and fungi are extensively used in bread making and cheese production, respectively.

Additionally, the increasing emphasis on sustainable practices and the growing preference for enzymes derived from renewable microbial sources, as opposed to animal or plant-based sources, is fueling the demand for microbial enzymes. Microbial enzymes also offer advantages in terms of stability and resistance to extreme conditions like high temperatures or pH variations, which enhances their effectiveness in industrial food applications. As the demand for efficient, sustainable, and high-performing enzymes continues to rise, microbial enzymes will maintain their dominance in the food enzyme market.

By Form Analysis

The lyophilized powder form of food enzymes is poised to hold a dominant position in the market due to its superior stability, ease of storage, and long shelf life. The process of lyophilization (freeze-drying) removes moisture from enzymes, which significantly prolongs their viability, allowing for longer storage and reducing the risk of enzymatic degradation over time. This form is particularly advantageous for enzyme manufacturers, as it enables easy handling, transportation, and application of enzymes in various industries, especially where temperature control and logistics are essential.

Lyophilized enzymes are highly preferred for bulk packaging and export due to their stability and convenience. Unlike liquid enzymes, which require careful temperature regulation and are often more prone to contamination and degradation, lyophilized powders maintain their activity over extended periods, making them ideal for large-scale food manufacturing processes. Additionally, the powder form offers flexibility in precise dosing, allowing food processors to mix the right quantity of enzyme into production processes with minimal waste.

Another advantage is that lyophilized enzymes can be rehydrated before use, providing an efficient solution for companies that require enzymes in specific concentrations. The growing trend of food manufacturers adopting more efficient and cost-effective solutions in production processes further boosts the demand for lyophilized powder enzymes. This, combined with its broader application across industries such as baking, brewing, dairy, and beverages, ensures the continued dominance of lyophilized powders in the global food enzymes market.

By Application Analysis

The food application segment is projected to be the largest and most dominant in the global food enzymes market due to the integral role enzymes play in improving the quality, safety, and processing efficiency of a wide array of food products. Food enzymes are used in various stages of food production, including processing, preservation, and fermentation, to enhance product quality and extend shelf life. In the baking industry, enzymes like amylases and lipases are used to improve dough texture, prevent staling, and enhance flavor, making them essential for producing high-quality bread, cakes, and pastries. Similarly, enzymes are used in brewing to break down starches into fermentable sugars, improving the efficiency of alcohol production.

Enzymes also offer significant benefits in the dairy industry, where they are crucial in cheese production, fermentation, and lactose-free dairy product manufacturing. Lactase, for example, is widely used to break down lactose in milk, catering to the growing number of lactose-intolerant consumers worldwide. The growing demand for functional foods, including low-sugar, gluten-free, and fat-reduced products, further propels the application of enzymes in food. Consumers are increasingly looking for foods that offer additional health benefits, and enzymes contribute by enhancing digestibility, improving nutrient bioavailability, and increasing the shelf life of products.

Moreover, the increasing emphasis on sustainability and reducing food waste is driving the adoption of enzymes in food processing. Enzymes help reduce raw material waste, improve yields, and lower energy consumption during food manufacturing. As consumers continue to prioritize healthier, more nutritious, and eco-friendly food options, the food application segment will remain the dominant force in the food enzymes market, accounting for a significant portion of the industry’s growth. The versatility and effectiveness of enzymes in improving food quality, sustainability, and consumer health ensure that the food application segment will continue to lead the market in the coming years.

The Global Food Enzymes Market Report is segmented on the basis of the following:

By Type

- Carbohydrase

- Amylase

- Α-Amylase

- Β-Amylase

- Glucoamylase

- Cellulase

- Endoglucanase

- Exoglucanase

- Β-Glucosidase)

- Lactase

- Pectinase

- Polygalacturonase

- Pectin Lyase

- Xylanase

- Mannanase

- Other Carbohydrases

- Proteases

- Endopeptidases

- Exopeptidases

- Serine Proteases

- Cysteine Proteases

- Metalloproteases

- Aspartic Proteases

- Lipases

- Triglyceride Lipase

- Phospholipase

- Polymerase & Nuclease

- DNA Polymerase

- RNA Polymerase

- Dnase

- Other Types

By Source

- Microorganism

- Plant

- Fruits

- Vegetables

- Seeds & Grains

- Animal

- Mammalian

- Insect-Derived

- Marine

By Form

- Lyophilized Powder

- Liquid

- Other Formulations

By Application

- Food

- Meat Products

- Bakery & Confectionery Products

- Dairy Products

- Nutraceuticals

- Other Food Products

- Beverages

- Juices

- Brewing

- Other Beverages

- Textiles

- Detergents

- Animal Feed

Global Food Enzymes Market: Regional Analysis

Region with Highest Market Share

Asia-Pacific is projected to dominate the global food enzymes market as it holds 37.1% of market share by the end of 2025 due to its large and rapidly growing population, which drives increasing food production and consumption. The region, particularly countries like China, India, and Japan, has a substantial consumer base and diverse dietary preferences that require a wide range of food processing technologies, making enzymes indispensable. As economic growth continues in many of these countries, urbanization and an expanding middle class are increasing demand for processed, packaged, and convenience foods, all of which rely heavily on enzymes for production and preservation.

In addition to population growth, Asia-Pacific is also home to a robust agricultural sector, which further fuels the demand for food enzymes. The use of enzymes in food processing helps enhance product quality, reduce waste, and improve efficiency in agricultural processing. Moreover, growing consumer awareness about the health benefits of enzyme-based products, including lactose-free and gluten-free foods, is propelling market growth. The rising preference for sustainable food production methods and the adoption of enzyme technologies across industries like bakery, dairy, and beverages further solidify the region’s dominance in the food enzymes market.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Region with the Highest CAGR

North America is poised to experience the highest Compound Annual Growth Rate (CAGR) in the global food enzymes market, driven primarily by increasing consumer demand for healthy, functional, and clean-label foods. The region’s growing focus on health and wellness, coupled with heightened awareness of food allergies and intolerances, has spurred the adoption of enzymes in food production, such as lactase for lactose-free dairy products and amylase for gluten-free foods.

Additionally, North America is home to a well-established food processing industry that continuously seeks innovations to improve efficiency, reduce waste, and enhance product quality. The region's food and beverage manufacturers are increasingly turning to enzymes for cost-effective solutions to optimize production processes. Furthermore, regulatory support and the emphasis on sustainability have led many food companies in North America to adopt enzyme-based technologies. These factors, combined with a mature market for functional and fortified foods, contribute to North America's highest CAGR in the food enzymes market.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Global Food Enzymes Market: Competitive Landscape

The global food enzymes market is highly competitive, with key players constantly innovating to enhance their product offerings and expand their market presence. Major players such as Novozymes, DSM, and DuPont hold a dominant position due to their broad product portfolios, strong research and development capabilities, and robust distribution networks. These companies are investing significantly in innovation, focusing on enzyme solutions that cater to the growing demand for sustainable food production and health-conscious products.

Strategic partnerships, acquisitions, and mergers are common tactics employed by leading companies to strengthen their market position. For example, collaborations between enzyme manufacturers and food producers allow for customized enzyme solutions tailored to specific processing needs. Additionally, companies are increasingly focusing on the development of plant-based and microorganism-derived enzymes as consumers shift toward plant-based, eco-friendly, and clean-label foods.

Smaller, specialized players are also carving out niches in the market by offering enzymes with specific functionalities, such as improving texture, reducing sugar content, or extending shelf life. The increasing trend of clean-label products has led to the development of enzyme formulations that meet consumer demands for transparency, sustainability, and natural ingredients. As a result, the competitive landscape remains dynamic, with both established players and new entrants working to capture a share of the growing food enzymes market.

Some of the prominent players in the Global Food Enzymes Market are:

- Novozymes

- DuPont (Danisco)

- DSM

- BASF

- Chr. Hansen

- AB Enzymes

- Advanced Enzyme Technologies

- Kerry Group

- Syngenta

- Lesaffre

- Amano Enzyme

- Brenntag

- The Archer Daniels Midland Company (ADM)

- Insta-Pro International

- Evonik Industries

- Cargill

- Sanofi

- Prosol SpA

- Verenium Corporation

- Rivertop Renewables

- Other Key Players

Recent Developments in the Global Food Enzymes Market

- April 2025: Novozymes announced the launch of a new line of plant-based amylases designed to meet the rising demand for gluten-free and low-sugar foods. The new enzymes will allow for better starch conversion in gluten-free baking, enhancing the texture and shelf life of bread and cakes. The launch reflects Novozymes' strategy to expand its product range to cater to health-conscious consumers.

- March 2025: DSM, in collaboration with global food manufacturers, launched a suite of dairy enzymes aimed at improving the efficiency of dairy fermentation processes. These new enzymes aim to optimize cheese production, reduce waste, and enhance the yield of quality cheese. This product launch positions DSM to capitalize on the growing demand for sustainable dairy products.

- December 2024: DuPont announced the expansion of its enzyme production facility in the U.S. to increase the production capacity of its specialty food enzymes. This expansion is part of DuPont's ongoing investment in providing innovative enzyme solutions for the growing plant-based food sector, particularly for meat and dairy substitutes.

- November 2024: Chr. Hansen launched a new microbial enzyme solution for improving the fermentation of plant-based beverages. The enzyme, derived from specific strains of yeast, will help plant-based beverage producers improve taste, texture, and nutritional profiles without using artificial additives. This move aligns with the growing consumer preference for clean-label and plant-based products.

- October 2024: BASF partnered with a leading Chinese food processor to create enzyme solutions tailored to local tastes and food production processes. The collaboration seeks to innovate enzyme-based solutions for improving bread and noodle production, which are staples in the region. This partnership signals BASF’s focus on expanding in the rapidly growing Chinese food market.

Investments in the Food Enzymes Market

- April 2025: Novozymes secured an investment of $50 million in expanding its global manufacturing capabilities for food enzymes. The investment will be used to build state-of-the-art facilities aimed at increasing enzyme production for bakery, dairy, and beverage industries, addressing the surge in demand for more sustainable and functional food products.

- January 2025: DuPont announced a $30 million investment in its biotechnology division, focusing on developing enzymes for plant-based food alternatives. This initiative reflects DuPont’s commitment to meeting the growing consumer demand for plant-based protein products and addressing sustainability concerns in the food sector.

- December 2024: Enzyme Development Corporation (EDC) received a $15 million funding round from private equity investors to scale its enzyme production and research initiatives. The funds will be used to enhance the company’s capacity to provide enzymes that cater to both conventional and alternative food sectors, including plant-based meats and dairy.

- August 2024: Chr. Hansen made a $25 million investment in its enzyme R&D center in Denmark. The investment will help boost research into new enzyme applications that can improve food preservation and extend the shelf life of products while reducing food waste. This investment aligns with Chr. Hansen’s sustainability goals.

Collaborations in the Food Enzymes Market

- March 2025: DSM and Syngenta entered into a strategic partnership to co-develop enzyme solutions for plant-based food manufacturers. The collaboration aims to accelerate the development of enzyme formulations that improve protein extraction, enhancing the quality and texture of plant-based meat alternatives.

- February 2025: BASF teamed up with a leading Indian food producer to develop custom enzyme blends for enhancing the production of processed snacks. The collaboration is aimed at improving texture, shelf-life, and flavor profiles of products such as chips and crackers, in line with the growing demand for healthier snack options.

- December 2024: Novozymes and Cargill signed a joint development agreement to develop enzymes that optimize sugar production in soft drink manufacturing. The partnership will focus on improving efficiency and sustainability, helping beverage manufacturers reduce sugar content while maintaining taste and quality.

Expos & Conferences in the Food Enzymes Market

- March 2025: The International Food Ingredients Expo (IFE 2025), held in Tokyo, Japan, featured a major segment on food enzymes, with global leaders like Novozymes and DSM showcasing their latest enzyme solutions. Key topics discussed included enzyme innovation in sustainable food production, clean-label food products, and the rise of functional foods.

- September 2024: The Food Ingredients Asia (FIA 2024) in Jakarta, Indonesia, highlighted emerging trends in enzyme applications for functional foods and beverages. Companies like Chr. Hansen and BASF presented their latest enzyme-based products designed to address health concerns, including digestive health and sugar reduction in food production.

- June 2024: The Global Food Enzyme Summit (GFES 2024) took place in Paris, France, with notable participation from DuPont and Novozymes. The conference focused on the role of food enzymes in enhancing sustainability in food production and showcased various enzyme solutions that improve processing efficiency and reduce food waste.

Mergers & Acquisitions in the Food Enzymes Market

- April 2025: DuPont acquired Tate & Lyle’s enzymes business for $75 million, strengthening its position in the enzyme market for food and beverages. The acquisition is expected to enhance DuPont’s capabilities in enzyme production, particularly for the bakery and beverage sectors, as well as expand its footprint in North America.

- February 2025: Novozymes and Azelis entered into a merger agreement to combine their enzyme and biotechnology capabilities, creating a more robust global supply chain for food enzyme products. The merger will provide enhanced market access and innovation in enzyme solutions for the food, beverage, and nutraceutical industries.

- November 2024: BASF acquired Enzyme Technologies, Inc., a U.S.-based enzyme producer specializing in dairy and beverage enzymes, for $45 million. The acquisition will bolster BASF’s enzyme portfolio, particularly in dairy, where the company plans to expand its market presence by offering innovative enzyme solutions that improve product consistency and efficiency in dairy production.

- August 2024: Chr. Hansen merged its food enzyme division with that of FMC Corporation, creating a combined entity focused on innovation and sustainable enzyme solutions. The move was aimed at expanding their capabilities in producing enzymes for plant-based food products, further cementing their position in the growing market for plant-based alternatives.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 6,413.8 Mn |

| Forecast Value (2034) |

USD 12,928.4 Mn |

| CAGR (2025–2034) |

8.1% |

| The US Market Size (2025) |

USD 1,618.2 Mn |

| Historical Data |

2019 – 2024 |

| Forecast Data |

2026 – 2034 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Type (Carbohydrase, Proteases, Lipases, Polymerase & Nuclease, Other types), By Source (Microorganism, Plant, Animal), By Form (Lyophilized powder, Liquid, Other formulations), By Application (Food, Beverages, Textiles, Detergents, Animal Feed) |

| Regional Coverage |

North America – US, Canada; Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA |

| Prominent Players |

Novozymes, DuPont (Danisco), DSM, BASF, Chr. Hansen, AB Enzymes, Advanced Enzyme Technologies, Kerry Group, Syngenta, Lesaffre, Amano Enzyme, Brenntag, The Archer Daniels Midland Company (ADM), Insta-Pro International, Evonik Industries, Cargill, Sanofi, Prosol SpA, Verenium Corporation, and Rivertop Renewables., and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |

Frequently Asked Questions

How big is the Global Food Enzymes Market?

▾ The Global Food Enzymes Market size is estimated to have a value of USD 6,413.8 million in 2025 and is expected to reach USD 12,928.4 million by the end of 2034.

What is the size of the US Food Enzymes Market?

▾ The US Food Enzymes Market is projected to be valued at USD 1,618.2 million in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 3,130.6 million in 2034 at a CAGR of 7.6%.

Which region accounted for the largest Global Food Enzymes Market?

▾ Asia Pacific is expected to have the largest market share in the Global Food Enzymes Market with a share of about 37.1% in 2025.

Who are the key players in the Global Food Enzymes Market?

▾ Some of the major key players in the Global Food Enzymes Market are Novozymes, DuPont (Danisco), DSM, BASF, Chr. Hansen, AB Enzymes, Advanced Enzyme Technologies, Kerry Group, Syngenta, Lesaffre, Amano Enzyme, and many others.

What is the growth rate in the Global Food Enzymes Market in 2025?

▾ The market is growing at a CAGR of 8.1 percent over the forecasted period of 2025.