Market Overview

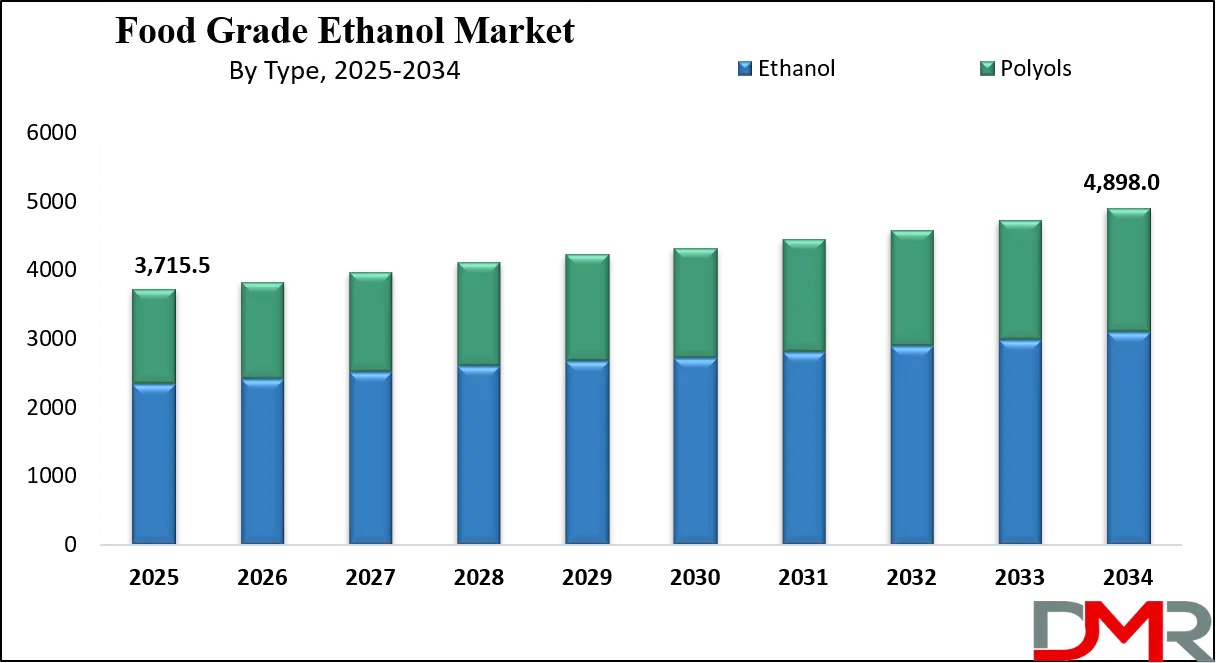

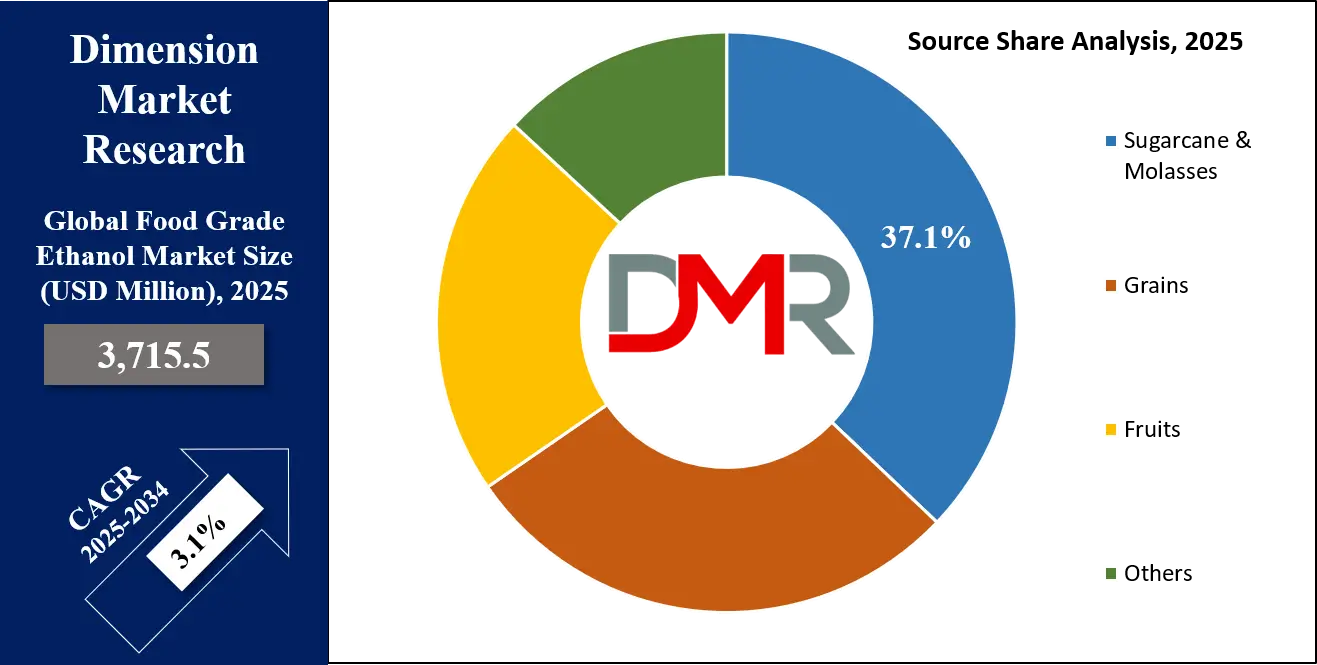

The Global Food Grade Ethanol Market is projected to reach USD 3,715.5 million in 2025 and grow at a compound annual growth rate of 3.1% from there until 2034 to reach a value of USD 4,898.9 million.

The global food grade ethanol market is witnessing sustained growth, fueled by rising demand across multiple industries including food processing, beverage manufacturing, pharmaceuticals, and personal care. Ethanol’s role as a natural preservative, solvent, and flavor enhancer makes it an essential ingredient in the formulation of numerous consumer products. The shift toward natural and organic ingredients is further propelling the adoption of food grade ethanol as a clean-label solution.

Additionally, technological innovations in fermentation and distillation have enhanced production efficiency, ensuring consistent purity and quality standards that meet stringent food safety regulations worldwide.

Emerging economies in Asia-Pacific and Latin America present lucrative opportunities due to the expansion of the packaged food sector and increased consumer spending on processed products. The trend of using ethanol in nutraceuticals, functional foods, and botanical extractions is accelerating, opening up new application avenues. Moreover, government initiatives promoting renewable bio-based chemicals align with the global sustainability drive, fostering investment in ethanol production.

Nevertheless, the market faces restraints such as volatile prices of feedstocks like corn, sugarcane, and wheat, which can directly impact production costs. Environmental concerns regarding land use and food security may also limit large-scale cultivation of ethanol-producing crops. Regulatory compliance with global food and drug safety norms can be another operational challenge.

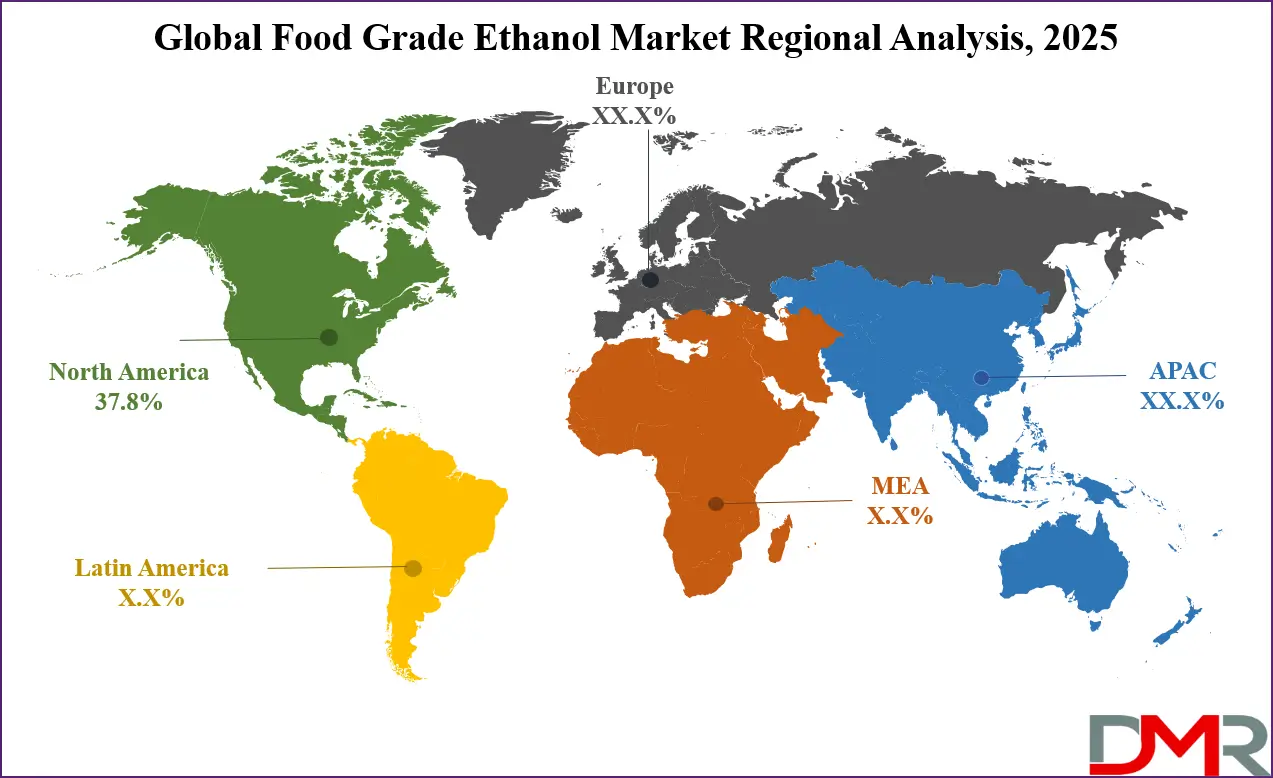

North America is projected to dominates due to its high ethanol production capacity and demand for processed consumables, followed by Europe’s strong focus on sustainability. Innovation, regulatory alignment, and feedstock diversification will remain critical to future market success.

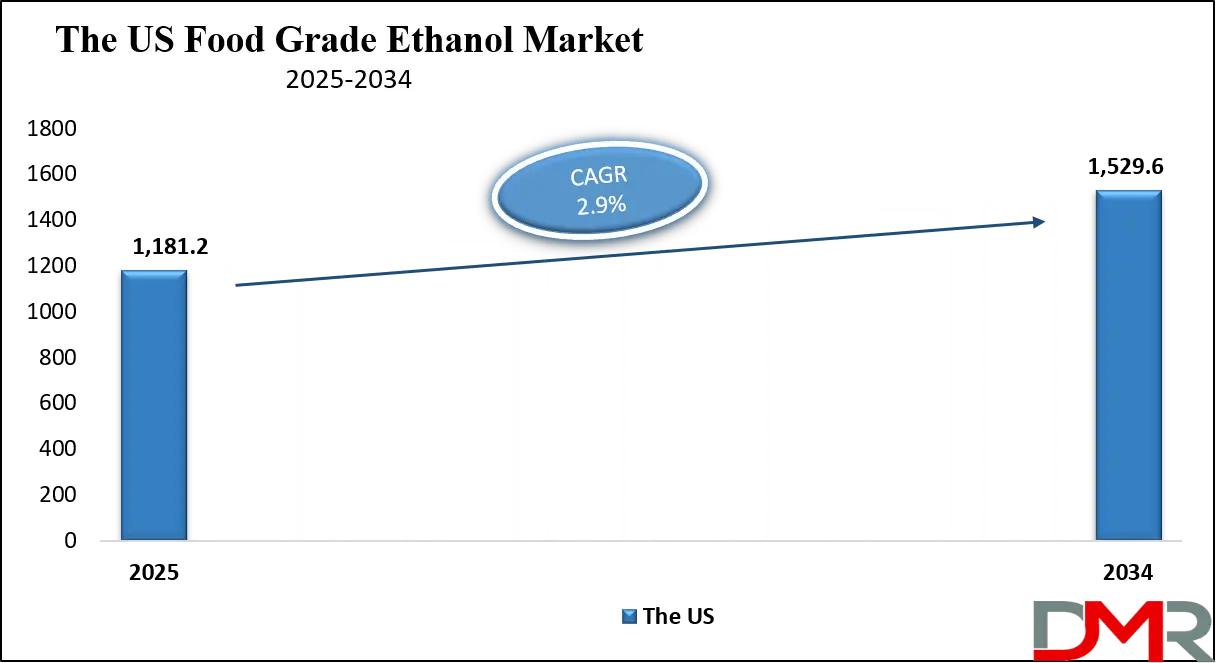

The US Food Grade Ethanol Market

The US Food Grade Ethanol Market is projected to reach USD 1,181.2 million in 2025 at a compound annual growth rate of 2.9% over its forecast period.

The United States holds a dominant position in the global food grade ethanol market, supported by a strong agricultural base and advanced ethanol refining technologies. The country is among the largest corn producers globally, providing abundant raw material for ethanol production. With a well-established network of distilleries and bio-refineries across major states such as Iowa, Illinois, and Nebraska, the U.S. can produce billions of gallons of ethanol annually, ensuring steady domestic supply and surplus for export.

Federal mandates like the Renewable Fuel Standard and state-level incentives encourage continuous ethanol production, creating spillover benefits for the food-grade segment. Although primarily designed for fuel-grade ethanol, these policies have stimulated technological growth and economies of scale for ethanol refining overall. The U.S. also boasts a diverse and large consumer base, with a high demand for processed and packaged foods, personal hygiene products, and over-the-counter medications all of which utilize ethanol during formulation.

The aging population and growing health consciousness are further fueling the pharmaceutical and nutraceutical sectors, where food grade ethanol plays a role as a solvent and ingredient carrier. Additionally, a surge in demand for clean-label, alcohol-based sanitizers and disinfectants post-COVID has expanded food-grade ethanol’s industrial scope.

With strong regulatory infrastructure from agencies like the FDA and USDA, U.S. manufacturers uphold high standards of food safety, ensuring compliance in food-grade ethanol production. Robust logistics and export capabilities make the country a global leader, with potential for continued growth in food, beverage, and bio-based product applications.

The Europe Food Grade Ethanol Market

The Europe Food Grade Ethanol Market is estimated to be valued at USD 654.3 million in 2025 and is Europe’s food grade ethanol market is characterized by its strong alignment with environmental sustainability, bioeconomy policies, and innovation in agricultural practices. Major ethanol-producing countries such as France, Germany, and the Netherlands contribute significantly to the market with widespread use of wheat, rye, and sugar beet as primary feedstocks. These countries benefit from well-developed agro-industrial ecosystems and government subsidies that support bio-refinery operations.

The European Union’s regulatory framework under the Renewable Energy Directive promotes renewable chemical manufacturing, including ethanol. While the directive primarily governs biofuel production, it fosters technological improvements and efficient feedstock utilization, which benefit the food-grade ethanol sector. A rising demand for alcohol-based confectioneries, cooking extracts, and botanical infusions in European cuisines has also contributed to market expansion.

Europe’s consumer market favors clean-label and natural ingredients, driving the demand for ethanol in flavorings, organic preservatives, and botanical extracts. The region’s commitment to low-carbon economies ensures steady R&D investment in second-generation ethanol from non-food biomass, improving market resilience against crop price volatility.

Demographically, Europe has an aging but health-conscious population. The pharmaceutical and nutraceutical industries are expanding rapidly, especially in countries like Germany and Sweden, where food grade ethanol is used in oral solutions, elixirs, and health supplements.

Furthermore, Europe’s strong export capability, advanced supply chains, and collaboration between academia and industry create a favorable climate for innovation. As demand rises in premium food products and pharmaceutical ingredients, Europe remains a mature yet growing market with a strong emphasis on sustainability and compliance.

The Japan Food Grade Ethanol Market

The Japan Food Grade Ethanol Market is projected to be valued at USD 222.9 million in 2025. It is further expected to witness subsequent growth in the upcoming period, holding USD 290.8 million in 2034 at a CAGR of 3.0%.

Japan’s food grade ethanol market is uniquely shaped by its limited natural resources, high-quality standards, and import-reliant ethanol supply chain. The country’s ethanol production capacity is relatively modest, owing to scarce arable land and unfavorable conditions for large-scale cultivation of ethanol-yielding crops such as sugarcane and corn. As a result, Japan depends heavily on imported ethanol, primarily for use in non-fuel applications such as food additives, personal care products, and pharmaceuticals.

Government policies in Japan encourage the gradual shift toward renewable energy and sustainable chemical inputs. While fuel-grade ethanol has seen limited adoption due to high electric vehicle penetration and declining gasoline demand, food grade ethanol consumption is increasing in tandem with demand from health-conscious and aging consumers. Japan has one of the world’s oldest populations, creating significant demand for pharmaceutical products and wellness foods where ethanol serves as a solvent and carrier agent.

Japanese food and beverage industries are renowned for their emphasis on safety, cleanliness, and minimal processing. Ethanol is used in food preservation, flavor extraction, and traditional beverage production such as sake, contributing to its diverse utility in the market. Additionally, growing popularity of natural personal care products has spurred demand for ethanol as a key component in toners, sanitizers, and herbal extracts.

Advanced research institutions and government-backed innovation programs are exploring ways to improve ethanol yields from cellulosic biomass, which could reduce import dependence in the long term. Despite structural limitations, Japan's food grade ethanol market continues to grow steadily through quality-focused, high-value applications.

Global Food Grade Ethanol Market: Key Takeaways

- Global Market Size Insights: The Global Food Grade Ethanol Market size is estimated to have a value of USD 3,715.5 million in 2025 and is expected to reach USD 4,898.9 million by the end of 2034.

- The US Market Size Insights: The US Food Grade Ethanol Market is projected to be valued at USD 1,181.2 million in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 1,529.6 million in 2034 at a CAGR of 2.9%.

- Regional Insights: North America is expected to have the largest market share in the Global Food Grade Ethanol Market with a share of about 37.8% in 2025.

- Key Players: Some of the major key players in the Global Food Grade Ethanol Market are Archer Daniels Midland Company, Cargill Incorporated, MGP Ingredients Inc., Wilmar International Limited, Cristalco, Grain Processing Corporation, Manildra Group, Greenfield Global Inc., Roquette Frères, Tereos S.A., and many others.

- The Global Market Growth Rate: The market is growing at a CAGR of 3.1 percent over the forecasted period of 2025.

Global Food Grade Ethanol Market: Use Cases

- Alcoholic Beverages: Food grade ethanol is a key component in brewing and distilling spirits such as vodka, gin, rum, and whiskey. Its high purity ensures flavor consistency and safety in the final product, aligning with beverage industry regulations for alcoholic content and cleanliness in manufacturing.

- Natural Flavor Extracts: Ethanol is widely used in producing flavor concentrates like vanilla, citrus, and herbal extracts. Its solvent properties enable efficient extraction from raw botanical materials, preserving aromatic compounds and enhancing the flavor profile in candies, baked goods, and dairy-based food products.

- Pharmaceutical Formulations: In the pharmaceutical industry, food grade ethanol functions as a stabilizer, solvent, and carrier in liquid medications, tinctures, and antiseptic solutions. Its antimicrobial nature ensures extended shelf life, and it aids in dissolving active ingredients for better therapeutic performance in consumer healthcare products.

- Personal Care Products: Personal care brands utilize ethanol in perfumes, deodorants, mouthwashes, and sanitizers for its volatility and quick evaporation. It also acts as a preservative and delivery agent, enhancing product stability and fragrance longevity while meeting cosmetic industry purity standards.

- Food Preservation: Ethanol helps in preserving perishable food items like baked goods and meat by inhibiting microbial growth. It serves as a clean-label preservative, extending shelf life without synthetic additives, and is especially favored in organic and ready-to-eat food segments demanding natural solutions.

Global Food Grade Ethanol Market: Stats & Facts

United States Department of Agriculture (USDA)

- In 2022, the U.S. produced approximately 15.4 billion gallons of ethanol, a substantial volume of which is diverted to food-grade and industrial applications such as beverage alcohol, pharmaceutical solvents, and flavor carriers.

- USDA projected that U.S. ethanol producers would consume 5.45 billion bushels of corn in the 2023–2024 marketing year, marking a 5.3% increase from the prior year, signifying growing demand for ethanol across fuel and food-grade sectors.

- In 2024, U.S. ethanol exports for non-beverage uses reached a value of $4.31 billion, with key export destinations including Canada ($1.47 billion), the United Kingdom ($535.12 million), and India ($441.25 million), indicating the expanding global demand for food and industrial-grade ethanol from the U.S.

Government of India

- India is pushing aggressively toward its ethanol blending target of 20% by 2025–26, up from a current average of 13%-14%, with parallel implications for expanding food-grade ethanol infrastructure and distilleries.

- The government has granted sugar mills permission to produce ethanol directly from sugarcane juice or syrup, allowing greater diversification and efficiency in ethanol production pathways, including for food-grade applications.

- As part of its ethanol expansion drive, India is increasingly relying on corn as a raw material, turning the country into a net importer of corn, with projections estimating 1 million metric tons of corn imports in 2024 to meet ethanol feedstock demand.

Brazilian Government

- Brazil produced 26.72 billion liters (7.06 billion U.S. gallons) of ethanol fuel in 2017, accounting for 26.1% of the global ethanol fuel supply. While primarily used as biofuel, significant volumes are refined into food-grade ethanol due to Brazil’s sugarcane-based production advantages.

- The country remains a leading producer of sugarcane-based ethanol, which is also widely used in food, beverages, and cosmetics, making Brazil a dominant exporter of food-grade ethanol in global markets.

Australian Government

- In New South Wales, government mandates require 6% of petrol sales to be derived from bioethanol, effectively meaning that 60% of all petrol sales must be E10 fuel, supporting ethanol processing infrastructure that overlaps with food-grade ethanol capabilities.

- Queensland mandates that ethanol comprise 3% of total regular and ethanol-blended unleaded petrol sales each quarter, stimulating ethanol production systems that also cater to food, beverage, and pharmaceutical ethanol standards.

Renewable Fuels Association (RFA)

- In 2024, the United States accounted for 52% of global ethanol production, producing around 16.219 billion gallons, a significant share of which supports food, beverage, and industrial-grade ethanol applications.

- Brazil followed closely as the second-largest producer, contributing 8.78 billion gallons, or 28% of the global ethanol output, with a large share derived from sugarcane and used across food, beverage, and export industries.

- The total global ethanol production in 2024 was 31.21 billion gallons, showcasing the extensive scale of the ethanol market with broad applications in food-grade, industrial, and fuel sectors.

Global Food Grade Ethanol Market: Market Dynamic

Driving Factors in the Global Food Grade Ethanol Market

Expanding Processed Food and Beverage Industries Globally

The rapid growth of the global processed food and beverage industries is a primary driver for the food-grade ethanol market. With increasing urbanization, changing consumer lifestyles, and growing disposable incomes especially in emerging economies such as China, India, Brazil, and Indonesia there has been a dramatic rise in the consumption of packaged and convenience foods.

Food-grade ethanol is widely used in these industries as a solvent for food colors and flavors, a carrier for active ingredients, and a preservative for shelf-life extension. In beverages, especially in alcoholic drinks, ethanol forms the primary ingredient in spirits such as vodka, gin, and liqueurs. With alcohol consumption growing in developing regions and premiumization trends dominating in mature markets, the need for high-purity ethanol is escalating.

Moreover, the increasing demand for ready-to-drink (RTD) cocktails and low-alcohol beverages is reinforcing the ethanol supply chain. Globally, multinational food and beverage companies are expanding production capacities, particularly in Asia-Pacific and Latin America, thereby generating substantial demand for consistent, high-quality food-grade ethanol.

Additionally, the foodservice sector's rebound post-pandemic has also contributed to higher demand for processed food ingredients and beverage alcohol, further propelling the growth of the food-grade ethanol market across both developing and developed regions.

Regulatory Support for Ethanol in Food Applications

Government regulations and food safety standards that support the use of ethanol in food processing are acting as strong growth drivers for the global food-grade ethanol market. Regulatory authorities such as the U.S. Food and Drug Administration (FDA), the European Food Safety Authority (EFSA), and the Food Safety and Standards Authority of India (FSSAI) recognize ethanol as Generally Recognized As Safe (GRAS) when used in accordance with specified guidelines.

These approvals have facilitated its use in various food and beverage products, including extracts, colorants, preservatives, and spirits. Furthermore, as global food laws continue to converge towards harmonized safety standards, international food manufacturers are increasing their reliance on compliant food-grade ethanol sources to ensure cross-border regulatory adherence.

The use of ethanol in organic and clean-label formulations is also receiving regulatory encouragement, especially in the EU and the U.S., where natural solvents are being promoted over synthetic alternatives. Moreover, ethanol is increasingly being incorporated into national bioeconomy policies, which emphasize sustainability and renewable inputs in food systems. This alignment between food-grade ethanol and eco-friendly, compliant manufacturing further strengthens its market position. As food safety regulations tighten worldwide, demand for traceable, certified, and high-purity ethanol is expected to rise steadily.

Restraints in the Global Food Grade Ethanol Market

Fluctuating Raw Material Prices and Supply Chain Disruptions

One of the most significant restraints in the food-grade ethanol market is the volatility in raw material prices, particularly for feedstocks such as corn, sugarcane, wheat, and other grains. These agricultural commodities are heavily influenced by seasonal cycles, weather anomalies, trade policies, and geopolitical tensions. For example, adverse climatic conditions in key producing regions like the U.S. Midwest or Brazil can severely disrupt corn or sugarcane harvests, leading to supply shortages and spikes in ethanol prices.

Additionally, the global supply chain disruptions triggered by the COVID-19 pandemic and exacerbated by ongoing conflicts (e.g., Russia-Ukraine) have impacted transportation, freight availability, and input costs.Ethanol producers often pass these costs onto downstream buyers, making it harder for food manufacturers, especially small and medium enterprises, to sustain production costs.

Moreover, fluctuations in oil prices also impact ethanol demand for fuel blending, which in turn influences production allocation for food-grade use. Inconsistent supply of quality feedstock and rising input prices make it challenging to maintain consistent ethanol purity and safety standards, leading to potential quality assurance concerns. Overall, the unpredictability in raw material sourcing and related cost escalations remain major challenges hindering the smooth growth of the global food-grade ethanol market.

Regulatory Restrictions and Taxation on Alcoholic Content in Some Countries

In several countries, especially in parts of the Middle East, Asia, and Africa, stringent regulations and high taxation on alcohol-related products hinder the free usage and trade of food-grade ethanol. Even though food-grade ethanol is non-consumable in its industrial or raw form, its association with beverage and recreational alcohol triggers strict regulatory scrutiny.

In countries with religious or cultural prohibitions on alcohol, ethanol used in food products such as flavor extracts, tinctures, and colorants may be subject to import bans, licensing issues, or lengthy clearance processes. These restrictions significantly limit the ability of global manufacturers to penetrate these markets.

Moreover, tax policies in some jurisdictions classify food-grade ethanol similarly to beverage-grade ethanol, imposing high excise duties that inflate the cost structure for food and beverage processors. Such regulatory hurdles discourage investment and restrict innovation in food product development. Companies often face added burdens in terms of documentation, safety compliance, and traceability requirements, which can delay market entry and add operational complexity. Therefore, restrictive regulatory environments in several emerging and culturally conservative regions represent a considerable obstacle to the universal growth of food-grade ethanol across global markets.

Opportunities in the Global Food Grade Ethanol Market

Rise of Organic and Plant-Based Food Production

The global surge in organic and plant-based food production presents a major opportunity for the food-grade ethanol market. Organic food manufacturers are turning to ethanol as a key solvent and carrier because of its compatibility with organic certification processes. Ethanol derived from organic corn, sugarcane, or grains aligns perfectly with the clean-label demands of organic food consumers, who seek transparency, sustainability, and minimal processing.

Additionally, plant-based meat alternatives and dairy-free products often utilize ethanol-based flavor systems to replicate traditional taste profiles. These food categories are rapidly expanding, particularly in Western Europe and North America, where plant-forward diets are becoming mainstream.

In such applications, ethanol acts as a medium to deliver botanical extracts and natural flavors without compromising the product's organic integrity. Moreover, the rising demand for organic herbal teas, natural tinctures, and alcohol-free elixirs, especially in e-commerce-driven health and wellness niches, has created an emerging avenue for food-grade ethanol suppliers. Producers capable of offering non-GMO, certified organic ethanol are well-positioned to benefit from this trend. As organic food markets expand in Asia-Pacific and Latin America, and regulatory certifications become more accessible, the growth potential for food-grade ethanol in plant-based and organic sectors is immense.

Expansion of Ethanol Applications in Culinary Innovations and Molecular Gastronomy

Food-grade ethanol is increasingly being embraced by chefs, mixologists, and food technologists involved in molecular gastronomy and culinary innovation. Ethanol's solvent properties, rapid evaporation rate, and flavor enhancement capabilities make it an ideal medium in avant-garde cooking techniques such as cold infusion, extract creation, and texture modification.

Culinary schools and high-end restaurants are adopting ethanol-based methodologies for creating artisan infusions, edible perfumes, alcohol-based gels, and spray-on flavorings. This innovation trend is particularly strong in regions like North America, Western Europe, and Japan, where the premium dining sector continuously explores unique food experiences.

Furthermore, ethanol is used to develop non-traditional emulsions, spherification solutions, and rapid-marination systems that appeal to gourmet and experimental cooking segments. As consumer interest grows in chef-driven and high-sensory culinary formats, demand for safe, high-purity food-grade ethanol is expected to follow suit.

This trend is further magnified by the emergence of experiential dining, food science education, and craft beverage segments, including small-batch distilling and mixology. The intersection of ethanol’s technical functionality and creative flexibility offers a fertile ground for market expansion beyond traditional food processing, positioning food-grade ethanol as a vital ingredient in the evolving gastronomic landscape.

Trends in the Global Food Grade Ethanol Market

Increasing Consumer Shift Toward Natural and Clean-Label Ingredients

A growing global preference for clean-label and naturally derived food and beverage ingredients is significantly influencing the demand for food-grade ethanol. Consumers are increasingly seeking transparency in product labeling, prompting manufacturers to replace synthetic solvents and preservatives with natural alternatives. Food-grade ethanol, being derived from plant-based sources such as corn, sugarcane, or wheat, is widely used as a carrier solvent in natural flavorings, extracts, and botanical infusions.

This shift is particularly strong in developed markets like North America and Europe, where organic and minimally processed food trends dominate consumer behavior. Additionally, regulatory bodies such as the FDA and EFSA support the use of ethanol in food processing, reinforcing its acceptance in clean-label product formulations.

As the natural food trend continues to rise in Asia-Pacific and Latin America, propelled by urbanization and increased health awareness, the global demand for food-grade ethanol is expected to grow steadily. This trend is also influencing innovation among ethanol producers, leading to the development of higher purity grades and specialty alcohols for functional food applications. Consequently, food-grade ethanol is no longer viewed solely as a processing aid but as an active component contributing to the marketability of food products in the “natural ingredients” segment.

Adoption of Bio-Ethanol in Nutraceutical and Functional Foods

Food-grade ethanol is increasingly being utilized in the formulation of nutraceuticals, herbal supplements, and functional beverages. This trend is driven by the growing popularity of plant-based and herbal remedies, especially in regions such as Asia-Pacific, where traditional medicine systems are being integrated with modern food and beverage innovations.

Ethanol acts as an effective extraction solvent for bioactive compounds such as polyphenols, alkaloids, flavonoids, and essential oils from medicinal plants. The purity and safety profile of food-grade ethanol ensures that it meets stringent pharmaceutical and food safety standards, making it suitable for encapsulated nutraceutical products and ready-to-drink wellness beverages.

Additionally, global consumers increasingly associate plant-derived functional foods with health benefits ranging from cognitive enhancement to immune support, further driving demand. In Western markets, clean-label wellness shots, tinctures, and organic tonics often incorporate ethanol-based botanical extracts.

This evolving demand is pushing food-grade ethanol producers to collaborate with nutraceutical and beverage companies for tailor-made solutions. As regulatory environments continue to approve more herbal ingredients for mainstream use, the utilization of food-grade ethanol in functional food and beverage categories is poised to escalate, firmly anchoring it as a trend in health-conscious food processing globally.

Global Food Grade Ethanol Market: Research Scope and Analysis

By Type Analysis

Ethanol is projected to dominate the type segment in the global food-grade ethanol market due to its widespread functional versatility, regulatory acceptance, and critical role as a core solvent and carrier in food and beverage formulations. Ethanol’s primary advantage lies in its superior solvent properties, enabling it to efficiently extract and preserve flavor compounds, essential oils, and bioactives from natural sources.

This makes it indispensable in the manufacturing of food flavorings, herbal tinctures, colorants, and essential culinary extracts such as vanilla. Moreover, food-grade ethanol meets stringent purity standards and is classified as Generally Recognized As Safe (GRAS) by major regulatory bodies, including the FDA and EFSA, further driving its extensive adoption in food processing and beverage industries.

Ethanol is also the key ingredient in alcoholic beverages such as vodka, rum, whiskey, and liqueurs. Its dominance is further bolstered by the rising demand for craft spirits, low-alcohol RTD beverages, and wellness drinks infused with ethanol-extracted botanicals.

Additionally, ethanol’s compatibility with clean-label, natural, and organic food trends makes it a preferred solvent over synthetic or petrochemical alternatives. Its biodegradability and renewable sourcing potential align with global sustainability goals, strengthening its relevance across diverse applications.

Technological advancements in purification techniques, such as molecular distillation, allow producers to achieve food-grade and even pharmaceutical-grade ethanol with exceptional purity, expanding its usability. Owing to these factors, functionality, regulatory favorability, and evolving consumer preferences, ethanol has firmly cemented its position as the dominant type in the global food-grade ethanol market and is expected to maintain this lead in the foreseeable future.

By Source Analysis

Sugarcane and molasses are poised to dominate the source segment of the global food-grade ethanol market due to their high fermentable sugar content, cost-effectiveness, and strong regional availability, particularly in ethanol-producing powerhouses like Brazil, India, and Thailand. These feedstocks offer a sustainable and efficient raw material base, allowing ethanol producers to achieve high conversion yields with relatively lower environmental impact compared to grain-based alternatives such as corn or wheat. Sugarcane, in particular, contains sucrose, which is easily fermentable, reducing the need for enzymatic treatment and energy-intensive processing, thereby lowering production costs.

Molasses, a byproduct of sugar refining, adds further economic viability to the supply chain. It enables ethanol production without competing with food crops, aligning with circular economy principles and boosting its appeal in sustainability-conscious markets. Moreover, sugarcane and molasses-derived ethanol are widely used in food applications due to their naturally derived and non-GMO profiles, making them ideal for organic, halal, and kosher-certified food and beverage formulations.

From a regulatory standpoint, countries with abundant sugarcane resources have structured favorable bioethanol policies and subsidies, enhancing the commercial attractiveness of these feedstocks. Brazil, for instance, is a global leader in ethanol production from sugarcane and maintains significant export capacity for food-grade ethanol.

The scalability and availability of sugarcane and molasses-based ethanol, coupled with its compliance with international food safety standards, position it as the dominant source. As sustainability pressures and feedstock optimization trends intensify, sugarcane and molasses are likely to continue leading the global food-grade ethanol source segment.

By Ethanol Plant Type Analysis

Standalone ethanol plants are expected to dominate the ethanol plant type segment in the global food-grade ethanol market due to their specialized infrastructure, production efficiency, and capability to maintain stringent quality control standards essential for food-grade outputs. Unlike integrated plants, which produce ethanol as a secondary output from sugar or starch processing, standalone facilities are dedicated solely to ethanol production, allowing for process optimization tailored to purity, flavor neutrality, and safety requirements demanded in food and beverage applications.

These plants are designed with state-of-the-art distillation columns, dehydration units, and advanced purification technologies such as molecular sieves and rectification columns. This technical sophistication enables producers to consistently achieve ethanol grades of 95% or higher purity, which is critical for use in flavor extracts, herbal infusions, and consumable products. Furthermore, the controlled environment and closed-loop operations of standalone plants reduce contamination risk, ensuring compliance with international food safety standards such as HACCP, ISO 22000, and GMP certifications.

Standalone ethanol plants also offer flexibility in feedstock sourcing, allowing manufacturers to adapt to local availability of sugarcane, molasses, or grains. This adaptability improves cost-effectiveness while maintaining consistent product quality. Additionally, these facilities typically benefit from economies of scale, streamlined supply chains, and more predictable output levels, making them attractive to multinational food and beverage manufacturers requiring large volumes of food-grade ethanol.

With increasing demand from the food, beverage, and nutraceutical sectors for high-purity, consistent, and regulation-compliant ethanol, standalone plants are uniquely positioned to meet these needs, thereby securing their dominance in the global food-grade ethanol production landscape.

By Function Analysis

Flavoring agents are poised to command the function segment of the global food-grade ethanol market due to ethanol’s unmatched efficacy in extracting, preserving, and delivering concentrated flavor profiles from both natural and synthetic sources. Ethanol is highly effective at dissolving both hydrophilic and lipophilic flavor compounds, making it ideal for creating complex flavor blends used extensively in processed foods, confections, snacks, and beverages. Its volatility ensures that it evaporates quickly after delivering the flavor, leaving no residue or aftertaste, which is particularly critical in delicate food applications.

The demand for natural flavorings is rapidly growing, especially with the global push toward clean-label, organic, and minimally processed foods. Ethanol allows manufacturers to extract flavors from botanicals, spices, fruits, and herbs without the need for synthetic carriers or chemical solvents. As a result, it plays a pivotal role in enabling clean-label product development, especially in premium segments like gourmet foods, wellness beverages, and plant-based meat alternatives.

Moreover, ethanol-based flavoring agents are extensively used in alcoholic beverages such as liqueurs, bitters, and craft spirits, where the preservation of nuanced flavor notes is vital. The combination of ethanol’s preservative qualities and its ability to carry volatile aromatic compounds ensures shelf stability and flavor integrity over time. Regulatory approvals by major food authorities further reinforce ethanol’s role in flavoring applications. As the flavor enhancement trend continues to influence global food innovation, food-grade ethanol remains indispensable, thus ensuring flavoring agents retain the dominant share in the function segment of the market.

By Application Analysis

Beverages are anticipated to hold the dominant position in the application segment of the global food-grade ethanol market, primarily because ethanol is a foundational ingredient in the production of both alcoholic and functional beverages. In alcoholic drinks, ethanol is the core component in spirits such as vodka, whiskey, rum, and liqueurs.

The global rise in premiumization of alcohol, along with the surge in demand for craft and artisanal beverages, has significantly increased the need for high-purity food-grade ethanol. Consumers are increasingly seeking clean, high-quality formulations, making food-grade ethanol the preferred choice for beverage manufacturers looking to maintain consistency, safety, and superior taste profiles.

In non-alcoholic and functional beverage segments, ethanol plays a critical role as a carrier solvent for natural extracts, botanical flavors, and herbal infusions. Wellness beverages, energy shots, and plant-based tonics often use ethanol-extracted ingredients to enhance efficacy and taste while complying with clean-label standards. The quick evaporation and preservative nature of ethanol also ensure extended shelf life without compromising flavor integrity.

Moreover, evolving consumer preferences for personalized and natural beverage options have led to a surge in ethanol-based tinctures, bitters, and elixirs. Regions such as North America and Western Europe are experiencing an uptick in low- and no-alcohol beverages where ethanol is used in micro-doses for flavor extraction. Coupled with robust regulatory support and growing innovation in beverage formulations, these factors collectively contribute to the dominance of the beverage segment in the global food-grade ethanol market.

The Global Food Grade Ethanol Market Report is segmented on the basis of the following:

By Type

- Ethanol

- Polyols

- Sorbitol

- Xylitol

- Glycerol

- Mannitol

By Source

- Sugarcane & Molasses

- Grains

- Fruits

- Others

By Ethanol Plant Type

- Standalone Ethanol Plants

- Integrated Ethanol Plants

- Cellulosic Ethanol Plants

By Function

- Flavoring Agents

- Preservatives

- Coloring Agents

- Coatings

- Others

By Application

- Beverages

- Food

- Pharmaceuticals & Nutraceuticals

- Personal Care & Cosmetics

- Others

Global Food Grade Ethanol Market: Regional Analysis

Region with the Largest Revenue Share

North America is projected to dominate the global food-grade ethanol market as it holds 37.8% of the total market revenue by the end of 2025, due to its advanced ethanol production infrastructure, regulatory clarity, and strong demand from the food and beverage industries. The United States is one of the largest producers and exporters of ethanol, benefiting from a robust supply chain and large-scale corn-based ethanol manufacturing.

The region has a high prevalence of processed food and beverage consumption, which requires ethanol for flavoring, extraction, and preservation. Regulatory approvals by agencies such as the U.S. FDA and USDA reinforce confidence in ethanol use for food-grade applications. Additionally, the region supports innovation through clean-label, organic, and fortified food trends sectors, where ethanol is extensively used.

Major beverage manufacturers and food processing giants headquartered in North America ensure consistent demand and contribute to technological advancement in ethanol purification. Furthermore, favorable ethanol blending mandates and subsidies, along with export-oriented policies, have strengthened the region’s ethanol industry. These factors collectively position North America as the leading region in both production and consumption of food-grade ethanol.

Region with the Highest CAGR

Asia Pacific exhibits the highest CAGR in the global food-grade ethanol market due to its expanding food processing sector, rising health-conscious population, and increasing demand for premium and functional foods. Countries such as India, China, Thailand, and Indonesia are investing heavily in bioethanol production using sugarcane and molasses, which are widely available in the region. These feedstocks offer cost-effective ethanol production, encouraging local manufacturing of food-grade ethanol for flavorings, extracts, and herbal infusions.

rapid urbanization and evolving consumer preferences in the Asia Pacific are driving demand for processed beverages, ready-to-eat foods, and natural additives segments, where ethanol plays a vital role. Additionally, growing regulatory alignment with international food safety standards is creating new export opportunities for ethanol producers in the region. The increasing presence of multinational food and beverage companies, along with government-led ethanol production incentives, continues to fuel industry growth. As a result, Asia Pacific is projected to record the fastest growth in food-grade ethanol consumption globally.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Global Food Grade Ethanol Market: Competitive Landscape

The global food-grade ethanol market is characterized by the presence of both multinational ethanol producers and regionally integrated companies specializing in high-purity ethanol for food and beverage applications. Leading players such as Cargill Incorporated, Archer Daniels Midland Company, and Green Plains Inc. have established a dominant position through vertically integrated supply chains, access to abundant raw materials, and advanced purification technologies. These companies consistently invest in distillation and dehydration innovations to meet stringent food safety standards and address the growing demand for organic, non-GMO, and kosher-certified ethanol.

European players like CropEnergies AG and Cristalco play a significant role by leveraging sugar beet and wheat-based ethanol production tailored for the beverage and food flavoring sectors. In Brazil and Asia, companies such as Tereos and Manildra Group are expanding their capacities to meet regional and export demand, especially with increasing sugarcane-based ethanol output.

Strategic partnerships with beverage manufacturers, certifications for international food safety standards, and sustainable production practices are key differentiators in the competitive landscape. M&A activities and geographic expansion remain critical strategies as companies look to enhance their market presence and serve high-growth regions such as Asia Pacific and Latin America. Competitive pricing and product customization are also crucial for long-term positioning.

Some of the prominent players in the Global Food Grade Ethanol Market are:

- Archer Daniels Midland Company (ADM)

- Cargill, Incorporated

- MGP Ingredients, Inc.

- Wilmar International Limited

- Cristalco

- Grain Processing Corporation

- Manildra Group

- Greenfield Global Inc.

- Roquette Frères

- Tereos S.A.

- ALCOGROUP

- EthanolSA Pty Ltd

- Godavari Biorefineries Ltd.

- Sasol Limited

- United Ethanol LLC

- BP Bunge Bioenergia

- CropEnergies AG

- The Andersons, Inc.

- Kavita Industries

- Sigma-Aldrich (Merck Group)

- Other Key Players

Recent Developments in the Global Food Grade Ethanol Market

- February 2025: Cargill Inc. completed the acquisition of the remaining 50% stake in SJC Bionergia, significantly boosting its ethanol production capabilities and solidifying its footprint in Brazil’s food and beverage sector.

- January 2025: RCM Technologies launched its New Ethanol Expansion Technology (NEXT) program to help modernize ethanol plant infrastructure and improve production capacity without requiring major capital investments in equipment.

- November 2024: The 28th Annual Distillers Grains Symposium was hosted in St. Louis, Missouri, focusing on key ethanol byproducts, regulatory frameworks, and innovation in ethanol coproduct utilization in food and feed sectors.

- September 2024: Novonesis introduced the Innova Yeast series, a line of highly engineered yeast strains aimed at enhancing ethanol production yields, cutting down fermentation time, and reducing energy input for food-grade ethanol manufacturing.

- August 2024: Be8 began construction of a new ethanol plant in Brazil to process triticale and wheat, aiming to diversify feedstock sources for food-grade ethanol. Praj Industries provided engineering and licensing support. The plant received a R$729.7 million investment from BNDES and is expected to be operational by 2026.

- June 2024: The International Fuel Ethanol Workshop & Expo in Omaha, Nebraska, gathered global stakeholders to explore cutting-edge ethanol production technologies, focusing on food-grade and low-carbon ethanol applications.

- February 2024: Roquette expanded its NUTRALYS® pea protein portfolio to complement its ethanol business, targeting high-protein nutritional products and enhancing ethanol’s use in health-focused food categories.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 3,715.5 Mn |

| Forecast Value (2034) |

USD 4,898.9 Mn |

| CAGR (2025–2034) |

3.1% |

| The US Market Size (2025) |

USD 1,181.2 Mn |

| Historical Data |

2019 – 2024 |

| Forecast Data |

2026 – 2034 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Type (Ethanol, Polyols), By Source (Sugarcane & Molasses, Grains, Fruits, Others), By Ethanol Plant Type (Standalone Ethanol Plants, Integrated Ethanol Plants, Cellulosic Ethanol Plants), By Function (Flavoring Agents, Preservatives, Coloring Agents, Coatings, Others), By Application (Beverages, Food, Pharmaceuticals & Nutraceuticals, Personal Care & Cosmetics, Others) |

| Regional Coverage |

North America – US, Canada; Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA |

| Prominent Players |

Archer Daniels Midland Company, Cargill Incorporated, MGP Ingredients Inc., Wilmar International Limited, Cristalco, Grain Processing Corporation, Manildra Group, Greenfield Global Inc., Roquette Frères, Tereos S.A., ALCOGROUP, EthanolSA Pty Ltd, Godavari Biorefineries Ltd., Sasol Limited, United Ethanol LLC, BP Bunge Bioenergia, CropEnergies AG, The Andersons Inc., Kavita Industries, Sigma-Aldrich (Merck Group), and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |

Frequently Asked Questions

The Global Food Grade Ethanol Market size is estimated to have a value of USD 3,715.5 million in 2025 and is expected to reach USD 4,898.9 million by the end of 2034.

The US Food Grade Ethanol Market is projected to be valued at USD 1,181.2 million in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 1,529.6 million in 2034 at a CAGR of 2.9%.

North America is expected to have the largest market share in the Global Food Grade Ethanol Market, with a share of about 37.8% in 2025.

Some of the major key players in the Global Food Grade Ethanol Market are Archer Daniels Midland Company, Cargill Incorporated, MGP Ingredients Inc., Wilmar International Limited, Cristalco, Grain Processing Corporation, Manildra Group, Greenfield Global Inc., Roquette Frères, Tereos S.A., and many others.

The market is growing at a CAGR of 3.1 percent over the forecasted period of 2025.