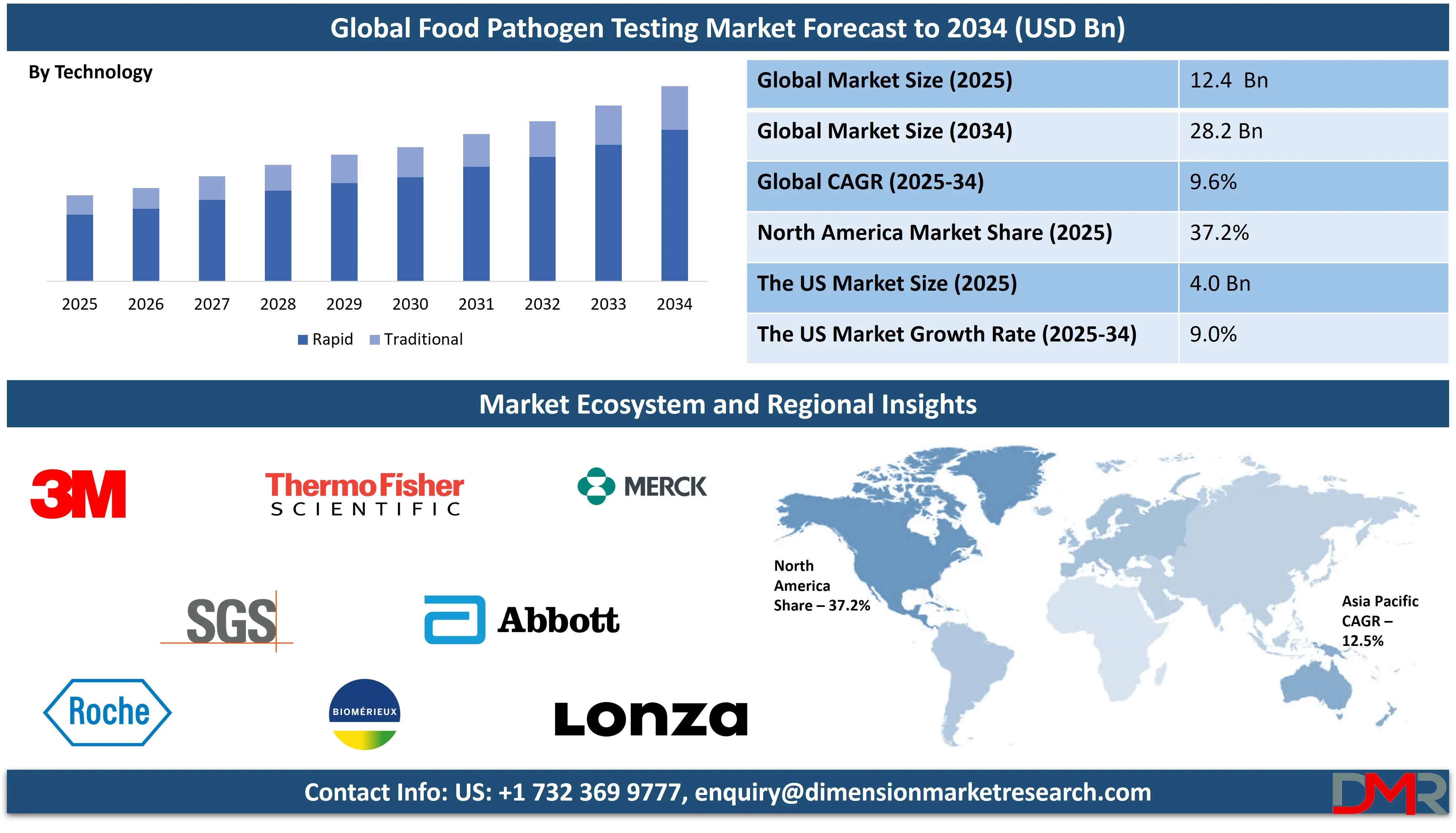

in 2025 and grow at a compound annual growth rate of 9.6% from there until 2034 to reach a value of

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Food pathogen testing is the process of checking food for harmful bacteria, viruses, or other microorganisms that can cause illness. These tiny organisms, also called pathogens, include Salmonella, E. coli, Listeria, and others. The goal of this testing is to make sure that the food we eat is safe. It is done at different stages, from production and processing to packaging and before the food reaches consumers. This testing is very important in preventing foodborne diseases and protecting public health.

In recent years, there has been a growing demand for food pathogen testing. One reason is the rising number of food safety concerns around the world. As more people rely on packaged and ready-to-eat foods, the chances of contamination have increased. Also, global food trade means that any outbreak in one country can affect many others. This has made it necessary for food companies to test more frequently and more accurately. Governments also require strict testing rules, which adds to the demand.

Many new trends are shaping how food pathogen testing is done. One major trend is the shift from traditional methods to faster, more modern techniques. Earlier, testing took days, but now newer tools can give results in just a few hours. Rapid testing, DNA-based methods like PCR (polymerase chain reaction), and automation are now widely used. These methods help food producers detect problems quickly and act fast. The use of smart technologies, such as sensors and data analytics, is also becoming more common.

Another important trend is the focus on testing not just for final food products, but also for raw materials, equipment, and surfaces in food factories. Companies are using environmental monitoring to find pathogens in places where food is made. This approach helps stop contamination before it happens. There is also more interest in preventive strategies, where testing helps avoid problems rather than just solving them.

Recent years have seen several foodborne illness outbreaks that have made headlines. These events have led to product recalls, health risks, and damage to company reputations. Such cases push both companies and governments to improve testing systems. Public awareness has also grown, with people now more concerned about the safety of what they eat. This pressure encourages stricter testing rules and better technologies.

In conclusion, food pathogen testing is a vital part of the food safety system. With rising demand, new testing methods, and growing awareness, the industry continues to evolve. The focus is now on speed, accuracy, and prevention. As food systems become more complex, reliable testing will remain a key tool in keeping people safe.

The US Food Pathogen Testing Market

The US Food Pathogen Testing Market size is projected to reach USD 4.0 billion in 2025 at a compound annual growth rate of 9.0% over its forecast period.

The US plays a leading role in the food pathogen testing market due to its strong focus on food safety and advanced technology development. Strict government regulations and agencies actively enforce testing standards to prevent foodborne illnesses. The US food industry invests heavily in innovative testing methods, such as rapid and DNA-based technologies, to ensure product safety. Research institutions and private companies in the US drive continuous improvement in testing accuracy and speed. Additionally, the US is a major exporter of food products, which increases the need for rigorous testing to meet both domestic and international standards. Overall, the US market acts as a trendsetter, influencing global practices and encouraging wider adoption of advanced pathogen testing solutions.

Europe Food Pathogen Testing Market

Europe Food Pathogen Testing Market size is projected to reach USD 3.7 billion in 2025 at a compound annual growth rate of 9.3% over its forecast period.

Europe plays a vital role in the food pathogen testing market by maintaining some of the strictest food safety regulations in the world. European authorities closely monitor food production and distribution to prevent contamination and protect public health. The region emphasizes using advanced testing technologies, including rapid detection and molecular methods, to quickly identify harmful pathogens.

Europe’s diverse food industry, ranging from small producers to large multinational companies, drives demand for reliable testing solutions. Additionally, strong consumer awareness about food safety pushes businesses to adopt thorough testing practices. The European market also focuses on sustainability and traceability, integrating testing with broader food quality controls. This approach makes Europe an important leader in promoting safer food standards worldwide.

Japan Food Pathogen Testing Market

Japan Food Pathogen Testing Market size is projected to reach USD 0.6 billion in 2025 at a compound annual growth rate of 11.1% over its forecast period.

Japan plays a significant role in the food pathogen testing market by emphasizing food safety through strict regulations and advanced technology adoption. The country’s government and industry prioritize protecting consumers from foodborne illnesses, especially given Japan’s large seafood and processed food sectors. Japanese companies invest in innovative testing methods like rapid and molecular techniques to ensure quick and accurate detection of pathogens.

Japan also focuses on maintaining high standards in food quality and hygiene, supporting both domestic consumption and exports. Additionally, Japan is known for integrating automation and smart technologies in its testing processes, improving efficiency and reliability. Overall, Japan’s commitment to food safety and technological innovation strengthens its position as a key player in the global food pathogen testing market.

Food Pathogen Testing Market: Key Takeaways

- Market Growth: The Food Pathogen Testing Market size is expected to grow by USD 14.7 billion, at a CAGR of 9.6%, during the forecasted period of 2026 to 2034.

- By End Use: The food manufacturer segment is anticipated to get the majority share of the Food Pathogen Testing Market in 2025.

- By Technology: The rapid segment is expected to get the largest revenue share in 2025 in the Food Pathogen Testing Market.

- Regional Insight: North America is expected to hold a 37.2% share of revenue in the Global Food Pathogen Testing Market in 2025.

- Use Cases: Some of the use cases of Food Pathogen Testing include food processing plants, retail & supermarkets, and more.

Food Pathogen Testing Market: Use Cases

- Food Processing Plants: Food pathogen testing is used regularly in food processing facilities to check raw ingredients and finished products. It helps identify harmful bacteria like Salmonella or Listeria before products reach consumers. This reduces the risk of recalls and protects the brand’s reputation.

- Dairy and Meat Industry: Testing is crucial in dairy and meat production due to the high risk of contamination. Samples from products and surfaces are tested to ensure safety. Regular checks help meet regulatory standards and keep consumers safe from foodborne illnesses.

- Retail and Supermarkets: Large retailers use food pathogen testing to check the quality of food from suppliers. They may perform spot checks on products to ensure they meet safety guidelines. This builds customer trust and avoids selling unsafe food.

- Catering and Food Service: Restaurants, caterers, and institutional kitchens use testing to monitor food preparation areas. Swabs from surfaces, utensils, and ingredients are tested to prevent outbreaks. This helps in maintaining hygiene and passing health inspections.

Stats & Facts

- According to WHO, unsafe food leads to over 200 different diseases, from mild conditions like diarrhoea to severe outcomes such as cancers, with an estimated 600 million people falling ill annually due to contaminated food. This results in 420,000 deaths and causes a global loss of around 33 million healthy life years (DALYs), showing the serious health burden posed by food safety failures.

- As reported by the UK Government, 26% of all food-related incidents over the past three years were linked to microorganisms such as Shiga toxin-producing E. coli, Listeria, and Salmonella, which triggered action from authorities and food businesses to protect public health and maintain food safety standards.

- WHO highlights that food safety, nutrition, and food security are closely connected, especially in vulnerable groups like infants, the elderly, and the sick. Unsafe food causes a vicious cycle of illness and malnutrition, affecting health outcomes and economic stability across countries.

- In the UK, between 2020/21 and 2023/24, an average of 96.8% of food businesses in England, Wales, and Northern Ireland earned a satisfactory or higher rating under the Food Hygiene Rating Scheme (FHRS), while 92.3% of businesses in Scotland achieved a ‘Pass’ under the Food Hygiene Information Scheme (FHIS), according to the UK Government.

- WHO states that food safety plays a key role in supporting national economies, trade, and tourism, contributing to sustainable development by preventing public health risks linked to unsafe food through effective prevention, detection, and response mechanisms at global and country levels.

- According to the UK Government, the number of people expressing concerns over food prices has increased since 2021, with 93% of Scottish respondents and 72% in England, Wales, and Northern Ireland citing cost as their top food-related concern in 2023, reflecting broader economic challenges.

- WHO notes that changes in global food systems, population growth, climate change, and international trade are all contributing factors that impact food safety and raise the need for stronger safety systems and more resilient public health responses worldwide.

- Based on UK Government findings, trust in national food safety authorities has remained high, with 69% to 78% of people in England, Wales, and Northern Ireland, and 71% to 81% in Scotland, reporting trust in the Food Standards Agency and Food Standards Scotland between 2020 and 2023.

- WHO underscores that globalization and shifting food production systems increase the complexity of maintaining safe food, making international cooperation and investment in testing, surveillance, and response capacity more crucial than ever.

- UK Government data confirms that Campylobacter spp. remains the most common bacterial pathogen causing foodborne gastrointestinal illness in the UK, followed by non-typhoidal Salmonella spp., showing consistent patterns in causative agents and related hospitalizations from 2019 to 2023.

- As highlighted by the UK Government, although most food businesses are meeting hygiene standards, there is still a backlog in inspections, indicating the ongoing pressure on regulatory systems to keep up with food safety demands in the post-COVID period.

- WHO emphasizes the global aim to strengthen country-level capacities to respond to food safety threats, as unsafe food affects not only health systems but also development goals by undermining confidence in food supply chains and hurting economies.

Market Dynamic

Driving Factors in the Food Pathogen Testing Market

Increasing Food Safety RegulationsOne of the main drivers of growth in the food pathogen testing market is the rise in strict food safety laws around the world. Governments are setting higher standards for testing to prevent foodborne illnesses and protect public health. These regulations require food producers and processors to regularly test their products and environments for harmful pathogens. As a result, companies must invest more in advanced testing methods and technologies to comply with these rules. This leads to greater demand for faster, more reliable, and easier-to-use testing solutions. Additionally, stricter rules help increase consumer confidence in food safety, which encourages businesses to adopt better testing practices to avoid penalties and recalls.

Growing Consumer Awareness and Demand for Safe Food

Consumers today are more aware of food safety risks and expect higher quality and safer products. Media coverage of foodborne outbreaks has made people more cautious about what they eat. This increased awareness pushes food manufacturers, retailers, and restaurants to prioritize pathogen testing to ensure their food is safe. Companies respond by adopting advanced testing technologies to quickly detect contamination and prevent health hazards. This rising demand for safe food drives the market’s growth by encouraging innovation in testing tools and services. Moreover, as consumers seek transparency, food businesses use testing as a way to build trust and strengthen their brand reputation.

Restraints in the Food Pathogen Testing Market

High Costs of Advanced Testing Technologies

One of the major restraints in the food pathogen testing market is the high cost of modern testing equipment and methods. Advanced technologies like DNA-based tests and rapid detection tools often require expensive machines and trained personnel. Small and medium-sized food businesses may find it difficult to afford these costs, limiting their ability to adopt the latest testing solutions. Additionally, the ongoing expenses for maintenance, reagents, and quality control add to the financial burden. This can slow down the market growth, especially in developing regions where budgets for food safety are limited. As a result, many companies still rely on traditional, slower methods that may not provide timely results.

Lack of Skilled Workforce and Infrastructure

Another challenge restraining the market is the shortage of skilled professionals who can perform and interpret complex pathogen tests accurately. Proper training is needed to handle advanced testing equipment and follow strict protocols. In many areas, especially rural or less developed regions, there is limited access to well-equipped laboratories and trained staff. This lack of infrastructure makes it difficult for food producers to conduct regular and reliable testing. Without sufficient expertise and facilities, the effectiveness of food pathogen testing is reduced, impacting food safety efforts. This gap slows down the adoption of newer technologies and limits market growth potential.

Opportunities in the Food Pathogen Testing Market

Advancements in Rapid and Portable Testing Technologies

There is a significant opportunity for the food pathogen testing market to grow through the development of rapid and portable testing devices. These new technologies allow food producers and inspectors to conduct tests quickly on-site without needing a full laboratory. Portable testing kits and handheld devices can deliver results within minutes, enabling faster decision-making and reducing the risk of contaminated food reaching consumers. This convenience is especially valuable for small businesses and remote locations. As technology continues to improve, these tools will become more affordable and user-friendly, encouraging wider adoption. This trend opens up new markets and helps strengthen food safety across the supply chain.

Expansion in Emerging Markets and Food Industries

Emerging economies present a strong growth opportunity for the food pathogen testing market. As these regions develop, their food production and processing industries are expanding rapidly. With increasing exports and domestic consumption, there is a growing need to meet international food safety standards. This drives demand for reliable pathogen testing solutions to prevent outbreaks and build consumer trust. Additionally, newer food sectors such as organic foods, ready-to-eat meals, and plant-based products are gaining popularity, requiring specialized testing methods. The market can benefit by introducing customized testing services and affordable technologies tailored to these emerging industries and markets.

Trends in the Food Pathogen Testing Market

Adoption of Rapid and Portable Testing Solutions

The food pathogen testing market is witnessing a significant shift towards rapid and portable testing methods. Traditional laboratory-based tests often require days to yield results, whereas newer technologies, such as paper-based color-changing tests, can detect pathogens like Salmonella within hours. These advancements not only expedite the detection process but also reduce costs, making pathogen testing more accessible for small-scale producers and foodservice establishments. The development of such user-friendly and cost-effective tools is expected to enhance food safety practices across various sectors.

Integration of Artificial Intelligence and Automation

Another prominent trend is the integration of artificial intelligence (AI) and automation into pathogen testing processes. AI algorithms are increasingly being employed to analyze testing data, predict contamination risks, and optimize testing protocols. Additionally, automated systems are streamlining testing procedures, reducing human error, and increasing throughput in laboratories. This technological convergence is leading to more efficient, accurate, and scalable pathogen testing solutions, aligning with the growing demand for high-throughput testing capabilities in the food industry.

Research Scope and Analysis

By Pathogen Type Analysis

Salmonella as a pathogen type is expected to lead the food pathogen testing market in 2025 with a share of 28.9%, driven by the high number of foodborne illness cases it causes worldwide. This bacteria is commonly found in raw meat, eggs, dairy products, and even fresh produce, making it a major concern across the entire food industry. Due to its widespread impact, food manufacturers and processors are increasing their efforts to test for Salmonella at multiple stages, from raw materials to final packaged goods. Governments across different regions are also tightening food safety rules, requiring regular and accurate testing.

As a result, the demand for rapid testing technologies and reliable detection kits continues to grow. The need to prevent product recalls, ensure public health, and maintain brand trust further supports the growth of Salmonella testing. This makes it one of the most important segments contributing to the overall expansion of the food pathogen testing market.

Norovirus as a pathogen type is set to show significant growth in the food pathogen testing market over the forecast period due to its highly contagious nature and impact on public health. It spreads easily through contaminated food, water, and surfaces, often causing outbreaks in food service environments like restaurants, schools, and hospitals. The growing need to control such outbreaks has led to rising demand for frequent and accurate testing.

As testing environments become more automated, the use of autonomous service robots is helping streamline sample handling and improve hygiene in food testing labs. These robots assist in transporting samples, reducing human contact, and speeding up the testing process. With increased attention on sanitation, technology, and quick pathogen detection, the role of norovirus testing is becoming more important in ensuring food safety across the supply chain.

By Technology Analysis

Rapid technology is set to dominate the food pathogen testing market in 2025 with an expected share of 77.6%, driven by its ability to deliver quick and accurate results. This technology helps food producers detect harmful pathogens like Salmonella, Listeria, and E. coli in just a few hours, reducing the time needed to take action. Unlike traditional methods, rapid testing fits well into fast-paced food production environments where speed is critical.

It supports real-time monitoring and helps prevent contaminated products from reaching consumers. The growing need for quick decision-making in food safety, especially in processed and packaged food sectors, is pushing the adoption of rapid testing tools. With rising consumer expectations and strict safety rules, businesses are choosing these modern solutions to avoid recalls and maintain brand trust, making rapid technology a key driver in the market’s continued growth.

Traditional technology continues to hold a role in the food pathogen testing market, showing significant growth over the forecast period due to its reliability and long-standing use. Although slower than rapid methods, traditional techniques like culture-based testing are still trusted for their accuracy in identifying foodborne pathogens. In many labs, especially in smaller facilities or developing regions, these methods remain widely used. As testing volumes increase, the support of autonomous service robots is helping ease the manual workload linked with traditional methods.

These robots assist with tasks like moving samples, sterilizing tools, and handling repetitive processes, improving lab efficiency and hygiene. While newer technologies are expanding fast, traditional methods, supported by automation, continue to provide valuable confirmation testing and help meet regulatory standards in food safety.

By Food Type Analysis

Meat & poultry is projected to lead the food pathogen testing market in 2025 with a share of 27.3%, due to the high risk of contamination in these products. These food types are common sources of dangerous pathogens like Salmonella, Listeria, and E. coli, which can easily spread during processing, packaging, or storage. To avoid foodborne outbreaks and costly recalls, producers in the meat and poultry sector invest heavily in regular and thorough pathogen testing. Strict government rules and rising global demand for safe, high-quality meat products further support the need for advanced testing methods. Companies use rapid and traditional tests to ensure every step of the supply chain is monitored. As consumer awareness grows and export standards become tighter, food safety becomes a top priority in meat and poultry production, driving strong demand for reliable pathogen detection solutions in this segment.

Beverages as a food type are showing strong growth in the food pathogen testing market over the forecast period, especially with the rise in ready-to-drink, dairy-based, and health-focused drinks. These products are sensitive to microbial contamination, which can affect taste, shelf life, and consumer health. To manage these risks, beverage producers rely on regular testing of water sources, ingredients, and packaging environments.

As testing requirements increase, many facilities are using autonomous service robots to help automate sample handling, reduce contamination, and support consistent lab procedures. These robots assist with repetitive tasks, helping labs maintain faster turnaround times while following hygiene standards. The growing variety of beverage types, combined with consumer demand for safety and quality, is pushing producers to strengthen their testing processes, boosting the segment’s role in the food pathogen testing market.

By End Use Analysis

Food manufacturers are projected to lead the food pathogen testing market in 2025 with an estimated share of 43.5%, driven by their need to meet strict safety standards and protect public health. These businesses handle large volumes of raw ingredients and processed foods daily, making regular pathogen testing essential to prevent contamination and product recalls. With increasing consumer demand for clean and safe food, manufacturers are adopting both rapid and traditional testing methods across various production stages.

Government regulations and global export requirements further push food companies to maintain strict hygiene and testing protocols. Investing in advanced detection technologies helps them reduce risks and ensure consistent product quality. By maintaining rigorous in-house testing, food manufacturers not only comply with legal requirements but also build consumer trust, which is vital for brand reputation and long-term success in an increasingly competitive food industry.

Independent test labs are playing a growing role in the food pathogen testing market, showing significant expansion over the forecast period. These labs serve food businesses that lack in-house testing facilities, offering expert analysis and advanced detection tools. As the demand for third-party verification rises, especially among small and medium-sized producers, independent labs are expanding their services. To improve efficiency and accuracy, many labs are adopting autonomous service robots to manage tasks like sample transfer, labeling, and sterilization.

These robots help maintain hygiene, reduce human error, and speed up processing in busy testing environments. With more complex food products and stricter safety standards emerging, independent labs are becoming crucial in ensuring reliable pathogen detection. Their expertise, combined with automation and modern technologies, positions them as essential partners in the growing food safety landscape.

The Food Pathogen Testing Market Report is segmented on the basis of the following

By Pathogen Type

- Salmonella

- Listeria

- E. coli

- Campylobacter

- Norovirus

- Others

By Technology

- Traditional

- Rapid

- PCR (Polymerase Chain Reaction)

- Immunoassay

- Biosensors

- Chromatography

- Others

By Food Type

- Meat & Poultry

- Dairy

- Processed Foods

- Fruits & Vegetables

- Cereals & Grains

- Seafood

- Beverages

- Others

By End Use

- Food Manufacturers

- Food Service Providers

- Retailers

- Government & Regulatory Bodies

- Independent Testing Laboratories

Regional Analysis

Leading Region in the Food Pathogen Testing Market

North America is leading the growth of the food pathogen testing market, with an estimated share of 37.2% in 2025. This strong position is driven by the region’s focus on food safety and strict government regulations that require thorough testing of food products. The presence of advanced technology and well-established food industries also supports market growth. Many companies in North America are adopting rapid and accurate testing methods to quickly detect harmful pathogens and prevent foodborne illnesses.

Consumer awareness about food safety continues to rise, pushing businesses to improve their testing processes. The region also benefits from significant investments in research and development, helping to introduce innovative testing solutions. Additionally, the increasing demand for packaged and ready-to-eat foods adds to the need for regular pathogen testing.

Fastest Growing Region in the Food Pathogen Testing Market

The Asia Pacific region is showing significant growth in the food pathogen testing market over the forecast period, with increasing attention on food safety and quality control. Rapid urbanization, rising population, and expanding food processing industries are driving the demand for reliable testing methods to detect harmful bacteria and contaminants. Many countries in this region are strengthening their food safety regulations, which encourages more frequent and advanced pathogen testing.

Additionally, growing consumer awareness about health and hygiene is pushing food manufacturers to adopt better testing technologies. The rise in exports of food products from Asia Pacific also requires compliance with international safety standards, further boosting the market’s growth and adoption of modern food pathogen testing solutions.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The food pathogen testing market is highly competitive, with many companies offering similar types of testing tools and services. Businesses compete by developing faster, more accurate, and easier-to-use testing methods to meet the growing demand for food safety. Innovation plays a big role, as companies try to create solutions that save time and reduce the risk of contamination. Some focus on developing advanced technologies like DNA-based tests, while others offer complete testing kits or lab services. Price, speed, and reliability are key factors that set competitors apart. The market also sees partnerships between testing companies and food producers to ensure safer food supply chains. As food safety rules get stricter, more players are entering the market, increasing the level of competition.

Some of the prominent players in the Global Food Pathogen Testing are

- 3M

- Thermo Fisher Scientifics

- Merck

- SGS

- Abbott

- Roche Diagnostics

- Bio-Rad Laboratories

- bioMerieux

- Neogen Corp

- Danaher Corp

- Intertek Group

- Charm Sciences

- Hygiena

- Lonza Group

- InstantLabs

- BioChek

- Biotecon

- FoodChek Systems

- Other Key Players

Recent Developments

- In April 2025, TOKU-E Company, a global producer of small molecules, gene selectors, and fine chemicals for upstream manufacturing, has announced the availability of high-purity Pirlimycin Hydrochloride for food safety testing. This compound, used in treating bovine mastitis—a common livestock disease—targets Gram-positive bacteria.

- In March 2025, The Union Minister of State for Railways and Food Processing Industries announced that the Ministry of Food Processing Industries (MOFPI) will provide financial assistance for setting up 100 new food testing laboratories across India in the 2025–26 financial year. These labs will be NABL-accredited, aiming to strengthen food safety infrastructure and ensure higher testing standards nationwide. This initiative reflects the government's commitment to improving food quality monitoring and supporting the growing need for reliable and certified food testing facilities across the country.

- In March 2025, Food Safety Net Services (FSNS), part of the Certified Group, has announced the launch of its new food testing laboratory in St. Louis, Missouri. This addition expands FSNS' network to over 30 ISO-accredited labs across North America, enhancing its ability to deliver reliable food safety testing services. The new facility reflects FSNS' ongoing commitment to supporting food manufacturers and processors with advanced testing solutions, ensuring high standards of safety and quality throughout the food production and supply chain.

- In February 2025, bioMérieux launched GENE-UP® TYPER, a real-time PCR solution designed to support rapid root cause analysis in the food industry. With 600 million people affected by foodborne illnesses annually (WHO), contamination remains a major challenge despite rigorous safety controls. GENE-UP® TYPER enables food companies to trace contamination sources more efficiently, helping them take corrective actions, reduce costly recalls, and strengthen their food safety systems to prevent future incidents.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 12.4 Bn |

| Forecast Value (2034) |

USD 28.2 Bn |

| CAGR (2025–2034) |

9.0% |

| Historical Data |

2019 – 2024 |

| The US Market Size (2025) |

USD 4.0 Bn |

| Forecast Data |

2025 – 2033 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Pathogen Type (Salmonella, Listeria, E. coli, Campylobacter, Norovirus, and Others), By Technology (Traditional and Rapid), By Food Type (Meat & Poultry, Dairy, Processed Foods, Fruits & Vegetables, Cereals & Grains, Seafood, Beverages, and Others), By End Use (Food Manufacturers, Food Service Providers, Retailers, Government & Regulatory BodiesE, and Independent Testing Laboratories) |

| Regional Coverage |

North America – US, Canada;

Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe;

Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC;

Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America;

Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA

|

| Prominent Players |

3M, Thermo Fisher Scientifics, Merck, SGS, Abbott, Roche Diagnostics, Bio-Rad Laboratories, bioMerieux, Neogen Corp, Danaher Corp, Intertek Group, Charm Sciences, Hygiena, Lonza Group, InstantLabs, BioChek, Biotecon, FoodChek Systems, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user),

Multi-User License (Up to 5 Users), and

Corporate Use License (Unlimited User) along with free report customization equivalent to

0 analyst working days, 3 analysts working days, and 5 analysts working days respectively.

|