Market Overview

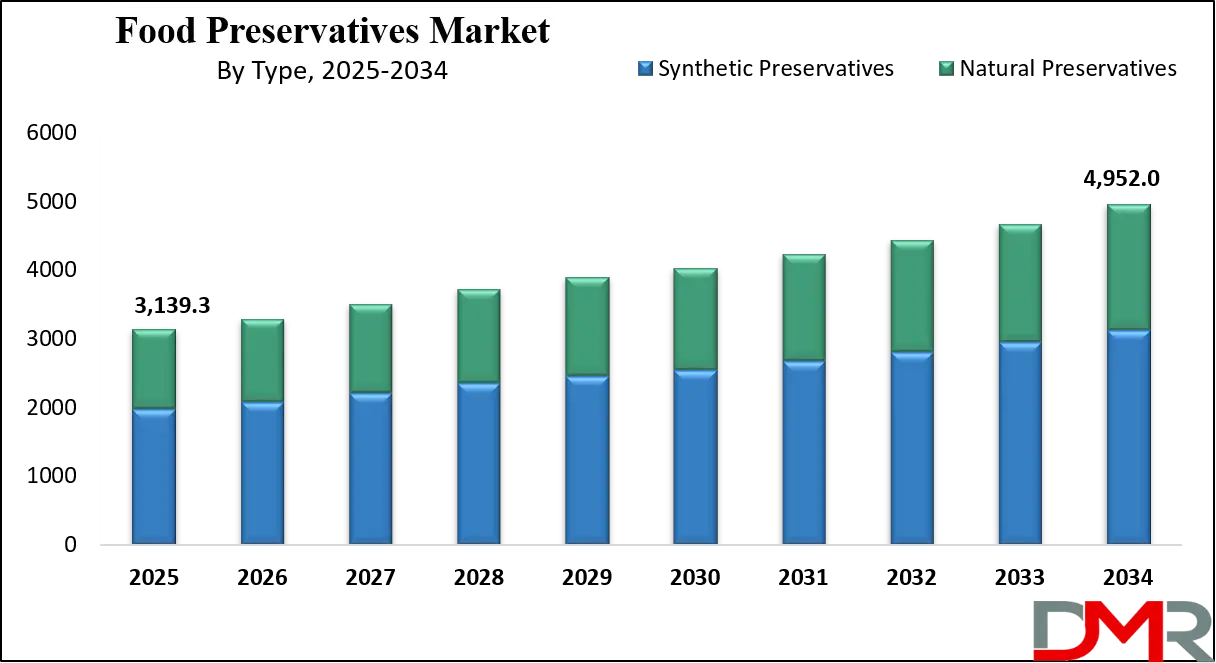

The Global Food Preservatives Market size is expected to be valued at USD 3,319.3 million in 2025, and it is further anticipated to reach a market value of USD 4,952.0 million by 2034 at a CAGR of 5.2%.

At present, the food preservatives market keeps expanding globally based on three main factors, such as the growth of processed foods consumption and packaged foods consumption and consumer health awareness, and extending shelf life needs. The emerging economy market shows rapid growth of convenience food demand since urbanization and hectic schedules have become common features.

Consumers who want quick prep meals now depend on food manufacturers to use preservatives, which both maintain food quality and extend shelf life. The marker undergoes ongoing changes attributed to multiple factors, including rising clean-label requirements, together with an interest in organic and natural preservatives, and a better understanding among consumers about synthetic chemical risks. The food preservatives market is undergoing significant shifts because users now choose foods that contain reduced numbers of artificial preservatives and additives.

The food industry shows rising interest in natural preservatives from plants and herbs, and spice materials because people view their health implications positively against conventional synthetic additives. The market presently shows increasing acceptance of natural food preservatives that include the combination of vinegar and citric acid with essential oils like rosemary because they exhibit antimicrobial and antioxidant properties.

The market receives advantages from new preservation techniques that utilize beneficial microorganisms to decrease society's need for synthetic chemical preservatives. The market encounters two major obstacles, which include the implementation of strict regulatory mandates, while consumers show increasing alarm about particular preservative safety.

The European Food Safety Authority (EFSA) conducts thorough examinations of all food additives under review in Europe, which causes difficulties for businesses that depend on synthetic preservatives. The food preservatives market will experience elevated growth as technology advances for food preservation and processed food consumption scales up, together with consumer preferences for natural ingredients.

The US Food Preservatives Market

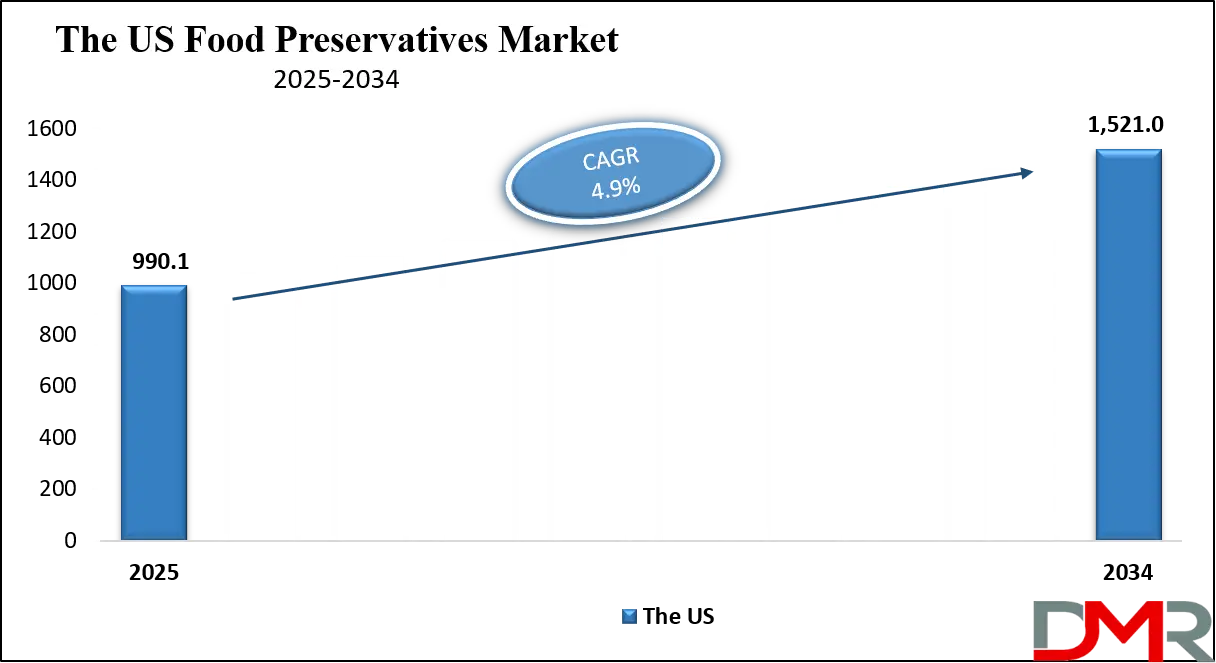

The US Food Preservatives Market is estimated to be valued at USD 990.1 million in 2025, and projections suggest it will grow to USD 1,521.0 million by 2034, at a steady CAGR of 4.9%.

The U.S. food preservatives market ranks as one of the biggest global markets because Americans consume large amounts of processed as well as packaged, and convenience food products. Processing foods constitutes half of the average American diet, according to data from the U.S. Food and Drug Administration (FDA); therefore, preservatives must be added to ensure food quality and increase shelf stability.

Food preservatives act as essential elements to protect ready-to-eat foods and frozen foods, as well as snacks, because consumers choose them more frequently for long-term storage than they do for consumption. Because Americans focus on health more and more every year, they are choosing natural preservatives over conventional options for food protection in the U.S. market. The FDA tracks food preservatives and food additives for safety purposes, while multiple companies follow the rising consumer demand for natural and clean-label products.

The U.S. population composition significantly influences the development of the market. Food convenience continues to grow in popularity since the vast and varied population of the United States consumes a quick-paced day-to-day life. The USDA and FDA, together with the government, maintain control over food safety standards by ensuring that food preservatives used in products adhere to rigorous safety protocols, which support a reliable regulatory system.

The expansion of plant-based foods, together with growing sensitivity to food allergies, prompted producers to switch toward preservative solutions containing no artificial components. The U.S. food preservative market will expand further in the future because businesses dedicate funds to developing novel preservation methods while creating preservative-free items that meet the demands of health-focused consumers.

The European Food Preservatives Market

The European Food Preservatives Market size is estimated to be valued at USD 552.21 million in 2025, and projections suggest it will grow to USD 791.56 million by 2034, at a steady CAGR of 4.2%.

A growing demand in the European food preservatives market exists for clean-label products that consumers see as healthier and safer for their consumption. The European Food Safety Authority (EFSA) enforces strict guidelines for all food preservatives, which surpass national standards in the European Union (EU). Food safety regulations of the EU enable them to allow preservatives that meet their safety standards in food products. Natural preservatives are gaining significant attention from the market as replacement solutions for synthetic chemicals because three major European countries, including Germany, France, and the UK, maintain a large population of health-focused consumers.

European consumers who want to know exactly what goes into their food have caused food producers to minimize artificial additives, including preservatives, within their products. Organic and locally sourced food trends boost the market demand for preservatives that match consumer preferences. The rising plant-based dietary trends throughout Europe require preservative solutions compatible with vegan food items, including plant-based meats, along with plant-based cheese products.

The popularity of convenience foods continues to rise in urban environments of Italy and Spain since these countries face high demands for foods designed to withstand extended shelf life. Innovation within the European food preservatives market includes bio-preservation alongside fermentation methods to offer natural preservation solutions for increasing market requirements.

The Japan Food Preservatives Market

It is expected that the Japan Food Preservatives Market will be valued at USD 188.36 million in 2025 and is likely to grow to USD 292.73 million by 2034, registering a CAGR of 5.1%.

The Japan Food Preservatives market exists due to a combination of traditional eating habits, together with demanding nutritional requirements and advanced technological developments. The Ministry of Health, Labour and Welfare, along with other Japanese authorities, maintains strict food preservative safety guidelines. The increasing elderly demographic in Japan requires easy-to-make convenience foods, which results in rising demand for such items. The aging Japan demographic and consumer demand for healthier and preservative-free foods has increased interest in plant extracts and organic acids, along with other natural preservative methods.

Japanese consumers desire high-quality food products, thus, their expectations strongly affect preservative market trends. Public health safety is safeguarded by the Food Sanitation Law because this legislation establishes restrictions regarding permitted food preservatives. Fresh, high-quality foods remain important to Japanese culture, and this drives preservative use for maintaining fresh characteristics in packaged meals and snacks as well as beverages. Japan stands at the forefront of innovative food technology development because its scientists create preservation methods that offer superior shelf stability while preserving food nutrition and taste profile.

The expanding Japanese food manufacturing sector utilizes an effective distribution network to deliver products swiftly to consumers, thus driving the requirement for valuable preservatives. The rising demand for plant-based and functional foods in Japan drives manufacturers to seek preservatives appropriate for these developing food sectors. The Japanese food preservatives market advances together with shifting consumer demands while benefiting from government interventions supporting innovation and food safety.

Global Food Preservatives Market: Key Takeaways

- The Global Market Share Insights: The Global Food Preservatives Market size is estimated to have a value of USD 3,139.3 million in 2025 and is expected to reach USD 4,952.0 million by the end of 2034.

- The US Market Share Insights: The US Food Preservatives Market is projected to be valued at USD 990.1 million in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 1,521.0 million in 2034 at a CAGR of 4.9%.

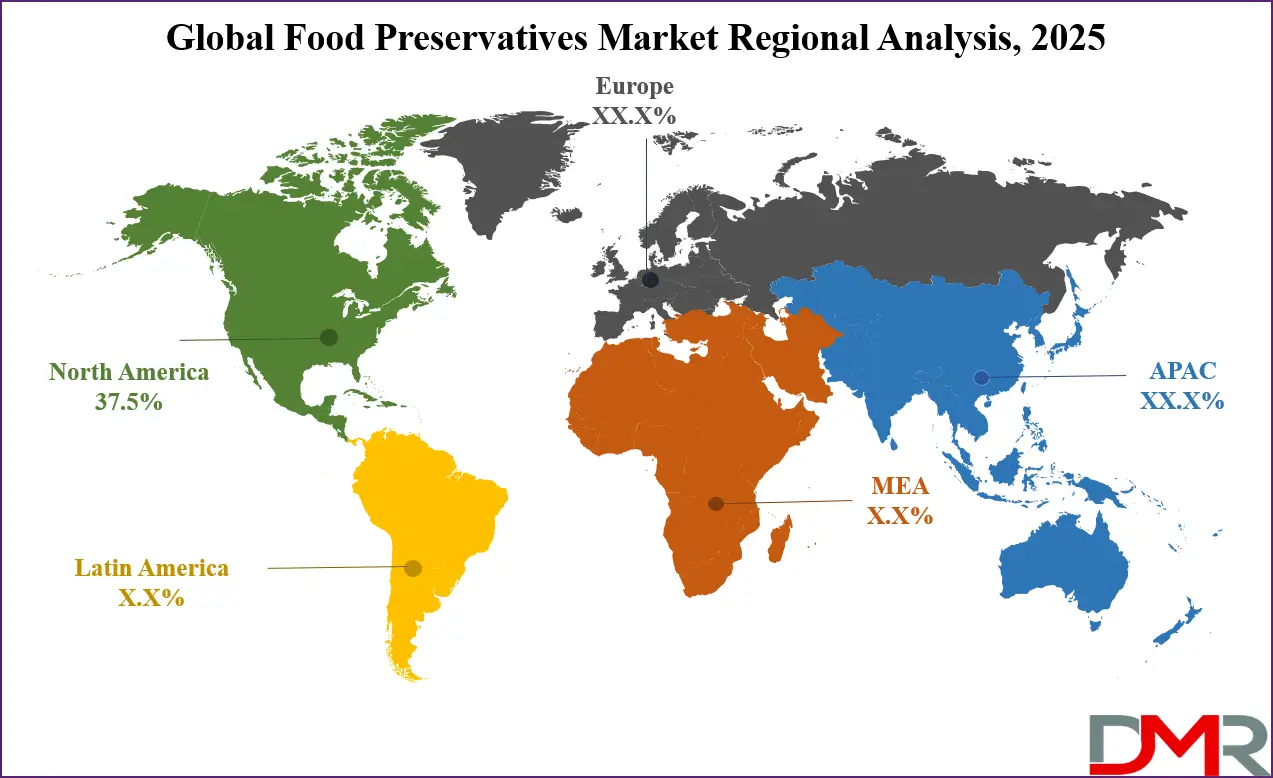

- Regional Insights: North America is expected to have the largest market share in the Global Food Preservatives Market, with a share of about 37.5% in 2025.

- Key Players Insights: Some of the major key players in the Global Food Preservatives Market are ADM, Cargill, Kerry Group, BASF, Dow Chemical, DuPont, Chr. Hansen, Tate & Lyle, and many others.

- The Global Market Growth Rate Insights: The market is growing at a CAGR of 5.2 percent over the forecasted period of 2025.

Global Food Preservatives Market: Use Cases

- Meat Preservation: Processors use sodium nitrate and sodium nitrite preservatives in bacon and sausages, alongside hot dogs, to minimize Clostridium botulinum bacterial growth and thereby extend their shelf life.

- Beverage Preservation: Potassium sorbate and sodium benzoate act as beverage preservatives that stop mold, yeast, and bacterial growth within soft drinks and fruit juices, and alcoholic beverages in the beverage industry. The preservatives help beverages retain their freshness and maintain taste, along with safe product conditions throughout the storage and distribution period.

- Bakery Products: The bakery sector utilizes calcium propionate together with other preservatives to stop mold development, which occurs in bread and pastries, including cakes. The preservatives protect bakery products' texture alongside their flavor elements and extend shelf life while ensuring continued product freshness.

- Dairy Products: Food manufacturers use lactic acid and citric acid in dairy products, including milk and yogurt, and cheese, to stop microbial spoilage. The active preservatives control microbial growth and protect food from developing bad odors while guaranteeing uniformity throughout each item.

- Confectionery: The confectionery industry frequently uses ascorbic acid and rosemary extract for protecting chocolates, together with candies and other sweet products. The natural preservatives block fats and sugars from breaking down, thus maintaining flavor along with texture and overall product quality for increased shelf stability.

Global Food Preservatives Market: Stats & Facts

U.S. Department of Agriculture (USDA)

- The U.S. processed food market is worth over $1 trillion, with preservatives playing a key role in extending the shelf life of products.

- 51% of the average American diet consists of processed foods, most of which contain preservatives to maintain quality over extended periods.

U.S. Food and Drug Administration (FDA)

- The FDA has approved 3,000 food additives, including preservatives, for use in food products, all of which must meet safety standards under the Federal Food, Drug, and Cosmetic Act.

- The FDA’s Food Code includes guidelines for preservatives used in restaurants, grocery stores, and other food establishments to ensure safety during storage and preparation.

European Food Safety Authority (EFSA)

- The EFSA has evaluated more than 70 different preservatives for safety since its inception, ensuring that only safe preservatives are used in the EU.

- 200+ food additives, including preservatives, are authorized for use in food within the EU, and their safety is regularly reviewed.

Food and Agriculture Organization (FAO)

- 5-10% of global food production is lost due to spoilage, which highlights the importance of preservatives in reducing food waste.

- The FAO estimates that 30% of global food production is wasted, and preservatives could reduce this percentage by extending the shelf life of perishable items.

World Health Organization (WHO)

- The WHO has established a global action plan to prevent foodborne diseases, emphasizing the role of food preservatives in reducing contamination.

- According to the WHO, 2 million people die annually from foodborne illnesses, which could be mitigated by effective food preservation methods.

USDA National Agricultural Statistics Service (NASS)

- The total U.S. fruit and vegetable production value in 2020 exceeded $60 billion, with preservatives essential for extending the shelf life of packaged produce.

- 80% of U.S. meat production is processed and preserved using methods like curing and freezing to increase shelf life.

European Commission

- The European Commission's regulatory body for food additives has approved over 300 food additives that include preservatives, with a focus on ensuring safe consumption across all EU member states.

- 40% of European consumers are now actively seeking out food products with fewer artificial preservatives as part of the growing demand for clean-label foods.

Japan Ministry of Health, Labour and Welfare (MHLW)

- In Japan, the use of preservatives is governed by strict regulations, with fewer than 50 preservatives approved for use in food products to ensure public health safety.

- Japan’s food safety protocols allow the use of less than 5% of the total weight of preservatives in packaged foods to minimize chemical exposure.

Australian Department of Agriculture, Water and the Environment

- Australia’s food industry is estimated to be worth $110 billion, with preservatives playing a crucial role in ensuring the longevity of packaged foods, especially in export markets.

- The Australian government has set strict maximum limits for preservatives in certain food categories, particularly in beverages and canned foods.

U.S. Centers for Disease Control and Prevention (CDC)

- The CDC reports that foodborne illnesses, many of which could be prevented with proper food preservation, affect approximately 48 million Americans annually, leading to 128,000 hospitalizations and 3,000 deaths.

- The use of preservatives such as antioxidants and antimicrobials in food products is a key factor in reducing the spread of foodborne illnesses.

National Institutes of Health (NIH)

- The NIH estimates that over 15% of foodborne diseases are caused by spoilage or contamination in meat and poultry products, many of which are preserved with chemical additives.

- According to the NIH, preservatives in dairy products help prevent the growth of bacteria like Listeria and Salmonella, contributing to the safety of 2 billion servings of dairy consumed globally each year.

U.S. Department of Commerce

- The U.S. exports over $15 billion in processed food annually, with preservatives being essential for maintaining food quality during transportation.

- In 2021, the value of processed food exports from the U.S. increased by 8% compared to the previous year, with preservatives ensuring the safety of the products during long-distance shipping.

FDA Food Additive Safety Guidelines

- The FDA requires all preservatives to undergo rigorous safety assessments to ensure they do not pose a risk to public health. Only approved preservatives are allowed for use in food products in the U.S.

- Preservatives such as sodium nitrate and sodium benzoate are among the most commonly used in the U.S. meat processing industry.

European Union (EU) Health and Food Safety

- The EU has strict regulations limiting the maximum allowable levels of preservatives in processed foods. For example, the maximum level of sodium benzoate in soft drinks is 150 mg/liter.

- The EU also mandates that all food products must include clear labeling if they contain preservatives to ensure consumer awareness.

Japan National Food Safety Risk Assessment (NFSA)

- In Japan, preservatives such as sorbic acid and benzoic acid are commonly used in packaged foods, with the NFSA monitoring their safety to prevent any adverse health effects from long-term consumption.

- Japan’s Food Sanitation Law prohibits the use of preservatives in baby foods and infant formula, ensuring that vulnerable populations are protected from chemical exposure.

Food Safety Australia New Zealand (FSANZ)

- FSANZ is responsible for setting food safety standards in Australia and New Zealand, including the permissible limits for preservatives in foods such as meat, dairy, and beverages.

- FSANZ ensures that all preservatives used in food are clearly labeled to allow consumers to make informed choices about their food consumption.

United Nations (UN)

- The UN's Food and Agriculture Organization (FAO) has identified food spoilage as a major issue in developing countries, where up to 40% of food is lost due to inadequate preservation methods.

- FAO's efforts to reduce food waste include promoting the use of safe preservatives in food processing to minimize spoilage, particularly in fruits and vegetables.

China’s National Food Safety Standard

- China has regulations on the use of preservatives in food that allow specific levels of benzoic acid, sorbic acid, and sodium nitrate in meat products, beverages, and dairy.

- The Chinese government enforces a zero-tolerance policy for preservatives in infant food products to ensure the health and safety of children.

Health Canada

- Health Canada’s regulations stipulate that preservatives such as sodium benzoate and potassium sorbate can be used in certain food products, but they must meet the maximum allowable limits to ensure safety.

- In 2020, Canada reported that 8% of its processed food market was impacted by food preservation needs, particularly for export and long-term storage.

Food Standards Agency (FSA) UK

- The FSA in the UK monitors the use of preservatives in food products, including those used in ready meals and processed snacks. The FSA reports that 2 million tons of preservatives are used in the U.K. food industry annually.

- The FSA mandates that all food preservatives used in products sold in the UK must pass rigorous testing and comply with EU safety regulations.

Indian Food Safety and Standards Authority (FSSAI)

- In India, the FSSAI has approved the use of specific preservatives like sodium benzoate and potassium sorbate in processed foods, with maximum limits for each category set by the authority.

- The FSSAI has conducted regular food safety audits, confirming that over 60% of food products in India contain some form of preservatives to ensure safety during storage.

National Food Safety and Quality Service (SENASA), Argentina

- SENASA reports that 40% of food products in Argentina rely on preservatives to meet the growing demand for convenience and packaged foods.

- Argentina’s food safety regulations ensure that only preservatives with proven safety records are permitted for use in food products.

Brazilian Ministry of Agriculture

- Brazil has approved over 70 preservatives for use in food, focusing on minimizing health risks while supporting the expanding food manufacturing sector.

- The Brazilian government has strict guidelines for preservatives used in meat and dairy products to ensure safe consumption for the country’s population of 213 million.

Global Food Preservatives Market: Market Dynamic

Driving Factors in the Global Food Preservatives Market

Rising Demand for Processed and Packaged Foods

The main role player propelling growth in the global food preservatives market stems from consumers purchasing more processed and packaged food items. Our society now consumes ready-to-eat meals and beverages, and snacks at an explosive rate because of the combination of hectic lifestyles and urban development, along with changing consumer food habits toward convenience products.

All these food products require preservative addition because they need to stay fresh and maintain their original taste and quality throughout distribution time. The combination of package design for extended shelf life creates a vital need for preservatives that keep extended shelf-life products stored safely and tasty during prolonged storage time. E-commerce platforms, together with better distribution channels of packaged goods, are boosting market expansion.

Consumer choices in supermarkets and digital platforms create escalating demand for durable items with preserved quality through preservatives in the market. The process of food manufacturing is creating a new requirement in developing economies because increased urbanization and boosted purchasing power lead consumers to adopt packaged and convenience foods. Expansion of processed food markets worldwide, especially within Asia-Pacific and Latin America, serves as the main catalyst for the food preservatives industry's growth.

Expanding Demand for Meat, Dairy, and Beverage ProductsThe expanding worldwide market for meat and dairy products, together with beverages, including emerging economies, stimulates the requirement for preservatives. Governments across developed and developing nations support increasing meat usage, thus driving manufacturers to use preservatives in processed meats, along with sausages and salami, as well as ready-to-eat meals. Manufacturers within the dairy industry depend on preservatives to protect milk, cheese, Greek yogurt, and yogurt while extending their shelf life without resulting in nutritional deterioration.

Manufacturer of beverages employ preservatives as essential components to sustain the quality standards and taste, and security features of their product line, which includes soft drinks and fruit juices, and alcoholic drinks. Note that both population growth and growing urbanization drive steady expansion of product demand, which in turn drives investments in preservative technology. The simultaneous increase in functional drinks consumption and convenience needs generates market expansion opportunities for preservatives within this sector.

Transportation times between locations due to food globalization and international trade have extended, thus demonstrating why preservatives must be used for food safety protection and quality maintenance throughout transit. The global meat, dairy, and beverage market growth will drive preservative market demand through the upcoming years.

Restraints in the Global Food Preservatives Market

Stringent Regulatory Environment

The global food preservatives market experiences limitations from rigorous guidelines that control food additive usage, especially among preservatives. Each national agency, together with both EFSA and FDA, operates to enforce specific guidelines that control which preservatives manufacturers can utilize for food products, including their permitted levels. The European Union requires strict safety assessments for preservatives, which leads to banning preservatives that prove harmful to human health from use.

Regulatory standards reduce the ability of manufacturers to use flexible approaches in product development since they force delays in both development timelines and market entry for companies using synthetic preservatives. Food manufacturers face rising costs because regulatory requirements force them to spend more on matters such as food labeling regulations and transparency reporting, particularly for producers of processed foods.

Clean-label product requirements from consumers have intensified the examination process of synthetic preservatives. Natural preservatives encounter extensive regulatory challenges before EU markets approve them because the region demands thorough safety examinations for all new preservative substances. Manufacturers face challenges when introducing new preservative solutions to the market because demanding regulatory frameworks slow their speed to market and increase production costs.

Consumer Concerns Over Health Risks

The consumer market expresses caution about synthetic preservatives, including sodium nitrite, sodium benzoate, and potassium sorbate, despite their common industry presence, because they believe these chemicals might present health hazards. The growing health risks linked to synthetic preservative consumption in food have intensified worries about food ingredients, thus prompting companies to share preservative information more clearly via labels.

The connection between certain preservatives and allergic reactions, together with harmful health effects and child hyperactivity, has resulted in consumer doubts about chemically preserved products. The worry about synthetic preservatives mainly affects customers focused on their health, together with parents and people who prefer organic and clean-label diets. Food manufacturers now adopt natural preservatives because consumers want them to use substances that appear safer than traditional additives, including essential oils alongside vinegar and citric acid.

Natural preservatives face limitations as market entry barriers in price-sensitive markets because they demonstrate inferior efficiency while maintaining higher costs when compared to synthetic alternatives. The negative perception of synthetic preservatives by consumers could constrain market expansion because health-conscious consumers in developed markets are increasing, while demand for safe preservatives remains strong.

Opportunities in the Global Food Preservatives Market

Expansion in Emerging Markets

The food preservatives market shows substantial development potential in emerging markets located within the Asia-Pacific area. The Asian and Latin American populations now choose more packaged and processed foods because their incomes have grown, while their cities have expanded, and their life habits have changed. The developing middle classes across China, India, and Brazil will drive explosive growth in their market demand for durable food products of superior quality.

Food manufacturers have an excellent market opportunity in food preservation because a rising population of busy urban residents seeks convenient food options while insisting on safety standards. The food preservatives market now receives increased investment in developing markets to fulfill growing requirements for secure and shelf-stable foods. Population demand for ready-to-eat convenience foods, such as meals and beverages, and snacks, drives increased use of preservatives within growing markets.

Clean-label production preferences are rising in consumer demand, which provides opportunities for natural preservatives to gain importance in the market. Corporate entities initiate the launch of customized preservative solutions that address specific regional food preferences of consumers across emerging markets. The development of new markets generates rising demand for organic and health-oriented foods, which opens unprecedented growth prospects for natural preservatives as a substitute for traditional approaches to food preservation.

Innovation in Preservation Technologies and Sustainable Solutions

The need for healthier, sustainable food products leads manufacturers to develop new preservation technologies. The expansion of energy-efficient, eco-friendly preservation methods needs urgent development to fulfill regulatory needs and satisfy consumer preferences. The food preservation market grows through the introduction of bio-preservation, which uses natural microorganisms for preservation, together with green preservation methods that rely on plant-based preservatives.

Bio-preservation methods, especially for dairy and meat products, will expand due to growing manufacturer interest in finding synthetic preservative substitutes. Research efforts now focus on packaging development, which embeds preservatives into material structures so manufacturers can eliminate additives while improving safety standards. The food production industry moves toward sustainability by following this direction. New technologies based on HPP, along with PEF, are increasing their market share.

Through these technologies, business owners can extend shelf life by using alternative methods that never require chemical preservatives while retaining food quality levels. The market presents manufacturers with a compelling chance to invest in sustainability-focused innovative preservation techniques to meet regulatory standards while following upcoming consumer trends regarding food production.

Trends in the Global Food Preservatives Market

Shift Toward Natural and Clean-Label PreservativesCustomers have developed a greater interest in healthful food products that contain minimal artificial additives. High demand from consumers drives the global food preservatives market toward adopting plant-based antimicrobials, together with antioxidants and essential oils derived from herbs and spices as natural preservatives. The market has seen a growing interest in natural preservatives, which now includes rosemary extract, vinegar, and citric acid due to their appeal toward consumer demand for clean ingredients.

Additionally, antimicrobial coating technologies are being explored to enhance food preservation by preventing microbial contamination and extending shelf life, complementing the shift toward natural and sustainable preservation methods.

Customers gravitate toward clear-label products that contain no synthetic compounds or extra additives. The public requests detailed food labeling information, and this forces manufacturers to use natural preservatives in their products. Company alterations of their preservative strategies happen because consumer preference patterns now drive them to use natural and organic substances, which suit the clean-label formula movement.

The market penetration of natural preservatives for food applications continues to increase because people view them as safer and more environmentally friendly than traditional synthetic preservatives. Thus, natural preservatives find adoption in meat products as well as dairy and beverage sectors. Organic and plant-based foods are gaining popularity, which leads the market to require preservative solutions that match these modern dietary patterns.

Technological Advancements in Preservation Methods

Technological improvements in preservation techniques have transformed the food preservatives industry over the last few years. Food preservation methods have changed with the introduction of high-pressure processing (HPP) alongside pulsed electric fields (PEF) and bio-preservation using beneficial microorganisms. These modern preservation methods expand food stability by replacing conventional chemical stabilizers.

The high-pressure processing technique enables the preservation of food structures and aromas while extending durability by eliminating microorganisms from affecting products. Electric field application through PEF technology kills microorganisms in foods without altering their nutritional value. The use of lactic acid bacteria alongside natural microorganisms in bio-preservation methods serves as a substitute for synthetic preservatives, becoming more frequent within dairy and meat product production.

The latest developments match consumer patterns toward purchasing food products that use natural processing methods. Companies spend large amounts on research and development for new preservation systems, which they use to produce healthier, sustainable food products that reach consumers. The market will expand its adoption of sustainable food preservation techniques that minimize the use of synthetic chemicals because of developing food technology innovations. This expansion accelerates the clean-label and natural food preservation approach in the industry.

Global Food Preservatives Market: Research Scope and Analysis

By Type Analysis

Synthetic preservatives are projected to dominate the global food preservatives market. A leading position in the food preservatives market exists primarily with synthetic preservatives because they have proven results and lower costs, and broad distribution channels. Synthetic preservatives maintain their leading position in food preservation due to their wide range of advantages over natural alternatives, which industries have used for decades. The primary attraction of synthetic preservatives in the market arises from their power to obstruct microbial growth while prolonging the shelf stability of different food products.

Synthetic chemicals such as sodium benzoate, sulfur dioxide, and potassium sorbate demonstrate high effectiveness in stopping bacterial growth as well as mold growth and yeast proliferation, which protects foods from ruin. The longevity of products increases through synthetic preservation techniques, which decrease food waste and prepare products for extended storage and distribution.

Synthetic preservatives remain the economical choice over natural alternatives for food production and packaged goods because they are cheaper to acquire. These substances lack environmental sensitivity which supports their uniform performance among multiple food products. The consolidate performance together with their reduced cost makes synthetic preservatives necessary for creating mass-produced food items such as processed snacks and ready-to-eat beverages.

The combination of cost-effective features as well as established efficiency of synthetic preservatives maintains their position as market leaders despite rising consumer interest in natural clean-label products. The food preservatives market will stay dominated by synthetic preservatives until natural preservatives either match their shelf life extension effectiveness at equivalent costs.

By Function Analysis

Antimicrobial preservatives are expected to be the global food preservatives market in this segment because they are essential for inhibiting foodborne disease transmission and maintaining product longevity. The preservation protectants sodium nitrate, together with sodium benzoate and sorbic acid, accomplish essential microbial growth prevention of bacteria, molds, and yeasts that result in food spoilage and contamination. Antimicrobial preservatives maintain food safety over time by controlling microbial growth, which therefore stops potentially dangerous foodborne disease outbreaks in consumers.

Food safety is just one of the vital roles antimicrobial preservatives play since they also protect the taste and appearance, together with the texture of food products. The meat industry uses antimicrobial agents to stop pathogenic bacteria, Salmonella and E. coli, from multiplying because their growth leads to serious illness. Antimicrobial agents used in dairy products stop mold and yeast from deteriorating the product quality during storage. Antimicrobial preservatives play a vital role in beverages because they enable shelf life extension while maintaining perfect taste and product quality.

The extensive use of antimicrobial preservatives can be attributed to how well they work together with market acceptance from developed nations, along with emerging markets. Food manufacturers can use antimicrobial preservatives to meet their increased need for processed products while providing reliable quality and safety solutions. The food preservation industry maintains antimicrobial preservatives as its market leader because of continuing worldwide food safety issues.

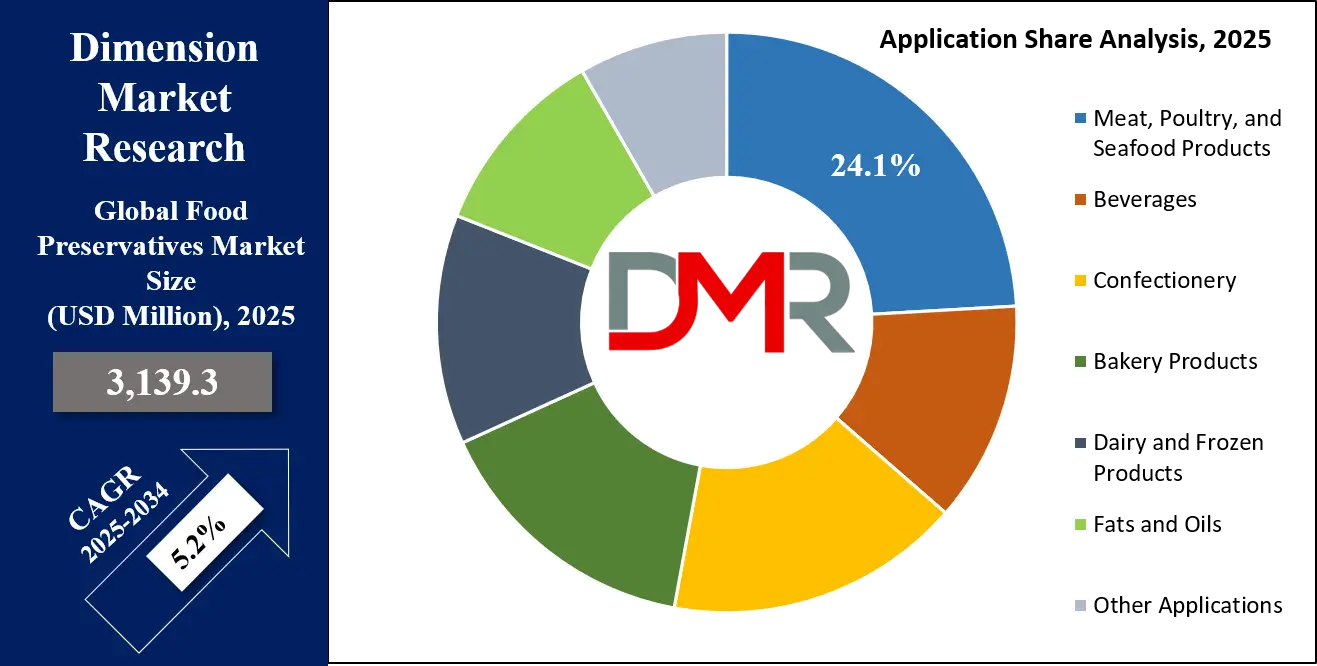

By Application Analysis

The food preservatives market is projected to be predominantly controlled by the meat, poultry, and seafood segment because these items quickly spoil and require efficient preservation techniques to maintain their shelf stability. Fresh meat and poultry, along with seafood, need microbial protection and preservatives because these products rapidly spoil after production to maintain safety for consumers. These perishable food items would become unfit for use within several days if they lacked preservatives, so manufacturers face losses and consumers risk food contamination.

Meat manufacturers utilize antimicrobial preservatives, including sodium nitrate, sodium nitrite, and potassium sorbate, to guarantee protection against Clostridium botulinum bacteria and other harmful bacteria during meat product preservation. The preservatives deliver both color characteristics as well as flavor that defines cured meats. The addition of preservatives stops microbial spoilage in poultry and seafood products, including canned seafood, from occurring, which prevents odorous and texture defects and quality deterioration. Producers use seafood preservation solutions, which include citric acid and phosphates, to protect seafood from damage while stopping discolorations.

This market segment leads due to persistent consumer demand for packaged meat, poultry, and seafood items. The combination of increasing consumer demands for processed foods and shorter life schedules has simultaneously pushed up the need for longer-lasting and safer food products. The market for food preservatives maintains its substantial emphasis on meat and poultry products, together with seafood, because manufacturers remain devoted to creating advanced preservation techniques that prevent food safety risks and preserve premium quality.

The Global Food Preservatives Market Report is segmented on the basis of the following:

By Type

- Synthetic Preservatives

- Natural Preservatives

By Function

- Antimicrobials

- Antioxidants

- Other Functions

By Application

- Meat, Poultry, and Seafood Products

- Beverages

- Confectionery

- Bakery Products

- Dairy and Frozen Products

- Fats and Oils

- Other Applications

Global Food Preservatives Market: Regional Analysis

Region with the Highest Market Share in the Food Preservatives Market

North America is projected to hold a dominant position in the global food preservatives market as it commands over 37.5% of the market share by the end of 2025. The food preservatives market shows dominant presence in North America because of both its robust food processing industry, as well as its strong market demand for packaged goods, together with its advanced production technology base.

Food processing facilities in the U.S., along with Canada, operate among the most advanced systems because consumers now choose convenient pre-packaged foods. Food preservatives gain support from people who want longer shelf life for packaged goods and strong food safety measures, and from the well-established retail and e-commerce sectors. Food safety regulations within this area maintain high standards for preservatives, allowing the region to utilize advanced preservation technologies.

Food quality and safety transparency from consumers increases the market demand for synthetic and natural food preservatives throughout the supply chain. The North American manufacturing sector rapidly embraces new preservation methods, including high-pressure processing (HPP) and bio-preservation, because of their strong market position. Consumer demand for clean-label food products using natural organic preservation solutions continues to increase because such products exclude artificial preservatives despite their growing popularity in the market.

Region with the Highest CAGR in the Food Preservatives Market

Asia-Pacific is expected to lead the food preservatives market with the highest compound annual growth rate (CAGR) because emerging markets in China and India, alongside Southeast Asia, experience rapid urbanization and rising consumer spending, and evolving cultural demands. People increasingly buy processed foods and packaged products, and convenience foods, due to their busy work days, combined with urban trends and an expanding middle-class population.

These regions show increasing adoption of Western eating patterns, which results in substantial growth of food preservative demand for shelf extension alongside food protection. The demand for preservatives has increased because people are more aware of foodborne illnesses and because modern food safety standards have been established.

A growing number of consumers in the Asia-Pacific region choose natural preservatives over other options because they focus on health and seek products without artificial labels. The market expands because government initiatives focus on food quality and safety standards, which in turn support the usage of preservatives. The Asia-Pacific region maintains its dominant position for market growth because beneficial conditions will sustain its leading position in terms of growth potential.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Global Food Preservatives Market: Competitive Landscape

Food preservatives present high market competition because numerous companies offer different solutions that serve the rising requirements for food protection while enhancing shelf life. The market leadership lies with BASF SE, along with Dow Chemical Company and Cargill Inc. and Archer Daniels Midland Company, and Tate & Lyle PLC control the market through synthetic and natural preservatives at various levels. Companies with substantial research capabilities use their expertise to design modern preservative products that match the clean-label and natural ingredient requirements of consumers.

The competitive market contains two main segments, with both global and regional companies competing through specialized applications and market segments. Businesses dedicate their resources to creating new solutions and strategic alliances to support rising consumer needs for natural preservatives because customers prefer nutritious food approaches. Corporation Kerry Group, together with Chr. Hansen invests in plant-derived and microorganism-based natural preservatives to serve consumers concerned about their health.

Vital developments in the competitive market include the emerging trend of market consolidations through business mergers and acquisitions performed by organizations to widen their product range and distribution. The competitive market is influenced by food companies that implement advanced preservation methods, including high-pressure processing methods and bio-preserving techniques, for producing safe and environmentally friendly food products.

Some of the prominent players in the Global Food Preservatives Market are:

- Archer Daniels Midland Company (ADM)

- Cargill, Inc.

- Kerry Group

- BASF SE

- Dow Chemical Company

- DuPont de Nemours, Inc.

- Chr. Hansen Holding A/S

- Tate & Lyle PLC

- Ingredion Incorporated

- Corbion N.V.

- Ajinomoto Co., Inc.

- Wilmar International Ltd.

- Mosaic Company

- Sigma-Aldrich (now part of Merck Group)

- Sensient Technologies Corporation

- FMC Corporation

- E.I. du Pont de Nemours and Company (DuPont)

- Naturex S.A.

- Vitae Naturals

- Celanese Corporation

- Other Key Players

Recent Developments in the Global Food Preservatives Market

- May 2025, Mergers & Acquisitions: In May 2025, Kerry Group, a global leader in food ingredients, acquired Biosecuritix, a company specializing in natural and plant-based preservatives. This acquisition is aimed at expanding Kerry’s product portfolio to meet the growing demand for clean-label and sustainable preservation solutions, particularly in the meat and dairy sectors. This move supports Kerry's ongoing strategy of enhancing its natural ingredients range, positioning it to cater to the increasing consumer preference for healthy, sustainable, and naturally preserved foods.

- April 2025, Investment: In April 2025, Chr. Hansen announced a significant investment of $40 million in its global R&D facilities to focus on innovations in microbial food preservation. This investment will strengthen the company's capabilities in natural antimicrobial solutions, helping to accelerate the development of preservatives that meet the rising consumer demand for organic and clean-label products. Chr. Hansen has long been a leader in using probiotics and beneficial microorganisms to preserve food, and this investment will further enhance their production of bio-based preservatives.

- March 2025, Collaboration: In March 2025, Tate & Lyle PLC entered into a strategic collaboration with Eden Labs to co-develop a new line of essential oil-based natural preservatives. This partnership is focused on addressing the growing demand for sustainable and natural alternatives to synthetic preservatives in the packaged food sector.

- February 2025, Conference: In February 2025, the International Conference on Food Science and Technology (ICFST) was held in Berlin, Germany. This global event gathered industry experts, including representatives from leading food preservative manufacturers such as BASF SE and Dow Chemical Company, to discuss the latest trends, challenges, and technological advancements in food preservation.

- January 2025, Expo: The Food Ingredients Europe 2025 Expo took place in Paris, showcasing over 800 exhibitors from across the global food and beverage sectors. Leading preservatives companies like Cargill and DSM presented their latest innovations in both synthetic and natural preservatives. Notably, Cargill unveiled a new line of plant-based preservatives derived from algae and citrus extracts, designed to meet the increasing consumer demand for clean-label, natural alternatives to synthetic chemicals.

- December 2024, Mergers & Acquisitions: In December 2024, Ecolab Inc. acquired Microbe Shield, a company specializing in bio-preservation techniques for dairy and meat products. The acquisition will enable Ecolab to expand its portfolio of food safety solutions, adding more antimicrobial and natural preservatives that cater to emerging markets, particularly in Asia-Pacific.

- November 2024, Investment: In November 2024, BASF SE invested $30 million in a new food preservation technology research facility in the United States. The new center will focus on innovations related to food safety, shelf life extension, and the development of natural preservatives derived from bio-based sources. BASF plans to use this facility to enhance its global presence in the food preservatives market, particularly in the growing natural preservatives segment.

- October 2024, Collaboration: In October 2024, Archer Daniels Midland Company (ADM) partnered with the University of California, Davis, to launch a research initiative aimed at exploring alternative preservation methods, including the use of plant-based ingredients and fermentation processes. This collaboration focuses on advancing food preservation technologies that can extend shelf life while maintaining the nutritional content of food products.

- September 2024, Expo: The Global Food Innovation Expo, held in Dubai, UAE, in September 2024, featured presentations from key players like DSM and BASF on cutting-edge preservative solutions. DSM unveiled a breakthrough in using plant-based preservatives for beverages and snacks, aiming to extend shelf life without the need for artificial additives.

- August 2024, Conference: The International Symposium on Food Quality and Safety in Tokyo, Japan, in August 2024 hosted discussions on the future of food preservatives. Industry leaders, including representatives from Cargill and Dow Chemical, presented on the evolving role of preservatives in global food safety and the rising demand for preservatives that are both effective and natural.

- July 2024, Mergers & Acquisitions: In July 2024, Givaudan acquired Unilever’s Preservative Solutions Business to expand its food preservatives portfolio. This acquisition will allow Givaudan to strengthen its position in the natural preservatives market, particularly in plant-based and bio-preservation solutions.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 3,139.3 Mn |

| Forecast Value (2034) |

USD 4,952.0 Mn |

| CAGR (2025–2034) |

5.2% |

| The US Market Size (2025) |

USD 990.1 Mn |

| Historical Data |

2019 – 2024 |

| Forecast Data |

2026 – 2034 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Type (Synthetic And Natural Preservatives), By Function (Antimicrobials, Antioxidants, And Other Functions), And Application (Meat, Poultry & Seafood, Beverages, Confectionery, Bakery, Dairy & Frozen Products, Fats & Oils, And Other Applications) |

| Regional Coverage |

North America – US, Canada; Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA |

| Prominent Players |

ADM, Cargill, Kerry Group, BASF, Dow Chemical, DuPont, Chr. Hansen, Tate & Lyle, Ingredion, Corbion, Ajinomoto, Wilmar, Mosaic, Sigma-Aldrich, Sensient, FMC, Naturex, Vitae Naturals, and Celanese, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |

Frequently Asked Questions

The Global Food Preservatives Market size is estimated to have a value of USD 3,139.3 million in 2025 and is expected to reach USD 4,952.0 million by the end of 2034.

The US Food Preservatives Market is projected to be valued at USD 990.1 million in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 1,521.0 million in 2034 at a CAGR of 4.9%.

North America is expected to have the largest market share in the Global Food Preservatives Market, with a share of about 37.5% in 2025.

Some of the major key players in the Global Food Preservatives Market are ADM, Cargill, Kerry Group, BASF, Dow Chemical, DuPont, Chr. Hansen, Tate & Lyle, and many others.

The market is growing at a CAGR of 5.2 percent over the forecasted period of 2025.